Key Insights

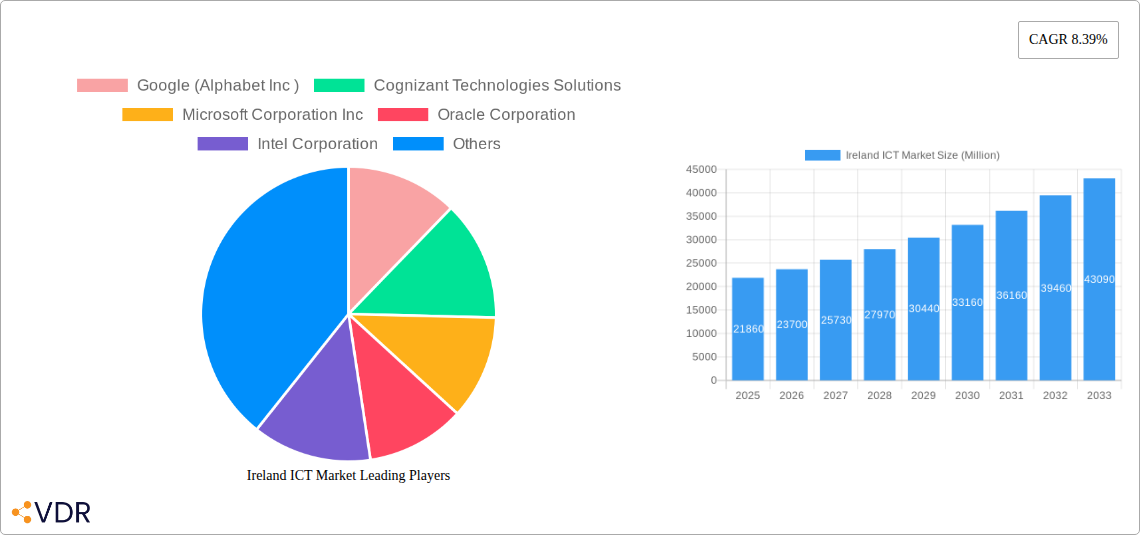

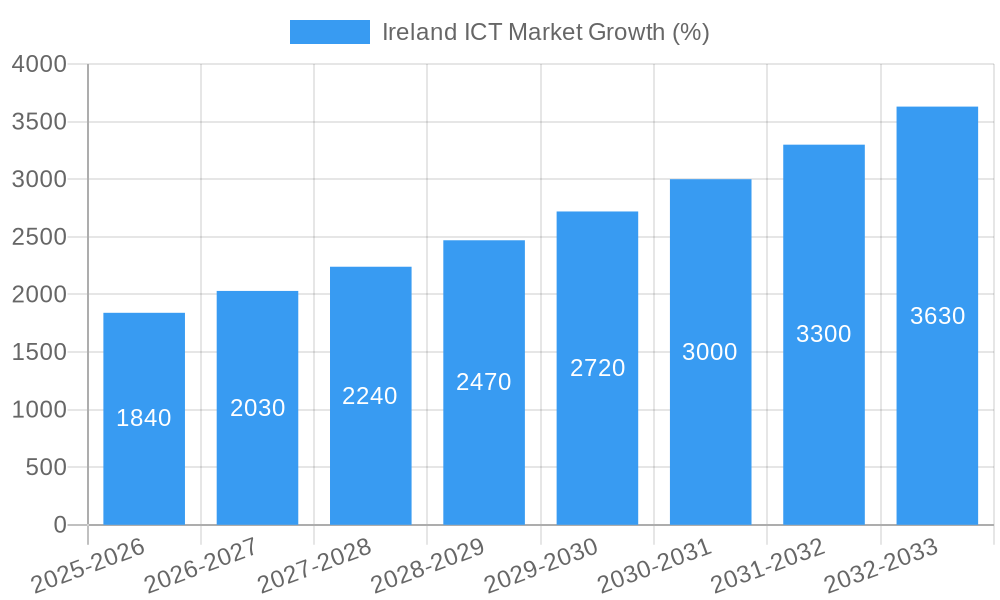

The Irish ICT market, valued at €21.86 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.39% from 2025 to 2033. This growth is fueled by several key drivers. Increased government investment in digital infrastructure, particularly broadband expansion and 5G rollout, is creating a more favorable environment for technology adoption across various sectors. Furthermore, the thriving fintech sector in Ireland, coupled with a growing emphasis on cloud computing and data analytics, is driving demand for advanced ICT solutions. The rising adoption of AI and machine learning across industries, from healthcare to finance, further contributes to market expansion. While data privacy regulations and cybersecurity threats present some challenges, the overall outlook remains positive, driven by the country's strong focus on innovation and its strategic location within the European Union.

Competition in the Irish ICT market is intense, with major global players like Google (Alphabet Inc.), Microsoft, Amazon Web Services (AWS), and Salesforce alongside established players such as Cognizant Technologies Solutions, Oracle, IBM, and SAP SE actively vying for market share. Smaller, specialized firms focusing on niche areas such as cybersecurity and software development also contribute significantly to the market's dynamism. The segmentation of the market (while unspecified in the initial data) likely includes software, hardware, IT services, telecommunications, and potentially specialized segments like cloud services and cybersecurity. Future growth will likely depend on the continued investment in digital infrastructure, the success of government initiatives promoting digital transformation, and the ability of Irish companies to capitalize on emerging technologies and global market opportunities. The forecast period of 2025-2033 suggests significant potential for further expansion and consolidation within the sector.

Ireland ICT Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Ireland ICT market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report delves into parent and child markets within the Irish ICT sector, providing granular insights into market segmentation and growth drivers. The market value is presented in Million units.

Ireland ICT Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Irish ICT sector. The Irish ICT market demonstrates a moderately concentrated structure with several dominant players and a thriving ecosystem of smaller firms. Technological innovation, driven by cloud computing, AI, and 5G, is a key growth driver, while regulatory frameworks, such as GDPR, significantly influence market practices. The market experiences competitive pressure from substitute products and services, but technological advancements often create new market opportunities. End-user demographics are diverse, ranging from large multinational corporations to SMEs and individual consumers. M&A activity remains a significant aspect of market consolidation and expansion, as demonstrated by recent substantial investments.

- Market Concentration: xx% held by top 5 players (2024).

- Technological Innovation: Key drivers include Cloud Computing, AI, 5G, and Cybersecurity.

- Regulatory Frameworks: GDPR, data privacy regulations heavily influence market operations.

- M&A Activity: High level of consolidation and strategic partnerships. Deal volume in 2024 estimated at xx deals.

- Innovation Barriers: High R&D costs, talent acquisition challenges, and regulatory complexities.

Ireland ICT Market Growth Trends & Insights

The Irish ICT market exhibits robust growth, driven by increasing digitalization across various sectors. Market size has grown steadily during the historical period (2019-2024), and this trend is projected to continue into the forecast period (2025-2033). The CAGR during 2025-2033 is estimated at xx%. Increased adoption rates of cloud services, AI solutions, and IoT devices fuel market expansion. Technological disruptions, such as the emergence of edge computing and quantum computing, are reshaping market dynamics, while shifting consumer behaviors towards digital services further accelerate growth. Market penetration of key technologies shows consistent upward trajectory, with cloud adoption exceeding xx% in 2024.

Dominant Regions, Countries, or Segments in Ireland ICT Market

Dublin remains the dominant region within the Irish ICT market, concentrating a significant portion of the country’s ICT activity. This dominance is fueled by factors such as a robust infrastructure, a skilled workforce, and a favorable regulatory environment attracting significant foreign investment. Strong government support for technological advancement and innovation, coupled with advantageous tax policies, further enhances Dublin’s leadership position. Other regions are catching up, but Dublin’s established ecosystem remains the key growth driver, benefiting from strong connections to major European and global ICT hubs.

- Key Drivers:

- Strong infrastructure (fiber optic networks, data centers).

- Skilled workforce and talent pool.

- Favorable regulatory environment and government support.

- Access to venture capital and foreign investment.

- Dominance Factors:

- High concentration of ICT companies.

- Significant market share (xx% in 2024).

- High growth potential due to ongoing investment and innovation.

Ireland ICT Market Product Landscape

The Irish ICT market offers a diverse product landscape, including software solutions, hardware components, cloud services, and IT infrastructure. Product innovation focuses on enhanced security features, improved user experience, and AI-driven functionalities. Key performance indicators emphasize efficiency, scalability, and cost-effectiveness, aligning with the increasing demands of digital transformation initiatives. Unique selling propositions often center on customized solutions, tailored to meet the specific requirements of Irish businesses and consumers. Technological advancements, particularly in areas like AI, IoT, and cybersecurity, are continually driving product evolution.

Key Drivers, Barriers & Challenges in Ireland ICT Market

Key Drivers:

- Growing digitalization across all sectors.

- Government investment in digital infrastructure.

- Increasing adoption of cloud computing and AI.

- Rising demand for cybersecurity solutions.

Challenges:

- Skill shortages in specialized areas like AI and cybersecurity. (estimated impact on market growth: xx% reduction)

- High costs associated with digital transformation initiatives.

- Competition from international players. (market share erosion: xx% in the last year).

- Data privacy regulations (GDPR compliance costs estimated at xx Million annually).

Emerging Opportunities in Ireland ICT Market

Emerging opportunities abound in areas such as the expanding FinTech sector, the growing adoption of IoT solutions across various industries, and the increasing need for AI-powered automation. Untapped markets exist in rural areas where digital connectivity needs improvement. Innovative applications leveraging AI and big data analytics offer substantial potential. Evolving consumer preferences towards personalized and secure digital experiences present further opportunities for ICT companies to innovate and expand their offerings.

Growth Accelerators in the Ireland ICT Market Industry

Technological breakthroughs, particularly in areas like AI and 5G, are accelerating market growth. Strategic partnerships between ICT companies and other sectors further stimulate innovation. Market expansion strategies, such as penetration into new customer segments and geographic regions, represent significant growth drivers. Government initiatives promoting digitalization and investment in digital infrastructure provide additional support.

Key Players Shaping the Ireland ICT Market Market

- Google (Alphabet Inc)

- Cognizant Technologies Solutions

- Microsoft Corporation Inc

- Oracle Corporation

- Intel Corporation

- International Business Machines Corporation (IBM)

- Salesforce Inc

- SAP SE

- Amazon Web Services (AWS)

- *List Not Exhaustive

Notable Milestones in Ireland ICT Market Sector

- June 2024: Apollo Global Management's expected USD 11 billion acquisition of a 49% stake in Intel's Fab 34 facility in Leixlip, Ireland, signifies a major investment in Ireland's semiconductor industry.

- March 2024: Oracle's launch of Ireland-specific Oracle Payroll, integrated into its Fusion Cloud HCM, enhances HR capabilities for Irish businesses, driving adoption of cloud-based HR solutions.

In-Depth Ireland ICT Market Market Outlook

The Irish ICT market is poised for continued strong growth, driven by ongoing technological advancements, increased investment in digital infrastructure, and expanding adoption of digital services across various sectors. Strategic partnerships, government support, and a skilled workforce position Ireland favorably for capturing significant opportunities within the global ICT landscape. The expanding FinTech and IoT markets present particularly promising avenues for future growth and innovation.

Ireland ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Ireland ICT Market Segmentation By Geography

- 1. Ireland

Ireland ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Strong Digital Infrastructure; Emerging Technologies such as AI and IoT

- 3.3. Market Restrains

- 3.3.1. Growing Strong Digital Infrastructure; Emerging Technologies such as AI and IoT

- 3.4. Market Trends

- 3.4.1. Large Enterprises Hold the Major Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ireland ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Ireland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Google (Alphabet Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cognizant Technologies Solutions

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microsoft Corporation Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oracle Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Intel Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 International Business Machines Corporation (IBM)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Salesforce Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAP SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amazon Web Services (AWS)*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Google (Alphabet Inc )

List of Figures

- Figure 1: Ireland ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Ireland ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Ireland ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Ireland ICT Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Ireland ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Ireland ICT Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Ireland ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 6: Ireland ICT Market Volume Billion Forecast, by Size of Enterprise 2019 & 2032

- Table 7: Ireland ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 8: Ireland ICT Market Volume Billion Forecast, by Industry Vertical 2019 & 2032

- Table 9: Ireland ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Ireland ICT Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Ireland ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Ireland ICT Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Ireland ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 14: Ireland ICT Market Volume Billion Forecast, by Size of Enterprise 2019 & 2032

- Table 15: Ireland ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 16: Ireland ICT Market Volume Billion Forecast, by Industry Vertical 2019 & 2032

- Table 17: Ireland ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Ireland ICT Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ireland ICT Market?

The projected CAGR is approximately 8.39%.

2. Which companies are prominent players in the Ireland ICT Market?

Key companies in the market include Google (Alphabet Inc ), Cognizant Technologies Solutions, Microsoft Corporation Inc, Oracle Corporation, Intel Corporation, International Business Machines Corporation (IBM), Salesforce Inc, SAP SE, Amazon Web Services (AWS)*List Not Exhaustive.

3. What are the main segments of the Ireland ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Strong Digital Infrastructure; Emerging Technologies such as AI and IoT.

6. What are the notable trends driving market growth?

Large Enterprises Hold the Major Share of the Market.

7. Are there any restraints impacting market growth?

Growing Strong Digital Infrastructure; Emerging Technologies such as AI and IoT.

8. Can you provide examples of recent developments in the market?

June 2024: Apollo Global Management, a buyout firm, was expected to acquire a 49% equity stake in Intel's manufacturing facility in Ireland for a substantial USD 11 billion. This acquisition specifically targeted Intel's Fab 34 facility in Leixlip, Ireland, which notably houses the US chipmaker's cutting-edge Intel 4 manufacturing process, utilizing advanced extreme ultraviolet lithography machines. The transaction, planned for closure in the second quarter, not only marked a strategic move for Apollo but also positioned Intel to reallocate its resources, potentially bolstering other segments of the business.March 2024: Oracle unveiled its plan to introduce Oracle Payroll, tailored specifically for Ireland, as an integral component of Oracle Fusion Cloud Human Capital Management (HCM). This localized offering, an extension of Oracle's renowned global payroll system, is set to bring advanced features to the Irish workforce. These include AI-powered risk management, streamlined workflows, compliance tools, enhanced data analytics, and expedited payroll processing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ireland ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ireland ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ireland ICT Market?

To stay informed about further developments, trends, and reports in the Ireland ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence