Key Insights

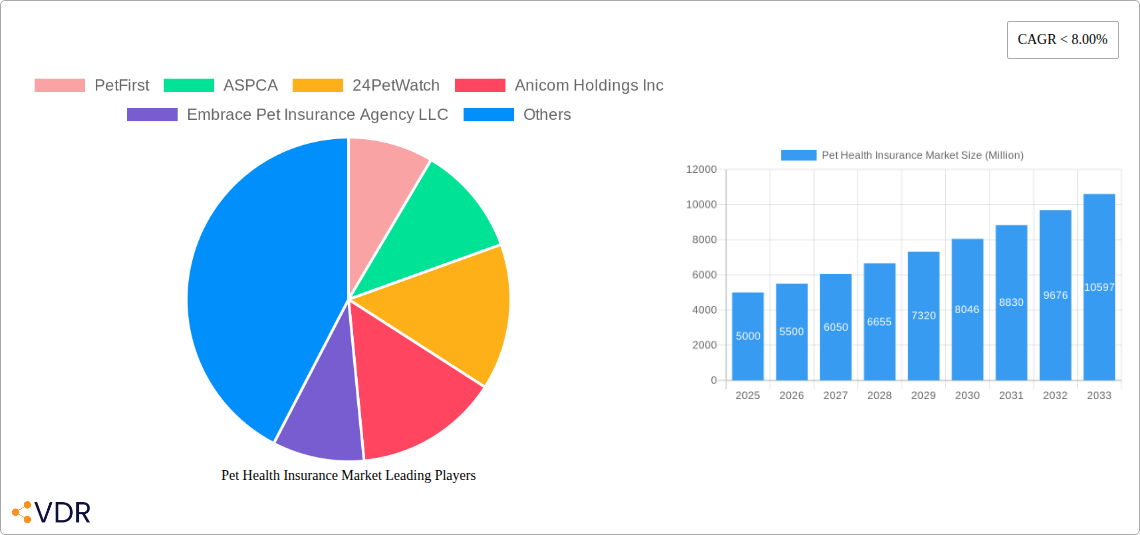

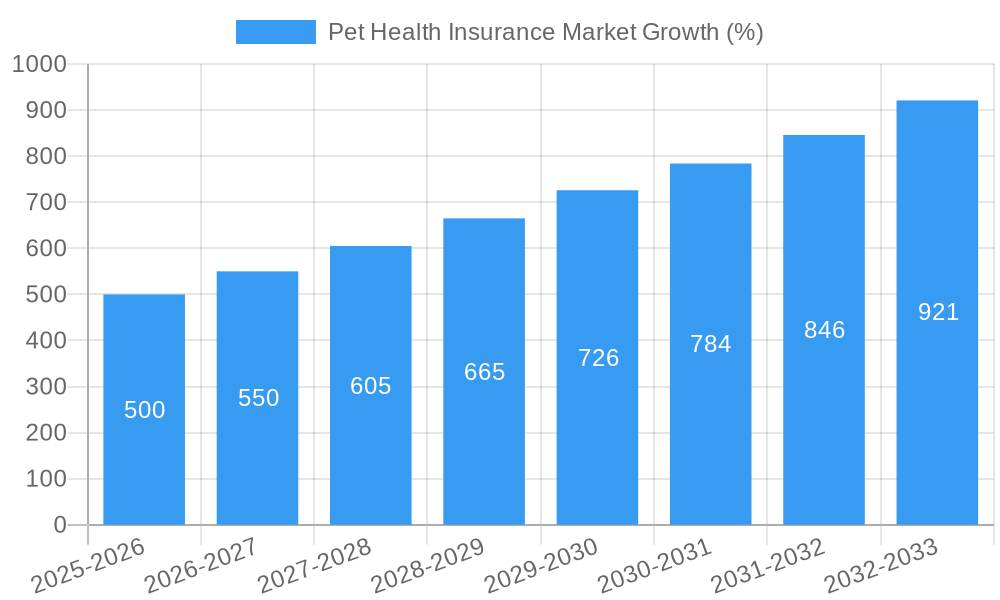

The pet health insurance market is experiencing robust growth, driven by increasing pet ownership, rising veterinary costs, and a growing awareness of pet health among owners. The study period from 2019 to 2033 reveals a significant expansion, with a considerable Compound Annual Growth Rate (CAGR) throughout. While the exact market size for 2025 isn't provided, analyzing the historical period (2019-2024) and projecting forward based on typical industry CAGR for similar markets suggests a substantial market value in the billions of dollars by 2025. This growth is further fueled by the introduction of innovative insurance products, including comprehensive coverage options and wellness plans, appealing to a broader segment of pet owners. The increasing availability of online platforms and digital distribution channels simplifies the purchasing process and increases accessibility.

Looking ahead to the forecast period (2025-2033), the market is poised for continued expansion. Factors such as the rising humanization of pets, leading to increased spending on pet care, and the expansion into emerging markets, will contribute to this growth. Technological advancements, such as telehealth services for pets, are also creating new opportunities within the sector. However, challenges remain, including fluctuating veterinary costs, varying regulatory landscapes across different regions, and potential increases in insurance premiums. Despite these factors, the long-term outlook remains positive, indicating a substantial and sustained expansion of the pet health insurance market.

Pet Health Insurance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Pet Health Insurance market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. This report is crucial for industry professionals, investors, and anyone seeking a thorough understanding of this rapidly evolving market, segmented by pet type (dogs, cats, others) and coverage type (accident-only, accident & illness).

Pet Health Insurance Market Dynamics & Structure

The pet health insurance market is experiencing robust growth, driven by increasing pet ownership, rising veterinary costs, and a growing awareness of pet health needs. Market concentration is moderate, with several key players holding significant shares, but also allowing for smaller niche players to thrive. Technological innovations, such as telehealth and data analytics, are reshaping the industry. Regulatory frameworks vary across geographies, impacting market accessibility and pricing. Competitive substitutes, such as savings plans, are present but often lack the comprehensive coverage offered by insurance. The end-user demographic is broadening, encompassing millennials and Gen Z pet owners who are increasingly tech-savvy and receptive to digital solutions. M&A activity is moderate, with strategic acquisitions aiming to expand service offerings and geographical reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Telehealth integration, AI-powered claims processing, and personalized risk assessment driving innovation.

- Regulatory Frameworks: Vary across regions, impacting product offerings and pricing strategies. Compliance costs represent xx Million in 2024.

- Competitive Substitutes: Savings plans and preventative care packages offer limited alternatives.

- End-User Demographics: Shift towards younger, tech-savvy pet owners driving digital adoption.

- M&A Trends: Consolidation expected to continue, driven by economies of scale and enhanced service offerings. XX M&A deals closed in 2024.

Pet Health Insurance Market Growth Trends & Insights

The global pet health insurance market is witnessing significant growth, fueled by several factors. The market size expanded from xx Million in 2019 to xx Million in 2024, exhibiting a CAGR of xx%. This growth is driven by increasing pet ownership, particularly in developed countries, and rising awareness of the financial burden associated with unexpected veterinary expenses. Technological advancements, such as mobile apps and online platforms, are streamlining the purchasing and claims processes, enhancing accessibility. A shift towards proactive pet healthcare, including preventative care and wellness plans, is boosting adoption rates. Market penetration remains relatively low in many regions, indicating substantial growth potential. Consumer behavior is evolving, with increasing preference for customized plans and digital services.

- Market Size: Projected to reach xx Million by 2033, exhibiting a CAGR of xx% during 2025-2033.

- Adoption Rates: Increasing steadily, driven by rising awareness and improved accessibility. Penetration rate stood at xx% in 2024.

- Technological Disruptions: Telemedicine integration, AI-driven risk assessment, and personalized plans are disrupting traditional models.

- Consumer Behavior Shifts: Demand for customizable plans, digital convenience, and bundled services growing rapidly.

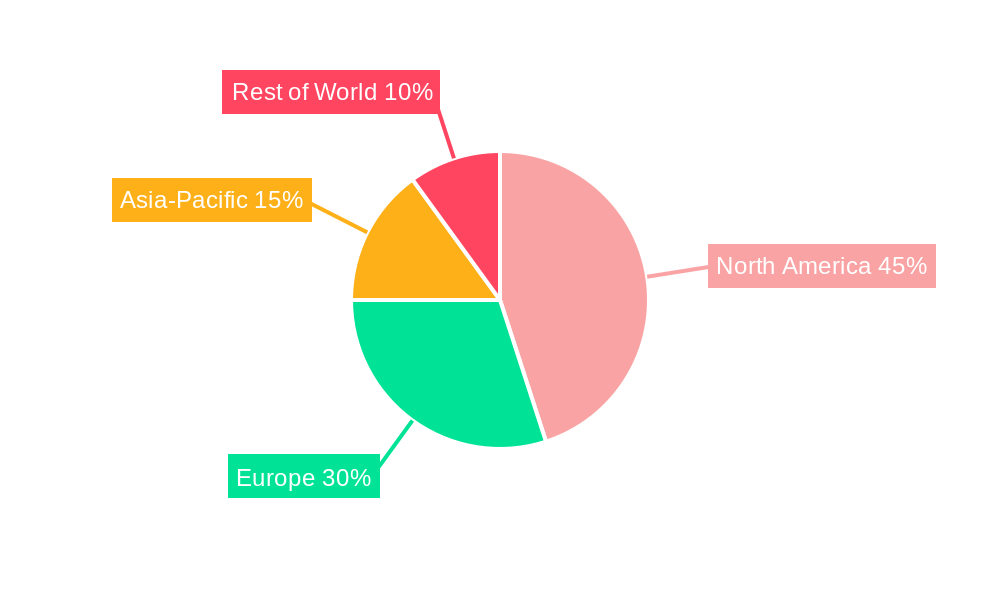

Dominant Regions, Countries, or Segments in Pet Health Insurance Market

North America (specifically the US) currently holds the largest market share in the pet health insurance sector, driven by high pet ownership rates, increased disposable incomes, and robust veterinary infrastructure. Europe follows as a significant market, with the UK and Germany showing strong growth. Asia-Pacific is emerging as a high-growth region, fueled by rising pet ownership and increased awareness of pet health insurance benefits. Key drivers include favorable government policies, improving economic conditions, and increased pet healthcare expenditure. Market dominance is determined by several factors:

- North America: High pet ownership, advanced veterinary care infrastructure, and strong consumer spending. Market Share in 2024: xx%.

- Europe: Growing pet ownership and increasing awareness of pet health insurance benefits. Market Share in 2024: xx%.

- Asia-Pacific: Rapidly developing market driven by rising pet ownership and economic growth. Market Share in 2024: xx%.

Pet Health Insurance Market Product Landscape

The pet health insurance product landscape offers a variety of plans, catering to different pet owner needs and budgets. Products range from basic accident-only coverage to comprehensive accident and illness plans, including add-ons for wellness care, dental, and alternative therapies. Technological advancements are driving the integration of telehealth services, digital claims processing, and personalized risk assessments into product offerings. This leads to enhanced customer experience, streamlined processes, and more accurate pricing models. Unique selling propositions include customized plans, wellness packages, and 24/7 veterinary telehealth access.

Key Drivers, Barriers & Challenges in Pet Health Insurance Market

Key Drivers: Rising pet ownership, increasing veterinary costs, growing awareness of pet health, technological advancements in pet care and insurance delivery, and changing consumer preferences towards pet wellness.

Key Challenges: High claims costs, fraud and abuse, regulatory complexities, maintaining profitability with competitive pricing, and limited market penetration in emerging economies. These challenges collectively impacted the market by an estimated xx Million in 2024.

Emerging Opportunities in Pet Health Insurance Market

Untapped markets in developing countries present significant opportunities. The integration of wearable technology for pet health monitoring and the development of personalized pet insurance plans based on individual risk profiles offer substantial potential for innovation and growth. The expanding market for pet wellness services presents an opportunity for bundled insurance plans that include preventive and proactive care.

Growth Accelerators in the Pet Health Insurance Market Industry

Strategic partnerships between insurers and veterinary providers are enhancing service offerings and customer reach. Technological advancements in data analytics and AI are improving risk assessment, fraud detection, and claim processing efficiency. Market expansion into emerging economies with rising pet ownership is also a critical growth accelerator.

Key Players Shaping the Pet Health Insurance Market Market

- PetFirst

- ASPCA

- 24PetWatch

- Anicom Holdings Inc

- Embrace Pet Insurance Agency LLC

- Figo Pet Insurance LLC

- HartVille

- Healthy Paws Pet Insurance LLC

- Hollard

- Oneplan

Notable Milestones in Pet Health Insurance Market Sector

- 2021 (June): MetLife expands pet insurance benefits to include virtual vet visits, rollover benefits, family plans, and grief counseling. This significantly expanded market access and improved benefits.

- 2021: Wagmo raises 12.5 Million USD to offer pet insurance and a wellness service, disrupting traditional models by offering bundled services.

In-Depth Pet Health Insurance Market Market Outlook

The pet health insurance market is poised for continued strong growth, driven by the factors outlined above. Strategic partnerships, technological innovations, and expansion into new markets will be key to unlocking future potential. The integration of telehealth and data analytics will lead to more personalized and efficient service offerings, while increasing market penetration in developing economies will unlock substantial untapped potential. The market is expected to witness significant consolidation, further shaping the competitive landscape in the coming years.

Pet Health Insurance Market Segmentation

-

1. Policy

- 1.1. Illness and Accidents

- 1.2. Chronic Conditions

- 1.3. Others

-

2. Provider

- 2.1. Public

- 2.2. Private

Pet Health Insurance Market Segmentation By Geography

- 1. North America

- 2. Latin America

- 3. Europe

- 4. Asia Pacific

- 5. Middle East and Africa

Pet Health Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Pet Adoption; Rising Awareness Regarding Pet Insurance

- 3.3. Market Restrains

- 3.3.1. Increasing Number of Pet Adoption; Rising Awareness Regarding Pet Insurance

- 3.4. Market Trends

- 3.4.1. Increasing Pet Healthcare Act as a Driver for Pet Insurance Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Policy

- 5.1.1. Illness and Accidents

- 5.1.2. Chronic Conditions

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Provider

- 5.2.1. Public

- 5.2.2. Private

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Latin America

- 5.3.3. Europe

- 5.3.4. Asia Pacific

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Policy

- 6. North America Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Policy

- 6.1.1. Illness and Accidents

- 6.1.2. Chronic Conditions

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Provider

- 6.2.1. Public

- 6.2.2. Private

- 6.1. Market Analysis, Insights and Forecast - by Policy

- 7. Latin America Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Policy

- 7.1.1. Illness and Accidents

- 7.1.2. Chronic Conditions

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Provider

- 7.2.1. Public

- 7.2.2. Private

- 7.1. Market Analysis, Insights and Forecast - by Policy

- 8. Europe Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Policy

- 8.1.1. Illness and Accidents

- 8.1.2. Chronic Conditions

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Provider

- 8.2.1. Public

- 8.2.2. Private

- 8.1. Market Analysis, Insights and Forecast - by Policy

- 9. Asia Pacific Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Policy

- 9.1.1. Illness and Accidents

- 9.1.2. Chronic Conditions

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Provider

- 9.2.1. Public

- 9.2.2. Private

- 9.1. Market Analysis, Insights and Forecast - by Policy

- 10. Middle East and Africa Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Policy

- 10.1.1. Illness and Accidents

- 10.1.2. Chronic Conditions

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Provider

- 10.2.1. Public

- 10.2.2. Private

- 10.1. Market Analysis, Insights and Forecast - by Policy

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 PetFirst

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ASPCA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 24PetWatch

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Anicom Holdings Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Embrace Pet Insurance Agency LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Figo Pet Insurance LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HartVille

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Healthy Paws Pet Insurance LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hollard

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oneplan

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 PetFirst

List of Figures

- Figure 1: Global Pet Health Insurance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 3: North America Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 4: North America Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 5: North America Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 6: North America Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 9: Latin America Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 10: Latin America Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 11: Latin America Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 12: Latin America Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Latin America Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 15: Europe Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 16: Europe Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 17: Europe Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 18: Europe Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 21: Asia Pacific Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 22: Asia Pacific Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 23: Asia Pacific Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 24: Asia Pacific Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Pacific Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East and Africa Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 27: Middle East and Africa Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 28: Middle East and Africa Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 29: Middle East and Africa Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 30: Middle East and Africa Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pet Health Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 3: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 4: Global Pet Health Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 6: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 7: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 9: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 10: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 12: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 13: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 15: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 16: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 18: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 19: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Health Insurance Market?

The projected CAGR is approximately < 8.00%.

2. Which companies are prominent players in the Pet Health Insurance Market?

Key companies in the market include PetFirst, ASPCA, 24PetWatch, Anicom Holdings Inc, Embrace Pet Insurance Agency LLC, Figo Pet Insurance LLC, HartVille, Healthy Paws Pet Insurance LLC, Hollard, Oneplan.

3. What are the main segments of the Pet Health Insurance Market?

The market segments include Policy, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Pet Adoption; Rising Awareness Regarding Pet Insurance.

6. What are the notable trends driving market growth?

Increasing Pet Healthcare Act as a Driver for Pet Insurance Market Growth.

7. Are there any restraints impacting market growth?

Increasing Number of Pet Adoption; Rising Awareness Regarding Pet Insurance.

8. Can you provide examples of recent developments in the market?

In 2021, MetLife expands pet insurance benefits to include virtual vet visits. Through MetLife's new pet insurance benefit, employers will be able to provide employee pet parents with access to veterinary telehealth services, roll over benefits, family plans for coverage of more than one pet and grief counseling. Additionally, employees switching from one insurance provider to MetLife will not be denied if their dog or cat has a preexisting condition, an exclusive perk of the employee benefit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pet Health Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pet Health Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pet Health Insurance Market?

To stay informed about further developments, trends, and reports in the Pet Health Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence