Key Insights

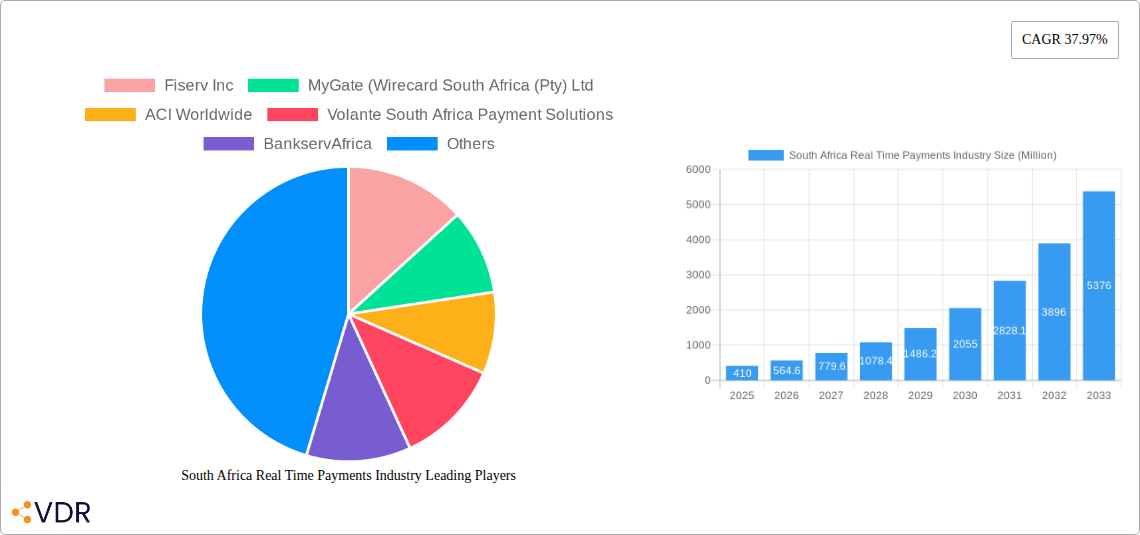

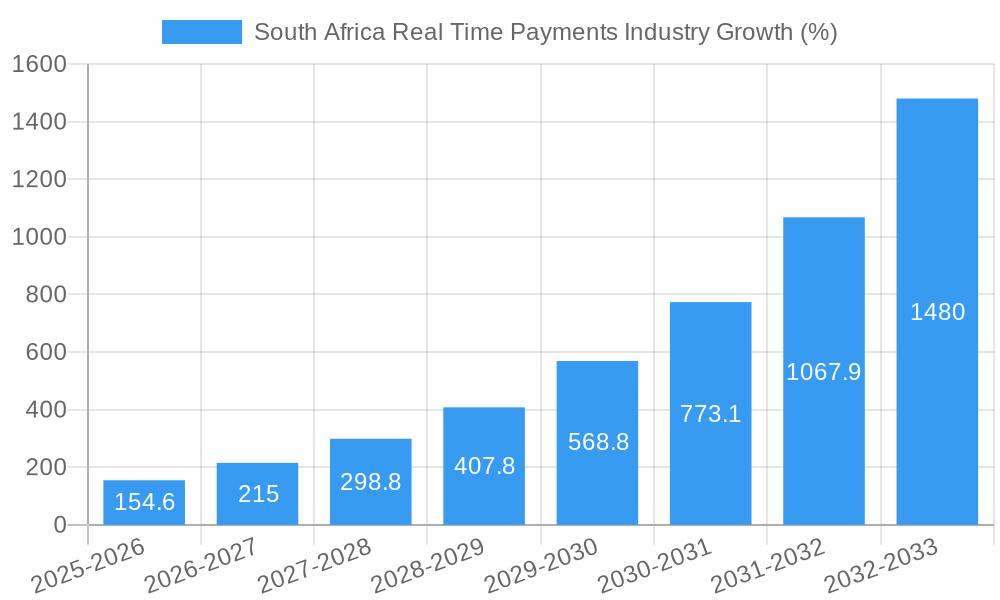

The South African real-time payments (RTP) industry is experiencing explosive growth, projected to reach a significant market size driven by increasing smartphone penetration, a burgeoning digital economy, and a growing preference for convenient, instant transactions. The 37.97% Compound Annual Growth Rate (CAGR) from 2019 to 2024 signifies a rapid adoption of RTP systems across various segments. This growth is fueled by the rising popularity of Person-to-Person (P2P) payments, facilitated by mobile money platforms and fintech innovations, along with increasing demand for Person-to-Business (P2B) payments for streamlined business operations. Key players like Fiserv, MyGate, and ACI Worldwide are capitalizing on this opportunity, contributing to the competitive landscape. Regulatory support and government initiatives promoting digital financial inclusion further bolster the sector's growth trajectory. However, challenges like infrastructure limitations in certain regions and concerns about cybersecurity pose potential restraints. Overcoming these challenges will be crucial for sustainable expansion.

Looking ahead to 2033, the South African RTP market is poised for continued expansion. The estimated market size of 0.41 million in 2025 is projected to increase significantly, driven by factors like increased financial literacy, the expansion of mobile network coverage, and the integration of RTP systems into various sectors such as e-commerce and government services. Continued innovation in payment technology, including the development of more sophisticated and secure systems, is expected to be a key driver of future growth. The competition among established players and new entrants will likely intensify, leading to increased investment in technology and infrastructure improvements. Strategic partnerships and collaborations between fintech companies, banks, and telecommunication providers will be vital for driving wider adoption and achieving greater market penetration across all regions within South Africa.

South Africa Real Time Payments Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Africa real-time payments industry, encompassing market dynamics, growth trends, key players, and future opportunities. The study period covers 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The report leverages extensive data analysis to offer actionable insights for industry professionals, investors, and strategic decision-makers. The parent market is the broader South African financial technology sector, while the child market is specifically real-time payment solutions. This report quantifies market values in millions.

South Africa Real Time Payments Industry Market Dynamics & Structure

This section analyzes the South African real-time payments market's competitive landscape, technological advancements, regulatory environment, and market trends. The market is characterized by a dynamic interplay between established players and innovative fintech startups.

- Market Concentration: The market exhibits a moderately concentrated structure, with key players such as BankservAfrica holding significant market share (xx%). However, the entry of new players and technological advancements are gradually increasing competition.

- Technological Innovation Drivers: The adoption of mobile money, open banking initiatives, and cloud-based solutions are accelerating the growth of real-time payments. Innovation in areas such as biometric authentication and AI-powered fraud detection is also shaping the landscape.

- Regulatory Frameworks: The South African Reserve Bank (SARB) plays a crucial role in shaping the regulatory framework for real-time payments. Regulations related to data privacy, cybersecurity, and consumer protection influence industry practices.

- Competitive Product Substitutes: Traditional payment methods such as cheques and bank transfers face increasing competition from real-time payment options due to their speed and convenience.

- End-User Demographics: The increasing smartphone penetration and digital literacy rates among South Africans are driving the adoption of real-time payment solutions. Younger demographics, in particular, demonstrate a preference for digital payment options.

- M&A Trends: The market has witnessed several mergers and acquisitions (M&As) in recent years, with larger players acquiring smaller fintech companies to expand their product portfolios and market reach. The estimated volume of M&A deals between 2019 and 2024 was xx deals, resulting in a xx% market share shift. Innovation barriers include high initial investment costs, integration complexities, and the need for robust security measures.

South Africa Real Time Payments Industry Growth Trends & Insights

The South African real-time payments market is experiencing robust growth, driven by several factors. Market size increased from xx million in 2019 to xx million in 2024, exhibiting a CAGR of xx%. This upward trajectory is projected to continue, with the market size estimated at xx million in 2025 and forecast to reach xx million by 2033, indicating a substantial CAGR of xx% during the forecast period. Market penetration is expected to increase from xx% in 2024 to xx% by 2033. Several factors contribute to this growth, including increasing smartphone penetration, the expanding digital economy, and government initiatives promoting financial inclusion. Technological advancements, such as the introduction of innovative payment platforms like PayShap, also contribute to market growth. Consumer behavior shifts towards cashless transactions and the increasing preference for real-time payments further fuel this expansion.

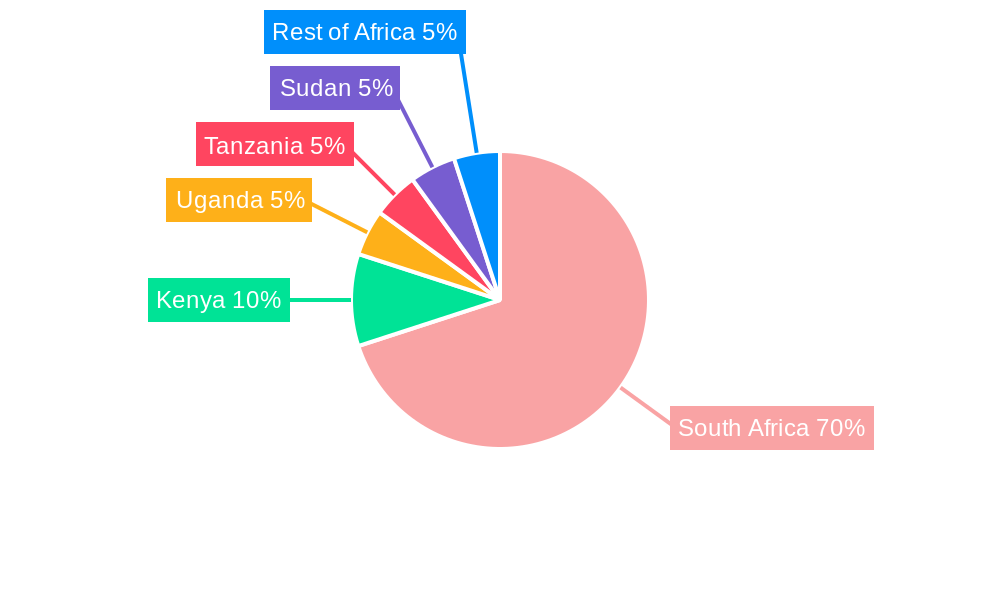

Dominant Regions, Countries, or Segments in South Africa Real Time Payments Industry

The South African real-time payments market is geographically widespread, with significant growth observed across various regions. However, urban areas exhibit higher adoption rates due to better infrastructure and digital literacy. By payment type, the P2P (person-to-person) segment holds the largest market share and is the fastest-growing segment.

- Key Drivers for P2P Segment Growth:

- Increasing smartphone penetration and internet access.

- Growing popularity of mobile money platforms.

- Convenience and speed of P2P transactions.

- Government initiatives promoting financial inclusion.

- Dominance Factors: The P2P segment's dominance stems from the ease of use and widespread adoption of mobile money platforms. The increasing preference for peer-to-peer transactions for personal remittances and social payments contributes to its significant market share. The growth potential of the P2P segment is further amplified by the increasing adoption of super apps and embedded finance solutions.

South Africa Real Time Payments Industry Product Landscape

The South African real-time payments landscape is characterized by a diverse range of products and services. These include mobile payment apps, online banking platforms offering real-time transfers, and specialized real-time payment gateways. Key features include enhanced security measures, user-friendly interfaces, and interoperability across different platforms. Technological advancements such as blockchain technology and AI-driven fraud detection are constantly enhancing the functionality and security of these solutions. Unique selling propositions include features like instant transaction processing, lower transaction fees, and increased convenience.

Key Drivers, Barriers & Challenges in South Africa Real Time Payments Industry

Key Drivers:

- Government Initiatives: The SARB's focus on promoting digital financial inclusion and the launch of initiatives like PayShap are key drivers.

- Technological Advancements: Innovation in mobile payments and digital banking infrastructure is accelerating adoption.

- Increased Smartphone Penetration: The widespread availability of smartphones is facilitating access to real-time payment solutions.

Key Challenges:

- Cybersecurity Threats: The increasing reliance on digital platforms poses significant cybersecurity risks. The cost of mitigating these risks can impact smaller players.

- Financial Inclusion: Reaching underserved populations with limited access to technology and financial literacy remains a challenge. xx% of the population still lacks access to formal banking systems.

- Regulatory Complexity: Navigating the evolving regulatory landscape can be complex and resource-intensive for businesses.

Emerging Opportunities in South Africa Real Time Payments Industry

- Expansion into Underserved Markets: Targeting rural populations and promoting financial inclusion presents significant growth opportunities.

- Integration with Other Financial Services: Combining real-time payments with other financial services, such as lending and insurance, creates new revenue streams.

- Development of Innovative Payment Solutions: Creating tailored solutions for specific industries or consumer segments presents potential.

Growth Accelerators in the South Africa Real Time Payments Industry

The South African real-time payments industry is poised for sustained growth, driven by several factors. Continued technological advancements, strategic partnerships between fintech companies and traditional banks, and expanding market penetration in underserved areas will accelerate market expansion. Government support and policies aimed at promoting financial inclusion will further catalyze growth. The evolution of the industry's infrastructure and the integration of real-time payments with other financial services will further strengthen its position.

Key Players Shaping the South Africa Real Time Payments Industry Market

- Fiserv Inc

- MyGate (Wirecard South Africa (Pty) Ltd)

- ACI Worldwide

- Volante South Africa Payment Solutions

- BankservAfrica

- Pay4it ApS

- Electrum Payments

- Ozow (Pty) Ltd

- PayFast (Pty) Ltd (DPO Group)

- iVeri Payment Technologies

- PayU Payments Private Limited

- BankservAfric

Notable Milestones in South Africa Real Time Payments Industry Sector

- March 2023: Launch of PayShap, a real-time rapid payment platform by the SARB.

- February 2022: ACI Worldwide partners with Nedbank to enhance its real-time payment capabilities.

In-Depth South Africa Real Time Payments Industry Market Outlook

The South African real-time payments market holds significant long-term growth potential. The increasing adoption of digital technologies, coupled with supportive government regulations and a growing digital economy, positions the market for continued expansion. Strategic partnerships, investments in innovative technologies, and a focus on financial inclusion will further drive market growth. The continued development and integration of new payment solutions will solidify the industry's position as a leading player in the African fintech landscape.

South Africa Real Time Payments Industry Segmentation

-

1. Type of Payment

- 1.1. P2P

- 1.2. P2B

South Africa Real Time Payments Industry Segmentation By Geography

- 1. South Africa

South Africa Real Time Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 37.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Smartphone Penetration; Falling Reliance on Traditional Banking; Ease of Convenience

- 3.3. Market Restrains

- 3.3.1. Lack of a standard legislative policy remains especially in the case of cross-border transactions

- 3.4. Market Trends

- 3.4.1. BFSI is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Real Time Payments Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 5.1.1. P2P

- 5.1.2. P2B

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 6. South Africa South Africa Real Time Payments Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Real Time Payments Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Real Time Payments Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Real Time Payments Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Real Time Payments Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Real Time Payments Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Fiserv Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 MyGate (Wirecard South Africa (Pty) Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ACI Worldwide

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Volante South Africa Payment Solutions

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 BankservAfrica

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Pay4it ApS

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Electrum Payments

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Ozow (Pty) Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 PayFast (Pty) Ltd (DPO Group)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 iVeri Payment Technologies

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 PayU Payments Private Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 BankservAfric

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Fiserv Inc

List of Figures

- Figure 1: South Africa Real Time Payments Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Real Time Payments Industry Share (%) by Company 2024

List of Tables

- Table 1: South Africa Real Time Payments Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Real Time Payments Industry Revenue Million Forecast, by Type of Payment 2019 & 2032

- Table 3: South Africa Real Time Payments Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: South Africa Real Time Payments Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: South Africa South Africa Real Time Payments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Sudan South Africa Real Time Payments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Uganda South Africa Real Time Payments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Tanzania South Africa Real Time Payments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kenya South Africa Real Time Payments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Africa South Africa Real Time Payments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Africa Real Time Payments Industry Revenue Million Forecast, by Type of Payment 2019 & 2032

- Table 12: South Africa Real Time Payments Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Real Time Payments Industry?

The projected CAGR is approximately 37.97%.

2. Which companies are prominent players in the South Africa Real Time Payments Industry?

Key companies in the market include Fiserv Inc, MyGate (Wirecard South Africa (Pty) Ltd, ACI Worldwide, Volante South Africa Payment Solutions, BankservAfrica, Pay4it ApS, Electrum Payments, Ozow (Pty) Ltd, PayFast (Pty) Ltd (DPO Group), iVeri Payment Technologies, PayU Payments Private Limited, BankservAfric.

3. What are the main segments of the South Africa Real Time Payments Industry?

The market segments include Type of Payment.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Smartphone Penetration; Falling Reliance on Traditional Banking; Ease of Convenience.

6. What are the notable trends driving market growth?

BFSI is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of a standard legislative policy remains especially in the case of cross-border transactions.

8. Can you provide examples of recent developments in the market?

March 2023: The South African Reserve Bank (SARB) has announced the launch of PayShap, a real-time rapid payment platform that aims to provide South Africans with safer, quicker, and noticeably more comfortable payment choices. BankservAfrica, the Payments Association of South Africa, and the South African banking community collaborated across industries to create PayShap to modernize the domestic payments business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Real Time Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Real Time Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Real Time Payments Industry?

To stay informed about further developments, trends, and reports in the South Africa Real Time Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence