Key Insights

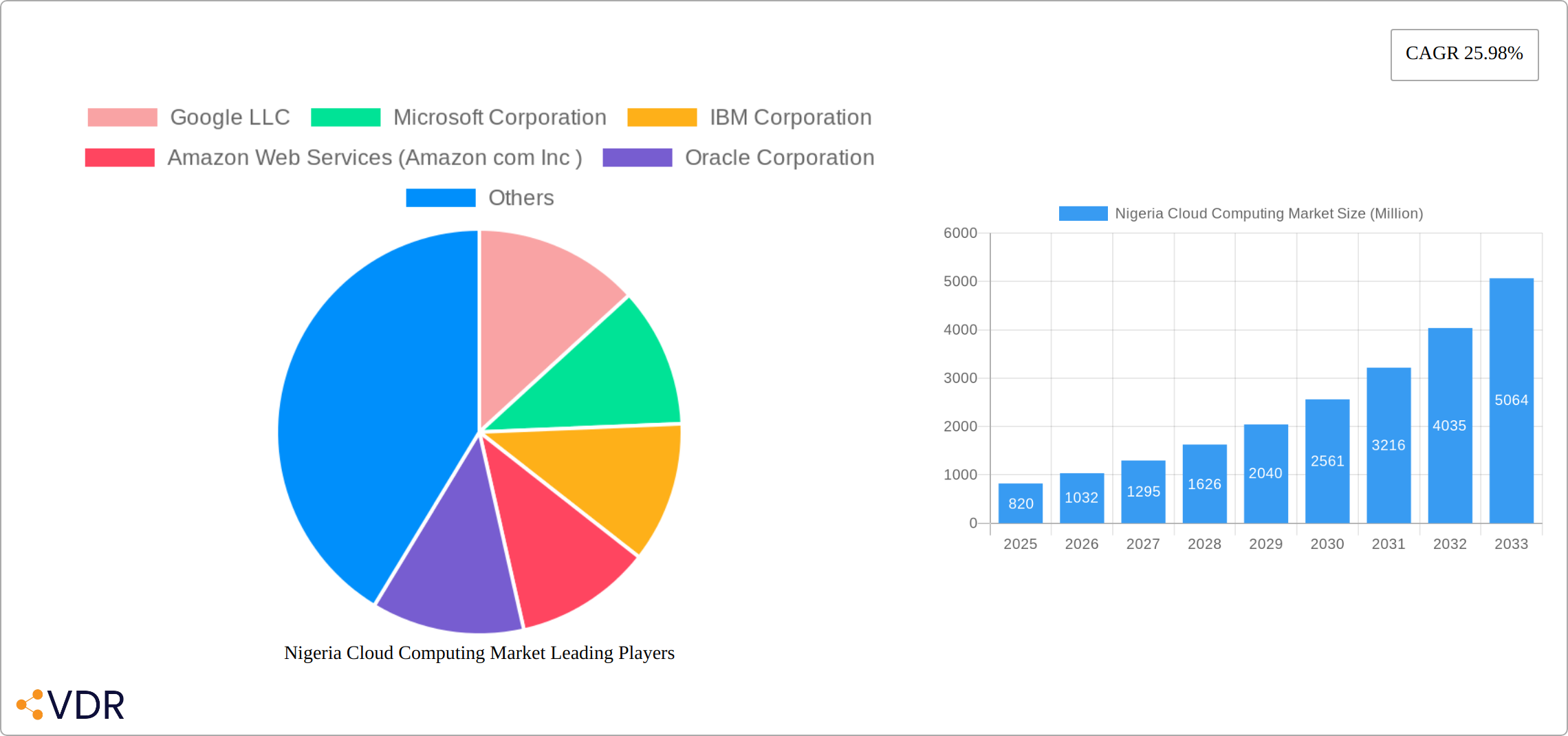

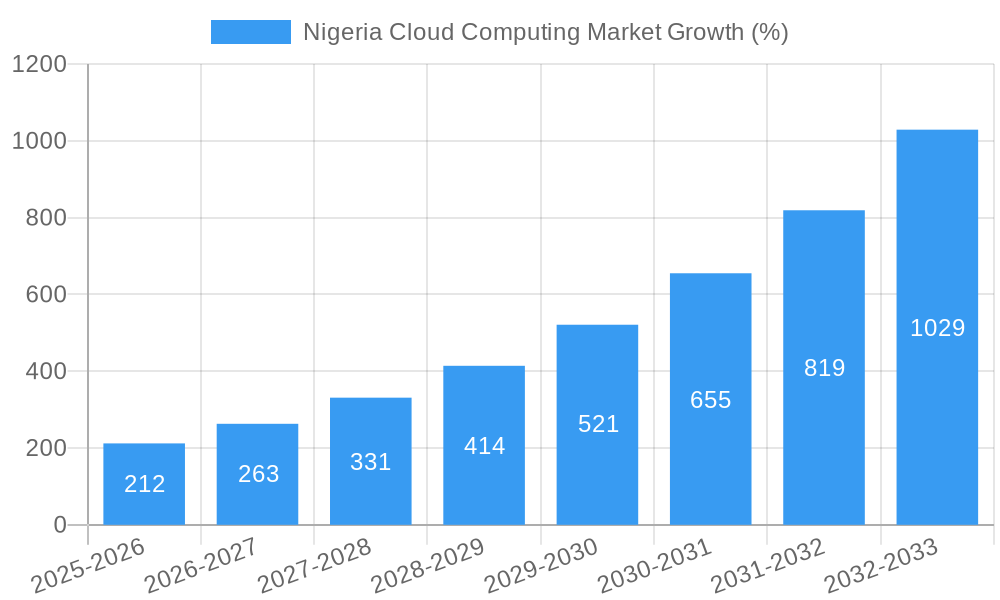

The Nigeria cloud computing market is experiencing robust growth, projected to reach $0.82 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 25.98% from 2019 to 2033. This expansion is driven by several key factors. Increasing digitalization across various sectors, including finance, telecommunications, and government, fuels the demand for scalable and cost-effective cloud solutions. Furthermore, the rising adoption of mobile devices and the expanding internet penetration in Nigeria are creating a fertile ground for cloud services. Improved infrastructure investments, including data centers and reliable internet connectivity, are also contributing significantly to market growth. However, challenges remain, such as concerns about data security and privacy, a lack of skilled cloud professionals, and the need for more robust regulatory frameworks. Despite these hurdles, the long-term outlook for the Nigerian cloud computing market remains exceptionally positive, fueled by the nation's burgeoning digital economy and the continuous advancements in cloud technologies.

The market's segmentation likely reflects the diversity of cloud services offered. Major players such as Google, Microsoft, IBM, Amazon Web Services, Oracle, and local providers like MTN Nigeria are actively competing for market share. These companies are strategically investing in local partnerships and tailored solutions to cater to the specific needs of Nigerian businesses and organizations. The regional distribution of the market might showcase stronger growth in urban centers with higher internet penetration and technological infrastructure compared to rural areas. The forecast period (2025-2033) suggests continued market expansion driven by sustained government initiatives promoting digital transformation and the growing adoption of cloud solutions across various industry verticals. The historical period (2019-2024) provides a base for understanding the market's initial growth trajectory and the factors contributing to its current momentum.

Nigeria Cloud Computing Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic Nigeria cloud computing market, offering invaluable insights for businesses, investors, and industry professionals. With a detailed study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's current state, growth trajectory, and future potential. The report delves into key market segments, influential players like Google LLC, Microsoft Corporation, IBM Corporation, Amazon Web Services (Amazon.com Inc.), Oracle Corporation, Cybercloud Systems, SAP SE, and MTN Nigeria Communications PLC (and others), and significant industry developments. The report uses Million units as the unit of measurement for all values.

Nigeria Cloud Computing Market Dynamics & Structure

This section analyzes the competitive landscape of Nigeria's cloud computing market, examining market concentration, technological advancements, regulatory influence, and market dynamics. The analysis includes quantitative data such as market share percentages and M&A deal volumes alongside qualitative factors influencing market growth.

- Market Concentration: The Nigerian cloud computing market exhibits a moderately concentrated structure, with a few major international players holding significant market share. However, the emergence of local players like Cybercloud Systems is challenging this dominance. We estimate that the top 5 players hold approximately 70% of the market share in 2025.

- Technological Innovation: The market is driven by continuous innovation in areas such as AI, machine learning, and serverless computing, with ongoing efforts to improve infrastructure and affordability. However, challenges such as unreliable power supply and internet connectivity hinder wider adoption.

- Regulatory Framework: The Nigerian government is actively working on policies to support the growth of the digital economy, including cloud computing. However, regulatory clarity on data privacy and security remains crucial for fostering further growth.

- Competitive Substitutes: While cloud computing offers significant advantages, traditional on-premise solutions still compete, particularly amongst smaller businesses with limited IT resources. This competition is expected to decrease over the forecast period due to increased affordability and accessibility of cloud services.

- End-User Demographics: The market is largely driven by enterprises (45% market share in 2025), followed by government organizations (20%) and small and medium-sized businesses (SMBs) (25%). The remaining 10% comes from other consumers. The adoption rate amongst SMBs is expected to grow significantly over the forecast period due to increasing awareness and affordability.

- M&A Trends: The Nigerian cloud computing market has seen a moderate number of mergers and acquisitions (M&A) deals in recent years, primarily involving smaller companies being acquired by larger players. The total value of M&A deals in 2024 was estimated at xx Million.

Nigeria Cloud Computing Market Growth Trends & Insights

This section provides a detailed analysis of the Nigeria cloud computing market's growth trends, driven by factors such as increasing digital transformation initiatives across various sectors, rising mobile penetration, and growing demand for data storage and processing solutions.

The market size grew from xx Million in 2019 to xx Million in 2024, exhibiting a CAGR of xx%. We project the market size to reach xx Million by 2033, with a CAGR of xx% during the forecast period. This growth is influenced by the adoption rates across different sectors, technological disruptions and changing consumer behavior. The increasing penetration of high-speed internet and mobile data is expected to accelerate cloud adoption amongst individuals and businesses alike. The rising popularity of cloud-based solutions for various industries, from finance to healthcare, further strengthens market growth prospects.

Dominant Regions, Countries, or Segments in Nigeria Cloud Computing Market

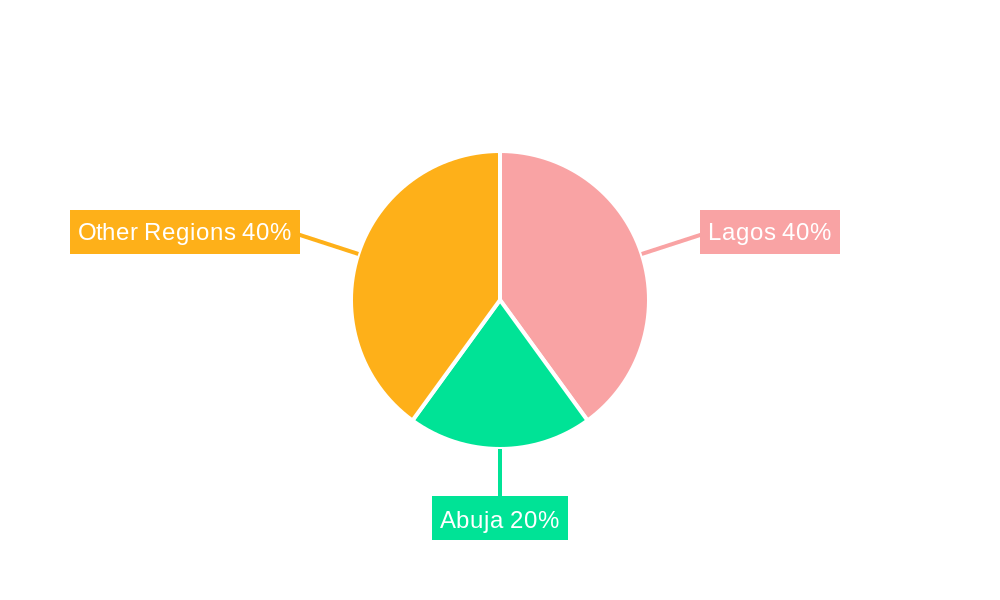

Lagos and Abuja are the dominant regions driving the market growth, accounting for approximately 60% of the market share in 2025. This dominance is primarily attributed to their well-developed infrastructure, higher concentration of businesses, and relatively greater internet penetration.

- Key Drivers:

- Government Initiatives: Government investment in ICT infrastructure and supportive policies aimed at promoting the digital economy are key drivers.

- Improved Infrastructure: Continued investment in improved electricity supply and internet connectivity in these regions are essential for widespread cloud adoption.

- Business Concentration: A significant concentration of businesses in these urban centers fuels demand for cloud-based solutions.

The growth potential in other regions remains substantial, driven by increasing government investments in digital infrastructure and rising internet adoption.

Nigeria Cloud Computing Market Product Landscape

The Nigerian cloud computing market offers a diverse range of products and services, including Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), Software-as-a-Service (SaaS), and other value-added services. Significant advancements are observed in areas like AI/ML-powered solutions, edge computing, and serverless computing. These offerings cater to diverse needs and budgets, from large enterprises seeking scalable solutions to smaller businesses requiring cost-effective services. Unique selling propositions increasingly focus on localization, affordability, and superior customer support tailored to the Nigerian market.

Key Drivers, Barriers & Challenges in Nigeria Cloud Computing Market

Key Drivers:

- Rising Digitalization: Increasing adoption of digital technologies across sectors is driving demand for cloud-based solutions.

- Government Support: Favorable government policies promoting digital transformation are fueling market growth.

- Affordability: The emergence of more affordable cloud solutions is making them accessible to a wider range of businesses.

Key Challenges:

- Power Instability: Frequent power outages remain a significant barrier to cloud adoption, requiring substantial investment in backup power solutions.

- Internet Connectivity: Uneven internet penetration and limited bandwidth in certain areas restrict cloud service accessibility.

- Cybersecurity Concerns: Growing cyber threats necessitate robust security measures, increasing the cost and complexity of cloud adoption. The impact of these challenges is estimated to reduce the market growth by xx% annually.

Emerging Opportunities in Nigeria Cloud Computing Market

The Nigerian cloud computing market presents numerous opportunities, particularly in areas with limited infrastructure. The rising demand for cloud-based solutions in underserved sectors and the growing adoption of mobile technologies represent significant untapped potential. The focus on creating customized solutions tailored to local needs and preferences offers lucrative opportunities for both international and local players. Innovative applications in areas such as fintech, healthcare, and agriculture present a huge potential for future expansion.

Growth Accelerators in the Nigeria Cloud Computing Market Industry

Long-term growth will be driven by technological innovations such as edge computing, AI-powered solutions, and the expansion of 5G networks. Strategic partnerships between international and local companies are also instrumental in fostering market growth. Furthermore, governmental initiatives focused on improving digital infrastructure and promoting cloud adoption are expected to significantly accelerate market expansion in the coming years.

Key Players Shaping the Nigeria Cloud Computing Market Market

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Amazon Web Services (Amazon.com Inc.)

- Oracle Corporation

- Cybercloud Systems

- SAP SE

- MTN Nigeria Communications PLC

Notable Milestones in Nigeria Cloud Computing Market Sector

- July 2024: Okra, a Nigerian fintech, secured USD 16.5 million in funding to build a more affordable cloud infrastructure alternative to international giants.

- May 2024: MTN Nigeria partnered with Microsoft to offer advanced data hosting and Microsoft Business Licenses to SMEs, accelerating digital transformation.

In-Depth Nigeria Cloud Computing Market Market Outlook

The Nigerian cloud computing market holds significant future potential, driven by factors such as increasing digitalization, government support, and technological advancements. Strategic opportunities exist for companies focused on providing affordable, reliable, and secure cloud solutions tailored to the specific needs of the Nigerian market. Further investment in infrastructure, particularly reliable power and internet connectivity, will be key to unlocking the full potential of this rapidly expanding market.

Nigeria Cloud Computing Market Segmentation

-

1. Type

-

1.1. Public Cloud

- 1.1.1. IaaS

- 1.1.2. PaaS

- 1.1.3. SaaS

- 1.2. Private Cloud

- 1.3. Hybrid Cloud

-

1.1. Public Cloud

-

2. Organization Size

- 2.1. SMEs

- 2.2. Large Enterprises

-

3. End-user Industries

- 3.1. Manufacturing

- 3.2. Education

- 3.3. Retail

- 3.4. Transportation and Logistics

- 3.5. Healthcare

- 3.6. BFSI

- 3.7. IT and Telecom

- 3.8. Government and Public Sector

- 3.9. Others (Utilities, Media & Entertainment etc)

Nigeria Cloud Computing Market Segmentation By Geography

- 1. Niger

Nigeria Cloud Computing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 25.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services

- 3.3. Market Restrains

- 3.3.1. Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services

- 3.4. Market Trends

- 3.4.1. Robust Shift Towards Digital Transformation is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Cloud Computing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Public Cloud

- 5.1.1.1. IaaS

- 5.1.1.2. PaaS

- 5.1.1.3. SaaS

- 5.1.2. Private Cloud

- 5.1.3. Hybrid Cloud

- 5.1.1. Public Cloud

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. SMEs

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Industries

- 5.3.1. Manufacturing

- 5.3.2. Education

- 5.3.3. Retail

- 5.3.4. Transportation and Logistics

- 5.3.5. Healthcare

- 5.3.6. BFSI

- 5.3.7. IT and Telecom

- 5.3.8. Government and Public Sector

- 5.3.9. Others (Utilities, Media & Entertainment etc)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Google LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Microsoft Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amazon Web Services (Amazon com Inc )

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oracle Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cybercloud Systems

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SAP SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MTN Nigeria Communications PLC*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Google LLC

List of Figures

- Figure 1: Nigeria Cloud Computing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Nigeria Cloud Computing Market Share (%) by Company 2024

List of Tables

- Table 1: Nigeria Cloud Computing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Nigeria Cloud Computing Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Nigeria Cloud Computing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Nigeria Cloud Computing Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Nigeria Cloud Computing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 6: Nigeria Cloud Computing Market Volume Billion Forecast, by Organization Size 2019 & 2032

- Table 7: Nigeria Cloud Computing Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 8: Nigeria Cloud Computing Market Volume Billion Forecast, by End-user Industries 2019 & 2032

- Table 9: Nigeria Cloud Computing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Nigeria Cloud Computing Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Nigeria Cloud Computing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Nigeria Cloud Computing Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Nigeria Cloud Computing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 14: Nigeria Cloud Computing Market Volume Billion Forecast, by Organization Size 2019 & 2032

- Table 15: Nigeria Cloud Computing Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 16: Nigeria Cloud Computing Market Volume Billion Forecast, by End-user Industries 2019 & 2032

- Table 17: Nigeria Cloud Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Nigeria Cloud Computing Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Cloud Computing Market?

The projected CAGR is approximately 25.98%.

2. Which companies are prominent players in the Nigeria Cloud Computing Market?

Key companies in the market include Google LLC, Microsoft Corporation, IBM Corporation, Amazon Web Services (Amazon com Inc ), Oracle Corporation, Cybercloud Systems, SAP SE, MTN Nigeria Communications PLC*List Not Exhaustive.

3. What are the main segments of the Nigeria Cloud Computing Market?

The market segments include Type, Organization Size, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services.

6. What are the notable trends driving market growth?

Robust Shift Towards Digital Transformation is Driving the Market.

7. Are there any restraints impacting market growth?

Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services.

8. Can you provide examples of recent developments in the market?

July 2024: Okra, a Nigerian fintech that recently secured USD 16.5 million in funding, is venturing into cloud infrastructure. With backing from TLcom, Okra aims to provide a budget-friendly and reliable alternative to international cloud giants such as AWS and Azure. This move comes at a crucial juncture, as local startups seek to rein in expenses due to surging inflation and elevated interest rates.May 2024: MTN Nigeria, a telecommunications and technology enabler, forged a strategic alliance with Microsoft. This partnership aims to deliver advanced data hosting solutions and Microsoft Business Licenses to small and medium enterprises. This move underscores MTN Nigeria's dedication to fast-tracking the digital transformation of businesses throughout the nation, harnessing its robust and reliable connectivity. Through this collaboration, customers secure access to a holistic suite of services on Microsoft's Azure Cloud platform, emphasizing flexibility, scalability, and security.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Cloud Computing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Cloud Computing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Cloud Computing Market?

To stay informed about further developments, trends, and reports in the Nigeria Cloud Computing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence