Key Insights

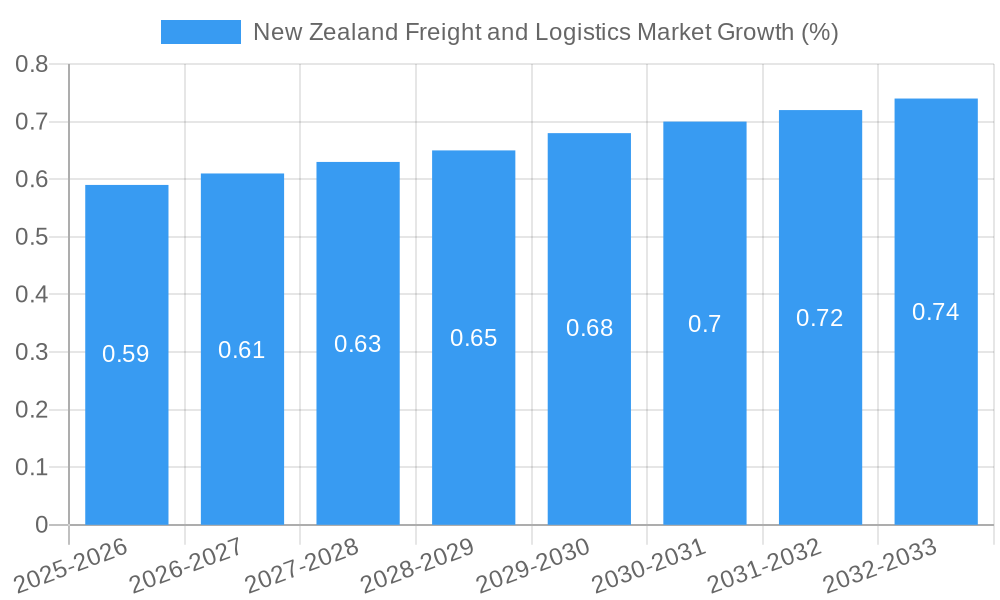

The New Zealand freight and logistics market, valued at $17.71 million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.21% from 2025 to 2033. This growth is fueled by several key drivers. The burgeoning e-commerce sector necessitates efficient and reliable delivery networks, stimulating demand for freight forwarding, warehousing, and value-added services. Simultaneously, growth in key sectors like manufacturing, particularly automotive and food and beverage production, contributes significantly to increased freight volumes. Furthermore, infrastructure developments aimed at improving transport connectivity across New Zealand are expected to enhance operational efficiency and reduce logistical bottlenecks. However, challenges such as fluctuating fuel prices, driver shortages, and the need for ongoing investment in sustainable logistics solutions represent potential restraints on market expansion. The market is segmented by function (freight transport, rail, forwarding, warehousing, value-added services) and end-user (manufacturing, automotive, oil & gas, mining, agriculture, construction, distributive trade, and others). Major players in the market include both international giants like Kuehne + Nagel and DHL, and established local companies such as Mainfreight and Toll Group, illustrating a dynamic competitive landscape.

The forecast period (2025-2033) anticipates a gradual but consistent expansion of the New Zealand freight and logistics market. The continued growth of e-commerce, coupled with government initiatives promoting efficient supply chains, will likely outweigh the challenges posed by rising fuel costs and labor shortages. Companies are increasingly focusing on technology integration, such as advanced tracking systems and optimized routing software, to improve operational efficiency and reduce costs. The focus on sustainability is also gaining momentum, with companies investing in fuel-efficient vehicles and eco-friendly warehousing practices. This trend is anticipated to drive further market growth, as environmentally conscious practices become increasingly important to both businesses and consumers. The diversification of the end-user segments provides further resilience to the market, mitigating the risk of over-reliance on any single sector.

New Zealand Freight & Logistics Market: 2019-2033 Report

This comprehensive report provides an in-depth analysis of the New Zealand freight and logistics market, covering the period 2019-2033. It delves into market dynamics, growth trends, key players, and future opportunities, equipping industry professionals with actionable insights for strategic decision-making. The report leverages extensive data analysis to forecast market size and growth, providing valuable intelligence for investors, businesses, and policymakers.

New Zealand Freight and Logistics Market Market Dynamics & Structure

This section analyzes the structure and dynamics of New Zealand's freight and logistics market, examining market concentration, technological advancements, regulatory influences, competitive landscapes, and M&A activity.

Market Concentration: The market exhibits a mix of large multinational corporations and smaller, specialized local companies. Mainfreight Limited holds a significant market share, while other key players include Freightways Ltd, and New Zealand Post Ltd. The market's concentration ratio (CRx) for the top 5 players is estimated at xx% in 2025, indicating a moderately concentrated market.

Technological Innovation: The adoption of automation, AI, and IoT technologies is accelerating, driven by the need for efficiency and cost reduction. However, barriers to adoption include high initial investment costs and a lack of skilled labor.

Regulatory Framework: New Zealand's regulatory environment impacts operational costs and market entry. The government's focus on sustainability and emissions reduction influences investment in green logistics solutions.

Competitive Landscape: The market faces competition from various modes of transport (road, rail, sea, air) and alternative logistics solutions. Price competition and service differentiation are crucial factors influencing market share.

M&A Activity: Recent acquisitions, such as Qube Holdings' acquisition of Pinnacle Corporation and Kalari in 2023, and Lineage Logistics' acquisition of Grupo Fuentes and Cold Storage Nelson in 2022, highlight the increasing consolidation within the industry. The total value of M&A deals in the New Zealand freight and logistics sector is estimated at xx Million in 2024, representing a xx% increase from 2019.

- Market Concentration: CR5 (Top 5 players) estimated at xx% in 2025.

- Technological Adoption: Slowed by high initial investment costs and skills gaps.

- Regulatory Impacts: Stringent regulations influence operational costs.

- M&A Deal Volume: Estimated at xx Million in 2024.

New Zealand Freight and Logistics Market Growth Trends & Insights

This section examines the growth trajectory of the New Zealand freight and logistics market, utilizing extensive data analysis to provide a detailed market size evolution, adoption rates, technological disruptions, and consumer behavior shifts.

The New Zealand freight and logistics market experienced consistent growth during the historical period (2019-2024), driven by factors such as increasing e-commerce adoption, economic growth, and infrastructural developments. The market size reached xx Million in 2024 and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is further bolstered by advancements in technology, leading to improved efficiency and supply chain visibility. Changing consumer behavior, particularly the increasing preference for faster and more reliable delivery services, is also stimulating market growth. Furthermore, the government's ongoing infrastructure investments and initiatives to support the logistics sector will play a significant role in driving market expansion in the coming years. However, potential external factors such as global economic downturns or unforeseen supply chain disruptions could impact the predicted growth trajectory.

Dominant Regions, Countries, or Segments in New Zealand Freight and Logistics Market

This section identifies the leading regions, countries, or segments within the New Zealand freight and logistics market, focusing on Function (Freight Transport, Rail, Freight Forwarding, Warehousing, Value-added Services) and End-User (Manufacturing, Oil & Gas, Agriculture, Construction, Distributive Trade, Other).

The Distributive Trade (Wholesale and Retail, including FMCG) segment dominates the market, representing approximately xx% of the total market value in 2025. This dominance stems from the significant growth in e-commerce and the increasing demand for efficient logistics solutions to support the distribution of fast-moving consumer goods (FMCG). The Manufacturing and Automotive sector follows closely, contributing xx% of the market value due to robust manufacturing activity and supply chain requirements.

Key Drivers for Dominant Segments:

- Distributive Trade: E-commerce growth, increasing consumer demand for fast delivery, and the rise of omnichannel retail strategies.

- Manufacturing & Automotive: Strong domestic manufacturing output and the need for efficient supply chains to support production and distribution.

New Zealand Freight and Logistics Market Product Landscape

The New Zealand freight and logistics market showcases a diverse range of products and services, encompassing traditional freight forwarding, warehousing, and transportation alongside emerging technologies like advanced tracking systems, automated warehousing solutions, and integrated logistics platforms. These innovations deliver enhanced efficiency, improved tracking capabilities, and reduced operational costs. The unique selling propositions of these products center around their ability to optimize supply chains, improving delivery times and minimizing costs while providing real-time visibility. Technological advancements in areas like AI and machine learning are further revolutionizing logistics operations, enabling predictive analytics and automated decision-making.

Key Drivers, Barriers & Challenges in New Zealand Freight and Logistics Market

Key Drivers:

The market is driven by factors such as the growth of e-commerce, increasing urbanization, and rising demand for faster delivery services. Government initiatives promoting infrastructure development and sustainable logistics also contribute significantly.

Key Challenges:

The industry faces challenges including infrastructure limitations, particularly in road capacity and port congestion. Skills shortages, rising fuel costs, and increasing regulatory complexities present additional hurdles. These factors can lead to increased operational costs and decreased efficiency, impacting overall market growth. For example, port congestion can lead to delays and increased shipping costs, potentially impacting market competitiveness.

Emerging Opportunities in New Zealand Freight and Logistics Market

Emerging opportunities include the growing demand for specialized logistics solutions, such as cold chain logistics and hazardous materials handling. The increasing adoption of sustainable logistics practices presents a significant opportunity for growth, as businesses seek environmentally friendly transport and warehousing solutions. The development of integrated logistics platforms and the use of advanced technologies like blockchain and AI offer potential for enhancing efficiency and transparency across the supply chain.

Growth Accelerators in the New Zealand Freight and Logistics Market Industry

Long-term growth will be driven by continued infrastructure investment, fostering improved connectivity and efficiency. Technological innovations such as automation and AI will enhance productivity and reduce operational costs. Strategic partnerships between logistics providers and technology firms will also accelerate growth. Expansion into new markets and the adoption of sustainable practices will play a crucial role in shaping the future of the industry.

Key Players Shaping the New Zealand Freight and Logistics Market Market

- Mainfreight Limited

- Freightways Ltd

- New Zealand Post Ltd

- First Global Logistics

- Kuehne + Nagel International AG

- Hellmann Worldwide Logistics Limited

- FedEx Corporation

- DSV

- Online Distribution Ltd

- Agility Logistics Pvt Ltd

- Carrolls Cartage Limited

- Cardinal Logistics

- TIL Logistics Group Limited

- Deutsche Post DHL Group

- Bollore Logistics

- Nexus Logistics

- Goddards Cartage

- March Logistics (NZ) Ltd

- PBT

- Mondiale Freight Services Ltd

- Owens Transport Ltd

- Fliway Group Ltd

- Scales Logistics

- Crown Worldwide

- BPW Transport

- Efficiency NZ Ltd

- Champion Freight

- Central Transport Limited

- Charter Transport

- Rohlig New Zealand Limited

- Malcolm Total Logistics

- Burnard International Limited

- Alderson Bulk Lines Limited

- DB Schenker

- Toll Group

- K&S Corporation Limited

- Linfox Pty Ltd

- CEVA Logistics

- Yusen Logistics Co Ltd

Notable Milestones in New Zealand Freight and Logistics Market Sector

- May 2023: Qube Holdings acquires a 50% stake in Pinnacle Corporation and 100% of Kalari, expanding its presence in the New Zealand mining and resources logistics sector.

- August 2022: Lineage Logistics acquires Grupo Fuentes and Cold Storage Nelson (CNS), strengthening its cold chain logistics capabilities in New Zealand.

In-Depth New Zealand Freight and Logistics Market Market Outlook

The future of the New Zealand freight and logistics market appears promising, driven by ongoing investments in infrastructure, technological advancements, and a growing focus on sustainability. Opportunities exist in specialized logistics segments and the integration of technology to enhance efficiency and visibility. Strategic partnerships and market expansion initiatives will further solidify the industry's position in the global logistics landscape. However, proactive management of challenges, such as skills shortages and rising fuel costs, is essential to sustain long-term growth.

New Zealand Freight and Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Shipping and Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Other Functions

-

1.1. Freight Transport

-

2. End-User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distribu

- 2.6. Other En

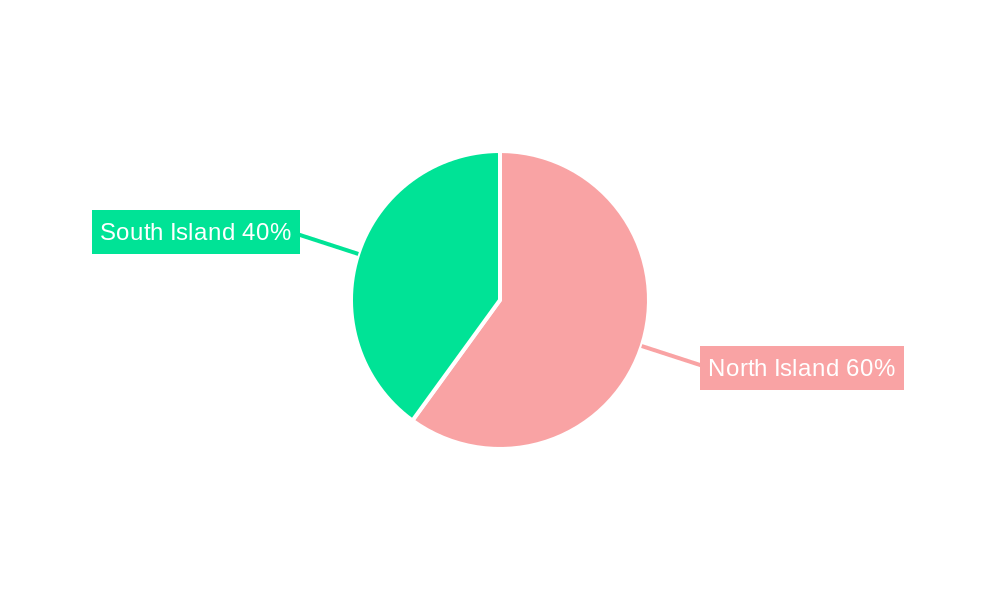

New Zealand Freight and Logistics Market Segmentation By Geography

- 1. New Zealand

New Zealand Freight and Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in global trade activites; Increase in infrastrustrure and construction

- 3.3. Market Restrains

- 3.3.1. Long distances and sometimes difficult terrain can contribute to increased transportation costs

- 3.4. Market Trends

- 3.4.1. Increase in cross-border trade driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. New Zealand Freight and Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Shipping and Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Other Functions

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 4 First Global Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 7 Kuehne + Nagel International AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 3 Hellmann Worldwide Logistics Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 8 FedEx Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 International Companies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 10 DSV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 9 Freightways Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 8 Online Distribution Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 1 Mainfreight Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 5 Agility Logistics Pvt Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 10 New Zealand Post Ltd *

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 3 Carrolls Cartage Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Other Companies (Key Information/Overview)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 2 Cardinal Logistics

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 5 TIL Logistics Group Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 1 Deutsche Post DHL Group

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 1 Bollore Logistics Nexus Logistics Goddards Cartage March Logistics (NZ) Ltd PBT Mondiale Freight Services Ltd Owens Transport Ltd Fliway Group Ltd Scales Logistics Crown Worldwide BPW Transport Efficiency NZ Ltd Champion Freight Central Transport Limited Charter Transport Rohlig New Zealand Limited Malcolm Total Logistics Burnard International Limited Alderson Bulk Lines Limited*List Not Exhaustive

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 9 DB Schenker

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 6 Toll Group

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 7 K&S Corporation Limited

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 6 Linfox Pty Ltd

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Local Companies

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 4 CEVA Logistics

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.24 2 Yusen Logistics Co Ltd

- 6.2.24.1. Overview

- 6.2.24.2. Products

- 6.2.24.3. SWOT Analysis

- 6.2.24.4. Recent Developments

- 6.2.24.5. Financials (Based on Availability)

- 6.2.1 4 First Global Logistics

List of Figures

- Figure 1: New Zealand Freight and Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: New Zealand Freight and Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: New Zealand Freight and Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: New Zealand Freight and Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 3: New Zealand Freight and Logistics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: New Zealand Freight and Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: New Zealand Freight and Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: New Zealand Freight and Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 7: New Zealand Freight and Logistics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: New Zealand Freight and Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Zealand Freight and Logistics Market?

The projected CAGR is approximately 3.21%.

2. Which companies are prominent players in the New Zealand Freight and Logistics Market?

Key companies in the market include 4 First Global Logistics, 7 Kuehne + Nagel International AG, 3 Hellmann Worldwide Logistics Limited, 8 FedEx Corporation, International Companies, 10 DSV, 9 Freightways Ltd, 8 Online Distribution Ltd, 1 Mainfreight Limited, 5 Agility Logistics Pvt Ltd, 10 New Zealand Post Ltd *, 3 Carrolls Cartage Limited, Other Companies (Key Information/Overview), 2 Cardinal Logistics, 5 TIL Logistics Group Limited, 1 Deutsche Post DHL Group, 1 Bollore Logistics Nexus Logistics Goddards Cartage March Logistics (NZ) Ltd PBT Mondiale Freight Services Ltd Owens Transport Ltd Fliway Group Ltd Scales Logistics Crown Worldwide BPW Transport Efficiency NZ Ltd Champion Freight Central Transport Limited Charter Transport Rohlig New Zealand Limited Malcolm Total Logistics Burnard International Limited Alderson Bulk Lines Limited*List Not Exhaustive, 9 DB Schenker, 6 Toll Group, 7 K&S Corporation Limited, 6 Linfox Pty Ltd, Local Companies, 4 CEVA Logistics, 2 Yusen Logistics Co Ltd.

3. What are the main segments of the New Zealand Freight and Logistics Market?

The market segments include Function, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in global trade activites; Increase in infrastrustrure and construction.

6. What are the notable trends driving market growth?

Increase in cross-border trade driving the market.

7. Are there any restraints impacting market growth?

Long distances and sometimes difficult terrain can contribute to increased transportation costs.

8. Can you provide examples of recent developments in the market?

May 2023: Australia-based logistics company Qube Holdings acquired a 50% stake in New Zealand’s Pinnacle Corporation and 100% of Kalari. Qube acquired Kalari from Swire Investments (Australia). Kalari is a leading logistics provider to the Australian mining and resources industry, specializing in on-road and remote bulk haulage through a fleet of predominantly performance-based standards vehicles, materials handling, and supply chain optimization.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Zealand Freight and Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Zealand Freight and Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Zealand Freight and Logistics Market?

To stay informed about further developments, trends, and reports in the New Zealand Freight and Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence