Key Insights

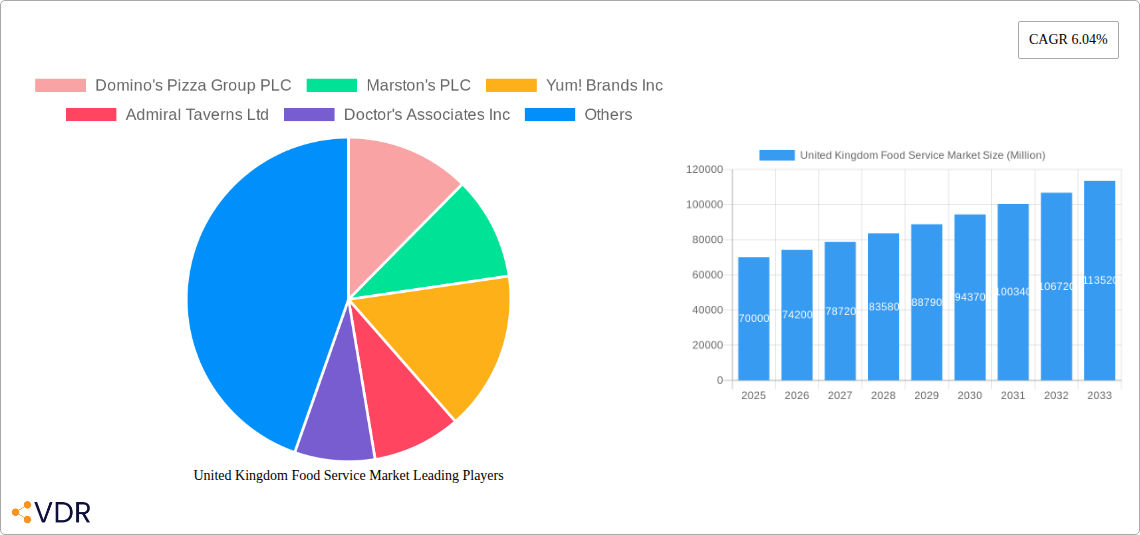

The United Kingdom food service market, valued at approximately £70 billion in 2025, is projected to experience robust growth, driven by several key factors. The rising popularity of diverse cuisines, particularly from QSR (Quick Service Restaurant) segments like cafes, bars, and other international options, fuels demand. Increased disposable incomes and a growing preference for convenience contribute significantly to this market expansion. The dominance of chained outlets like McDonald's, Costa Coffee, and Domino's highlights the preference for established brands and consistent quality. However, the market also sees significant participation from independent outlets, catering to a demand for unique and localized experiences. The thriving tourism sector in the UK, particularly in major cities and popular tourist destinations, further boosts demand within the leisure, lodging, and travel segments. While rising inflation and potential economic uncertainties pose some restraints, the market's resilience is expected to continue, fueled by ongoing innovation and the enduring appeal of eating out.

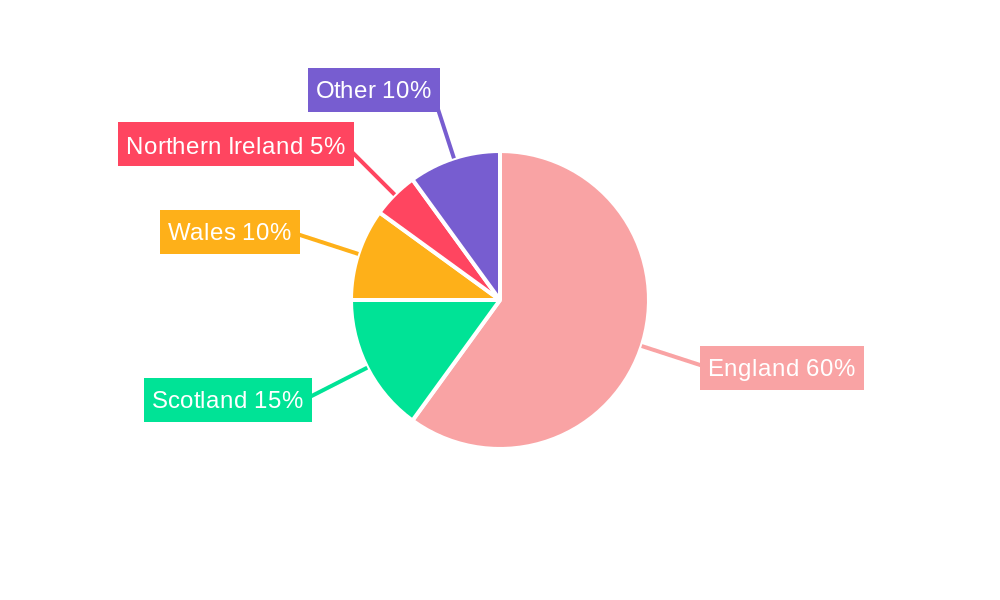

The segmentation of the UK food service market reveals a dynamic landscape. Location-wise, the leisure, lodging, and retail segments show substantial growth potential, driven by increasing urbanization and a shift towards experiential consumption. The food service type segment shows a clear preference for established QSR chains, although the "Other QSR Cuisines" category indicates a growing appetite for culinary diversity. The strong presence of both chained and independent outlets signifies a balance between brand recognition and the desire for unique dining experiences. Regional variations exist, with London and other major metropolitan areas exhibiting higher market concentration and faster growth rates. The forecast period (2025-2033) suggests continued expansion, although the actual CAGR might be influenced by external factors like economic conditions and changing consumer preferences. Continuous monitoring of these dynamics is crucial for effective market strategy and forecasting.

United Kingdom Food Service Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United Kingdom food service market, encompassing market dynamics, growth trends, key players, and future outlook. The study covers the period 2019-2033, with a focus on 2025 as the base and estimated year. We delve into the parent market's performance and its diverse child markets, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by location (Leisure, Lodging, Retail, Standalone, Travel), foodservice type (Cafes & Bars, Other QSR Cuisines), and outlet type (Chained Outlets, Independent Outlets). Key players analyzed include Domino's Pizza Group PLC, Marston's PLC, Yum! Brands Inc, Admiral Taverns Ltd, Doctor's Associates Inc, The Restaurant Group PLC, PizzaExpress (Restaurants) Limited, Nando's Group Holdings Limited, Stonegate Group, Tesco PLC, Co-operative Group Limited, Costa Coffee, Starbucks Corporation, Mitchells & Butlers PLC, McDonald's Corporation, Pizza Hut (U K ) Limited, Whitbread PLC, and Greggs PLC. The market size is presented in Million units throughout the report.

United Kingdom Food Service Market Dynamics & Structure

The UK food service market is characterized by intense competition, rapid technological advancements, and evolving consumer preferences. Market concentration is moderate, with a few large players dominating specific segments while numerous smaller independent operators cater to niche demands. Technological innovation, particularly in online ordering, delivery platforms, and kitchen automation, is a significant driver. Regulatory frameworks concerning food safety, hygiene, and labor laws significantly impact operational costs and strategies. The rise of healthy eating trends and plant-based alternatives presents both opportunities and challenges. Mergers and acquisitions (M&A) activity has been significant in recent years, leading to consolidation within the sector.

- Market Concentration: Moderate, with xx% market share held by the top 5 players in 2024.

- Technological Innovation: Strong focus on online ordering, delivery apps, and kitchen automation.

- Regulatory Framework: Stringent food safety and hygiene regulations impacting operational costs.

- Competitive Substitutes: Home-cooked meals, meal delivery kits, and supermarket ready-meals.

- End-User Demographics: Shifting towards younger, more health-conscious consumers.

- M&A Trends: Significant consolidation in recent years, with xx M&A deals recorded between 2019 and 2024.

United Kingdom Food Service Market Growth Trends & Insights

The UK food service market exhibited consistent growth during the historical period (2019-2024), experiencing a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to several factors, including rising disposable incomes, changing lifestyles, increasing urbanization, and the burgeoning popularity of food delivery services. The market size reached £xx million in 2024. Technological disruptions, such as the rise of online ordering and delivery platforms, have significantly reshaped consumer behavior. Consumers increasingly value convenience, personalization, and diverse culinary experiences. Market penetration of online ordering is expected to reach xx% by 2033. The adoption of new technologies in restaurants, such as AI-powered ordering systems and robotic kitchen assistants, is also growing, enhancing efficiency and customer satisfaction.

Dominant Regions, Countries, or Segments in United Kingdom Food Service Market

The London region dominates the UK food service market, accounting for approximately xx% of the total market value in 2024 due to high population density, tourism, and diverse culinary offerings. The "Cafes & Bars" segment shows strong growth potential, driven by evolving consumer preferences for social experiences and diverse beverage options. Chained outlets hold a larger market share compared to independent outlets, benefitting from brand recognition, economies of scale, and efficient operations.

- Key Drivers:

- High population density in London and major cities.

- Robust tourism sector.

- Increasing disposable incomes and spending on food outside the home.

- Diversification of culinary offerings.

- Dominance Factors:

- Established brands with strong market recognition.

- Economies of scale.

- Efficient supply chain management.

- Effective marketing and branding strategies.

- High footfall in prime locations.

United Kingdom Food Service Market Product Landscape

Product innovation in the UK food service market is marked by a focus on customization, convenience, and health-conscious options. Restaurants are introducing personalized menus, customized meal kits, and diverse plant-based alternatives. Technological advancements in food preparation and delivery are significantly enhancing efficiency and speed. Unique selling propositions often include innovative recipes, superior ingredients, and exceptional customer service. The introduction of mobile ordering and loyalty programs improves the customer experience and drives repeat business.

Key Drivers, Barriers & Challenges in United Kingdom Food Service Market

Key Drivers:

- Rising disposable incomes and increased spending on leisure activities.

- Growing demand for convenience and quick-service options.

- Increasing popularity of online food delivery services.

- Expansion of diverse culinary offerings.

- Technological advancements in food preparation and service.

Key Challenges:

- Increasing operating costs, including labor and food prices. (xx% increase in labor costs projected by 2028).

- Intense competition from established and emerging players.

- Regulatory hurdles related to food safety, hygiene, and environmental regulations.

- Supply chain disruptions impacting ingredient availability and prices.

Emerging Opportunities in United Kingdom Food Service Market

The UK food service market presents several emerging opportunities, including the growth of personalized meal experiences, expansion into underserved markets (e.g., smaller towns and rural areas), and the rising popularity of sustainable and ethical food sourcing. The adoption of new technologies such as AI-powered ordering systems and robotic kitchen assistants also presents immense opportunities for efficiency improvement and customer satisfaction enhancement. The increasing health consciousness among consumers also creates opportunities for healthier food options.

Growth Accelerators in the United Kingdom Food Service Market Industry

Long-term growth in the UK food service market will be propelled by the continued adoption of technology for enhancing operational efficiency and customer experience. Strategic partnerships between food service providers and technology companies will play a crucial role in accelerating market expansion. Furthermore, the increasing focus on sustainability and ethical sourcing practices will shape consumer choices and open new market segments.

Key Players Shaping the United Kingdom Food Service Market Market

- Domino's Pizza Group PLC

- Marston's PLC

- Yum! Brands Inc

- Admiral Taverns Ltd

- Doctor's Associates Inc

- The Restaurant Group PLC

- PizzaExpress (Restaurants) Limited

- Nando's Group Holdings Limited

- Stonegate Group

- Tesco PLC

- Co-operative Group Limited

- Costa Coffee

- Starbucks Corporation

- Mitchells & Butlers PLC

- McDonald's Corporation

- Pizza Hut (U K ) Limited

- Whitbread PLC

- Greggs PLC

Notable Milestones in United Kingdom Food Service Market Sector

- December 2022: Co-op partnered with Just Eat for on-demand delivery, boosting convenience shopping access.

- January 2023: Costa Coffee expanded its menu with new food and beverage offerings, catering to diverse consumer preferences.

- August 2023: Starbucks announced a USD 32.78 million investment to open 100 new outlets, reflecting market growth confidence.

In-Depth United Kingdom Food Service Market Market Outlook

The UK food service market is poised for continued growth, driven by technological advancements, changing consumer preferences, and strategic industry developments. Future market potential lies in leveraging data-driven insights to personalize customer experiences, expanding into new geographical areas, and exploring innovative food and beverage concepts. The strategic focus on sustainability and ethical sourcing will further shape the market landscape, creating opportunities for businesses that prioritize these values. The market is expected to reach £xx million by 2033, representing a CAGR of xx%.

United Kingdom Food Service Market Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United Kingdom Food Service Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Food Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

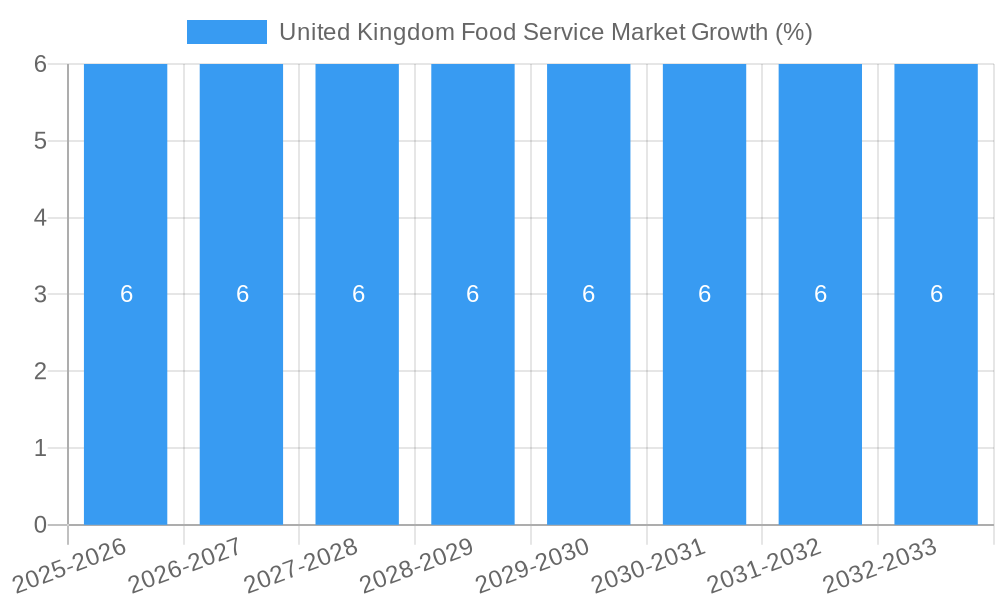

| Growth Rate | CAGR of 6.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. Rising coffee and tea consumption in the country especially in speciality tea/coffee is driving the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. Germany United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 7. France United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe United Kingdom Food Service Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Domino's Pizza Group PLC

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Marston's PLC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Yum! Brands Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Admiral Taverns Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Doctor's Associates Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 The Restaurant Group PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 PizzaExpress (Restaurants) Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Nando's Group Holdings Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Stonegate Group

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Tesco PLC

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Co-operative Group Limited

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Costa Coffee

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Starbucks Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Mitchells & Butlers PLC

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 McDonald's Corporation

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Pizza Hut (U K ) Limited

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Whitbread PLC

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 Greggs PLC

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.1 Domino's Pizza Group PLC

List of Figures

- Figure 1: United Kingdom Food Service Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Food Service Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: United Kingdom Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: United Kingdom Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: United Kingdom Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany United Kingdom Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France United Kingdom Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy United Kingdom Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom United Kingdom Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands United Kingdom Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden United Kingdom Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe United Kingdom Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 15: United Kingdom Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 16: United Kingdom Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 17: United Kingdom Food Service Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Food Service Market?

The projected CAGR is approximately 6.04%.

2. Which companies are prominent players in the United Kingdom Food Service Market?

Key companies in the market include Domino's Pizza Group PLC, Marston's PLC, Yum! Brands Inc, Admiral Taverns Ltd, Doctor's Associates Inc, The Restaurant Group PLC, PizzaExpress (Restaurants) Limited, Nando's Group Holdings Limited, Stonegate Group, Tesco PLC, Co-operative Group Limited, Costa Coffee, Starbucks Corporation, Mitchells & Butlers PLC, McDonald's Corporation, Pizza Hut (U K ) Limited, Whitbread PLC, Greggs PLC.

3. What are the main segments of the United Kingdom Food Service Market?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

Rising coffee and tea consumption in the country especially in speciality tea/coffee is driving the market growth.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

August 2023: Coffee shop chain Starbucks announced plans to invest USD 32.78 million toward opening 100 new outlets across the United Kingdom in 2023, as it expects its growth momentum to continue.January 2023: Costa Coffee added new servings to its menu like Cajun Spiced Chicken Pizza Wrap, uzeTea Mellow Mango Superfuzions Tea, FuzeTea Spiced Apple flavor Superfuzions Tea, FuzeTea Citrus Zing Superfuzions Tea, vegan BBQ Chick'n Panini, Burts BBQ Lentil Chips, Poached Egg & Bacon Brioche, M&S Smoked Ham & Coleslaw Sandwich or the new M&S Minestrone with Bacon Soup, M&S pineapple chunks, and a new range of Chocolate Cornflake Cake and caramel cakes at its outlets in the United Kingdom.December 2022: Co-op partnered with Just Eat to launch an on-demand online delivery partnership, increasing access to quick convenience shopping in communities nationwide. Through the tie-up, shoppers can order items from Co-op for speedy delivery in under 30 minutes via the Just Eat app and website.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Food Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Food Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Food Service Market?

To stay informed about further developments, trends, and reports in the United Kingdom Food Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence