Key Insights

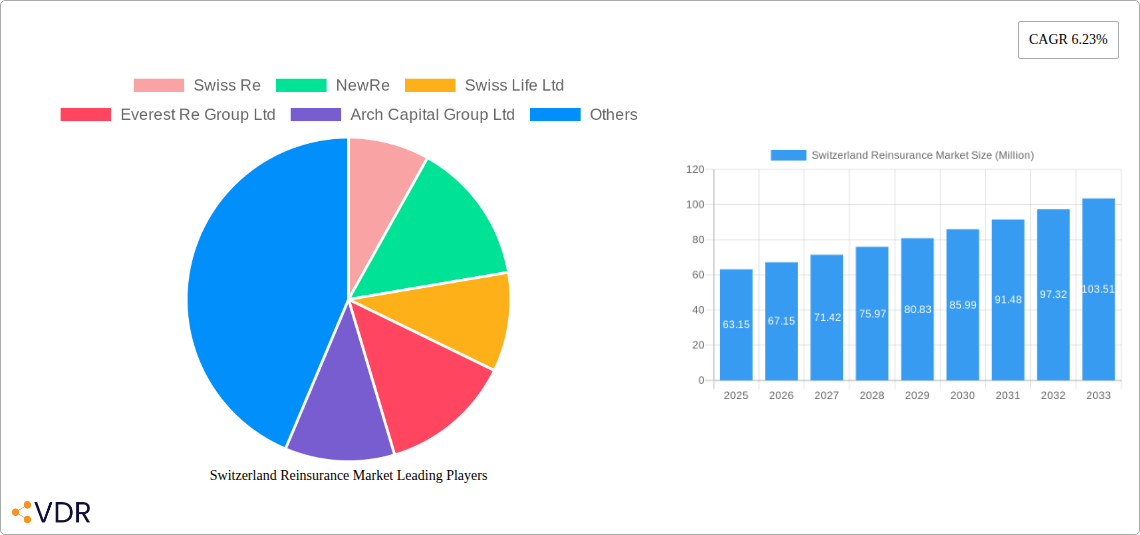

The Switzerland reinsurance market, valued at $63.15 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.23% from 2025 to 2033. This expansion is fueled by several key factors. Increasing global risks, such as natural catastrophes and cyber threats, are compelling businesses to seek robust reinsurance coverage to mitigate potential financial losses. Furthermore, stringent regulatory requirements in the Swiss financial sector are encouraging greater adoption of reinsurance solutions, particularly among smaller and medium-sized enterprises (SMEs). The growing complexity of insurance products and the need for specialized risk management strategies are also contributing to market expansion. Leading players like Swiss Re, Zurich Insurance Group, and other international reinsurers are actively investing in technological advancements, such as AI-powered risk assessment tools, to improve efficiency and enhance their service offerings, further driving growth.

The market is segmented by reinsurance type (e.g., property, casualty, life, health), distribution channels (direct and intermediary), and customer base (corporates, individuals). While precise segmental data is not currently available, analysis of global reinsurance market trends suggests that the property and casualty segment likely holds the largest market share within Switzerland, followed by life and health reinsurance. Competitive dynamics within the market are characterized by a mix of established international players and specialized local insurers. While significant opportunities exist, the market faces certain challenges, including increasing competition, macroeconomic uncertainties affecting insurance demand, and potential regulatory changes. Nevertheless, the long-term outlook for the Swiss reinsurance market remains positive, underpinned by a consistently growing need for risk mitigation and insurance solutions.

Switzerland Reinsurance Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Switzerland reinsurance market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market. Parent market considered is the broader Swiss insurance market and the child market is the reinsurance segment.

Switzerland Reinsurance Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory environment shaping the Swiss reinsurance market. The market is characterized by a moderate level of concentration, with several major players holding significant market share. Technological innovation, particularly in data analytics and risk modeling, is a key driver of growth, while regulatory changes and evolving risk profiles present both opportunities and challenges. Mergers and acquisitions (M&A) activity has been moderate, influencing market consolidation.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025 (estimated).

- Technological Innovation: Increased adoption of AI and machine learning in risk assessment and claims processing.

- Regulatory Framework: The Swiss Financial Market Supervisory Authority (FINMA) plays a crucial role in regulating the industry, impacting market dynamics and innovation.

- Competitive Substitutes: Alternative risk transfer mechanisms and captive insurance arrangements compete with traditional reinsurance.

- End-User Demographics: The market serves a diverse range of clients, including primary insurers, corporations, and institutional investors.

- M&A Trends: The past five years have seen xx M&A deals in the Swiss reinsurance market, primarily focused on consolidation and expansion into new segments. Innovation barriers include high initial investment costs for new technologies and the need for specialized expertise.

Switzerland Reinsurance Market Growth Trends & Insights

The Switzerland reinsurance market exhibited steady growth during the historical period (2019-2024), driven by increasing insurance penetration, economic growth, and a rise in catastrophic events. The market is projected to continue its expansion during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx% Market penetration is currently at xx% and is expected to reach xx% by 2033. Technological advancements, changing consumer behavior, and evolving risk landscapes are shaping future growth trajectories.

Dominant Regions, Countries, or Segments in Switzerland Reinsurance Market

Zurich, as the financial center of Switzerland, remains the dominant region within the Swiss reinsurance market. This dominance is driven by a strong concentration of key players, advanced infrastructure, and a supportive regulatory environment. Other regions play a supporting role, particularly those with significant insurance activity.

- Key Drivers:

- Strong Financial Infrastructure: Zurich's robust financial infrastructure attracts both domestic and international players.

- Skilled Workforce: Availability of highly skilled professionals in actuarial science, risk management, and finance.

- Supportive Regulatory Environment: FINMA's regulatory framework fosters stability and attracts international investment.

- Market Share and Growth Potential: Zurich holds approximately xx% of the Swiss reinsurance market in 2025 (estimated), exhibiting growth potential in line with the overall market CAGR.

Switzerland Reinsurance Market Product Landscape

The Swiss reinsurance market offers a range of products tailored to diverse client needs, including property catastrophe reinsurance, life and health reinsurance, and specialty lines. Recent product innovations focus on parametric insurance, utilizing real-time data and advanced analytics for faster and more efficient claims processing. Unique selling propositions often revolve around specialized expertise, customized solutions, and strong financial backing. Technological advancements continue to enhance product features and efficiency, leading to improved risk assessment and pricing.

Key Drivers, Barriers & Challenges in Switzerland Reinsurance Market

Key Drivers: Growing demand for risk transfer solutions from primary insurers, increasing frequency and severity of natural catastrophes, and technological advancements driving efficiency and new product offerings are key market drivers.

Key Challenges: Intense competition, regulatory changes, and economic uncertainty pose challenges to market participants. Supply chain disruptions (though less directly impactful on reinsurance than some sectors) can affect the availability of data and resources. Regulatory hurdles, such as capital adequacy requirements, can impact profitability. Competitive pressures from global reinsurance players and alternative risk transfer mechanisms are significant.

Emerging Opportunities in Switzerland Reinsurance Market

Emerging opportunities include expansion into new lines of reinsurance (such as cyber risk), leveraging data analytics to improve risk modeling and pricing, and developing innovative risk transfer solutions for emerging risks associated with climate change. Untapped markets exist in specialized sectors and emerging economies.

Growth Accelerators in the Switzerland Reinsurance Market Industry

Technological advancements in data analytics and AI, strategic partnerships between reinsurers and technology providers, and geographic expansion into new markets will fuel long-term growth. This includes exploring partnerships with Insurtech companies.

Key Players Shaping the Switzerland Reinsurance Market Market

- Swiss Re

- NewRe

- Swiss Life Ltd

- Everest Re Group Ltd

- Arch Capital Group Ltd

- RenaissanceRe

- EUROPA Re Ltd

- Allianz SE Reinsurance

- SCOR

- List Not Exhaustive

Notable Milestones in Switzerland Reinsurance Market Sector

- November 2023: Arch U.S. MI Holdings, a wholly owned subsidiary of Arch Capital Group Ltd., acquired RMIC Companies, Inc., expanding its run-off mortgage insurance portfolio. This acquisition is likely to enhance Arch Capital Group Ltd's position in the market.

- July 2022: Swiss Life International acquired elipsLife, strengthening its presence in the institutional client segment. This broadened Swiss Life's product offerings and client base.

In-Depth Switzerland Reinsurance Market Market Outlook

The Swiss reinsurance market is poised for continued growth driven by technological innovation, evolving risk landscapes, and increasing demand for risk transfer solutions. Strategic partnerships, expansion into new product lines, and effective risk management strategies will be crucial for success. The market's long-term potential is strong, with significant opportunities for both established players and new entrants.

Switzerland Reinsurance Market Segmentation

-

1. Type

- 1.1. Facultative Reinsurance

- 1.2. Treaty Reinsurance

-

2. Application

- 2.1. Property & Casualty Reinsurance

- 2.2. Life & Health Reinsurance

-

3. Distribution Channel

- 3.1. Direct

- 3.2. Broker

-

4. Mode

- 4.1. Online

- 4.2. Offline

Switzerland Reinsurance Market Segmentation By Geography

- 1. Switzerland

Switzerland Reinsurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements are Driving the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Technological Advancements are Driving the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Growing Claim Paid by Insurance Companies Increased the Need of Reinsurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Reinsurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Facultative Reinsurance

- 5.1.2. Treaty Reinsurance

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Property & Casualty Reinsurance

- 5.2.2. Life & Health Reinsurance

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct

- 5.3.2. Broker

- 5.4. Market Analysis, Insights and Forecast - by Mode

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Swiss Re

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NewRe

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Swiss Life Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Everest Re Group Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arch Capital Group Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 RenaissanceRe

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EUROPA Re Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Allianz SE Reinsurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SCOR**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Swiss Re

List of Figures

- Figure 1: Switzerland Reinsurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Switzerland Reinsurance Market Share (%) by Company 2024

List of Tables

- Table 1: Switzerland Reinsurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Switzerland Reinsurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Switzerland Reinsurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Switzerland Reinsurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Switzerland Reinsurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Switzerland Reinsurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 7: Switzerland Reinsurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Switzerland Reinsurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 9: Switzerland Reinsurance Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 10: Switzerland Reinsurance Market Volume Billion Forecast, by Mode 2019 & 2032

- Table 11: Switzerland Reinsurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Switzerland Reinsurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 13: Switzerland Reinsurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Switzerland Reinsurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 15: Switzerland Reinsurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Switzerland Reinsurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 17: Switzerland Reinsurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: Switzerland Reinsurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 19: Switzerland Reinsurance Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 20: Switzerland Reinsurance Market Volume Billion Forecast, by Mode 2019 & 2032

- Table 21: Switzerland Reinsurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Switzerland Reinsurance Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Reinsurance Market?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the Switzerland Reinsurance Market?

Key companies in the market include Swiss Re, NewRe, Swiss Life Ltd, Everest Re Group Ltd, Arch Capital Group Ltd, RenaissanceRe, EUROPA Re Ltd, Allianz SE Reinsurance, SCOR**List Not Exhaustive.

3. What are the main segments of the Switzerland Reinsurance Market?

The market segments include Type, Application, Distribution Channel, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements are Driving the Growth of the Market.

6. What are the notable trends driving market growth?

Growing Claim Paid by Insurance Companies Increased the Need of Reinsurance.

7. Are there any restraints impacting market growth?

Technological Advancements are Driving the Growth of the Market.

8. Can you provide examples of recent developments in the market?

November 2023: Arch U.S. MI Holdings, a wholly owned subsidiary of Arch Capital Group Ltd., announced it has entered into a definitive agreement to acquire RMIC Companies, Inc. (RMIC) and its subsidiaries that together comprise the run-off mortgage insurance business of Old Republic International Corporation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Reinsurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Reinsurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Reinsurance Market?

To stay informed about further developments, trends, and reports in the Switzerland Reinsurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence