Key Insights

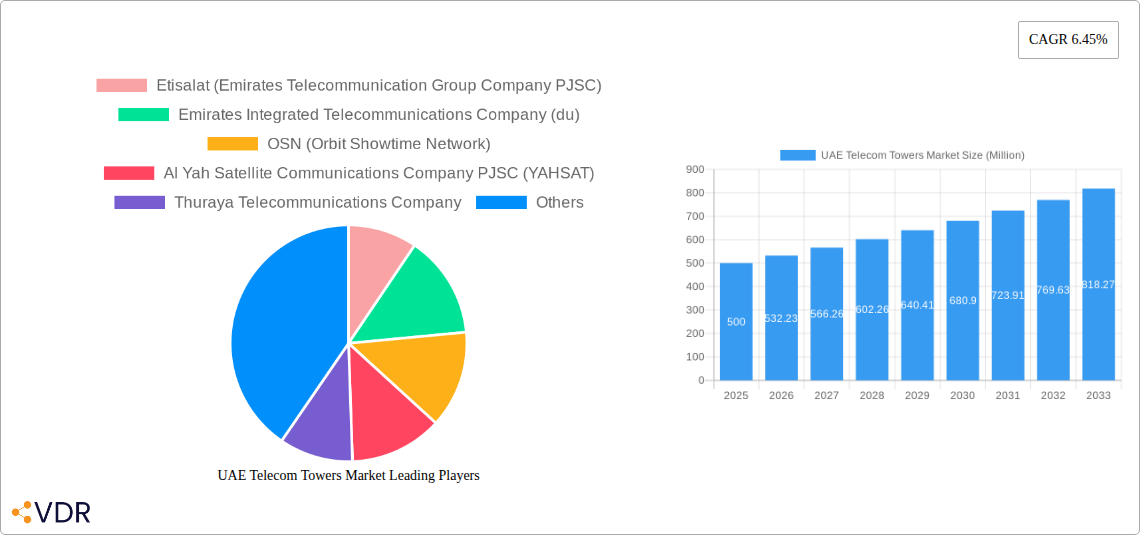

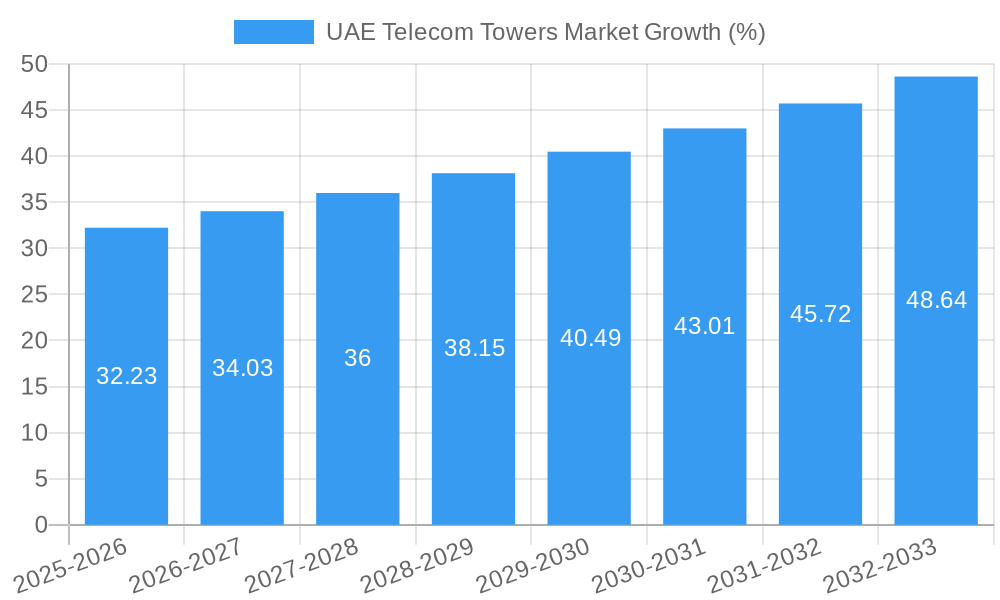

The UAE Telecom Towers market, exhibiting a robust CAGR of 6.45%, presents a lucrative investment opportunity. Driven by the increasing demand for high-speed mobile broadband, 5G network deployment, and the proliferation of IoT devices, the market is poised for significant growth throughout the forecast period (2025-2033). Key players like Etisalat, du, and Yahsat are actively investing in infrastructure upgrades to meet this surging demand. Furthermore, the government's initiatives to foster digital transformation and smart city projects are further fueling market expansion. The market segmentation likely includes macro towers, small cells, and rooftop towers, each catering to specific network requirements and geographic locations. Competition among tower companies, including Helios Towers and IHS Towers, is expected to remain intense, driving innovation and potentially leading to mergers and acquisitions. While regulatory hurdles and land acquisition challenges might pose some restraints, the overall market outlook remains optimistic, with substantial growth projected throughout the forecast period. The increasing adoption of cloud-based network management solutions and the emergence of private 5G networks are likely to shape future market trends. Based on a 6.45% CAGR and a 2025 market size of let's assume $XX million (replacing XX with a plausible figure based on regional telecom market data – a reasonable starting point might be $500 million, for example), a projection can be made for future years.

The substantial growth is fueled by a combination of factors including the UAE's commitment to digitalization, the rising number of smartphone users, and the increasing demand for reliable and high-speed internet connectivity, particularly in urban areas. The continuous expansion of 4G and the rollout of 5G networks require substantial investment in telecom tower infrastructure. The market's competitive landscape, featuring both domestic and international players, is driving innovation and ensuring affordability for service providers. Future growth will likely see an emphasis on shared infrastructure to maximize efficiency and reduce costs. The market also benefits from strong regulatory support and a favorable business environment within the UAE. This results in a confident projection of sustained growth and continued investment in the coming years.

UAE Telecom Towers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE Telecom Towers market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is invaluable for telecom operators, tower companies, investors, and industry professionals seeking to understand and capitalize on opportunities within this dynamic sector.

Keywords: UAE Telecom Towers Market, Telecom Infrastructure, 5G Deployment, Tower Infrastructure, Telecommunications, Etisalat, du, Helios Towers, IHS Towers, Market Size, Market Share, Market Growth, M&A, Regulatory Landscape, Investment Opportunities, UAE Telecom Market, Middle East Telecom, Wireless Infrastructure, Telecom Towers, Tower Colocation, Fiber Optics, FTTH.

UAE Telecom Towers Market Dynamics & Structure

The UAE telecom towers market is characterized by a moderate level of concentration, with a few dominant players alongside smaller, specialized providers. The market exhibits substantial growth driven by rapid technological innovation, particularly the widespread adoption of 5G technology and the expansion of FTTH networks. Regulatory frameworks, while generally supportive of infrastructure development, play a significant role in shaping market dynamics. The competitive landscape involves both direct competition among tower companies and indirect competition from alternative technologies. Consolidation through mergers and acquisitions (M&A) is a notable trend, aiming to optimize infrastructure and enhance market share.

- Market Concentration: Etisalat and du collectively hold approximately xx% of the market share in 2025, indicating a moderately concentrated landscape. Other players like Helios Towers and IHS Towers contribute to the remaining xx%.

- Technological Innovation: 5G deployment is a key driver, demanding increased tower density and capacity upgrades. The shift towards fiber optics (FTTH) further fuels infrastructure investments.

- Regulatory Framework: The TDRA's regulatory policies, including spectrum allocation and infrastructure sharing initiatives, influence market expansion and competition.

- Competitive Substitutes: While limited, alternative infrastructure solutions such as small cells and distributed antenna systems (DAS) present some level of competition.

- M&A Trends: Consolidation through acquisitions and mergers are expected to continue in the forecast period to optimize resources and gain economies of scale. The estimated deal volume from 2025-2033 is projected at xx Million USD.

- End-User Demographics: The increasing mobile penetration rate and data consumption in the UAE drive the demand for robust telecom infrastructure.

UAE Telecom Towers Market Growth Trends & Insights

The UAE telecom towers market is experiencing robust growth, fueled by rising mobile penetration, escalating data traffic, and the ongoing rollout of 5G networks. The market size, valued at xx Million USD in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated xx Million USD by 2033. This growth is driven by increasing demand for high-speed data connectivity, fueling the need for more sophisticated and extensive tower infrastructure. The adoption rate of advanced tower technologies, such as those supporting 5G and FTTH networks, is accelerating, reflecting the evolving consumer demand for enhanced network performance. Significant investments in infrastructure development by both private and public entities further contribute to the market expansion. Consumer behavior shows a strong preference for seamless and high-speed mobile connectivity, supporting the need for substantial tower network enhancements.

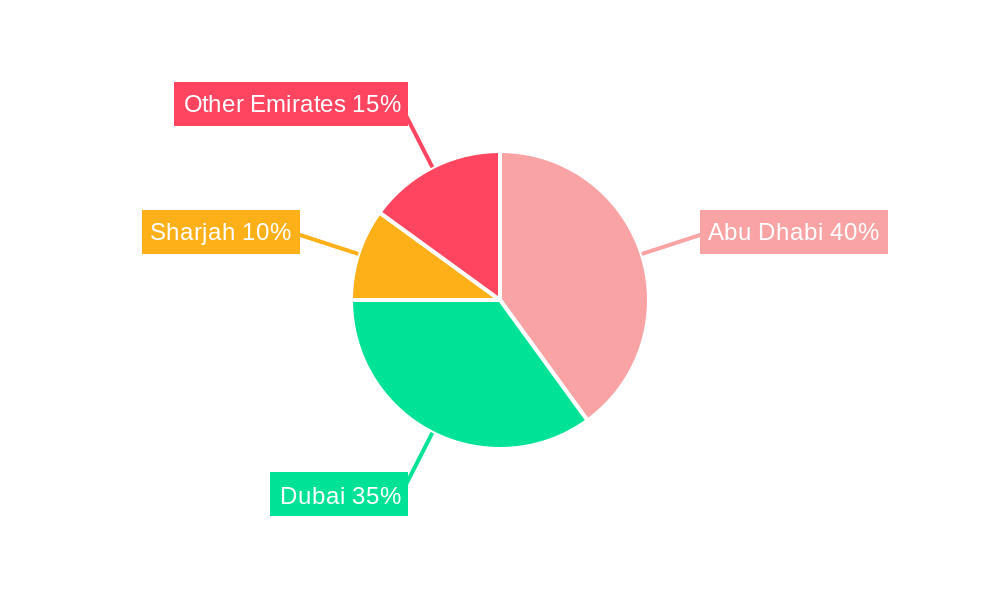

Dominant Regions, Countries, or Segments in UAE Telecom Towers Market

The UAE telecom towers market shows consistent growth across major urban centers and densely populated regions, with significant demand in metropolitan areas like Abu Dhabi and Dubai. These regions benefit from high population density, substantial mobile penetration, and robust economic activities.

Key Drivers:

- Government initiatives: Investments in digital infrastructure and smart city projects directly impact market growth.

- Economic prosperity: The UAE's strong economy fuels high demand for advanced communication services.

- Technological advancements: 5G deployment and the expansion of FTTH networks are major contributors to growth.

Dominance Factors: High population density in urban areas, strategic government initiatives promoting digital infrastructure, and the presence of major telecom operators create a favorable environment for market dominance. The market share of major cities like Dubai and Abu Dhabi is projected to be above xx% in 2033.

UAE Telecom Towers Market Product Landscape

The UAE telecom towers market encompasses a range of products, including traditional macrocell towers, small cells, and distributed antenna systems (DAS). Innovations focus on enhancing capacity, improving signal strength, and optimizing energy efficiency. The deployment of 5G-ready infrastructure is a significant trend, incorporating advanced antenna technologies and improved backhaul solutions. Key performance indicators include tower height, capacity, energy consumption, and signal coverage. The emphasis is on creating robust, reliable, and environmentally sustainable infrastructure to meet the evolving demands of a growing mobile population.

Key Drivers, Barriers & Challenges in UAE Telecom Towers Market

Key Drivers:

- The widespread adoption of 5G is a primary driver, requiring significant investment in new tower infrastructure.

- Government initiatives promoting digital transformation and smart cities are key enablers for market growth.

- Increasing mobile penetration and data consumption necessitates expanding network capacity.

Key Challenges and Restraints:

- Securing permits and navigating regulatory processes can be time-consuming and complex.

- Finding suitable locations for new towers, especially in densely populated urban areas, is a significant challenge.

- Competition among tower companies and alternative infrastructure solutions creates price pressures.

Emerging Opportunities in UAE Telecom Towers Market

- The increasing demand for private 5G networks presents opportunities for customized tower solutions for businesses.

- Expansion into rural areas with limited connectivity offers significant potential for market growth.

- The integration of IoT technologies with telecom towers provides opportunities for innovative applications.

Growth Accelerators in the UAE Telecom Towers Market Industry

The long-term growth of the UAE telecom towers market will be fueled by continued 5G expansion, strategic partnerships between tower companies and telecom operators, and government support for infrastructure development. Technological advancements in antenna design, energy efficiency, and network management will play a critical role in shaping future market dynamics. Expansion into new applications, such as private 5G networks and IoT deployments, will also contribute to sustained growth.

Key Players Shaping the UAE Telecom Towers Market Market

- Etisalat (Emirates Telecommunication Group Company PJSC)

- Emirates Integrated Telecommunications Company (du)

- OSN (Orbit Showtime Network)

- Al Yah Satellite Communications Company PJSC (YAHSAT)

- Thuraya Telecommunications Company

- Helios Towers

- IHS Towers

- NXN Group

- Inteltec Emirates

- Gulf Bridge International (GBI)

Notable Milestones in UAE Telecom Towers Market Sector

- June 2024: The TDRA's CHF 1.9 million (USD 2.21 million) contribution to the ITU for enhancing global radiocommunication databases signifies a commitment to advancing telecom infrastructure globally, indirectly benefiting the UAE market.

- May 2024: Sterlite Technologies' partnership with du for advanced optical fiber cables signifies the ongoing investment in enhancing network performance, particularly for FTTH networks, which indirectly increases demand for tower infrastructure.

In-Depth UAE Telecom Towers Market Market Outlook

The future of the UAE telecom towers market is bright, with continued growth driven by technological advancements, increasing demand for mobile data, and supportive government policies. Strategic partnerships and investments in innovative technologies will play a crucial role in shaping the market's trajectory. The market presents lucrative opportunities for both established players and new entrants, particularly those focused on 5G infrastructure, private networks, and sustainable solutions. The market is poised for continued expansion, offering significant potential for long-term growth and investment returns.

UAE Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive sites

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

UAE Telecom Towers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs

- 3.4. Market Trends

- 3.4.1. 5G Deployment to Address the Increasing Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive sites

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. North America UAE Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Ownership

- 6.1.1. Operator-owned

- 6.1.2. Private-owned

- 6.1.3. MNO Captive sites

- 6.2. Market Analysis, Insights and Forecast - by Installation

- 6.2.1. Rooftop

- 6.2.2. Ground-based

- 6.3. Market Analysis, Insights and Forecast - by Fuel Type

- 6.3.1. Renewable

- 6.3.2. Non-renewable

- 6.1. Market Analysis, Insights and Forecast - by Ownership

- 7. South America UAE Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Ownership

- 7.1.1. Operator-owned

- 7.1.2. Private-owned

- 7.1.3. MNO Captive sites

- 7.2. Market Analysis, Insights and Forecast - by Installation

- 7.2.1. Rooftop

- 7.2.2. Ground-based

- 7.3. Market Analysis, Insights and Forecast - by Fuel Type

- 7.3.1. Renewable

- 7.3.2. Non-renewable

- 7.1. Market Analysis, Insights and Forecast - by Ownership

- 8. Europe UAE Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Ownership

- 8.1.1. Operator-owned

- 8.1.2. Private-owned

- 8.1.3. MNO Captive sites

- 8.2. Market Analysis, Insights and Forecast - by Installation

- 8.2.1. Rooftop

- 8.2.2. Ground-based

- 8.3. Market Analysis, Insights and Forecast - by Fuel Type

- 8.3.1. Renewable

- 8.3.2. Non-renewable

- 8.1. Market Analysis, Insights and Forecast - by Ownership

- 9. Middle East & Africa UAE Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Ownership

- 9.1.1. Operator-owned

- 9.1.2. Private-owned

- 9.1.3. MNO Captive sites

- 9.2. Market Analysis, Insights and Forecast - by Installation

- 9.2.1. Rooftop

- 9.2.2. Ground-based

- 9.3. Market Analysis, Insights and Forecast - by Fuel Type

- 9.3.1. Renewable

- 9.3.2. Non-renewable

- 9.1. Market Analysis, Insights and Forecast - by Ownership

- 10. Asia Pacific UAE Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Ownership

- 10.1.1. Operator-owned

- 10.1.2. Private-owned

- 10.1.3. MNO Captive sites

- 10.2. Market Analysis, Insights and Forecast - by Installation

- 10.2.1. Rooftop

- 10.2.2. Ground-based

- 10.3. Market Analysis, Insights and Forecast - by Fuel Type

- 10.3.1. Renewable

- 10.3.2. Non-renewable

- 10.1. Market Analysis, Insights and Forecast - by Ownership

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Etisalat (Emirates Telecommunication Group Company PJSC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Emirates Integrated Telecommunications Company (du)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 OSN (Orbit Showtime Network)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Yah Satellite Communications Company PJSC (YAHSAT)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thuraya Telecommunications Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Helios Towers

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IHS Towers

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NXN Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inteltec Emirates

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gulf Bridge International (GBI

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Etisalat (Emirates Telecommunication Group Company PJSC)

List of Figures

- Figure 1: Global UAE Telecom Towers Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America UAE Telecom Towers Market Revenue (Million), by Ownership 2024 & 2032

- Figure 3: North America UAE Telecom Towers Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 4: North America UAE Telecom Towers Market Revenue (Million), by Installation 2024 & 2032

- Figure 5: North America UAE Telecom Towers Market Revenue Share (%), by Installation 2024 & 2032

- Figure 6: North America UAE Telecom Towers Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 7: North America UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 8: North America UAE Telecom Towers Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America UAE Telecom Towers Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America UAE Telecom Towers Market Revenue (Million), by Ownership 2024 & 2032

- Figure 11: South America UAE Telecom Towers Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 12: South America UAE Telecom Towers Market Revenue (Million), by Installation 2024 & 2032

- Figure 13: South America UAE Telecom Towers Market Revenue Share (%), by Installation 2024 & 2032

- Figure 14: South America UAE Telecom Towers Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 15: South America UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 16: South America UAE Telecom Towers Market Revenue (Million), by Country 2024 & 2032

- Figure 17: South America UAE Telecom Towers Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe UAE Telecom Towers Market Revenue (Million), by Ownership 2024 & 2032

- Figure 19: Europe UAE Telecom Towers Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 20: Europe UAE Telecom Towers Market Revenue (Million), by Installation 2024 & 2032

- Figure 21: Europe UAE Telecom Towers Market Revenue Share (%), by Installation 2024 & 2032

- Figure 22: Europe UAE Telecom Towers Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 23: Europe UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 24: Europe UAE Telecom Towers Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe UAE Telecom Towers Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East & Africa UAE Telecom Towers Market Revenue (Million), by Ownership 2024 & 2032

- Figure 27: Middle East & Africa UAE Telecom Towers Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 28: Middle East & Africa UAE Telecom Towers Market Revenue (Million), by Installation 2024 & 2032

- Figure 29: Middle East & Africa UAE Telecom Towers Market Revenue Share (%), by Installation 2024 & 2032

- Figure 30: Middle East & Africa UAE Telecom Towers Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 31: Middle East & Africa UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 32: Middle East & Africa UAE Telecom Towers Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East & Africa UAE Telecom Towers Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Asia Pacific UAE Telecom Towers Market Revenue (Million), by Ownership 2024 & 2032

- Figure 35: Asia Pacific UAE Telecom Towers Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 36: Asia Pacific UAE Telecom Towers Market Revenue (Million), by Installation 2024 & 2032

- Figure 37: Asia Pacific UAE Telecom Towers Market Revenue Share (%), by Installation 2024 & 2032

- Figure 38: Asia Pacific UAE Telecom Towers Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 39: Asia Pacific UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 40: Asia Pacific UAE Telecom Towers Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific UAE Telecom Towers Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAE Telecom Towers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAE Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 3: Global UAE Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 4: Global UAE Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Global UAE Telecom Towers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global UAE Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 7: Global UAE Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 8: Global UAE Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 9: Global UAE Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Canada UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Mexico UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global UAE Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 14: Global UAE Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 15: Global UAE Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 16: Global UAE Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of South America UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global UAE Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 21: Global UAE Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 22: Global UAE Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 23: Global UAE Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Kingdom UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Germany UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Italy UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Russia UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Benelux UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Nordics UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Europe UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global UAE Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 34: Global UAE Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 35: Global UAE Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 36: Global UAE Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global UAE Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 44: Global UAE Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 45: Global UAE Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 46: Global UAE Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific UAE Telecom Towers Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Telecom Towers Market?

The projected CAGR is approximately 6.45%.

2. Which companies are prominent players in the UAE Telecom Towers Market?

Key companies in the market include Etisalat (Emirates Telecommunication Group Company PJSC), Emirates Integrated Telecommunications Company (du), OSN (Orbit Showtime Network), Al Yah Satellite Communications Company PJSC (YAHSAT), Thuraya Telecommunications Company, Helios Towers, IHS Towers, NXN Group, Inteltec Emirates, Gulf Bridge International (GBI.

3. What are the main segments of the UAE Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

5G Deployment to Address the Increasing Market Demand.

7. Are there any restraints impacting market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs.

8. Can you provide examples of recent developments in the market?

June 2024: The UAE's Telecommunications and Digital Government Regulatory Authority (TDRA) pledged a voluntary contribution of CHF 1.9 million (USD 2.21 million) to the International Telecommunication Union (ITU). This contribution stems from a surplus in the budget allocated for WRC-23, held in Dubai, UAE, late last year in 2023. The ITU plans to utilize these funds to refresh global radiocommunication databases and enhance the software applications and tools offered by the ITU Radiocommunication Bureau (BR). These upgrades will aid countries globally in applying for radio frequency assignments, aligning with the newly revised Radio Regulations (2024 Version).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Telecom Towers Market?

To stay informed about further developments, trends, and reports in the UAE Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence