Key Insights

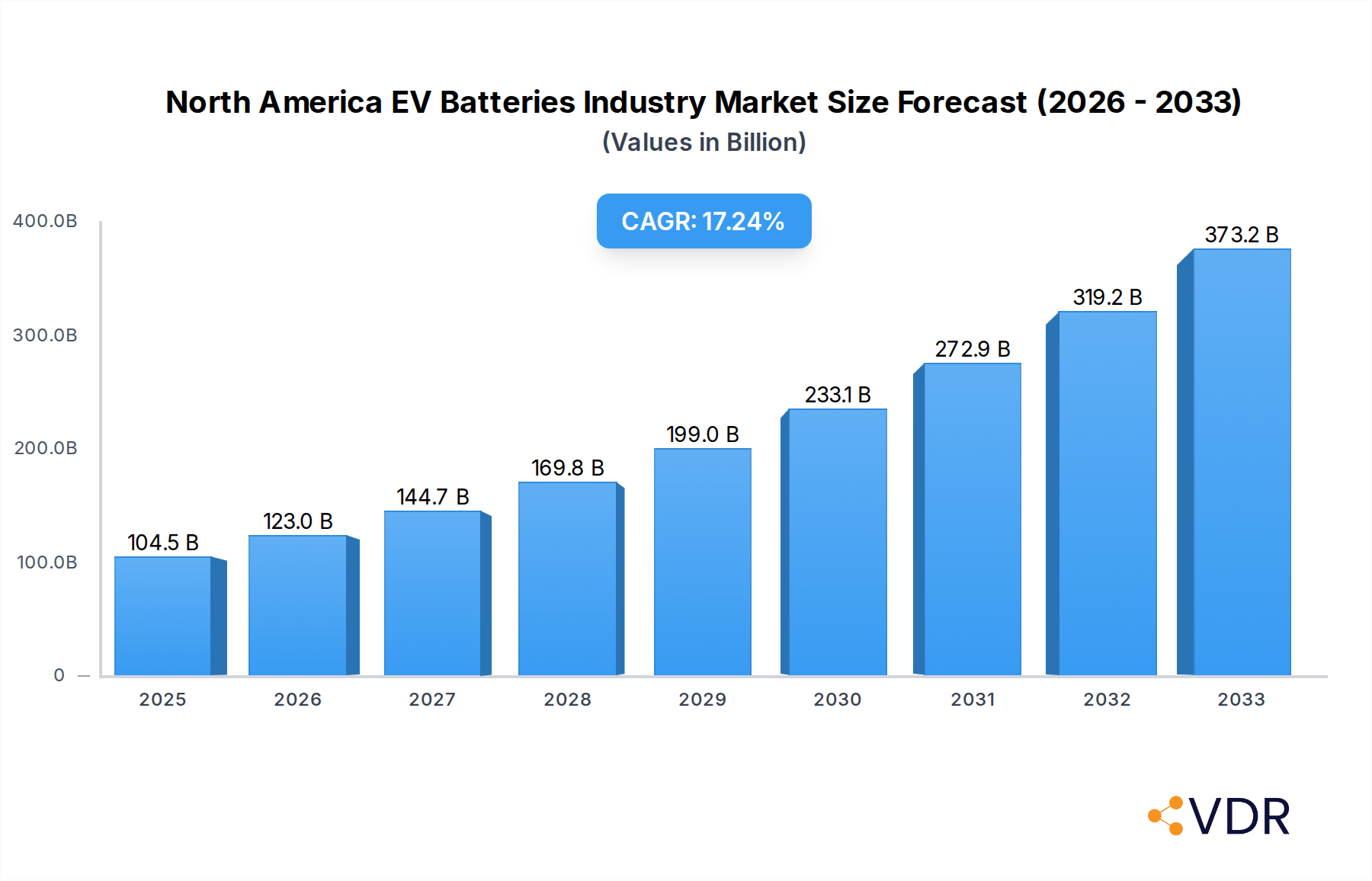

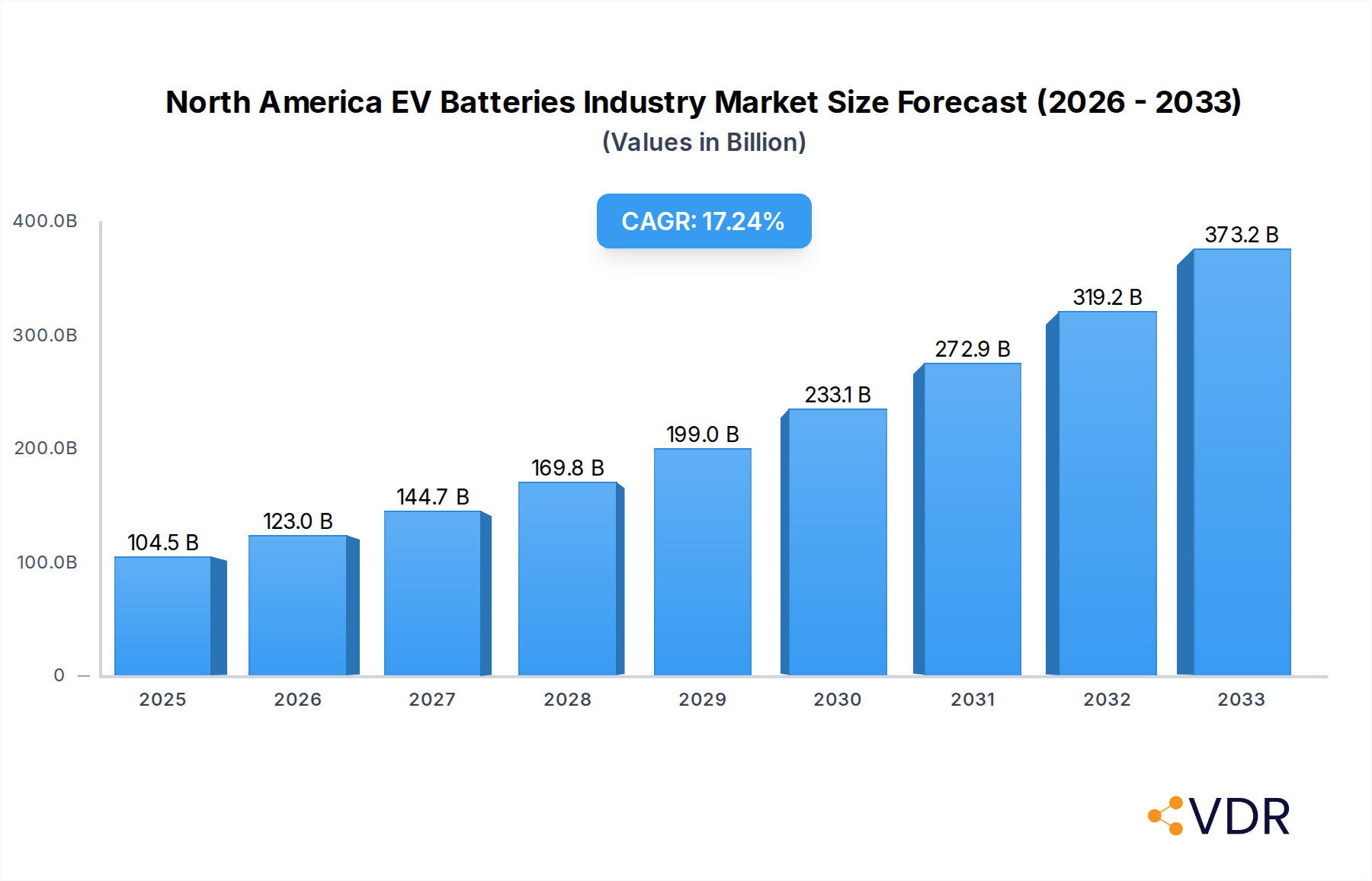

The North America Electric Vehicle (EV) Batteries market is poised for explosive growth, projected to reach USD 104.51 billion by 2025, fueled by a remarkable Compound Annual Growth Rate (CAGR) of 17.9% throughout the forecast period of 2025-2033. This robust expansion is primarily driven by escalating government incentives and stringent emission regulations across the United States, Canada, and Mexico, compelling automakers to accelerate their EV production and adoption. Furthermore, increasing consumer awareness regarding environmental sustainability and the rising cost of fossil fuels are significantly boosting demand for electric vehicles, consequently driving the need for advanced battery technologies. The market's dynamism is further underscored by rapid advancements in battery chemistry, particularly the growing preference for Lithium Iron Phosphate (LFP) batteries due to their enhanced safety, longer lifespan, and reduced reliance on cobalt. Innovations in battery form factors like pouch and prismatic cells, alongside efficient manufacturing methods such as laser welding, are contributing to lighter, more powerful, and cost-effective EV battery solutions. The increasing capacity of batteries, with a significant trend towards configurations ranging from 40 kWh to 80 kWh and above 80 kWh, indicates a clear move towards longer-range EVs, catering to diverse consumer needs.

North America EV Batteries Industry Market Size (In Billion)

The competitive landscape of the North America EV Batteries market is characterized by the presence of major global players and emerging domestic manufacturers, all vying for market share through strategic collaborations, technological innovations, and capacity expansions. Key companies such as Contemporary Amperex Technology Co Ltd (CATL), LG Energy Solution Ltd, SK Innovation Co Ltd, and Panasonic Holdings Corporation are at the forefront, investing heavily in research and development to enhance battery performance, safety, and cost-effectiveness. The ongoing shift in propulsion types towards Battery Electric Vehicles (BEVs) is a dominant trend, while Plug-in Hybrid Electric Vehicles (PHEVs) continue to hold a significant, albeit smaller, market share. The market segmentation reveals a strong emphasis on battery components like cathodes, anodes, and electrolytes, with materials such as lithium, nickel, and natural graphite being critical. The capacity segments highlight a market increasingly demanding higher energy densities to support the growing range of EVs. This intricate interplay of technological advancements, policy support, and consumer demand creates a highly dynamic and opportunity-rich environment for the North America EV Batteries industry.

North America EV Batteries Industry Company Market Share

North America EV Batteries Industry Report: Comprehensive Analysis & Forecast 2019-2033

This in-depth report delivers a critical analysis of the North American Electric Vehicle (EV) Batteries Industry, covering the historical period (2019-2024), base year (2025), and a detailed forecast period (2025-2033). We provide granular insights into market dynamics, growth trajectories, dominant segments, product innovation, key players, and emerging opportunities within the expansive North America EV Battery Market, Electric Vehicle Battery Market North America, and Automotive Battery Market North America. This report is meticulously crafted for industry professionals, investors, and stakeholders seeking to understand the evolving landscape of EV Battery Production North America, Lithium-ion Battery North America, and Solid-state Battery North America. Our analysis delves into parent and child market segments to offer a holistic view of this rapidly expanding sector.

North America EV Batteries Industry Market Dynamics & Structure

The North American EV Batteries Industry is characterized by a dynamic and evolving market concentration, driven by significant technological innovation, a complex web of regulatory frameworks, and intense competition from existing and emerging product substitutes. Key drivers include advancements in battery chemistry, such as the widespread adoption of LFP, NCA, NCM, and NMC chemistries, and innovations in battery form factors like cylindrical, pouch, and prismatic cells. The growing demand for high-capacity batteries, particularly in the 40 kWh to 80 kWh and Above 80 kWh categories for Passenger Cars and M&HDT segments, fuels continuous R&D. Regulatory incentives and emissions standards are pivotal in shaping market entry and expansion, while consumer demand for longer range and faster charging accelerates innovation in Anode, Cathode, Electrolyte, and Separator components, along with materials like Cobalt, Lithium, Manganese, Natural Graphite, and Nickel. Mergers and acquisitions (M&A) are a growing trend, with companies seeking to secure supply chains, acquire cutting-edge technology, and expand manufacturing capabilities.

- Market Concentration: Shifting from a few dominant players to a more fragmented landscape with new entrants, particularly in advanced battery chemistries and manufacturing.

- Technological Innovation Drivers: Focus on increasing energy density, improving safety, reducing costs, and enhancing charging speeds, with significant investment in Solid-state Battery research.

- Regulatory Frameworks: Government incentives, tax credits, and stringent emission standards are critical for market growth and adoption of EVs and their associated battery technologies.

- Competitive Product Substitutes: While lithium-ion dominates, research into alternative battery chemistries and advanced materials aims to address limitations and sustainability concerns.

- End-User Demographics: Growing consumer preference for electric vehicles across various segments, from personal transportation to commercial fleets.

- M&A Trends: Strategic acquisitions and partnerships aimed at vertical integration, supply chain security, and technological advancement.

North America EV Batteries Industry Growth Trends & Insights

The North American EV Batteries Industry is poised for unprecedented growth, fueled by a confluence of factors including robust governmental support, escalating consumer adoption of electric vehicles (EVs), and continuous technological breakthroughs. Market size is projected to witness a significant expansion, driven by the increasing penetration of BEV and PHEV models across Passenger Car, LCV, and M&HDT segments. Adoption rates are accelerating as battery costs decline and charging infrastructure expands, making EVs a more viable and attractive option for a broader consumer base. Technological disruptions, such as advancements in battery management systems, faster charging technologies, and the development of next-generation battery chemistries, are actively reshaping the market landscape. Consumer behavior shifts, including a growing awareness of environmental sustainability and the total cost of ownership benefits of EVs, are further propelling demand. The industry is expected to experience a compound annual growth rate (CAGR) of XX% over the forecast period, with market penetration reaching XX% by 2033. The demand for batteries in Capacity: 40 kWh to 80 kWh and Above 80 kWh is particularly strong, reflecting the consumer desire for extended range. Innovations in Prismatic and Pouch battery forms are becoming more prevalent due to their efficient space utilization in vehicle designs.

Dominant Regions, Countries, or Segments in North America EV Batteries Industry

The North American EV Batteries Industry is witnessing a dynamic interplay of regional dominance, country-specific strategies, and segment-specific growth. The United States stands out as the leading country, propelled by substantial government investments in battery manufacturing, R&D incentives, and a rapidly expanding EV market share. Federal and state policies, such as tax credits for EV purchases and manufacturing, are instrumental in driving this dominance. Geographically, regions with established automotive manufacturing hubs and significant clean energy initiatives are leading the charge.

Within the Body Type segment, Passenger Cars currently represent the largest market share, driven by consumer demand for personal mobility. However, significant growth is anticipated in the M&HDT (Medium and Heavy-Duty Trucks) and LCV (Light Commercial Vehicles) segments as fleet operators increasingly adopt electric alternatives for operational efficiency and sustainability. The Propulsion Type segment is overwhelmingly dominated by BEVs (Battery Electric Vehicles), with PHEVs (Plug-in Hybrid Electric Vehicles) playing a transitional role.

The Battery Chemistry landscape is evolving, with NCM (Nickel Cobalt Manganese) and NCA (Nickel Cobalt Aluminum) chemistries historically leading due to their high energy density, making them ideal for performance-oriented vehicles. However, LFP (Lithium Iron Phosphate) is rapidly gaining traction, particularly for its enhanced safety, longer lifespan, and lower cost, making it a strong contender for various applications, including heavy-duty vehicles and mass-market passenger cars.

In terms of Capacity, batteries ranging from 40 kWh to 80 kWh and Above 80 kWh are dominating the market for passenger cars, catering to the demand for extended driving ranges. The Less than 15 kWh and 15 kWh to 40 kWh segments are crucial for smaller EVs, plug-in hybrids, and potentially for energy storage applications within the automotive ecosystem.

The Battery Form market is seeing a significant shift towards Prismatic and Pouch cells, offering advantages in volumetric energy density and vehicle integration compared to traditional Cylindrical cells. The choice between Laser and Wire methods for battery component manufacturing is influenced by precision requirements, production scale, and cost-effectiveness.

Key drivers for dominance in these segments include:

- Economic Policies: Favorable government subsidies, tax incentives, and investment in domestic manufacturing.

- Infrastructure Development: Expansion of charging networks and grid modernization.

- Technological Advancements: Continuous innovation in battery materials and manufacturing processes.

- Consumer Demand: Increasing awareness of environmental benefits and declining EV purchase costs.

- Raw Material Availability: Strategic sourcing and domestic processing of critical battery materials.

The Material Type segment sees Lithium, Nickel, and Cobalt as critical components for high-energy-density batteries, while Manganese and Natural Graphite play crucial roles in various cathode and anode formulations. Innovations in reducing or eliminating Cobalt are a major R&D focus.

North America EV Batteries Industry Product Landscape

The North American EV Batteries Industry is characterized by a vibrant product landscape focused on enhancing energy density, improving safety, and reducing costs. Key product innovations include the development of advanced cathode materials like high-nickel NCM and NCA chemistries, alongside the growing adoption of LFP batteries for their safety and longevity. Manufacturers are also innovating in battery pack design, incorporating cell-to-pack technology and advanced thermal management systems to optimize performance and lifespan. Specific applications range from high-performance passenger cars demanding lightweight and energy-dense batteries to heavy-duty trucks leveraging robust LFP solutions for cost-effective electrification. Unique selling propositions revolve around extended range capabilities, faster charging times, and enhanced battery durability, with companies like LG Energy Solution, SK Innovation, and CATL leading the charge in delivering cutting-edge battery solutions.

Key Drivers, Barriers & Challenges in North America EV Batteries Industry

The North American EV Batteries Industry is propelled by several key drivers. Foremost among these are government incentives and supportive policies aimed at accelerating EV adoption and domestic battery manufacturing. Technological advancements in battery chemistry, energy density, and charging speed continue to make EVs more appealing. The growing environmental consciousness among consumers and a desire for reduced operational costs further fuel demand.

However, the industry faces significant barriers and challenges. The high upfront cost of EVs, heavily influenced by battery prices, remains a deterrent for some consumers. Supply chain volatility for critical raw materials like lithium, cobalt, and nickel poses a substantial risk, impacting production costs and availability. Regulatory hurdles and evolving environmental standards can also create complexities. Furthermore, the significant capital investment required for establishing large-scale battery manufacturing facilities presents a considerable barrier to entry. Competition from established internal combustion engine (ICE) vehicle manufacturers and the need for robust charging infrastructure development are also critical challenges.

Emerging Opportunities in North America EV Batteries Industry

Emerging opportunities in the North American EV Batteries Industry are plentiful and diverse. The rapidly growing demand for electric mobility across all vehicle segments, from personal cars to commercial fleets, presents a significant market expansion potential. The development of next-generation battery technologies, such as solid-state batteries, offers a chance to overcome current limitations in energy density and safety. Furthermore, the increasing focus on battery recycling and second-life applications creates opportunities for circular economy business models. Innovations in battery materials, including the use of abundant and sustainable elements, also present a promising avenue for differentiation and cost reduction. Untapped markets in fleet electrification and the integration of batteries with renewable energy sources for grid stabilization are also key growth areas.

Growth Accelerators in the North America EV Batteries Industry Industry

Several factors are acting as significant growth accelerators for the North America EV Batteries Industry. Technological breakthroughs in battery materials and manufacturing processes are continuously improving performance and reducing costs, making EVs more competitive. Strategic partnerships between automakers, battery manufacturers, and raw material suppliers are crucial for securing supply chains and fostering innovation. Government mandates and financial incentives, such as federal tax credits and state-level clean vehicle programs, are directly stimulating demand and investment in domestic production. The expansion of charging infrastructure, supported by public and private investments, is a critical enabler for widespread EV adoption. Furthermore, the growing consumer acceptance of EVs, driven by environmental awareness and the desire for lower running costs, acts as a powerful market pull.

Key Players Shaping the North America EV Batteries Industry Market

- Nikola Corporation

- Electrovaya Inc

- QuantumScape Corp

- LG Energy Solution Ltd

- A123 Systems LLC

- American Battery Solutions Inc

- Contemporary Amperex Technology Co Ltd (CATL)

- Clarios International Inc

- SK Innovation Co Ltd

- Panasonic Holdings Corporation

- Envision AESC Japan Co Ltd

- ACDELCO (Subsidiary Of General Motors)

Notable Milestones in North America EV Batteries Industry Sector

- June 2023: CATL announced the launch of Qiji Energy, a comprehensive battery swap solution designed for heavy-duty trucks. This innovative system includes Qiji Swapping Electric Blocks, a Qiji Battery Swap Station, and a Qiji Cloud Platform. Leveraging CATL’s 3rd-generation LFP battery chemistry, the Qiji Swapping Electric Blocks incorporate advanced NP (Non Propagation) technology and CTP (cell-to-pack) technology, effectively balancing safety and cost-efficiency. The Qiji Battery Swap Station is engineered for one-stop swapping across different truck models and brands, significantly enhancing operational efficiency for commercial fleets.

- January 2023: Shinhan Securities Co., Ltd. and SK On Co., Ltd. (SK On) formalized an investment alliance through a Memorandum of Understanding (MOU) aimed at fostering the secondary battery ecosystem. This collaboration signals a strategic move to bolster investment and development within the crucial battery sector.

- December 2022: Contemporary Amperex Technology Co., Limited (CATL) and Gresham House Energy Storage Holdings plc entered into a significant long-term agreement for the supply of up to 7.5 GWh of battery energy storage systems (BESS). This agreement underscores the growing demand for large-scale energy storage solutions and CATL's prominent role in meeting this demand.

In-Depth North America EV Batteries Industry Market Outlook

The North America EV Batteries Industry market outlook is overwhelmingly positive, driven by a sustained surge in EV adoption and continuous technological advancements. Growth accelerators such as supportive government policies, declining battery costs, and expanding charging infrastructure are creating a fertile ground for expansion. Strategic partnerships between key industry players, from raw material suppliers to automakers, are solidifying supply chains and fostering innovation. The increasing consumer demand for sustainable transportation solutions, coupled with the performance advantages of modern EV batteries, ensures a robust market trajectory. Emerging opportunities in areas like solid-state battery technology, battery recycling, and vehicle-to-grid integration further enhance the long-term potential, positioning the North American market for substantial growth in the coming years.

North America EV Batteries Industry Segmentation

-

1. Body Type

- 1.1. Bus

- 1.2. LCV

- 1.3. M&HDT

- 1.4. Passenger Car

-

2. Propulsion Type

- 2.1. BEV

- 2.2. PHEV

-

3. Battery Chemistry

- 3.1. LFP

- 3.2. NCA

- 3.3. NCM

- 3.4. NMC

- 3.5. Others

-

4. Capacity

- 4.1. 15 kWh to 40 kWh

- 4.2. 40 kWh to 80 kWh

- 4.3. Above 80 kWh

- 4.4. Less than 15 kWh

-

5. Battery Form

- 5.1. Cylindrical

- 5.2. Pouch

- 5.3. Prismatic

-

6. Method

- 6.1. Laser

- 6.2. Wire

-

7. Component

- 7.1. Anode

- 7.2. Cathode

- 7.3. Electrolyte

- 7.4. Separator

-

8. Material Type

- 8.1. Cobalt

- 8.2. Lithium

- 8.3. Manganese

- 8.4. Natural Graphite

- 8.5. Nickel

- 8.6. Other Materials

North America EV Batteries Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America EV Batteries Industry Regional Market Share

Geographic Coverage of North America EV Batteries Industry

North America EV Batteries Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems

- 3.3. Market Restrains

- 3.3.1. Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America EV Batteries Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Bus

- 5.1.2. LCV

- 5.1.3. M&HDT

- 5.1.4. Passenger Car

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. BEV

- 5.2.2. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Battery Chemistry

- 5.3.1. LFP

- 5.3.2. NCA

- 5.3.3. NCM

- 5.3.4. NMC

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Capacity

- 5.4.1. 15 kWh to 40 kWh

- 5.4.2. 40 kWh to 80 kWh

- 5.4.3. Above 80 kWh

- 5.4.4. Less than 15 kWh

- 5.5. Market Analysis, Insights and Forecast - by Battery Form

- 5.5.1. Cylindrical

- 5.5.2. Pouch

- 5.5.3. Prismatic

- 5.6. Market Analysis, Insights and Forecast - by Method

- 5.6.1. Laser

- 5.6.2. Wire

- 5.7. Market Analysis, Insights and Forecast - by Component

- 5.7.1. Anode

- 5.7.2. Cathode

- 5.7.3. Electrolyte

- 5.7.4. Separator

- 5.8. Market Analysis, Insights and Forecast - by Material Type

- 5.8.1. Cobalt

- 5.8.2. Lithium

- 5.8.3. Manganese

- 5.8.4. Natural Graphite

- 5.8.5. Nickel

- 5.8.6. Other Materials

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nikola Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Electrovaya Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 QuantumScape Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Energy Solution Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 A123 Systems LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 American Battery Solutions Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Contemporary Amperex Technology Co Ltd (CATL)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Clarios International Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SK Innovation Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Holdings Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Envision AESC Japan Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ACDELCO (Subsidiary Of General Motors)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nikola Corporation

List of Figures

- Figure 1: North America EV Batteries Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America EV Batteries Industry Share (%) by Company 2025

List of Tables

- Table 1: North America EV Batteries Industry Revenue billion Forecast, by Body Type 2020 & 2033

- Table 2: North America EV Batteries Industry Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 3: North America EV Batteries Industry Revenue billion Forecast, by Battery Chemistry 2020 & 2033

- Table 4: North America EV Batteries Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 5: North America EV Batteries Industry Revenue billion Forecast, by Battery Form 2020 & 2033

- Table 6: North America EV Batteries Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 7: North America EV Batteries Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 8: North America EV Batteries Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 9: North America EV Batteries Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 10: North America EV Batteries Industry Revenue billion Forecast, by Body Type 2020 & 2033

- Table 11: North America EV Batteries Industry Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 12: North America EV Batteries Industry Revenue billion Forecast, by Battery Chemistry 2020 & 2033

- Table 13: North America EV Batteries Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 14: North America EV Batteries Industry Revenue billion Forecast, by Battery Form 2020 & 2033

- Table 15: North America EV Batteries Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 16: North America EV Batteries Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 17: North America EV Batteries Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 18: North America EV Batteries Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United States North America EV Batteries Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada North America EV Batteries Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America EV Batteries Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America EV Batteries Industry?

The projected CAGR is approximately 17.9%.

2. Which companies are prominent players in the North America EV Batteries Industry?

Key companies in the market include Nikola Corporation, Electrovaya Inc, QuantumScape Corp, LG Energy Solution Ltd, A123 Systems LLC, American Battery Solutions Inc, Contemporary Amperex Technology Co Ltd (CATL), Clarios International Inc, SK Innovation Co Ltd, Panasonic Holdings Corporation, Envision AESC Japan Co Ltd, ACDELCO (Subsidiary Of General Motors).

3. What are the main segments of the North America EV Batteries Industry?

The market segments include Body Type, Propulsion Type, Battery Chemistry, Capacity, Battery Form, Method, Component, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 104.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint.

8. Can you provide examples of recent developments in the market?

June 2023: CATL announced that it launched Qiji Energy, a battery swap solution for heavy-duty trucks. The solution consists of Qiji Swapping Electric Blocks, Qiji Battery Swap Station, and Qiji Cloud Platform. Based on the CATL’s 3rd-generation LFP battery chemistry, Qiji Swapping Electric Blocks adopt the innovative NP (Non Propagation) technology and CTP (cell-to-pack) technology, striking a balance between safety and usage costs. Qiji Battery Swap Station enables one-stop swapping for different truck models and brands.January 2023: Shinhan Securities Co., Ltd. has signed an MOU with SK On Co., Ltd. (SK On) on an investment alliance for a secondary battery ecosystem.December 2022: Contemporary Amperex Technology Co., Limited (CATL) and Gresham House Energy Storage Holdings plc recently entered into a long-term agreement on the supply of up to 7.5 GWh of battery energy storage systems (BESS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America EV Batteries Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America EV Batteries Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America EV Batteries Industry?

To stay informed about further developments, trends, and reports in the North America EV Batteries Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence