Key Insights

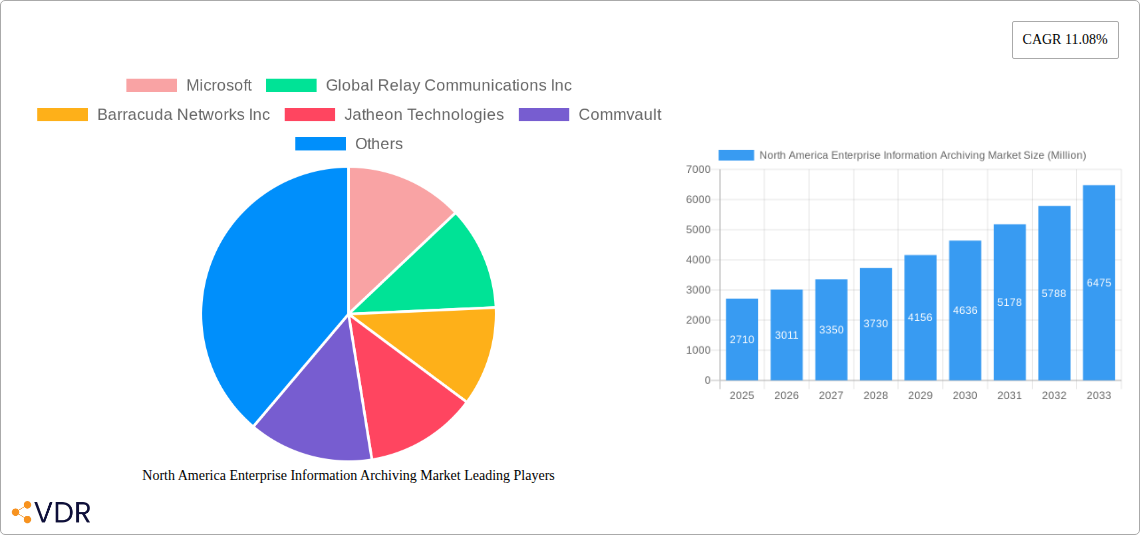

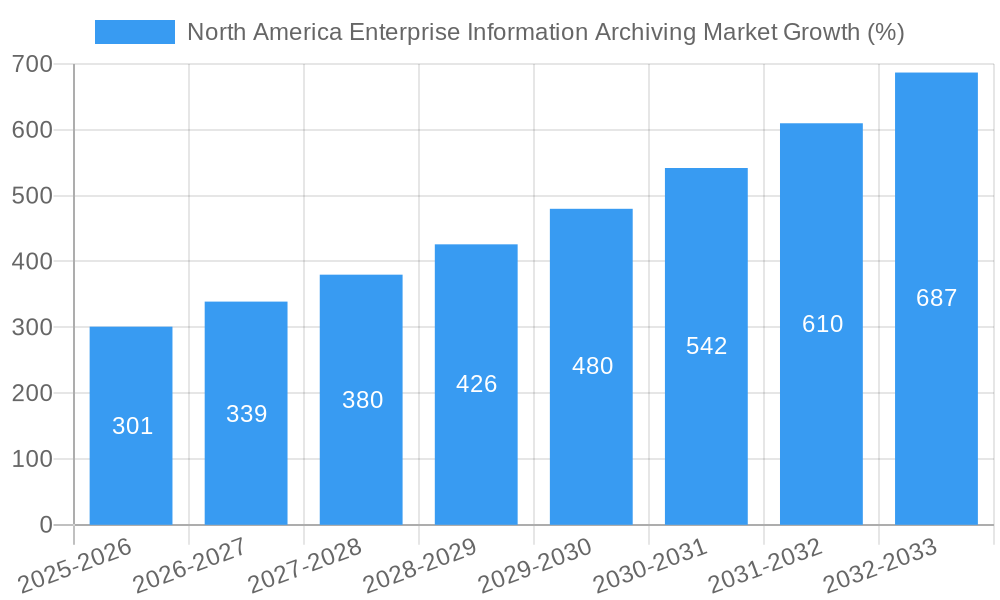

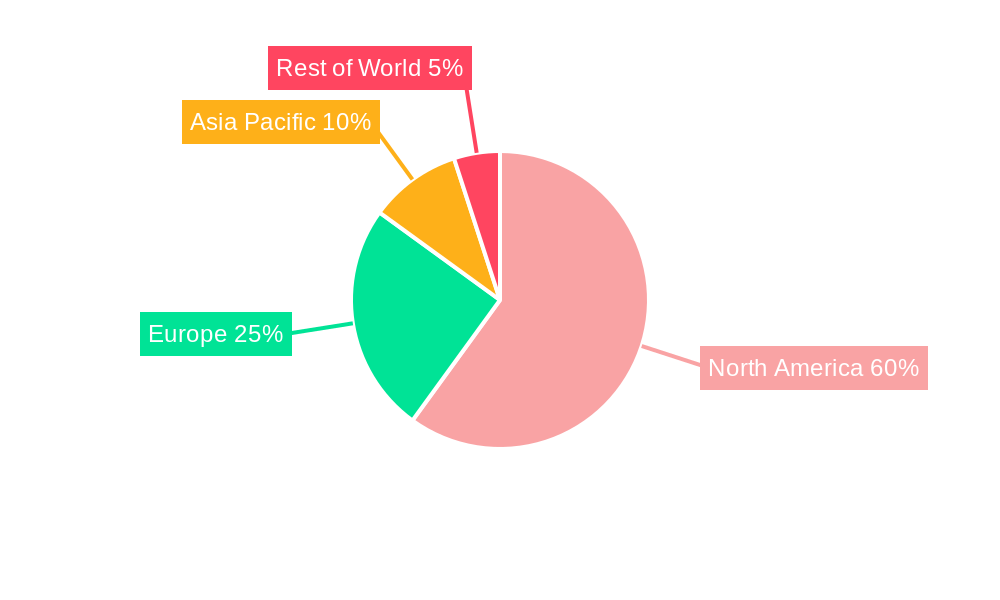

The North America Enterprise Information Archiving market is experiencing robust growth, projected to reach \$2.71 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 11.08% from 2025 to 2033. This expansion is fueled by several key factors. Increasing regulatory compliance mandates across sectors like BFSI (Banking, Financial Services, and Insurance), healthcare, and government are driving the adoption of robust archiving solutions. The escalating volume of unstructured data generated by businesses, coupled with the rising need for efficient data management and disaster recovery capabilities, further contributes to market growth. Furthermore, the shift towards cloud-based deployments offers scalability and cost-effectiveness, attracting SMEs and large enterprises alike. The market is segmented by offering (software and services), deployment (cloud and on-premises), organization size (SMEs and large enterprises), and end-user industries, with BFSI, IT and Telecom, and Retail and E-commerce representing significant market segments. Competition is fierce, with major players like Microsoft, Global Relay, and others constantly innovating to provide comprehensive solutions. The strong presence of established technology companies, combined with the burgeoning demand for secure and compliant data management, positions the North American market for continued significant growth.

The dominance of North America in this market stems from factors such as advanced technological infrastructure, high adoption rates of cloud technologies, and stringent data privacy regulations. Within North America, the United States holds the largest market share, driven by its substantial IT sector and robust regulatory environment. Canada follows as a significant contributor, characterized by increasing digital transformation initiatives within various industries. While the on-premises segment currently holds a notable market share, the cloud-based segment is projected to experience faster growth due to its inherent scalability and cost advantages. The increasing adoption of AI and machine learning within archiving solutions will also contribute significantly to the future market expansion, allowing for smarter data management and enhanced compliance. The competitive landscape is characterized by both established players and emerging technology providers, fostering innovation and driving the market towards enhanced solutions.

North America Enterprise Information Archiving Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Enterprise Information Archiving market, encompassing market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report segments the market by offering (Software, Service), deployment (Cloud, On-premises), organization size (SMEs, Large Enterprises), end-user industry (BFSI, IT & Telecom, Retail & E-commerce, Healthcare, Government, Media & Entertainment, Education, Other), and country (United States, Canada). The market size is presented in million units.

North America Enterprise Information Archiving Market Dynamics & Structure

The North American enterprise information archiving market is characterized by a moderately concentrated landscape with key players like Microsoft, Global Relay Communications Inc, Barracuda Networks Inc, and others vying for market share. Technological innovation, driven by advancements in cloud computing, AI, and data analytics, significantly impacts market growth. Stringent data privacy regulations (e.g., GDPR, CCPA) are shaping market practices, while the emergence of sophisticated data backup and recovery solutions presents competitive substitution. The market exhibits a diverse end-user demographic, with large enterprises currently dominating due to higher data volumes and complex compliance needs. M&A activity has been moderate, with a recorded xx deals in the past five years, primarily focused on strengthening technological capabilities and expanding market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Cloud-based solutions, AI-powered data analytics, and enhanced security features are key drivers.

- Regulatory Framework: Compliance with data privacy regulations (GDPR, CCPA, etc.) is a significant factor.

- Competitive Substitutes: Data backup and recovery solutions pose competitive pressure.

- End-User Demographics: Large enterprises dominate, followed by SMEs.

- M&A Trends: xx M&A deals over the past five years, focusing on technological advancement and market expansion.

North America Enterprise Information Archiving Market Growth Trends & Insights

The North American enterprise information archiving market experienced significant growth during the historical period (2019-2024), expanding from xx million units in 2019 to xx million units in 2024. This growth is attributed to the increasing volume of enterprise data, stringent regulatory compliance needs, and the rising adoption of cloud-based solutions. The market is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. Technological disruptions, such as the rise of AI-powered data management and the increasing adoption of hybrid cloud models, are reshaping the market landscape. Shifts in consumer behavior toward more robust data security and privacy are also driving demand. Market penetration is currently at xx% in large enterprises and xx% in SMEs, with significant potential for future expansion.

Dominant Regions, Countries, or Segments in North America Enterprise Information Archiving Market

The United States is the dominant market within North America, holding approximately xx% of the overall market share in 2024, driven by a large number of enterprises, robust IT infrastructure, and high regulatory scrutiny. Canada represents a significantly smaller, yet growing segment with increasing adoption of cloud-based solutions.

By Offering: The service segment holds a larger market share (xx%) compared to the software segment (xx%) due to the increasing demand for managed archiving services. By Deployment: Cloud deployment is rapidly gaining traction (xx% market share in 2024), exceeding on-premises solutions (xx%) due to its scalability, cost-effectiveness, and ease of access. By Organization Size: Large enterprises are the primary consumers of enterprise information archiving solutions, comprising xx% of the market share in 2024, due to their substantial data volumes and compliance requirements. By End-user Industry: The BFSI sector leads the market (xx% market share in 2024) due to strict regulatory requirements and large data volumes. The government sector is witnessing rapid growth driven by increasing digitalization and stringent data governance standards.

- Key Drivers for US Market Dominance:

- Large enterprise base

- Robust IT infrastructure

- Stringent data privacy regulations

- High levels of technological adoption

- Key Drivers for Canadian Market Growth:

- Growing adoption of cloud-based solutions

- Increasing government initiatives

- Expanding enterprise sector

North America Enterprise Information Archiving Market Product Landscape

The North American enterprise information archiving market showcases a diverse range of products, encompassing software solutions, managed services, and hybrid models. Key product innovations focus on improving data security, enhancing compliance capabilities, and streamlining data management processes through advanced features like AI-powered data discovery and automated retention policies. These solutions offer features like robust data encryption, granular access control, and seamless integration with existing enterprise systems, providing improved efficiency and cost savings. Technological advancements emphasize scalability, ease of use, and integration with cloud platforms.

Key Drivers, Barriers & Challenges in North America Enterprise Information Archiving Market

Key Drivers: The increasing volume of enterprise data, growing concerns about data security and privacy, and the rising need to comply with stringent data regulations are major drivers of market growth. The shift toward cloud-based solutions and the adoption of AI-powered data management further accelerates market expansion.

Key Challenges: High implementation costs, complex integration with existing systems, and the lack of skilled professionals to manage archiving solutions pose challenges. Moreover, concerns regarding data security and privacy, and evolving regulatory landscapes create hurdles for market growth. The competitive pressure from established players and new entrants also impacts market dynamics. Supply chain disruptions have caused xx% increase in pricing for some key components.

Emerging Opportunities in North America Enterprise Information Archiving Market

Emerging opportunities lie in the untapped potential of SMEs, particularly in sectors like education and other end-user industries. Innovative applications like AI-powered data analytics for regulatory compliance and advanced data discovery tools are opening new avenues. The increasing adoption of hybrid cloud models offers a compelling opportunity for vendors to offer flexible and scalable solutions. Finally, the growing demand for secure and compliant archiving solutions in the public sector presents a substantial growth opportunity.

Growth Accelerators in the North America Enterprise Information Archiving Market Industry

Technological advancements, particularly in AI and machine learning, will significantly drive market growth by automating data management tasks and improving data security. Strategic partnerships between technology vendors and cloud service providers will broaden the market reach and increase the accessibility of archiving solutions. Expansion into untapped markets, especially SMEs and emerging industries, coupled with the development of innovative applications to cater to specific sector needs, offers substantial growth potential.

Key Players Shaping the North America Enterprise Information Archiving Market Market

- Microsoft

- Global Relay Communications Inc

- Barracuda Networks Inc

- Jatheon Technologies

- Commvault

- Veritas Technologies LLC

- Proofpoint Inc

- Smarsh Inc

- Open Text Corporation

- Dell Technologies

Notable Milestones in North America Enterprise Information Archiving Market Sector

- December 2023: Preservica launched a FOIA tool and public records archiving service, enhancing government sector efficiency and compliance.

- June 2023: Accenture Federal Services secured a USD 329 million contract for USAID's information assurance and privacy program, highlighting the growing government demand for enterprise information archiving.

In-Depth North America Enterprise Information Archiving Market Market Outlook

The North American enterprise information archiving market is poised for robust growth, driven by technological advancements, increasing data volumes, and stringent regulatory requirements. Strategic investments in R&D, expansion into new markets, and the development of innovative solutions tailored to specific sector needs will shape future market dynamics. The rising adoption of cloud-based solutions and the increasing focus on data security and privacy will further fuel market expansion, presenting significant opportunities for market players to capitalize on.

North America Enterprise Information Archiving Market Segmentation

-

1. Offering

- 1.1. Software

- 1.2. Service

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premises

-

3. Organization Size

- 3.1. SMEs

- 3.2. Large Enterprises

-

4. End-user Industries

- 4.1. BFSI

- 4.2. IT and Telecom

- 4.3. Retail and E-commerce

- 4.4. Healthcare

- 4.5. Government

- 4.6. Media and Entertainment

- 4.7. Education

- 4.8. Other End-user Industries

North America Enterprise Information Archiving Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Enterprise Information Archiving Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.08% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Cloud-based and Subscription-based Model; Rapid Increase in the Data Volumes in Enterprises; Integration of Big Data Analytics and AI Technologies

- 3.3. Market Restrains

- 3.3.1. Lack of Technical Expertise in Dealing With High Content Volume; Concerns Related to Security and Privacy of Enterprise Data

- 3.4. Market Trends

- 3.4.1. Cloud Segment to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Enterprise Information Archiving Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Software

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. SMEs

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End-user Industries

- 5.4.1. BFSI

- 5.4.2. IT and Telecom

- 5.4.3. Retail and E-commerce

- 5.4.4. Healthcare

- 5.4.5. Government

- 5.4.6. Media and Entertainment

- 5.4.7. Education

- 5.4.8. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. United States North America Enterprise Information Archiving Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Enterprise Information Archiving Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Enterprise Information Archiving Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Enterprise Information Archiving Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Microsoft

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Global Relay Communications Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Barracuda Networks Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Jatheon Technologies

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Commvault

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Veritas Technologies LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Google

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Proofpoint Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Smarsh Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Open Text Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Dell Technologie

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Microsoft

List of Figures

- Figure 1: North America Enterprise Information Archiving Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Enterprise Information Archiving Market Share (%) by Company 2024

List of Tables

- Table 1: North America Enterprise Information Archiving Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Enterprise Information Archiving Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: North America Enterprise Information Archiving Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: North America Enterprise Information Archiving Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 5: North America Enterprise Information Archiving Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 6: North America Enterprise Information Archiving Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Enterprise Information Archiving Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Enterprise Information Archiving Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Enterprise Information Archiving Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Enterprise Information Archiving Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America Enterprise Information Archiving Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America Enterprise Information Archiving Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 13: North America Enterprise Information Archiving Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 14: North America Enterprise Information Archiving Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 15: North America Enterprise Information Archiving Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 16: North America Enterprise Information Archiving Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United States North America Enterprise Information Archiving Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada North America Enterprise Information Archiving Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico North America Enterprise Information Archiving Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Enterprise Information Archiving Market?

The projected CAGR is approximately 11.08%.

2. Which companies are prominent players in the North America Enterprise Information Archiving Market?

Key companies in the market include Microsoft, Global Relay Communications Inc, Barracuda Networks Inc, Jatheon Technologies, Commvault, Veritas Technologies LLC, Google, Proofpoint Inc, Smarsh Inc, Open Text Corporation, Dell Technologie.

3. What are the main segments of the North America Enterprise Information Archiving Market?

The market segments include Offering, Deployment, Organization Size, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Cloud-based and Subscription-based Model; Rapid Increase in the Data Volumes in Enterprises; Integration of Big Data Analytics and AI Technologies.

6. What are the notable trends driving market growth?

Cloud Segment to Witness Major Growth.

7. Are there any restraints impacting market growth?

Lack of Technical Expertise in Dealing With High Content Volume; Concerns Related to Security and Privacy of Enterprise Data.

8. Can you provide examples of recent developments in the market?

December 2023- Preservica launched a FOIA tool and public records archiving service. The new tool can save officials from labor-intensive efforts to keep minutes, communications, and other documents because it integrates with Microsoft 365. Officials and staff can use a unified information government strategy across the complete records life cycle without learning and using separate vendors' specific compliance archiving and discovery tools due to the new technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Enterprise Information Archiving Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Enterprise Information Archiving Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Enterprise Information Archiving Market?

To stay informed about further developments, trends, and reports in the North America Enterprise Information Archiving Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence