Key Insights

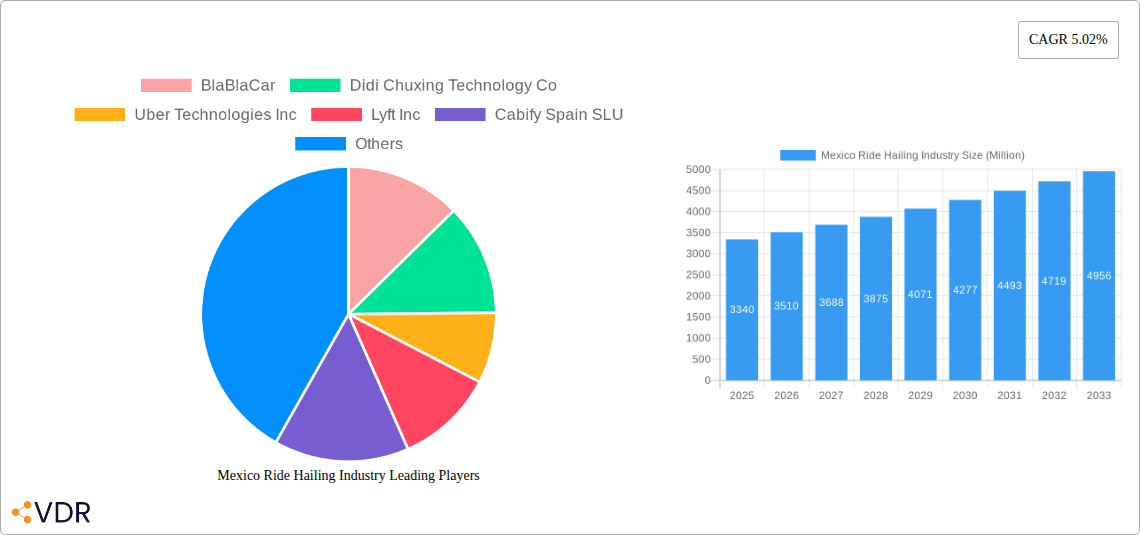

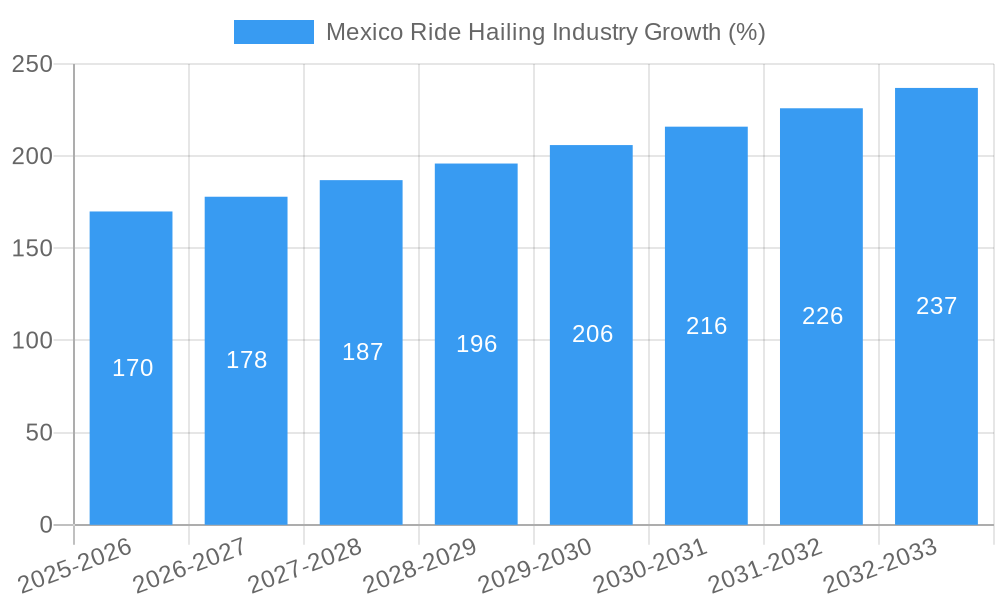

The Mexico ride-hailing market, valued at $3.34 billion in 2025, is projected to experience robust growth, fueled by increasing smartphone penetration, rising urbanization, and a growing preference for convenient and affordable transportation options. The Compound Annual Growth Rate (CAGR) of 5.02% from 2019 to 2024 suggests a consistently expanding market, which is expected to continue its trajectory through 2033. Key growth drivers include the increasing popularity of e-hailing services, particularly among younger demographics, coupled with the expansion of ride-sharing platforms into smaller cities and towns. The dominance of online booking channels further underscores the market's digital transformation. While challenges such as regulatory hurdles and intense competition among established players like Uber and Didi, alongside local competitors, exist, the market's underlying growth fundamentals remain strong. The segmentation by service type (e-hailing, car-sharing, car rental), booking channel (online, offline), and vehicle type (two-wheelers, passenger cars) offers various opportunities for specialized service providers to cater to specific market niches. The continued expansion of Mexico's middle class and improvements in digital infrastructure will likely bolster the market's growth in the coming years.

The market's sustained growth is further supported by evolving consumer preferences. The increasing demand for efficient and reliable transportation alternatives, especially in congested urban areas, contributes significantly to the market expansion. Technological advancements, such as improved ride-hailing apps, integrated payment systems, and enhanced safety features, are further enhancing the user experience and driving market adoption. While the market faces challenges like fluctuating fuel prices and concerns about driver safety and employment regulations, the government's focus on improving infrastructure and promoting sustainable transportation could help mitigate some of these challenges, ultimately fostering continued, albeit moderated, growth. The competitive landscape, while intense, presents opportunities for innovation and differentiation, driving further market evolution.

Mexico Ride Hailing Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the dynamic Mexico ride-hailing market, encompassing its current state, future trajectory, and key players. From market sizing and segmentation to growth drivers and emerging opportunities, this report equips industry professionals, investors, and strategists with actionable insights for informed decision-making. The report covers the period 2019-2033, with a focus on 2025 as the base and estimated year.

Mexico Ride Hailing Industry Market Dynamics & Structure

This section analyzes the structure and dynamics of the Mexican ride-hailing market, considering market concentration, technological advancements, regulatory landscapes, competitive substitutes, user demographics, and mergers & acquisitions (M&A) activity. The market is characterized by a relatively concentrated structure, with major players like Uber and Didi holding significant market share. However, smaller players and niche services are emerging, creating a more competitive landscape.

- Market Concentration: Uber and Didi dominate, holding approximately xx% and xx% market share respectively in 2025. Other players like Cabify and Beat have smaller but significant shares.

- Technological Innovation: The market is driven by advancements in GPS technology, mobile app development, and data analytics, enabling efficient matching, dynamic pricing, and improved user experience. However, challenges remain in ensuring reliable internet connectivity and addressing security concerns.

- Regulatory Framework: The regulatory environment is evolving, with varying rules across different states and municipalities, creating complexities for operators. This includes issues around licensing, insurance, driver background checks, and fare regulations.

- Competitive Substitutes: Public transportation (buses, metro) and personal vehicle ownership remain significant competitive substitutes, particularly in price-sensitive segments.

- End-User Demographics: The primary user base consists of young adults and urban dwellers, with increasing adoption among older demographics and in suburban areas.

- M&A Trends: The past five years have seen a moderate level of M&A activity, primarily focusing on smaller players being acquired by larger entities. The total deal value during 2019-2024 was approximately XX Million USD.

Mexico Ride Hailing Industry Growth Trends & Insights

The Mexican ride-hailing market has experienced significant growth over the past few years, driven by increasing smartphone penetration, rising urbanization, and growing demand for convenient and affordable transportation options. The market is expected to maintain a strong growth trajectory throughout the forecast period (2025-2033). The Compound Annual Growth Rate (CAGR) for the market is projected to be xx% between 2025 and 2033, reaching a market size of XX Million USD by 2033. This growth is fueled by factors such as increasing disposable incomes, improved infrastructure in certain areas, and the expanding adoption of ride-hailing apps across various demographics. Consumer behavior is shifting towards on-demand services, with convenience and safety playing key roles in the selection process.

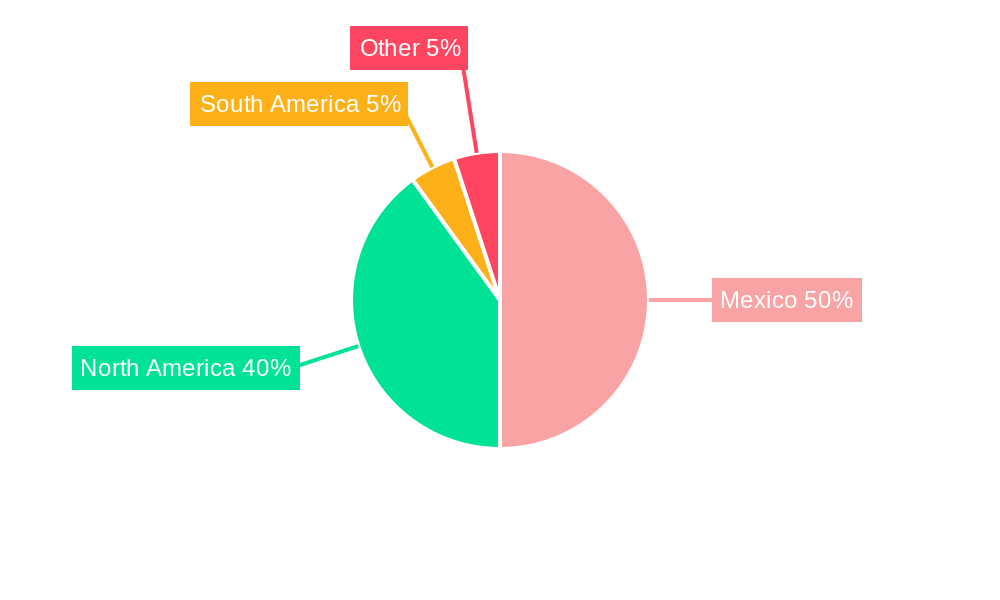

Dominant Regions, Countries, or Segments in Mexico Ride Hailing Industry

The Mexican ride-hailing market exhibits significant regional variations. Mexico City and other major metropolitan areas account for the highest market share, driven by higher population density, greater affordability of ride-hailing, and improved digital infrastructure. E-hailing remains the dominant service type, with car-sharing and car rental showing moderate growth. Online booking is significantly more prevalent than offline booking. Passenger cars are the predominant vehicle type, although two-wheelers are gradually gaining traction in specific market segments.

- By Service Type: E-hailing (80%), Car Sharing (10%), Car Rental (5%), Other (5%)

- By Booking Channel: Online (90%), Offline (10%)

- By Vehicle Type: Passenger Cars (95%), Two Wheelers (5%)

- Key Drivers: High population density in urban centers, increasing smartphone penetration, rising disposable incomes, and government initiatives promoting digital economy.

Mexico Ride Hailing Industry Product Landscape

The ride-hailing market offers a range of services, from basic point-to-point transportation to premium options with luxury vehicles. Innovation focuses on improving user experience through features such as real-time tracking, fare transparency, payment options, safety features (e.g., emergency buttons), and driver ratings. The introduction of electric vehicles in some services represents a significant step towards sustainability. Unique selling propositions focus on providing convenience, affordability, safety, and diverse options to cater to a wide range of customer needs.

Key Drivers, Barriers & Challenges in Mexico Ride Hailing Industry

Key Drivers: Increasing urbanization, rising disposable incomes, and the growing popularity of the gig economy are major growth catalysts. Technological advancements continue to drive efficiency and accessibility. Government initiatives aimed at fostering digitalization and innovation also contribute to market expansion.

Key Barriers and Challenges: Regulatory uncertainty and inconsistent enforcement across different regions create operational difficulties. Competition from established public transport systems and personal vehicle ownership presents a significant challenge. Ensuring driver safety and security, addressing concerns around fare transparency and surge pricing, and managing traffic congestion also pose challenges. The impact of these challenges is estimated to reduce the market growth rate by approximately xx% annually.

Emerging Opportunities in Mexico Ride Hailing Industry

Untapped markets exist in smaller cities and rural areas where public transportation is limited. Opportunities also exist in developing specialized services targeting specific customer segments (e.g., elderly, disabled) or incorporating new technologies (e.g., autonomous vehicles, drone delivery). The expansion of car-sharing and bike-sharing services presents further opportunities for growth.

Growth Accelerators in the Mexico Ride Hailing Industry

Long-term growth is likely to be driven by technological breakthroughs in autonomous driving and electric vehicles, leading to increased efficiency and sustainability. Strategic partnerships between ride-hailing companies and other businesses (e.g., logistics companies, retailers) will create new revenue streams and expand market reach. Government initiatives promoting digital infrastructure and sustainable transportation will further accelerate growth.

Key Players Shaping the Mexico Ride Hailing Industry Market

- BlaBlaCar

- Didi Chuxing Technology Co

- Uber Technologies Inc

- Lyft Inc

- Cabify Spain SLU

- BEAT

Notable Milestones in Mexico Ride Hailing Industry Sector

- February 2024: inDrive partnered with R2 to offer driver loans.

- July 2023: Hoop Carpool secured USD 1.3 Million in funding.

- June 2022: IFC invested USD 15 Million in BlaBlaCar.

- February 2022: Beat launched Beat Zero, an electric vehicle service.

In-Depth Mexico Ride Hailing Industry Market Outlook

The Mexican ride-hailing market shows strong potential for continued growth, fueled by technological advancements, strategic partnerships, and expanding market penetration into underserved areas. The focus on sustainability and improved safety measures will shape future market dynamics. Opportunities for innovation abound in areas such as autonomous vehicles, integrated mobility solutions, and specialized transportation services, presenting significant opportunities for both established players and new entrants.

Mexico Ride Hailing Industry Segmentation

-

1. Service Type

- 1.1. E-hailing

- 1.2. Car Sharing

- 1.3. Car Rental

- 1.4. Other Service Types

-

2. Type

- 2.1. Peer-to-peer Sharing

- 2.2. Business Sharing

-

3. Booking Channel

- 3.1. Online

- 3.2. Offline

-

4. Vehicle Type

- 4.1. Two Wheelers

- 4.2. Passenger Cars

-

5. Distance

- 5.1. Intercity

- 5.2. Intracity

Mexico Ride Hailing Industry Segmentation By Geography

- 1. Mexico

Mexico Ride Hailing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism Industry in Australia

- 3.3. Market Restrains

- 3.3.1. Varying Government Regulations on Taxi Services

- 3.4. Market Trends

- 3.4.1. Online Booking Channel is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Ride Hailing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. E-hailing

- 5.1.2. Car Sharing

- 5.1.3. Car Rental

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Peer-to-peer Sharing

- 5.2.2. Business Sharing

- 5.3. Market Analysis, Insights and Forecast - by Booking Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Two Wheelers

- 5.4.2. Passenger Cars

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Intercity

- 5.5.2. Intracity

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BlaBlaCar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Didi Chuxing Technology Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Uber Technologies Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lyft Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cabify Spain SLU

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BEAT

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 BlaBlaCar

List of Figures

- Figure 1: Mexico Ride Hailing Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Ride Hailing Industry Share (%) by Company 2024

List of Tables

- Table 1: Mexico Ride Hailing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Ride Hailing Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Mexico Ride Hailing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Mexico Ride Hailing Industry Revenue Million Forecast, by Booking Channel 2019 & 2032

- Table 5: Mexico Ride Hailing Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 6: Mexico Ride Hailing Industry Revenue Million Forecast, by Distance 2019 & 2032

- Table 7: Mexico Ride Hailing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Mexico Ride Hailing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Mexico Ride Hailing Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 10: Mexico Ride Hailing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Mexico Ride Hailing Industry Revenue Million Forecast, by Booking Channel 2019 & 2032

- Table 12: Mexico Ride Hailing Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 13: Mexico Ride Hailing Industry Revenue Million Forecast, by Distance 2019 & 2032

- Table 14: Mexico Ride Hailing Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Ride Hailing Industry?

The projected CAGR is approximately 5.02%.

2. Which companies are prominent players in the Mexico Ride Hailing Industry?

Key companies in the market include BlaBlaCar, Didi Chuxing Technology Co, Uber Technologies Inc, Lyft Inc, Cabify Spain SLU, BEAT.

3. What are the main segments of the Mexico Ride Hailing Industry?

The market segments include Service Type, Type, Booking Channel, Vehicle Type, Distance.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism Industry in Australia.

6. What are the notable trends driving market growth?

Online Booking Channel is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Varying Government Regulations on Taxi Services.

8. Can you provide examples of recent developments in the market?

February 2024: The ride-share platform inDrive collaborated with the financial technology firm R2 to offer loans to its drivers in Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Ride Hailing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Ride Hailing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Ride Hailing Industry?

To stay informed about further developments, trends, and reports in the Mexico Ride Hailing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence