Key Insights

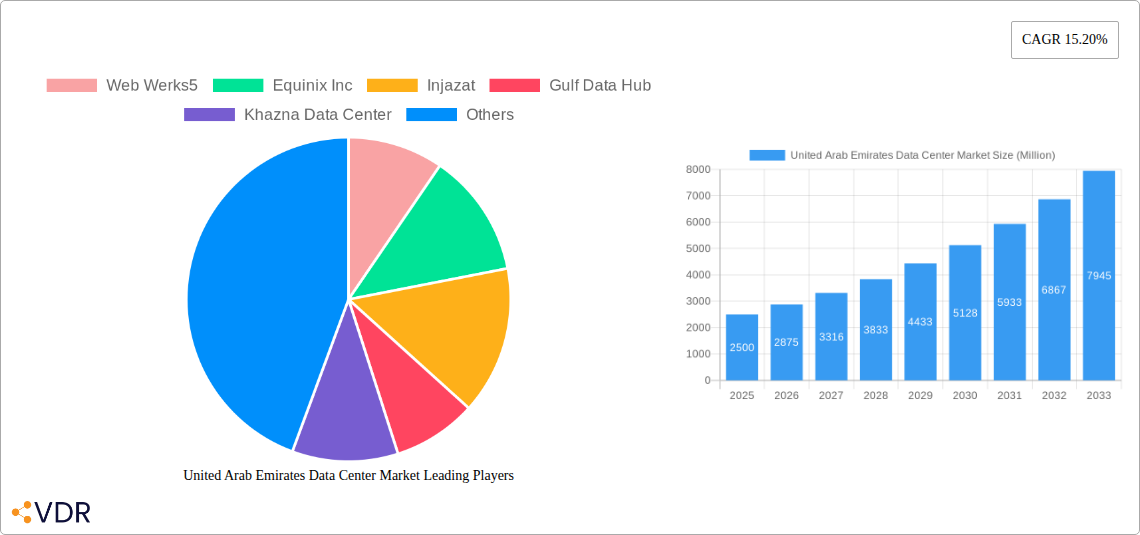

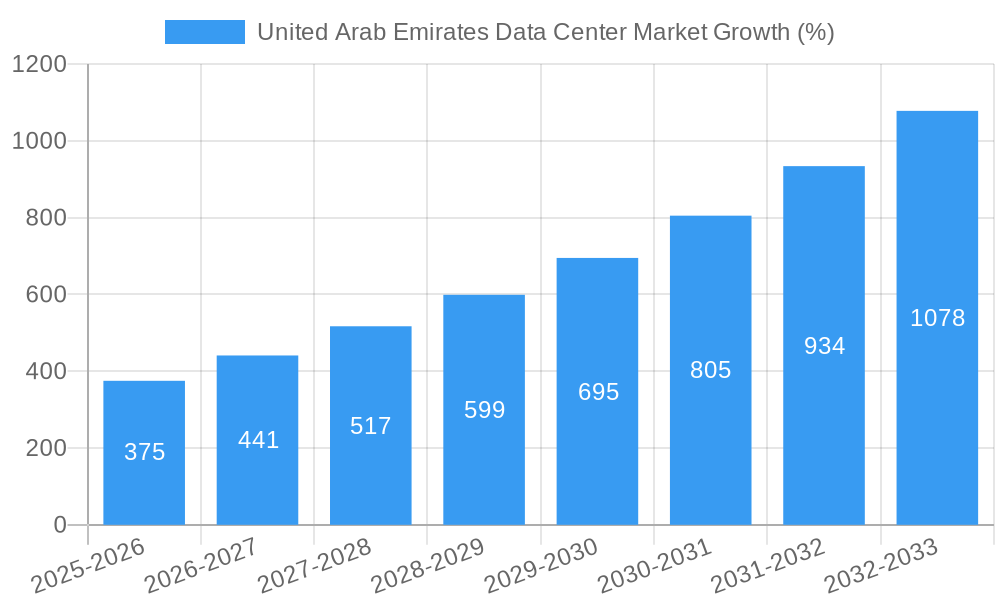

The United Arab Emirates (UAE) data center market is experiencing robust growth, driven by a burgeoning digital economy, increasing cloud adoption, and the government's proactive investments in digital infrastructure. The market's Compound Annual Growth Rate (CAGR) of 15.20% from 2019 to 2024 indicates significant expansion. This growth is fueled by several key factors: the UAE's strategic location as a regional hub for business and technology, the increasing demand for data storage and processing capabilities from various sectors (including finance, telecommunications, and government), and the development of advanced digital services. The expansion of 5G networks and the rise of the Internet of Things (IoT) are further contributing to the market's upward trajectory. While precise market sizing for previous years is not available, based on a 15.20% CAGR and estimating a 2025 market size, we can project a substantial increase in market value in the coming years. The market is segmented by end-user (e.g., other end-users), geographic location (Abu Dhabi, Dubai, Rest of UAE), data center size (Small, Medium, Mega, Massive, Large), tier type (Tier 1, Tier 2, Tier 3, Tier 4), and absorption (Utilized, Non-Utilized). Competition in the UAE data center market is intense, with major players including Web Werks, Equinix Inc, Injazat, Gulf Data Hub, Khazna Data Center, Moro Hub, Etisalat, eHosting DataFort, datamena, Pacific Controls, and Dcvaults all vying for market share. The continued growth is expected to attract further investment and innovation within the sector.

The forecast period of 2025-2033 promises continued expansion, with the market likely exceeding current projections due to sustained government initiatives focusing on technological advancement and diversification of the economy. Key challenges include ensuring sufficient power supply to meet the growing energy demands of data centers, managing the increasing volumes of data generated, and addressing cybersecurity concerns. However, the strong governmental support, strategic location, and thriving business environment position the UAE to maintain its leading role in the Middle East data center market, exceeding regional growth trends and attracting significant international investment. The increasing adoption of edge computing and the potential for further expansion into specialized sectors like AI and blockchain will further shape the market's future.

United Arab Emirates Data Center Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Arab Emirates (UAE) data center market, encompassing market dynamics, growth trends, regional segmentation, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for investors, data center operators, technology providers, and government agencies seeking to understand and capitalize on the rapidly expanding UAE data center landscape. The report segments the market by data center size (Small, Medium, Mega, Large, Massive), tier type (Tier 1, Tier 2, Tier 3), absorption (Utilized, Non-Utilized), and end-user (Other End User), while focusing on key hotspots like Abu Dhabi and Dubai.

United Arab Emirates Data Center Market Dynamics & Structure

The UAE data center market is characterized by high growth potential, driven by factors such as increasing digital transformation, government initiatives promoting digital economy, and robust investment in infrastructure. Market concentration is moderate, with a mix of international and regional players. Technological innovation is a key driver, with a focus on cloud computing, edge computing, and AI. The regulatory framework is supportive, encouraging investment and competition. The market faces competition from substitute technologies, primarily cloud services. M&A activity is significant, reflecting consolidation and expansion strategies.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on cloud, edge, and AI, driving demand for advanced data center infrastructure.

- Regulatory Framework: Supportive, fostering investment and competition.

- Competitive Product Substitutes: Cloud services pose a competitive threat.

- End-User Demographics: Primarily driven by government, finance, telecom, and e-commerce sectors.

- M&A Trends: Significant consolidation and expansion activities recorded in the last 5 years, totaling xx deals valued at approximately xx Million.

United Arab Emirates Data Center Market Growth Trends & Insights

The UAE data center market has experienced robust growth over the past five years (2019-2024), with a CAGR of xx%. This growth is projected to continue throughout the forecast period (2025-2033), driven by increasing data consumption, the expansion of digital services, and government initiatives to promote a digital economy. Market penetration for data center services remains relatively low compared to mature markets, indicating significant growth potential. Adoption of advanced technologies, such as AI and IoT, is accelerating, further fueling market expansion. Consumer behavior shifts toward digital services and increased reliance on cloud-based solutions are key factors. The market size is projected to reach xx Million by 2033.

- Market Size (2024): xx Million

- Projected Market Size (2033): xx Million

- CAGR (2025-2033): xx%

- Market Penetration (2024): xx%

Dominant Regions, Countries, or Segments in United Arab Emirates Data Center Market

Abu Dhabi and Dubai are the dominant regions, accounting for xx% and xx% of the market, respectively, driven by substantial investments in infrastructure and a high concentration of businesses and government entities. The large data center segment dominates, representing xx% of the market, due to growing demand from hyperscale cloud providers and large enterprises. Utilized capacity is significantly higher than non-utilized, reflecting strong demand. Tier 3 data centers comprise the majority of the market.

- Dominant Regions: Abu Dhabi and Dubai.

- Key Drivers: Government initiatives, robust infrastructure, and strategic location.

- Market Share (Abu Dhabi): xx%

- Market Share (Dubai): xx%

- Dominant Segment: Large Data Centers (xx% Market Share)

- Capacity Absorption: Predominantly Utilized.

United Arab Emirates Data Center Market Product Landscape

The UAE data center market offers a wide range of products and services, including colocation, cloud services, managed services, and hyperscale data centers. Recent innovations include the adoption of advanced cooling technologies, increased energy efficiency measures, and the integration of renewable energy sources. Unique selling propositions focus on security, reliability, and connectivity. Technological advancements in areas like AI-powered infrastructure management and edge computing are shaping the product landscape.

Key Drivers, Barriers & Challenges in United Arab Emirates Data Center Market

Key Drivers:

- Increasing digital transformation across various sectors.

- Government support and initiatives promoting digitalization.

- Rising demand for cloud services and data storage.

- Growth of e-commerce and online services.

Challenges:

- High energy costs and the need for sustainable solutions.

- Limited skilled workforce in data center operations.

- Competition from international and regional players.

- Regulatory compliance and data security concerns. These factors can potentially decrease growth by xx% if not addressed effectively.

Emerging Opportunities in United Arab Emirates Data Center Market

- Growth of edge computing to cater to low latency applications.

- Expansion of cloud services and hybrid cloud models.

- Increasing demand for data center services from the healthcare and education sectors.

- Opportunities to leverage renewable energy sources to improve sustainability.

Growth Accelerators in the United Arab Emirates Data Center Market Industry

The long-term growth of the UAE data center market is fueled by ongoing investments in digital infrastructure, strategic partnerships between government entities and private sector players, and the adoption of innovative technologies to enhance efficiency and sustainability. The expansion of 5G networks and the growing adoption of IoT devices will also contribute to future growth.

Key Players Shaping the United Arab Emirates Data Center Market Market

- Web Werks5

- Equinix Inc (Equinix Inc)

- Injazat

- Gulf Data Hub

- Khazna Data Center

- Moro Hub (Data Hub Integrated Solutions Moro LLC)

- Etisalat

- eHosting DataFort

- datamena

- Pacific Controls

- Dcvaults

Notable Milestones in United Arab Emirates Data Center Market Sector

- October 2022: Khazna Data Centers, Masdar, and EDF partner to build a solar PV plant for a new data center in Masdar City.

- October 2022: Khazna Data Centers announces development of DXB2 and DXB3 data centers with a combined 43 MW IT load.

- September 2022: Khazna Data Centers and GDS IDC Services Pte Ltd. sign an MoU to explore wholesale data center development opportunities.

In-Depth United Arab Emirates Data Center Market Market Outlook

The UAE data center market is poised for sustained growth over the next decade, driven by the factors outlined above. Strategic opportunities exist for players who can offer innovative solutions, embrace sustainable practices, and cater to the specific needs of the growing digital economy. The market's future success hinges on addressing challenges related to energy costs, talent acquisition, and regulatory compliance. A focus on collaboration and technological advancements will unlock further growth and development in this dynamic sector.

United Arab Emirates Data Center Market Segmentation

-

1. Hotspot

- 1.1. Abu Dhabi

- 1.2. Dubai

- 1.3. Rest of United Arab Emirates

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

United Arab Emirates Data Center Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Securing Confidential Data and Protection Against Data Loss; Growing Demand for Improving Archived Content across Channels; Ongoing efforts to promote Digitization at Workplaces

- 3.3. Market Restrains

- 3.3.1. Transition from Legacy Systems Chips; Customization Challenges Leading to Implementation Issues

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Abu Dhabi

- 5.1.2. Dubai

- 5.1.3. Rest of United Arab Emirates

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

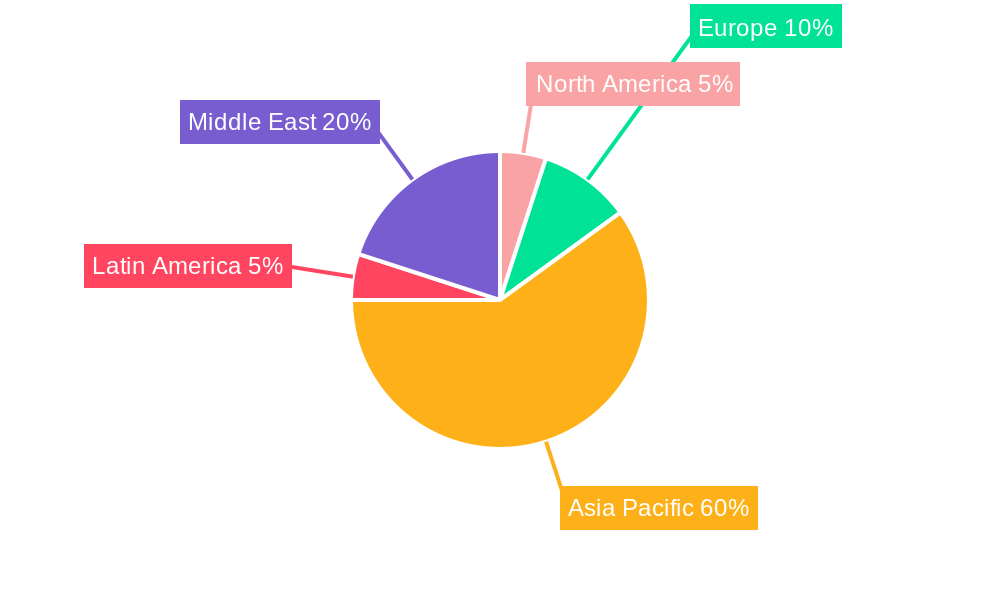

- 6. North America United Arab Emirates Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United Arab Emirates Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United Arab Emirates Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America United Arab Emirates Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East United Arab Emirates Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Web Werks5

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Equinix Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Injazat

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gulf Data Hub

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Khazna Data Center

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Moro Hub (Data Hub Integrated Solutions Moro LLC)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Etisalat

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 eHosting DataFort

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 datamena

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pacific Controls

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dcvaults

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Web Werks5

List of Figures

- Figure 1: United Arab Emirates Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 3: United Arab Emirates Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 4: United Arab Emirates Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 5: United Arab Emirates Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 6: United Arab Emirates Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: United Arab Emirates Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Arab Emirates Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Arab Emirates Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Arab Emirates Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Arab Emirates Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Arab Emirates Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Arab Emirates Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Arab Emirates Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United Arab Emirates Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Arab Emirates Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Arab Emirates Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 18: United Arab Emirates Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 19: United Arab Emirates Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: United Arab Emirates Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: United Arab Emirates Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Data Center Market?

The projected CAGR is approximately 15.20%.

2. Which companies are prominent players in the United Arab Emirates Data Center Market?

Key companies in the market include Web Werks5, Equinix Inc, Injazat, Gulf Data Hub, Khazna Data Center, Moro Hub (Data Hub Integrated Solutions Moro LLC), Etisalat, eHosting DataFort, datamena, Pacific Controls, Dcvaults.

3. What are the main segments of the United Arab Emirates Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Securing Confidential Data and Protection Against Data Loss; Growing Demand for Improving Archived Content across Channels; Ongoing efforts to promote Digitization at Workplaces.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Transition from Legacy Systems Chips; Customization Challenges Leading to Implementation Issues.

8. Can you provide examples of recent developments in the market?

October 2022: The prominent network of hyperscale data centers in the Middle East and North Africa region, a joint venture between Khazna Data Centers, and Masdar and EDF have inked a deal to build a ground-mounted solar photovoltaic (PV) plant to power Khazna's new data center in Masdar City.October 2022: The company announced the development of DXB2 and DXB3 with a joint capacity of 43 MW of IT load. The DXB3 facility is an extension of an existing facility transferred to Khazna following the strategic partnership between G42 and e&.September 2022: A Memorandum of Understanding (MoU) between Khazna Data Centers Corporation and GDS IDC Services Pte Ltd. (GDS) has been signed to discuss ways to work together on the development of wholesale data centers throughout Greater China, Asia-Pacific (APAC), and the Middle East regions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Data Center Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence