Key Insights

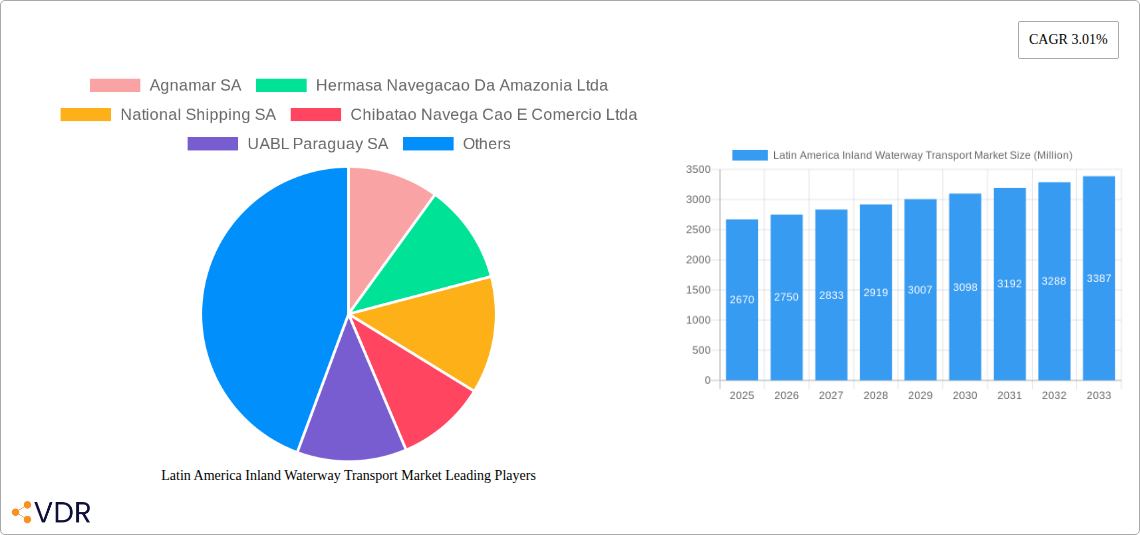

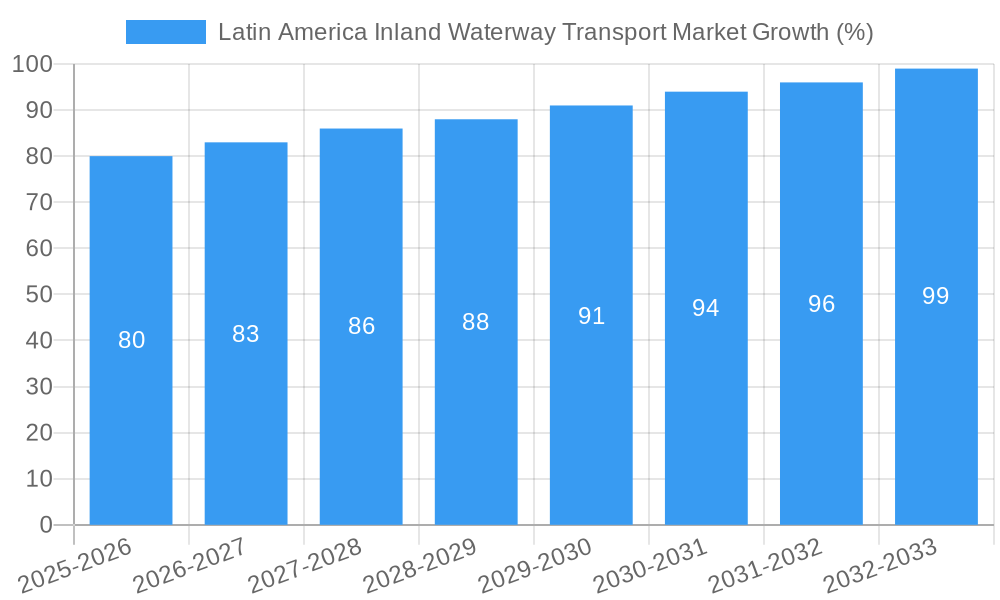

The Latin America Inland Waterway Transport Market, valued at $2.67 billion in 2025, is projected to experience steady growth, driven by increasing trade volumes, infrastructure development initiatives across key regions, and the rising adoption of efficient and sustainable logistics solutions. The Compound Annual Growth Rate (CAGR) of 3.01% from 2025 to 2033 indicates a consistent, albeit moderate, expansion of the market. Key drivers include the growing need for cost-effective transportation alternatives, especially for bulk commodities like agricultural products and minerals, coupled with government investments in waterway modernization and expansion. The market is segmented by vessel type (barges, tugboats, etc.), cargo type, and geographical region. While data on specific segment contributions is unavailable, the market's growth is expected to be relatively evenly distributed across these segments, with potentially higher growth in regions with significant ongoing infrastructure projects. The presence of established players such as Hamburg Süd, CMA CGM, and Maersk Line, alongside regional operators like Agnamar SA and Hermasa Navegacao Da Amazonia Ltda, reflects both the market's maturity and ongoing opportunities for expansion.

Challenges include the inconsistencies of waterway infrastructure across different countries within Latin America, potential regulatory hurdles impacting operational efficiency, and fluctuating fuel prices. Despite these restraints, the long-term outlook remains positive. Increased cross-border trade within the region, combined with efforts to improve the efficiency and reliability of waterway transportation, will likely fuel further market growth, attracting both domestic and international investment in the sector. This positive trajectory is further reinforced by the increasing focus on sustainable transportation options, aligning with global efforts to minimize carbon emissions in the logistics sector.

Latin America Inland Waterway Transport Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America Inland Waterway Transport Market, encompassing market dynamics, growth trends, dominant regions, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The parent market is the Latin American Transportation sector, and the child market is Inland Waterway Transportation within Latin America. The market size is projected to reach xx Million by 2033.

Latin America Inland Waterway Transport Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market forces shaping the Latin America Inland Waterway Transport market. The market exhibits a moderately concentrated structure, with key players holding significant shares. However, smaller regional operators also play a vital role.

- Market Concentration: The top 10 players (including Agnamar SA, Hermasa Navegacao Da Amazonia Ltda, National Shipping SA, Chibatao Navega Cao E Comercio Ltda, UABL Paraguay SA, Hamburg Sud, CMA CGM, Maersk Line, MSC Mediterranean Shipping Company, Grimaldi Group, and 63 other companies) account for approximately 70% of the market share. Smaller, regional players make up the remaining 30%.

- Technological Innovation: Technological advancements, such as improved navigation systems, vessel tracking technologies, and optimized logistics software, are driving efficiency and reducing operational costs. However, adoption rates vary depending on the region and the size of the operator. Lack of reliable internet connectivity in some areas presents a barrier to widespread adoption.

- Regulatory Frameworks: Varying regulatory frameworks across Latin American countries create complexities for operators. Harmonization of regulations across borders would foster greater efficiency and attract further investment. Bureaucratic hurdles and inconsistent enforcement also pose challenges.

- Competitive Product Substitutes: Road and rail transport are the main substitutes for inland waterway transport. However, waterway transport offers advantages in terms of cost-effectiveness for bulk cargo over long distances.

- End-User Demographics: The primary end-users are agricultural product exporters, mining companies, and manufacturers of goods requiring bulk transport. Growth in these sectors directly impacts market demand.

- M&A Trends: The past five years have witnessed xx M&A deals within the Latin American inland waterway transport sector, driven primarily by efforts to enhance operational efficiency, expand geographic reach and gain access to new technologies.

Latin America Inland Waterway Transport Market Growth Trends & Insights

The Latin America Inland Waterway Transport market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is fueled by increasing trade volumes within Latin America, infrastructure development projects, and government initiatives promoting efficient logistics. However, seasonal variations in water levels and infrastructure limitations in certain regions pose challenges. Market penetration is currently at xx%, with significant potential for growth in underserved areas. Technological disruptions, such as autonomous vessels and digital logistics platforms, will further transform the market landscape, though implementation faces significant challenges. Consumer behavior is shifting towards greater demand for reliable, cost-effective, and sustainable transportation solutions.

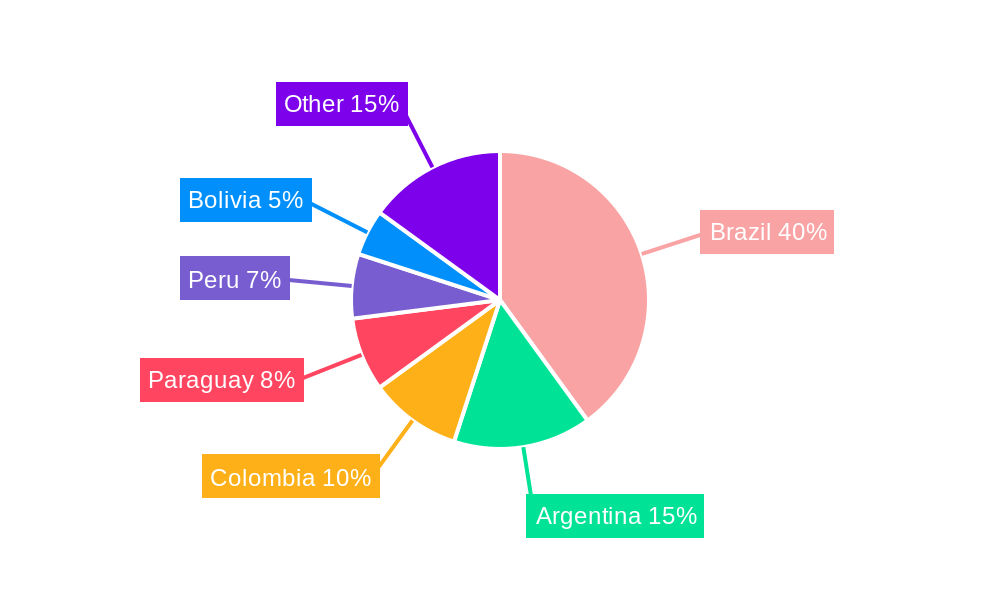

Dominant Regions, Countries, or Segments in Latin America Inland Waterway Transport Market

The Amazon River basin remains the most dominant region, followed by the Parana-Paraguay River system. Brazil and Argentina are the leading countries, benefiting from extensive river networks and established infrastructure.

Key Drivers:

- Extensive River Networks: The Amazon and Parana-Paraguay rivers provide extensive navigable waterways.

- Government Initiatives: Governments are investing in infrastructure improvements and promoting waterway transport as a cost-effective mode of transportation.

- Agricultural & Mining Sectors: Growth in agricultural exports and mining activities fuel demand for inland waterway transport.

Dominance Factors: Brazil and Argentina's dominance stems from their mature inland waterway transport infrastructure, established logistics networks, and significant volumes of agricultural and mineral exports. Their large river systems and favorable government policies provide a substantial competitive advantage. The market share of Brazil is estimated at xx%, and Argentina at xx%. The remaining share is distributed across other countries in the region.

Latin America Inland Waterway Transport Market Product Landscape

The market encompasses a range of vessels, from barges and push boats to specialized vessels designed for specific cargo types. Technological advancements are focused on improving fuel efficiency, reducing emissions, enhancing navigation safety, and optimizing vessel operations through the integration of sophisticated monitoring and control systems. Innovation in vessel design, including the introduction of environmentally friendly technologies, is becoming increasingly important.

Key Drivers, Barriers & Challenges in Latin America Inland Waterway Transport Market

Key Drivers:

- Increased trade volumes within Latin America, requiring efficient and cost-effective transportation solutions.

- Government initiatives to improve infrastructure and promote waterway transport.

- Growth in agricultural exports and mining activities.

Key Challenges:

- Infrastructure Limitations: Inadequate infrastructure in some regions restricts accessibility and efficiency.

- Seasonal Variations: Water levels fluctuate, impacting navigability and operational reliability.

- Regulatory Hurdles: Inconsistent regulatory frameworks across countries add complexity and costs.

- Security Concerns: Piracy and theft pose risks, especially in remote areas. These issues are estimated to cause annual losses of approximately xx Million.

Emerging Opportunities in Latin America Inland Waterway Transport Market

- Expanding into underserved regions with developing infrastructure.

- Leveraging technological advancements to improve efficiency and reduce costs.

- Developing sustainable and environmentally friendly transport solutions.

- Collaboration between public and private sectors to improve infrastructure and regulatory frameworks.

Growth Accelerators in the Latin America Inland Waterway Transport Market Industry

Technological breakthroughs in vessel design, navigation systems, and logistics software will significantly enhance efficiency and reduce operating costs. Strategic partnerships between public and private sectors can accelerate infrastructure development and attract investment. Government initiatives supporting the development of inland waterways will play a crucial role in driving long-term growth.

Key Players Shaping the Latin America Inland Waterway Transport Market Market

- Agnamar SA

- Hermasa Navegacao Da Amazonia Ltda

- National Shipping SA

- Chibatao Navega Cao E Comercio Ltda

- UABL Paraguay SA

- Hamburg Sud

- CMA CGM

- Maersk Line

- MSC Mediterranean Shipping Company

- Grimaldi Group

- 63 Other Companies

Notable Milestones in Latin America Inland Waterway Transport Market Sector

- September 2023: Blue Water opened a new office in Santiago, Chile, expanding its presence in Latin America and positioning itself to serve the growing demand for project logistics.

- April 2024: Unifeeder Group inaugurated a regional office in Panama City, further solidifying its commitment to Latin American trade and growth. This was accompanied by the development of new trade routes in the region.

In-Depth Latin America Inland Waterway Transport Market Market Outlook

The Latin America Inland Waterway Transport market is poised for significant growth over the next decade. Continued infrastructure improvements, coupled with technological advancements and supportive government policies, will unlock significant potential in underserved regions. Strategic partnerships and investments in sustainable solutions will be key to realizing this potential and capitalizing on the opportunities presented by this dynamic sector. The market's future is bright, driven by the region's increasing trade and economic growth.

Latin America Inland Waterway Transport Market Segmentation

-

1. Type of Carrgo

-

1.1. Bulk

- 1.1.1. Liquid Bulk Transportation

- 1.1.2. Dry Bulk Transportation

- 1.2. Container

-

1.1. Bulk

-

2. Geography

- 2.1. Mexico

- 2.2. Brazil

- 2.3. Chile

- 2.4. Colombia

- 2.5. Rest of Latin America

Latin America Inland Waterway Transport Market Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Chile

- 4. Colombia

- 5. Rest of Latin America

Latin America Inland Waterway Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Enhanced connectivity and intermodal integration4.; Economic growth and trade driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; Enhanced connectivity and intermodal integration4.; Economic growth and trade driving the market

- 3.4. Market Trends

- 3.4.1. Rise in container throughput driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Inland Waterway Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 5.1.1. Bulk

- 5.1.1.1. Liquid Bulk Transportation

- 5.1.1.2. Dry Bulk Transportation

- 5.1.2. Container

- 5.1.1. Bulk

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Mexico

- 5.2.2. Brazil

- 5.2.3. Chile

- 5.2.4. Colombia

- 5.2.5. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Chile

- 5.3.4. Colombia

- 5.3.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 6. Mexico Latin America Inland Waterway Transport Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 6.1.1. Bulk

- 6.1.1.1. Liquid Bulk Transportation

- 6.1.1.2. Dry Bulk Transportation

- 6.1.2. Container

- 6.1.1. Bulk

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Mexico

- 6.2.2. Brazil

- 6.2.3. Chile

- 6.2.4. Colombia

- 6.2.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 7. Brazil Latin America Inland Waterway Transport Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 7.1.1. Bulk

- 7.1.1.1. Liquid Bulk Transportation

- 7.1.1.2. Dry Bulk Transportation

- 7.1.2. Container

- 7.1.1. Bulk

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Mexico

- 7.2.2. Brazil

- 7.2.3. Chile

- 7.2.4. Colombia

- 7.2.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 8. Chile Latin America Inland Waterway Transport Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 8.1.1. Bulk

- 8.1.1.1. Liquid Bulk Transportation

- 8.1.1.2. Dry Bulk Transportation

- 8.1.2. Container

- 8.1.1. Bulk

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Mexico

- 8.2.2. Brazil

- 8.2.3. Chile

- 8.2.4. Colombia

- 8.2.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 9. Colombia Latin America Inland Waterway Transport Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 9.1.1. Bulk

- 9.1.1.1. Liquid Bulk Transportation

- 9.1.1.2. Dry Bulk Transportation

- 9.1.2. Container

- 9.1.1. Bulk

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Mexico

- 9.2.2. Brazil

- 9.2.3. Chile

- 9.2.4. Colombia

- 9.2.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 10. Rest of Latin America Latin America Inland Waterway Transport Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 10.1.1. Bulk

- 10.1.1.1. Liquid Bulk Transportation

- 10.1.1.2. Dry Bulk Transportation

- 10.1.2. Container

- 10.1.1. Bulk

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Mexico

- 10.2.2. Brazil

- 10.2.3. Chile

- 10.2.4. Colombia

- 10.2.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Type of Carrgo

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Agnamar SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hermasa Navegacao Da Amazonia Ltda

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 National Shipping SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Chibatao Navega Cao E Comercio Ltda

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 UABL Paraguay SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hamburg Sud

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CMA CGM

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Maersk Line

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MSC Mediterranean Shipping Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Grimaldi Group*6 3 Other Companie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Agnamar SA

List of Figures

- Figure 1: Latin America Inland Waterway Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Inland Waterway Transport Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Type of Carrgo 2019 & 2032

- Table 4: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Type of Carrgo 2019 & 2032

- Table 5: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Geography 2019 & 2032

- Table 7: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Type of Carrgo 2019 & 2032

- Table 10: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Type of Carrgo 2019 & 2032

- Table 11: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Geography 2019 & 2032

- Table 13: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Type of Carrgo 2019 & 2032

- Table 16: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Type of Carrgo 2019 & 2032

- Table 17: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Geography 2019 & 2032

- Table 19: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Country 2019 & 2032

- Table 21: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Type of Carrgo 2019 & 2032

- Table 22: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Type of Carrgo 2019 & 2032

- Table 23: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Geography 2019 & 2032

- Table 25: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Type of Carrgo 2019 & 2032

- Table 28: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Type of Carrgo 2019 & 2032

- Table 29: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Geography 2019 & 2032

- Table 31: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Country 2019 & 2032

- Table 33: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Type of Carrgo 2019 & 2032

- Table 34: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Type of Carrgo 2019 & 2032

- Table 35: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 36: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Geography 2019 & 2032

- Table 37: Latin America Inland Waterway Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Latin America Inland Waterway Transport Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Inland Waterway Transport Market?

The projected CAGR is approximately 3.01%.

2. Which companies are prominent players in the Latin America Inland Waterway Transport Market?

Key companies in the market include Agnamar SA, Hermasa Navegacao Da Amazonia Ltda, National Shipping SA, Chibatao Navega Cao E Comercio Ltda, UABL Paraguay SA, Hamburg Sud, CMA CGM, Maersk Line, MSC Mediterranean Shipping Company, Grimaldi Group*6 3 Other Companie.

3. What are the main segments of the Latin America Inland Waterway Transport Market?

The market segments include Type of Carrgo, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.67 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Enhanced connectivity and intermodal integration4.; Economic growth and trade driving the market.

6. What are the notable trends driving market growth?

Rise in container throughput driving the market.

7. Are there any restraints impacting market growth?

4.; Enhanced connectivity and intermodal integration4.; Economic growth and trade driving the market.

8. Can you provide examples of recent developments in the market?

April 2024: In its push to bolster trade and economic growth in Latin America (LATAM), Unifeeder Group inaugurated its inaugural regional office in Panama City. This move followed the company's establishment of new trade routes across LATAM.September 2023: Blue Water strategically positioned itself in the Latin American market with the inauguration of its Santiago office. Complementing its existing presence in Brazil, this move equipped the global transport and logistics giant to cater to the rising demand for project logistics in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Inland Waterway Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Inland Waterway Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Inland Waterway Transport Market?

To stay informed about further developments, trends, and reports in the Latin America Inland Waterway Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence