Key Insights

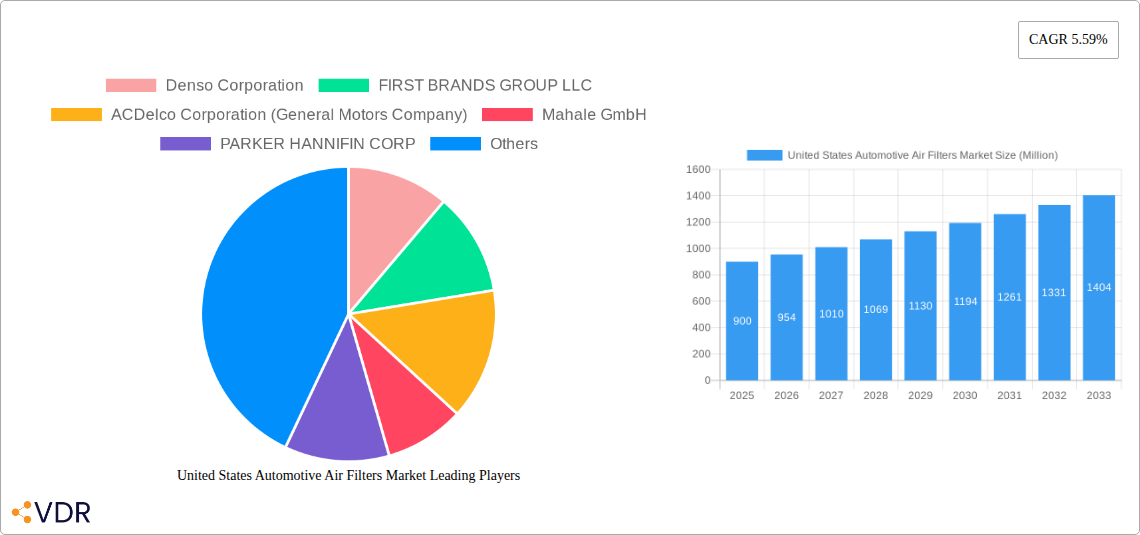

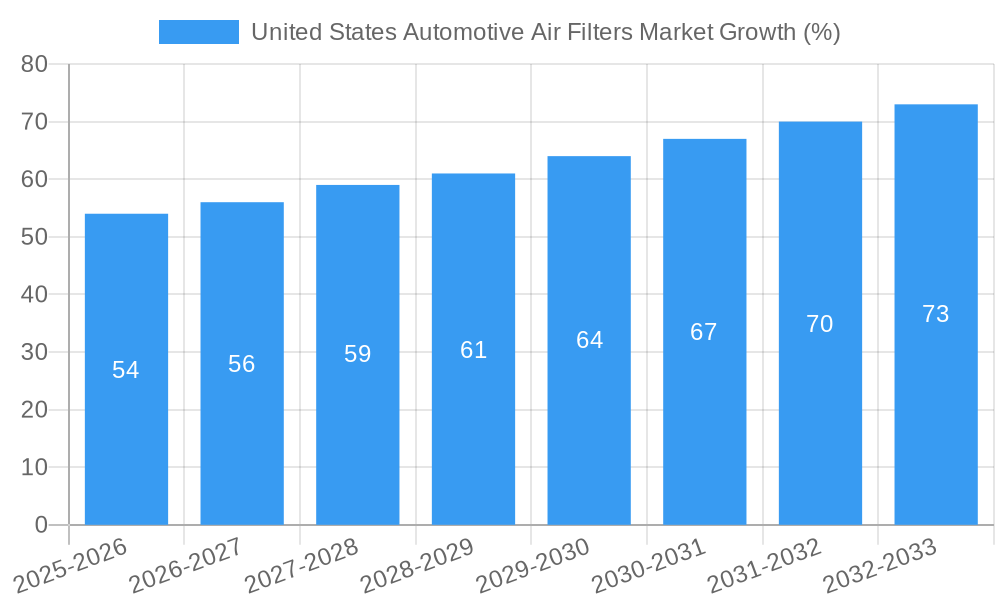

The United States automotive air filter market, valued at approximately $900 million in 2025, is projected to experience steady growth, driven by factors such as increasing vehicle ownership, stringent emission regulations, and rising awareness of air quality. The market's Compound Annual Growth Rate (CAGR) of 5.59% from 2019 to 2024 suggests a continuing upward trajectory through 2033. Key segments contributing to this growth include passenger car filters, which dominate the market due to higher vehicle sales compared to commercial vehicles. Within the material types, paper air filters currently hold the largest market share, owing to their cost-effectiveness and widespread use. However, the demand for higher-efficiency filters, such as synthetic intake and cabin filters, is increasing, driven by a preference for enhanced filtration and longer lifespan. The aftermarket sales channel is expected to witness significant growth, fueled by the rising popularity of DIY maintenance and the increasing availability of affordable aftermarket filters. Leading players like Denso, Mann+Hummel, and Bosch are leveraging technological advancements to enhance filter performance and cater to the growing demand for advanced filtration solutions.

The competitive landscape is characterized by the presence of both established global players and regional manufacturers. Intense competition is driving innovation and leading to the development of more efficient and durable automotive air filters. Factors such as fluctuating raw material prices and the economic health of the automotive industry could influence market growth. However, the long-term outlook remains positive, driven by factors such as the increasing adoption of advanced driver-assistance systems (ADAS) and the growing trend towards electric vehicles, which require specialized air filtration systems. Continued regulatory pressure to reduce emissions will also play a crucial role in shaping the market's future. The market's segmentation by material type (paper, gauze, foam, etc.), filter type (intake, cabin), vehicle type (passenger cars, commercial vehicles), and sales channel (OEM, aftermarket) allows for a comprehensive understanding of the varied market dynamics and opportunities.

United States Automotive Air Filters Market: A Comprehensive Market Report (2019-2033)

This comprehensive report offers an in-depth analysis of the United States automotive air filters market, providing valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, growth trends, and key players, forecasting market trajectory until 2033. The report segments the market by material type (paper, gauze, foam, and other), filter type (intake, cabin), vehicle type (passenger cars, commercial vehicles), and sales channel (OEM, aftermarket). The market is valued in million units.

United States Automotive Air Filters Market Dynamics & Structure

The United States automotive air filter market is characterized by a moderately consolidated structure, with key players like Denso Corporation, FIRST BRANDS GROUP LLC, ACDelco Corporation, and Mann+Hummel holding significant market share. Technological innovation, particularly in filtration technologies targeting improved fuel efficiency and air quality, is a key driver. Stringent emission regulations and increasing consumer awareness of air quality are also influencing market growth. The market experiences considerable M&A activity, with smaller companies often acquired by larger players to expand their product portfolios and geographic reach. Competitive pressures are primarily driven by the introduction of new filter materials and designs. The aftermarket segment is particularly competitive due to the presence of numerous independent filter manufacturers.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on high-efficiency particulate air (HEPA) filters, improved filtration media, and smart filter technologies.

- Regulatory Framework: Stringent emission standards and safety regulations drive demand for high-performance filters.

- Competitive Substitutes: Limited direct substitutes, but alternative air purification systems present indirect competition.

- End-User Demographics: Primarily driven by passenger car owners and commercial fleet operators.

- M&A Trends: Moderate level of M&A activity, primarily focused on expanding product portfolios and geographic reach (xx deals in the past 5 years).

United States Automotive Air Filters Market Growth Trends & Insights

The United States automotive air filters market has witnessed consistent growth over the historical period (2019-2024), driven by a combination of factors including rising vehicle sales, increasing vehicle age (leading to higher aftermarket demand), and growing environmental concerns. The market is projected to maintain a steady Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the introduction of electric vehicles and advanced driver-assistance systems (ADAS), are creating new opportunities for specialized air filter designs. Consumer behavior shifts towards prioritizing air quality inside vehicles are also contributing to market expansion. Market penetration of advanced filtration technologies like HEPA filters is steadily increasing.

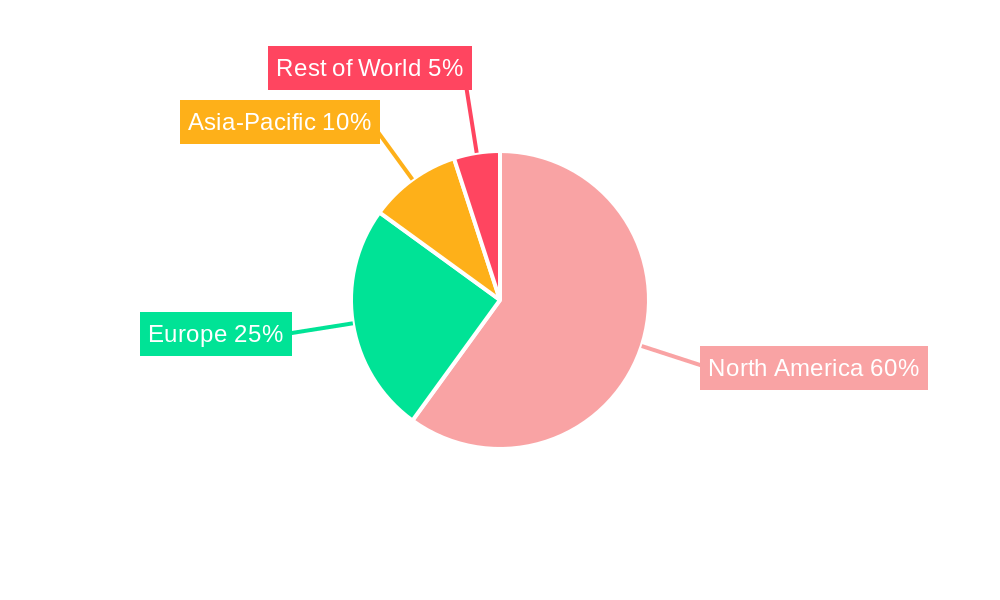

Dominant Regions, Countries, or Segments in United States Automotive Air Filters Market

The largest segment by vehicle type is passenger cars, accounting for approximately xx million units in 2024, driven by high vehicle ownership rates and replacement cycles. The aftermarket sales channel dominates the market, representing xx million units in 2024, fueled by the large number of older vehicles on the road. California and Texas emerge as leading states, due to their large populations and high vehicle ownership. Paper air filters continue to represent the largest material segment, with xx million units in 2024, owing to their cost-effectiveness.

- Key Drivers (Passenger Cars): High vehicle ownership, replacement cycles, and consumer preference for cleaner air.

- Key Drivers (Aftermarket): Large number of older vehicles, cost-consciousness among consumers, and readily available aftermarket products.

- Key Drivers (Paper Air Filters): Cost-effectiveness, wide availability, and suitability for many vehicle applications.

- Growth Potential: Significant growth is anticipated in the cabin air filter segment due to increasing consumer awareness of indoor air quality.

United States Automotive Air Filters Market Product Landscape

The automotive air filter market showcases continuous innovation, with manufacturers introducing filters incorporating advanced materials and designs. Key features include improved filtration efficiency, extended service life, and enhanced fuel economy. HEPA filters, offering superior particulate matter removal, are gaining traction. The integration of sensors and smart technology is also transforming air filter design, allowing for real-time monitoring of filter performance.

Key Drivers, Barriers & Challenges in United States Automotive Air Filters Market

Key Drivers: Rising vehicle sales, increasing vehicle age, stringent emission regulations, and growing consumer awareness of air quality are major drivers. Technological advancements, such as HEPA filters and smart filter technologies are also fueling market growth.

Key Challenges: Intense competition from numerous manufacturers, fluctuating raw material prices, supply chain disruptions, and the need to meet stringent regulatory requirements are major challenges. Approximately xx% of manufacturers faced significant supply chain issues in 2024.

Emerging Opportunities in United States Automotive Air Filters Market

Emerging opportunities lie in the development and adoption of high-efficiency filters for electric vehicles, advanced filtration systems for autonomous vehicles, and customized air filtration solutions for specific environmental conditions. Furthermore, the integration of smart sensors and connected technologies within air filters presents lucrative possibilities for data-driven preventative maintenance.

Growth Accelerators in the United States Automotive Air Filters Market Industry

Strategic partnerships between filter manufacturers and automotive OEMs are accelerating market growth by facilitating the development and integration of advanced filtration technologies. Technological advancements, such as improved filter media and sensor integration, are further enhancing product performance and creating new market opportunities.

Key Players Shaping the United States Automotive Air Filters Market Market

- Denso Corporation

- FIRST BRANDS GROUP LLC

- ACDelco Corporation (General Motors Company)

- Mahale GmbH

- PARKER HANNIFIN CORP

- MANN+HUMMEL

- Purolator Filters LLC

- Robert Bosch GmbH

- AL Group LTD

- K & N Engineering Inc

Notable Milestones in United States Automotive Air Filters Market Sector

- January 2022: Tesla Inc. introduced a HEPA filter and bioweapon defense mode in the Model Y.

- October 2022: Audi announced the introduction of an Urban Air Purifier in its electric vehicles.

- January 2023: Panasonic Automotive Systems introduced its nano X portable in-vehicle air cleaner.

- February 2023: Cummins Inc. announced the launch of the optiAir FX Filter.

In-Depth United States Automotive Air Filters Market Market Outlook

The United States automotive air filters market is poised for sustained growth, driven by technological advancements, stringent regulations, and increasing consumer demand for improved air quality. Strategic partnerships and the development of innovative filtration solutions will play a crucial role in shaping the future of this dynamic market. The market is expected to reach xx million units by 2033.

United States Automotive Air Filters Market Segmentation

-

1. Material Type

- 1.1. Paper Airfilter

- 1.2. Gauze Airfilter

- 1.3. Foam Airfilters

- 1.4. Other Material Types

-

2. Type

-

2.1. Intake Filters

- 2.1.1. Cellulose Intake

- 2.1.2. Synthetic Intake

-

2.2. Cabin Filter

- 2.2.1. Particulate Type

- 2.2.2. Activated Carbon

-

2.1. Intake Filters

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

-

4. Sales Channel

- 4.1. OEM

- 4.2. Aftermarket

United States Automotive Air Filters Market Segmentation By Geography

- 1. United States

United States Automotive Air Filters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In Vehicle Production Across the Country

- 3.3. Market Restrains

- 3.3.1. Cost and Innovation in Alternate Production Processes; Others

- 3.4. Market Trends

- 3.4.1. Commercial Vehicle Segment Captures Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Automotive Air Filters Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Paper Airfilter

- 5.1.2. Gauze Airfilter

- 5.1.3. Foam Airfilters

- 5.1.4. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Intake Filters

- 5.2.1.1. Cellulose Intake

- 5.2.1.2. Synthetic Intake

- 5.2.2. Cabin Filter

- 5.2.2.1. Particulate Type

- 5.2.2.2. Activated Carbon

- 5.2.1. Intake Filters

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. OEM

- 5.4.2. Aftermarket

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. United States United States Automotive Air Filters Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Canada United States Automotive Air Filters Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Rest of the North America United States Automotive Air Filters Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Denso Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 FIRST BRANDS GROUP LLC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 ACDelco Corporation (General Motors Company)

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Mahale GmbH

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 PARKER HANNIFIN CORP

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 MANN+HUMMEL

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Purolator Filters LLC

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Robert Bosch GmbH

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 AL Group LTD

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 K & N Engineering Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Denso Corporation

List of Figures

- Figure 1: United States Automotive Air Filters Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Automotive Air Filters Market Share (%) by Company 2024

List of Tables

- Table 1: United States Automotive Air Filters Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Automotive Air Filters Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: United States Automotive Air Filters Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United States Automotive Air Filters Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: United States Automotive Air Filters Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 6: United States Automotive Air Filters Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: United States Automotive Air Filters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Automotive Air Filters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United States Automotive Air Filters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Automotive Air Filters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Automotive Air Filters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Automotive Air Filters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States Automotive Air Filters Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 14: United States Automotive Air Filters Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: United States Automotive Air Filters Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 16: United States Automotive Air Filters Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 17: United States Automotive Air Filters Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Automotive Air Filters Market?

The projected CAGR is approximately 5.59%.

2. Which companies are prominent players in the United States Automotive Air Filters Market?

Key companies in the market include Denso Corporation, FIRST BRANDS GROUP LLC, ACDelco Corporation (General Motors Company), Mahale GmbH, PARKER HANNIFIN CORP, MANN+HUMMEL, Purolator Filters LLC, Robert Bosch GmbH, AL Group LTD, K & N Engineering Inc.

3. What are the main segments of the United States Automotive Air Filters Market?

The market segments include Material Type, Type, Vehicle Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise In Vehicle Production Across the Country.

6. What are the notable trends driving market growth?

Commercial Vehicle Segment Captures Market.

7. Are there any restraints impacting market growth?

Cost and Innovation in Alternate Production Processes; Others.

8. Can you provide examples of recent developments in the market?

February 2023: Cummins Inc. announced to launch of optiAir FX Filter. The optiAir FX Filter enhances the fuel economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Automotive Air Filters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Automotive Air Filters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Automotive Air Filters Market?

To stay informed about further developments, trends, and reports in the United States Automotive Air Filters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence