Key Insights

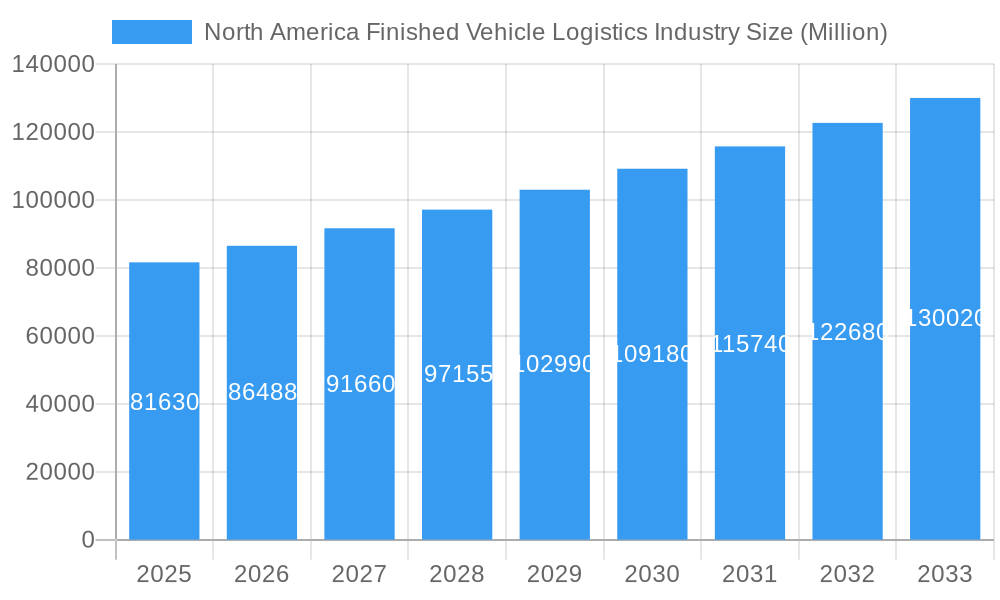

The North American finished vehicle logistics market, valued at $81.63 billion in 2025, is projected to experience robust growth, driven by increasing vehicle production and sales, particularly in the US and Mexico. The market's Compound Annual Growth Rate (CAGR) of 5.68% from 2025 to 2033 indicates a significant expansion over the forecast period. Key drivers include the rising demand for new vehicles fueled by economic growth and favorable consumer financing options, the expansion of automotive manufacturing facilities within North America, and the increasing adoption of advanced logistics technologies like real-time tracking and predictive analytics to optimize transportation efficiency and minimize vehicle damage. Growth is also fueled by the increasing focus on sustainable logistics practices, with a greater emphasis on fuel efficiency and reduced carbon emissions in transportation. The market segmentation reveals significant opportunities across different service types, including transportation, warehousing, distribution, and inventory management, with transportation currently dominating the market share. The finished vehicle segment holds a considerable portion of the market, owing to its higher value and complex logistical requirements. Competitive dynamics are characterized by the presence of both large multinational logistics providers such as DB Schenker, DHL, and UPS, alongside regional players, resulting in a diverse landscape with varied service offerings and competitive pricing.

North America Finished Vehicle Logistics Industry Market Size (In Billion)

Challenges for market participants include fluctuations in fuel prices, driver shortages, and evolving trade policies. Further complexities arise from managing the logistics of increasingly sophisticated and diverse vehicle models, requiring specialized handling and transportation equipment. Despite these challenges, the long-term outlook for the North American finished vehicle logistics market remains positive, propelled by the automotive industry's continued expansion and increasing sophistication in supply chain management. Opportunities exist for logistics providers to leverage technological advancements, strategic partnerships, and sustainable practices to gain a competitive edge in this dynamic market, particularly those focused on specialized services for electric vehicles (EVs) and other emerging vehicle technologies. Continued investment in infrastructure improvements, particularly in border crossings and cross-dock facilities, will further contribute to growth and efficiency within the industry.

North America Finished Vehicle Logistics Industry Company Market Share

North America Finished Vehicle Logistics Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North American finished vehicle logistics industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year. This report is crucial for automotive manufacturers, logistics providers, investors, and anyone seeking to understand this dynamic sector. The report analyzes the parent market of Automotive Logistics and the child market of Finished Vehicle Logistics in North America.

North America Finished Vehicle Logistics Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the North American finished vehicle logistics industry. The market is moderately concentrated, with key players holding significant market share. However, the presence of numerous smaller players fosters competition.

- Market Concentration: The top 5 players (DB Schenker, CEVA Logistics AG, DHL, United Parcel Service Inc, and 3 other companies) hold an estimated xx% market share in 2025. Further consolidation through mergers and acquisitions (M&A) is anticipated. The total M&A deal volume in the period 2019-2024 was approximately xx Million USD.

- Technological Innovation: Technological advancements such as AI-powered route optimization, blockchain for enhanced supply chain transparency, and autonomous vehicles are disrupting the industry. However, high implementation costs and integration challenges represent significant barriers.

- Regulatory Framework: Government regulations concerning emissions, safety, and cross-border transportation significantly impact operational costs and strategies. Recent policy changes focusing on electric vehicle infrastructure are expected to create new opportunities.

- Competitive Product Substitutes: While direct substitutes are limited, alternative transportation modes (rail, sea) pose indirect competition, particularly for long-haul transportation.

- End-User Demographics: The primary end-users are automotive manufacturers (OEMs) and dealerships. The increasing demand for electric vehicles is driving changes in logistics requirements.

- M&A Trends: Consolidation within the industry is expected to continue as larger players seek to expand their market share and service offerings.

North America Finished Vehicle Logistics Industry Growth Trends & Insights

The North American finished vehicle logistics market experienced significant growth during the historical period (2019-2024), with a CAGR of xx%. This growth is projected to continue during the forecast period (2025-2033), driven by factors such as increasing vehicle production, rising consumer demand, and expanding e-commerce. The market size is expected to reach xx million units by 2033. The increasing adoption of advanced logistics technologies is further fueling market expansion. Consumer preferences are shifting towards a seamless and transparent delivery experience, pushing logistics companies to invest in innovative solutions. Market penetration of advanced technologies is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in North America Finished Vehicle Logistics Industry

The United States dominates the North American finished vehicle logistics market due to its large automotive manufacturing base and high vehicle sales volume. Mexico shows strong growth potential due to its increasing automotive production and export activities. Within the segments:

- By Service: Transportation holds the largest market share (xx%), followed by Warehousing (xx%), Distribution and Inventory Management (xx%), and Other Services (xx%).

- By Type: Finished Vehicles constitutes the major segment (xx%), with Auto Components (xx%) and Other Types (xx%) also contributing significantly.

- By Country: The United States commands the largest market share (xx%), followed by Mexico (xx%) and Canada (xx%).

Key Drivers:

- Strong Automotive Production: High vehicle production in the US and Mexico drives demand for logistics services.

- Robust Infrastructure: Developed transportation networks in the US facilitate efficient vehicle movement.

- Government Initiatives: Government support for clean energy and electric vehicle infrastructure creates opportunities.

North America Finished Vehicle Logistics Industry Product Landscape

The industry offers a range of services including transportation (road, rail, sea), warehousing, distribution, inventory management, and value-added services like vehicle preparation and inspection. Technological advancements are leading to the adoption of real-time tracking systems, predictive analytics for inventory optimization, and automated warehousing solutions. Unique selling propositions include customized solutions, global network coverage, and focus on security and efficiency.

Key Drivers, Barriers & Challenges in North America Finished Vehicle Logistics Industry

Key Drivers:

- Rising vehicle production and sales.

- Increasing demand for efficient and cost-effective logistics solutions.

- Technological advancements enabling optimization and automation.

Challenges:

- Fluctuating fuel prices and driver shortages impact operational costs.

- Stringent regulatory compliance and environmental concerns.

- Intense competition from established and emerging players. The impact of these challenges is estimated to reduce market growth by xx% by 2033.

Emerging Opportunities in North America Finished Vehicle Logistics Industry

- Growth in electric vehicle (EV) logistics presents significant opportunities.

- Expanding into last-mile delivery solutions for direct-to-consumer vehicle sales.

- Leveraging data analytics and AI to enhance efficiency and reduce costs.

Growth Accelerators in the North America Finished Vehicle Logistics Industry

Strategic partnerships between logistics providers and automotive manufacturers, expansion into emerging markets, and ongoing technological innovations will drive long-term growth. Investments in sustainable and environmentally friendly logistics solutions will also play a crucial role.

Key Players Shaping the North America Finished Vehicle Logistics Industry Market

- DB Schenker

- CEVA Logistics AG

- DHL

- United Parcel Service Inc

- GEODIS

- Nippon Express Co Ltd

- XPO Logistics Inc

- KUEHNE + NAGEL International AG

- DSV

- Ryder System Inc

Notable Milestones in North America Finished Vehicle Logistics Industry Sector

- December 2023: USD 250 million investment by the US Department of Energy to support clean energy supply chains for EV production and improve logistics efficiency.

- May 2023: Bolloré Logistics opened a new automotive competence center in Mexico, focusing on customer needs within the automotive sector.

In-Depth North America Finished Vehicle Logistics Industry Market Outlook

The North American finished vehicle logistics market is poised for substantial growth driven by increasing vehicle production, technological advancements, and government support for clean energy initiatives. Strategic investments in automation, sustainable practices, and innovative solutions will be crucial for companies seeking to capitalize on emerging opportunities. The market's future potential is significant, with continued expansion anticipated throughout the forecast period.

North America Finished Vehicle Logistics Industry Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing, Distribution and Inventory Management

- 1.3. Other Services

-

2. Type

- 2.1. Finished Vehicle

- 2.2. Auto Components

- 2.3. Other types

North America Finished Vehicle Logistics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Finished Vehicle Logistics Industry Regional Market Share

Geographic Coverage of North America Finished Vehicle Logistics Industry

North America Finished Vehicle Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Environmental Concerns and Regulations; Technological Advancements in Automotive Technology

- 3.3. Market Restrains

- 3.3.1. Economic Uncertainty

- 3.4. Market Trends

- 3.4.1. Demand for Light Vehicle Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Finished Vehicle Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing, Distribution and Inventory Management

- 5.1.3. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Finished Vehicle

- 5.2.2. Auto Components

- 5.2.3. Other types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CEVA Logistics AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 United Parcel Service Inc **List Not Exhaustive 7 3 Other Companie

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GEODIS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nippon Express Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 XPO Logistics Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 KUEHNE + NAGEL International AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DSV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ryder System Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: North America Finished Vehicle Logistics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Finished Vehicle Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Finished Vehicle Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: North America Finished Vehicle Logistics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: North America Finished Vehicle Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Finished Vehicle Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 5: North America Finished Vehicle Logistics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: North America Finished Vehicle Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Finished Vehicle Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Finished Vehicle Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Finished Vehicle Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Finished Vehicle Logistics Industry?

The projected CAGR is approximately 5.68%.

2. Which companies are prominent players in the North America Finished Vehicle Logistics Industry?

Key companies in the market include DB Schenker, CEVA Logistics AG, DHL, United Parcel Service Inc **List Not Exhaustive 7 3 Other Companie, GEODIS, Nippon Express Co Ltd, XPO Logistics Inc, KUEHNE + NAGEL International AG, DSV, Ryder System Inc.

3. What are the main segments of the North America Finished Vehicle Logistics Industry?

The market segments include Service, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 81.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Environmental Concerns and Regulations; Technological Advancements in Automotive Technology.

6. What are the notable trends driving market growth?

Demand for Light Vehicle Production.

7. Are there any restraints impacting market growth?

Economic Uncertainty.

8. Can you provide examples of recent developments in the market?

December 2023: Government departments in the United States coordinated a wide range of funding initiatives for clean energy and circular economy to support the production of electric vehicles and batteries and improve logistics efficiency. To establish clean energy supply chains in locations affected by the closure of power plants or coal mines, the Department of Energy's Advanced Energy Manufacturing and Recycling Grant Programme will invest USD 250 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Finished Vehicle Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Finished Vehicle Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Finished Vehicle Logistics Industry?

To stay informed about further developments, trends, and reports in the North America Finished Vehicle Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence