Key Insights

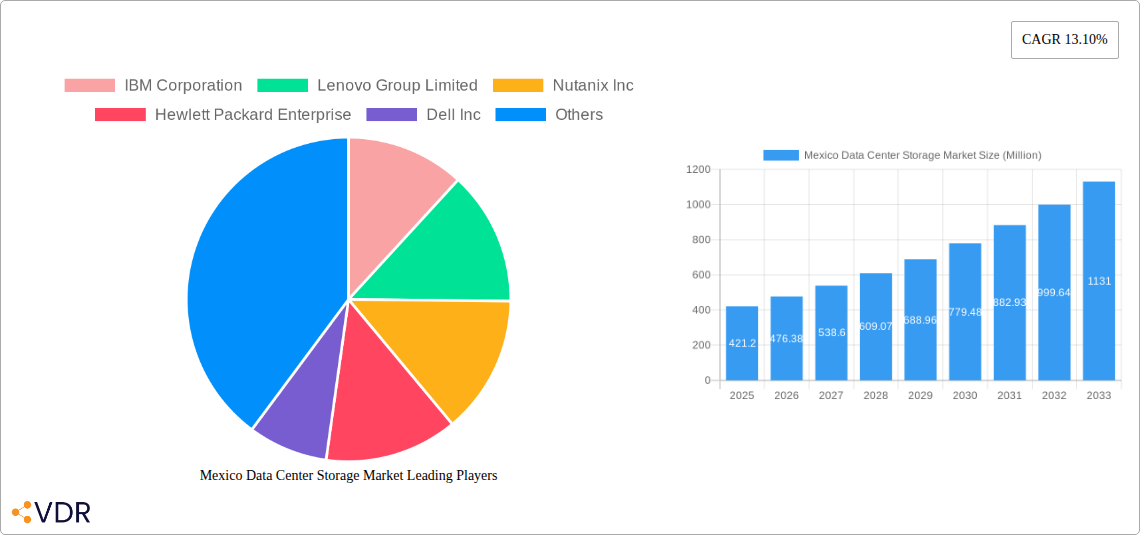

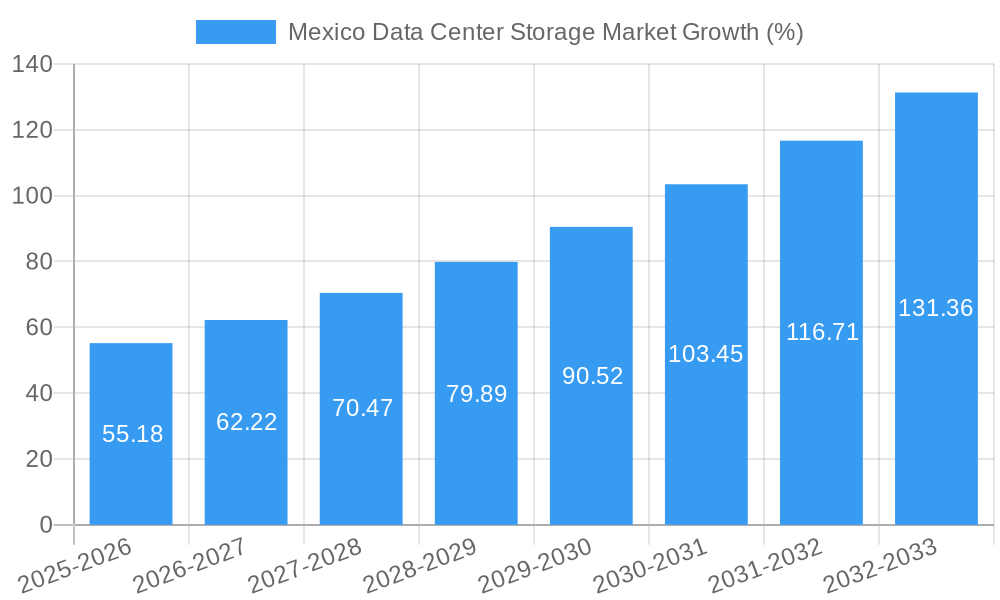

The Mexico data center storage market, valued at $421.20 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 13.10% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of cloud computing and digital transformation initiatives across various sectors, including IT & telecommunications, BFSI (Banking, Financial Services, and Insurance), and the government, fuels demand for efficient and scalable storage solutions. Furthermore, the burgeoning media and entertainment industry in Mexico contributes significantly to this growth, necessitating advanced storage infrastructure for handling large volumes of data. The market's segmentation reveals a preference for Network Attached Storage (NAS) and All-flash Storage solutions, reflecting the need for high performance and data accessibility. However, challenges remain, including concerns regarding data security and the need for skilled professionals to manage complex storage systems. These restraints are expected to be mitigated by increasing investments in cybersecurity and training programs.

Looking ahead, the market is expected to witness significant shifts. The growing popularity of hybrid cloud models will likely drive demand for hybrid storage solutions. Furthermore, the adoption of Artificial Intelligence (AI) and Machine Learning (ML) applications is anticipated to further accelerate the growth of the all-flash storage segment. Key players like IBM, Lenovo, Nutanix, and Hewlett Packard Enterprise are actively competing in this dynamic market, constantly innovating to meet the evolving needs of Mexican businesses and government organizations. This competitive landscape fosters technological advancements and price competitiveness, contributing positively to the overall market expansion. The continued focus on digital infrastructure development within Mexico is expected to fuel further growth throughout the forecast period.

Mexico Data Center Storage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico Data Center Storage Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. It segments the market by storage technology (NAS, SAN, DAS, other), storage type (traditional, all-flash, hybrid), and end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, others), offering a granular view of this dynamic market. The market size is presented in millions of units.

Mexico Data Center Storage Market Dynamics & Structure

The Mexico Data Center Storage Market is characterized by moderate concentration, with a few dominant players and several smaller, specialized vendors. Technological innovation, particularly in areas like all-flash storage and cloud-based solutions, is a major driver. The regulatory environment, while relatively stable, plays a role in data security and privacy compliance, influencing vendor strategies. The market witnesses continuous evolution with competitive product substitutes emerging and influencing pricing and adoption. End-user demographics show a growing demand from IT and telecommunications, BFSI, and government sectors. M&A activity remains relatively modest compared to global trends, with xx deals recorded in the historical period (2019-2024).

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Strong focus on all-flash, hybrid, and software-defined storage solutions.

- Regulatory Framework: Compliance with data protection regulations, such as the Ley Federal de Protección de Datos Personales en Posesión de los Particulares (LFPDPPP), influences vendor strategies.

- Competitive Substitutes: Cloud storage services pose a competitive threat to traditional on-premise solutions.

- End-User Demographics: IT & Telecommunication, BFSI, and Government sectors represent the largest end-user segments.

- M&A Trends: Low to moderate activity, with an average of xx deals annually during 2019-2024.

Mexico Data Center Storage Market Growth Trends & Insights

The Mexico Data Center Storage Market exhibited a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. This growth is attributed to increasing data center deployments, cloud adoption, and the growing demand for high-performance computing. The market is expected to continue its growth trajectory, with a projected CAGR of xx% from 2025 to 2033, driven by digital transformation initiatives across various sectors, particularly in the BFSI and government sectors. Technological disruptions, including the increasing adoption of AI and Machine Learning, are further fueling demand for advanced storage solutions. Consumer behavior shifts towards cloud-based services and increased data security concerns are also shaping the market dynamics. Market penetration for all-flash storage is expected to increase from xx% in 2024 to xx% in 2033.

Dominant Regions, Countries, or Segments in Mexico Data Center Storage Market

The Mexico City metropolitan area and other major urban centers dominate the Data Center Storage Market due to high concentrations of IT infrastructure and businesses. Within the segments, the All-flash Storage segment displays the highest growth potential due to its superior performance and increasing affordability. The IT and Telecommunications sector represents the largest end-user segment, showing significant investment in data center infrastructure modernization and expansion. The Government sector is also expected to drive substantial growth, fuelled by initiatives for digital government transformation and increased data security measures.

- Key Drivers:

- Increasing government investments in digital infrastructure.

- Growing adoption of cloud computing and big data analytics.

- Expansion of IT and telecom sectors.

- Dominant Segments:

- All-Flash Storage (By Storage Type): High growth potential due to performance and cost advantages.

- IT & Telecommunication (By End-User): Largest market share driven by high data storage requirements.

- Mexico City Metropolitan Area (By Region): Highest concentration of data centers and businesses.

Mexico Data Center Storage Market Product Landscape

The Mexico Data Center Storage Market offers a diverse range of products, encompassing Network Attached Storage (NAS), Storage Area Networks (SAN), Direct Attached Storage (DAS), and emerging technologies like software-defined storage. These solutions cater to varying needs, from basic file sharing to high-performance computing and mission-critical applications. Key innovations include advancements in flash memory technology, improved data management capabilities, and enhanced security features. Unique selling propositions often center on performance, scalability, reliability, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Mexico Data Center Storage Market

Key Drivers: The market is driven by increasing data volumes generated by businesses and government agencies, the adoption of cloud computing and big data analytics, and the need for robust data security and disaster recovery solutions. Government initiatives promoting digitalization further boost growth.

Key Challenges: Supply chain disruptions, particularly during periods of global uncertainty, have impacted the availability of storage components. Regulatory hurdles related to data privacy and security add to vendor compliance costs. Intense competition from global and domestic players creates pricing pressures and necessitates differentiation.

Emerging Opportunities in Mexico Data Center Storage Market

The growing adoption of AI and Machine Learning presents significant opportunities for high-performance storage solutions. The increasing demand for edge computing creates opportunities for decentralized storage solutions. Untapped markets in smaller cities and regions hold significant growth potential. Focus on tailored solutions for specific industry verticals is crucial.

Growth Accelerators in the Mexico Data Center Storage Market Industry

Technological breakthroughs in areas like NVMe-over-Fabrics (NVMe-oF) and composable infrastructure are accelerating market growth. Strategic partnerships between storage vendors and cloud providers are expanding market reach and accessibility. Market expansion strategies focusing on underserved regions and industries are further boosting growth. The increasing adoption of hybrid cloud models offers further opportunities for growth.

Key Players Shaping the Mexico Data Center Storage Market Market

- IBM Corporation

- Lenovo Group Limited

- Nutanix Inc

- Hewlett Packard Enterprise

- Dell Inc

- SMART Modular Technologies Inc

- Intel Corporation

- Huawei Technologies Co Ltd

- Oracle Corporation

- Pure Storage Inc

Notable Milestones in Mexico Data Center Storage Market Sector

- March 2024: Dell's collaboration with NVIDIA to validate Dell PowerScale for NVIDIA DGX SuperPOD accelerates AI and GenAI adoption in Mexico.

- April 2023: Hewlett Packard Enterprise launches new data services to improve data management efficiency and reduce costs for Mexican businesses.

In-Depth Mexico Data Center Storage Market Market Outlook

The future of the Mexico Data Center Storage Market appears bright, fueled by sustained growth in data generation, increasing cloud adoption, and government investments in digital infrastructure. Strategic opportunities lie in providing specialized solutions for emerging technologies like AI and IoT, focusing on robust data security and disaster recovery solutions, and expanding into untapped markets in Mexico. The market is poised for significant growth in the coming years.

Mexico Data Center Storage Market Segmentation

-

1. Storage Technology

- 1.1. Network Attached Storage (NAS)

- 1.2. Storage Area Network (SAN)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Other Technologies

-

2. Storage Type

- 2.1. Traditional Storage

- 2.2. All-flash Storage

- 2.3. Hybrid Storage

-

3. End User

- 3.1. IT and Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Media and Entertainment

- 3.5. Other End Users

Mexico Data Center Storage Market Segmentation By Geography

- 1. Mexico

Mexico Data Center Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Storage Capacity and Price Reduction Leading to Preference over HDDs; Evolution of Hybrid Flash Arrays and Increased Sales of all Flash Arrays

- 3.3. Market Restrains

- 3.3.1. Compatibility and Optimum Storage Performance Issues

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 5.1.1. Network Attached Storage (NAS)

- 5.1.2. Storage Area Network (SAN)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Traditional Storage

- 5.2.2. All-flash Storage

- 5.2.3. Hybrid Storage

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT and Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Media and Entertainment

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lenovo Group Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nutanix Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hewlett Packard Enterprise

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SMART Modular Technologies Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Intel Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei Technologies Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pure Storage Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Mexico Data Center Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Data Center Storage Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 3: Mexico Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 4: Mexico Data Center Storage Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Mexico Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Mexico Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Mexico Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 8: Mexico Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 9: Mexico Data Center Storage Market Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Mexico Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Data Center Storage Market?

The projected CAGR is approximately 13.10%.

2. Which companies are prominent players in the Mexico Data Center Storage Market?

Key companies in the market include IBM Corporation, Lenovo Group Limited, Nutanix Inc, Hewlett Packard Enterprise, Dell Inc, SMART Modular Technologies Inc, Intel Corporation, Huawei Technologies Co Ltd, Oracle Corporation, Pure Storage Inc.

3. What are the main segments of the Mexico Data Center Storage Market?

The market segments include Storage Technology, Storage Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 421.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Storage Capacity and Price Reduction Leading to Preference over HDDs; Evolution of Hybrid Flash Arrays and Increased Sales of all Flash Arrays.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Compatibility and Optimum Storage Performance Issues.

8. Can you provide examples of recent developments in the market?

March 2024: Dell's collaborated with NVIDIA. This collaboration will help customers take advantage of a validated combination of NVIDIA DGX systems. With Dell PowerScale becoming validated for NVIDIA DGX SuperPOD, customers can confidently accelerate their AI and GenAI initiatives with Dell's industry-leading network-attached storage. NVIDIA DGX SuperPOD includes the NVIDIA AI Enterprise software platform to provide a full-stack, secure, and stable AI supercomputing solution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Data Center Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Data Center Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Data Center Storage Market?

To stay informed about further developments, trends, and reports in the Mexico Data Center Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence