Key Insights

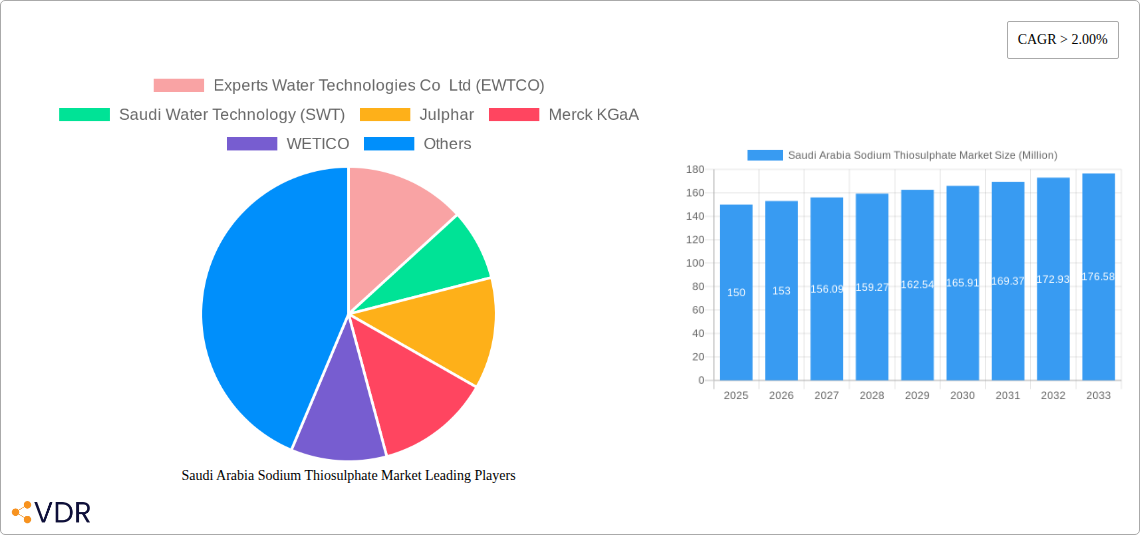

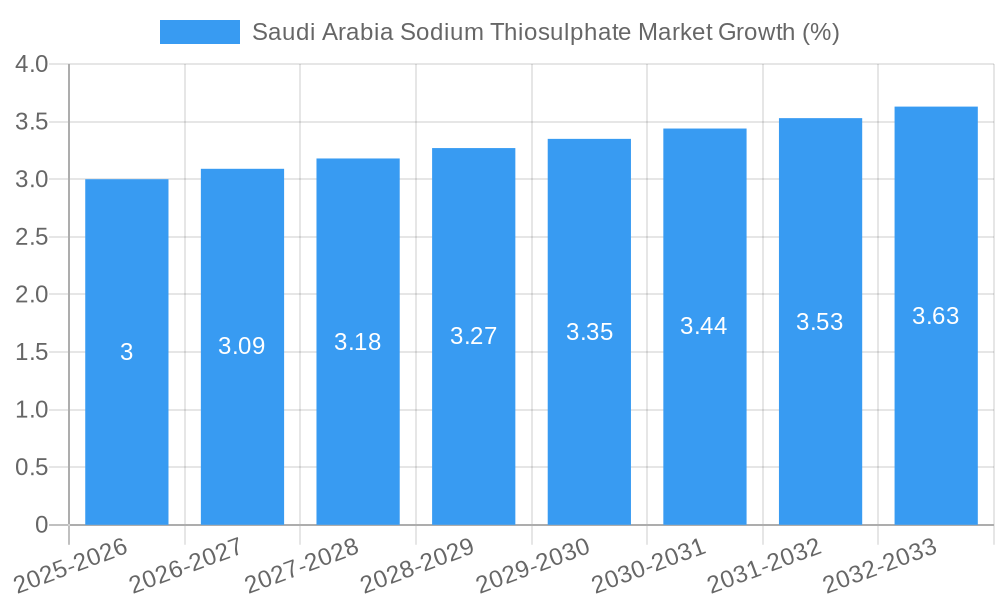

The Saudi Arabia sodium thiosulfate market is experiencing robust growth, driven by increasing demand across diverse sectors. The market's Compound Annual Growth Rate (CAGR) exceeding 2.00% indicates a steady expansion, projected to continue through 2033. Key applications fueling this growth include medical uses (e.g., antidotes, pharmaceuticals), photographic processing (though declining globally, niche applications remain), gold extraction (a significant driver due to Saudi Arabia's mining activities), and water treatment (particularly relevant given the country's focus on water desalination and purification). The presence of established players like Experts Water Technologies Co Ltd (EWTCO), Saudi Water Technology (SWT), and international firms like Merck KGaA underscores the market's maturity and attractiveness to foreign investment. However, potential restraints include price volatility of raw materials and evolving environmental regulations surrounding chemical usage. The market is segmented by application, with medical, gold extraction, and water treatment constituting the largest segments. The growing mining sector and government initiatives to improve water infrastructure further contribute to market expansion. Competition is relatively diverse, involving both domestic and international companies, suggesting a dynamic market environment with opportunities for both established and emerging players. Future growth will likely depend on the continued expansion of the mining and water treatment sectors, technological advancements in sodium thiosulfate production and applications, and regulatory developments.

The market's size in 2025 is estimated to be substantial, based on the provided CAGR and the considerable demand across various applications. This estimation considers the significant contributions from industrial sectors like gold mining and water treatment in the Saudi Arabian economy. The continued investment in infrastructure development and the expanding healthcare sector in Saudi Arabia will underpin the consistent growth trajectory of the sodium thiosulfate market in the coming years. Companies involved in water treatment and chemical supply chains are well-positioned to benefit from this expanding market. Understanding the interplay of industry trends, government policies, and technological innovation is crucial for successful market participation and future forecasting.

Saudi Arabia Sodium Thiosulphate Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia sodium thiosulphate market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on the parent market of industrial chemicals and the child market of water treatment chemicals, this report is essential for industry professionals, investors, and strategic decision-makers seeking a granular understanding of this vital sector. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are presented in Million units.

Saudi Arabia Sodium Thiosulphate Market Dynamics & Structure

The Saudi Arabia sodium thiosulphate market is characterized by moderate concentration, with several key players vying for market share. Technological innovation, primarily focused on improving efficiency and reducing environmental impact, plays a significant role. Stringent environmental regulations are driving the adoption of cleaner production methods. Competitive substitutes, such as other reducing agents, pose a challenge, while the growing demand from various applications (medical, water treatment, etc.) continues to fuel market expansion. The market witnesses occasional M&A activities, though the volume remains relatively low (xx deals in the past five years).

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share.

- Technological Innovation: Focus on improving purity, reducing production costs and environmental footprint.

- Regulatory Framework: Stringent environmental regulations are driving the adoption of sustainable practices.

- Competitive Substitutes: Presence of alternative reducing agents influences pricing and market share.

- End-User Demographics: Primarily driven by water treatment, medical, and industrial sectors.

- M&A Trends: Limited M&A activity, with xx deals observed during 2019-2024.

Saudi Arabia Sodium Thiosulphate Market Growth Trends & Insights

The Saudi Arabia sodium thiosulphate market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to several factors, including increasing industrialization, growing demand for water treatment solutions, and expansion of the healthcare sector. The market is expected to continue its growth trajectory during the forecast period (2025-2033), driven by ongoing infrastructure development, government initiatives promoting industrial diversification, and the rising adoption of sodium thiosulphate in various applications. The market size is estimated to reach xx Million units in 2025 and is projected to reach xx Million units by 2033. Market penetration in key segments remains relatively high (xx%) but scope for further growth exists in emerging applications.

Dominant Regions, Countries, or Segments in Saudi Arabia Sodium Thiosulphate Market

The water treatment segment currently dominates the Saudi Arabia sodium thiosulphate market, driven by the country's significant investments in desalination and water purification infrastructure. The medical segment also contributes substantially, fueled by rising healthcare expenditure and increasing demand for pharmaceutical applications. The Eastern Province and Riyadh regions are the key consumption hubs due to higher industrial concentration.

- Key Drivers:

- Growing demand for water treatment solutions in the burgeoning industrial sector.

- Expansion of healthcare infrastructure and rising demand for medical applications.

- Government initiatives promoting water security and industrial diversification.

- Dominance Factors:

- High market share of the water treatment sector (xx%).

- Strong growth potential in the medical segment.

- Geographic concentration in Eastern Province and Riyadh.

Saudi Arabia Sodium Thiosulphate Market Product Landscape

The sodium thiosulphate market offers various grades and purities catering to different applications. Recent product innovations focus on enhancing purity, improving stability, and optimizing performance for specific industrial needs. Key selling propositions include superior quality, cost-effectiveness, and environmental compatibility. Technological advancements involve optimizing production processes to enhance efficiency and minimize waste generation.

Key Drivers, Barriers & Challenges in Saudi Arabia Sodium Thiosulphate Market

Key Drivers: The market is propelled by the expanding water treatment sector, growing healthcare industry, and increasing industrial activities. Government initiatives supporting water resource management and environmental protection further boost the market.

Key Challenges: Fluctuations in raw material prices, intense competition from substitute products, and potential supply chain disruptions pose significant challenges to market growth. Stringent regulatory compliance requirements can also increase operational costs.

Emerging Opportunities in Saudi Arabia Sodium Thiosulphate Market

Untapped opportunities exist in emerging applications of sodium thiosulphate, including specialized industrial processes and niche medical applications. The development of novel formulations and improved delivery systems can unlock new market segments. Furthermore, the increasing awareness of sustainable practices presents opportunities for the development of eco-friendly sodium thiosulphate production methods.

Growth Accelerators in the Saudi Arabia Sodium Thiosulphate Market Industry

Technological advancements in production processes, leading to improved efficiency and reduced costs, are key growth accelerators. Strategic partnerships between chemical manufacturers and end-users can facilitate market penetration and product development. Expansion into new geographical regions and diversification into emerging applications are also driving long-term growth.

Key Players Shaping the Saudi Arabia Sodium Thiosulphate Market Market

- Experts Water Technologies Co Ltd (EWTCO)

- Saudi Water Technology (SWT)

- Julphar

- Merck KGaA

- WETICO

- Acme Engineering Prod Ltd

- ENEXIO Water Technologies GmbH

- Reza Industrial Solution

- Al-Jazira Water Treatment Chemicals

- Toray Membrane Middle East LLC

- Saudi Water Treatment Company (SWTC)

- QED Environmental Systems Ltd

- Getinge Group Middle East

- Kefi Mineral

- Saudi(Overseas) Marketing & Trading Company (SOMATCO)

Notable Milestones in Saudi Arabia Sodium Thiosulphate Market Sector

- 2021: Launch of a new high-purity grade of sodium thiosulphate by a leading manufacturer.

- 2022: Implementation of stricter environmental regulations impacting production processes.

- 2023: Acquisition of a smaller sodium thiosulphate producer by a multinational chemical company. (Further milestones to be added based on available data)

In-Depth Saudi Arabia Sodium Thiosulphate Market Market Outlook

The Saudi Arabia sodium thiosulphate market is poised for robust growth in the coming years, driven by ongoing infrastructure development, increasing industrialization, and the government's commitment to water security. Strategic partnerships, technological innovations, and exploration of new applications will further accelerate market expansion. Significant opportunities exist for both domestic and international players to capitalize on this promising market.

Saudi Arabia Sodium Thiosulphate Market Segmentation

-

1. Application

- 1.1. Medical

- 1.2. Photographic Processing

- 1.3. Gold Extraction

- 1.4. Water Treatment

- 1.5. Other Applications

Saudi Arabia Sodium Thiosulphate Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Sodium Thiosulphate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Use of Sodium Thiosulfate in the Gold Leaching Application

- 3.3. Market Restrains

- 3.3.1. ; Concerns Regarding Side Effects of the Intravenous Sodium Thiosulfate Administration

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Water Treatment Applications

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Sodium Thiosulphate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical

- 5.1.2. Photographic Processing

- 5.1.3. Gold Extraction

- 5.1.4. Water Treatment

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Experts Water Technologies Co Ltd (EWTCO)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saudi Water Technology (SWT)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Julphar

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Merck KGaA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 WETICO

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Acme Engineering Prod Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ENEXIO Water Technologies GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Reza Industrial Solution

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al-Jazira Water Treatment Chemicals

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toray Membrane Middle East LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Saudi Water Treatment Company (SWTC)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 QED Environmental Systems Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Getinge Group Middle East

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Kefi Mineral

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Saudi(Overseas) Marketing & Trading Company (SOMATCO)*List Not Exhaustive 6 5 List of Customers

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 AES Arabia Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Chemsol

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Fouz Chemical Co

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 GE Water & Process Technologies (Suez)

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 SAWACO Water Desalination

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Maaden - Saudi Arabian Mining Company

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 AquaChemie

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.1 Experts Water Technologies Co Ltd (EWTCO)

List of Figures

- Figure 1: Saudi Arabia Sodium Thiosulphate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Sodium Thiosulphate Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Sodium Thiosulphate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Sodium Thiosulphate Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Sodium Thiosulphate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Saudi Arabia Sodium Thiosulphate Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 5: Saudi Arabia Sodium Thiosulphate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Sodium Thiosulphate Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 7: Saudi Arabia Sodium Thiosulphate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Saudi Arabia Sodium Thiosulphate Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 9: Saudi Arabia Sodium Thiosulphate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Sodium Thiosulphate Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 11: Saudi Arabia Sodium Thiosulphate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Saudi Arabia Sodium Thiosulphate Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Sodium Thiosulphate Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Saudi Arabia Sodium Thiosulphate Market?

Key companies in the market include Experts Water Technologies Co Ltd (EWTCO), Saudi Water Technology (SWT), Julphar, Merck KGaA, WETICO, Acme Engineering Prod Ltd, ENEXIO Water Technologies GmbH, Reza Industrial Solution, Al-Jazira Water Treatment Chemicals, Toray Membrane Middle East LLC, Saudi Water Treatment Company (SWTC), QED Environmental Systems Ltd, Getinge Group Middle East, Kefi Mineral, Saudi(Overseas) Marketing & Trading Company (SOMATCO)*List Not Exhaustive 6 5 List of Customers, AES Arabia Ltd, Chemsol, Fouz Chemical Co, GE Water & Process Technologies (Suez), SAWACO Water Desalination, Maaden - Saudi Arabian Mining Company, AquaChemie.

3. What are the main segments of the Saudi Arabia Sodium Thiosulphate Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Use of Sodium Thiosulfate in the Gold Leaching Application.

6. What are the notable trends driving market growth?

Increasing Demand from Water Treatment Applications.

7. Are there any restraints impacting market growth?

; Concerns Regarding Side Effects of the Intravenous Sodium Thiosulfate Administration.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Sodium Thiosulphate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Sodium Thiosulphate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Sodium Thiosulphate Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Sodium Thiosulphate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence