Key Insights

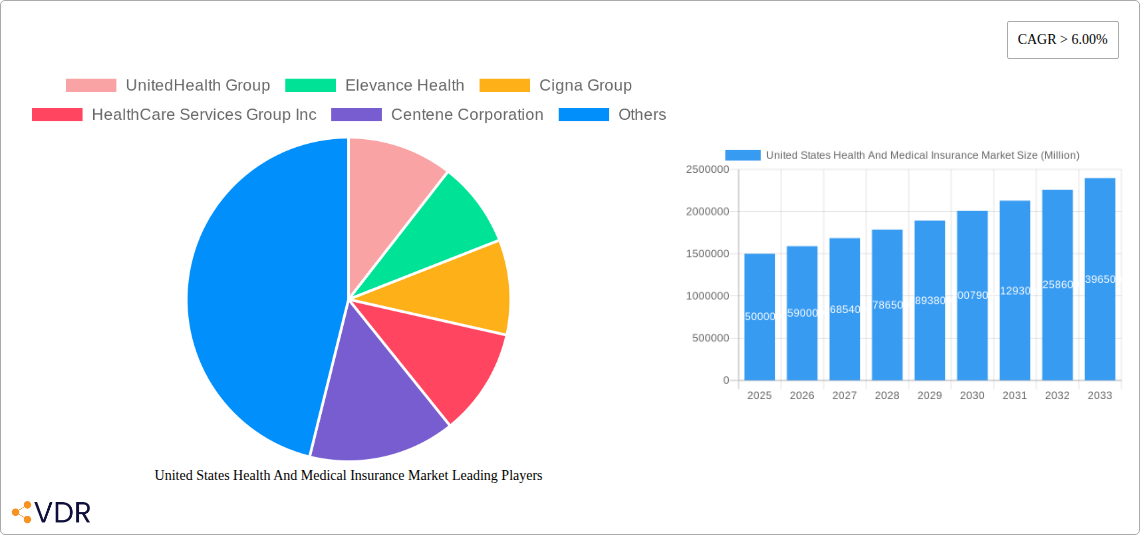

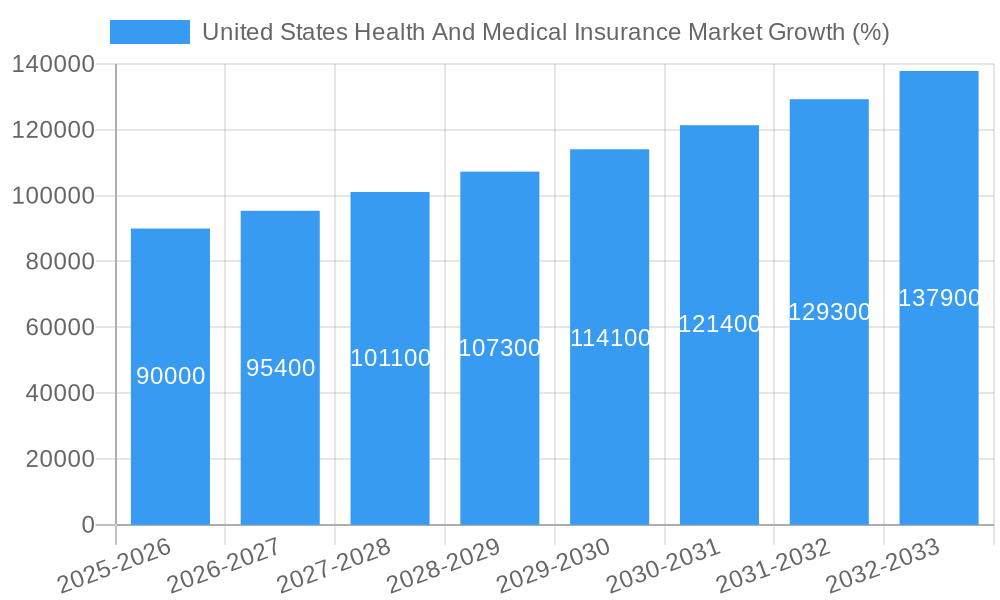

The United States health and medical insurance market, a $1.5 trillion industry in 2025, is projected to experience robust growth, exceeding a 6% compound annual growth rate (CAGR) from 2025 to 2033. This expansion is driven by several key factors. The aging population necessitates increased healthcare services and insurance coverage, fueling demand. Rising chronic disease prevalence, particularly among older adults, further contributes to higher healthcare expenditures and insurance utilization. Technological advancements, such as telemedicine and improved data analytics, are enhancing efficiency and potentially lowering costs in the long term, while simultaneously creating new market segments and opportunities for innovation. However, the market faces challenges including rising healthcare costs, concerns about insurance affordability and accessibility, and ongoing debates surrounding healthcare reform. Regulatory changes and political landscape also create uncertainty, impacting market trajectory. Major players like UnitedHealth Group, Elevance Health, and Cigna Group are vying for market share through strategic acquisitions, technological investments, and expanded service offerings. Despite these restraints, the overall market outlook remains positive, driven by fundamental demographic shifts and the enduring need for comprehensive healthcare coverage.

The competitive landscape is highly concentrated, with large, established players dominating the market. These firms employ various strategies to maintain their market position, including expanding their provider networks, developing innovative insurance products, and investing in advanced technologies. Smaller, niche players are also emerging, focusing on specific segments of the population or specialized healthcare services. The increasing emphasis on value-based care models and population health management is reshaping the industry, pushing insurers to move beyond traditional fee-for-service models and adopt strategies that promote preventative care and improved health outcomes. Regional variations in healthcare costs and insurance coverage remain significant, presenting opportunities for tailored insurance solutions. Future growth will likely be shaped by the success of initiatives aimed at improving healthcare access, controlling costs, and advancing innovative healthcare delivery models.

This comprehensive report provides an in-depth analysis of the United States Health and Medical Insurance Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is essential for industry professionals, investors, and strategic decision-makers seeking to understand this vital and ever-evolving sector. This analysis explores the parent market of the Healthcare Industry and its child market, Health Insurance, providing granular insights into market segmentation and competitive dynamics. The market size is presented in million units.

United States Health And Medical Insurance Market Dynamics & Structure

The U.S. health and medical insurance market is characterized by high concentration among major players, significant technological innovation, and a complex regulatory framework. Market concentration is driven by the scale required for efficient operations and the consolidation of smaller providers through mergers and acquisitions (M&A). The market is witnessing significant technological advancements such as telehealth, AI-driven diagnostics, and big data analytics. However, regulatory hurdles such as HIPAA compliance and pricing regulations act as barriers to entry and innovation. Furthermore, the market is impacted by competitive product substitutes (e.g., alternative health solutions, wellness programs) and evolving end-user demographics (aging population, increasing chronic disease prevalence).

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- M&A Activity: Over the historical period (2019-2024), an average of xx M&A deals were recorded annually, with a total deal value of xx million.

- Technological Innovation: Adoption of telehealth and AI-driven solutions is projected to grow at a CAGR of xx% during the forecast period.

- Regulatory Landscape: Compliance with HIPAA and other regulations represents a significant operational cost and barrier for smaller players.

United States Health And Medical Insurance Market Growth Trends & Insights

The U.S. health and medical insurance market experienced robust growth during the historical period (2019-2024), driven by factors such as an aging population, rising healthcare costs, and increasing demand for comprehensive coverage. Market size expanded from xx million in 2019 to xx million in 2024, exhibiting a CAGR of xx%. Technological disruptions, such as the adoption of telehealth and digital health platforms, are accelerating market growth and changing consumer behavior. Consumers are increasingly demanding more convenient, personalized, and cost-effective healthcare options. This is leading to the rise of value-based care models and a greater focus on preventative health. The market penetration of digital health technologies is expected to reach xx% by 2033.

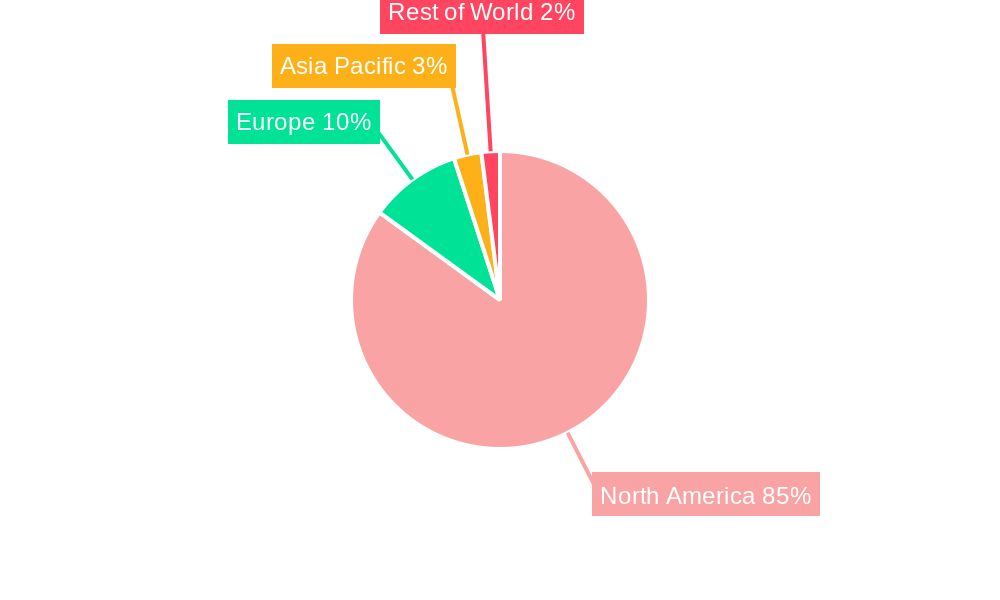

Dominant Regions, Countries, or Segments in United States Health And Medical Insurance Market

The market is geographically diverse, with significant variations in growth rates and market share across states and regions. California, Texas, and Florida represent some of the largest markets due to their large populations and higher healthcare spending. Market growth is primarily driven by favorable economic conditions, a robust healthcare infrastructure, and supportive government policies.

- California: Holds the largest market share, driven by a large population and high density of healthcare providers.

- Texas: Significant growth driven by a burgeoning population and increasing demand for health insurance.

- Medicare Advantage: This segment exhibits strong growth due to the aging population and increasing preference for managed care plans.

United States Health And Medical Insurance Market Product Landscape

The market offers a diverse range of products, from traditional fee-for-service plans to managed care plans, including HMOs, PPOs, and Medicare Advantage plans. Recent innovations focus on value-based care models, personalized medicine, and digital health platforms that offer remote monitoring and virtual consultations. These advancements aim to improve healthcare outcomes, enhance patient experience, and reduce overall costs. Key selling propositions often include cost savings, comprehensive coverage, and access to a wide network of providers.

Key Drivers, Barriers & Challenges in United States Health And Medical Insurance Market

Key Drivers: An aging population, rising healthcare costs, increasing prevalence of chronic diseases, and technological advancements in healthcare delivery are key drivers of market growth. Government initiatives to expand healthcare coverage (e.g., the Affordable Care Act) further stimulate market expansion.

Key Challenges: High administrative costs, regulatory complexities, rising premiums, and concerns about healthcare affordability pose significant challenges. Supply chain disruptions in pharmaceuticals and medical devices can also impact market dynamics. The competitive landscape, characterized by large established players, creates significant barriers to entry for new entrants.

Emerging Opportunities in United States Health And Medical Insurance Market

Emerging opportunities include the growth of telehealth, the expansion of value-based care models, personalized medicine, and the increasing adoption of digital health tools. Untapped markets exist in underserved communities and among specific demographic groups. Innovations in preventative care and chronic disease management also present significant growth opportunities.

Growth Accelerators in the United States Health And Medical Insurance Market Industry

Technological advancements, strategic partnerships between insurers and healthcare providers, expansion into new geographic markets, and the development of innovative insurance products are key growth catalysts. Efforts to improve interoperability within the healthcare system and address healthcare affordability concerns are also crucial for long-term growth.

Key Players Shaping the United States Health And Medical Insurance Market Market

- UnitedHealth Group

- Elevance Health

- Cigna Group

- HealthCare Services Group Inc

- Centene Corporation

- Aetna Inc

- Kaiser Foundation Group

- Independence Health Group

- Molina Healthcare

- Guidewell Mutual Holding

- Humana

- CVS Health

- List Not Exhaustive

Notable Milestones in United States Health And Medical Insurance Market Sector

- January 2024: HCSC's acquisition of Cigna Group's Medicare-related businesses significantly expands HCSC's presence in the Medicare Advantage market.

- January 2024: Elevance Health's acquisition of Paragon Healthcare Inc. strengthens its position in the specialty pharmaceutical services sector.

In-Depth United States Health And Medical Insurance Market Market Outlook

The U.S. health and medical insurance market is poised for continued growth, driven by long-term demographic trends, technological innovation, and evolving consumer preferences. Strategic partnerships, expansion into new markets, and the development of innovative products and services will be crucial for companies to capitalize on future market opportunities. The market is expected to experience sustained growth, creating lucrative opportunities for established players and new entrants alike.

United States Health And Medical Insurance Market Segmentation

-

1. Procurement Type

- 1.1. Directly/individually Purchased

-

1.2. Employer-Based

- 1.2.1. Small Group Market

- 1.2.2. Large Group Market

-

2. Products and Services Offered

- 2.1. Pharmacy Benefit Management

- 2.2. High Deductible Health Plans

- 2.3. Free-For-Service Plans

- 2.4. Managed Care Plans

-

3. Place of Purchase

- 3.1. On Exchange

- 3.2. Off Exchange

United States Health And Medical Insurance Market Segmentation By Geography

- 1. United States

United States Health And Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Subsidized Health Insurance Schemes is Boosting the Sales of Health and Medical Insurance Policies; Aging Population in United States and increasing Healthcare Costs

- 3.3. Market Restrains

- 3.3.1. Government Subsidized Health Insurance Schemes is Boosting the Sales of Health and Medical Insurance Policies; Aging Population in United States and increasing Healthcare Costs

- 3.4. Market Trends

- 3.4.1. The Online Channel is Expected to Witness New Growth Avenues in the Coming Future

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Health And Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Procurement Type

- 5.1.1. Directly/individually Purchased

- 5.1.2. Employer-Based

- 5.1.2.1. Small Group Market

- 5.1.2.2. Large Group Market

- 5.2. Market Analysis, Insights and Forecast - by Products and Services Offered

- 5.2.1. Pharmacy Benefit Management

- 5.2.2. High Deductible Health Plans

- 5.2.3. Free-For-Service Plans

- 5.2.4. Managed Care Plans

- 5.3. Market Analysis, Insights and Forecast - by Place of Purchase

- 5.3.1. On Exchange

- 5.3.2. Off Exchange

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Procurement Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 UnitedHealth Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Elevance Health

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cigna Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HealthCare Services Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Centene Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aetna Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kaiser Foundation Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Independence Health Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Molina Healthcare

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Guidewell Mutual Holding

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Humana

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CVS Health**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 UnitedHealth Group

List of Figures

- Figure 1: United States Health And Medical Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Health And Medical Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: United States Health And Medical Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Health And Medical Insurance Market Volume Trillion Forecast, by Region 2019 & 2032

- Table 3: United States Health And Medical Insurance Market Revenue Million Forecast, by Procurement Type 2019 & 2032

- Table 4: United States Health And Medical Insurance Market Volume Trillion Forecast, by Procurement Type 2019 & 2032

- Table 5: United States Health And Medical Insurance Market Revenue Million Forecast, by Products and Services Offered 2019 & 2032

- Table 6: United States Health And Medical Insurance Market Volume Trillion Forecast, by Products and Services Offered 2019 & 2032

- Table 7: United States Health And Medical Insurance Market Revenue Million Forecast, by Place of Purchase 2019 & 2032

- Table 8: United States Health And Medical Insurance Market Volume Trillion Forecast, by Place of Purchase 2019 & 2032

- Table 9: United States Health And Medical Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United States Health And Medical Insurance Market Volume Trillion Forecast, by Region 2019 & 2032

- Table 11: United States Health And Medical Insurance Market Revenue Million Forecast, by Procurement Type 2019 & 2032

- Table 12: United States Health And Medical Insurance Market Volume Trillion Forecast, by Procurement Type 2019 & 2032

- Table 13: United States Health And Medical Insurance Market Revenue Million Forecast, by Products and Services Offered 2019 & 2032

- Table 14: United States Health And Medical Insurance Market Volume Trillion Forecast, by Products and Services Offered 2019 & 2032

- Table 15: United States Health And Medical Insurance Market Revenue Million Forecast, by Place of Purchase 2019 & 2032

- Table 16: United States Health And Medical Insurance Market Volume Trillion Forecast, by Place of Purchase 2019 & 2032

- Table 17: United States Health And Medical Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Health And Medical Insurance Market Volume Trillion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Health And Medical Insurance Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the United States Health And Medical Insurance Market?

Key companies in the market include UnitedHealth Group, Elevance Health, Cigna Group, HealthCare Services Group Inc, Centene Corporation, Aetna Inc, Kaiser Foundation Group, Independence Health Group, Molina Healthcare, Guidewell Mutual Holding, Humana, CVS Health**List Not Exhaustive.

3. What are the main segments of the United States Health And Medical Insurance Market?

The market segments include Procurement Type, Products and Services Offered, Place of Purchase.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Subsidized Health Insurance Schemes is Boosting the Sales of Health and Medical Insurance Policies; Aging Population in United States and increasing Healthcare Costs.

6. What are the notable trends driving market growth?

The Online Channel is Expected to Witness New Growth Avenues in the Coming Future.

7. Are there any restraints impacting market growth?

Government Subsidized Health Insurance Schemes is Boosting the Sales of Health and Medical Insurance Policies; Aging Population in United States and increasing Healthcare Costs.

8. Can you provide examples of recent developments in the market?

January 2024: HCSC entered into a binding contract with The Cigna Group to purchase its Medicare Advantage, Medicare Supplemental Benefits, Medicare Part D, and CareAllies businesses. This acquisition will bring significant advantages to HCSC's existing and prospective members, as it will strengthen the company's capabilities and expand its presence, especially in the expanding Medicare sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Health And Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Health And Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Health And Medical Insurance Market?

To stay informed about further developments, trends, and reports in the United States Health And Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence