Key Insights

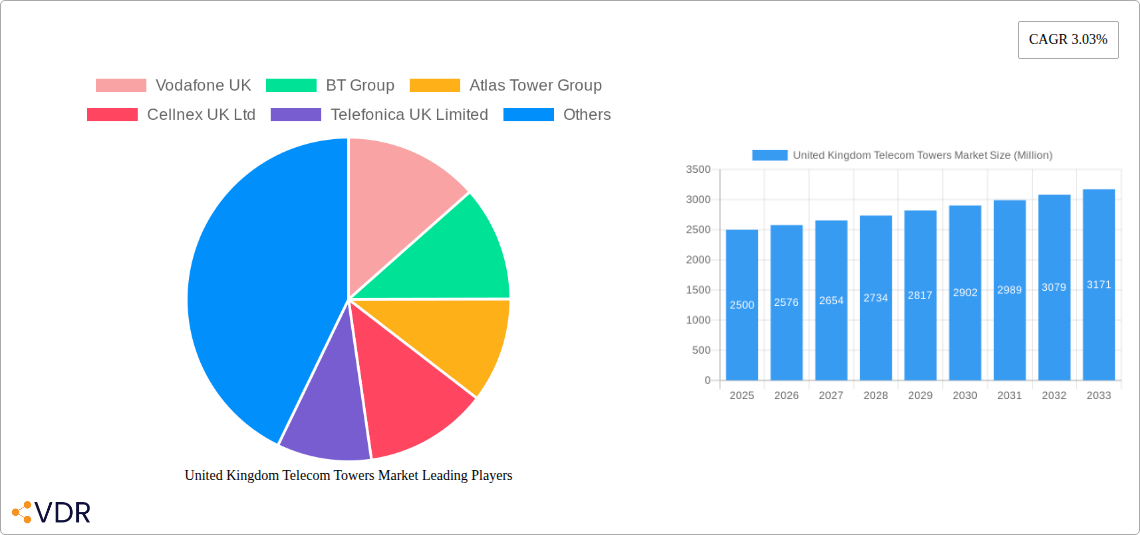

The United Kingdom Telecom Towers market, valued at approximately £X billion in 2025 (assuming a reasonable market size based on comparable European markets and the provided CAGR), is projected to experience steady growth at a Compound Annual Growth Rate (CAGR) of 3.03% from 2025 to 2033. This expansion is driven primarily by the increasing demand for enhanced mobile broadband services, the proliferation of 5G network deployments, and the growing adoption of Internet of Things (IoT) devices. Significant investments in network infrastructure upgrades by major telecommunication companies like Vodafone UK, BT Group, and Virgin Media O2 are further fueling market growth. The rise of private 5G networks, particularly within industrial sectors, presents a lucrative opportunity for tower infrastructure providers. However, regulatory hurdles related to site acquisition and deployment, along with the increasing competition within the sector, could pose challenges to the market's sustained expansion. The market is segmented by tower type (macrocells, small cells, etc.), ownership (independent tower companies, MNO-owned), and geographic location, each contributing to the overall market dynamics.

The competitive landscape features a mix of large established players like Vodafone UK and BT Group, alongside specialized independent tower companies such as Atlas Tower Group and Cellnex UK Ltd. These companies are actively pursuing strategies such as mergers and acquisitions, infrastructure sharing agreements, and technological advancements to maintain their market share and capitalize on growth opportunities. The focus on energy efficiency, the adoption of smart tower technologies, and the increasing demand for robust network infrastructure in underserved areas are shaping the future trajectory of the UK Telecom Towers market. Continued investment in fiber connectivity and the development of advanced tower technologies are key factors influencing the market's evolution throughout the forecast period. Future market success hinges on the agility of operators to adapt to evolving technological advancements and regulatory changes.

United Kingdom Telecom Towers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom Telecom Towers Market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report segments the market to provide granular insights and actionable intelligence for industry professionals. The market is valued at XX million in 2025 and is projected to reach XX million by 2033, exhibiting a CAGR of XX%.

United Kingdom Telecom Towers Market Dynamics & Structure

The UK telecom towers market is characterized by a moderate level of concentration, with key players like Vodafone UK, BT Group, and Cellnex UK Ltd holding significant market share. Technological innovation, primarily driven by 5G deployment and the increasing demand for improved network coverage and capacity, is a key driver. The regulatory framework, including spectrum allocation policies and infrastructure sharing guidelines, significantly influences market dynamics. While fiber optics present a competitive substitute for some applications, the reliance on towers for wide-area coverage remains substantial. The end-user demographic is largely driven by the increasing mobile phone penetration and data consumption among individuals and businesses. M&A activity has been relatively active, with recent deals reflecting consolidation trends within the sector.

- Market Concentration: Moderately concentrated, with top 3 players holding approximately xx% market share (2025).

- Technological Innovation: 5G deployment, densification initiatives, and small cell technology are key drivers.

- Regulatory Framework: OFCOM regulations and spectrum allocation significantly impact market growth.

- Competitive Substitutes: Fiber optics present competition in specific areas, but tower infrastructure remains crucial for wide-area coverage.

- End-User Demographics: Increasing mobile penetration and data consumption drive demand.

- M&A Trends: Moderate level of M&A activity, with xx major deals recorded between 2019-2024.

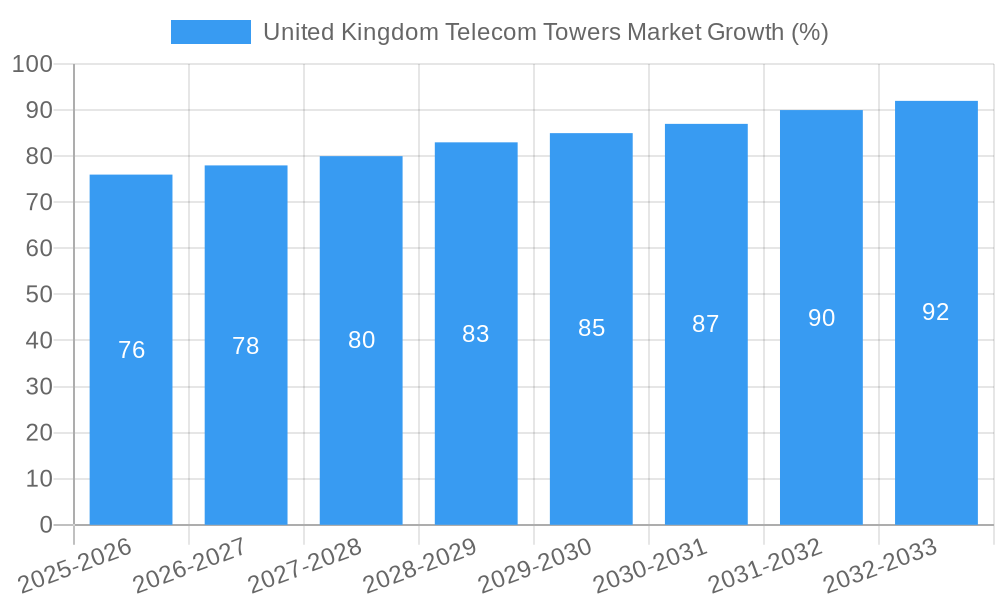

United Kingdom Telecom Towers Market Growth Trends & Insights

The UK telecom towers market has witnessed robust growth over the historical period (2019-2024), fueled by rising mobile data consumption, expanding 5G network deployments, and increasing demand for improved network infrastructure. This growth is projected to continue throughout the forecast period (2025-2033), albeit at a potentially moderating pace compared to the preceding years. The increasing adoption of IoT devices, the growth of the mobile private network market (projected to reach GBP 528 million by 2030), and ongoing network densification initiatives are major contributors to market expansion. Technological advancements, including the integration of AI and machine learning for network optimization, further bolster this growth trajectory. Consumer behavior shifts towards greater reliance on mobile services for communication, entertainment, and business applications significantly impact market demand.

- Market Size (2025): XX million

- Market Size (2033): XX million

- CAGR (2025-2033): XX%

- Market Penetration (2025): xx%

Dominant Regions, Countries, or Segments in United Kingdom Telecom Towers Market

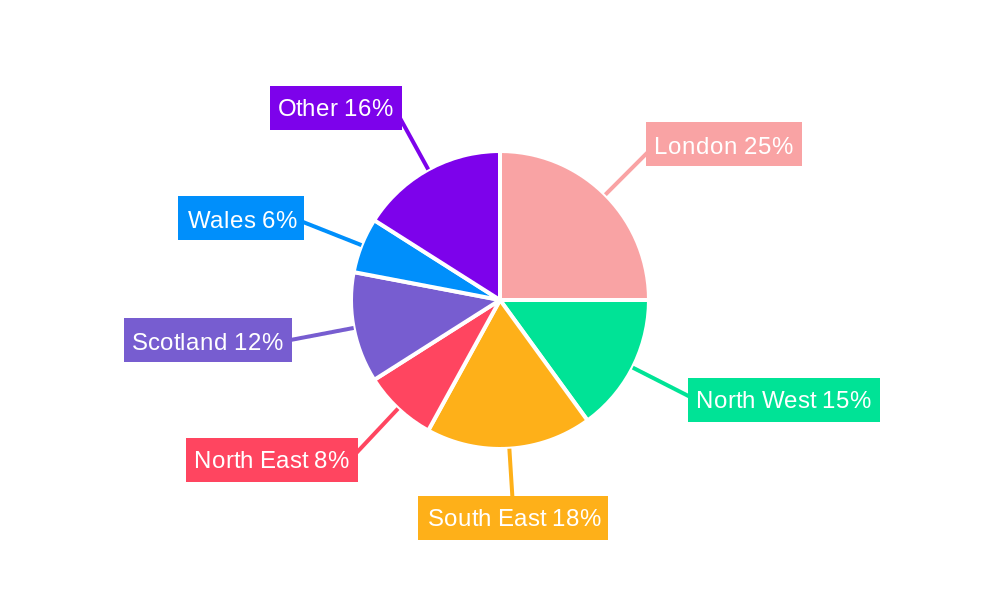

The London and South East region demonstrates the highest market dominance in the UK telecom towers market, driven by high population density, increased mobile device usage, and robust economic activity. Other major urban centers throughout the UK also contribute significantly to overall market growth. The segment focusing on macrocell towers currently holds the largest market share, but the small cell segment is experiencing faster growth due to network densification requirements for improved 5G coverage.

- Key Drivers (London & South East): High population density, robust economic activity, significant mobile penetration.

- Market Share (London & South East): xx% (2025)

- Growth Potential (Small Cell Segment): High growth potential due to 5G deployment and densification.

United Kingdom Telecom Towers Market Product Landscape

The market offers a range of products, including macrocell towers, small cells, and distributed antenna systems (DAS). Recent innovations focus on enhancing tower capacity, optimizing energy efficiency, and improving network performance. Key advancements include the integration of advanced antenna technologies, improved power management systems, and AI-powered network optimization tools. These innovations enable operators to meet growing network demands while reducing operational costs.

Key Drivers, Barriers & Challenges in United Kingdom Telecom Towers Market

Key Drivers:

- Increasing demand for improved mobile network coverage and capacity driven by 5G rollouts and rising mobile data consumption.

- Government initiatives supporting the expansion of digital infrastructure.

- Investments in smart city development.

Challenges & Restraints:

- High upfront capital expenditures associated with tower construction and maintenance.

- Obtaining necessary planning permissions and navigating complex regulatory procedures.

- Competition among tower companies and potential pricing pressures.

Emerging Opportunities in United Kingdom Telecom Towers Market

- Growth of private 5G networks in various industries (e.g., manufacturing, logistics).

- Expansion of rural broadband access through tower infrastructure.

- Development of multi-operator tower sharing agreements to enhance efficiency and reduce costs.

Growth Accelerators in the United Kingdom Telecom Towers Market Industry

Long-term growth will be driven by continuous investment in 5G network infrastructure, strategic partnerships to share infrastructure and reduce costs, and innovative applications of tower infrastructure, including opportunities beyond traditional mobile network deployments. The integration of new technologies like AI and IoT will further accelerate market growth.

Key Players Shaping the United Kingdom Telecom Towers Market Market

- Vodafone UK

- BT Group

- Atlas Tower Group

- Cellnex UK Ltd

- Telefonica UK Limited

- Crown Castle UK Limited

- Virgin Media O2

- Wireless Infrastructure Group

- Helios Towers

- Freshwav

Notable Milestones in United Kingdom Telecom Towers Market Sector

- July 2024: Cellnex UK signed a long-term agreement with Vodafone and Virgin Media O2 for tower infrastructure and related services.

- May 2024: Virgin Media O2 and Accenture partnered to capitalize on the growing UK mobile private network market.

In-Depth United Kingdom Telecom Towers Market Market Outlook

The UK telecom towers market is poised for continued growth, driven by the ongoing rollout of 5G networks, increased demand for mobile data, and the emergence of new applications like private 5G networks. Strategic partnerships and the adoption of innovative technologies present significant opportunities for market participants. The market's future success will depend on addressing challenges related to regulatory approvals, infrastructure investment, and competition.

United Kingdom Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive Sites

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

United Kingdom Telecom Towers Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment

- 3.3. Market Restrains

- 3.3.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment

- 3.4. Market Trends

- 3.4.1. 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive Sites

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Vodafone UK

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BT Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Atlas Tower Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cellnex UK Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Telefonica UK Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Crown Castle UK Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Virgin Media O2

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wireless Infrastructure Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Helios Towers

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Freshwav

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Vodafone UK

List of Figures

- Figure 1: United Kingdom Telecom Towers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Telecom Towers Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Telecom Towers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 3: United Kingdom Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 4: United Kingdom Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: United Kingdom Telecom Towers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 7: United Kingdom Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 8: United Kingdom Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 9: United Kingdom Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Telecom Towers Market?

The projected CAGR is approximately 3.03%.

2. Which companies are prominent players in the United Kingdom Telecom Towers Market?

Key companies in the market include Vodafone UK, BT Group, Atlas Tower Group, Cellnex UK Ltd, Telefonica UK Limited, Crown Castle UK Limited, Virgin Media O2, Wireless Infrastructure Group, Helios Towers, Freshwav.

3. What are the main segments of the United Kingdom Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment.

6. What are the notable trends driving market growth?

5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment.

7. Are there any restraints impacting market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment.

8. Can you provide examples of recent developments in the market?

July 2024: Cellnex UK signed a long-term agreement with Vodafone and Virgin Media O2, supplying the two MNOs with tower infrastructure and related services. This agreement fortifies and expands the existing partnership, ensuring stability for all parties involved.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Telecom Towers Market?

To stay informed about further developments, trends, and reports in the United Kingdom Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence