Key Insights

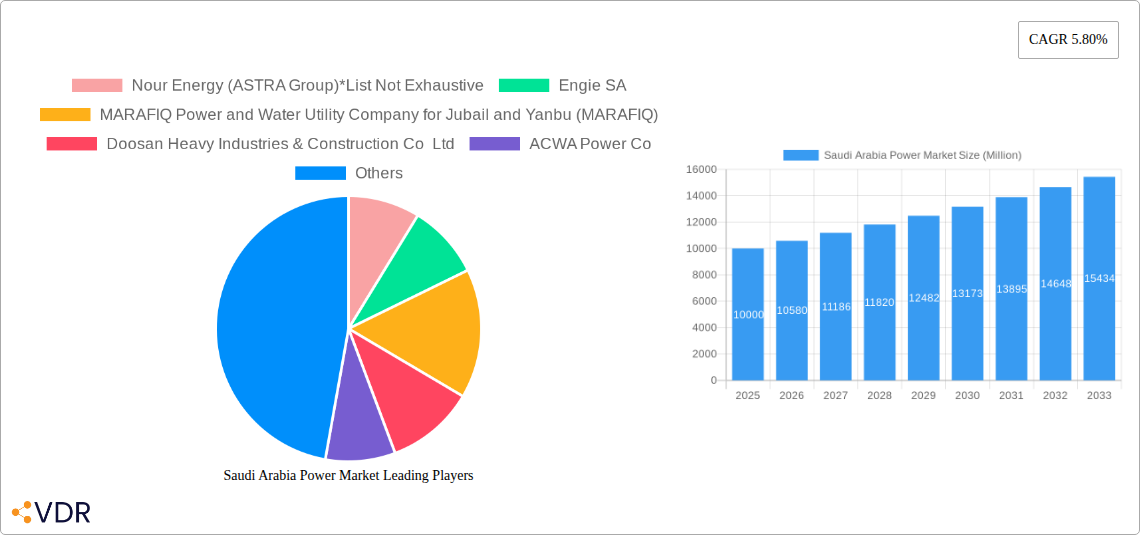

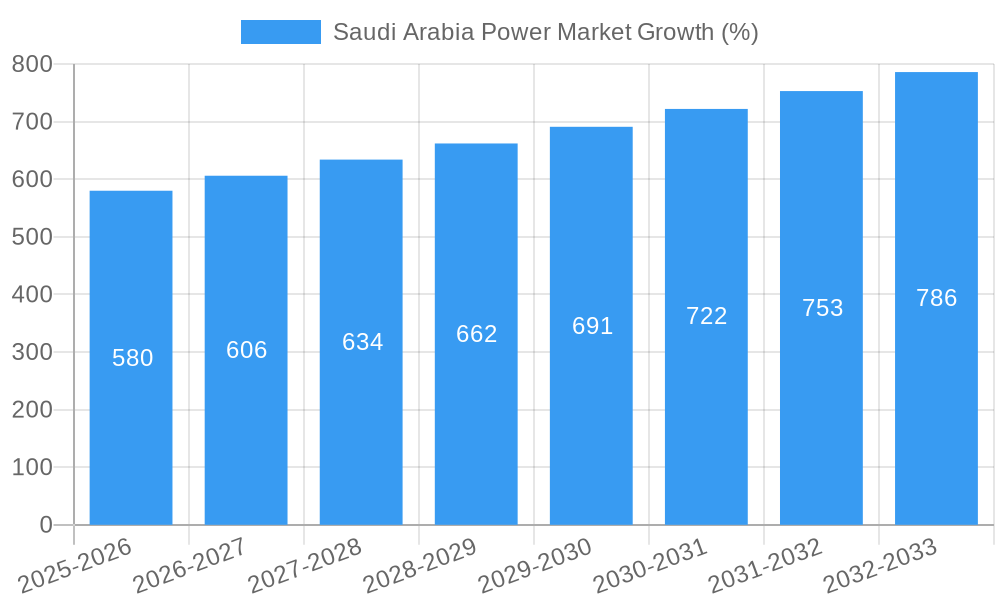

The Saudi Arabian power market is experiencing robust growth, driven by the nation's ambitious Vision 2030 economic diversification plan, which necessitates significant increases in electricity generation and distribution capacity. The market, estimated at approximately $XX million in 2025 (assuming a reasonable market size based on a 5.80% CAGR from a known prior year), is projected to maintain a steady 5.80% Compound Annual Growth Rate (CAGR) through 2033. This growth is fueled by several key factors: increasing industrialization and urbanization leading to higher energy demand; a shift towards renewable energy sources to achieve sustainability goals; and significant investments in large-scale power projects across the country's regions (Central, Eastern, Western, and Southern). The expansion of commercial and industrial sectors, particularly in oil and gas, as well as the growing residential population, contributes significantly to the rising energy demand. Furthermore, the government's focus on enhancing grid infrastructure and improving power transmission and distribution networks supports market expansion.

However, the market also faces challenges. These include the inherent volatility of global energy prices and the need for continuous investments in infrastructure to meet the escalating demands. Furthermore, maintaining grid stability as more renewable sources are integrated and ensuring reliable power supply across diverse geographical regions present ongoing operational hurdles. The market is segmented by installation location (indoor, outdoor), capacity (medium voltage, high voltage), and end-user (commercial & industrial, utility, residential). Key players like ACWA Power, Saudi Electricity Company, and international giants like Engie and EDF are actively shaping the market landscape, competing for large-scale projects and contributing to the country's power generation capacity expansion. The forecast period of 2025-2033 promises considerable opportunities for both domestic and international power sector companies.

Saudi Arabia Power Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia power market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering invaluable insights for industry professionals, investors, and policymakers. The report delves into parent markets (renewable and non-renewable energy generation) and child markets (high and medium voltage power solutions, residential, commercial and industrial end-user segments), providing a granular understanding of the market landscape. Market values are presented in millions of units.

Saudi Arabia Power Market Dynamics & Structure

The Saudi Arabian power market is experiencing significant transformation driven by ambitious national diversification strategies and the global shift towards renewable energy. Market concentration is moderate, with a mix of large international players and domestic entities. Technological innovation, particularly in renewable energy technologies like solar and wind, is a key driver, spurred by government incentives and a commitment to reducing reliance on fossil fuels. The regulatory framework is evolving to support this transition, with policies encouraging private sector participation and investment in renewable energy projects.

- Market Concentration: Moderate, with SEC maintaining significant share but increasing private sector involvement. xx% market share held by top 5 players in 2025.

- Technological Innovation: Strong focus on solar and wind power, driven by Vision 2030 targets. Barriers include initial capital investment and grid integration challenges.

- Regulatory Framework: Supportive of renewable energy adoption through feed-in tariffs and streamlined permitting processes.

- Competitive Product Substitutes: Limited direct substitutes, but efficiency improvements and smart grid technologies present indirect competition.

- End-User Demographics: Rapid urbanization and industrial growth drive demand, with a shift towards commercial and industrial sectors.

- M&A Trends: Increasing activity in renewable energy sector, with several large-scale projects attracting significant investment. xx M&A deals concluded in the renewable energy sector between 2019 and 2024.

Saudi Arabia Power Market Growth Trends & Insights

The Saudi Arabian power market is experiencing robust growth, driven by significant investments in infrastructure development, population growth, and the increasing demand for electricity across residential, commercial, and industrial sectors. The market size (in MW) is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx MW by 2033. This growth is fueled by ambitious government targets for renewable energy integration, particularly through large-scale solar and wind projects. The adoption rate of renewable energy technologies is rapidly increasing, driven by supportive government policies and decreasing technology costs. Technological disruptions are reshaping the industry, with smart grids and energy storage solutions playing an increasingly crucial role. Consumer behavior is shifting towards greater energy efficiency and a growing awareness of sustainable energy sources.

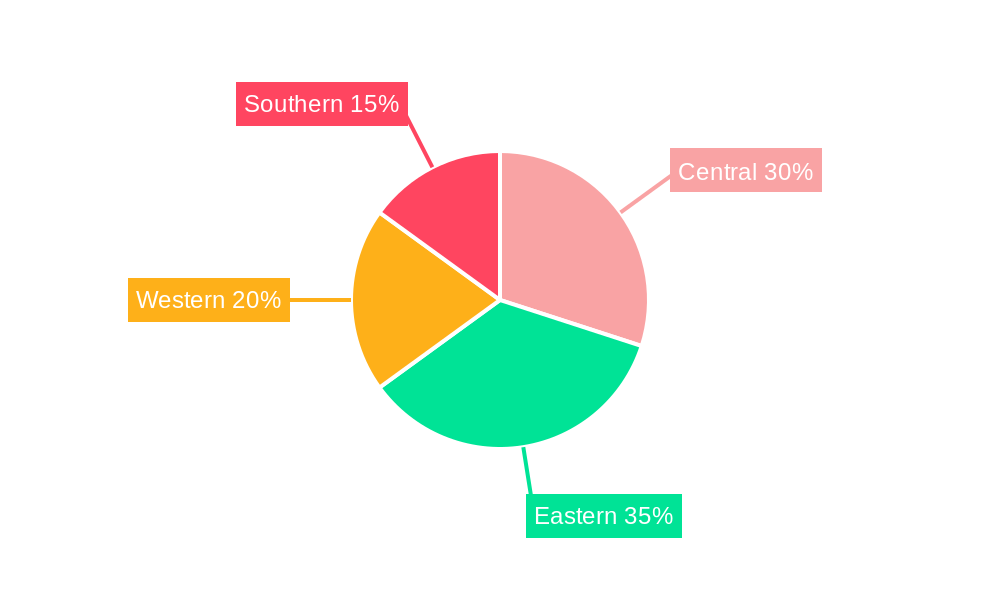

Dominant Regions, Countries, or Segments in Saudi Arabia Power Market

The Saudi Arabian power market exhibits regional variations in growth, primarily driven by differing levels of infrastructure development and economic activity. The Eastern Province, due to its concentration of industrial activities, maintains its position as the dominant region for power consumption and generation. However, substantial investments are being channeled into other regions to ensure widespread access to reliable power. The Utility segment continues to be the largest end-user, accounting for xx% of total consumption in 2025, followed by the Commercial & Industrial sector (xx%) and the Residential sector (xx%). High-voltage capacity projects are dominating the capacity segment due to the large-scale infrastructure projects undertaken.

- Key Drivers: Government investments in infrastructure, industrial growth, urbanization, and supportive renewable energy policies.

- Dominance Factors: High industrial concentration in certain regions, government focus on key infrastructure projects, and the significant size of utility sector.

- Growth Potential: Untapped potential exists in renewable energy adoption across diverse regions and end-user segments.

Saudi Arabia Power Market Product Landscape

The Saudi Arabian power market showcases a dynamic product landscape marked by continuous innovations in renewable energy technologies, smart grid solutions, and energy storage systems. Solar photovoltaic (PV) systems, wind turbines, and hybrid power plants are gaining significant traction. Manufacturers are focusing on improving efficiency, reliability, and cost-effectiveness. These advancements are driving the adoption of sophisticated power management systems, including intelligent energy metering and real-time grid monitoring. Unique selling propositions include localized production strategies, enhanced maintenance services, and integration with advanced analytics platforms to optimize performance and reduce operational costs.

Key Drivers, Barriers & Challenges in Saudi Arabia Power Market

Key Drivers:

- Government initiatives aimed at diversifying the energy mix and reducing carbon emissions.

- Rapid economic growth and industrialization driving electricity demand.

- Significant investments in renewable energy infrastructure projects.

Challenges:

- High initial capital investment costs for renewable energy projects.

- Dependence on imported technology and expertise for certain components.

- Grid integration challenges related to the intermittent nature of renewable energy sources. (Quantifiable impact: xx% delay in project completion due to grid integration challenges).

Emerging Opportunities in Saudi Arabia Power Market

- Increased adoption of microgrids and distributed generation technologies.

- Growing demand for energy storage solutions, improving grid stability.

- Expanding market for energy management systems and smart grid technologies.

- Development of large-scale renewable energy projects for industrial power supply.

Growth Accelerators in the Saudi Arabia Power Market Industry

The long-term growth of the Saudi Arabian power market is propelled by several key accelerators. Technological advancements in renewable energy, particularly in improving energy storage and grid integration capabilities, will significantly enhance the market’s trajectory. Strategic partnerships between international and domestic players will drive knowledge transfer, facilitate technology adoption, and accelerate project implementation. Expanding regional power grids will ensure widespread access to renewable energy and promote economic development across the Kingdom.

Key Players Shaping the Saudi Arabia Power Market Market

- Nour Energy (ASTRA Group)

- Engie SA

- MARAFIQ Power and Water Utility Company for Jubail and Yanbu (MARAFIQ)

- Doosan Heavy Industries & Construction Co Ltd

- ACWA Power Co

- Shandong Electric Power Construction Corporation III (SEPCO III)

- Electricite de France SA (EDF)

- Saudi Electricity Company (SEC) SJSC

- Arabian Electrical Transmission Line Construction Company (AETCON)

- Masdar Abu Dhabi Future Energy Co

Notable Milestones in Saudi Arabia Power Market Sector

- November 2022: ACWA Power signed an agreement to build the world's largest single-site solar power plant (2,060 MW) in Al Shuaibah, commissioning expected in 2025. This significantly boosts renewable energy capacity and demonstrates the Kingdom's commitment to its sustainability goals.

- December 2022: Announcement of 10 new renewable energy projects (7 GW combined capacity). This indicates a strong push towards diversifying the energy mix and achieving renewable energy targets, shaping the future landscape.

- 2024 Target: Saudi Arabia aims to produce 15.1 TWh of renewable energy. This ambitious goal underscores the massive scale of investment and development underway in the sector.

In-Depth Saudi Arabia Power Market Market Outlook

The Saudi Arabian power market is poised for sustained and significant growth, driven by the Kingdom's Vision 2030 and the ongoing investments in renewable energy infrastructure. The transition to a more diversified energy mix presents numerous strategic opportunities for businesses to participate in the development and operation of solar, wind, and hybrid power plants, grid modernization, energy storage, and smart grid technologies. The market's long-term potential is substantial, creating attractive investment prospects and promoting technological advancements in the energy sector.

Saudi Arabia Power Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Saudi Arabia Power Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Diversification of Energy Sources from Oil and Gas to Cleaner Energy Sources4.; Supportive Government Policies for Increasing Renewable Power Capacity

- 3.3. Market Restrains

- 3.3.1. The Unstable Geopolitics of the Country

- 3.4. Market Trends

- 3.4.1. Thermal Power Source to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Central Saudi Arabia Power Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Power Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Power Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Power Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nour Energy (ASTRA Group)*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Engie SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 MARAFIQ Power and Water Utility Company for Jubail and Yanbu (MARAFIQ)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Doosan Heavy Industries & Construction Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ACWA Power Co

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Shandong Electric Power Construction Corporation III (SEPCO III)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Electricite de France SA (EDF)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Saudi Electricity Company (SEC) SJSC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Arabian Electrical Transmission Line Construction Company ( AETCON )

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Masdar Abu Dhabi Future Energy Co

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Nour Energy (ASTRA Group)*List Not Exhaustive

List of Figures

- Figure 1: Saudi Arabia Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Power Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Power Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Power Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Saudi Arabia Power Market Volume gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 5: Saudi Arabia Power Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Saudi Arabia Power Market Volume gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Saudi Arabia Power Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Saudi Arabia Power Market Volume gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Saudi Arabia Power Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Saudi Arabia Power Market Volume gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Saudi Arabia Power Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Saudi Arabia Power Market Volume gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Saudi Arabia Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Saudi Arabia Power Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 15: Saudi Arabia Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Saudi Arabia Power Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 17: Central Saudi Arabia Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Central Saudi Arabia Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Eastern Saudi Arabia Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Eastern Saudi Arabia Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 21: Western Saudi Arabia Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Western Saudi Arabia Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 23: Southern Saudi Arabia Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Southern Saudi Arabia Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 25: Saudi Arabia Power Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 26: Saudi Arabia Power Market Volume gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 27: Saudi Arabia Power Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 28: Saudi Arabia Power Market Volume gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 29: Saudi Arabia Power Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 30: Saudi Arabia Power Market Volume gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 31: Saudi Arabia Power Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 32: Saudi Arabia Power Market Volume gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 33: Saudi Arabia Power Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 34: Saudi Arabia Power Market Volume gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 35: Saudi Arabia Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Saudi Arabia Power Market Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Power Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Saudi Arabia Power Market?

Key companies in the market include Nour Energy (ASTRA Group)*List Not Exhaustive, Engie SA, MARAFIQ Power and Water Utility Company for Jubail and Yanbu (MARAFIQ), Doosan Heavy Industries & Construction Co Ltd, ACWA Power Co, Shandong Electric Power Construction Corporation III (SEPCO III), Electricite de France SA (EDF), Saudi Electricity Company (SEC) SJSC, Arabian Electrical Transmission Line Construction Company ( AETCON ), Masdar Abu Dhabi Future Energy Co.

3. What are the main segments of the Saudi Arabia Power Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Diversification of Energy Sources from Oil and Gas to Cleaner Energy Sources4.; Supportive Government Policies for Increasing Renewable Power Capacity.

6. What are the notable trends driving market growth?

Thermal Power Source to Dominate the Market.

7. Are there any restraints impacting market growth?

The Unstable Geopolitics of the Country.

8. Can you provide examples of recent developments in the market?

November 2022: ACWA Power signed an agreement with Water and Electricity Holding Company (Badeel) to build the world's largest single-site solar-power plant in Al Shuaibah, Mecca province. The plant was projected to have a generation capacity of 2,060 MW and commissioned in 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Power Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence