Key Insights

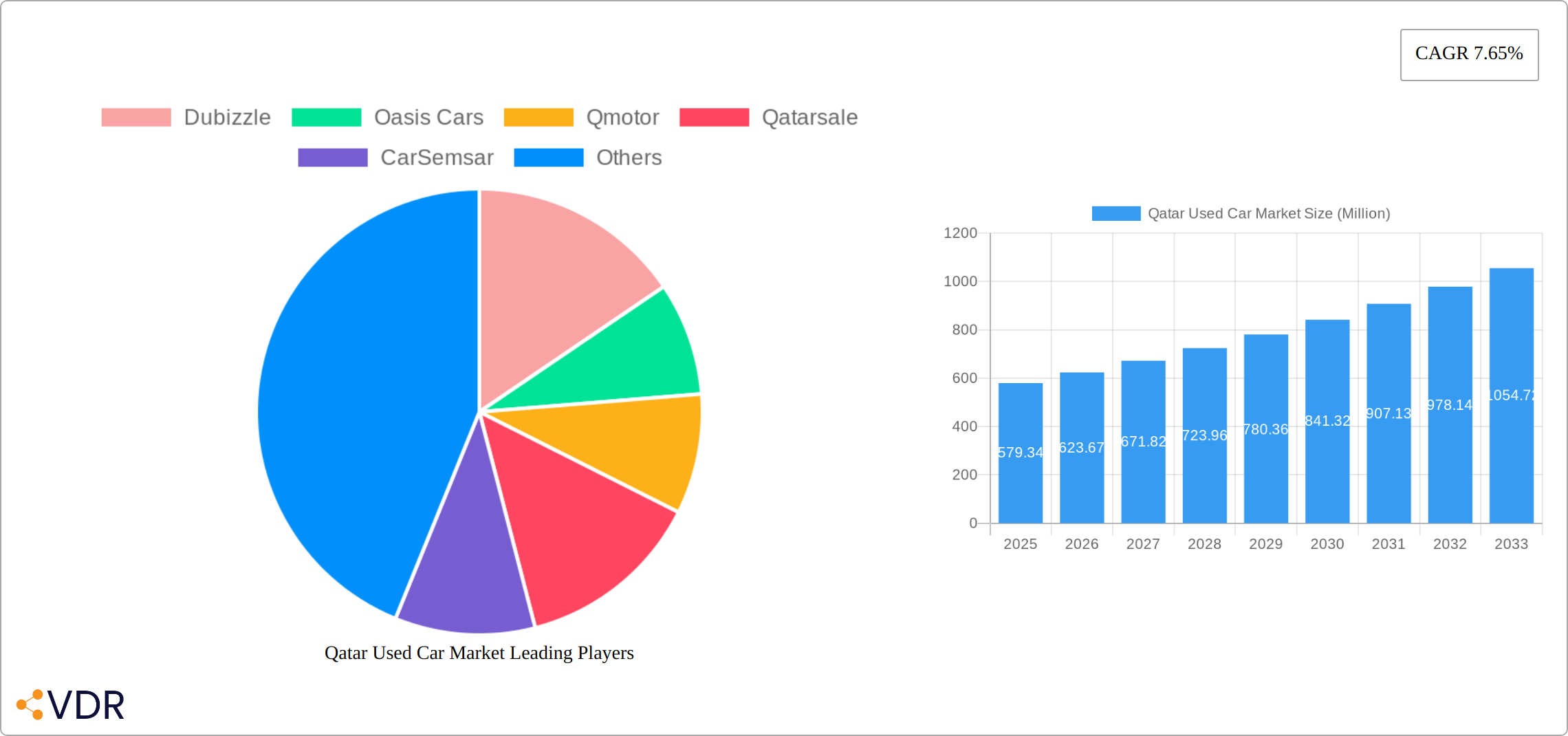

The Qatar used car market, valued at $579.34 million in 2025, is projected to experience robust growth, driven by a rising population, increasing disposable incomes, and a preference for affordable transportation options. The market's Compound Annual Growth Rate (CAGR) of 7.65% from 2019 to 2024 indicates consistent expansion. Key segments driving this growth include SUVs/MPVs, reflecting a preference for larger vehicles suitable for families. The online sales channel is also witnessing significant expansion, mirroring a global trend towards digital commerce. While the organized sector dominates, the unorganized sector continues to play a notable role, presenting opportunities for consolidation and formalization within the market. Factors such as fluctuating fuel prices and government regulations related to vehicle imports and emissions could influence market trajectory in the coming years. Competition among established players like Dubizzle, Oasis Cars, and Qmotor is intense, necessitating strategic pricing, improved customer service, and innovative marketing strategies to gain a competitive edge. The forecast period of 2025-2033 promises sustained expansion, fueled by anticipated economic growth and increasing vehicle demand within Qatar.

The diverse fuel types represented in the market, including petrol, diesel, and electric, highlight evolving consumer preferences and the gradual adoption of sustainable transportation solutions. Growth in the electric vehicle segment is anticipated to be influenced by government initiatives promoting green transportation and the increasing availability of charging infrastructure. The segmentation by vehicle type (Hatchbacks, Sedans, SUVs/MPVs) offers valuable insights into consumer preferences and purchasing power within different socio-economic groups. Future market performance will likely hinge on the interplay of economic conditions, evolving consumer preferences, governmental regulations, and the competitive landscape characterized by both established and emerging players. Understanding these dynamics will be crucial for businesses operating within or planning to enter the thriving Qatar used car market.

Qatar Used Car Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Qatar used car market, encompassing market dynamics, growth trends, key players, and future outlook. Targeting industry professionals, investors, and market researchers, this report offers crucial insights into this dynamic sector, utilizing data from 2019-2024 (historical period) and forecasting to 2033. The base year for this analysis is 2025, with the forecast period covering 2025-2033. This report utilizes current market trends to predict and forecast the future of the market.

Keywords: Qatar used car market, used car sales Qatar, Qatar automotive market, pre-owned car market Qatar, online car sales Qatar, used car dealerships Qatar, Qatar car market size, Dubizzle, Oasis Cars, Qmotor, Qatarsale, CarSemsar, Autobahn Qatar, Hatla2ee, Edition Motors, Elite Motors, Automall Qatar, Qatar Living, AutoZ Qatar, Yallamotor, Petrol cars Qatar, Diesel cars Qatar, Electric cars Qatar, SUV market Qatar, Hatchback market Qatar, Sedan market Qatar.

Qatar Used Car Market Dynamics & Structure

The Qatar used car market is characterized by a mix of organized and unorganized players, with online platforms increasingly gaining traction. Market concentration is moderate, with a few dominant players alongside numerous smaller dealerships. Technological advancements, particularly in online marketplaces and vehicle inspection technologies, are reshaping the market landscape. The regulatory framework, including consumer protection laws (as evidenced by the March 2023 fines), plays a significant role in shaping market practices. Substitute products include leasing and car rental services; however, the affordability of used cars remains a primary driver. The demographic trends in Qatar, with a young and growing population, fuels demand for vehicles. M&A activity remains relatively low but is expected to increase as online platforms consolidate.

- Market Concentration: Moderately concentrated, with xx% market share held by the top 5 players.

- Technological Innovation: Increasing adoption of online platforms and digital inspection tools.

- Regulatory Framework: Stringent consumer protection laws impacting dealership practices.

- Competitive Substitutes: Leasing and car rental services offer alternatives.

- End-User Demographics: Young and growing population driving demand.

- M&A Trends: Low current activity, but potential for future consolidation (xx deals predicted in next 5 years).

Qatar Used Car Market Growth Trends & Insights

The Qatar used car market demonstrated robust growth between 2019 and 2024, reaching an estimated [Insert Precise Figure] million units in 2024. This expansion is fueled by several key factors: rising disposable incomes among Qatari citizens, supportive government policies fostering automotive trade, and a prevailing preference for more budget-friendly vehicles compared to new car purchases. The market has also experienced significant disruption due to technological advancements, most notably the surge in popularity of online marketplaces. This digital transformation has fundamentally altered consumer behavior, driving a shift towards online platforms for used car transactions. This transition is characterized by increased pricing transparency and enhanced market efficiency. The compound annual growth rate (CAGR) during the historical period (2019-2024) is estimated at [Insert Precise Percentage]%, and the market is projected to reach [Insert Precise Figure] million units by 2033, with a forecasted CAGR of [Insert Precise Percentage]% (2025-2033). The penetration rate of used cars compared to new cars currently stands at approximately [Insert Precise Percentage]%, highlighting the substantial share of the used car segment within Qatar's overall automotive market.

Dominant Regions, Countries, or Segments in Qatar Used Car Market

While Qatar is a single country, a granular analysis reveals key market segments driving growth. The Petrol segment maintains dominance in the fuel type market, commanding approximately [Insert Precise Percentage]% of the market share. Diesel vehicles follow at [Insert Precise Percentage]%, while the Electric vehicle segment, although relatively small, exhibits promising growth at [Insert Precise Percentage]%. The online sales channel is experiencing rapid expansion, outpacing offline channels in terms of growth rate, although offline sales still retain a significant majority market share. SUVs/MPVs constitute the largest vehicle type segment, accounting for [Insert Precise Percentage]%, largely due to the preference for larger vehicles among Qatari families. Organized vendors, encompassing dealerships and established online marketplaces, hold a considerably larger market share than the unorganized sector.

- By Fuel Type: Petrol ([Insert Precise Figure] million units), Diesel ([Insert Precise Figure] million units), Electric ([Insert Precise Figure] million units), Other ([Insert Precise Figure] million units)

- By Sales Channel: Online ([Insert Precise Figure] million units), Offline ([Insert Precise Figure] million units)

- By Vehicle Type: SUVs/MPVs ([Insert Precise Figure] million units), Sedans ([Insert Precise Figure] million units), Hatchbacks ([Insert Precise Figure] million units)

- By Vendor Type: Organized ([Insert Precise Figure] million units), Unorganized ([Insert Precise Figure] million units)

Qatar Used Car Market Product Landscape

The used car market offers a wide range of vehicles, from economy cars to luxury SUVs. Key product differentiators include vehicle age, mileage, condition, and features. Recent innovations include the introduction of advanced inspection technologies and certification programs offering increased transparency for buyers. Online platforms incorporate advanced search filters, allowing users to precisely find suitable cars based on various criteria.

Key Drivers, Barriers & Challenges in Qatar Used Car Market

Key Drivers: Increasing disposable income, preference for cost-effective mobility solutions, growing population, and the expanding reach of online marketplaces. Government initiatives aimed at infrastructure development and easing car ownership also contribute.

Challenges: The fluctuating prices of used cars due to global supply chain disruptions are a challenge. Stringent regulatory compliance requirements place burdens on dealerships. Competition from new car sales and leasing/rental options remain a key competitive pressure.

Emerging Opportunities in Qatar Used Car Market

Significant untapped potential exists within the used electric vehicle (EV) market, presenting opportunities for specialized platforms catering to specific EV models and needs. The expansion of consumer financing options and the integration of AI-driven vehicle valuation tools are also noteworthy growth opportunities. Furthermore, innovations in used car financing and insurance products tailored to the unique aspects of the Qatari market can effectively address unmet consumer needs and drive further market expansion.

Growth Accelerators in the Qatar Used Car Market Industry

The widespread adoption of advanced technologies, such as AI-powered vehicle valuation tools and blockchain-based transaction systems, is poised to significantly accelerate market growth. Strategic alliances between prominent online platforms and reputable financial institutions will streamline the car buying process, further boosting market expansion. Targeted expansion into underserved market segments, with a particular focus on electric vehicles, will unlock additional growth potential and cater to the evolving preferences of environmentally conscious consumers. Government initiatives supporting sustainable transportation could also act as a significant accelerator.

Key Players Shaping the Qatar Used Car Market Market

- Dubizzle

- Oasis Cars

- Qmotor

- Qatarsale

- CarSemsar

- Autobahn Qatar

- Hatla2ee

- Edition Motors

- Elite Motors

- Automall Qatar

- Qatar Living

- AutoZ Qatar

- Yallamotor

Notable Milestones in Qatar Used Car Market Sector

- March 2023: Qatari authorities issued fines to 36 used and new car dealerships for non-compliance with consumer protection laws.

- May 2022: Automall distributed over 1,000 iftar meal boxes as a corporate social responsibility initiative.

In-Depth Qatar Used Car Market Market Outlook

The Qatar used car market is poised for continued growth, driven by technological advancements, favorable demographic trends, and evolving consumer preferences. Strategic investments in online platforms, innovative financing solutions, and expansion into emerging segments such as electric vehicles will shape future market dynamics. The market presents significant opportunities for established players and new entrants alike to capitalize on this growth trajectory.

Qatar Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Petrol

- 3.2. Diesel

- 3.3. Electric

- 3.4. Other Fuel Types (LPG, CNG, etc.)

-

4. Sales Channel

- 4.1. Online

- 4.2. Offline

Qatar Used Car Market Segmentation By Geography

- 1. Qatar

Qatar Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Digital Technologies; Others

- 3.3. Market Restrains

- 3.3.1. Promotion Offers on New Car Models of Chinese Make to Hamper the Demand for Used Cars

- 3.4. Market Trends

- 3.4.1. Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Petrol

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Other Fuel Types (LPG, CNG, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Dubizzle

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Oasis Cars

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Qmotor

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Qatarsale

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CarSemsar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Autobahn Qata

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hatla2ee

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Edition Motors

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Elite Motors

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Automall Qatar

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Qatar Living

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 AutoZ Qatar

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Yallamotor

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Dubizzle

List of Figures

- Figure 1: Qatar Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: Qatar Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Qatar Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: Qatar Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Qatar Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 6: Qatar Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Qatar Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Qatar Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 9: Qatar Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 10: Qatar Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 11: Qatar Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 12: Qatar Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Used Car Market?

The projected CAGR is approximately 7.65%.

2. Which companies are prominent players in the Qatar Used Car Market?

Key companies in the market include Dubizzle, Oasis Cars, Qmotor, Qatarsale, CarSemsar, Autobahn Qata, Hatla2ee, Edition Motors, Elite Motors, Automall Qatar, Qatar Living, AutoZ Qatar, Yallamotor.

3. What are the main segments of the Qatar Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 579.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Digital Technologies; Others.

6. What are the notable trends driving market growth?

Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market.

7. Are there any restraints impacting market growth?

Promotion Offers on New Car Models of Chinese Make to Hamper the Demand for Used Cars.

8. Can you provide examples of recent developments in the market?

March 2023: Qatari Authorities issued fines to 36 used and new car dealerships across Qatar for non-compliance with consumer protection law. The authorities undertook the decision after receiving several complaints from consumers that these dealerships needed to adhere to contracts by delaying the delivery of purchased or reserved cars despite the transactions being made.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Used Car Market?

To stay informed about further developments, trends, and reports in the Qatar Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence