Key Insights

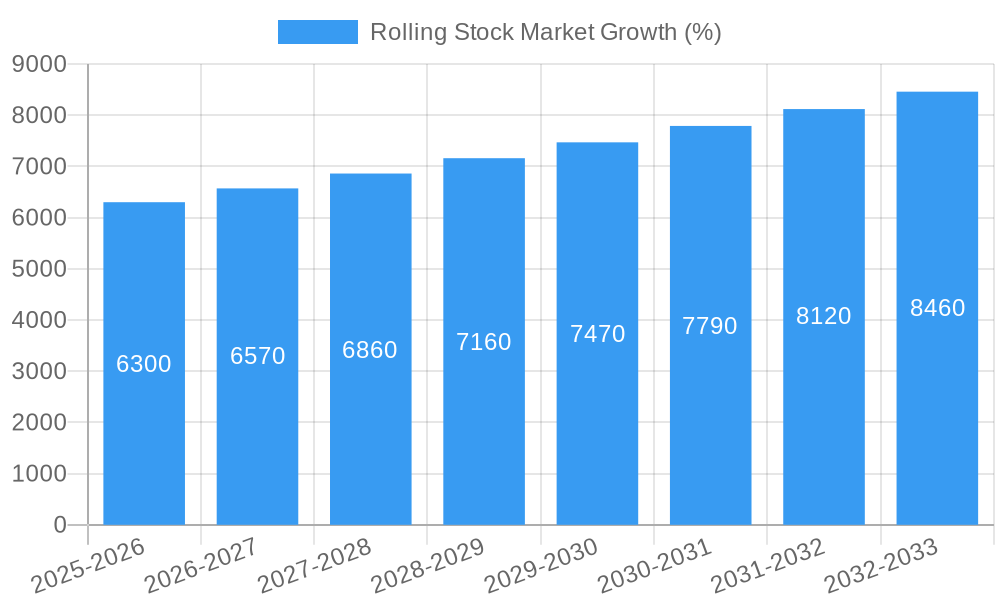

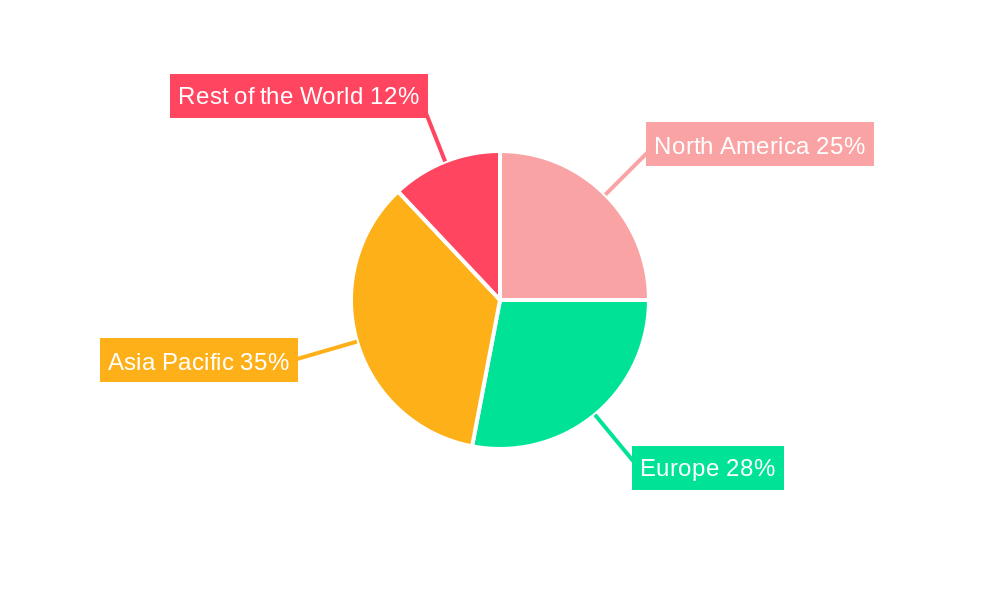

The global rolling stock market is experiencing robust growth, driven by increasing urbanization, expanding passenger and freight transportation networks, and government initiatives to modernize railway infrastructure. A CAGR exceeding 4.20% indicates a significant expansion, with the market valued at (estimated) $XX million in 2025. This growth is fueled by several key factors: a rising demand for high-speed rail systems, particularly in Asia-Pacific and Europe; the electrification of railway lines to reduce emissions and improve efficiency; and the increasing adoption of advanced technologies like digital signaling and predictive maintenance. The market is segmented by type (locomotives, metros, passenger coaches, and others) and propulsion type (diesel, electric, electro-diesel), reflecting diverse technological advancements and infrastructure needs. Electric and electro-diesel propulsion systems are gaining traction due to environmental concerns and the pursuit of sustainable transportation solutions. While robust growth is projected, challenges remain, including high initial investment costs for new rolling stock, supply chain disruptions, and geopolitical factors that can influence project timelines and resource allocation. Major players like CRCC, Transmashholding, Siemens, Alstom, and others are actively engaged in technological innovation and strategic partnerships to enhance their market position and cater to evolving customer demands. The Asia-Pacific region, particularly India and China, is expected to witness significant growth due to substantial investments in railway infrastructure development. North America and Europe also contribute substantially to market growth, driven by modernization projects and increasing passenger traffic.

The forecast period (2025-2033) anticipates continued market expansion, albeit potentially at a slightly moderated pace compared to previous years. This moderation could be attributed to economic fluctuations or the completion of major infrastructure projects in certain regions. However, long-term growth drivers, such as the ongoing transition towards sustainable transportation and the expanding global railway network, will continue to support a healthy market trajectory. The competitive landscape is characterized by both established players and emerging regional manufacturers, leading to innovation and diversification in product offerings. Market participants are increasingly focusing on offering integrated solutions, encompassing rolling stock manufacturing, maintenance, and digital services, to strengthen their market positions and provide comprehensive support to railway operators.

Rolling Stock Market: A Comprehensive Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the global Rolling Stock Market, encompassing its current dynamics, future growth trajectories, and key players. The study covers the historical period (2019-2024), the base year (2025), and forecasts until 2033, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by Type (Locomotives, Metros, Passenger coaches, Other Types) and Propulsion Type (Diesel, Electric, Electro-diesel), providing a granular understanding of market performance across various segments. The total market size is projected to reach xx Million units by 2033.

Rolling Stock Market Dynamics & Structure

The global rolling stock market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Technological innovation, driven by the need for enhanced efficiency, safety, and sustainability, is a key market driver. Stringent regulatory frameworks concerning safety and environmental compliance significantly influence market dynamics. The market also witnesses competitive pressure from alternative transportation modes, such as road and air travel. The increasing demand for efficient public transportation systems, particularly in rapidly urbanizing regions, fuels market growth. Furthermore, mergers and acquisitions (M&A) activities play a crucial role in shaping market consolidation and technological advancements. Over the historical period, the annual M&A deal volume averaged approximately xx deals, with a noticeable increase in activity during recent years.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on automation, digitalization, lightweight materials, and energy-efficient propulsion systems.

- Regulatory Landscape: Stringent safety and environmental regulations impacting product design and operational procedures.

- Competitive Substitutes: Road and air transport present alternative options impacting market share.

- End-User Demographics: Growth driven by increasing urbanization and demand for efficient public transportation.

- M&A Trends: Consolidation through acquisitions and strategic partnerships driving market growth and innovation.

Rolling Stock Market Growth Trends & Insights

The global rolling stock market has experienced substantial growth over the historical period (2019-2024), driven by factors such as increasing infrastructure development, government initiatives promoting public transportation, and technological advancements. The market size, valued at xx Million units in 2024, is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. This growth is largely attributed to the increasing adoption of electric and hybrid rolling stock owing to environmental concerns and government regulations. Technological disruptions, such as the development of autonomous trains and advanced signaling systems, further fuel market expansion. Shifts in consumer behavior, with a growing preference for comfortable and efficient public transportation, contribute to market growth.

Dominant Regions, Countries, or Segments in Rolling Stock Market

The Asia-Pacific region is projected to dominate the rolling stock market throughout the forecast period, driven by substantial investments in infrastructure development, particularly in countries like China and India. Within the market segments, the demand for passenger coaches is expected to remain significant, followed by locomotives and metros. The electric propulsion segment is projected to witness the fastest growth, propelled by governmental initiatives promoting sustainable transportation and the reduction of carbon emissions.

Key Drivers in Asia-Pacific:

- Massive infrastructure investments in high-speed rail and metro projects.

- Government initiatives promoting public transportation.

- Rapid urbanization and population growth.

Dominant Segments:

- Passenger Coaches: Highest demand due to increasing passenger traffic.

- Electric Propulsion: Fastest-growing segment driven by sustainability goals.

Rolling Stock Market Product Landscape

The rolling stock market is characterized by continuous innovation in product design and performance. Manufacturers are focusing on developing lightweight, energy-efficient, and technologically advanced rolling stock to meet evolving customer demands. This includes advancements in materials science, propulsion systems, and onboard technologies such as passenger information systems and Wi-Fi connectivity. Unique selling propositions often focus on improved comfort, safety, and operational efficiency. Technological advancements include the integration of predictive maintenance systems and autonomous driving capabilities.

Key Drivers, Barriers & Challenges in Rolling Stock Market

Key Drivers:

- Increasing investments in public transportation infrastructure globally.

- Growing demand for efficient and sustainable transportation solutions.

- Technological advancements leading to enhanced performance and safety.

Key Challenges & Restraints:

- High initial investment costs associated with rolling stock procurement and infrastructure development.

- Supply chain disruptions and material cost fluctuations impacting profitability.

- Stringent regulatory compliance requirements and safety standards. This increases development time and costs by approximately xx%.

Emerging Opportunities in Rolling Stock Market

The rolling stock market presents several exciting emerging opportunities. The growing adoption of autonomous trains and advanced signaling systems presents a lucrative market segment. Furthermore, the increasing demand for high-speed rail networks in developing countries opens up new market frontiers. Finally, the integration of digital technologies and IoT applications within rolling stock offers considerable growth potential.

Growth Accelerators in the Rolling Stock Market Industry

Long-term growth in the rolling stock market is significantly influenced by ongoing technological breakthroughs in areas such as battery technology for electric trains and improved materials for lightweight construction. Strategic partnerships between rolling stock manufacturers and railway operators are crucial in driving market expansion and securing contracts. The expansion of high-speed rail networks and the development of intermodal transportation solutions further accelerate growth prospects.

Key Players Shaping the Rolling Stock Market Market

- China Railway Construction Corporation Limited (CRCC)

- CJSC Transmashholding

- Siemens AG

- Alstom SA

- Mitsubishi Heavy Industries Lt

- Kawasaki Heavy Industries Ltd

- Wabtec Corporation

- Hyundai Rotem

- Construcciones y Auxiliar de Ferrocarriles SA

- Stadler Rail

Notable Milestones in Rolling Stock Market Sector

- January 2022: Wabtec Corporation acquired MASU, expanding its brake product portfolio and installed base.

- May 2021: SNCF and partners commenced testing an autonomous regional train prototype, marking a significant step towards autonomous rail transport.

In-Depth Rolling Stock Market Market Outlook

The future of the rolling stock market is promising, with sustained growth driven by technological innovations and ongoing infrastructure development. Strategic partnerships and a focus on sustainable and efficient transportation solutions will be key to success. The market's expansion into untapped markets and the adoption of advanced technologies will continue to shape its trajectory, providing significant opportunities for growth and innovation in the coming years.

Rolling Stock Market Segmentation

-

1. Type

- 1.1. Locomotives

- 1.2. Metros

- 1.3. Passenger coaches

- 1.4. Other Types

-

2. Propulsion Type

- 2.1. Diesel

- 2.2. Electric

- 2.3. Electro-diesel

Rolling Stock Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. United Arab Emirates

- 4.3. Other Countries

Rolling Stock Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity for Aftermarket Vehicle Modification May Drive the Market

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations Against Modifications

- 3.4. Market Trends

- 3.4.1. Government Contribution is Promoting to the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rolling Stock Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Locomotives

- 5.1.2. Metros

- 5.1.3. Passenger coaches

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Diesel

- 5.2.2. Electric

- 5.2.3. Electro-diesel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Rolling Stock Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Locomotives

- 6.1.2. Metros

- 6.1.3. Passenger coaches

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.2.1. Diesel

- 6.2.2. Electric

- 6.2.3. Electro-diesel

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Rolling Stock Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Locomotives

- 7.1.2. Metros

- 7.1.3. Passenger coaches

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.2.1. Diesel

- 7.2.2. Electric

- 7.2.3. Electro-diesel

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Rolling Stock Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Locomotives

- 8.1.2. Metros

- 8.1.3. Passenger coaches

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.2.1. Diesel

- 8.2.2. Electric

- 8.2.3. Electro-diesel

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Rolling Stock Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Locomotives

- 9.1.2. Metros

- 9.1.3. Passenger coaches

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.2.1. Diesel

- 9.2.2. Electric

- 9.2.3. Electro-diesel

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Rolling Stock Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Rolling Stock Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Spain

- 11.1.6 Rest of Europe

- 12. Asia Pacific Rolling Stock Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Rolling Stock Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 United Arab Emirates

- 13.1.3 Other Countries

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 China Railway Construction Corporation Limited (CRCC)

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 CJSC Transmashholding

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Siemens AG

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Alstom SA

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Mitsubishi Heavy Industries Lt

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Kawasaki Heavy Industries Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Wabtec Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Hyundai Rotem

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 DescriptionConstrucciones y Auxiliar de Ferrocarriles SA

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Stadler Rail

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 China Railway Construction Corporation Limited (CRCC)

List of Figures

- Figure 1: Global Rolling Stock Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Rolling Stock Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Rolling Stock Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Rolling Stock Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Rolling Stock Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Rolling Stock Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Rolling Stock Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Rolling Stock Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Rolling Stock Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Rolling Stock Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Rolling Stock Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Rolling Stock Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 13: North America Rolling Stock Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 14: North America Rolling Stock Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Rolling Stock Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Rolling Stock Market Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Rolling Stock Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Rolling Stock Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 19: Europe Rolling Stock Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 20: Europe Rolling Stock Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Rolling Stock Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Rolling Stock Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Asia Pacific Rolling Stock Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Asia Pacific Rolling Stock Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 25: Asia Pacific Rolling Stock Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 26: Asia Pacific Rolling Stock Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Rolling Stock Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Rolling Stock Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Rest of the World Rolling Stock Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Rest of the World Rolling Stock Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 31: Rest of the World Rolling Stock Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 32: Rest of the World Rolling Stock Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Rolling Stock Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Rolling Stock Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Rolling Stock Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Rolling Stock Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 4: Global Rolling Stock Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Rolling Stock Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Rolling Stock Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Rolling Stock Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: India Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: China Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Rolling Stock Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Arab Emirates Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Other Countries Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Rolling Stock Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Rolling Stock Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 28: Global Rolling Stock Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of North America Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Rolling Stock Market Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Rolling Stock Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 34: Global Rolling Stock Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Germany Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Kingdom Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: France Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Spain Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Rolling Stock Market Revenue Million Forecast, by Type 2019 & 2032

- Table 42: Global Rolling Stock Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 43: Global Rolling Stock Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: India Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: China Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Korea Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Rolling Stock Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global Rolling Stock Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 51: Global Rolling Stock Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Brazil Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: United Arab Emirates Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Other Countries Rolling Stock Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rolling Stock Market?

The projected CAGR is approximately > 4.20%.

2. Which companies are prominent players in the Rolling Stock Market?

Key companies in the market include China Railway Construction Corporation Limited (CRCC), CJSC Transmashholding, Siemens AG, Alstom SA, Mitsubishi Heavy Industries Lt, Kawasaki Heavy Industries Ltd, Wabtec Corporation, Hyundai Rotem, DescriptionConstrucciones y Auxiliar de Ferrocarriles SA, Stadler Rail.

3. What are the main segments of the Rolling Stock Market?

The market segments include Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity for Aftermarket Vehicle Modification May Drive the Market.

6. What are the notable trends driving market growth?

Government Contribution is Promoting to the Market Growth.

7. Are there any restraints impacting market growth?

Stringent Regulations Against Modifications.

8. Can you provide examples of recent developments in the market?

In January 2022, Wabtec Corporation acquired MASU's a leading manufacturer of friction products in the rail and automotive industry. This acquisition will help Wabtec Corporation to expand its installed base and speed up growth throughout its brake product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rolling Stock Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rolling Stock Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rolling Stock Market?

To stay informed about further developments, trends, and reports in the Rolling Stock Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence