Key Insights

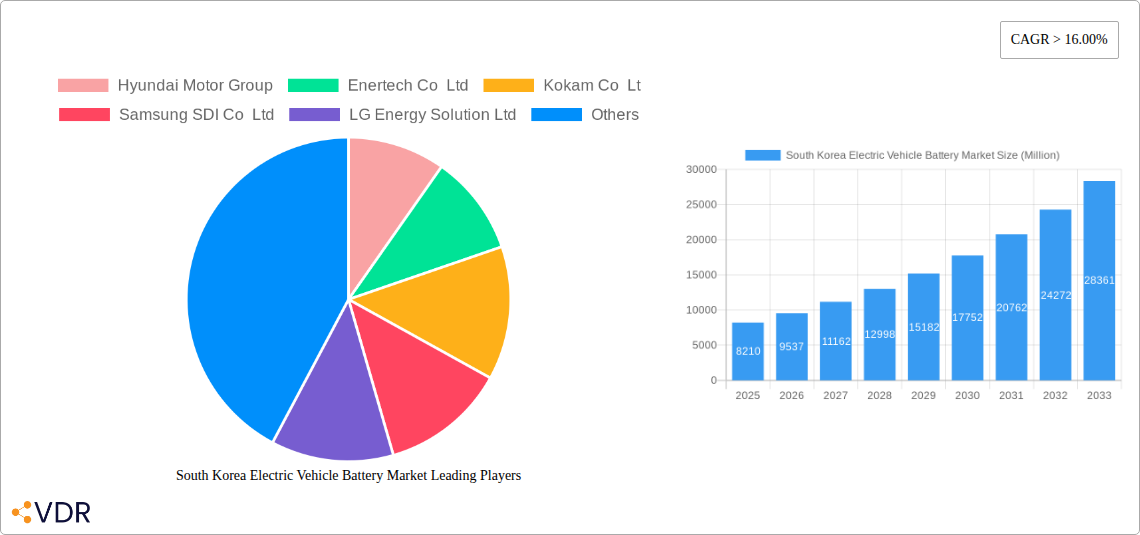

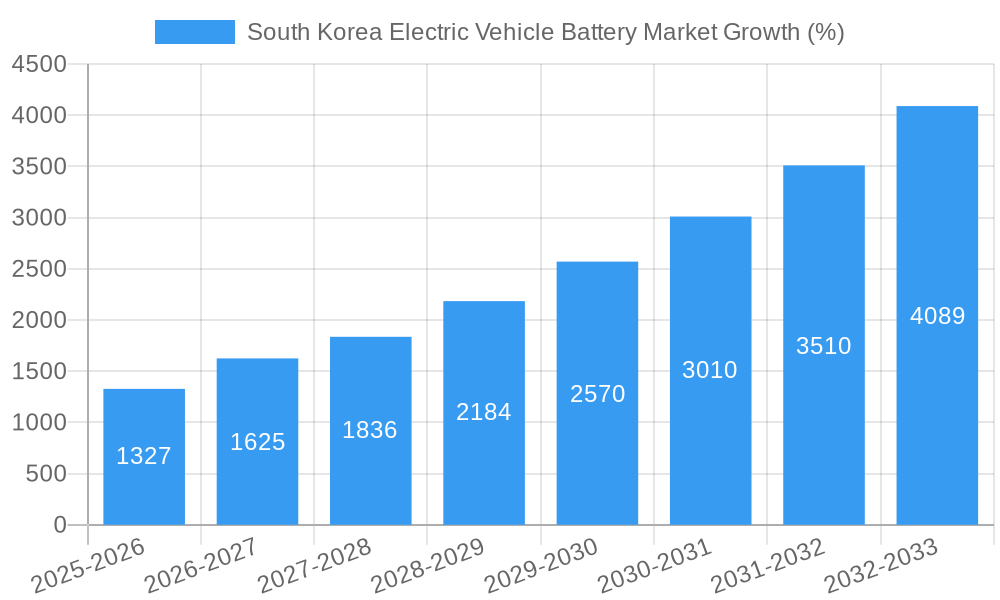

The South Korean electric vehicle (EV) battery market, valued at $8.21 billion in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 16% from 2025 to 2033. This robust expansion is driven by South Korea's strong government support for EV adoption, a burgeoning domestic EV manufacturing sector, and the increasing global demand for electric vehicles. Key market drivers include the government's ambitious targets for EV penetration, substantial investments in battery research and development, and the presence of globally competitive battery manufacturers like LG Energy Solution, Samsung SDI, and SK Innovation within the country. Furthermore, the growing consumer preference for eco-friendly transportation and advancements in battery technology, particularly in lithium-ion batteries offering improved energy density and lifespan, are fueling market growth. The market segmentation reveals a strong preference for lithium-ion batteries over lead-acid counterparts, reflecting the technological advancements and performance advantages of lithium-ion technology in the EV sector. The dominance of South Korean manufacturers in the global EV battery supply chain significantly contributes to the market's overall strength.

However, the market faces certain restraints. Fluctuations in raw material prices, particularly for lithium and cobalt, pose a challenge to consistent growth and profitability. Furthermore, concerns about battery safety and disposal remain a factor requiring ongoing technological advancements and robust regulatory frameworks. The market’s future trajectory will be shaped by the continued innovation in battery technologies, the ongoing expansion of the EV charging infrastructure, and the success of South Korea in maintaining its competitive edge in the global EV battery market. The substantial investment in research and development, particularly focused on solid-state batteries, suggests a promising outlook for continued market expansion and technological leadership in the coming years. Analyzing the segment by vehicle type, Battery Electric Vehicles (BEVs) are expected to hold the largest market share, reflecting the growing consumer preference for fully electric vehicles.

South Korea Electric Vehicle Battery Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South Korea electric vehicle (EV) battery market, encompassing market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market (South Korea's overall automotive industry) and the child market (EV batteries specifically), providing a nuanced understanding of market forces. Expected market size values are presented in million units.

South Korea Electric Vehicle Battery Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the South Korean EV battery market. The market is characterized by a moderately high concentration, with key players like LG Energy Solution, Samsung SDI, and SK Innovation holding significant market share. Technological innovation, driven by the demand for higher energy density and faster charging, is a key driver. Stringent government regulations regarding battery safety and performance significantly shape the market. The rise of alternative energy storage solutions presents competitive pressure, while mergers and acquisitions (M&A) activity remains a prominent aspect of market consolidation.

- Market Concentration: High (xx%), with top 3 players holding xx% combined market share in 2024.

- Technological Innovation: Focus on solid-state batteries, improved thermal management, and increased energy density.

- Regulatory Framework: Stringent safety standards and environmental regulations impacting battery production and disposal.

- Competitive Substitutes: Advancements in fuel cell technology and alternative energy sources pose potential threats.

- M&A Trends: Consistent M&A activity observed, with xx major deals recorded between 2019 and 2024.

- End-User Demographics: Growing adoption amongst younger demographics and urban populations.

South Korea Electric Vehicle Battery Market Growth Trends & Insights

The South Korea EV battery market is experiencing robust growth, driven by increasing EV adoption, government support for the EV industry, and technological advancements in battery technology. The market size has expanded significantly from xx million units in 2019 to xx million units in 2024, exhibiting a CAGR of xx% during the historical period. Technological disruptions, such as the transition from lead-acid to lithium-ion batteries, are further fueling market expansion. Shifting consumer preferences towards environmentally friendly vehicles are also contributing to market growth. The forecast period (2025-2033) predicts continued expansion, with a projected CAGR of xx%, reaching xx million units by 2033. Market penetration is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in South Korea Electric Vehicle Battery Market

The South Korean EV battery market is largely driven by the strong domestic demand for EVs, particularly in urban areas. The Lithium-ion battery segment dominates by a significant margin due to its superior energy density and performance characteristics. The Battery Electric Vehicles (BEV) segment leads the vehicle type category, followed by Plug-in Hybrid Electric Vehicles (PHEV). Government policies encouraging EV adoption and substantial investments in battery technology research and development are key growth accelerators.

- By Battery Type: Lithium-ion batteries dominate (xx%), followed by lead-acid batteries (xx%) and other battery types (xx%).

- By Vehicle Type: BEVs lead the market (xx%), followed by PHEVs (xx%) and HEVs (xx%).

- Regional Dominance: Urban areas like Seoul and Gyeonggi-do show the highest concentration of EV adoption and battery demand.

South Korea Electric Vehicle Battery Market Product Landscape

The South Korean EV battery market showcases a diverse range of lithium-ion battery chemistries, including NMC (Nickel Manganese Cobalt), LFP (Lithium Iron Phosphate), and NCA (Nickel Cobalt Aluminum). These batteries are designed for various EV applications, optimized for energy density, power output, lifespan, and safety. Continuous improvements in cell design, materials science, and battery management systems are driving performance enhancements and cost reductions. The focus is on developing high-energy-density batteries with fast charging capabilities and improved thermal stability to meet growing consumer demand and enhance safety.

Key Drivers, Barriers & Challenges in South Korea Electric Vehicle Battery Market

Key Drivers:

- Government Incentives: Significant government investments in R&D and supportive policies accelerate market growth.

- Technological Advancements: Innovations in battery chemistry and manufacturing improve performance and reduce costs.

- Rising EV Adoption: Growing consumer preference for eco-friendly transportation fuels market expansion.

Key Challenges:

- Supply Chain Disruptions: Global supply chain vulnerabilities impact raw material availability and production costs.

- Safety Concerns: Recent EV fire incidents highlight the need for enhanced safety standards and regulations.

- Price Competitiveness: The cost of EV batteries remains a barrier to wider adoption, necessitating continued cost reduction efforts.

Emerging Opportunities in South Korea Electric Vehicle Battery Market

- Second-life Battery Applications: Exploring opportunities for repurposing used EV batteries in stationary energy storage systems.

- Advanced Battery Technologies: Research and development in solid-state batteries and other next-generation technologies.

- Smart Battery Management Systems: Development of sophisticated BMS to enhance battery performance, safety, and longevity.

Growth Accelerators in the South Korea Electric Vehicle Battery Market Industry

Continued government support, substantial investments in R&D, and collaborative efforts between industry players and research institutions are crucial growth catalysts. Technological breakthroughs in battery chemistry and manufacturing processes, along with strategic partnerships and expansions into new markets, will further propel market growth.

Key Players Shaping the South Korea Electric Vehicle Battery Market Market

- Hyundai Motor Group

- Enertech Co Ltd

- Kokam Co Ltd

- Samsung SDI Co Ltd

- LG Energy Solution Ltd

- Kia Corporation

- ECOPROBM Co Ltd

- SK Innovation Co Ltd

- POSCO Energy

Notable Milestones in South Korea Electric Vehicle Battery Market Sector

- April 2023: USD 15 billion investment in advanced battery technologies announced.

- May 2023: Stricter safety standards called for following EV fire incidents.

In-Depth South Korea Electric Vehicle Battery Market Market Outlook

The South Korea EV battery market is poised for continued strong growth, driven by technological advancements, supportive government policies, and a rising demand for EVs. Strategic partnerships, investments in R&D, and focus on improving battery safety and performance will shape the future of the market. The market presents significant opportunities for both established players and new entrants, with the potential for substantial market expansion in the coming years.

South Korea Electric Vehicle Battery Market Segmentation

-

1. Battery Type

- 1.1. Lead-acid Battery

- 1.2. Lithium-ion Battery

- 1.3. Other Battery Types

-

2. Vehicle Type

- 2.1. Battery Electric Vehicles

- 2.2. Hybrid Electric Vehicles

- 2.3. Plug-in Hybrid Electric Vehicles

South Korea Electric Vehicle Battery Market Segmentation By Geography

- 1. South Korea

South Korea Electric Vehicle Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 16.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Electric Vehicle Sales is Likely to Fuel the Demand

- 3.3. Market Restrains

- 3.3.1. Limited Raw Material Resources Could Hinder the Price Equilibrium

- 3.4. Market Trends

- 3.4.1. Increasing Electric Vehicle Charging Station will Possess a Positive Outlook

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Electric Vehicle Battery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lead-acid Battery

- 5.1.2. Lithium-ion Battery

- 5.1.3. Other Battery Types

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Battery Electric Vehicles

- 5.2.2. Hybrid Electric Vehicles

- 5.2.3. Plug-in Hybrid Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hyundai Motor Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Enertech Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kokam Co Lt

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samsung SDI Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LG Energy Solution Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kia Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ECOPROBM Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SK Innovation Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 POSCO Energy

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Hyundai Motor Group

List of Figures

- Figure 1: South Korea Electric Vehicle Battery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Electric Vehicle Battery Market Share (%) by Company 2024

List of Tables

- Table 1: South Korea Electric Vehicle Battery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Electric Vehicle Battery Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 3: South Korea Electric Vehicle Battery Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: South Korea Electric Vehicle Battery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Korea Electric Vehicle Battery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Korea Electric Vehicle Battery Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 7: South Korea Electric Vehicle Battery Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 8: South Korea Electric Vehicle Battery Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Electric Vehicle Battery Market?

The projected CAGR is approximately > 16.00%.

2. Which companies are prominent players in the South Korea Electric Vehicle Battery Market?

Key companies in the market include Hyundai Motor Group, Enertech Co Ltd, Kokam Co Lt, Samsung SDI Co Ltd, LG Energy Solution Ltd, Kia Corporation, ECOPROBM Co Ltd, SK Innovation Co Ltd, POSCO Energy.

3. What are the main segments of the South Korea Electric Vehicle Battery Market?

The market segments include Battery Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Electric Vehicle Sales is Likely to Fuel the Demand.

6. What are the notable trends driving market growth?

Increasing Electric Vehicle Charging Station will Possess a Positive Outlook.

7. Are there any restraints impacting market growth?

Limited Raw Material Resources Could Hinder the Price Equilibrium.

8. Can you provide examples of recent developments in the market?

May 2023: South Korea called for stricter safety standards regarding electric vehicle (EV) fires following recent incidents. The South Korean Ministry of Trade, Industry, and Energy stated that it will enhance safety standards for EV batteries and charging facilities, conduct risk assessments, and improve response measures. These actions aim to ensure the safety of EVs and boost consumer confidence in the technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Electric Vehicle Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Electric Vehicle Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Electric Vehicle Battery Market?

To stay informed about further developments, trends, and reports in the South Korea Electric Vehicle Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence