Key Insights

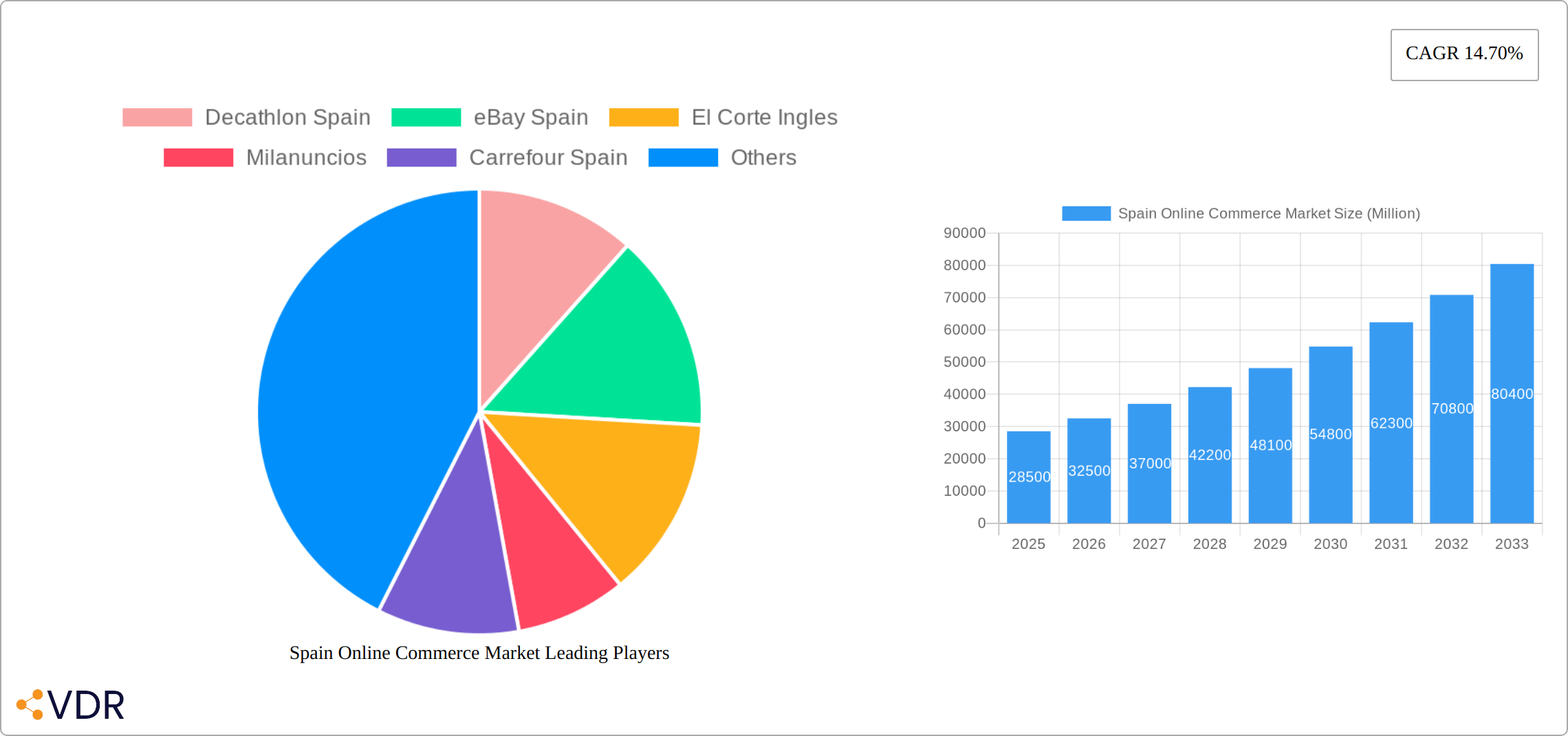

The Spanish online commerce market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 14.70% from 2019 to 2024, is poised for continued expansion throughout the forecast period (2025-2033). This growth is fueled by rising internet and smartphone penetration, increasing consumer trust in online transactions, and the expanding range of products and services available online. Key drivers include the convenience of online shopping, competitive pricing strategies employed by major players like Amazon Spain, and the increasing adoption of e-commerce by businesses of all sizes. Furthermore, trends like mobile commerce, social commerce, and the increasing popularity of subscription services are significantly accelerating market growth. While challenges like concerns about data security and the logistical complexities of last-mile delivery exist, the overall market trajectory remains strongly positive. The market segmentation by application (e.g., fashion, electronics, groceries) presents opportunities for targeted growth strategies, with each segment showing varying growth potential based on consumer preferences and evolving market dynamics. The competitive landscape, featuring prominent players such as Decathlon Spain, eBay Spain, and Amazon Spain, fosters innovation and price competition, benefiting consumers.

The substantial growth observed from 2019-2024 suggests a substantial market size in 2025. Estimating conservatively, considering the provided CAGR, let's assume a 2024 market size of approximately €25 billion. This would imply a 2025 market size of around €28.5 billion (calculated using the CAGR). Projection to 2033, using the same CAGR, indicates substantial market expansion. It is vital for businesses to adapt to evolving consumer behavior, leverage emerging technologies, and refine their logistical capabilities to effectively participate in this dynamic and competitive market. The continued penetration of e-commerce across various demographics and product categories points toward a sustained period of expansion in the Spanish online commerce sector.

Spain Online Commerce Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Spain online commerce market, covering market dynamics, growth trends, key players, and future outlook. With a focus on market segmentation by application and industry developments, this report is an essential resource for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this rapidly evolving market. The report utilizes data from 2019-2024 (Historical Period), estimates for 2025 (Estimated Year), and forecasts from 2025-2033 (Forecast Period), with 2025 serving as the Base Year. Market values are presented in million units.

Spain Online Commerce Market Dynamics & Structure

The Spanish online commerce market is characterized by a dynamic interplay of factors influencing its structure and growth. Market concentration is moderate, with a few dominant players like Amazon Spain and El Corte Ingles alongside numerous smaller businesses and niche players. Technological innovation, particularly in areas like AI-powered personalization and mobile commerce, acts as a key driver. The regulatory framework, including data protection laws and consumer rights legislation, plays a significant role in shaping market practices. Competitive product substitutes, including traditional brick-and-mortar stores and alternative online marketplaces, exert pressure on market share. The end-user demographic is diverse, spanning various age groups, income levels, and technological proficiency, influencing consumer preferences and purchasing behavior. M&A activity has been relatively moderate in recent years, with a recorded xx deals in the past five years, primarily focused on consolidating market share within specific segments.

- Market Concentration: Moderate, with a few dominant players and numerous smaller businesses.

- Technological Innovation: AI-driven personalization, mobile commerce, and improved logistics are key drivers.

- Regulatory Framework: Data protection (GDPR) and consumer rights laws influence market practices.

- Competitive Substitutes: Traditional retail and alternative online marketplaces pose competitive pressure.

- End-User Demographics: Diverse age groups, income levels, and technological literacy impact consumer behavior.

- M&A Activity: xx deals over the past 5 years, primarily focused on consolidation within segments.

Spain Online Commerce Market Growth Trends & Insights

The Spanish online commerce market experienced significant growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to increasing internet penetration, rising smartphone usage, and a shift in consumer preferences towards online shopping. Technological disruptions, such as the rise of mobile commerce and the increasing adoption of e-wallets, have further accelerated market expansion. Consumer behavior is evolving towards greater convenience, personalization, and omnichannel experiences. Market penetration increased from xx% in 2019 to xx% in 2024, reflecting growing acceptance of online shopping across various product categories. Future growth will be driven by factors such as expanding logistics infrastructure, increasing digital literacy, and the ongoing adoption of innovative technologies. The projected CAGR for the forecast period (2025-2033) is estimated to be xx%. The market size is expected to reach xx million units by 2033.

Dominant Regions, Countries, or Segments in Spain Online Commerce Market

The Spanish online commerce market exhibits regional variations in growth and adoption rates. While the country as a whole demonstrates robust growth, major urban centers like Madrid and Barcelona lead in terms of market size and penetration. This is driven by factors such as higher internet access rates, increased disposable income, and higher density of online retail infrastructure. Specific segments like fashion, electronics, and groceries have demonstrated rapid growth, fueled by consumer demand, enhanced logistics, and the adoption of innovative delivery models. The growth in these segments is primarily driven by increased consumer confidence in online purchases, the ease and convenience offered by online platforms, and the increasing availability of competitive pricing and offers. The strong growth in e-grocery is notable, driven by the increasing use of mobile apps and the implementation of quick delivery services by online marketplaces.

- Key Drivers: Higher internet penetration in urban centers, increased disposable income, developed logistics infrastructure.

- Dominance Factors: High concentration of online retailers, strong consumer demand, sophisticated logistics networks in urban areas.

- Growth Potential: Continued growth in e-grocery, fashion, and electronics, driven by consumer preference shifts and technological innovations.

Spain Online Commerce Market Product Landscape

The Spanish online commerce market showcases a vibrant and diverse product landscape spanning numerous categories. This dynamic market is characterized by relentless product innovation, fueled by intense competition and the ever-evolving preferences of Spanish consumers. Leading online retailers are increasingly integrating sophisticated technologies, such as AI-powered product recommendations and personalized shopping experiences, to enhance customer engagement and drive sales. Significant advancements in logistics and delivery, including the widespread adoption of same-day and next-day delivery options, are contributing to heightened consumer satisfaction and fueling market expansion. Furthermore, innovative marketing strategies, including targeted social media campaigns and influencer collaborations, are effectively reaching broader audiences and building brand loyalty. Successful businesses are differentiating themselves through compelling unique selling propositions (USPs), focusing on superior customer service, exclusive product offerings, and robust loyalty programs to foster customer retention and advocacy.

Key Drivers, Barriers & Challenges in Spain Online Commerce Market

Key Drivers:

- Rapidly increasing internet and smartphone penetration rates, particularly among younger demographics.

- A growing cultural shift towards the convenience and accessibility of online shopping, driven by busy lifestyles and changing consumer habits.

- Continuous technological advancements that streamline online transactions, enhance security, and improve the overall user experience.

- Supportive government initiatives aimed at promoting digitalization and fostering the growth of the e-commerce sector within the Spanish economy.

Key Barriers and Challenges:

- Persistent concerns regarding online security and data privacy, requiring robust security measures and transparent data handling practices.

- Ongoing logistical challenges in efficiently reaching remote and geographically dispersed areas, necessitating innovative last-mile delivery solutions.

- Intense competition from well-established brick-and-mortar retailers who are actively expanding their online presence and capabilities.

- Navigating complex regulatory hurdles and ensuring strict compliance with evolving legal and ethical requirements. The cumulative impact of these challenges is estimated to moderate annual market growth by approximately [Insert Percentage or Range] annually. This requires proactive risk management and strategic adaptation.

Emerging Opportunities in Spain Online Commerce Market

- Growth of Mobile Commerce: The increasing use of smartphones creates opportunities for mobile-first strategies.

- Expansion into Rural Areas: Reaching underserved populations with improved logistics presents significant potential.

- Personalization and AI: AI-driven recommendations and personalized experiences will enhance customer engagement.

- Focus on Sustainability: Eco-friendly delivery options and sustainable product offerings align with consumer values.

Growth Accelerators in the Spain Online Commerce Market Industry

The long-term growth trajectory of the Spanish online commerce market is poised for significant expansion, driven by several key accelerators. The continued rollout of 5G networks and the broader adoption of advanced analytics will further elevate the online shopping experience, offering seamless connectivity and personalized recommendations. Strategic collaborations between e-commerce platforms and logistics providers will lead to enhanced efficiency and improved delivery capabilities, ensuring timely and reliable order fulfillment. Moreover, the exploration of new and emerging product categories, such as personalized healthcare products and experiential offerings, presents substantial growth opportunities, catering to evolving consumer demands. These factors, combined with steadily increasing consumer confidence in online transactions and the sustained support of government policies, are expected to propel substantial and sustained market expansion in the coming years.

Key Players Shaping the Spain Online Commerce Market Market

- Decathlon Spain

- eBay Spain

- El Corte Ingles

- Milanuncios

- Carrefour Spain

- Media Markt Spain

- Leroy Merlin

- PC Componentes

- Ali Express

- Amazon Spain

Notable Milestones in Spain Online Commerce Market Sector

- November 2021: AliExpress launches a supermarket service in its Spanish app, partnering with Lola Market.

- April 2022: Veepee expands its flash-sale service to Spain, launching its Re-Cycle initiative.

- April 2022: Media Markt installs Bitcoin ATMs in twelve Austrian branches, expanding potential payment options in future.

- May 2022: Increased adoption of AI in fashion retail improves product recommendations and enhances consumer experience.

In-Depth Spain Online Commerce Market Market Outlook

The future of the Spain online commerce market is bright, driven by a confluence of factors. Continued technological innovation, expanding infrastructure, and evolving consumer preferences create a favorable environment for sustained growth. Strategic partnerships and market expansion strategies will further strengthen the sector's competitiveness. The market's potential is vast, with opportunities in underserved areas and new product categories to be explored. The forecast period is expected to witness robust growth, driven by the factors discussed above and leading to a significant increase in market size and market share for key players.

Spain Online Commerce Market Segmentation

-

1. Industry vertical

- 1.1. Beauty & Personal Care

- 1.2. Consumer Electronics

- 1.3. Fashion & Apparel

- 1.4. Food & Beverage

- 1.5. Furniture & Home

- 1.6. Others (Toys, DIY, Media, etc.)

-

2. Type

- 2.1. B2C E-commerce

- 2.2. B2B E-commerce

Spain Online Commerce Market Segmentation By Geography

- 1. Spain

Spain Online Commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Smartphone Users and Increasing Use of Healthcare Applications; Rising Prevalence of Chronic Disorders

- 3.3. Market Restrains

- 3.3.1. Lack of Structured Data in the Healthcare Industry; Concerns Regarding Data Privacy

- 3.4. Market Trends

- 3.4.1. Increasing smartphone penetration

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Online Commerce Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Industry vertical

- 5.1.1. Beauty & Personal Care

- 5.1.2. Consumer Electronics

- 5.1.3. Fashion & Apparel

- 5.1.4. Food & Beverage

- 5.1.5. Furniture & Home

- 5.1.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. B2C E-commerce

- 5.2.2. B2B E-commerce

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Industry vertical

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Decathlon Spain

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 eBay Spain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 El Corte Ingles

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Milanuncios

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Carrefour Spain

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Media Markt Spain

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Leroy Merlin

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PC Componentes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ali Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amazon Spain

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Decathlon Spain

List of Figures

- Figure 1: Spain Online Commerce Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Online Commerce Market Share (%) by Company 2024

List of Tables

- Table 1: Spain Online Commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Online Commerce Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Spain Online Commerce Market Revenue Million Forecast, by Industry vertical 2019 & 2032

- Table 4: Spain Online Commerce Market Volume K Unit Forecast, by Industry vertical 2019 & 2032

- Table 5: Spain Online Commerce Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Spain Online Commerce Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 7: Spain Online Commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Spain Online Commerce Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Spain Online Commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Spain Online Commerce Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Spain Online Commerce Market Revenue Million Forecast, by Industry vertical 2019 & 2032

- Table 12: Spain Online Commerce Market Volume K Unit Forecast, by Industry vertical 2019 & 2032

- Table 13: Spain Online Commerce Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Spain Online Commerce Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 15: Spain Online Commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Spain Online Commerce Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Online Commerce Market?

The projected CAGR is approximately 14.70%.

2. Which companies are prominent players in the Spain Online Commerce Market?

Key companies in the market include Decathlon Spain, eBay Spain, El Corte Ingles, Milanuncios, Carrefour Spain, Media Markt Spain, Leroy Merlin, PC Componentes, Ali Express, Amazon Spain.

3. What are the main segments of the Spain Online Commerce Market?

The market segments include Industry vertical, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Smartphone Users and Increasing Use of Healthcare Applications; Rising Prevalence of Chronic Disorders.

6. What are the notable trends driving market growth?

Increasing smartphone penetration.

7. Are there any restraints impacting market growth?

Lack of Structured Data in the Healthcare Industry; Concerns Regarding Data Privacy.

8. Can you provide examples of recent developments in the market?

May 2022- Artificial intelligence (AI) has changed the pattern of fashion business strategies by artificial intelligence (AI). There are numerous ways in which artificial intelligence has aided the fashion industry. This includes recognizing product features using predictive analytics and computer vision. The use of AI in the fashion industry has grown, primarily to analyze search behaviors and provide similar product recommendations based on consumer preferences.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Online Commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Online Commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Online Commerce Market?

To stay informed about further developments, trends, and reports in the Spain Online Commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence