Key Insights

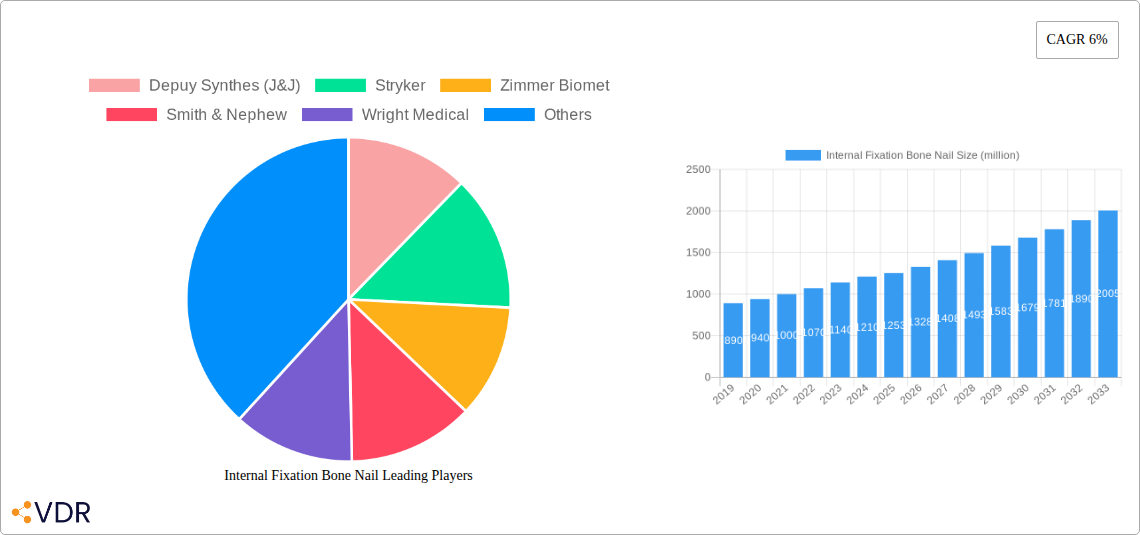

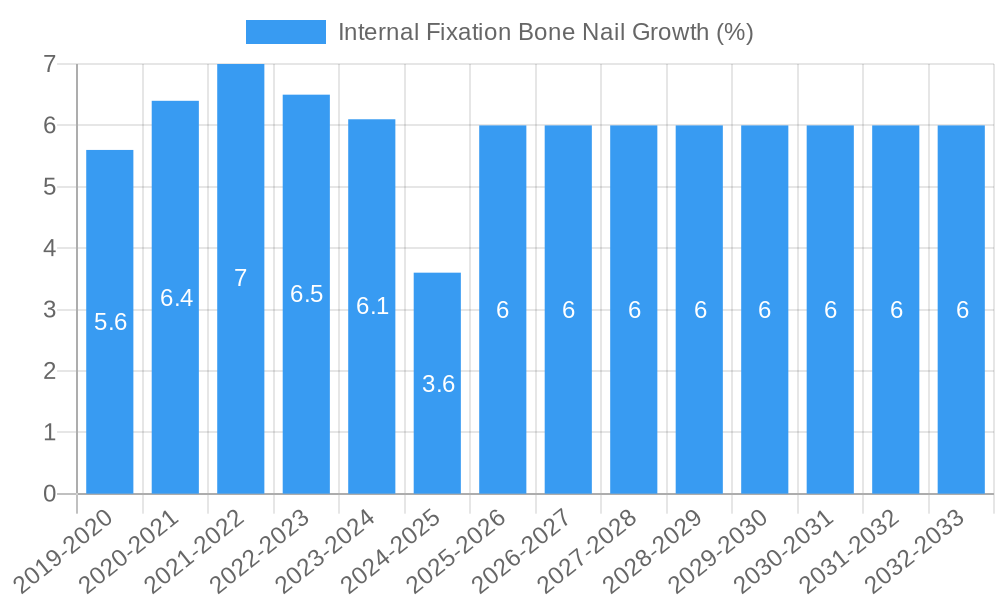

The global Internal Fixation Bone Nail market is poised for robust expansion, projected to reach a market size of approximately \$1,253 million by 2025 and expected to grow at a Compound Annual Growth Rate (CAGR) of 6% through 2033. This sustained growth is fueled by an increasing prevalence of orthopedic injuries, a rising aging population susceptible to fractures, and advancements in medical technology leading to more effective and less invasive fixation procedures. The demand for advanced fixation solutions for both upper and lower extremities continues to surge, driven by the need for faster patient recovery and improved functional outcomes. Key market drivers include the growing incidence of sports-related injuries, the escalating number of road traffic accidents, and the increasing adoption of minimally invasive surgical techniques, which necessitate specialized internal fixation devices like bone nails. Furthermore, the rising healthcare expenditure globally, particularly in emerging economies, is significantly contributing to market expansion as more individuals gain access to advanced orthopedic treatments.

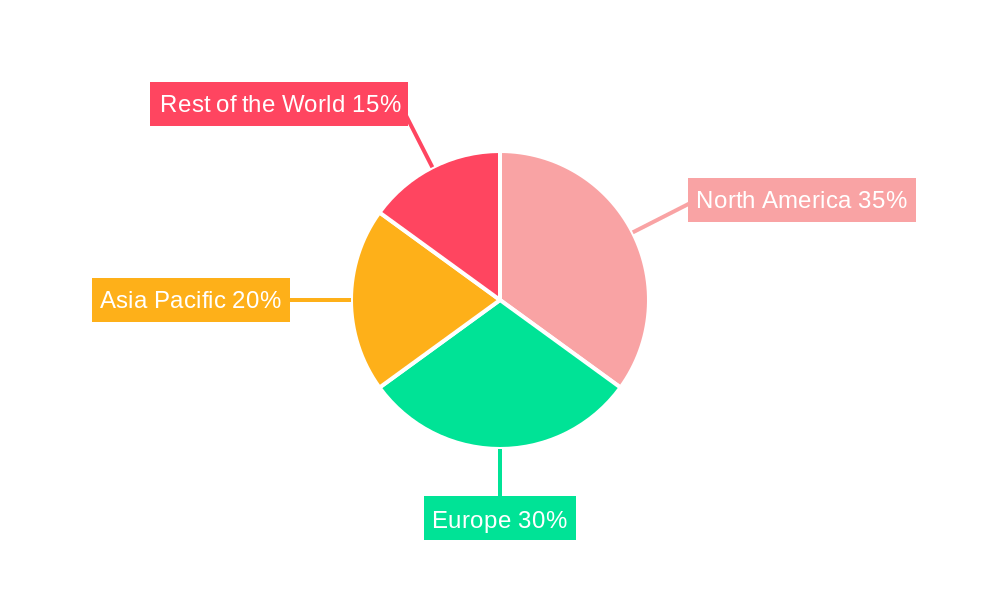

The market landscape for internal fixation bone nails is characterized by dynamic trends and strategic initiatives from leading players. The adoption of innovative materials such as advanced stainless steel alloys and biocompatible titanium is a significant trend, offering enhanced strength, durability, and reduced allergenic responses. The market is segmented by application into Upper Extremities and Lower Extremities, with the latter segment typically commanding a larger share due to the higher incidence of fractures in weight-bearing bones. Geographically, North America and Europe are expected to remain dominant markets owing to well-established healthcare infrastructure, high patient awareness, and significant investment in R&D. However, the Asia Pacific region is anticipated to exhibit the fastest growth, propelled by increasing healthcare investments, a burgeoning middle class, and a rising demand for sophisticated orthopedic implants. Competitive strategies revolve around product innovation, strategic partnerships, mergers and acquisitions, and expanding distribution networks to cater to the diverse needs of a global patient base.

Here is a comprehensive, SEO-optimized report description for Internal Fixation Bone Nail, designed for immediate use without modification.

Internal Fixation Bone Nail Market Dynamics & Structure

The global Internal Fixation Bone Nail market is characterized by a moderate level of concentration, with key players like Depuy Synthes (J&J), Stryker, Zimmer Biomet, Smith & Nephew, and Medtronic holding significant market share. Technological innovation is a primary driver, fueled by advancements in biomaterials, surgical techniques, and imaging modalities. The regulatory landscape, governed by bodies such as the FDA and EMA, ensures product safety and efficacy, influencing market entry and product development. Competitive product substitutes, including plates and screws, present an ongoing challenge, necessitating continuous innovation in nail design and functionality. End-user demographics are shifting towards an aging population and increased incidence of trauma and orthopedic conditions, expanding the addressable market. Mergers and acquisitions (M&A) are a notable trend, with companies consolidating to enhance their product portfolios, expand geographical reach, and achieve economies of scale. For instance, the historical period (2019-2024) saw several strategic acquisitions aimed at strengthening market positions. Innovation barriers include high R&D costs, lengthy clinical trial processes, and stringent regulatory approvals.

- Market Concentration: Moderate, with top players holding substantial share.

- Technological Innovation Drivers: Biomaterials, surgical techniques, imaging advancements.

- Regulatory Frameworks: FDA, EMA, impacting product development and market access.

- Competitive Product Substitutes: Plates, screws, driving need for advanced nail solutions.

- End-User Demographics: Aging population, increased trauma cases.

- M&A Trends: Consolidation for portfolio expansion and market reach.

- Innovation Barriers: High R&D costs, long approval times.

Internal Fixation Bone Nail Growth Trends & Insights

The global Internal Fixation Bone Nail market is poised for robust growth, projected to expand from an estimated $2.5 billion in 2024 to $3.8 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period. This expansion is underpinned by several critical trends shaping market size evolution and adoption rates. The increasing global prevalence of orthopedic disorders, including fractures resulting from road traffic accidents, sports injuries, and age-related conditions like osteoporosis, directly fuels demand for effective bone fixation solutions. As the global population continues to age, the incidence of fragility fractures is expected to rise, creating a larger patient pool requiring internal fixation bone nails for effective healing and mobility restoration. Furthermore, advancements in surgical robotics and minimally invasive techniques are transforming surgical procedures, making them less traumatic and leading to faster recovery times. These technological disruptions are encouraging greater adoption of advanced internal fixation bone nails that are designed for easier insertion and enhanced biocompatibility, thereby increasing market penetration.

Consumer behavior shifts are also playing a significant role. Patients are increasingly seeking less invasive surgical options with improved aesthetic outcomes and quicker return to daily activities. This demand is driving manufacturers to develop innovative, patient-centric nail designs, including bioabsorbable materials and patient-matched implants. The growing emphasis on sports medicine and the rising participation in athletic activities globally contribute to a higher incidence of sports-related fractures, further boosting market demand. Economic factors, such as increasing healthcare expenditure in emerging economies and favorable reimbursement policies for orthopedic procedures, are also contributing to the market's upward trajectory. The base year of 2025 marks a pivotal point for assessing current market dynamics and future potential, with the historical period from 2019 to 2024 providing essential context for understanding past growth patterns and emerging trends. The estimated year of 2025 serves as a baseline for projecting future market expansion.

Dominant Regions, Countries, or Segments in Internal Fixation Bone Nail

The Lower Extremities segment is the dominant force driving growth within the global Internal Fixation Bone Nail market, contributing an estimated 65% of the total market revenue in the base year of 2025. This dominance is attributed to the higher incidence of fractures in the femur, tibia, fibula, and ankle bones, often resulting from trauma, accidents, and age-related conditions. The increasing global burden of road traffic accidents and the rising elderly population prone to falls contribute significantly to the demand for internal fixation bone nails in the lower extremities. The Titanium type segment also holds a substantial market share, estimated at 60% in 2025, due to its superior biocompatibility, strength-to-weight ratio, and corrosion resistance, making it the preferred material for orthopedic implants.

North America, particularly the United States, is the leading region, accounting for an estimated 35% of the global market share in 2025. This leadership is driven by a well-established healthcare infrastructure, high patient awareness, a high volume of orthopedic surgeries performed annually, and robust reimbursement policies. Advanced medical technologies and the presence of major market players like Depuy Synthes (J&J), Stryker, and Zimmer Biomet further solidify North America's dominant position.

Key drivers for the dominance of Lower Extremities include:

- High Fracture Incidence: Frequent fractures of femur, tibia, fibula, and ankle.

- Aging Population: Increased susceptibility to falls and osteoporosis-related fractures.

- Trauma & Accidents: Road traffic accidents and sports injuries are major contributors.

- Technological Advancements: Development of specialized nails for complex lower extremity fractures.

Drivers for the dominance of Titanium type include:

- Biocompatibility: Excellent integration with bone tissue, reducing rejection risks.

- Strength and Durability: Withstands significant biomechanical stress.

- Corrosion Resistance: Prevents degradation within the body.

- Lightweight Properties: Reduces patient discomfort and implant stress.

Key drivers for North America's regional dominance:

- Advanced Healthcare Infrastructure: State-of-the-art hospitals and surgical facilities.

- High Surgical Volume: Significant number of orthopedic procedures performed.

- Favorable Reimbursement: Strong insurance coverage for orthopedic treatments.

- Technological Adoption: Early adoption of innovative medical devices.

- Presence of Key Manufacturers: Concentration of leading global players.

Internal Fixation Bone Nail Product Landscape

The Internal Fixation Bone Nail market is characterized by continuous product innovation focused on enhancing patient outcomes and simplifying surgical procedures. Manufacturers are developing nails with improved designs, such as cannulated nails for easier insertion over guidewires and nails with locking screw capabilities for enhanced stability in complex fractures. Advanced materials like titanium alloys and biodegradable polymers are being increasingly utilized to improve biocompatibility, reduce stress shielding, and facilitate bone regeneration. Performance metrics such as tensile strength, fatigue resistance, and radiographic visibility are paramount, with ongoing research aimed at optimizing these attributes. Unique selling propositions often lie in novel fixation mechanisms, integrated drug delivery capabilities, and designs tailored for specific fracture patterns or anatomical locations, particularly within the upper and lower extremities. Technological advancements are also geared towards reducing surgical time and improving patient recovery.

Key Drivers, Barriers & Challenges in Internal Fixation Bone Nail

The Internal Fixation Bone Nail market is propelled by several key drivers. The escalating global burden of orthopedic injuries, including fractures from trauma and sports, coupled with the increasing prevalence of osteoporosis, significantly boosts demand. Advancements in surgical techniques, such as minimally invasive procedures and robotic-assisted surgery, encourage the adoption of innovative bone nail designs that facilitate these approaches. Furthermore, the growing elderly population, prone to fractures, creates a consistent and expanding patient base. Economic factors, including rising healthcare expenditure in emerging economies and favorable reimbursement policies for orthopedic treatments, also contribute to market growth.

However, the market faces significant barriers and challenges. High research and development costs coupled with stringent regulatory approval processes can prolong product commercialization and increase investment risk. The availability of alternative fixation methods, such as plates and screws, presents ongoing competition, necessitating continuous product differentiation. Supply chain disruptions, geopolitical instability, and raw material price volatility can impact manufacturing costs and product availability. Furthermore, the need for specialized surgical training for new nail technologies can be a limiting factor in wider adoption, particularly in resource-constrained settings.

Emerging Opportunities in Internal Fixation Bone Nail

Emerging opportunities in the Internal Fixation Bone Nail sector lie in the development and adoption of innovative technologies and materials. The increasing demand for patient-specific implants, designed using advanced imaging and 3D printing, presents a significant growth avenue, allowing for tailored fixation solutions. Furthermore, the integration of smart technologies, such as embedded sensors for monitoring bone healing or infection, could revolutionize post-operative care and rehabilitation. The untapped potential in emerging economies, where healthcare infrastructure is rapidly developing, offers substantial market expansion opportunities. Innovative applications in reconstructive surgery and addressing complex fracture patterns that are currently challenging for standard fixation devices also represent promising areas for product development and market penetration.

Growth Accelerators in the Internal Fixation Bone Nail Industry

Several key catalysts are accelerating growth within the Internal Fixation Bone Nail industry. Technological breakthroughs in biomaterials, such as the development of advanced bioresorbable polymers and ceramic-based implants, are creating novel therapeutic options with improved patient outcomes and reduced long-term complications. Strategic partnerships between implant manufacturers and technology providers, focusing on digital health solutions and AI-driven surgical planning, are enhancing efficiency and precision in orthopedic procedures. Market expansion strategies targeting underserved populations and geographical regions, particularly in Asia-Pacific and Latin America, are unlocking new revenue streams. The growing trend of active aging and increased participation in recreational sports also drives demand for robust and reliable fixation solutions that facilitate rapid recovery and return to activity.

Key Players Shaping the Internal Fixation Bone Nail Market

- Depuy Synthes (J&J)

- Stryker

- Zimmer Biomet

- Smith & Nephew

- Wright Medical

- Acumed

- B Braun

- OsteoMed

- Orthofix

- Medartis

- Globus Medical

- Lima Corporate

- Medtronic

- MicroPort

- Aap Implantate

Notable Milestones in Internal Fixation Bone Nail Sector

- 2019: Launch of novel bioabsorbable intramedullary nails for pediatric fractures.

- 2020: Significant M&A activity focused on consolidating market share and expanding product portfolios.

- 2021: Introduction of advanced locking head screws for enhanced stability in complex long bone fractures.

- 2022: Increased investment in research for patient-specific implant designs utilizing 3D printing technology.

- 2023: Development of integrated antibiotic-eluting bone nails to combat implant-associated infections.

- 2024: Advancements in imaging integration for real-time intraoperative guidance during nail insertion.

In-Depth Internal Fixation Bone Nail Market Outlook

The future outlook for the Internal Fixation Bone Nail market remains exceptionally promising, driven by persistent innovation and an expanding patient base. Growth accelerators such as the development of intelligent implants capable of real-time monitoring and the increasing adoption of robotic-assisted surgery will redefine surgical precision and patient care. Strategic alliances focused on expanding access to advanced orthopedic treatments in emerging markets are expected to unlock substantial untapped potential. The continuous evolution of biomaterials towards enhanced biocompatibility and osteoconductivity will further solidify the market's trajectory, ensuring sustained demand for effective bone fixation solutions. The market is well-positioned for robust growth, offering significant opportunities for stakeholders committed to advancing orthopedic care.

Internal Fixation Bone Nail Segmentation

-

1. Application

- 1.1. Upper Extremities

- 1.2. Lower Extremities

-

2. Types

- 2.1. Stainless Steel

- 2.2. Titanium

- 2.3. Other

Internal Fixation Bone Nail Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Internal Fixation Bone Nail REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Internal Fixation Bone Nail Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Upper Extremities

- 5.1.2. Lower Extremities

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Stainless Steel

- 5.2.2. Titanium

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Internal Fixation Bone Nail Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Upper Extremities

- 6.1.2. Lower Extremities

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Stainless Steel

- 6.2.2. Titanium

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Internal Fixation Bone Nail Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Upper Extremities

- 7.1.2. Lower Extremities

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Stainless Steel

- 7.2.2. Titanium

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Internal Fixation Bone Nail Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Upper Extremities

- 8.1.2. Lower Extremities

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Stainless Steel

- 8.2.2. Titanium

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Internal Fixation Bone Nail Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Upper Extremities

- 9.1.2. Lower Extremities

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Stainless Steel

- 9.2.2. Titanium

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Internal Fixation Bone Nail Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Upper Extremities

- 10.1.2. Lower Extremities

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Stainless Steel

- 10.2.2. Titanium

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Depuy Synthes (J&J)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Stryker

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Zimmer Biomet

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Smith & Nephew

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wright Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Acumed

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 B Braun

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 OsteoMed

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Orthofix

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Medartis

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Globus Medical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Lima Corporate

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Medtronic

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 MicroPort

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Aap Implantate

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Depuy Synthes (J&J)

List of Figures

- Figure 1: Global Internal Fixation Bone Nail Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Internal Fixation Bone Nail Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Internal Fixation Bone Nail Revenue (million), by Application 2024 & 2032

- Figure 4: North America Internal Fixation Bone Nail Volume (K), by Application 2024 & 2032

- Figure 5: North America Internal Fixation Bone Nail Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Internal Fixation Bone Nail Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Internal Fixation Bone Nail Revenue (million), by Types 2024 & 2032

- Figure 8: North America Internal Fixation Bone Nail Volume (K), by Types 2024 & 2032

- Figure 9: North America Internal Fixation Bone Nail Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Internal Fixation Bone Nail Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Internal Fixation Bone Nail Revenue (million), by Country 2024 & 2032

- Figure 12: North America Internal Fixation Bone Nail Volume (K), by Country 2024 & 2032

- Figure 13: North America Internal Fixation Bone Nail Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Internal Fixation Bone Nail Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Internal Fixation Bone Nail Revenue (million), by Application 2024 & 2032

- Figure 16: South America Internal Fixation Bone Nail Volume (K), by Application 2024 & 2032

- Figure 17: South America Internal Fixation Bone Nail Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Internal Fixation Bone Nail Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Internal Fixation Bone Nail Revenue (million), by Types 2024 & 2032

- Figure 20: South America Internal Fixation Bone Nail Volume (K), by Types 2024 & 2032

- Figure 21: South America Internal Fixation Bone Nail Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Internal Fixation Bone Nail Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Internal Fixation Bone Nail Revenue (million), by Country 2024 & 2032

- Figure 24: South America Internal Fixation Bone Nail Volume (K), by Country 2024 & 2032

- Figure 25: South America Internal Fixation Bone Nail Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Internal Fixation Bone Nail Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Internal Fixation Bone Nail Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Internal Fixation Bone Nail Volume (K), by Application 2024 & 2032

- Figure 29: Europe Internal Fixation Bone Nail Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Internal Fixation Bone Nail Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Internal Fixation Bone Nail Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Internal Fixation Bone Nail Volume (K), by Types 2024 & 2032

- Figure 33: Europe Internal Fixation Bone Nail Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Internal Fixation Bone Nail Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Internal Fixation Bone Nail Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Internal Fixation Bone Nail Volume (K), by Country 2024 & 2032

- Figure 37: Europe Internal Fixation Bone Nail Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Internal Fixation Bone Nail Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Internal Fixation Bone Nail Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Internal Fixation Bone Nail Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Internal Fixation Bone Nail Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Internal Fixation Bone Nail Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Internal Fixation Bone Nail Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Internal Fixation Bone Nail Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Internal Fixation Bone Nail Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Internal Fixation Bone Nail Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Internal Fixation Bone Nail Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Internal Fixation Bone Nail Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Internal Fixation Bone Nail Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Internal Fixation Bone Nail Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Internal Fixation Bone Nail Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Internal Fixation Bone Nail Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Internal Fixation Bone Nail Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Internal Fixation Bone Nail Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Internal Fixation Bone Nail Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Internal Fixation Bone Nail Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Internal Fixation Bone Nail Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Internal Fixation Bone Nail Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Internal Fixation Bone Nail Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Internal Fixation Bone Nail Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Internal Fixation Bone Nail Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Internal Fixation Bone Nail Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Internal Fixation Bone Nail Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Internal Fixation Bone Nail Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Internal Fixation Bone Nail Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Internal Fixation Bone Nail Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Internal Fixation Bone Nail Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Internal Fixation Bone Nail Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Internal Fixation Bone Nail Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Internal Fixation Bone Nail Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Internal Fixation Bone Nail Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Internal Fixation Bone Nail Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Internal Fixation Bone Nail Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Internal Fixation Bone Nail Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Internal Fixation Bone Nail Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Internal Fixation Bone Nail Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Internal Fixation Bone Nail Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Internal Fixation Bone Nail Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Internal Fixation Bone Nail Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Internal Fixation Bone Nail Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Internal Fixation Bone Nail Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Internal Fixation Bone Nail Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Internal Fixation Bone Nail Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Internal Fixation Bone Nail Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Internal Fixation Bone Nail Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Internal Fixation Bone Nail Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Internal Fixation Bone Nail Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Internal Fixation Bone Nail Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Internal Fixation Bone Nail Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Internal Fixation Bone Nail Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Internal Fixation Bone Nail Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Internal Fixation Bone Nail Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Internal Fixation Bone Nail Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Internal Fixation Bone Nail Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Internal Fixation Bone Nail Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Internal Fixation Bone Nail Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Internal Fixation Bone Nail Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Internal Fixation Bone Nail Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Internal Fixation Bone Nail Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Internal Fixation Bone Nail Volume K Forecast, by Country 2019 & 2032

- Table 81: China Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Internal Fixation Bone Nail Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Internal Fixation Bone Nail Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Internal Fixation Bone Nail?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Internal Fixation Bone Nail?

Key companies in the market include Depuy Synthes (J&J), Stryker, Zimmer Biomet, Smith & Nephew, Wright Medical, Acumed, B Braun, OsteoMed, Orthofix, Medartis, Globus Medical, Lima Corporate, Medtronic, MicroPort, Aap Implantate.

3. What are the main segments of the Internal Fixation Bone Nail?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 1253 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Internal Fixation Bone Nail," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Internal Fixation Bone Nail report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Internal Fixation Bone Nail?

To stay informed about further developments, trends, and reports in the Internal Fixation Bone Nail, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence