Key Insights

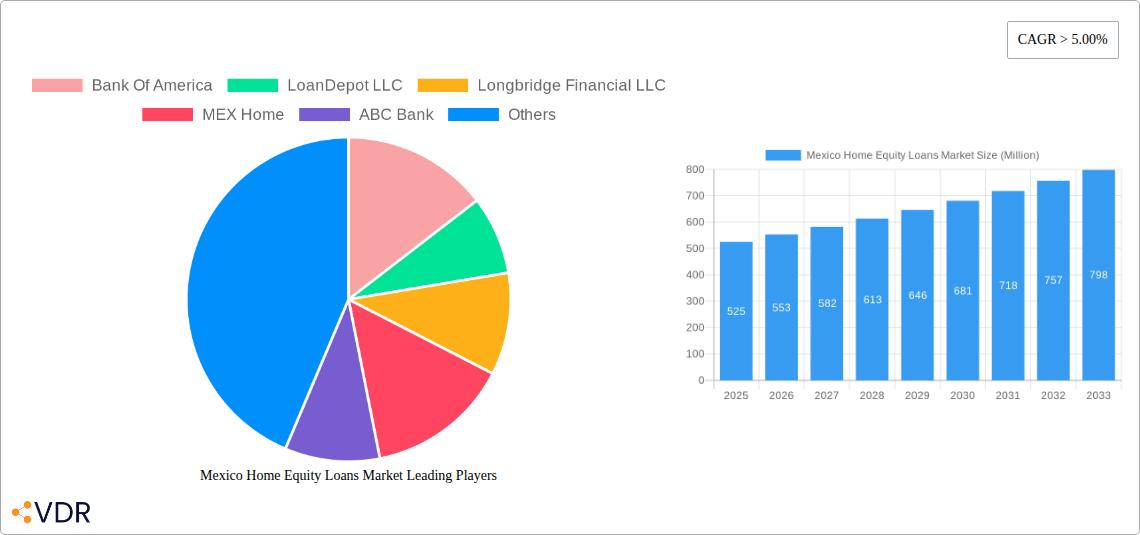

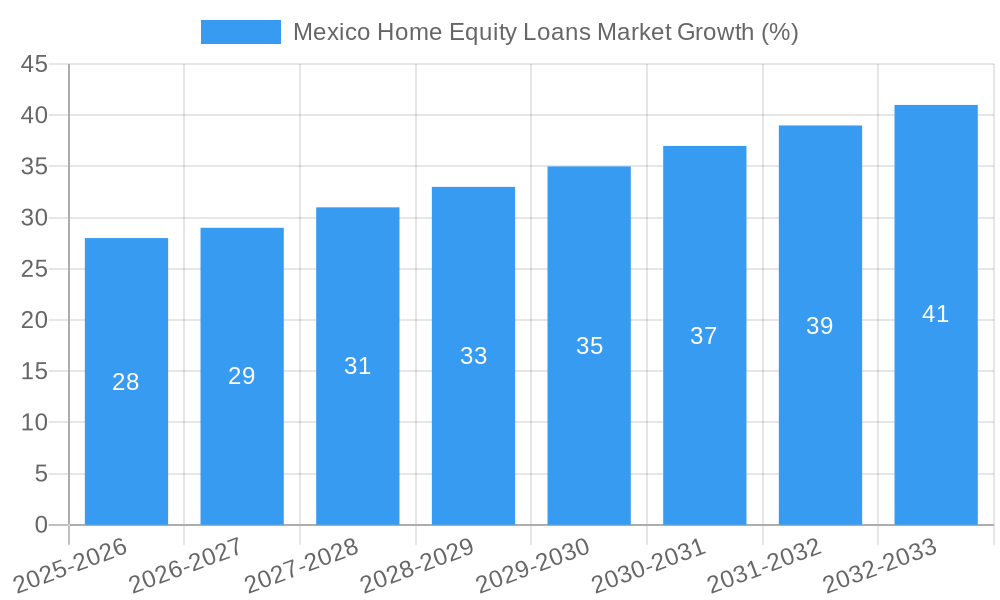

The Mexico home equity loan market, currently exhibiting a Compound Annual Growth Rate (CAGR) exceeding 5%, presents a compelling investment opportunity. While precise market size figures for 2025 are unavailable, a reasonable estimation can be derived considering the substantial growth trajectory. Assuming a 2024 market size of approximately $500 million (a conservative estimate given the positive CAGR and the presence of multiple significant players like Bank of America and LoanDepot LLC operating within the market), the 2025 market size would likely be around $525 million, reflecting the 5%+ growth. This projection assumes consistent economic growth and sustained demand for home equity loans. Key drivers for this growth include a rising homeownership rate, increasing property values in key Mexican metropolitan areas, and a growing awareness among homeowners about the financial benefits of leveraging their home equity. The market is segmented based on loan type (e.g., fixed-rate, adjustable-rate), loan amount, and borrower demographics (e.g., age, income). However, specific segment breakdowns are unavailable and would require further research.

Despite the positive outlook, several factors could restrain market growth. These include fluctuating interest rates, economic instability, and stringent lending regulations implemented by Mexican financial institutions. The competitive landscape is characterized by a mix of national and international banks, alongside specialized home equity lending firms. This competition is driving innovation in loan products and services, leading to a more customer-centric market. The forecast period of 2025-2033 is expected to witness further market expansion, driven by ongoing urbanization, population growth, and potential government initiatives to promote homeownership. Continued monitoring of macroeconomic conditions and regulatory changes will be crucial for accurately projecting future market performance. Future analyses should incorporate a more granular understanding of segment-specific growth and a detailed competitive analysis.

Mexico Home Equity Loans Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Mexico Home Equity Loans Market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The study focuses on the parent market of Residential Mortgage Lending and the child market of Home Equity Loans, offering valuable insights for industry professionals, investors, and strategic decision-makers. Market size is presented in Million Units.

Mexico Home Equity Loans Market Dynamics & Structure

This section analyzes the market structure, competitive landscape, and influencing factors within the Mexico Home Equity Loans Market. The market is characterized by a moderately concentrated structure with a few large players and numerous smaller regional lenders. Technological innovation, driven by digital lending platforms and fintech solutions, is a key driver, alongside regulatory changes impacting lending practices. The presence of competitive product substitutes, such as personal loans and credit lines, necessitates strategic differentiation.

- Market Concentration: xx% market share held by top 5 players (2024).

- Technological Innovation: Rapid adoption of digital lending platforms and AI-powered credit scoring.

- Regulatory Framework: Ongoing changes in lending regulations impacting lending rates and risk assessment.

- Competitive Substitutes: Personal loans, credit lines, and other debt financing options.

- End-User Demographics: Growing middle class and increasing homeownership rates are key drivers of market growth.

- M&A Trends: xx M&A deals recorded between 2019 and 2024, indicating consolidation within the market. (e.g., Guild Mortgage's acquisition of Legacy Mortgage in 2023). This trend is expected to continue as larger lenders seek to expand their market share. Innovation barriers include the need for significant investment in technology and regulatory compliance.

Mexico Home Equity Loans Market Growth Trends & Insights

The Mexico Home Equity Loans Market exhibits robust growth, driven by factors such as rising homeownership rates, increasing disposable incomes, and the availability of innovative financial products. The market size experienced a CAGR of xx% during the historical period (2019-2024), and is projected to reach xx Million Units by 2025 and continue growing at a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing adoption rates among homeowners seeking to leverage their home equity for various financial needs, such as debt consolidation, home improvements, or investments. Technological disruptions, including the rise of fintech companies and digital lending platforms, are accelerating market expansion and transforming consumer behavior. Consumers are increasingly seeking convenient, transparent, and efficient borrowing experiences.

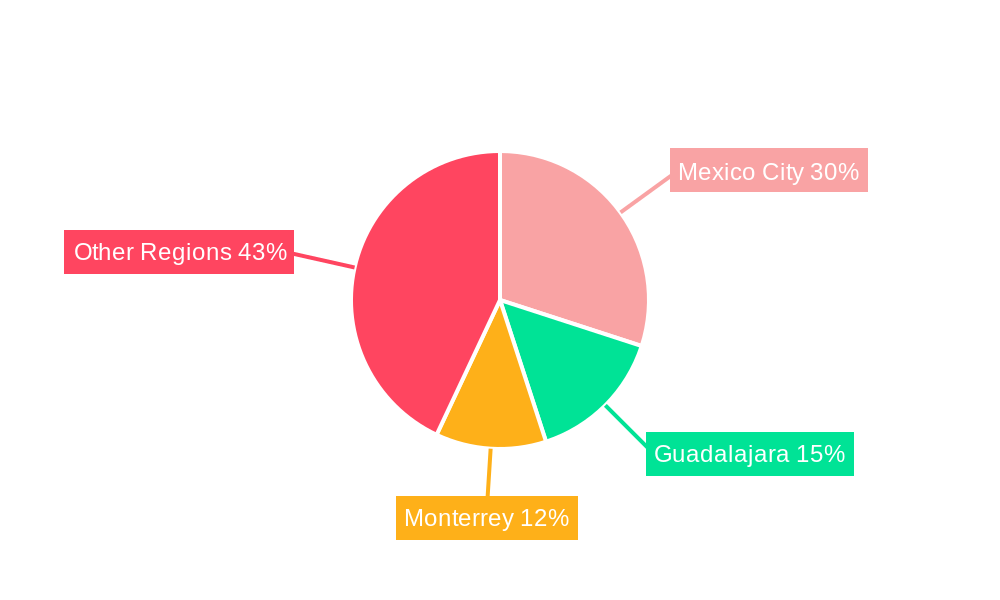

Dominant Regions, Countries, or Segments in Mexico Home Equity Loans Market

The xx region currently dominates the Mexico Home Equity Loans Market, contributing xx% of the total market share in 2024. This dominance is attributed to several factors:

- Economic Policies: Favorable government policies supporting homeownership and lending activities.

- Infrastructure: Well-developed banking infrastructure and efficient lending processes.

- High Homeownership Rates: A higher percentage of homeowners compared to other regions, creating a larger potential borrower base.

- Stronger Financial Markets: Deeper liquidity in financial markets facilitates home equity borrowing.

The xx region shows the highest growth potential due to factors including rising disposable incomes and increasing homeownership rates.

Mexico Home Equity Loans Market Product Landscape

The product landscape is evolving with the introduction of innovative home equity loan products, tailored to meet diverse consumer needs. These products often feature competitive interest rates, flexible repayment terms, and streamlined application processes. The integration of technology, such as online platforms and mobile applications, enhances convenience and customer experience. Unique selling propositions often revolve around speed of approval, lower interest rates, and personalized financial advice.

Key Drivers, Barriers & Challenges in Mexico Home Equity Loans Market

Key Drivers:

- Increasing homeownership rates

- Rising disposable incomes among the middle class

- Technological advancements (digital lending platforms)

- Favorable government policies

Challenges and Restraints:

- Stringent regulatory requirements

- Economic uncertainty and fluctuating interest rates

- Competition from alternative financial products

- Supply chain issues that may affect construction and thus home values (e.g., material shortages)

Emerging Opportunities in Mexico Home Equity Loans Market

Emerging opportunities include:

- Expansion into underserved markets

- Development of specialized loan products (e.g., green home equity loans)

- Adoption of advanced technologies (e.g., blockchain for improved security and transparency)

- Focus on improving customer experience through personalized financial advice and simplified processes

Growth Accelerators in the Mexico Home Equity Loans Market Industry

Long-term growth will be propelled by technological innovation, strategic partnerships between lenders and fintech companies, and expansion into new geographic markets. Government initiatives aimed at promoting financial inclusion and homeownership will further accelerate market expansion. The continued development of digital lending platforms and AI-powered credit scoring will contribute to efficiency and affordability.

Key Players Shaping the Mexico Home Equity Loans Market Market

- Bank Of America

- LoanDepot LLC

- Longbridge Financial LLC

- MEX Home

- ABC Bank

- WaFd Bank

- Bank of Albuquerque

- Mexlend

- Pinnacle Bank

- New Mexico Bank And Trust

List Not Exhaustive

Notable Milestones in Mexico Home Equity Loans Market Sector

- August 2022: Rocket Mortgage launches a home equity loan product in Mexico.

- February 2023: Guild Mortgage acquires Legacy Mortgage, expanding its presence in the Southwest.

In-Depth Mexico Home Equity Loans Market Market Outlook

The Mexico Home Equity Loans Market is poised for significant growth over the forecast period, driven by a confluence of factors including rising home values, increased consumer demand, and continued technological advancements. Strategic partnerships, innovative product development, and expansion into untapped markets will be key to capitalizing on future opportunities. The market presents compelling prospects for both established players and emerging fintech companies.

Mexico Home Equity Loans Market Segmentation

-

1. Types

- 1.1. Fixed Rate Loans

- 1.2. Home Equity Line of Credit

-

2. Service Provider

- 2.1. Commercial Banks

- 2.2. Financial Institutions

- 2.3. Credit Unions

- 2.4. Other Creditors

-

3. Mode

- 3.1. Online

- 3.2. Offline

Mexico Home Equity Loans Market Segmentation By Geography

- 1. Mexico

Mexico Home Equity Loans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk

- 3.3. Market Restrains

- 3.3.1. Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk

- 3.4. Market Trends

- 3.4.1. Financial And Socioeconomic Factors Favouring The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Home Equity Loans Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Fixed Rate Loans

- 5.1.2. Home Equity Line of Credit

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. Commercial Banks

- 5.2.2. Financial Institutions

- 5.2.3. Credit Unions

- 5.2.4. Other Creditors

- 5.3. Market Analysis, Insights and Forecast - by Mode

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bank Of America

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LoanDepot LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Longbridge Financial LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MEX Home

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ABC Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 WaFd Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bank of Albuquerque

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mexlend

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pinnacle Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 New Mexico Bank And Trust**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bank Of America

List of Figures

- Figure 1: Mexico Home Equity Loans Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Home Equity Loans Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Home Equity Loans Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Home Equity Loans Market Revenue Million Forecast, by Types 2019 & 2032

- Table 3: Mexico Home Equity Loans Market Revenue Million Forecast, by Service Provider 2019 & 2032

- Table 4: Mexico Home Equity Loans Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 5: Mexico Home Equity Loans Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Mexico Home Equity Loans Market Revenue Million Forecast, by Types 2019 & 2032

- Table 7: Mexico Home Equity Loans Market Revenue Million Forecast, by Service Provider 2019 & 2032

- Table 8: Mexico Home Equity Loans Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 9: Mexico Home Equity Loans Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Home Equity Loans Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Mexico Home Equity Loans Market?

Key companies in the market include Bank Of America, LoanDepot LLC, Longbridge Financial LLC, MEX Home, ABC Bank, WaFd Bank, Bank of Albuquerque, Mexlend, Pinnacle Bank, New Mexico Bank And Trust**List Not Exhaustive.

3. What are the main segments of the Mexico Home Equity Loans Market?

The market segments include Types, Service Provider, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk.

6. What are the notable trends driving market growth?

Financial And Socioeconomic Factors Favouring The Market.

7. Are there any restraints impacting market growth?

Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk.

8. Can you provide examples of recent developments in the market?

On August 2022, Rocket Mortgage, Mexico's largest mortgage lender and a part of Rocket Companies introduced a home equity loan to give Americans one more way to pay off debt that has risen along with inflation. Detroit-based Rocket Mortgage is enabling the American Dream of homeownership and financial freedom through its obsession with an industry-leading, digital-driven client experience

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Home Equity Loans Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Home Equity Loans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Home Equity Loans Market?

To stay informed about further developments, trends, and reports in the Mexico Home Equity Loans Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence