Key Insights

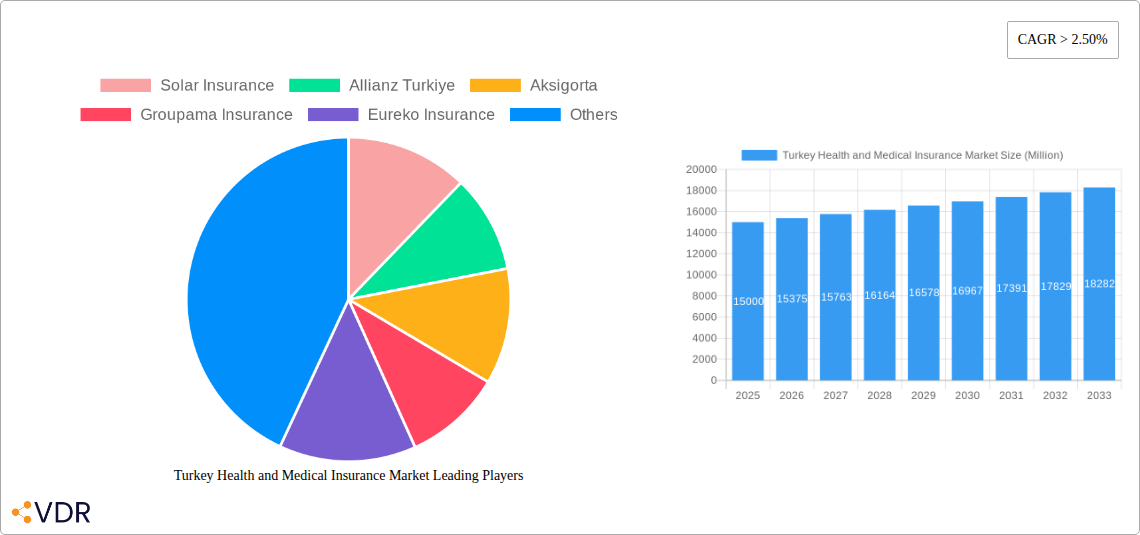

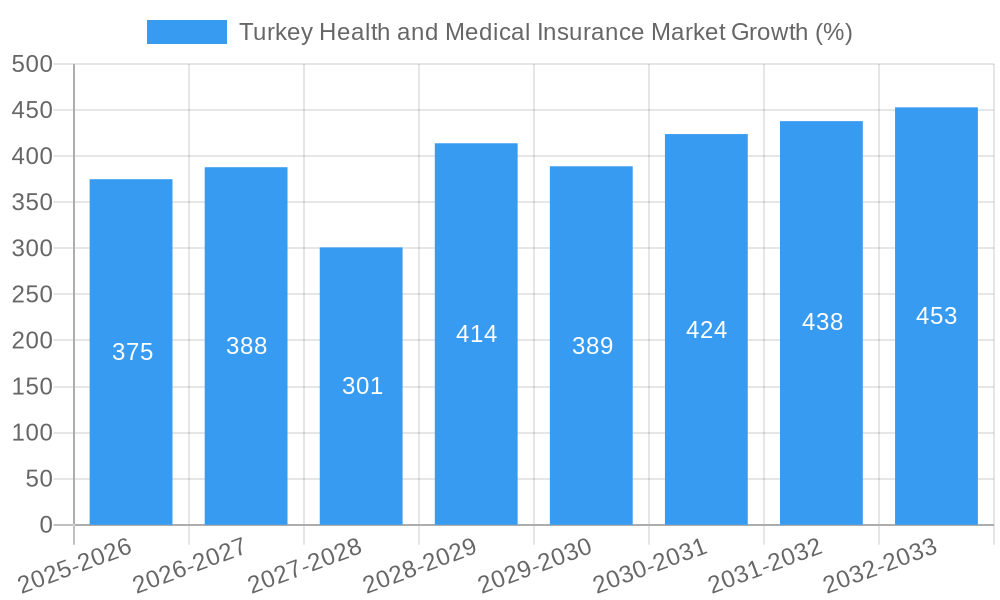

The Turkey Health and Medical Insurance Market is experiencing robust growth, fueled by a rising middle class with increased disposable income and a growing awareness of the importance of health insurance. The market's compound annual growth rate (CAGR) exceeding 2.50% from 2019 to 2024 indicates a consistent upward trajectory. Several key drivers contribute to this expansion, including government initiatives promoting health insurance coverage, an aging population requiring more healthcare services, and the increasing prevalence of chronic diseases. The market is segmented by product type (Private Health Insurance (PMI) and Public/Social Security Schemes), term of coverage (short-term and long-term), and distribution channels (brokers/agents, banks, direct sales, companies, and other channels). Private health insurance is a significant segment, driven by the desire for superior healthcare services and shorter wait times compared to public schemes. The long-term insurance segment is likely to dominate due to its comprehensive coverage and financial security it provides. Distribution channels such as brokers and agents are prominent, highlighting the importance of personalized consultations and tailored solutions in this market. Competition is intense, with both domestic players like Anadolu Insurance and Aksigorta, and international players like Allianz Türkiye and AXA Insurance vying for market share.

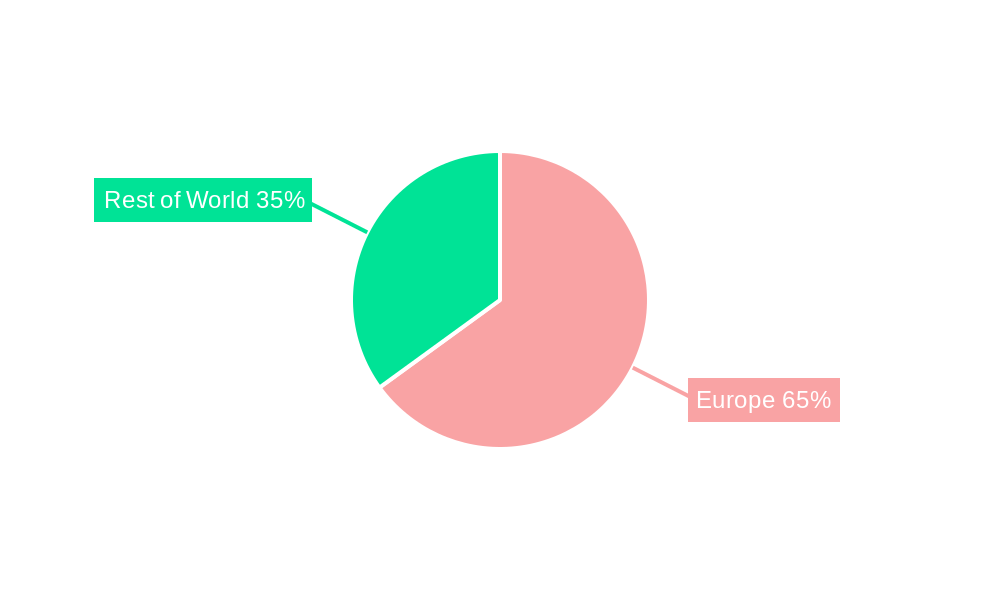

Growth projections for the forecast period (2025-2033) remain optimistic, driven by continued economic development and government support for healthcare infrastructure. However, challenges persist. These include rising healthcare costs, regulatory complexities, and the potential impact of economic fluctuations. To maintain growth momentum, insurers will need to focus on product innovation, expanding their distribution networks, and adopting digital technologies to enhance customer experience and operational efficiency. The market's success will also depend on addressing affordability concerns and increasing awareness among the population, particularly in rural areas. The European region, with countries like Germany and the UK significantly contributing to the global healthcare market's size, will play a crucial role in shaping future market trends for Turkey as a significant player in the global healthcare market and its connection to international investment.

Turkey Health and Medical Insurance Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Turkey health and medical insurance market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, growth trends, key players, and emerging opportunities within this dynamic sector. The report segments the market by product type (Private Health Insurance (PMI), Public/Social Security Schemes), term of coverage (short-term, long-term), and channel of distribution (brokers/agents, banks, direct, companies, other channels).

Turkey Health and Medical Insurance Market Dynamics & Structure

The Turkish health and medical insurance market exhibits a complex interplay of factors shaping its structure and growth trajectory. Market concentration is moderate, with a few large players like Allianz Türkiye and Anadolu Insurance holding significant market share, while numerous smaller players compete intensely. Technological innovation, particularly in telehealth and digital health platforms, is a key driver, though adoption rates vary across segments. The regulatory framework, while evolving, plays a significant role in market access and product offerings. Substitutes for private health insurance, such as out-of-pocket payments, still hold a considerable share, especially amongst lower-income segments. Demographics, with an aging population and rising health awareness, significantly influence market demand. Finally, mergers and acquisitions (M&A) activity reflects consolidation trends within the industry.

- Market Concentration: Moderate, with some players holding xx% market share.

- Technological Innovation: Telehealth and digital health platforms are gaining traction, but adoption faces barriers like digital literacy and infrastructure gaps.

- Regulatory Framework: Ongoing evolution impacts market entry and product regulations.

- Competitive Substitutes: Out-of-pocket payments remain a significant substitute.

- End-User Demographics: Aging population and rising health awareness drive demand for PMI.

- M&A Trends: Consolidation is evident with xx M&A deals recorded between 2019 and 2024 (estimated).

Turkey Health and Medical Insurance Market Growth Trends & Insights

The Turkish health and medical insurance market demonstrates robust growth, driven by a combination of factors. Market size has expanded significantly from xx Million in 2019 to an estimated xx Million in 2025, projecting a CAGR of xx% during the forecast period (2025-2033). Adoption rates for PMI are increasing, albeit gradually, particularly amongst the middle and upper-income segments. Technological disruptions, such as the rise of telehealth, are reshaping service delivery models. Shifting consumer behavior, characterized by a growing preference for comprehensive coverage and value-added services, is further driving market growth. This is coupled with an increase in government initiatives to expand health insurance coverage. The penetration rate of private health insurance, however, remains relatively low compared to developed nations, presenting considerable untapped market potential.

Dominant Regions, Countries, or Segments in Turkey Health and Medical Insurance Market

While detailed regional data is limited, the urban areas, particularly Istanbul and Ankara, represent the most significant segments due to higher disposable income and greater awareness of health insurance benefits. Within the product types, Private Medical Insurance (PMI) is the fastest-growing segment, although Public/Social Security Schemes still dominate the overall market in terms of coverage. Among the distribution channels, Brokers/Agents hold a large market share due to established networks and personalized service. Long-term health insurance policies are gradually gaining popularity as awareness regarding long-term care increases.

- Key Drivers: Rising disposable incomes in urban areas, increasing health awareness, and government initiatives promoting health insurance coverage.

- PMI Dominance: Fastest-growing segment driven by rising demand for superior healthcare.

- Broker/Agent Channel: Dominant distribution channel due to established networks and personalized services.

Turkey Health and Medical Insurance Market Product Landscape

The Turkish health and medical insurance market offers a diverse range of products, including comprehensive health plans, critical illness coverage, and specialized insurance for specific needs. These products are tailored to various customer segments, encompassing individuals, families, and corporations. Technological advancements are shaping product development, with features like telemedicine consultations, digital claims processing, and personalized health management tools becoming increasingly prevalent. Unique selling propositions focus on coverage breadth, ease of access, and value-added services, like discounts on healthcare providers.

Key Drivers, Barriers & Challenges in Turkey Health and Medical Insurance Market

Key Drivers: Rising healthcare costs, increasing prevalence of chronic diseases, and government support for health insurance expansion are key growth catalysts. Technological advancements enhance service delivery and efficiency.

Key Challenges: High inflation and economic instability can affect consumer spending on health insurance. Regulatory hurdles and complex administrative processes pose operational challenges. Competition from established players and new market entrants, combined with limited health insurance literacy among the population, remain major hurdles. The supply chain for healthcare services can also face issues like limited capacity and cost pressures.

Emerging Opportunities in Turkey Health and Medical Insurance Market

Untapped markets in rural areas and amongst lower-income segments offer significant growth potential. Innovative product offerings, tailored to specific needs, such as maternity care or specialized treatments, can unlock new markets. Growing consumer preferences for digital health solutions and wellness programs present opportunities for insurers to enhance their offerings.

Growth Accelerators in the Turkey Health and Medical Insurance Market Industry

Strategic partnerships with healthcare providers, technological integration for seamless service delivery, and expansion into new segments and geographies are key growth accelerators. Government initiatives to improve healthcare infrastructure and affordability also provide long-term impetus. Focus on digital transformation, including telehealth integration and data analytics for risk management and personalized services, promises substantial growth opportunities.

Key Players Shaping the Turkey Health and Medical Insurance Market Market

- Solar Insurance

- Allianz Türkiye

- Aksigorta

- Groupama Insurance

- Eureko Insurance

- AXA Insurance - Insurance Turkey's Trusted Brand

- Mapfre Insurance

- Anadolu Insurance

- ACIBADEM HEALTH GROUP

- Yapi Kredi Insurance

- Sompo Japan

Notable Milestones in Turkey Health and Medical Insurance Market Sector

- June 2022: Oman Insurance Company sells its Turkish operations to VHV Reasürans, reflecting industry consolidation.

- September 2023: Cigna Healthcare launches a new health benefits plan for seniors, catering to a growing demographic.

In-Depth Turkey Health and Medical Insurance Market Outlook

The Turkish health and medical insurance market is poised for continued growth, driven by underlying factors like rising healthcare costs and increasing health awareness. Strategic investments in technology, expansion into underserved segments, and innovative product development will be crucial for players to capitalize on emerging opportunities. The market's future hinges on effectively addressing challenges related to affordability, regulatory compliance, and ensuring access to quality healthcare services across the country.

Turkey Health and Medical Insurance Market Segmentation

-

1. Product Type

- 1.1. Private Health Insurance (PMI)

- 1.2. Public/Social Security Schemes

-

2. Term of Coverage

- 2.1. Short-term

- 2.2. Long-term

-

3. Channel of Distribution

- 3.1. Brokers/Agents

- 3.2. Banks

- 3.3. Direct

- 3.4. Companies

- 3.5. Other Channels of Distribution

Turkey Health and Medical Insurance Market Segmentation By Geography

- 1. Turkey

Turkey Health and Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand For Healthcare Services with ageing population; Government Healthcare Initiative increasing access to healthcare

- 3.3. Market Restrains

- 3.3.1. Economic fluctuations in turkey affecting the market.; Existing Regional differences in healthcare facilities affecting the market.

- 3.4. Market Trends

- 3.4.1. Rise In Private Health Insurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Private Health Insurance (PMI)

- 5.1.2. Public/Social Security Schemes

- 5.2. Market Analysis, Insights and Forecast - by Term of Coverage

- 5.2.1. Short-term

- 5.2.2. Long-term

- 5.3. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.3.1. Brokers/Agents

- 5.3.2. Banks

- 5.3.3. Direct

- 5.3.4. Companies

- 5.3.5. Other Channels of Distribution

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Turkey Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7. France Turkey Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Turkey Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Turkey Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Turkey Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Europe Turkey Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Solar Insurance

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Allianz Turkiye

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Aksigorta

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Groupama Insurance

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Eureko Insurance

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 AXA Insurance - Insurance Turkey's Trusted Brand

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mapfre Insurance

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Anadolu Insurance

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ACIBADEM HEALTH GROUP

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Yapi Kredi Insurance**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Sompo Japan

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Solar Insurance

List of Figures

- Figure 1: Turkey Health and Medical Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Turkey Health and Medical Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Term of Coverage 2019 & 2032

- Table 4: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 5: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Turkey Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Turkey Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Turkey Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Turkey Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Turkey Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Turkey Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Term of Coverage 2019 & 2032

- Table 15: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 16: Turkey Health and Medical Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Health and Medical Insurance Market?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the Turkey Health and Medical Insurance Market?

Key companies in the market include Solar Insurance, Allianz Turkiye, Aksigorta, Groupama Insurance, Eureko Insurance, AXA Insurance - Insurance Turkey's Trusted Brand, Mapfre Insurance, Anadolu Insurance, ACIBADEM HEALTH GROUP, Yapi Kredi Insurance**List Not Exhaustive, Sompo Japan.

3. What are the main segments of the Turkey Health and Medical Insurance Market?

The market segments include Product Type, Term of Coverage, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand For Healthcare Services with ageing population; Government Healthcare Initiative increasing access to healthcare.

6. What are the notable trends driving market growth?

Rise In Private Health Insurance.

7. Are there any restraints impacting market growth?

Economic fluctuations in turkey affecting the market.; Existing Regional differences in healthcare facilities affecting the market..

8. Can you provide examples of recent developments in the market?

In June 2022, Oman Insurance Company announced completing the sale of its insurance operations in Turkey to VHV Reasürans, Istanbul/Turkey, a company of VHV Group, Hannover/Germany. The deal resembles Oman Insurance's transformation and simplification strategy with the objective of focusing the company's resources on specific markets and segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Health and Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Health and Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Health and Medical Insurance Market?

To stay informed about further developments, trends, and reports in the Turkey Health and Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence