Key Insights

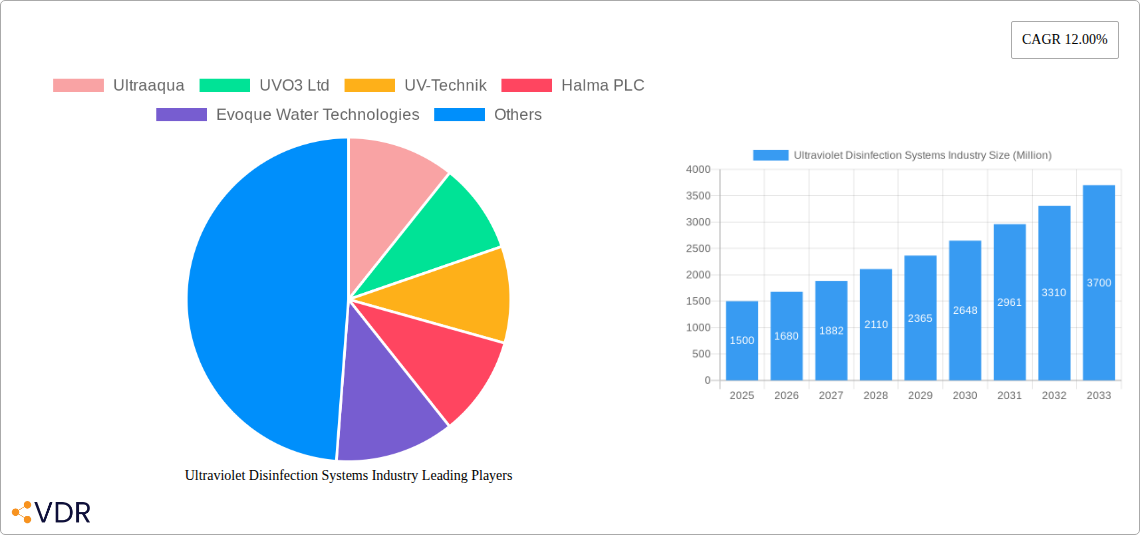

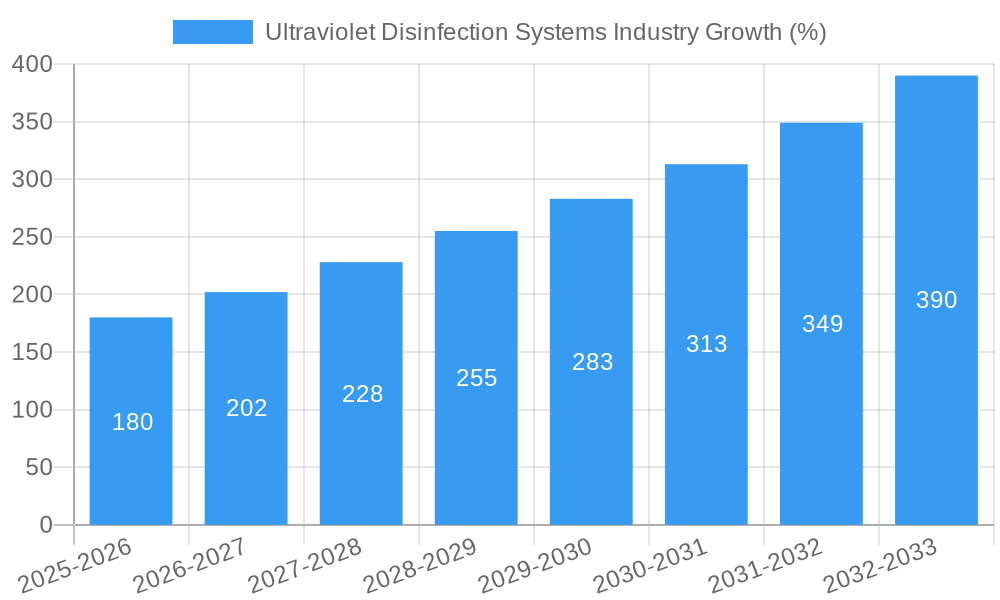

The ultraviolet (UV) disinfection systems market is experiencing robust growth, driven by increasing concerns over waterborne and airborne pathogens, stringent regulatory frameworks for water purity, and rising demand for hygiene in various sectors. The market's Compound Annual Growth Rate (CAGR) of 12% from 2019 to 2033 signifies a substantial expansion, projecting significant market value by 2033. Key applications driving this growth include surface disinfection in healthcare and food processing, airborne disinfection in HVAC systems, and water and wastewater treatment across residential, commercial, and industrial sectors. The rising prevalence of waterborne diseases in developing economies, coupled with the increasing adoption of UV disinfection technologies in municipal water treatment plants, significantly contributes to market expansion. Furthermore, the growing awareness of the effectiveness of UV disinfection in combating antibiotic-resistant bacteria is bolstering market demand. Technological advancements, such as the development of more efficient and cost-effective UV lamps and systems, further fuel market growth. While initial investment costs can be a restraint, the long-term operational cost savings and enhanced hygiene benefits are driving wider adoption.

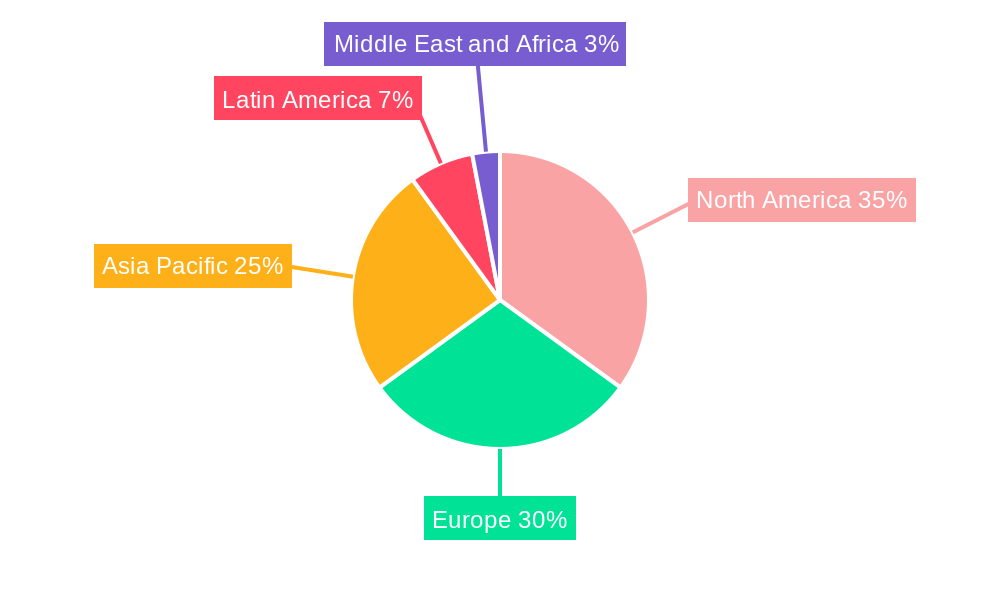

The market segmentation reveals that water and wastewater treatment currently holds a significant share, followed by surface disinfection. The industrial end-user vertical is expected to witness substantial growth due to increasing industrial applications requiring stringent sanitation protocols. Geographically, North America and Europe are currently leading the market due to established infrastructure and stringent regulations, but the Asia-Pacific region is projected to exhibit the fastest growth rate over the forecast period driven by rapid urbanization and industrialization. Key players in the UV disinfection systems market are continuously investing in research and development, expanding their product portfolios, and forging strategic partnerships to maintain a competitive edge and tap into emerging market opportunities. This competitive landscape fosters innovation and ensures the continuous improvement of UV disinfection technologies, further propelling market expansion.

Ultraviolet Disinfection Systems Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Ultraviolet (UV) Disinfection Systems market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report delves into the parent market of water treatment and the child market of UV disinfection technologies, offering granular insights for industry professionals, investors, and strategic decision-makers. The market size is presented in Million units.

Ultraviolet Disinfection Systems Industry Market Dynamics & Structure

The Ultraviolet Disinfection Systems market exhibits a moderately consolidated structure, with several key players holding significant market share. Technological innovation, particularly in UV-C LED technology and advanced system integration, is a major driver. Stringent regulatory frameworks concerning water and food safety globally influence market growth. Competitive substitutes include chemical disinfectants, but UV systems offer advantages in terms of environmental friendliness and residual chemical avoidance. The end-user demographic is diverse, spanning residential, commercial, industrial, and municipal sectors. Mergers and acquisitions (M&A) activity has been moderate, with strategic partnerships becoming increasingly prevalent for technological advancement and market penetration.

- Market Concentration: Moderately Consolidated (xx% held by top 5 players in 2024)

- Technological Innovation: UV-C LEDs, advanced automation, IoT integration.

- Regulatory Landscape: Stringent regulations driving adoption in water and food processing.

- Competitive Substitutes: Chemical disinfectants (Chlorine, Ozone).

- M&A Activity: Moderate; xx deals recorded between 2019-2024.

- Innovation Barriers: High initial investment costs, specialized technical expertise needed.

Ultraviolet Disinfection Systems Industry Growth Trends & Insights

The UV disinfection systems market has witnessed consistent growth over the historical period (2019-2024), driven by increasing concerns regarding waterborne diseases, stringent regulations, and the rising adoption of UV technology in various applications. The market is projected to experience robust growth during the forecast period (2025-2033), fueled by technological advancements, rising demand from emerging economies, and increasing focus on hygiene and sanitation across various sectors. The CAGR for the forecast period is estimated at xx%. Market penetration in developing regions presents significant opportunities. Shifting consumer behavior towards health and hygiene is also impacting this growth. Disruptive technologies like UV-C LEDs are altering the cost-effectiveness and efficiency of UV disinfection systems.

Dominant Regions, Countries, or Segments in Ultraviolet Disinfection Systems Industry

The North American and European regions are currently leading the UV disinfection systems market, driven by stringent environmental regulations, advanced infrastructure, and high consumer awareness. However, the Asia-Pacific region is anticipated to demonstrate the fastest growth rate during the forecast period due to rapid economic growth, increasing urbanization, and improving infrastructure. Within application segments, Water and Wastewater treatment holds the largest market share, followed by Food and Liquid processing. The industrial end-user vertical is also a significant growth driver.

- Leading Region: North America (Market Share: xx% in 2024)

- Fastest-Growing Region: Asia-Pacific (Projected CAGR: xx% 2025-2033)

- Largest Application Segment: Water and Wastewater Treatment (Market Share: xx% in 2024)

- Key Drivers (Asia-Pacific): Rapid urbanization, rising disposable incomes, increasing government investments in water infrastructure.

- Key Drivers (North America & Europe): Stringent regulations, high consumer awareness of hygiene and water quality, technological advancements.

Ultraviolet Disinfection Systems Industry Product Landscape

UV disinfection systems are offered in a range of configurations, including low-pressure mercury lamps, medium-pressure mercury lamps, and increasingly, UV-C LEDs. These systems are designed for diverse applications, catering to specific needs and budgets. Key performance metrics include UV intensity, treatment time, and energy efficiency. Technological advancements focus on enhancing system efficiency, reducing operating costs, and improving ease of maintenance. Unique selling propositions often include improved germicidal effectiveness, longer lifespan, and reduced environmental impact.

Key Drivers, Barriers & Challenges in Ultraviolet Disinfection Systems Industry

Key Drivers:

- Increasing prevalence of waterborne diseases.

- Stringent regulations on water and food safety.

- Growing awareness of hygiene and sanitation.

- Technological advancements in UV-C LEDs, reducing costs and improving efficiency.

- Rising investments in water and wastewater treatment infrastructure.

Key Challenges & Restraints:

- High initial investment costs.

- Potential for UV lamp degradation.

- Need for specialized technical expertise for installation and maintenance.

- Competition from other disinfection technologies.

- Supply chain disruptions impacting component availability (xx% impact estimated in 2023).

Emerging Opportunities in Ultraviolet Disinfection Systems Industry

- Expansion into emerging markets with limited access to clean water and sanitation.

- Development of integrated UV disinfection systems for smart buildings and cities.

- Application in air purification for healthcare and public spaces.

- Development of portable and compact UV disinfection devices for personal use.

- Growing demand for UV disinfection in food processing and packaging industries.

Growth Accelerators in the Ultraviolet Disinfection Systems Industry Industry

Technological innovations such as UV-C LEDs and advanced system controls are significantly accelerating market growth. Strategic partnerships between UV system manufacturers and water treatment companies are expanding market reach and accelerating adoption. Expansion into new applications, such as air purification and surface disinfection, is creating significant growth potential. Government initiatives and funding for water infrastructure development in emerging markets are further propelling the market forward.

Key Players Shaping the Ultraviolet Disinfection Systems Market

- Ultraaqua

- UVO3 Ltd

- UV-Technik

- Halma PLC

- Evoque Water Technologies

- Severn Trent Services

- Australian Ultra Violet Services Pty Ltd

- Lumalier Corporation

- Trojan Technologies

- Xylem Inc

- Hitech Ultraviolet Pvt Ltd

- Advanced UV Inc

Notable Milestones in Ultraviolet Disinfection Systems Industry Sector

- July 2022: Kemin Industries launched KEEPER and OXINE, chlorine-dioxide-based antimicrobial and disinfection solutions for food, water, and surfaces.

- November 2022: Royal HaskoningDHV and Schneider Electric collaborated on next-generation process control for Nereda wastewater treatment plants, improving efficiency and lifecycle management.

In-Depth Ultraviolet Disinfection Systems Industry Market Outlook

The UV disinfection systems market is poised for substantial growth over the forecast period, driven by a confluence of factors including technological advancements, increasing environmental concerns, and rising demand from various sectors. Strategic partnerships, expansion into new applications, and investments in research and development will further propel market expansion. The market presents significant opportunities for companies that can leverage technological innovation, offer cost-effective solutions, and effectively address the challenges related to implementation and maintenance. The market is projected to reach xx Million units by 2033.

Ultraviolet Disinfection Systems Industry Segmentation

-

1. Application

- 1.1. Surface Disinfection

- 1.2. Airborne Disinfection

- 1.3. Water and Wastewater

- 1.4. Process Water

- 1.5. Food and Liquid

-

2. End-user Vertical

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

- 2.4. Municipal

Ultraviolet Disinfection Systems Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Ultraviolet Disinfection Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Awareness for Hygiene and Cleanliness

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Availability

- 3.4. Market Trends

- 3.4.1. Municipal End Users are Expected to Project the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultraviolet Disinfection Systems Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Surface Disinfection

- 5.1.2. Airborne Disinfection

- 5.1.3. Water and Wastewater

- 5.1.4. Process Water

- 5.1.5. Food and Liquid

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.2.4. Municipal

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ultraviolet Disinfection Systems Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Surface Disinfection

- 6.1.2. Airborne Disinfection

- 6.1.3. Water and Wastewater

- 6.1.4. Process Water

- 6.1.5. Food and Liquid

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.2.4. Municipal

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Ultraviolet Disinfection Systems Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Surface Disinfection

- 7.1.2. Airborne Disinfection

- 7.1.3. Water and Wastewater

- 7.1.4. Process Water

- 7.1.5. Food and Liquid

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.2.4. Municipal

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Ultraviolet Disinfection Systems Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Surface Disinfection

- 8.1.2. Airborne Disinfection

- 8.1.3. Water and Wastewater

- 8.1.4. Process Water

- 8.1.5. Food and Liquid

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.2.4. Municipal

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Ultraviolet Disinfection Systems Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Surface Disinfection

- 9.1.2. Airborne Disinfection

- 9.1.3. Water and Wastewater

- 9.1.4. Process Water

- 9.1.5. Food and Liquid

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.2.4. Municipal

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Ultraviolet Disinfection Systems Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Surface Disinfection

- 10.1.2. Airborne Disinfection

- 10.1.3. Water and Wastewater

- 10.1.4. Process Water

- 10.1.5. Food and Liquid

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.2.4. Municipal

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Ultraviolet Disinfection Systems Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Ultraviolet Disinfection Systems Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Ultraviolet Disinfection Systems Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Ultraviolet Disinfection Systems Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Ultraviolet Disinfection Systems Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Ultraaqua

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 UVO3 Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 UV-Technik

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Halma PLC

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Evoque Water Technologies

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Severn Trent Services

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Australian Ultra Violet Services Pty Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Lumalier Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Trojan Technologies

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Xylem Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Hitech Ultraviolet Pvt Ltd*List Not Exhaustive

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Advanced UV Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Ultraaqua

List of Figures

- Figure 1: Global Ultraviolet Disinfection Systems Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Ultraviolet Disinfection Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Ultraviolet Disinfection Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Ultraviolet Disinfection Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Ultraviolet Disinfection Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Ultraviolet Disinfection Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Ultraviolet Disinfection Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Ultraviolet Disinfection Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Ultraviolet Disinfection Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Ultraviolet Disinfection Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Ultraviolet Disinfection Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Ultraviolet Disinfection Systems Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Ultraviolet Disinfection Systems Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Ultraviolet Disinfection Systems Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 15: North America Ultraviolet Disinfection Systems Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 16: North America Ultraviolet Disinfection Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Ultraviolet Disinfection Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Ultraviolet Disinfection Systems Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Ultraviolet Disinfection Systems Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Ultraviolet Disinfection Systems Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 21: Europe Ultraviolet Disinfection Systems Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 22: Europe Ultraviolet Disinfection Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Ultraviolet Disinfection Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Ultraviolet Disinfection Systems Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Pacific Ultraviolet Disinfection Systems Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Pacific Ultraviolet Disinfection Systems Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 27: Asia Pacific Ultraviolet Disinfection Systems Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 28: Asia Pacific Ultraviolet Disinfection Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Ultraviolet Disinfection Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Ultraviolet Disinfection Systems Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America Ultraviolet Disinfection Systems Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America Ultraviolet Disinfection Systems Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 33: Latin America Ultraviolet Disinfection Systems Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 34: Latin America Ultraviolet Disinfection Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Ultraviolet Disinfection Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Ultraviolet Disinfection Systems Industry Revenue (Million), by Application 2024 & 2032

- Figure 37: Middle East and Africa Ultraviolet Disinfection Systems Industry Revenue Share (%), by Application 2024 & 2032

- Figure 38: Middle East and Africa Ultraviolet Disinfection Systems Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 39: Middle East and Africa Ultraviolet Disinfection Systems Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 40: Middle East and Africa Ultraviolet Disinfection Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Ultraviolet Disinfection Systems Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Ultraviolet Disinfection Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Ultraviolet Disinfection Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Ultraviolet Disinfection Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Ultraviolet Disinfection Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Ultraviolet Disinfection Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 20: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 23: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 26: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 29: Global Ultraviolet Disinfection Systems Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultraviolet Disinfection Systems Industry?

The projected CAGR is approximately 12.00%.

2. Which companies are prominent players in the Ultraviolet Disinfection Systems Industry?

Key companies in the market include Ultraaqua, UVO3 Ltd, UV-Technik, Halma PLC, Evoque Water Technologies, Severn Trent Services, Australian Ultra Violet Services Pty Ltd, Lumalier Corporation, Trojan Technologies, Xylem Inc, Hitech Ultraviolet Pvt Ltd*List Not Exhaustive, Advanced UV Inc.

3. What are the main segments of the Ultraviolet Disinfection Systems Industry?

The market segments include Application, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Awareness for Hygiene and Cleanliness.

6. What are the notable trends driving market growth?

Municipal End Users are Expected to Project the Largest Market Share.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Availability.

8. Can you provide examples of recent developments in the market?

November 2022 - Royal HaskoningDHV and Schneider Electric collaborate on next-generation process control for Nereda wastewater treatment plants. As a preferred supplier, Schneider Electric will combine the capabilities of its EcoStruxure Automation Expert solution, the world's first universal automation system, with the Nereda technology to develop the next generation of Nereda Process Control. The control system will improve plant process efficiency and allow wastewater customers to have complete lifecycle management, seamless IT/OT services integration, and improved system diagnostics for their automation systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultraviolet Disinfection Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultraviolet Disinfection Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultraviolet Disinfection Systems Industry?

To stay informed about further developments, trends, and reports in the Ultraviolet Disinfection Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence