Key Insights

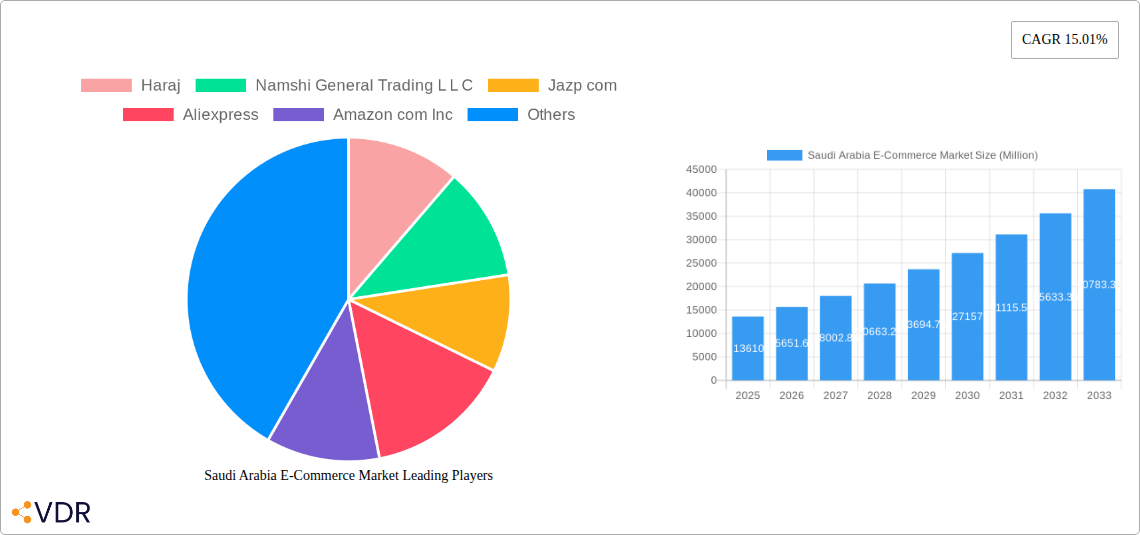

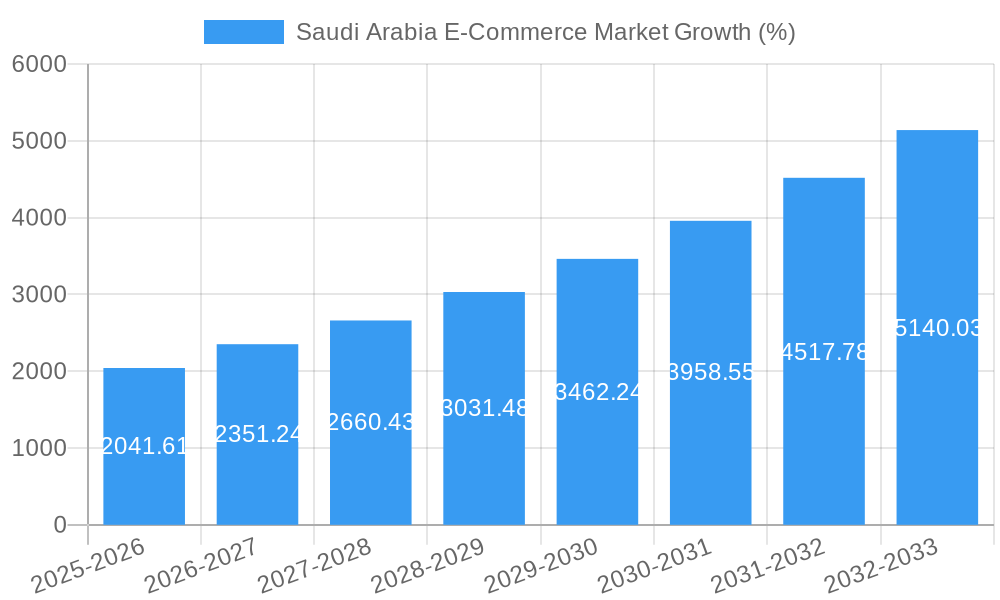

The Saudi Arabian e-commerce market, valued at $13.61 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.01% from 2025 to 2033. This surge is fueled by several key drivers. Rising internet and smartphone penetration are empowering a larger segment of the Saudi population to engage in online shopping. Government initiatives aimed at fostering digital transformation and economic diversification, such as Vision 2030, are creating a supportive regulatory environment. Furthermore, the increasing preference for convenience, wider product selection, and competitive pricing offered by e-commerce platforms are attracting both individual consumers and businesses. The market's segmentation reveals significant opportunities across various product categories, with fashion & apparel, electronics, and grocery leading the way. The B2B segment is also experiencing notable growth as businesses leverage e-commerce for procurement and supply chain management. However, challenges remain, including concerns regarding online payment security, logistics infrastructure limitations in certain regions, and competition from established international players.

Addressing these challenges requires continued investment in robust logistics networks and secure payment gateways. Further, fostering consumer trust through improved consumer protection regulations and initiatives promoting digital literacy will be crucial for sustainable growth. The market's strong growth trajectory and favorable demographics suggest that Saudi Arabia is well-positioned to become a major e-commerce hub in the Middle East and Africa, attracting further investments and technological innovation in the coming years. Competition among established players like Noon, Amazon, and others, combined with the entry of new players, will drive innovation and enhance consumer choice, ultimately benefiting the overall market expansion. Focusing on niche markets and providing localized services will be key for both established and emerging players to achieve success within this dynamic landscape.

Saudi Arabia E-Commerce Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Saudi Arabia e-commerce market, encompassing market dynamics, growth trends, dominant segments, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. This report is essential for businesses, investors, and industry professionals seeking to understand and capitalize on the opportunities within this rapidly evolving market. High-growth segments including Fashion & Apparel, Electronics, and Grocery are analyzed in detail, along with key players like Noon, Amazon, and others.

Saudi Arabia E-Commerce Market Dynamics & Structure

The Saudi Arabian e-commerce market is characterized by high growth potential, driven by increasing internet and smartphone penetration, a young and tech-savvy population, and government initiatives promoting digital transformation. However, challenges remain, including infrastructure limitations in certain regions and evolving regulatory frameworks.

Market Concentration: The market is relatively fragmented, with a mix of large international players and local businesses. Noon, Amazon, and others hold significant market share, while smaller players compete intensely. We estimate that the top 5 players control approximately xx% of the market in 2025.

Technological Innovation: Investment in logistics and fintech infrastructure is driving innovation. The adoption of AI, machine learning, and big data analytics is enhancing customer experience and operational efficiency. However, challenges in data security and cybersecurity remain.

Regulatory Framework: Government regulations are evolving to support e-commerce growth, including payment gateway regulations, consumer protection laws and data privacy regulations. These contribute to investor confidence and improved market stability.

Competitive Product Substitutes: Traditional retail remains a significant competitor, although the e-commerce sector's convenience and reach are attracting consumers rapidly.

End-User Demographics: The majority of e-commerce users are individual consumers (xx million in 2025), with a growing B2B and government segment (xx million and xx million respectively in 2025).

M&A Trends: The acquisition of Namshi by Noon in February 2023 highlights the ongoing consolidation within the market. We project xx M&A deals in the forecast period (2025-2033).

- Key Players: Noon, Amazon, AliExpress, Haraj, Namshi, Jazp.com, eBay, Carrefour.

- Market Size (Million USD): 2019 (xx), 2024 (xx), 2025 (xx), 2033 (xx).

- CAGR (2025-2033): xx%

Saudi Arabia E-Commerce Market Growth Trends & Insights

The Saudi Arabian e-commerce market exhibits robust growth, fueled by rising disposable incomes, increasing internet and smartphone penetration, and the government's Vision 2030 initiative. The market is transitioning from early adoption to widespread usage. Technological disruptions, such as the rise of mobile commerce and social commerce, are reshaping consumer behavior. Consumers are increasingly demanding seamless online experiences, including fast delivery, secure payment options, and personalized recommendations. The increasing adoption of mobile payment systems has facilitated a surge in online transactions, alongside a shift in consumer preference toward digital-first shopping habits. Furthermore, the expansion of logistics infrastructure and supportive government policies are key growth catalysts. The market is experiencing a shift from product-centric to experience-centric approaches, with businesses focusing on personalized shopping and brand loyalty programs.

- Market Size (Million USD): Historical (2019-2024), Estimated (2025), Forecast (2026-2033) data are provided in the full report.

- CAGR (2019-2024): xx%

- Market Penetration: xx% in 2025, projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Saudi Arabia E-Commerce Market

The major cities of Riyadh, Jeddah, and Dammam are driving e-commerce growth, owing to higher internet penetration and consumer spending. Within product type segmentation, Fashion & Apparel (xx million USD in 2025) and Electronics (xx million USD in 2025) are currently the leading segments, followed by Grocery, Beauty & Personal Care, Home Décor & Furniture, and Others.

Individual consumers constitute the dominant end-user segment, representing the largest share of market revenue. However, the B2B and Government & Institutions segments are showing strong growth potential, driven by government initiatives and digital transformation across various sectors.

- Leading Region: Riyadh (xx% Market Share in 2025)

- Leading Product Segment: Fashion & Apparel (xx% Market Share in 2025)

- Leading End-User Segment: Individual Consumers (xx% Market Share in 2025)

Saudi Arabia E-Commerce Market Product Landscape

The Saudi Arabian e-commerce market showcases a diverse product landscape, encompassing a wide array of goods and services. Innovations include personalized recommendations, augmented reality (AR) shopping experiences, and improved logistics and delivery networks, resulting in enhanced user experience and competitive advantages. The increasing adoption of omnichannel strategies is also a significant trend in the product landscape, blending both online and offline experiences.

Key Drivers, Barriers & Challenges in Saudi Arabia E-Commerce Market

Key Drivers: Increased internet and smartphone penetration, rising disposable incomes, government support for digital transformation (Vision 2030), and the expansion of logistics and payment infrastructure.

Key Challenges: Concerns about cybersecurity and data privacy, competition from traditional retail, limited logistics infrastructure in some areas, and the need for continuous improvement in digital literacy among consumers. The regulatory landscape is also subject to changes and requires continuous monitoring for compliance.

Emerging Opportunities in Saudi Arabia E-Commerce Market

Untapped potential exists in niche markets, such as specialized e-commerce platforms for specific demographics or product categories. The adoption of technologies like AI for improved customer service and personalized shopping experiences offers significant opportunities. Furthermore, expansion into rural areas with improved infrastructure will unlock new markets and enhance market penetration.

Growth Accelerators in the Saudi Arabia E-Commerce Market Industry

Technological advancements, particularly in areas such as Artificial Intelligence (AI), Big Data analytics and improved logistics networks, continue to fuel growth. Strategic partnerships between e-commerce platforms and local businesses strengthen the market and enhance supply chain efficiency. Moreover, government initiatives focused on digital transformation and infrastructure development are laying the foundation for sustained growth.

Key Players Shaping the Saudi Arabia E-Commerce Market Market

- Haraj

- Namshi General Trading L L C

- Jazp.com

- Aliexpress

- Amazon com Inc

- Carrefour

- eBay Inc

- Noon Ad Holdings Ltd (Noon E-Commerce)

Notable Milestones in Saudi Arabia E-Commerce Market Sector

- December 2022: Sideup, an e-commerce platform developer, secured USD 1.2 million in funding, signaling investor confidence in the sector's growth.

- February 2023: Noon's acquisition of Namshi for USD 335.2 million demonstrates market consolidation and expansion of Noon's fashion and lifestyle offerings.

In-Depth Saudi Arabia E-Commerce Market Market Outlook

The Saudi Arabian e-commerce market is poised for sustained growth, driven by favorable demographics, ongoing technological advancements, and supportive government policies. Opportunities for strategic partnerships, expansion into new market segments, and the adoption of innovative technologies will define the future of this dynamic market. The continued focus on improving logistics, cybersecurity, and consumer protection will strengthen the market's position and attract further foreign investment.

Saudi Arabia E-Commerce Market Segmentation

-

1. Product Type

- 1.1. Fashion & Apparel

- 1.2. Electronics

- 1.3. Grocery

- 1.4. Beauty & Personal Care

- 1.5. Home Décor & Furniture

- 1.6. Others

-

2. End-User

- 2.1. Individual Consumers

- 2.2. Businesses (B2B)

- 2.3. Government & Institutions

Saudi Arabia E-Commerce Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia E-Commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in Internet Penetration and Smartphone Usage; Promotion of E-commerce by the Government Sector

- 3.2.2 including Measures to Strengthen Last-Mile Delivery and Improvise Distribution Centers

- 3.3. Market Restrains

- 3.3.1. Privacy and security concerns

- 3.4. Market Trends

- 3.4.1. Fashion and Apparel Segment is Expected to Grow Exponentially

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fashion & Apparel

- 5.1.2. Electronics

- 5.1.3. Grocery

- 5.1.4. Beauty & Personal Care

- 5.1.5. Home Décor & Furniture

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Individual Consumers

- 5.2.2. Businesses (B2B)

- 5.2.3. Government & Institutions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. UAE Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Haraj

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Namshi General Trading L L C

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Jazp com

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aliexpress

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Amazon com Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Carrefou

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 eBay Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Noon Ad Holdings Ltd (Noon E-Commerce)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Haraj

List of Figures

- Figure 1: Saudi Arabia E-Commerce Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia E-Commerce Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: Saudi Arabia E-Commerce Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 7: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: UAE Saudi Arabia E-Commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: UAE Saudi Arabia E-Commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: South Africa Saudi Arabia E-Commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Saudi Arabia E-Commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Saudi Arabia Saudi Arabia E-Commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Saudi Arabia Saudi Arabia E-Commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of MEA Saudi Arabia E-Commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of MEA Saudi Arabia E-Commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 21: Saudi Arabia E-Commerce Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 22: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 23: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia E-Commerce Market?

The projected CAGR is approximately 15.01%.

2. Which companies are prominent players in the Saudi Arabia E-Commerce Market?

Key companies in the market include Haraj, Namshi General Trading L L C, Jazp com, Aliexpress, Amazon com Inc, Carrefou, eBay Inc, Noon Ad Holdings Ltd (Noon E-Commerce).

3. What are the main segments of the Saudi Arabia E-Commerce Market?

The market segments include Product Type , End-User .

4. Can you provide details about the market size?

The market size is estimated to be USD 13.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet Penetration and Smartphone Usage; Promotion of E-commerce by the Government Sector. including Measures to Strengthen Last-Mile Delivery and Improvise Distribution Centers.

6. What are the notable trends driving market growth?

Fashion and Apparel Segment is Expected to Grow Exponentially.

7. Are there any restraints impacting market growth?

Privacy and security concerns.

8. Can you provide examples of recent developments in the market?

February 2023: The online fashion retailer Namshi, which operated primarily in Saudi Arabia, was acquired by the e-commerce company Noon for a total cash consideration of USD 335.2 million, and this addition of more fashion and lifestyle brands to Noon's digital offering of goods and services in the country

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia E-Commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia E-Commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia E-Commerce Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia E-Commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence