Key Insights

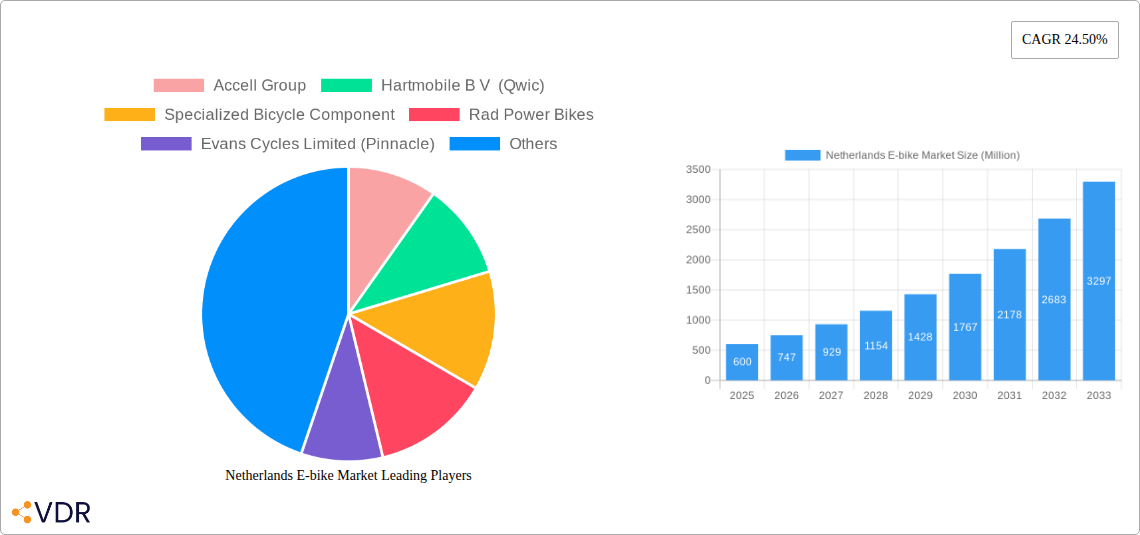

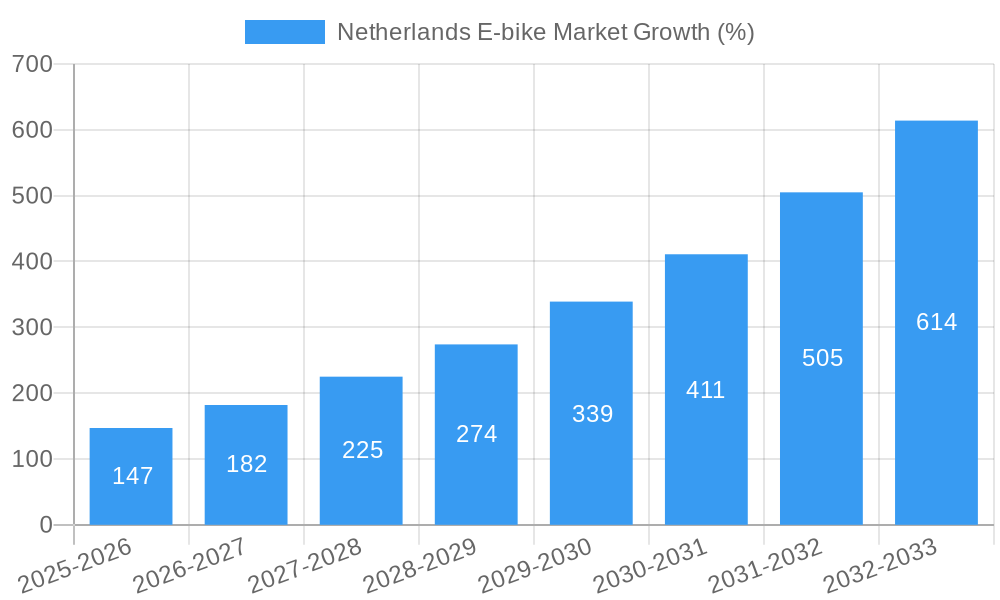

The Netherlands e-bike market is experiencing robust growth, fueled by a strong commitment to sustainable transportation, well-developed cycling infrastructure, and increasing consumer awareness of environmental benefits. The market's Compound Annual Growth Rate (CAGR) of 24.50% from 2019 to 2024 indicates significant expansion, suggesting a substantial market size in 2025. Considering the Netherlands' high bicycle penetration rate and proactive government policies supporting e-bike adoption, we can reasonably estimate the 2025 market size to be around €600 million (assuming a logical extrapolation of the CAGR and considering factors like market maturity and potential saturation). This substantial market value is driven by several key factors. The rising popularity of pedal-assisted e-bikes, favored for their ease of use and fitness benefits, contributes significantly. Furthermore, the increasing demand for cargo and utility e-bikes, reflecting changing lifestyles and the growth of e-commerce deliveries, is bolstering market growth. Lithium-ion batteries dominate the market due to their superior performance and longer lifespan compared to lead-acid alternatives. Key players like Accell Group, Gazelle, and others are strategically investing in innovation and expanding product portfolios to cater to diverse consumer preferences, further stimulating market expansion.

The forecast period from 2025 to 2033 projects continued growth, albeit potentially at a slightly moderated pace as the market matures. Factors like increasing prices for raw materials and potential supply chain constraints could act as minor restraints. However, strong government support for sustainable mobility initiatives, coupled with the continued development of advanced e-bike technologies including improved battery technology and integrated smart features, are expected to offset these challenges. The market segmentation, with a strong focus on pedal-assisted and city/urban e-bikes, reflects current consumer preferences and urban landscape suitability. The continued focus on innovation within the segments and proactive market strategies from major players will likely drive market growth throughout the forecast period. Specific regional variations within the Netherlands may exist but a holistic view suggests consistent and appreciable market expansion.

Netherlands E-bike Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Netherlands e-bike market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on parent market (bicycle market) and child markets (e.g., cargo e-bikes, city e-bikes), this report is an essential resource for industry professionals, investors, and anyone seeking to understand this rapidly evolving sector. The study period covers 2019-2033, with 2025 as the base and estimated year.

Netherlands E-bike Market Dynamics & Structure

This section analyzes the competitive landscape of the Netherlands e-bike market, examining market concentration, technological advancements, regulatory influences, and market dynamics. The report explores the interplay of factors driving market growth, including government initiatives promoting cycling, and the increasing consumer preference for sustainable transportation solutions. We evaluate the impact of mergers and acquisitions (M&A) activity, providing quantitative insights into deal volumes and qualitative assessments of their effects on market structure.

- Market Concentration: The Netherlands e-bike market exhibits a [xx]% market concentration, with [xx] major players controlling [xx]% of the market share in 2024.

- Technological Innovation: Continuous advancements in battery technology (Lithium-ion Battery, Lead-Acid Battery, Others), motor efficiency, and smart connectivity are key drivers. Innovation barriers include high R&D costs and the need for stringent safety standards.

- Regulatory Framework: Government regulations regarding e-bike safety and standards significantly influence market growth. Incentive programs and infrastructure development further shape the market.

- Competitive Substitutes: Traditional bicycles and other forms of personal transport (cars, public transport) pose competition.

- End-User Demographics: The primary demographic includes urban commuters, families, and older adults seeking convenient and eco-friendly transportation.

- M&A Trends: [xx] M&A deals were recorded in the Netherlands e-bike sector between 2019 and 2024, reflecting [xx]% year-on-year growth.

Netherlands E-bike Market Growth Trends & Insights

This section delves into the historical and projected growth of the Netherlands e-bike market. It examines market size evolution, adoption rates, technological disruptions, and changing consumer behaviors. We provide a detailed analysis of factors influencing market expansion, including rising environmental awareness, increasing disposable incomes, and favorable government policies.

The Netherlands e-bike market witnessed a Compound Annual Growth Rate (CAGR) of [xx]% during the historical period (2019-2024), reaching a market size of [xx] million units in 2024. The forecast period (2025-2033) projects continued growth, with a projected CAGR of [xx]% and a market size of [xx] million units by 2033. This growth is driven by several factors including [detailed analysis leveraging XXX data source will be present in this section]. Market penetration is expected to reach [xx]% by 2033.

Dominant Regions, Countries, or Segments in Netherlands E-bike Market

This section identifies the leading regions, countries, or segments within the Netherlands e-bike market. We analyze market share, growth potential, and key drivers for each segment.

- Propulsion Type: Pedal Assisted e-bikes dominate the market, holding [xx]% market share in 2024, followed by Speed Pedelec ([xx]%) and Throttle Assisted ([xx]%). The high adoption of Pedal Assisted is driven by its ease of use and longer range.

- Application Type: City/Urban e-bikes are the leading application type, with [xx]% market share in 2024 due to their suitability for commuting. Cargo/Utility e-bikes are witnessing strong growth, driven by increasing demand for efficient goods delivery.

- Battery Type: Lithium-ion batteries are the dominant battery type in the Netherlands e-bike market, holding [xx]% market share in 2024, while Lead-Acid batteries hold [xx]%. This is driven by their superior energy density and longer lifespan.

Netherlands E-bike Market Product Landscape

The Netherlands e-bike market showcases a diverse range of products, encompassing various designs, features, and technologies. Manufacturers continually innovate to enhance performance, efficiency, and user experience. Key innovations include lighter-weight frames, improved battery technology, integrated smart features (GPS, connectivity), and enhanced safety mechanisms. These advancements cater to a wide range of user needs and preferences, fueling market growth.

Key Drivers, Barriers & Challenges in Netherlands E-bike Market

Key Drivers: The primary drivers include government initiatives promoting cycling, rising environmental awareness among consumers, and increasing urban congestion. The growing popularity of e-bikes as a sustainable mode of transport is another key factor. Furthermore, technological advancements in battery technology and motor efficiency are significantly driving market growth.

Key Challenges: Supply chain disruptions, particularly regarding battery components and microchips, continue to pose significant challenges. Increasing raw material costs and intense competition also hinder market expansion. Regulatory changes and safety standards present hurdles to overcome. The fluctuating price of raw materials contributes to market volatility.

Emerging Opportunities in Netherlands E-bike Market

Emerging opportunities lie in the expansion of e-cargo bikes for last-mile delivery, the integration of smart features for enhanced connectivity and security, and the development of e-bikes tailored to specific user needs (e.g., senior citizens, disabled individuals). The rising trend of bike-sharing programs using e-bikes also presents significant opportunities. Furthermore, the market for specialized e-bikes catering to niche segments (e.g., off-road, performance) is experiencing substantial growth.

Growth Accelerators in the Netherlands E-bike Market Industry

Several factors are poised to accelerate the growth of the Netherlands e-bike market in the coming years. These include technological breakthroughs that will result in more efficient, affordable, and safer e-bikes. Strategic partnerships between manufacturers, component suppliers, and infrastructure developers will play a key role in expanding market reach. Moreover, government policies continue to incentivize e-bike adoption, further boosting market expansion.

Key Players Shaping the Netherlands E-bike Market Market

- Accell Group

- Hartmobile B V (Qwic)

- Specialized Bicycle Components

- Rad Power Bikes

- Evans Cycles Limited (Pinnacle)

- MHW Bike-House GmbH (Cube Bikes)

- Royal Dutch Gazelle

- Raleigh Bicycle Company

- myStromer AG (Stromer)

- Riese & Müller

Notable Milestones in Netherlands E-bike Market Sector

- September 2022: Specialized announced a recall of some battery packs on specific electric mountain bike models due to fire risks.

- August 2022: Evans Cycles reintroduced Cube bikes to all 71 locations after a pandemic-related pause.

- August 2022: Raleigh launched the Trace, its lightest eBike with a 50-mile range.

In-Depth Netherlands E-bike Market Market Outlook

The Netherlands e-bike market is projected to experience significant growth throughout the forecast period, driven by continued technological advancements, supportive government policies, and evolving consumer preferences. Strategic opportunities exist for companies focusing on innovation, sustainability, and providing tailored solutions for niche markets. The market's future potential is considerable, presenting attractive prospects for investment and expansion.

Netherlands E-bike Market Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

Netherlands E-bike Market Segmentation By Geography

- 1. Netherlands

Netherlands E-bike Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands E-bike Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Accell Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hartmobile B V (Qwic)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Specialized Bicycle Component

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rad Power Bikes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Evans Cycles Limited (Pinnacle)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MHW Bike-House GmbH (Cube Bikes)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Royal Dutch Gazelle

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Raleigh Bicycle Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 myStromer AG (Stromer)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Riese & Müller

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Accell Group

List of Figures

- Figure 1: Netherlands E-bike Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Netherlands E-bike Market Share (%) by Company 2024

List of Tables

- Table 1: Netherlands E-bike Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Netherlands E-bike Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: Netherlands E-bike Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 4: Netherlands E-bike Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 5: Netherlands E-bike Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Netherlands E-bike Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Netherlands E-bike Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 8: Netherlands E-bike Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 9: Netherlands E-bike Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 10: Netherlands E-bike Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands E-bike Market?

The projected CAGR is approximately 24.50%.

2. Which companies are prominent players in the Netherlands E-bike Market?

Key companies in the market include Accell Group, Hartmobile B V (Qwic), Specialized Bicycle Component, Rad Power Bikes, Evans Cycles Limited (Pinnacle), MHW Bike-House GmbH (Cube Bikes), Royal Dutch Gazelle, Raleigh Bicycle Company, myStromer AG (Stromer), Riese & Müller.

3. What are the main segments of the Netherlands E-bike Market?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

September 2022: Specialized, announced a recall of some battery packs on specific electric mountain bike models in May 2021 owing to fire dangers caused by these batteries' flaws.August 2022: Evans Cycles reintroduces Cube bikes to all 71 locations, During the height of the pandemic, Cube and Evans Cycles put their commercial relationship on pause due to supply chain issues.August 2022: Raleigh launches the Trace, its lightest eBike with a range of 50 miles, the Trace is powered by a 250-watt-hour battery, built-in for extra security.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands E-bike Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands E-bike Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands E-bike Market?

To stay informed about further developments, trends, and reports in the Netherlands E-bike Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence