Key Insights

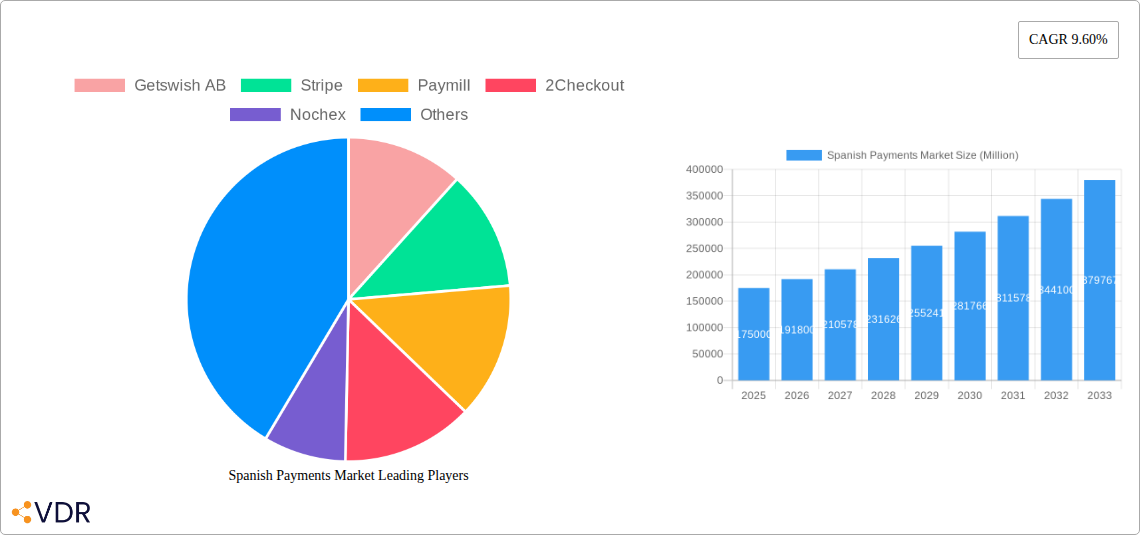

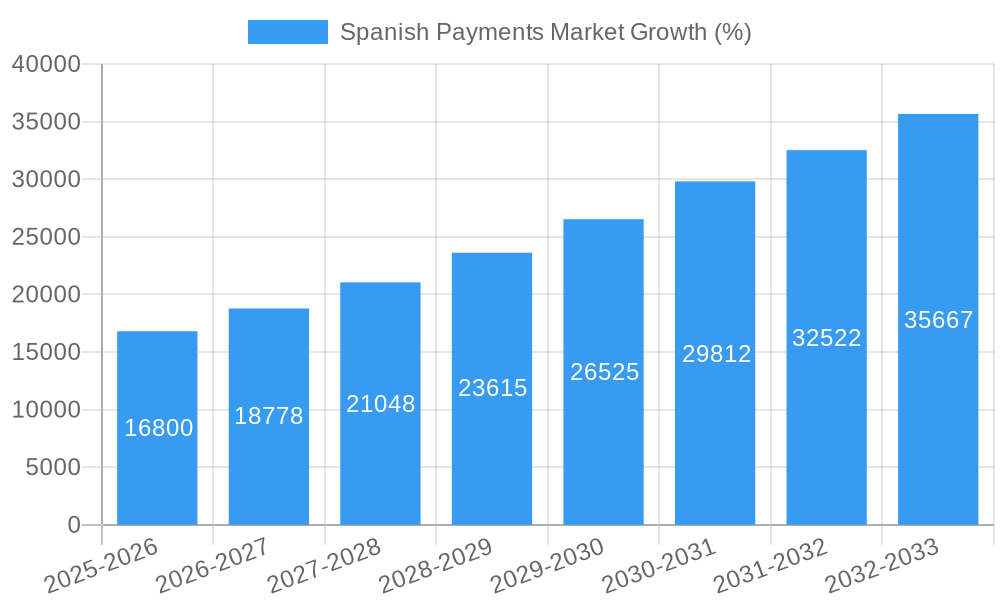

The Spanish payments market, exhibiting a robust CAGR of 9.60%, presents a compelling investment landscape. While precise market size figures for Spain are not provided, we can extrapolate valuable insights. Considering the global market trends and the relatively high adoption of digital technologies in Spain, a reasonable estimation for the Spanish payments market size in 2025 would be in the range of €150-€200 billion. This figure considers the diverse segments within the market, including retail, entertainment, healthcare, and hospitality, with Point of Sale (POS) and online sales driving growth. The increasing preference for contactless payments and mobile wallets, driven by factors like convenience and security, significantly contribute to this expansion.

Growth is fueled by factors such as rising e-commerce penetration, increased smartphone adoption, and government initiatives promoting digitalization. However, challenges exist. Concerns surrounding data security and fraud prevention could potentially hinder growth, requiring robust regulatory frameworks and technological advancements to mitigate these risks. The competitive landscape includes both international giants like Stripe and WorldPay, and local players. These companies compete on factors including transaction fees, security features, and ease of integration. The market segmentation, categorized by payment mode (POS vs. online) and end-user industry, provides opportunities for specialized service providers. The future outlook for the Spanish payments market remains positive, driven by continuous technological advancements and growing consumer demand for seamless and secure digital payment solutions. This makes it a dynamic and attractive sector for both established and emerging players.

Spanish Payments Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Spanish payments market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a focus on market dynamics, growth trends, key players, and future opportunities, this report covers the period from 2019 to 2033, with a base year of 2025. The report segments the market by mode of payment (Point of Sale, Online Sale) and end-user industry (Retail, Entertainment, Healthcare, Hospitality, Other End-user Industries). Projected market values are presented in millions of units.

Spanish Payments Market Dynamics & Structure

The Spanish payments market is characterized by a dynamic interplay of factors influencing its growth and structure. Market concentration is moderate, with several key players holding significant shares, but also ample room for smaller players and new entrants. Technological innovation, particularly in mobile payments and Buy Now Pay Later (BNPL) solutions, is a significant driver. The regulatory framework, including PSD2 and other relevant regulations, shapes the competitive landscape and influences adoption rates. Competitive product substitutes, such as cash and checks, still hold a presence, although their usage is declining. End-user demographics, with a growing young and tech-savvy population, favor digital payment methods. M&A activity has been relatively robust in recent years, with larger players consolidating their market position and expanding their service offerings.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Driven by mobile payments, BNPL, and open banking initiatives.

- Regulatory Framework: PSD2 compliance and other regulations influence market dynamics.

- Competitive Substitutes: Cash and checks are gradually losing market share to digital payments.

- M&A Activity: xx deals concluded between 2019 and 2024, with a focus on expanding digital capabilities and geographic reach.

- Innovation Barriers: High initial investment costs for new technologies and regulatory compliance hurdles.

Spanish Payments Market Growth Trends & Insights

The Spanish payments market has experienced significant growth in recent years, driven by increasing digital adoption, rising e-commerce penetration, and supportive government initiatives. The market size expanded from xx million in 2019 to xx million in 2024, exhibiting a CAGR of xx%. This growth is projected to continue through 2033, driven by the widespread adoption of contactless payments, mobile wallets, and alternative payment methods such as BNPL. Market penetration of digital payments is expected to reach xx% by 2033. Consumer behavior is shifting towards greater convenience and security, favoring digital and contactless solutions. Technological disruptions, such as the rise of mobile wallets and fintech innovations, further accelerate market growth. Factors like increasing smartphone penetration and improved internet infrastructure are contributing to this trend.

Dominant Regions, Countries, or Segments in Spanish Payments Market

The Spanish payments market demonstrates strong growth across various segments and regions. The online sales segment is experiencing rapid expansion fueled by the booming e-commerce sector. The retail segment remains a dominant force, with Point-of-Sale (POS) payments continuing to hold a significant share. Specific geographic regions are demonstrating higher-than-average growth rates based on increased digital literacy and infrastructure investments.

- By Mode of Payment: Online sales is the fastest growing segment, projected to reach xx million by 2033. Point of Sale (POS) remains significant, but its growth is slower compared to online.

- By End-user Industry: Retail remains the largest segment, followed by Entertainment. The hospitality sector is experiencing significant digital payment adoption growth.

- Key Drivers: Government initiatives promoting digital payments, increased smartphone penetration, expanding e-commerce sector.

- Dominance Factors: Market share, growth potential, technological readiness, and consumer preferences.

Spanish Payments Market Product Landscape

The Spanish payments market showcases a diverse range of products, encompassing traditional credit and debit cards, mobile wallets, online payment gateways, and emerging technologies like BNPL and crypto payments. Innovation focuses on enhancing security, convenience, and user experience, including features like biometric authentication and tokenization. Key performance indicators (KPIs) for these products include transaction volumes, processing speeds, success rates, and customer satisfaction levels. Unique selling propositions center on ease of use, affordability, and advanced security measures.

Key Drivers, Barriers & Challenges in Spanish Payments Market

Key Drivers:

- Increasing smartphone penetration and internet access.

- Growing adoption of e-commerce and online services.

- Government initiatives promoting digital payments.

- Technological advancements in payment processing.

Key Barriers and Challenges:

- Cybersecurity risks and data breaches.

- Regulatory hurdles and compliance costs.

- Competition from established players and fintech startups.

- Concerns around data privacy and consumer protection.

- Infrastructure limitations in certain regions.

Emerging Opportunities in Spanish Payments Market

- Expanding BNPL services to underserved markets.

- Integration of AI and machine learning for fraud prevention.

- Development of innovative solutions for micro-transactions.

- Growing demand for contactless payments and mobile wallets.

- Opportunities in the growing gig economy and freelancer markets.

Growth Accelerators in the Spanish Payments Market Industry

Technological advancements, particularly in mobile and contactless payments, are significant growth catalysts. Strategic partnerships between established players and fintech startups are fueling innovation and market expansion. Government support and initiatives aimed at promoting digitalization further accelerate growth. Furthermore, the increasing adoption of open banking solutions is creating new opportunities for payment providers to offer tailored services to consumers and businesses.

Key Players Shaping the Spanish Payments Market Market

- Getswish AB

- Stripe

- Paymill

- 2Checkout

- Nochex

- Braintree

- QuickPay

- Klarna Bank AB

- WorldPay

- Wirecard (List Not Exhaustive)

Notable Milestones in Spanish Payments Market Sector

- May 2022: Adyen expanded its partnership with Afterpay Limited, boosting BNPL adoption.

- March 2022: Skrill launched a Skrill Prepaid Mastercard for Apple Pay, enhancing contactless payments.

In-Depth Spanish Payments Market Market Outlook

The Spanish payments market is poised for continued strong growth driven by technological innovations, regulatory changes, and evolving consumer preferences. The increasing adoption of digital payments, combined with supportive government policies, presents significant opportunities for market participants. Strategic investments in infrastructure, security, and innovative payment solutions will be crucial for success in this dynamic market. The long-term outlook remains positive, with considerable potential for growth and expansion across various segments and regions.

Spanish Payments Market Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (includes Mobile Wallets)

- 1.1.3. Cash

- 1.1.4. Others

-

1.2. Online Sale

- 1.2.1. Others (

-

1.1. Point of Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

Spanish Payments Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Spanish Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 High adoption of e-commerce

- 3.2.2 including the rise of mobile and online payments

- 3.2.3 supported by increased consumer purchasing power; Enablement Programs by Key Retailers and Government encouraging digitization and contactless payments in the market

- 3.3. Market Restrains

- 3.3.1. Security Concerns Related to Cyber Attacks and Data Breaches; Lack of Robust and Reliable Infrastructure in Remote Regions

- 3.4. Market Trends

- 3.4.1. Retail industry to see significant growth in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Spanish Payments Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.1.4. Others

- 5.1.2. Online Sale

- 5.1.2.1. Others (

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. North America Spanish Payments Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6.1.1. Point of Sale

- 6.1.1.1. Card Pay

- 6.1.1.2. Digital Wallet (includes Mobile Wallets)

- 6.1.1.3. Cash

- 6.1.1.4. Others

- 6.1.2. Online Sale

- 6.1.2.1. Others (

- 6.1.1. Point of Sale

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Retail

- 6.2.2. Entertainment

- 6.2.3. Healthcare

- 6.2.4. Hospitality

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 7. South America Spanish Payments Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 7.1.1. Point of Sale

- 7.1.1.1. Card Pay

- 7.1.1.2. Digital Wallet (includes Mobile Wallets)

- 7.1.1.3. Cash

- 7.1.1.4. Others

- 7.1.2. Online Sale

- 7.1.2.1. Others (

- 7.1.1. Point of Sale

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Retail

- 7.2.2. Entertainment

- 7.2.3. Healthcare

- 7.2.4. Hospitality

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 8. Europe Spanish Payments Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 8.1.1. Point of Sale

- 8.1.1.1. Card Pay

- 8.1.1.2. Digital Wallet (includes Mobile Wallets)

- 8.1.1.3. Cash

- 8.1.1.4. Others

- 8.1.2. Online Sale

- 8.1.2.1. Others (

- 8.1.1. Point of Sale

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Retail

- 8.2.2. Entertainment

- 8.2.3. Healthcare

- 8.2.4. Hospitality

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 9. Middle East & Africa Spanish Payments Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 9.1.1. Point of Sale

- 9.1.1.1. Card Pay

- 9.1.1.2. Digital Wallet (includes Mobile Wallets)

- 9.1.1.3. Cash

- 9.1.1.4. Others

- 9.1.2. Online Sale

- 9.1.2.1. Others (

- 9.1.1. Point of Sale

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Retail

- 9.2.2. Entertainment

- 9.2.3. Healthcare

- 9.2.4. Hospitality

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 10. Asia Pacific Spanish Payments Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 10.1.1. Point of Sale

- 10.1.1.1. Card Pay

- 10.1.1.2. Digital Wallet (includes Mobile Wallets)

- 10.1.1.3. Cash

- 10.1.1.4. Others

- 10.1.2. Online Sale

- 10.1.2.1. Others (

- 10.1.1. Point of Sale

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Retail

- 10.2.2. Entertainment

- 10.2.3. Healthcare

- 10.2.4. Hospitality

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 11. North America Spanish Payments Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Spanish Payments Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United KIngdom

- 12.1.3 Italy

- 12.1.4 France

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Spanish Payments Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Australia

- 13.1.6 Rest of Asia Pacific

- 14. Latin America Spanish Payments Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa Spanish Payments Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 GCC

- 15.1.2 South Africa

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Getswish AB

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Stripe

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Paymill

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 2Checkout

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Nochex

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Braintree

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 QuickPay

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Klarna Bank AB

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 WorldPay

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Wirecard*List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Getswish AB

List of Figures

- Figure 1: Global Spanish Payments Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Spanish Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Spanish Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Spanish Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Spanish Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Spanish Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Spanish Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Spanish Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Spanish Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Spanish Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Spanish Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Spanish Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 13: North America Spanish Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 14: North America Spanish Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Spanish Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Spanish Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Spanish Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Spanish Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 19: South America Spanish Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 20: South America Spanish Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: South America Spanish Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: South America Spanish Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 23: South America Spanish Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Spanish Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 25: Europe Spanish Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 26: Europe Spanish Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Europe Spanish Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Europe Spanish Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Spanish Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East & Africa Spanish Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 31: Middle East & Africa Spanish Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 32: Middle East & Africa Spanish Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Middle East & Africa Spanish Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Middle East & Africa Spanish Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Spanish Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Spanish Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 37: Asia Pacific Spanish Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 38: Asia Pacific Spanish Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Asia Pacific Spanish Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Asia Pacific Spanish Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Spanish Payments Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Spanish Payments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Spanish Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 3: Global Spanish Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Spanish Payments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Spanish Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Spanish Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United KIngdom Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Spanish Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: India Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: China Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Spanish Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Latin America Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Spanish Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: GCC Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: South Africa Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Middle East and Africa Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Spanish Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 31: Global Spanish Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 32: Global Spanish Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United States Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Canada Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Mexico Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global Spanish Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 37: Global Spanish Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 38: Global Spanish Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Brazil Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Argentina Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Spanish Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 43: Global Spanish Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 44: Global Spanish Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: United Kingdom Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Germany Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: France Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Italy Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Spain Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Russia Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Benelux Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Nordics Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Europe Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Global Spanish Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 55: Global Spanish Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 56: Global Spanish Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Turkey Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Israel Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: GCC Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: North Africa Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Africa Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East & Africa Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Spanish Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 64: Global Spanish Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 65: Global Spanish Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: China Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: India Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Japan Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: South Korea Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: ASEAN Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Oceania Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of Asia Pacific Spanish Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spanish Payments Market?

The projected CAGR is approximately 9.60%.

2. Which companies are prominent players in the Spanish Payments Market?

Key companies in the market include Getswish AB, Stripe, Paymill, 2Checkout, Nochex, Braintree, QuickPay, Klarna Bank AB, WorldPay, Wirecard*List Not Exhaustive.

3. What are the main segments of the Spanish Payments Market?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High adoption of e-commerce. including the rise of mobile and online payments. supported by increased consumer purchasing power; Enablement Programs by Key Retailers and Government encouraging digitization and contactless payments in the market.

6. What are the notable trends driving market growth?

Retail industry to see significant growth in the country.

7. Are there any restraints impacting market growth?

Security Concerns Related to Cyber Attacks and Data Breaches; Lack of Robust and Reliable Infrastructure in Remote Regions.

8. Can you provide examples of recent developments in the market?

May 2022 - Adyen announced that it expanded its partnership with Afterpay Limited, one of the leading BNPL providers. Afterpay has partnered with Adyen to process payments in key markets such as Australia, New Zealand, Canada, Europe, the United States, and the United Kingdom to support the company's global growth and momentum.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spanish Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spanish Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spanish Payments Market?

To stay informed about further developments, trends, and reports in the Spanish Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence