Key Insights

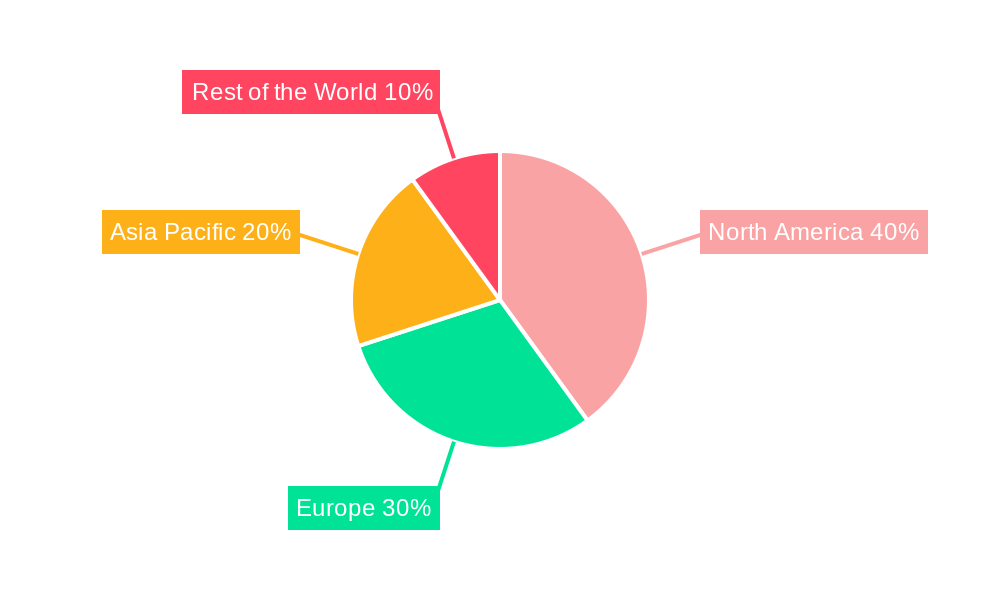

The off-road vehicle (ORV) market, valued at $16.72 billion in 2025, is projected to experience robust growth, driven by several key factors. Increasing disposable incomes in developing economies, coupled with a rising demand for recreational activities and adventure tourism, are fueling market expansion. The popularity of sports like ATV racing and off-roading, along with the growing use of ORVs in agriculture and other applications, contribute significantly to market demand. Technological advancements, such as the incorporation of advanced safety features, improved engine performance, and enhanced comfort features, are also driving market growth. The market is segmented by application (sports, agricultural, other) and vehicle type (ATV, UTV), with the sports segment currently dominating due to the recreational appeal. North America and Europe are currently the leading regional markets, driven by high consumer spending and established ORV cultures, though the Asia-Pacific region is anticipated to witness significant growth in the forecast period due to rising middle-class incomes and increasing infrastructure development supporting recreational pursuits. However, stringent emission norms and environmental concerns pose potential restraints on market expansion, necessitating the development of more eco-friendly ORV technologies.

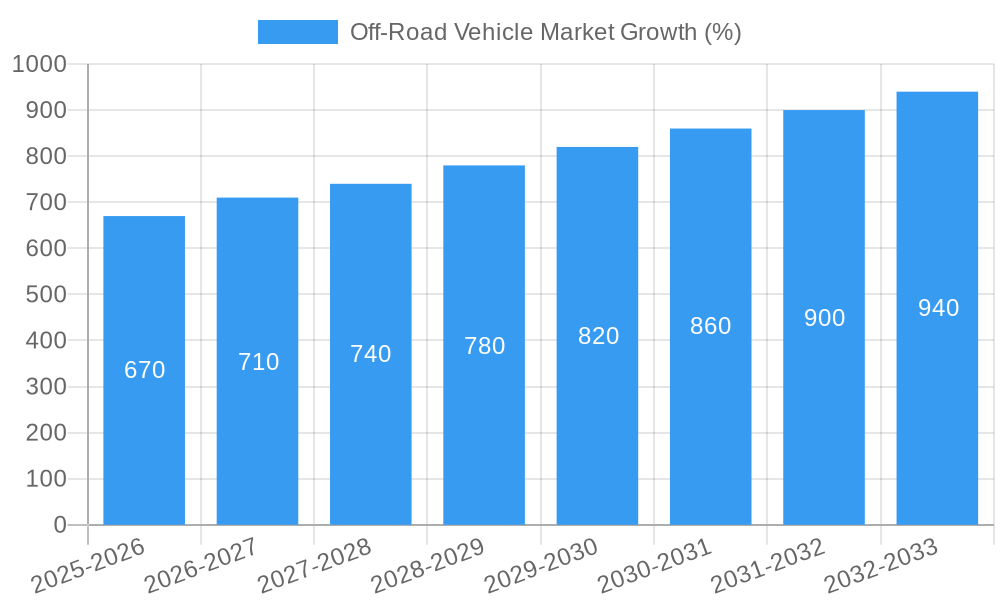

Competition in the off-road vehicle market is intense, with established players like Polaris Inc., Arctic Cat Inc., Bombardier Recreational Products Inc., Yamaha Motor Corporation, and Kawasaki Motors Corp. vying for market share. These companies are focusing on product innovation, strategic partnerships, and expansion into emerging markets to maintain a competitive edge. The forecast period (2025-2033) anticipates continued market growth, fueled by sustained demand and ongoing technological advancements. While challenges remain, such as navigating evolving regulatory landscapes and managing material costs, the overall outlook for the off-road vehicle market remains positive, with significant opportunities for growth across various segments and geographic regions. The CAGR of 4.12% suggests a steady, reliable growth trajectory throughout the forecast period. This growth is expected to be particularly strong in emerging markets where the demand for recreational vehicles is rapidly expanding.

Off-Road Vehicle Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Off-Road Vehicle (ORV) market, encompassing both the parent market (Recreational Vehicles) and child markets (All-Terrain Vehicles (ATVs) and Utility Task Vehicles (UTVs)). The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This in-depth analysis offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market. The global market size is projected to reach xx million units by 2033.

Off-Road Vehicle Market Dynamics & Structure

The off-road vehicle market is characterized by moderate concentration, with key players holding significant market share. Technological innovation, particularly in electric vehicle technology and autonomous features, is a major driver of growth. Stringent safety and environmental regulations are shaping product development and market access. Competitive pressures from substitute products, like motorcycles for certain applications, exist. The end-user demographic is diverse, encompassing recreational users, agricultural professionals, and industrial operators. M&A activity in the sector has been relatively stable, with xx deals recorded in the last five years, leading to xx% market consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of market share.

- Technological Innovation: Focus on electric powertrains, improved suspension systems, and advanced safety features.

- Regulatory Framework: Varying emission standards and safety regulations across different regions.

- Competitive Substitutes: Motorcycles, ATVs for specific agricultural tasks.

- End-User Demographics: Recreational enthusiasts, farmers, construction workers, and military.

- M&A Trends: Consolidation through strategic acquisitions focusing on technology and geographic expansion.

Off-Road Vehicle Market Growth Trends & Insights

The ORV market experienced significant growth during the historical period (2019-2024), driven by increasing disposable incomes, rising popularity of outdoor recreational activities, and advancements in vehicle technology. The market is expected to continue its growth trajectory, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by the adoption of electric UTVs and ATVs, along with the expanding use of ORVs in agriculture and other applications. Consumer behavior is shifting towards more technologically advanced and environmentally friendly models. Market penetration in emerging economies is expected to increase significantly.

Dominant Regions, Countries, or Segments in Off-Road Vehicle Market

North America currently dominates the global off-road vehicle market, holding approximately xx% market share in 2024. This dominance is attributed to high consumer spending, well-established recreational vehicle culture, and the presence of major manufacturers. Within the application segments, Sports dominates, accounting for xx% of the market, while the ATV segment leads the vehicle type market, representing xx% of the total. However, the agricultural and other application segments are projected to experience the highest growth rates during the forecast period, driven by increasing demand for efficient and versatile machines in these sectors.

- North America: High consumer spending, strong recreational culture, and presence of major manufacturers.

- Europe: Growing popularity of outdoor activities and increasing demand for specialized ORVs.

- Asia-Pacific: High growth potential due to rising disposable incomes and expanding recreational activities.

- ATV Segment: High demand driven by recreational use and accessibility.

- UTV Segment: Strong growth potential due to versatility and applicability in various sectors.

- Agricultural Applications: Increasing demand for efficient and specialized ORVs.

Off-Road Vehicle Market Product Landscape

The off-road vehicle market offers a wide array of products catering to diverse needs. Innovation focuses on improving power, efficiency, and safety features. Electric models are gaining traction, offering quieter operation, reduced emissions, and potentially lower running costs. Advanced suspension systems enhance comfort and performance, while safety features, such as roll cages and advanced braking systems, are being incorporated as standard. Unique selling propositions often center around performance, versatility, and technological advancements.

Key Drivers, Barriers & Challenges in Off-Road Vehicle Market

Key Drivers:

- Rising disposable incomes and increased participation in outdoor recreational activities.

- Technological advancements, such as electric powertrains and autonomous features.

- Expanding applications in agriculture, construction, and other industries.

Challenges & Restraints:

- Stringent environmental regulations impacting production costs.

- Supply chain disruptions affecting production and delivery timelines, impacting approximately xx% of production in 2024.

- Intense competition from existing and emerging players.

Emerging Opportunities in Off-Road Vehicle Market

- Growing demand for electric and hybrid off-road vehicles.

- Expanding applications in emerging markets and new industries.

- Development of autonomous features and advanced safety systems.

Growth Accelerators in the Off-Road Vehicle Market Industry

Strategic partnerships, technological breakthroughs, specifically in battery technology, and the expansion into new markets (especially developing countries with strong agricultural sectors) are vital growth accelerators. The integration of smart technologies and connectivity features will further drive market expansion.

Key Players Shaping the Off-Road Vehicle Market Market

- Arctic Cat Inc

- American LandMaster

- Bombardier Recreational Products Inc

- Yamaha Motor Corporation

- Kwang Yang Motor Co Ltd

- 1 Honda Company Motor Lt

- Polaris Inc

- Suzuki Motor Corporation

- Kawasaki Motors Corp

Notable Milestones in Off-Road Vehicle Market Sector

- July 2022: American Landmaster launched an electric UTV in the United States, featuring lithium-ion battery options with a range up to 45 miles on a single charge.

- July 2022: Volcon launched an electric UTV in Texas, boasting a peak power of 107 kW (143 hp), 265 lb-ft (360 Nm) of torque, a top speed of 130 kmph, and a range exceeding 160 km on a single charge. These launches signal a significant shift towards electric vehicles in the off-road sector.

In-Depth Off-Road Vehicle Market Market Outlook

The off-road vehicle market is poised for continued growth, driven by technological innovation, expanding applications, and increasing consumer demand. Strategic investments in electric vehicle technology, autonomous features, and advanced safety systems will shape the market landscape. Companies focusing on sustainable practices and catering to diverse consumer needs will be best positioned to capitalize on the market's long-term potential.

Off-Road Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. All-terrain Vehicle (ATV)

- 1.2. Utility Task Vehicle (UTV)

-

2. Application

- 2.1. Sports

- 2.2. Agricultural

- 2.3. Other Applications

Off-Road Vehicle Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Off-Road Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Electric Passenger and Commerical Vehicle Sales

- 3.3. Market Restrains

- 3.3.1. Integration of Vinyl Flooring Deters the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The All-Terrain Vehicle Segment is Likely to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Off-Road Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. All-terrain Vehicle (ATV)

- 5.1.2. Utility Task Vehicle (UTV)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sports

- 5.2.2. Agricultural

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Off-Road Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. All-terrain Vehicle (ATV)

- 6.1.2. Utility Task Vehicle (UTV)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Sports

- 6.2.2. Agricultural

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Off-Road Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. All-terrain Vehicle (ATV)

- 7.1.2. Utility Task Vehicle (UTV)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Sports

- 7.2.2. Agricultural

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Off-Road Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. All-terrain Vehicle (ATV)

- 8.1.2. Utility Task Vehicle (UTV)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Sports

- 8.2.2. Agricultural

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Off-Road Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. All-terrain Vehicle (ATV)

- 9.1.2. Utility Task Vehicle (UTV)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Sports

- 9.2.2. Agricultural

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. North America Off-Road Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Off-Road Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Off-Road Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Off-Road Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Arctic Cat Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 American LandMaster

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Bombardier Recreational Products Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Yamaha Motor Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Kwang Yang Motor Co Ltd

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 1 Honda Company Motor Lt

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Polaris Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Suzuki Motor Corporation

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Kawasaki Motors Corp

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.1 Arctic Cat Inc

List of Figures

- Figure 1: Global Off-Road Vehicle Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Off-Road Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Off-Road Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Off-Road Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Off-Road Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Off-Road Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Off-Road Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Off-Road Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Off-Road Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Off-Road Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 11: North America Off-Road Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 12: North America Off-Road Vehicle Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Off-Road Vehicle Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Off-Road Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Off-Road Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Off-Road Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 17: Europe Off-Road Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 18: Europe Off-Road Vehicle Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Off-Road Vehicle Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Off-Road Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Off-Road Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Off-Road Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 23: Asia Pacific Off-Road Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 24: Asia Pacific Off-Road Vehicle Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Pacific Off-Road Vehicle Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Pacific Off-Road Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Off-Road Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Off-Road Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 29: Rest of the World Off-Road Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 30: Rest of the World Off-Road Vehicle Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Rest of the World Off-Road Vehicle Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Rest of the World Off-Road Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Off-Road Vehicle Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Off-Road Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Off-Road Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Global Off-Road Vehicle Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Off-Road Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Off-Road Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Off-Road Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Off-Road Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Off-Road Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Off-Road Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Off-Road Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Off-Road Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Off-Road Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Off-Road Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 14: Global Off-Road Vehicle Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Off-Road Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Off-Road Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 17: Global Off-Road Vehicle Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Global Off-Road Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Off-Road Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 20: Global Off-Road Vehicle Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Off-Road Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Off-Road Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 23: Global Off-Road Vehicle Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Off-Road Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Off-Road Vehicle Market?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the Off-Road Vehicle Market?

Key companies in the market include Arctic Cat Inc, American LandMaster, Bombardier Recreational Products Inc, Yamaha Motor Corporation, Kwang Yang Motor Co Ltd, 1 Honda Company Motor Lt, Polaris Inc, Suzuki Motor Corporation, Kawasaki Motors Corp.

3. What are the main segments of the Off-Road Vehicle Market?

The market segments include Vehicle Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Electric Passenger and Commerical Vehicle Sales.

6. What are the notable trends driving market growth?

The All-Terrain Vehicle Segment is Likely to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Integration of Vinyl Flooring Deters the Growth of the Market.

8. Can you provide examples of recent developments in the market?

July 2022: American Landmaster launched the electric UTV in the United States. The electric UTV consists of a lithium-ion battery and has different battery options, the entry-level of which is good for 45 miles on a full charge.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Off-Road Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Off-Road Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Off-Road Vehicle Market?

To stay informed about further developments, trends, and reports in the Off-Road Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence