Key Insights

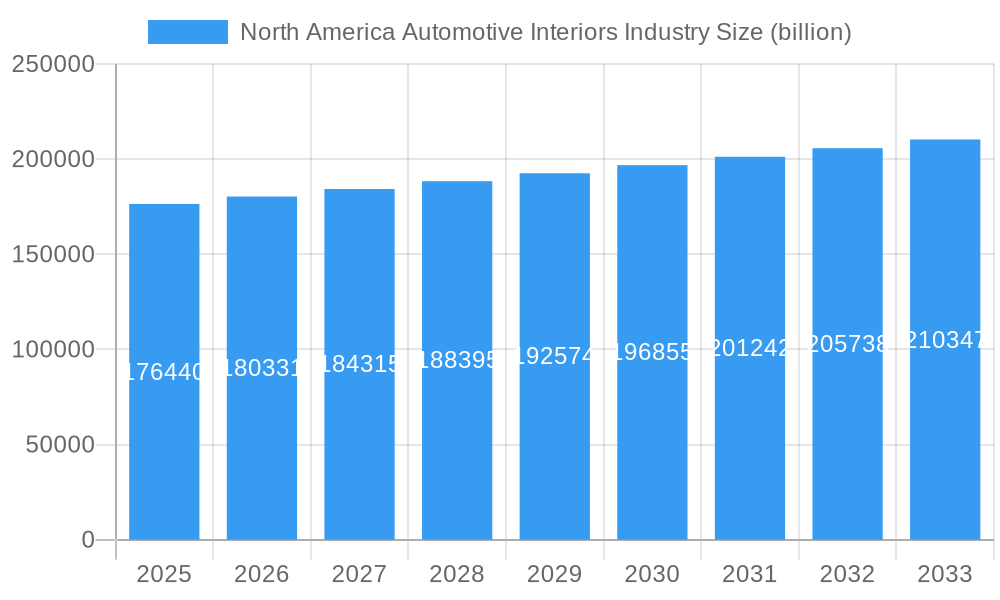

The North America Automotive Interiors Industry is poised for steady growth, projected to reach a significant $176.44 billion in 2025. This expansion is underpinned by a compound annual growth rate (CAGR) of 2.2% over the forecast period of 2025-2033, indicating a robust and sustained market trajectory. Key drivers fueling this growth include the increasing consumer demand for sophisticated and personalized in-car experiences, necessitating advanced infotainment systems and premium interior aesthetics. The rising production of both passenger cars and commercial vehicles within North America, coupled with the continuous innovation in materials science and technology for components like instrument panels, interior lighting, and other cabin features, are further propelling the market forward. Furthermore, stringent safety regulations and the growing adoption of electric vehicles (EVs) are also influencing interior design, with a focus on lightweight materials and integrated smart technologies.

North America Automotive Interiors Industry Market Size (In Billion)

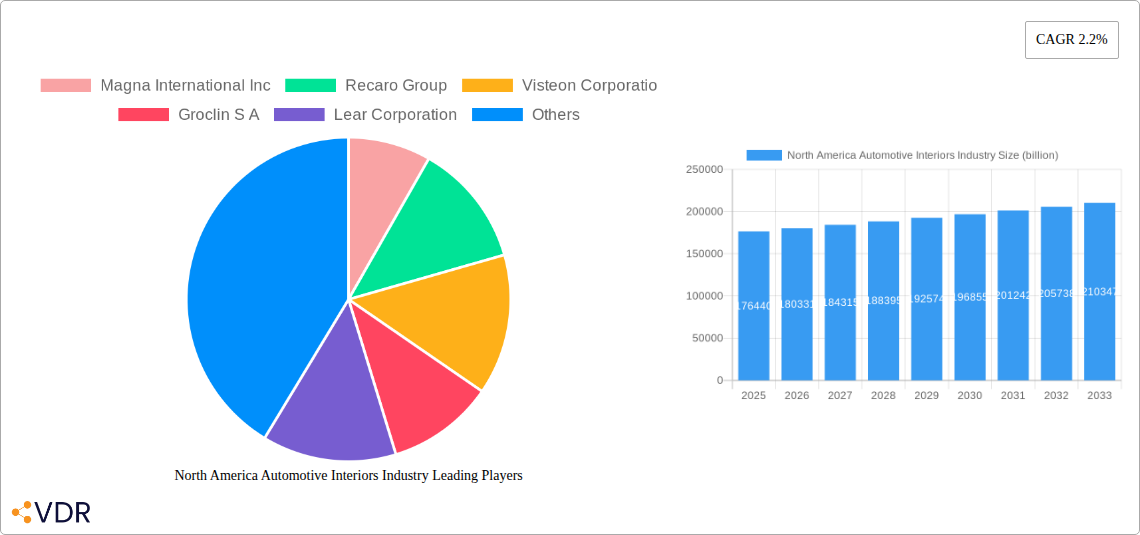

The competitive landscape is characterized by the presence of major global players such as Magna International Inc., Lear Corporation, Faurecia, and Adient PLC, alongside technology-focused companies like Visteon Corporation and Pioneer Corporation. These companies are actively investing in research and development to introduce innovative solutions that enhance passenger comfort, safety, and connectivity. Emerging trends revolve around the integration of augmented reality displays, sustainable and eco-friendly materials, and highly customizable interior configurations. While the market exhibits strong growth potential, potential restraints could include fluctuating raw material costs, supply chain disruptions, and the economic impact of global uncertainties. However, the consistent demand for enhanced vehicle interiors, driven by evolving consumer expectations and technological advancements, is expected to largely offset these challenges, solidifying the North American automotive interiors market's upward momentum.

North America Automotive Interiors Industry Company Market Share

North America Automotive Interiors Industry Report Description

This comprehensive report, "North America Automotive Interiors Industry: Market Dynamics, Growth Trends, and Future Outlook 2019-2033," offers an in-depth analysis of the evolving automotive interiors market across North America. The study encompasses a detailed examination of market structure, growth drivers, regional dominance, product innovation, and key players. With a focus on the automotive interior components market, in-car technology, automotive cockpit solutions, and automotive cabin electronics, this report is an indispensable resource for stakeholders seeking to capitalize on emerging opportunities and navigate the competitive landscape. We present all values in billion units, covering the historical period from 2019-2024, base year 2025, and a forecast period extending to 2033.

North America Automotive Interiors Industry Market Dynamics & Structure

The North American automotive interiors market exhibits a moderately concentrated structure, characterized by the strategic presence of global automotive suppliers and Tier 1 manufacturers. Technological innovation is a primary driver, with advancements in materials science, digital integration, and occupant comfort shaping product development. Regulatory frameworks, particularly those concerning safety, emissions, and sustainability, also influence design and manufacturing processes. Competitive product substitutes, such as aftermarket solutions and evolving material alternatives, create a dynamic competitive environment. End-user demographics, with an increasing demand for premium features and personalized cabin experiences, are significantly influencing market trends. Mergers and acquisitions (M&A) remain a key strategy for market consolidation and technology acquisition.

- Market Concentration: Dominated by a few key global players, with a significant presence of regional suppliers.

- Technological Innovation: Driven by advancements in AI, IoT for connected car features, advanced display technologies, and sustainable materials.

- Regulatory Frameworks: Focus on enhanced safety standards, fuel efficiency, and increasingly, the recyclability and sustainability of interior materials.

- Competitive Product Substitutes: Rise of modular interior designs and the increasing integration of third-party technology solutions.

- End-User Demographics: Growing demand for premium aesthetics, personalized lighting, advanced infotainment, and enhanced ergonomics, particularly from younger demographics and in the luxury segment.

- M&A Trends: Strategic acquisitions aimed at bolstering technological capabilities, expanding product portfolios, and securing market share. Expect an average of 15-20 M&A deals annually within the North American automotive interiors ecosystem during the forecast period.

North America Automotive Interiors Industry Growth Trends & Insights

The North American automotive interiors industry is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% between 2025 and 2033. This expansion is fueled by the increasing integration of sophisticated automotive infotainment systems, the growing demand for advanced instrument panels and interior lighting solutions, and a general shift towards more technologically advanced and comfortable vehicle cabins. The base year 2025 marks a significant point where the market is expected to reach an estimated value of $75.2 billion units in terms of revenue, and 6.1 billion units in terms of volume. The forecast period will witness a substantial increase in market size, driven by evolving consumer preferences for connected car experiences and augmented reality interfaces within vehicles.

The adoption rate of advanced interior technologies is accelerating, propelled by the increasing penetration of premium and semi-premium vehicle segments. Consumers are increasingly prioritizing features that enhance convenience, entertainment, and personalized comfort. This includes advancements in digital cockpits, heads-up displays (HUDs), and intelligent ambient lighting systems, all contributing to a more immersive and futuristic in-car experience. Technological disruptions, such as the miniaturization of components, the development of flexible displays, and the integration of haptic feedback, are reshaping the design possibilities for automotive interiors.

Consumer behavior shifts are pivotal, with a growing emphasis on sustainability and the use of eco-friendly materials. This trend is influencing manufacturers to adopt recycled plastics, natural fibers, and other sustainable alternatives in their interior designs. Furthermore, the rise of autonomous driving technologies is creating new opportunities for reconfigurable interior layouts and the integration of advanced entertainment and productivity features. The demand for personalized interior environments, allowing drivers and passengers to customize lighting, sound, and even scent profiles, is also a significant growth factor. The market's trajectory is also influenced by the ongoing electrification of vehicles, which often necessitates lighter-weight interior components to optimize range.

The "infotainment system" segment is expected to maintain its dominance, with an estimated market share of 35-40% in 2025. "Instrument panels" will follow closely, accounting for approximately 25-30%. The "interior lighting" segment, driven by customizable and dynamic lighting solutions, is projected to witness the highest CAGR, nearing 6.5%. The "others" category, encompassing a wide range of components like seating systems, door panels, and floor mats, will continue to be a substantial contributor.

By 2033, the North American automotive interiors market is projected to reach an estimated $110.5 billion units in revenue and 8.2 billion units in volume, reflecting a consistent upward trend driven by innovation and evolving consumer demands. The integration of AI-powered voice assistants, advanced driver-assistance systems (ADAS) interfaces, and sophisticated biometric authentication systems will further solidify the market's growth trajectory. The shift towards connected and intelligent mobility solutions will continue to redefine the automotive interior, transforming it from a passive space into an interactive and adaptive environment.

Dominant Regions, Countries, or Segments in North America Automotive Interiors Industry

The Passenger Cars segment is the undisputed leader within the North American automotive interiors industry, consistently driving market growth and innovation. In 2025, this segment is projected to account for an estimated 80% of the total market volume, translating to approximately 4.88 billion units, and a significant portion of the market's revenue. This dominance is attributed to the sheer volume of passenger vehicles manufactured and sold across the United States, Canada, and Mexico, coupled with a strong consumer appetite for advanced in-car technologies and premium interior features.

- Key Drivers for Passenger Car Dominance:

- High Production and Sales Volumes: North America remains a pivotal market for passenger car manufacturing and sales, directly translating to a large demand for interior components.

- Consumer Demand for Features: North American consumers, particularly in the United States, exhibit a high propensity to purchase vehicles equipped with the latest infotainment systems, advanced safety features integrated into the cabin, and premium comfort options.

- Technological Adoption: The passenger car segment is typically the first to adopt new interior technologies, from advanced displays and ambient lighting to sophisticated connectivity solutions.

- Luxury and Premium Segment Growth: The continued strength of the luxury and premium passenger car market segments further fuels demand for high-end, feature-rich automotive interiors.

The United States stands as the dominant country within the North American automotive interiors market, representing over 70% of the regional market share in 2025. This leadership is underpinned by its extensive automotive manufacturing base, significant consumer spending power, and a strong presence of key automotive OEMs and Tier 1 suppliers. The country's robust economic policies and ongoing investments in automotive research and development further solidify its position.

- Key Drivers for US Dominance:

- Automotive Manufacturing Hub: The US hosts a significant portion of global automotive manufacturing facilities, leading to substantial demand for interior components.

- Consumer Purchasing Power: A high disposable income allows consumers to invest in vehicles with advanced and premium interior features.

- R&D and Innovation: The presence of leading automotive technology companies and research institutions fosters continuous innovation in automotive interiors.

- Regulatory Influence: US regulations often set benchmarks for safety and technology integration, influencing product development across the region.

Among the component types, the Infotainment System segment is projected to be the largest and fastest-growing, capturing an estimated 35% market share in 2025, valued at approximately 2.1 billion billion units in terms of devices. This segment's growth is driven by the increasing demand for connected car features, advanced navigation systems, seamless smartphone integration, and in-car entertainment options. The evolution of vehicle architectures towards software-defined vehicles will further amplify the importance and complexity of infotainment systems.

- Key Drivers for Infotainment System Dominance:

- Connectivity and Digitalization: The increasing demand for seamless connectivity, over-the-air updates, and integrated digital services.

- Enhanced User Experience: Consumers expect intuitive interfaces, personalized content, and advanced entertainment options.

- Advancements in Display Technology: The widespread adoption of larger, higher-resolution, and more interactive displays.

- Integration of AI and Voice Assistants: The growing prevalence of AI-powered voice assistants for hands-free control and personalized interactions.

The Commercial Vehicles segment, while smaller than passenger cars, is also witnessing significant growth, driven by advancements in fleet management technologies, driver comfort features, and the integration of specialized cabin functionalities for various industries. The forecast indicates a CAGR of around 4.8% for this segment between 2025 and 2033, with an estimated market volume of 1.22 billion units in 2025.

- Key Drivers for Commercial Vehicle Growth:

- Fleet Management Solutions: Demand for integrated telematics and driver monitoring systems to optimize operational efficiency.

- Driver Comfort and Productivity: Increasing focus on ergonomic seating, advanced climate control, and in-cab connectivity for long-haul drivers.

- Specialized Vehicle Needs: Custom interior solutions for vocational trucks, delivery vans, and other specialized commercial applications.

North America Automotive Interiors Industry Product Landscape

The North American automotive interiors product landscape is characterized by a surge in innovative solutions focused on enhancing occupant experience, safety, and sustainability. Companies are increasingly integrating advanced materials, such as lightweight composites and recycled plastics, to reduce vehicle weight and improve fuel efficiency. The development of dynamic ambient lighting systems, configurable instrument clusters with augmented reality overlays, and haptic feedback interfaces are transforming the cabin into a personalized and interactive space. Furthermore, advancements in seamless smartphone integration and sophisticated voice command systems are pushing the boundaries of in-car infotainment and connectivity. The focus remains on creating aesthetically pleasing, highly functional, and environmentally conscious interior environments.

Key Drivers, Barriers & Challenges in North America Automotive Interiors Industry

Key Drivers: The North American automotive interiors industry is propelled by several key factors. The relentless pursuit of enhanced in-car user experience is a primary driver, with consumers demanding more sophisticated infotainment, connectivity, and comfort features. Technological advancements in areas like AI-powered assistants, advanced displays, and sustainable materials are creating new possibilities. Government mandates and safety regulations continue to influence the adoption of advanced safety features integrated into the interior. Furthermore, the growing demand for personalization and premium cabin aesthetics, especially in the passenger car segment, fuels innovation.

Barriers & Challenges: Despite the positive outlook, the industry faces significant challenges. Supply chain disruptions, particularly concerning semiconductor availability and raw material sourcing, continue to pose a substantial obstacle, impacting production volumes and timelines. The high cost of research and development for cutting-edge technologies, coupled with the relatively long development cycles in the automotive sector, presents an economic barrier. Intense competition among established players and emerging technology providers necessitates constant innovation and cost management. Navigating evolving regulatory landscapes related to environmental impact and data privacy also adds complexity. The transition to electric vehicles (EVs) also brings challenges related to battery integration and the redesign of interior spaces.

Emerging Opportunities in North America Automotive Interiors Industry

Emerging opportunities within the North American automotive interiors market are centered around the evolving needs of the connected and autonomous vehicle era. The increasing adoption of electric vehicles is creating a demand for novel interior designs optimized for space and passenger comfort, free from traditional engine constraints. The development of advanced cockpit electronics for autonomous driving, including sophisticated sensor integration and display technologies that provide occupants with information and entertainment during self-driving journeys, presents a significant growth avenue. Furthermore, the growing consumer emphasis on health and wellness within vehicles is fostering opportunities for smart cabin features like advanced air purification systems, personalized climate control, and biometric monitoring for driver fatigue. The circular economy is also opening doors for innovative material solutions and recycling initiatives within the interior components sector.

Growth Accelerators in the North America Automotive Interiors Industry Industry

Several catalysts are accelerating growth in the North American automotive interiors industry. The rapid advancement and widespread adoption of Artificial Intelligence (AI) and Machine Learning (ML) are enabling more intuitive and personalized human-machine interfaces within vehicles, revolutionizing the automotive cabin electronics experience. Strategic partnerships between automotive OEMs, Tier 1 suppliers, and technology companies are fostering co-creation and faster integration of innovative solutions. The increasing consumer demand for premium and customizable interior features, driven by a desire for a more engaging and comfortable mobility experience, is another major accelerator. Furthermore, the ongoing development and integration of advanced driver-assistance systems (ADAS) are creating new functionalities and aesthetic considerations within the automotive interior.

Key Players Shaping the North America Automotive Interiors Industry Market

- Magna International Inc

- Recaro Group

- Visteon Corporation

- Groclin S A

- Lear Corporation

- Faurecia

- Adient PLC

- Pioneer Corporation

- Grammer AG

- Panasonic Corporation

Notable Milestones in North America Automotive Interiors Industry Sector

- 2023: Widespread adoption of advanced driver-assistance systems (ADAS) integration into instrument panels for enhanced safety and driver awareness.

- 2023: Increased focus on sustainable materials and recycled plastics in interior components across multiple vehicle segments.

- 2022: Launch of highly integrated digital cockpit solutions featuring larger, curved displays and AI-powered voice assistants.

- 2022: Significant investment in R&D for flexible display technologies and augmented reality integration in infotainment systems.

- 2021: Expansion of customizable interior lighting solutions offering personalized ambiance and functional lighting.

- 2021: Introduction of advanced haptic feedback systems in steering wheels and dashboards for improved user interaction.

- 2020: Accelerated development and integration of advanced connectivity features for enhanced over-the-air updates and in-car services.

- 2019: Growing emphasis on lightweight materials and modular interior designs to improve vehicle efficiency.

In-Depth North America Automotive Interiors Industry Market Outlook

The future outlook for the North American automotive interiors industry is exceptionally bright, driven by persistent innovation and evolving consumer expectations. The increasing penetration of electric and autonomous vehicles will fundamentally reshape interior design, prioritizing passenger comfort, productivity, and entertainment. Advancements in automotive infotainment systems and integrated cockpit solutions will continue to be central to this transformation, offering more immersive and personalized experiences. The growing demand for sustainable and eco-friendly materials, coupled with sophisticated manufacturing techniques, will also play a crucial role. Strategic collaborations and a focus on digital integration are expected to accelerate market growth, positioning the automotive interior as a key differentiator in the future of mobility.

North America Automotive Interiors Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Component Type

- 2.1. Infotainment System

- 2.2. Instrument Panels

- 2.3. Interior Lighting

- 2.4. Others

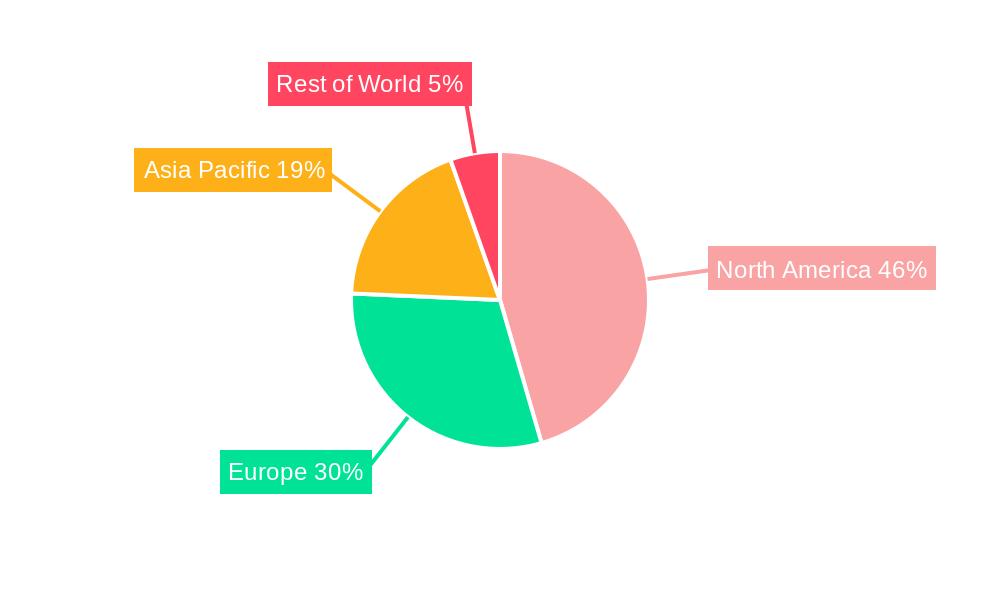

North America Automotive Interiors Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Automotive Interiors Industry Regional Market Share

Geographic Coverage of North America Automotive Interiors Industry

North America Automotive Interiors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. Electric Vehicles will Fuel the Growth of Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Interiors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Infotainment System

- 5.2.2. Instrument Panels

- 5.2.3. Interior Lighting

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Magna International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Recaro Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Visteon Corporatio

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Groclin S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lear Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Faurecia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Adient PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pioneer Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Grammer AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Magna International Inc

List of Figures

- Figure 1: North America Automotive Interiors Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Automotive Interiors Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Automotive Interiors Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: North America Automotive Interiors Industry Revenue billion Forecast, by Component Type 2020 & 2033

- Table 3: North America Automotive Interiors Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Automotive Interiors Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: North America Automotive Interiors Industry Revenue billion Forecast, by Component Type 2020 & 2033

- Table 6: North America Automotive Interiors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Automotive Interiors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Automotive Interiors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Automotive Interiors Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Interiors Industry?

The projected CAGR is approximately 2.2%.

2. Which companies are prominent players in the North America Automotive Interiors Industry?

Key companies in the market include Magna International Inc, Recaro Group, Visteon Corporatio, Groclin S A, Lear Corporation, Faurecia, Adient PLC, Pioneer Corporation, Grammer AG, Panasonic Corporation.

3. What are the main segments of the North America Automotive Interiors Industry?

The market segments include Vehicle Type, Component Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 176.44 billion as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Electric Vehicles will Fuel the Growth of Market..

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Interiors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Interiors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Interiors Industry?

To stay informed about further developments, trends, and reports in the North America Automotive Interiors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence