Key Insights

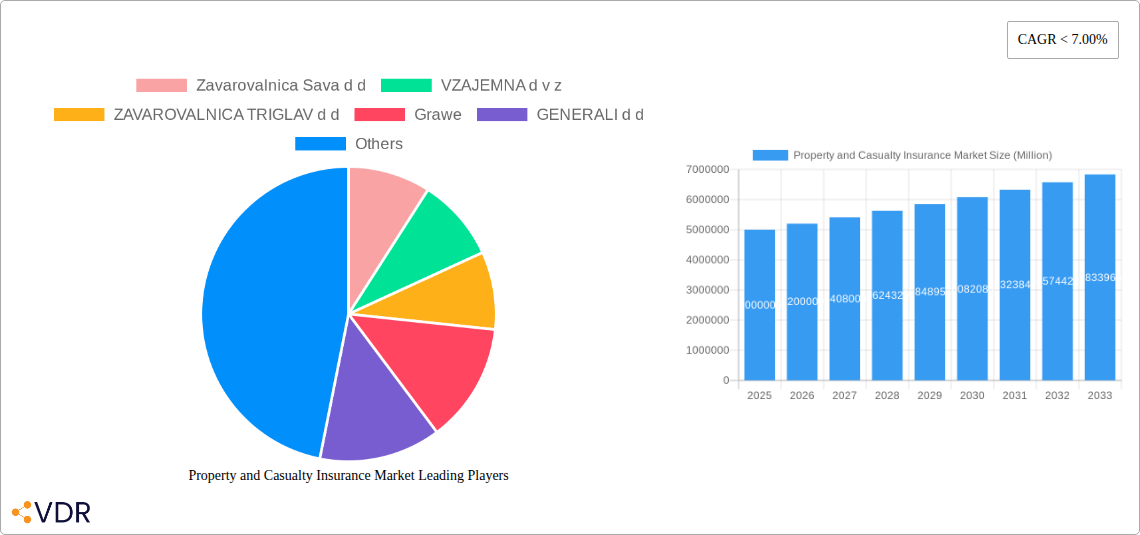

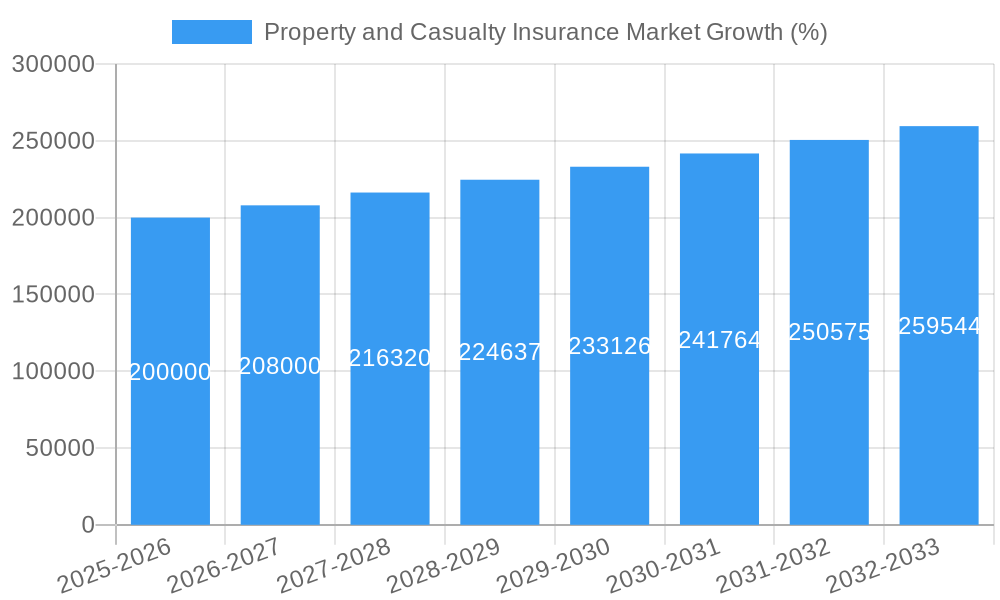

The Property and Casualty (P&C) insurance market is a significant sector characterized by its cyclical nature and sensitivity to macroeconomic factors. The period from 2019 to 2024 likely witnessed moderate growth, influenced by factors such as increasing urbanization, rising asset values, and evolving risk profiles. However, the impact of global events, including the COVID-19 pandemic and fluctuating inflation rates, likely introduced volatility, potentially impacting premium growth and claims frequency. The base year of 2025 serves as a crucial benchmark, reflecting a market stabilization after these disruptions. Assuming a reasonable market size of $5 trillion for 2025, and a conservative Compound Annual Growth Rate (CAGR) of 4% for the forecast period (2025-2033), the market is projected to demonstrate steady, albeit moderate expansion. This growth will be driven by several factors, including technological advancements such as AI-powered claims processing and risk assessment, increasing penetration of insurance in emerging markets, and the growing awareness of insurance needs among individuals and businesses.

The projected growth in the P&C insurance market from 2025 onwards will likely be influenced by a combination of organic growth and mergers and acquisitions. Insurers are expected to focus on developing innovative products and services tailored to evolving customer needs, emphasizing personalized risk management solutions and leveraging data analytics to improve efficiency and customer experience. Regulatory changes and evolving geopolitical landscapes will also play a crucial role in shaping market dynamics. The focus on sustainability and environmental, social, and governance (ESG) factors will increasingly influence investment decisions and risk assessment within the industry, leading to new product offerings and underwriting strategies. The competitive landscape will remain dynamic, with established players and insurtech startups vying for market share through technological innovation and superior customer service. Fluctuations in interest rates and inflation will continue to impact profitability and investment strategies.

Property & Casualty Insurance Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Property and Casualty (P&C) insurance market, encompassing market dynamics, growth trends, regional insights, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for insurance professionals, investors, and market researchers seeking to understand and capitalize on opportunities within this dynamic sector. The report delves into parent markets (insurance) and child markets (e.g., auto, homeowners, commercial) to offer a complete view. Market values are presented in millions.

Keywords: Property and Casualty Insurance, P&C Insurance Market, Insurance Market Analysis, Insurance Industry Trends, Market Size, Market Share, Market Growth, Market Forecast, Insurance Companies, Zavarovalnica Sava, VZAJEMNA, ZAVAROVALNICA TRIGLAV, Grawe, GENERALI, NLB Vita, MERKUR ZAVAROVALNICA, Wiener Städtische, ERGO Insurance, Allianz Insurance, Market Segmentation, Insurance Regulations, Technological Innovation in Insurance.

Property and Casualty Insurance Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the P&C insurance sector. We examine market concentration, identifying dominant players and their market share percentages (e.g., Zavarovalnica Triglav holding xx%, followed by Generali with xx%, etc.). The analysis includes an assessment of M&A activity during the historical period (2019-2024), quantifying deal volumes (xx deals) and identifying key drivers and implications for market structure. Technological innovations, such as AI-powered claims processing and telematics, are evaluated alongside their impact on market dynamics and the challenges faced by insurers in adopting these technologies. The regulatory framework is analyzed, including its effect on product offerings and market competition. Finally, the report explores the influence of substitute products and services and evolving end-user demographics on market growth.

- Market Concentration: Analysis of market share distribution among key players.

- Technological Innovation: Impact of AI, telematics, and data analytics on market efficiency and product offerings.

- Regulatory Framework: Assessment of the impact of insurance regulations on market growth and competitiveness.

- Competitive Substitutes: Examination of alternative risk management solutions impacting P&C insurance demand.

- End-User Demographics: Analysis of shifting demographic trends and their implications for insurance needs.

- M&A Trends: Quantitative and qualitative assessment of mergers and acquisitions, including deal volumes and their influence on market consolidation.

Property and Casualty Insurance Market Growth Trends & Insights

This section presents a detailed analysis of market size evolution from 2019 to 2033, using data to project growth trajectories. We explore the Compound Annual Growth Rate (CAGR) for the historical (xx%), estimated (xx%), and forecast periods (xx%). The analysis delves into factors driving market adoption rates, focusing on the influence of technological disruptions and changes in consumer behavior, such as increased digital engagement and demand for personalized insurance solutions. Specific metrics, such as market penetration rates for various product segments and customer acquisition costs, will be used to illustrate these trends. The analysis also examines the impact of economic cycles and macroeconomic factors on market growth.

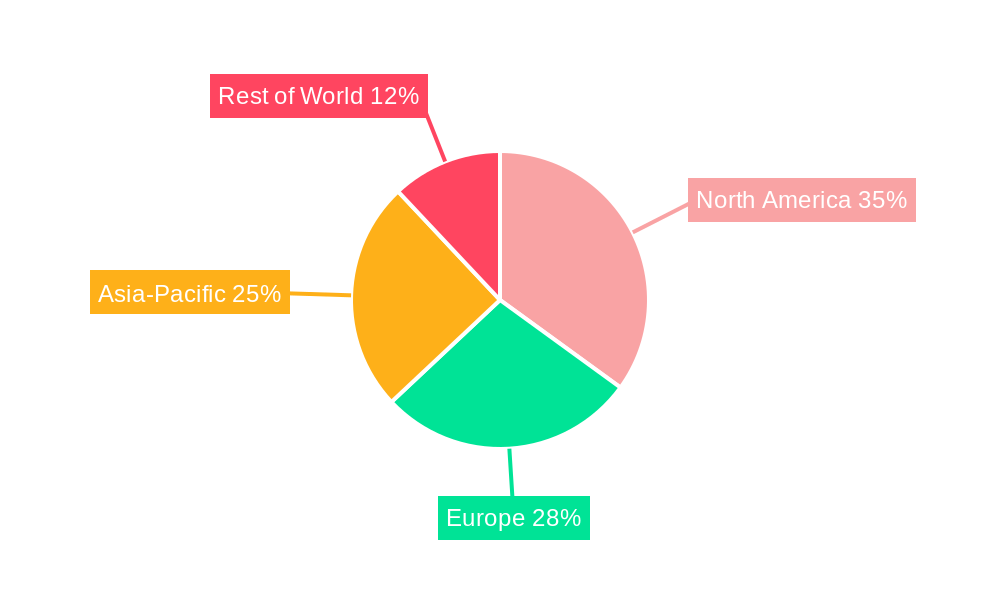

Dominant Regions, Countries, or Segments in Property and Casualty Insurance Market

This section identifies the leading regions, countries, and segments driving P&C insurance market growth. We determine the dominant region (e.g., Western Europe contributing xx% to total market value) and analyze the key drivers of its success using quantitative and qualitative data. Factors such as favorable economic policies, robust infrastructure, and high insurance penetration rates will be examined. Specific countries within the dominant region will be analyzed in terms of market size, growth potential, and underlying factors, e.g., a strong economy leading to high demand for commercial insurance. Market share data will be provided to illustrate the dominance of specific regions and segments.

- Key Growth Drivers: Detailed analysis of economic, regulatory, and demographic factors driving market growth in leading regions and segments.

- Market Share and Growth Potential: Assessment of market share distribution and future growth prospects for leading regions and segments.

- Regional Comparisons: A detailed comparative analysis of market dynamics and growth trends across different regions and segments.

Property and Casualty Insurance Market Product Landscape

This section offers a concise overview of the product landscape. The report describes significant product innovations and their applications, focusing on features such as AI-driven risk assessment, personalized pricing models, and bundled insurance products. It will highlight the unique selling propositions of various product types and evaluate the role of technological advancements in shaping product offerings. Key performance indicators (KPIs) like customer satisfaction scores and claims processing times will also be considered.

Key Drivers, Barriers & Challenges in Property and Casualty Insurance Market

This section explores the factors propelling market growth and the obstacles hindering its expansion. Key drivers include factors such as increasing urbanization, rising disposable incomes, growing awareness of risk, and the adoption of advanced technologies. Challenges will include regulatory hurdles, intense competition, and supply chain disruptions arising from global economic uncertainty. Quantifiable impacts of these challenges on market growth will be presented.

Emerging Opportunities in Property and Casualty Insurance Market

This section identifies emerging opportunities, focusing on untapped markets (e.g., underserved segments), the growing adoption of Insurtech solutions, and shifts in consumer preferences (e.g., demand for on-demand insurance).

Growth Accelerators in the Property and Casualty Insurance Market Industry

This section analyzes the catalysts that will drive long-term growth in the P&C insurance market. It emphasizes technological innovations, such as blockchain for enhanced security and data management, and strategic partnerships between traditional insurers and technology companies, leading to innovative products and services. Market expansion strategies, including geographic diversification and the development of new product lines, will also be examined.

Key Players Shaping the Property and Casualty Insurance Market Market

- Zavarovalnica Sava d d

- VZAJEMNA d v z

- ZAVAROVALNICA TRIGLAV d d

- Grawe

- GENERALI d d

- NLB Vita d d Ljubljana

- MERKUR ZAVAROVALNICA d d

- Wiener Städtische Insurance Company

- ERGO Insurance Company

- Allianz Insurance Company

Notable Milestones in Property and Casualty Insurance Market Sector

- 2020/03: Significant increase in demand for cyber insurance due to the rise in remote work.

- 2021/10: Launch of a major Insurtech platform by a leading P&C insurer.

- 2022/06: Merger between two smaller P&C insurers, leading to increased market consolidation. (Specific details of mergers and acquisitions will be included in the full report).

In-Depth Property and Casualty Insurance Market Market Outlook

This section summarizes the key growth accelerators identified in the report, providing a concise overview of the future market potential and strategic opportunities. The analysis will highlight areas poised for significant growth, emphasizing the potential for innovation and strategic partnerships to drive market expansion in the forecast period (2025-2033). The outlook will emphasize the need for insurers to adapt to technological advancements and changing consumer expectations.

Property and Casualty Insurance Market Segmentation

-

1. Insurance type

- 1.1. Home

- 1.2. Motor

- 1.3. Other Insurance Types

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

Property and Casualty Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Property and Casualty Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Non-life Insurance Density in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Property and Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Home

- 5.1.2. Motor

- 5.1.3. Other Insurance Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. North America Property and Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 6.1.1. Home

- 6.1.2. Motor

- 6.1.3. Other Insurance Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Direct

- 6.2.2. Agency

- 6.2.3. Banks

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 7. South America Property and Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 7.1.1. Home

- 7.1.2. Motor

- 7.1.3. Other Insurance Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Direct

- 7.2.2. Agency

- 7.2.3. Banks

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 8. Europe Property and Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 8.1.1. Home

- 8.1.2. Motor

- 8.1.3. Other Insurance Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Direct

- 8.2.2. Agency

- 8.2.3. Banks

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 9. Middle East & Africa Property and Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 9.1.1. Home

- 9.1.2. Motor

- 9.1.3. Other Insurance Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Direct

- 9.2.2. Agency

- 9.2.3. Banks

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 10. Asia Pacific Property and Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 10.1.1. Home

- 10.1.2. Motor

- 10.1.3. Other Insurance Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Direct

- 10.2.2. Agency

- 10.2.3. Banks

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Zavarovalnica Sava d d

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 VZAJEMNA d v z

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ZAVAROVALNICA TRIGLAV d d

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Grawe

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GENERALI d d

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NLB Vita d d Ljubljana

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MERKUR ZAVAROVALNICA d d

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wiener Städtische Insurance Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ERGO Insurance Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Allianz Insurance Compan

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Zavarovalnica Sava d d

List of Figures

- Figure 1: Global Property and Casualty Insurance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Property and Casualty Insurance Market Revenue (Million), by Insurance type 2024 & 2032

- Figure 3: North America Property and Casualty Insurance Market Revenue Share (%), by Insurance type 2024 & 2032

- Figure 4: North America Property and Casualty Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 5: North America Property and Casualty Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 6: North America Property and Casualty Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Property and Casualty Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Property and Casualty Insurance Market Revenue (Million), by Insurance type 2024 & 2032

- Figure 9: South America Property and Casualty Insurance Market Revenue Share (%), by Insurance type 2024 & 2032

- Figure 10: South America Property and Casualty Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 11: South America Property and Casualty Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 12: South America Property and Casualty Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Property and Casualty Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Property and Casualty Insurance Market Revenue (Million), by Insurance type 2024 & 2032

- Figure 15: Europe Property and Casualty Insurance Market Revenue Share (%), by Insurance type 2024 & 2032

- Figure 16: Europe Property and Casualty Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: Europe Property and Casualty Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: Europe Property and Casualty Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Property and Casualty Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Property and Casualty Insurance Market Revenue (Million), by Insurance type 2024 & 2032

- Figure 21: Middle East & Africa Property and Casualty Insurance Market Revenue Share (%), by Insurance type 2024 & 2032

- Figure 22: Middle East & Africa Property and Casualty Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 23: Middle East & Africa Property and Casualty Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 24: Middle East & Africa Property and Casualty Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Property and Casualty Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Property and Casualty Insurance Market Revenue (Million), by Insurance type 2024 & 2032

- Figure 27: Asia Pacific Property and Casualty Insurance Market Revenue Share (%), by Insurance type 2024 & 2032

- Figure 28: Asia Pacific Property and Casualty Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Asia Pacific Property and Casualty Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Asia Pacific Property and Casualty Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Property and Casualty Insurance Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Property and Casualty Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Property and Casualty Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 3: Global Property and Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Property and Casualty Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Property and Casualty Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 6: Global Property and Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Global Property and Casualty Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Property and Casualty Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 12: Global Property and Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global Property and Casualty Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Property and Casualty Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 18: Global Property and Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global Property and Casualty Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Property and Casualty Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 30: Global Property and Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 31: Global Property and Casualty Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Property and Casualty Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 39: Global Property and Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Global Property and Casualty Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Property and Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Property and Casualty Insurance Market?

The projected CAGR is approximately < 7.00%.

2. Which companies are prominent players in the Property and Casualty Insurance Market?

Key companies in the market include Zavarovalnica Sava d d, VZAJEMNA d v z, ZAVAROVALNICA TRIGLAV d d, Grawe, GENERALI d d, NLB Vita d d Ljubljana, MERKUR ZAVAROVALNICA d d, Wiener Städtische Insurance Company, ERGO Insurance Company, Allianz Insurance Compan.

3. What are the main segments of the Property and Casualty Insurance Market?

The market segments include Insurance type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Non-life Insurance Density in the Country.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Property and Casualty Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Property and Casualty Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Property and Casualty Insurance Market?

To stay informed about further developments, trends, and reports in the Property and Casualty Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence