Key Insights

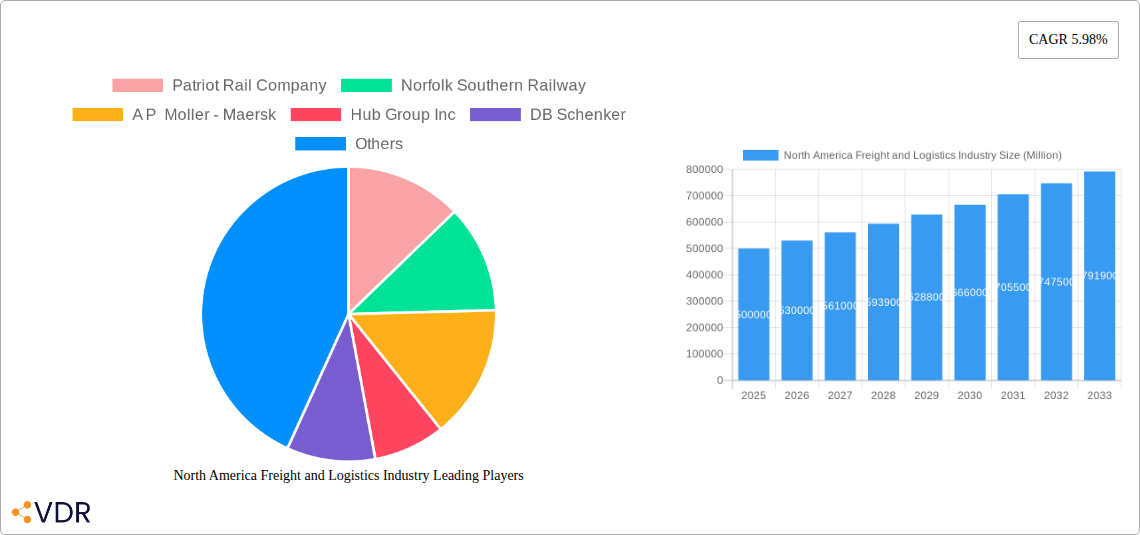

The North American freight and logistics industry, encompassing sectors like temperature-controlled transportation, courier services, and various end-user industries, exhibits robust growth potential. With a current market size estimated in the hundreds of billions (precise figures require more granular data but the provided CAGR of 5.98% and the named major players strongly suggest a substantial market), the industry is driven by factors such as the expansion of e-commerce, increasing cross-border trade, and the growing need for efficient supply chain management across diverse sectors including agriculture, manufacturing, and oil and gas. The industry's segmentation, encompassing diverse logistics functions (courier, express, parcel services) and end-user industries, underscores its complexity and the varied opportunities available within it. Key trends include the adoption of advanced technologies like automation, AI-powered route optimization, and blockchain for enhanced transparency and traceability. However, challenges remain including driver shortages, fluctuating fuel prices, and the need to maintain regulatory compliance across different jurisdictions.

The competitive landscape is characterized by a mix of large multinational corporations like FedEx, UPS, and DHL, alongside regional players and specialized logistics providers. The presence of these established players points to significant barriers to entry, though opportunities exist for innovative startups and niche players focusing on specific industry segments or technologies. The continued growth of e-commerce and the ongoing need for efficient supply chain solutions across numerous industries suggests a positive outlook for the North American freight and logistics sector over the forecast period (2025-2033), despite potential economic headwinds and regulatory hurdles. Further research into specific sub-segments, such as last-mile delivery or cold chain logistics, would yield even more detailed insights into growth drivers and opportunities. Focusing on sustainability initiatives within the sector could also unlock further growth and differentiation.

North America Freight and Logistics Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North American freight and logistics industry, encompassing the United States, Canada, Mexico, and the Rest of North America. The study period covers 2019-2033, with 2025 as the base and estimated year. We analyze market dynamics, growth trends, dominant segments, key players, and future opportunities, providing crucial insights for industry professionals, investors, and strategists. The report leverages extensive data analysis to deliver actionable intelligence for navigating this dynamic sector. Market values are presented in million units.

North America Freight and Logistics Industry Market Dynamics & Structure

The North American freight and logistics market is characterized by high competition, significant technological advancements, and evolving regulatory landscapes. Market concentration is moderate, with a few large players holding significant market share, but a considerable number of smaller, specialized companies also contributing significantly. The industry is experiencing rapid technological innovation driven by the need for increased efficiency, transparency, and sustainability. This includes the adoption of automation, AI, and data analytics across all aspects of the logistics chain.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025, while the remaining share is distributed across numerous smaller players.

- Technological Innovation: Significant investments in technologies like IoT, AI, and blockchain are transforming operations, improving visibility, and optimizing supply chains.

- Regulatory Frameworks: Stringent regulations related to safety, security, and environmental protection significantly influence industry practices.

- Competitive Product Substitutes: The emergence of innovative transportation modes and logistics solutions creates competitive pressures.

- End-User Demographics: The industry caters to diverse end-user sectors, including manufacturing (xx million units), wholesale and retail trade (xx million units), and others. Manufacturing and retail are among the major drivers.

- M&A Trends: Consolidation continues, with an estimated xx M&A deals in the last 5 years. This trend is driven by the need for scale, expanded service offerings, and technological capabilities. The average deal size was xx million units.

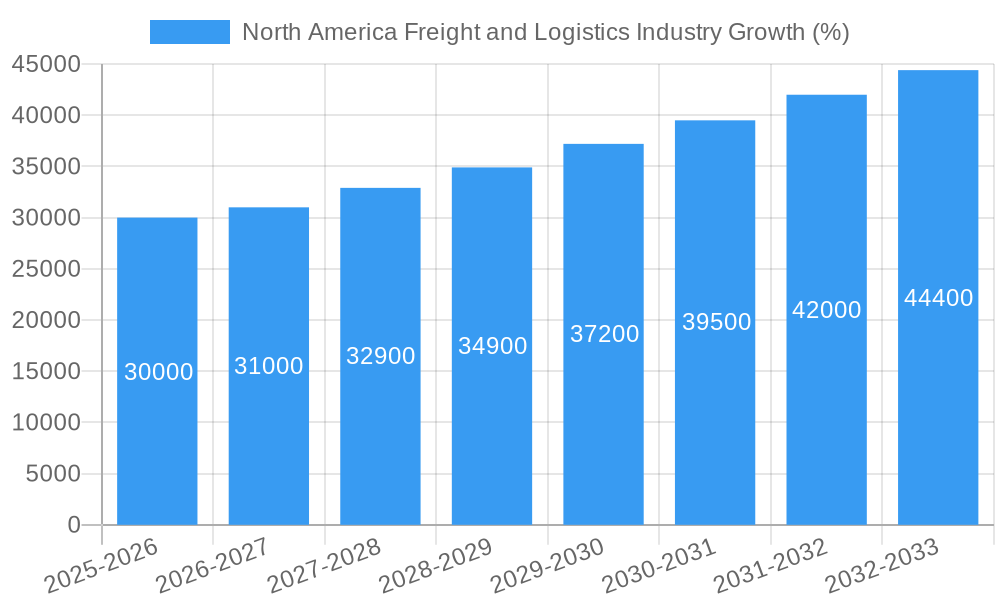

North America Freight and Logistics Industry Growth Trends & Insights

The North American freight and logistics market exhibits robust growth, driven by factors such as increasing e-commerce penetration, globalization of supply chains, and the expansion of manufacturing activities. The market size experienced a CAGR of xx% during 2019-2024 and is projected to grow at a CAGR of xx% from 2025 to 2033. This growth is influenced by changes in consumer behavior, with a shift towards faster delivery expectations and increased demand for specialized services like temperature-controlled logistics. Technological disruptions, such as the widespread adoption of automation and AI-powered solutions, further accelerate efficiency and reshape market dynamics. Market penetration of advanced technologies is increasing, with xx% of logistics companies currently utilizing AI-based solutions. The increasing prevalence of omnichannel retail strategies requires agile and robust logistics to manage the complexity of supply chains.

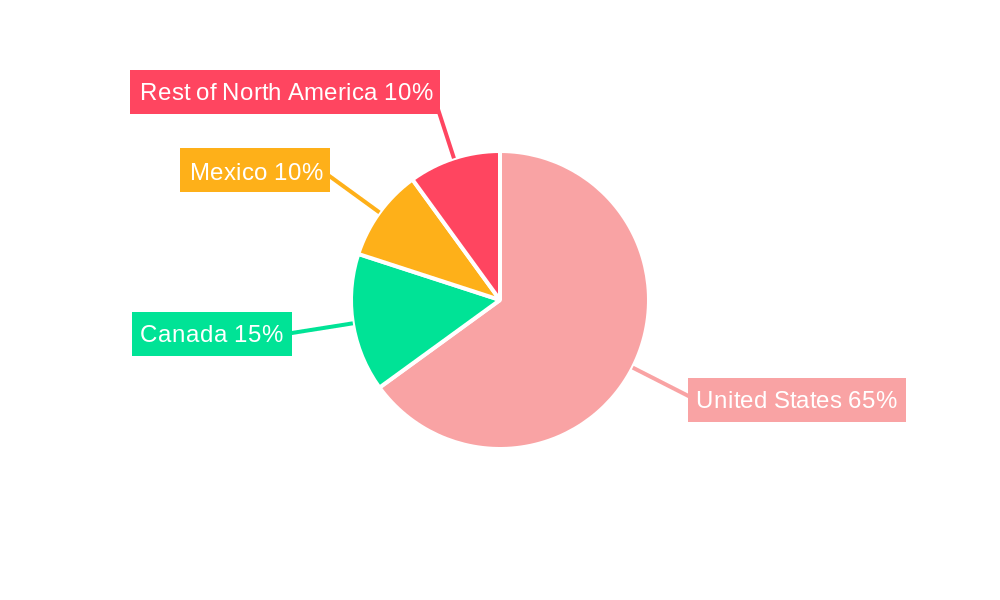

Dominant Regions, Countries, or Segments in North America Freight and Logistics Industry

The United States dominates the North American freight and logistics market, accounting for xx% of the total market value in 2025 due to its large economy and extensive infrastructure. However, Canada and Mexico also show significant growth potential. Within segments, the temperature-controlled segment displays strong growth due to the rising demand for perishable goods and pharmaceutical logistics. The "Other Services" segment, which includes value-added services like warehousing and distribution, is also experiencing significant growth driven by the growing sophistication of supply chains.

- Key Drivers for US Dominance:

- Extensive highway and rail networks.

- Large consumer base and robust manufacturing sector.

- Developed technology infrastructure.

- Growth Potential in Canada and Mexico:

- Expanding e-commerce market in both countries.

- Increasing cross-border trade.

- Government investments in infrastructure development.

- Temperature-Controlled Segment:

- Growth fueled by the increase in demand for fresh food and pharmaceutical products.

- Stringent regulations concerning food safety and product quality.

- Investment in specialized cold chain infrastructure and technologies.

- Other Services Segment:

- Growing demand for value-added services like warehousing and reverse logistics.

- Rise in third-party logistics (3PL) providers.

- Technological advancements leading to improved efficiency and visibility.

North America Freight and Logistics Industry Product Landscape

The industry offers a wide range of products and services, from basic transportation to highly specialized solutions like temperature-controlled logistics and specialized warehousing. Recent product innovations include AI-powered route optimization tools, real-time tracking systems, and blockchain-based supply chain management platforms. These innovations deliver increased efficiency, transparency, and enhanced security. The unique selling proposition of many companies lies in their ability to provide comprehensive, integrated logistics solutions tailored to the specific needs of their clients.

Key Drivers, Barriers & Challenges in North America Freight and Logistics Industry

Key Drivers:

- Increasing e-commerce adoption drives demand for faster and more efficient delivery.

- Globalization necessitates robust and reliable international shipping solutions.

- Technological advancements improve operational efficiency and reduce costs.

- Growing focus on sustainability encourages adoption of eco-friendly logistics practices.

Challenges:

- Driver shortages and labor costs are major concerns. The shortage is estimated to impact efficiency by xx% in 2025.

- Fuel price volatility creates uncertainty in transportation costs.

- Increased regulatory scrutiny necessitates compliance efforts.

- Intense competition among industry players puts downward pressure on pricing.

Emerging Opportunities in North America Freight and Logistics Industry

- Last-mile delivery optimization: Innovative solutions to address the challenges of efficient last-mile delivery.

- Sustainable logistics: Demand for eco-friendly transportation options and supply chain management practices.

- Data-driven decision-making: Harnessing big data analytics to improve forecasting and operational efficiency.

- Integration of automation and robotics: Implementing automation technologies to optimize warehouse operations and reduce manual labor.

Growth Accelerators in the North America Freight and Logistics Industry Industry

Long-term growth is driven by technological breakthroughs, particularly in automation, AI, and data analytics. Strategic partnerships between logistics providers and technology companies are fostering innovation. Market expansion strategies focusing on underserved regions and niche markets are also contributing to growth. The increasing adoption of omnichannel strategies by retailers presents significant opportunities for logistics providers to expand their services.

Key Players Shaping the North America Freight and Logistics Industry Market

- Patriot Rail Company

- Norfolk Southern Railway

- A P Moller - Maersk

- Hub Group Inc

- DB Schenker

- XPO Inc

- Nippon Express Holdings

- SEKO Logistics

- Transportation Insight Holding Company

- Old Dominion Freight Line

- Canada Post

- Landstar System Inc

- Fomento Económico Mexicano S A B de C V

- DHL Group

- Uber Technologies Inc

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Americold Logistics

- Knight-Swift Transportation

- M3 Transport LLC

- GEODIS

- Burris Logistics

- Penske Logistics

- Union Pacific Railroad

- Arrive Logistics

- Canadian National Railway Company

- Yellow Corporation

- FedEx

- GXO Logistics

- Fastfrate Group

- Lineage Logistics LLC

- Kuehne + Nagel

- MODE Global LLC

- Excel Group

- Berkshire Hathaway Inc (including BNSF Railway Company)

- United Parcel Service of America Inc (UPS)

- Total Quality Logistics LLC

- Polaris Development Corporation

- Werner Enterprises

- OnTrac

- Omni Logistics

- Ascent Global Logistics

- C H Robinson

- Mactrans Logistics

- Congebec

- Canadian Pacific Kansas City Limited

- AIT Worldwide Logistics

- ArcBest

- CSX Corporation

- Purolator

- NFI Industries

- Traxion

- Schneider National Inc

- Grupo Mexico

- TFI International Inc

- J B Hunt Transport Inc

- Brookfield Infrastructure Partners L P (including Genesee & Wyoming Inc )

- Capstone Logistics LLC

- KEX Express (US) LLC

- Expeditors International of Washington Inc

- Ryder System Inc

Notable Milestones in North America Freight and Logistics Industry Sector

- December 2023: Canadian National Railway Company upgraded its Falcon Premium Intermodal Service, reducing transit time between Canada, the US, and Mexico by a full day.

- January 2024: Kuehne + Nagel launched its Book & Claim insetting solution for electric vehicles, enhancing its decarbonization efforts.

- February 2024: C.H. Robinson introduced new AI-powered technology to streamline freight shipping appointment scheduling, significantly improving efficiency.

In-Depth North America Freight and Logistics Industry Market Outlook

The North American freight and logistics market is poised for continued growth, driven by technological advancements, evolving consumer expectations, and the increasing complexity of global supply chains. Opportunities exist in last-mile delivery optimization, sustainable logistics solutions, and the strategic use of data analytics to enhance decision-making. Companies that embrace innovation and adapt to the changing landscape will be best positioned to capitalize on the substantial growth potential within this dynamic industry.

North America Freight and Logistics Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

North America Freight and Logistics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Freight and Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. United States North America Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Patriot Rail Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Norfolk Southern Railway

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 A P Moller - Maersk

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hub Group Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 DB Schenker

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 XPO Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Nippon Express Holdings

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SEKO Logistics

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Transportation Insight Holding Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Old Dominion Freight Line

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Canada Post

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Landstar System Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Fomento Económico Mexicano S A B de C V

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 DHL Group

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Uber Technologies Inc

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Americold Logistics

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Knight-Swift Transportation

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 M3 Transport LLC

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 GEODIS

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.21 Burris Logistics

- 10.2.21.1. Overview

- 10.2.21.2. Products

- 10.2.21.3. SWOT Analysis

- 10.2.21.4. Recent Developments

- 10.2.21.5. Financials (Based on Availability)

- 10.2.22 Penske Logistics

- 10.2.22.1. Overview

- 10.2.22.2. Products

- 10.2.22.3. SWOT Analysis

- 10.2.22.4. Recent Developments

- 10.2.22.5. Financials (Based on Availability)

- 10.2.23 Union Pacific Railroad

- 10.2.23.1. Overview

- 10.2.23.2. Products

- 10.2.23.3. SWOT Analysis

- 10.2.23.4. Recent Developments

- 10.2.23.5. Financials (Based on Availability)

- 10.2.24 Arrive Logistics

- 10.2.24.1. Overview

- 10.2.24.2. Products

- 10.2.24.3. SWOT Analysis

- 10.2.24.4. Recent Developments

- 10.2.24.5. Financials (Based on Availability)

- 10.2.25 Canadian National Railway Company

- 10.2.25.1. Overview

- 10.2.25.2. Products

- 10.2.25.3. SWOT Analysis

- 10.2.25.4. Recent Developments

- 10.2.25.5. Financials (Based on Availability)

- 10.2.26 Yellow Corporatio

- 10.2.26.1. Overview

- 10.2.26.2. Products

- 10.2.26.3. SWOT Analysis

- 10.2.26.4. Recent Developments

- 10.2.26.5. Financials (Based on Availability)

- 10.2.27 FedEx

- 10.2.27.1. Overview

- 10.2.27.2. Products

- 10.2.27.3. SWOT Analysis

- 10.2.27.4. Recent Developments

- 10.2.27.5. Financials (Based on Availability)

- 10.2.28 GXO Logistics

- 10.2.28.1. Overview

- 10.2.28.2. Products

- 10.2.28.3. SWOT Analysis

- 10.2.28.4. Recent Developments

- 10.2.28.5. Financials (Based on Availability)

- 10.2.29 Fastfrate Group

- 10.2.29.1. Overview

- 10.2.29.2. Products

- 10.2.29.3. SWOT Analysis

- 10.2.29.4. Recent Developments

- 10.2.29.5. Financials (Based on Availability)

- 10.2.30 Lineage Logistics LLC

- 10.2.30.1. Overview

- 10.2.30.2. Products

- 10.2.30.3. SWOT Analysis

- 10.2.30.4. Recent Developments

- 10.2.30.5. Financials (Based on Availability)

- 10.2.31 Kuehne + Nagel

- 10.2.31.1. Overview

- 10.2.31.2. Products

- 10.2.31.3. SWOT Analysis

- 10.2.31.4. Recent Developments

- 10.2.31.5. Financials (Based on Availability)

- 10.2.32 MODE Global LLC

- 10.2.32.1. Overview

- 10.2.32.2. Products

- 10.2.32.3. SWOT Analysis

- 10.2.32.4. Recent Developments

- 10.2.32.5. Financials (Based on Availability)

- 10.2.33 Excel Group

- 10.2.33.1. Overview

- 10.2.33.2. Products

- 10.2.33.3. SWOT Analysis

- 10.2.33.4. Recent Developments

- 10.2.33.5. Financials (Based on Availability)

- 10.2.34 Berkshire Hathaway Inc (including BNSF Railway Company)

- 10.2.34.1. Overview

- 10.2.34.2. Products

- 10.2.34.3. SWOT Analysis

- 10.2.34.4. Recent Developments

- 10.2.34.5. Financials (Based on Availability)

- 10.2.35 United Parcel Service of America Inc (UPS)

- 10.2.35.1. Overview

- 10.2.35.2. Products

- 10.2.35.3. SWOT Analysis

- 10.2.35.4. Recent Developments

- 10.2.35.5. Financials (Based on Availability)

- 10.2.36 Total Quality Logistics LLC

- 10.2.36.1. Overview

- 10.2.36.2. Products

- 10.2.36.3. SWOT Analysis

- 10.2.36.4. Recent Developments

- 10.2.36.5. Financials (Based on Availability)

- 10.2.37 Polaris Development Corporation

- 10.2.37.1. Overview

- 10.2.37.2. Products

- 10.2.37.3. SWOT Analysis

- 10.2.37.4. Recent Developments

- 10.2.37.5. Financials (Based on Availability)

- 10.2.38 Werner Enterprises

- 10.2.38.1. Overview

- 10.2.38.2. Products

- 10.2.38.3. SWOT Analysis

- 10.2.38.4. Recent Developments

- 10.2.38.5. Financials (Based on Availability)

- 10.2.39 OnTrac

- 10.2.39.1. Overview

- 10.2.39.2. Products

- 10.2.39.3. SWOT Analysis

- 10.2.39.4. Recent Developments

- 10.2.39.5. Financials (Based on Availability)

- 10.2.40 Omni Logistics

- 10.2.40.1. Overview

- 10.2.40.2. Products

- 10.2.40.3. SWOT Analysis

- 10.2.40.4. Recent Developments

- 10.2.40.5. Financials (Based on Availability)

- 10.2.41 Ascent Global Logistics

- 10.2.41.1. Overview

- 10.2.41.2. Products

- 10.2.41.3. SWOT Analysis

- 10.2.41.4. Recent Developments

- 10.2.41.5. Financials (Based on Availability)

- 10.2.42 C H Robinson

- 10.2.42.1. Overview

- 10.2.42.2. Products

- 10.2.42.3. SWOT Analysis

- 10.2.42.4. Recent Developments

- 10.2.42.5. Financials (Based on Availability)

- 10.2.43 Mactrans Logistics

- 10.2.43.1. Overview

- 10.2.43.2. Products

- 10.2.43.3. SWOT Analysis

- 10.2.43.4. Recent Developments

- 10.2.43.5. Financials (Based on Availability)

- 10.2.44 Congebec

- 10.2.44.1. Overview

- 10.2.44.2. Products

- 10.2.44.3. SWOT Analysis

- 10.2.44.4. Recent Developments

- 10.2.44.5. Financials (Based on Availability)

- 10.2.45 Canadian Pacific Kansas City Limited

- 10.2.45.1. Overview

- 10.2.45.2. Products

- 10.2.45.3. SWOT Analysis

- 10.2.45.4. Recent Developments

- 10.2.45.5. Financials (Based on Availability)

- 10.2.46 AIT Worldwide Logistics

- 10.2.46.1. Overview

- 10.2.46.2. Products

- 10.2.46.3. SWOT Analysis

- 10.2.46.4. Recent Developments

- 10.2.46.5. Financials (Based on Availability)

- 10.2.47 ArcBest

- 10.2.47.1. Overview

- 10.2.47.2. Products

- 10.2.47.3. SWOT Analysis

- 10.2.47.4. Recent Developments

- 10.2.47.5. Financials (Based on Availability)

- 10.2.48 CSX Corporation

- 10.2.48.1. Overview

- 10.2.48.2. Products

- 10.2.48.3. SWOT Analysis

- 10.2.48.4. Recent Developments

- 10.2.48.5. Financials (Based on Availability)

- 10.2.49 Purolator

- 10.2.49.1. Overview

- 10.2.49.2. Products

- 10.2.49.3. SWOT Analysis

- 10.2.49.4. Recent Developments

- 10.2.49.5. Financials (Based on Availability)

- 10.2.50 NFI Industries

- 10.2.50.1. Overview

- 10.2.50.2. Products

- 10.2.50.3. SWOT Analysis

- 10.2.50.4. Recent Developments

- 10.2.50.5. Financials (Based on Availability)

- 10.2.51 Traxion

- 10.2.51.1. Overview

- 10.2.51.2. Products

- 10.2.51.3. SWOT Analysis

- 10.2.51.4. Recent Developments

- 10.2.51.5. Financials (Based on Availability)

- 10.2.52 Schneider National Inc

- 10.2.52.1. Overview

- 10.2.52.2. Products

- 10.2.52.3. SWOT Analysis

- 10.2.52.4. Recent Developments

- 10.2.52.5. Financials (Based on Availability)

- 10.2.53 Grupo Mexico

- 10.2.53.1. Overview

- 10.2.53.2. Products

- 10.2.53.3. SWOT Analysis

- 10.2.53.4. Recent Developments

- 10.2.53.5. Financials (Based on Availability)

- 10.2.54 TFI International Inc

- 10.2.54.1. Overview

- 10.2.54.2. Products

- 10.2.54.3. SWOT Analysis

- 10.2.54.4. Recent Developments

- 10.2.54.5. Financials (Based on Availability)

- 10.2.55 J B Hunt Transport Inc

- 10.2.55.1. Overview

- 10.2.55.2. Products

- 10.2.55.3. SWOT Analysis

- 10.2.55.4. Recent Developments

- 10.2.55.5. Financials (Based on Availability)

- 10.2.56 Brookfield Infrastructure Partners L P (including Genesee & Wyoming Inc )

- 10.2.56.1. Overview

- 10.2.56.2. Products

- 10.2.56.3. SWOT Analysis

- 10.2.56.4. Recent Developments

- 10.2.56.5. Financials (Based on Availability)

- 10.2.57 Capstone Logistics LLC

- 10.2.57.1. Overview

- 10.2.57.2. Products

- 10.2.57.3. SWOT Analysis

- 10.2.57.4. Recent Developments

- 10.2.57.5. Financials (Based on Availability)

- 10.2.58 KEX Express (US) LLC

- 10.2.58.1. Overview

- 10.2.58.2. Products

- 10.2.58.3. SWOT Analysis

- 10.2.58.4. Recent Developments

- 10.2.58.5. Financials (Based on Availability)

- 10.2.59 Expeditors International of Washington Inc

- 10.2.59.1. Overview

- 10.2.59.2. Products

- 10.2.59.3. SWOT Analysis

- 10.2.59.4. Recent Developments

- 10.2.59.5. Financials (Based on Availability)

- 10.2.60 Ryder System Inc

- 10.2.60.1. Overview

- 10.2.60.2. Products

- 10.2.60.3. SWOT Analysis

- 10.2.60.4. Recent Developments

- 10.2.60.5. Financials (Based on Availability)

- 10.2.1 Patriot Rail Company

List of Figures

- Figure 1: North America Freight and Logistics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Freight and Logistics Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Freight and Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Freight and Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: North America Freight and Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: North America Freight and Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Freight and Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Freight and Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 11: North America Freight and Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 12: North America Freight and Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Freight and Logistics Industry?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the North America Freight and Logistics Industry?

Key companies in the market include Patriot Rail Company, Norfolk Southern Railway, A P Moller - Maersk, Hub Group Inc, DB Schenker, XPO Inc, Nippon Express Holdings, SEKO Logistics, Transportation Insight Holding Company, Old Dominion Freight Line, Canada Post, Landstar System Inc, Fomento Económico Mexicano S A B de C V, DHL Group, Uber Technologies Inc, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Americold Logistics, Knight-Swift Transportation, M3 Transport LLC, GEODIS, Burris Logistics, Penske Logistics, Union Pacific Railroad, Arrive Logistics, Canadian National Railway Company, Yellow Corporatio, FedEx, GXO Logistics, Fastfrate Group, Lineage Logistics LLC, Kuehne + Nagel, MODE Global LLC, Excel Group, Berkshire Hathaway Inc (including BNSF Railway Company), United Parcel Service of America Inc (UPS), Total Quality Logistics LLC, Polaris Development Corporation, Werner Enterprises, OnTrac, Omni Logistics, Ascent Global Logistics, C H Robinson, Mactrans Logistics, Congebec, Canadian Pacific Kansas City Limited, AIT Worldwide Logistics, ArcBest, CSX Corporation, Purolator, NFI Industries, Traxion, Schneider National Inc, Grupo Mexico, TFI International Inc, J B Hunt Transport Inc, Brookfield Infrastructure Partners L P (including Genesee & Wyoming Inc ), Capstone Logistics LLC, KEX Express (US) LLC, Expeditors International of Washington Inc, Ryder System Inc.

3. What are the main segments of the North America Freight and Logistics Industry?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

February 2024: C.H. Robinson has developed a new technology that creates a major efficiency in freight shipping: removing the work of scheduling an appointment at the place where a load needs to be picked up and scheduling another appointment where the load needs to be delivered. The technology also uses artificial intelligence to determine the optimal appointment, based on transit-time data from C.H. Robinson’s millions of shipments across 300,000 shipping lanes.January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.December 2023: Canadian National Railway Company announced an upgrade to its Falcon Premium Intermodal Service. CN said recent operational changes by its business partner, Union Pacific (UP), will remove a full day of transit time for customers using the Canada-US-Mexico service. The Falcon Premium Intermodal Service is a best-in-class Mexico-US-Canada service with a seamless rail connection in Chicago, Illinois. It directly connects all CN origin points within Canada and Detroit, Michigan to GMXT terminals in Mexico. This service benefits intermodal customers shipping automotive parts, food, FAK (freight - all kinds), home appliances, and temperature-controlled products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Freight and Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Freight and Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Freight and Logistics Industry?

To stay informed about further developments, trends, and reports in the North America Freight and Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence