Key Insights

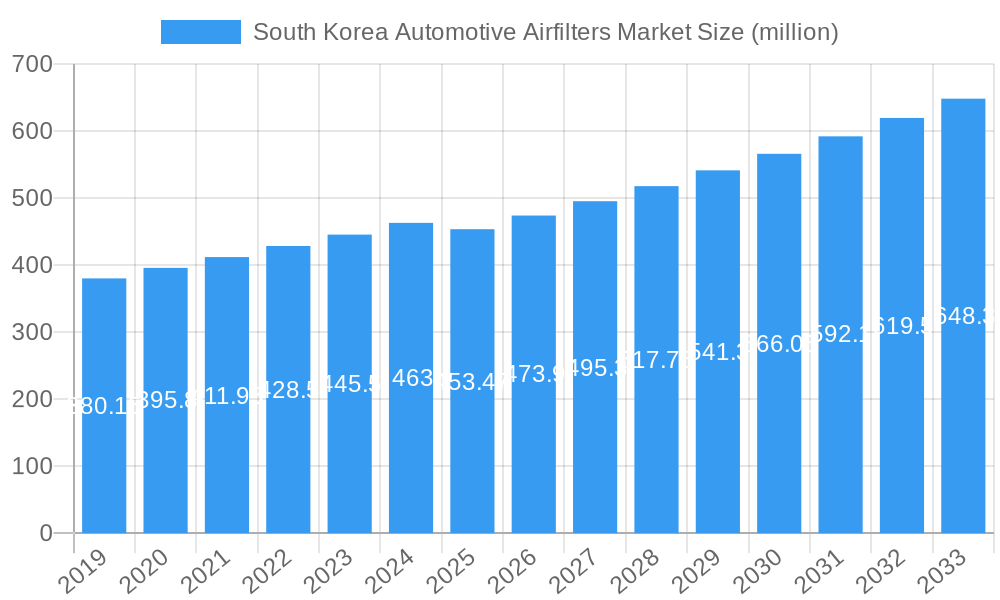

The South Korean automotive air filter market is poised for steady expansion, projected to reach $453.47 million in 2025, with a Compound Annual Growth Rate (CAGR) of 4.65% through 2033. This robust growth is primarily driven by the increasing demand for enhanced vehicle performance and fuel efficiency. As consumers become more conscious of vehicle maintenance and the impact of air quality on engine longevity, the adoption of high-quality air filters, including advanced paper, gauze, and foam variants, is on the rise. The substantial fleet of passenger cars and commercial vehicles operating in South Korea, coupled with a strong emphasis on regular maintenance, provides a consistent demand base. Furthermore, the growing aftermarket for automotive components, alongside the significant OEM sector, ensures a healthy competitive landscape and sustained market penetration for air filter manufacturers. Technological advancements in filter media, aiming for superior filtration efficiency and durability, will continue to shape product development and consumer preferences.

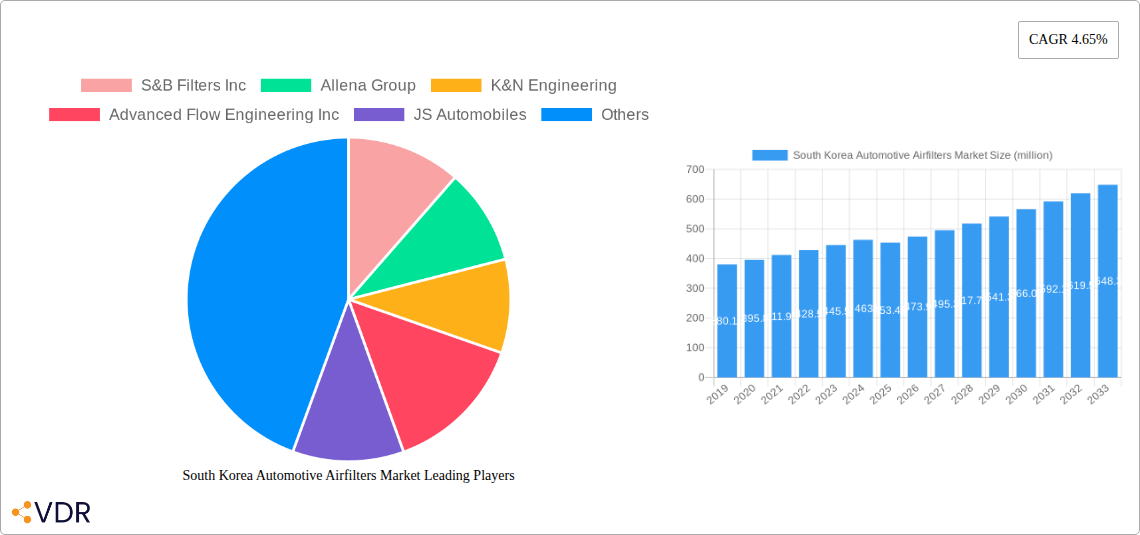

South Korea Automotive Airfilters Market Market Size (In Million)

The market dynamics are further influenced by evolving vehicle emission standards and a growing awareness of cabin air quality, especially in urbanized settings like South Korea. This trend is particularly benefiting the cabin filter segment, which is seeing increased adoption in both new vehicles and as an aftermarket upgrade. While the market benefits from robust demand, it is not without its challenges. Potential restraints could include the increasing lifespan of modern vehicle components, potentially reducing the frequency of filter replacements for some vehicle owners, and intense price competition among manufacturers, particularly in the aftermarket. However, the overarching trend towards vehicle electrification, while introducing new maintenance paradigms, still necessitates air filtration for both internal combustion engines (in hybrid vehicles) and other critical components within electric vehicles. Companies like Mann+Hummel, K&N Engineering, and S&B Filters Inc. are actively innovating to cater to these evolving needs, focusing on product differentiation and expanding their market reach across both OEM and aftermarket channels.

South Korea Automotive Airfilters Market Company Market Share

Here's the SEO-optimized report description for the South Korea Automotive Airfilters Market:

South Korea Automotive Airfilters Market: Comprehensive Market Analysis and Forecast 2019-2033

This in-depth report provides a granular analysis of the South Korea Automotive Airfilters Market, encompassing a detailed forecast from 2025 to 2033, with the base year set at 2025. Covering the historical period from 2019 to 2024, the study meticulously examines market dynamics, growth trends, dominant segments, and the competitive landscape of automotive air filter solutions. Our analysis leverages extensive data to deliver actionable insights for industry stakeholders, including manufacturers, suppliers, aftermarket service providers, and investors. The report delves into various segments, including Paper Airfilters, Gauze Airfilters, Foam Airfilters, and Others within the Material Type category. Furthermore, it dissects the market by Type, focusing on Intake Filters and Cabin Filters, and by Vehicle Type, segmenting it into Passenger Cars and Commercial Vehicles. The analysis also explores different Sales Channels, namely OEMs and the Aftermarket. Key companies profiled include S&B Filters Inc, Allena Group, K&N Engineering, Advanced Flow Engineering Inc, JS Automobiles, Purolator Filters LLC, Wsmridhi Manufacturing Co Pvt Ltd, Mann+Hummel, AL Filters, and AIRAID. With all values presented in million units, this report is an essential resource for understanding the current state and future trajectory of the South Korea automotive airfilters industry.

South Korea Automotive Airfilters Market Market Dynamics & Structure

The South Korea Automotive Airfilters Market exhibits a moderately concentrated structure, with a few key players holding significant market share, particularly in the OEM segment. Technological innovation remains a primary driver, with manufacturers continuously investing in R&D to develop advanced filtration materials and designs that enhance engine performance, fuel efficiency, and cabin air quality. Stringent emission regulations and evolving vehicle standards imposed by the South Korean government play a crucial role in shaping market demands, pushing for higher-performance and more sustainable air filter solutions. While direct product substitutes for essential engine air filters are limited, advancements in air purification technologies within vehicles and the increasing adoption of electric vehicles (EVs) pose potential long-term competitive threats, although EVs generally have different air intake systems. End-user demographics are shifting, with a growing preference for high-performance and long-lasting filters among car enthusiasts and a rising demand for effective cabin air filters driven by increasing health and environmental consciousness among consumers. Mergers and Acquisitions (M&A) activity, though not extensively high, has seen strategic collaborations aimed at expanding product portfolios, enhancing manufacturing capabilities, and strengthening market presence, reflecting a trend towards consolidation for competitive advantage.

- Market Concentration: Moderately concentrated with a few dominant players.

- Technological Innovation Drivers: Engine performance enhancement, fuel efficiency, emission control, cabin air quality improvement.

- Regulatory Frameworks: Stringent emission standards and evolving vehicle safety regulations.

- Competitive Product Substitutes: Advancements in alternative air purification technologies, long-term impact of EV adoption.

- End-User Demographics: Growing demand for performance filters and health-conscious consumers seeking improved cabin air.

- M&A Trends: Strategic collaborations for portfolio expansion and capability enhancement.

South Korea Automotive Airfilters Market Growth Trends & Insights

The South Korea Automotive Airfilters Market has witnessed consistent growth, driven by an expanding automotive parc and increasing vehicle production. The market size is projected to reach $XXX million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is underpinned by several key trends, including the increasing adoption of advanced filtration technologies that offer superior performance and longevity. Consumer awareness regarding the importance of air quality, both inside and outside the vehicle, has significantly boosted the demand for both intake and cabin air filters. The aftermarket segment, in particular, is experiencing robust expansion as vehicle owners prioritize regular maintenance to ensure optimal vehicle performance and longevity.

Technological disruptions are continuously reshaping the market, with manufacturers exploring innovative materials and designs to meet evolving OEM specifications and aftermarket demands. The integration of smart features, such as filter condition monitoring, is also gaining traction. Shifts in consumer behavior are evident, with a growing segment of consumers willing to invest in premium and high-performance air filters. The increasing lifespan of vehicles on the road, coupled with a focus on preventative maintenance, further fuels the demand for replacement air filters. The automotive industry's transition towards cleaner technologies, while presenting long-term shifts, currently still necessitates robust air filtration systems for internal combustion engine vehicles, which continue to form the majority of the fleet. Penetration rates for advanced cabin air filters are steadily increasing, especially in urban areas with higher air pollution levels. The overall market trajectory is one of steady expansion, fueled by a combination of existing vehicle maintenance needs and the ongoing evolution of automotive technology.

Dominant Regions, Countries, or Segments in South Korea Automotive Airfilters Market

Within the South Korea Automotive Airfilters Market, Passenger Cars emerge as the dominant vehicle type, accounting for a substantial market share due to the high volume of passenger vehicles on South Korean roads and a strong consumer market for personal transportation. The Aftermarket sales channel is also a significant driver, reflecting the mature automotive landscape where regular maintenance and replacement of parts are crucial for vehicle longevity and performance.

Key Drivers and Dominance Factors:

- Passenger Cars:

- High penetration rate of passenger vehicles in South Korea.

- Strong consumer demand for private transportation and vehicle upgrades.

- Continuous introduction of new passenger car models by leading automotive manufacturers.

- Growth in the used car market, driving demand for replacement parts.

- Aftermarket:

- Established network of auto repair shops and service centers.

- Increasing consumer awareness about the importance of regular vehicle maintenance for performance and resale value.

- Availability of a wide range of aftermarket air filter brands catering to diverse price points and performance requirements.

- Growth of e-commerce platforms facilitating easy access to automotive parts for consumers.

- Material Type - Paper Airfilter:

- Cost-effectiveness and widespread availability make paper air filters a preferred choice for many standard applications.

- Proven filtration efficiency for capturing particulate matter.

- Dominance in OEM specifications for a majority of passenger cars.

- Type - Intake Filters:

- Essential for engine protection and performance, driving consistent demand.

- Direct impact on fuel efficiency and emission control makes them a critical component.

- Growth Potential and Market Share: Passenger Cars and the Aftermarket channel are projected to maintain their leading positions due to the sheer volume of vehicles and the ongoing need for maintenance and replacement. While OEMs are critical for initial vehicle fitment, the aftermarket segment offers continuous revenue streams due to the service life of vehicles.

South Korea Automotive Airfilters Market Product Landscape

The South Korea Automotive Airfilters Market is characterized by a diverse product landscape focused on enhancing engine performance and ensuring cabin air purity. Innovations are centered on developing filtration media with improved particle capture efficiency, higher airflow capacity, and extended service life. This includes the use of advanced synthetic materials, multi-layer filtration technologies, and specialized coatings to trap finer contaminants. Applications range from protecting critical engine components from dust and debris in intake filters to providing a healthier interior environment with high-efficiency cabin air filters that remove allergens, pollutants, and odors. Unique selling propositions often revolve around superior filtration metrics, reduced engine wear, improved fuel economy, and enhanced passenger comfort. Technological advancements are also pushing towards more sustainable filter designs and materials.

Key Drivers, Barriers & Challenges in South Korea Automotive Airfilters Market

Key Drivers:

- Expanding Automotive Parc: A growing number of vehicles on South Korean roads directly translates to sustained demand for replacement air filters.

- Stringent Emission Standards: Government regulations pushing for cleaner vehicles necessitate high-efficiency air filtration systems.

- Consumer Awareness: Increasing understanding of the link between air quality and vehicle health/performance drives demand for quality filters.

- Technological Advancements: Development of more efficient and durable filter materials and designs.

Barriers & Challenges:

- Price Sensitivity: While quality is valued, a significant segment of consumers remains price-sensitive, especially in the aftermarket.

- OEM Dominance: Securing OEM contracts can be challenging due to established relationships and stringent qualification processes.

- Technological Obsolescence: The shift towards electric vehicles, which have different air intake requirements, poses a long-term challenge for traditional air filter manufacturers.

- Supply Chain Volatility: Global supply chain disruptions can impact the availability and cost of raw materials, affecting production and pricing.

- Counterfeit Products: The presence of counterfeit air filters in the aftermarket can dilute market value and damage brand reputation.

Emerging Opportunities in South Korea Automotive Airfilters Market

Emerging opportunities in the South Korea Automotive Airfilters Market are significantly influenced by the evolving automotive landscape and consumer preferences. The increasing adoption of hybrid and electric vehicles presents a unique opportunity for manufacturers to innovate in areas such as battery cooling system filters and cabin air filtration for the distinct environments of these vehicles. Furthermore, a growing consumer segment is willing to pay a premium for high-performance and eco-friendly air filters, such as those made from recycled materials or offering significantly extended service intervals. The expansion of the e-commerce channel for automotive parts also opens up new avenues for market reach and direct-to-consumer sales, enabling smaller manufacturers to compete more effectively. The demand for advanced cabin air filters with enhanced allergen and particulate matter removal capabilities, especially in urban and industrialized areas, continues to be a strong growth avenue.

Growth Accelerators in the South Korea Automotive Airfilters Market Industry

Several catalysts are propelling the long-term growth of the South Korea Automotive Airfilters Market. Technological breakthroughs in filtration media, such as the development of electrostatically charged fibers and nanostructured materials, are enhancing filter efficiency and capacity, leading to improved engine performance and reduced emissions. Strategic partnerships between air filter manufacturers and automotive OEMs are crucial for co-development and ensuring the integration of cutting-edge filtration solutions into new vehicle models. Market expansion strategies, including geographical diversification and the development of specialized filters for niche vehicle segments, are also key growth accelerators. Furthermore, government initiatives promoting cleaner transportation and stricter environmental regulations act as significant drivers, compelling the industry to innovate and adopt more advanced filtration technologies.

Key Players Shaping the South Korea Automotive Airfilters Market Market

- S&B Filters Inc

- Allena Group

- K&N Engineering

- Advanced Flow Engineering Inc

- JS Automobiles

- Purolator Filters LLC

- Wsmridhi Manufacturing Co Pvt Ltd

- Mann+Hummel

- AL Filters

- AIRAID

Notable Milestones in South Korea Automotive Airfilters Market Sector

- 2023 February: Introduction of advanced synthetic media filters by leading manufacturers, offering higher efficiency and longer service life.

- 2022 Q4: Increased focus on cabin air filter innovation, with new product lines featuring enhanced odor and allergen removal capabilities.

- 2021 Q2: Significant investment in R&D for sustainable air filter materials, exploring biodegradable and recyclable options.

- 2020: Rise in e-commerce sales channels for automotive aftermarket parts, including air filters, driven by convenience and wider product availability.

- 2019: Implementation of stricter emission standards in South Korea, prompting manufacturers to develop filters meeting these new benchmarks.

In-Depth South Korea Automotive Airfilters Market Market Outlook

The future outlook for the South Korea Automotive Airfilters Market remains positive, driven by a confluence of ongoing trends and emerging opportunities. The continued prevalence of internal combustion engine vehicles, coupled with the increasing adoption of hybrid technologies, ensures a sustained demand for engine air filters. The market is poised for growth fueled by technological advancements in filtration media, leading to more efficient, durable, and environmentally friendly products. The aftermarket segment is expected to expand further, driven by vehicle parc growth and a heightened consumer focus on vehicle maintenance. While the transition to full electric vehicles presents a long-term evolutionary challenge, it also opens new avenues for specialized filtration solutions. Strategic collaborations and a focus on innovation will be paramount for players aiming to capitalize on the evolving dynamics of this robust market.

South Korea Automotive Airfilters Market Segmentation

-

1. Material Type

- 1.1. Paper Airfilter

- 1.2. Gauze Airfilter

- 1.3. Foam Airfilter

- 1.4. Others

-

2. Type

- 2.1. Intake Filters

- 2.2. Cabin Filters

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

-

4. Sales Channel

- 4.1. OEMs

- 4.2. Aftermarket

South Korea Automotive Airfilters Market Segmentation By Geography

- 1. South Korea

South Korea Automotive Airfilters Market Regional Market Share

Geographic Coverage of South Korea Automotive Airfilters Market

South Korea Automotive Airfilters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Automotive Vehicle Sales Anticipated to Drive the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Cost Acting as Barrier for the Market

- 3.4. Market Trends

- 3.4.1. Commercial Vehicle Segment Captures Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Automotive Airfilters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Paper Airfilter

- 5.1.2. Gauze Airfilter

- 5.1.3. Foam Airfilter

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Intake Filters

- 5.2.2. Cabin Filters

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. OEMs

- 5.4.2. Aftermarket

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 S&B Filters Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Allena Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 K&N Engineering

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Advanced Flow Engineering Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JS Automobiles

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Purolator Filters LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wsmridhi Manufacturing Co Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mann+Hummel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AL Filters

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AIRAID

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 S&B Filters Inc

List of Figures

- Figure 1: South Korea Automotive Airfilters Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South Korea Automotive Airfilters Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Automotive Airfilters Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 2: South Korea Automotive Airfilters Market Revenue million Forecast, by Type 2020 & 2033

- Table 3: South Korea Automotive Airfilters Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 4: South Korea Automotive Airfilters Market Revenue million Forecast, by Sales Channel 2020 & 2033

- Table 5: South Korea Automotive Airfilters Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: South Korea Automotive Airfilters Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 7: South Korea Automotive Airfilters Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: South Korea Automotive Airfilters Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 9: South Korea Automotive Airfilters Market Revenue million Forecast, by Sales Channel 2020 & 2033

- Table 10: South Korea Automotive Airfilters Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Automotive Airfilters Market?

The projected CAGR is approximately 4.65%.

2. Which companies are prominent players in the South Korea Automotive Airfilters Market?

Key companies in the market include S&B Filters Inc, Allena Group, K&N Engineering, Advanced Flow Engineering Inc, JS Automobiles, Purolator Filters LLC, Wsmridhi Manufacturing Co Pvt Ltd, Mann+Hummel, AL Filters, AIRAID.

3. What are the main segments of the South Korea Automotive Airfilters Market?

The market segments include Material Type, Type, Vehicle Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 453.47 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Automotive Vehicle Sales Anticipated to Drive the Market.

6. What are the notable trends driving market growth?

Commercial Vehicle Segment Captures Market.

7. Are there any restraints impacting market growth?

High Initial Cost Acting as Barrier for the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Automotive Airfilters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Automotive Airfilters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Automotive Airfilters Market?

To stay informed about further developments, trends, and reports in the South Korea Automotive Airfilters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence