Key Insights

The Indonesia CPaaS (Communications Platform as a Service) market is experiencing robust growth, projected to reach a market size of $91.02 million in 2025, exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 34.87% from 2019 to 2033. This surge is driven primarily by the increasing adoption of digital communication channels by businesses across various sectors, including e-commerce, healthcare, and finance. The rising demand for omnichannel customer engagement strategies, coupled with the need for enhanced customer experience, fuels the market expansion. Furthermore, the Indonesian government's initiatives promoting digital transformation and the burgeoning startup ecosystem are contributing significantly to this growth trajectory. Key players like Twilio, Infobip, and local providers like Qiscus and Mekari Qontak are actively shaping the market landscape, fostering competition and innovation. The market's segmentation likely includes solutions categorized by messaging (SMS, WhatsApp, etc.), voice, and video, catering to diverse business requirements. While challenges like cybersecurity concerns and the need for robust infrastructure development might act as restraints, the overall market outlook remains exceptionally positive.

The forecast period (2025-2033) is anticipated to witness continued strong growth, driven by expanding internet and smartphone penetration, coupled with increasing business investments in digital technologies. The competitive landscape will likely remain dynamic, with both international and domestic players vying for market share through strategic partnerships, acquisitions, and product innovations. The focus on providing seamless, integrated communication solutions will be crucial for success, particularly given the growing preference for personalized and interactive customer engagement experiences. Government regulations surrounding data privacy and security will continue to play a significant role in shaping market practices and opportunities. Future growth will depend on the continued development of the digital infrastructure, and successful navigation of the regulatory landscape, as well as innovation in the solutions offered by CPaaS providers.

Indonesia CPaaS Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indonesia CPaaS (Communications Platform as a Service) market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for businesses, investors, and industry professionals seeking to understand and capitalize on the opportunities within this rapidly expanding market. The report delves into the parent market of cloud-based communication solutions and the child market of business messaging services within Indonesia.

Indonesia CPaaS Market Dynamics & Structure

The Indonesian CPaaS market exhibits a dynamic interplay of factors influencing its structure and growth. Market concentration is currently moderate, with several key players vying for dominance, but the market shows signs of consolidation. Technological innovation, particularly in areas like AI-powered chatbots and enhanced security features, is a major driver. The regulatory landscape, while evolving, presents both opportunities and challenges. The emergence of competitive substitutes, such as traditional SMS gateways, and the increasing adoption of messaging apps create ongoing pressure. End-user demographics reveal a burgeoning market driven by the increasing adoption of digital technologies across various industries. The historical period (2019-2024) witnessed several mergers and acquisitions (M&A), indicating the competitive intensity and attractiveness of this sector.

- Market Concentration: Moderate, with a few dominant players and many smaller competitors. The largest three players hold approximately xx% of the market share in 2025.

- Technological Innovation: AI-powered chatbots, enhanced security features, and integration with other enterprise software drive market growth.

- Regulatory Framework: The Indonesian government's focus on digitalization creates opportunities, but navigating regulatory complexities remains a challenge.

- Competitive Substitutes: Traditional SMS gateways and messaging apps pose competition, requiring continuous innovation.

- End-User Demographics: A growing young and digitally savvy population fuels demand. The Small and Medium-sized Enterprises (SME) sector represents a significant growth segment.

- M&A Trends: xx M&A deals were recorded during the historical period (2019-2024), indicating consolidation trends.

Indonesia CPaaS Market Growth Trends & Insights

The Indonesian CPaaS market is experiencing robust growth, driven by factors including increasing smartphone penetration, rising adoption of digital business strategies, and a growing demand for improved customer communication. The market size in 2025 is estimated at xx Million USD, reflecting a Compound Annual Growth Rate (CAGR) of xx% during the historical period. Market penetration is relatively low compared to other mature markets, suggesting significant untapped potential. Technological disruptions, such as the rise of RCS messaging and the integration of CPaaS with other enterprise software, are transforming the landscape. Consumer behavior shifts, driven by the preference for seamless and personalized communication experiences, are further fueling market expansion. The forecast period (2025-2033) anticipates continued strong growth, driven by factors discussed above.

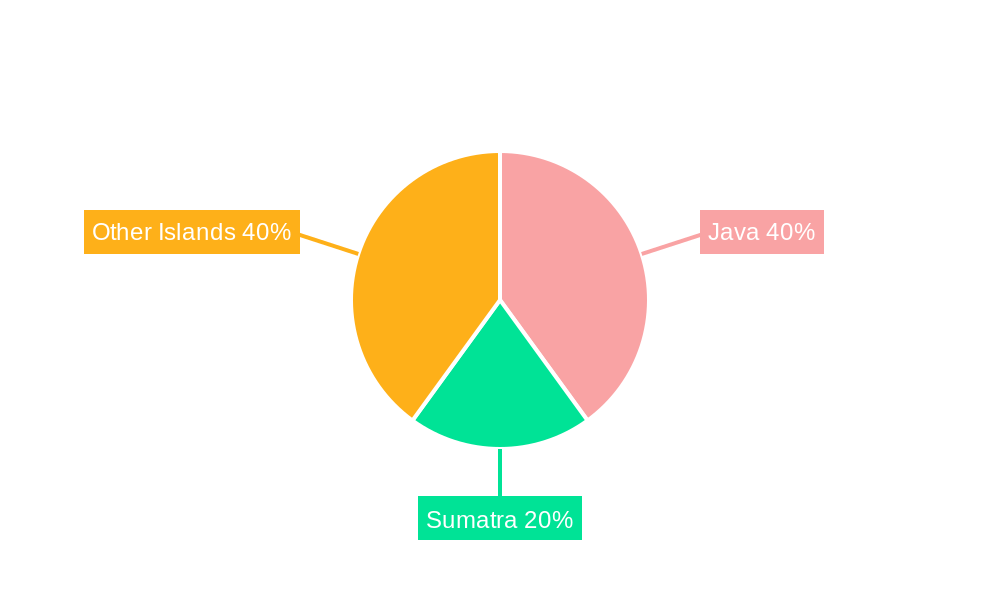

Dominant Regions, Countries, or Segments in Indonesia CPaaS Market

Java, the most populous island, represents the dominant region in the Indonesian CPaaS market. This dominance is fueled by high population density, concentration of businesses, and advanced digital infrastructure. Jakarta, the capital city, serves as a major hub for technological innovation and adoption. The SME sector showcases the highest growth potential, driven by the increasing need for cost-effective and efficient communication solutions.

- Key Drivers:

- High population density in Java and surrounding regions.

- Concentration of businesses and tech hubs in major cities.

- Developed digital infrastructure and increasing internet penetration.

- Government initiatives promoting digital transformation within SMEs.

- Dominance Factors:

- High market share compared to other regions (xx%).

- Significant growth potential within the SME segment.

- Advanced digital infrastructure compared to other regions.

Indonesia CPaaS Market Product Landscape

The Indonesian CPaaS market offers a diverse range of products, including SMS, voice, video, and chat APIs. These products are increasingly integrated with AI-powered features such as chatbots and sentiment analysis, enhancing their value proposition. Key performance metrics include message delivery rates, call quality, and API latency. Unique selling propositions often center around specific industry verticals, such as healthcare or finance, as well as robust security features to ensure data privacy and compliance. Continuous innovation and development of new features are crucial for staying competitive.

Key Drivers, Barriers & Challenges in Indonesia CPaaS Market

Key Drivers:

The Indonesian CPaaS market is propelled by factors such as the rising adoption of digital technologies across various sectors, the growing demand for enhanced customer engagement, and government initiatives supporting digital transformation. The burgeoning e-commerce industry and the expanding use of mobile applications also contribute significantly. Furthermore, the increasing need for efficient communication solutions within SMEs is a major driver of market growth.

Challenges and Restraints:

Challenges include the need for greater digital literacy among businesses and consumers, along with the cost of implementing and maintaining CPaaS solutions. Regulatory hurdles and the presence of competitive substitutes also pose challenges, potentially affecting market growth by approximately xx% in the next few years. Supply chain disruptions and the issue of data security, especially pertaining to personal data, present further barriers.

Emerging Opportunities in Indonesia CPaaS Market

Untapped markets within rural areas and underserved communities present significant growth opportunities. Innovative applications, such as the integration of CPaaS with IoT devices for improved supply chain management, also offer considerable potential. Evolving consumer preferences, leaning towards personalized and omnichannel communication, provide further opportunities for CPaaS providers. Focus on security and compliance is paramount given increasing regulations around data privacy.

Growth Accelerators in the Indonesia CPaaS Market Industry

Technological advancements, particularly in AI and machine learning, are pivotal for long-term market growth. Strategic partnerships between CPaaS providers and telecommunication companies expand market reach and facilitate faster adoption. Successful market expansion strategies, focusing on underserved segments and targeted vertical markets, are vital. Continuous innovation in products and services, coupled with adapting to evolving consumer demands, will further accelerate market expansion.

Key Players Shaping the Indonesia CPaaS Market Market

- Twilio Inc

- Infobip Ltd

- NTT Communications Corporation

- Plivo Inc

- OCA Indonesia Inc (Telkom Indonesia)

- Barantum

- 8x8 Inc

- Messagebird

- Route Mobile Limited

- PT Vfirst Komunikasi Indonesia

- Qiscus

- Mekari Qontak (PT Mid Solusi Nusantara)

Notable Milestones in Indonesia CPaaS Market Sector

- September 2023: 8x8 Inc. partnered with Coca-Cola Indonesia, integrating CPaaS solutions into Coca-Cola's loyalty program and launching 8x8 Omni Shield to combat fraudulent SMS.

- January 2024: Telkomsel collaborated with Google to introduce RCS-based business messaging, enhancing customer communication and driving market growth.

In-Depth Indonesia CPaaS Market Market Outlook

The Indonesian CPaaS market is poised for substantial growth, driven by strong underlying market forces. Continued technological innovation, strategic partnerships, and the expansion into untapped segments will further fuel market expansion. Focusing on security, compliance, and personalized customer communication experiences will be crucial for long-term success. The forecast period promises significant opportunities for both established players and new entrants.

Indonesia CPaaS Market Segmentation

-

1. Organization Size

- 1.1. SME

- 1.2. Large-Scale Organization

-

2. End User

- 2.1. IT and Telecom

- 2.2. BFSI

- 2.3. Retail and E-commerce

- 2.4. Healthcare

- 2.5. Other End-user Verticals

Indonesia CPaaS Market Segmentation By Geography

- 1. Indonesia

Indonesia CPaaS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 34.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Exponential Increase in the Uptake of CPaaS-based Solutions Over Other Adjacent Models; Growing Demand for Low-code Enablement to Make Enterprise CPaaS Highly Usable for Customer Operations

- 3.2.2 Service

- 3.2.3 and Marketing

- 3.3. Market Restrains

- 3.3.1 Exponential Increase in the Uptake of CPaaS-based Solutions Over Other Adjacent Models; Growing Demand for Low-code Enablement to Make Enterprise CPaaS Highly Usable for Customer Operations

- 3.3.2 Service

- 3.3.3 and Marketing

- 3.4. Market Trends

- 3.4.1. SME Organization Size Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia CPaaS Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. SME

- 5.1.2. Large-Scale Organization

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecom

- 5.2.2. BFSI

- 5.2.3. Retail and E-commerce

- 5.2.4. Healthcare

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Twilio Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infobip Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NTT Communications Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Plivo Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OCA Indonesia Inc (Telkom Indonesia)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Barantum

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 8x8 Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Messagebird

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Route Mobile Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Vfirst Komunikasi Indonesia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Qiscus

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mekari Qontak (PT Mid Solusi Nusantara

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Twilio Inc

List of Figures

- Figure 1: Indonesia CPaaS Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia CPaaS Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia CPaaS Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia CPaaS Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Indonesia CPaaS Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 4: Indonesia CPaaS Market Volume Million Forecast, by Organization Size 2019 & 2032

- Table 5: Indonesia CPaaS Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Indonesia CPaaS Market Volume Million Forecast, by End User 2019 & 2032

- Table 7: Indonesia CPaaS Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia CPaaS Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Indonesia CPaaS Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 10: Indonesia CPaaS Market Volume Million Forecast, by Organization Size 2019 & 2032

- Table 11: Indonesia CPaaS Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: Indonesia CPaaS Market Volume Million Forecast, by End User 2019 & 2032

- Table 13: Indonesia CPaaS Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Indonesia CPaaS Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia CPaaS Market?

The projected CAGR is approximately 34.87%.

2. Which companies are prominent players in the Indonesia CPaaS Market?

Key companies in the market include Twilio Inc, Infobip Ltd, NTT Communications Corporation, Plivo Inc, OCA Indonesia Inc (Telkom Indonesia), Barantum, 8x8 Inc, Messagebird, Route Mobile Limited, PT Vfirst Komunikasi Indonesia, Qiscus, Mekari Qontak (PT Mid Solusi Nusantara.

3. What are the main segments of the Indonesia CPaaS Market?

The market segments include Organization Size, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 91.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in the Uptake of CPaaS-based Solutions Over Other Adjacent Models; Growing Demand for Low-code Enablement to Make Enterprise CPaaS Highly Usable for Customer Operations. Service. and Marketing.

6. What are the notable trends driving market growth?

SME Organization Size Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Exponential Increase in the Uptake of CPaaS-based Solutions Over Other Adjacent Models; Growing Demand for Low-code Enablement to Make Enterprise CPaaS Highly Usable for Customer Operations. Service. and Marketing.

8. Can you provide examples of recent developments in the market?

January 2024 - Telkomsel, an Indonesian telecommunications company, collaborated with Google to introduce its Rich Communication Services (RCS)--based business messaging to support digital business transformation by enhancing customer communication experiences and providing more feature-rich short messaging solutions. The RCS services with RBM would be available for Telkomsel customers in Indonesia, which shows the market's future growth potential and would support market growth during the forecast period.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia CPaaS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia CPaaS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia CPaaS Market?

To stay informed about further developments, trends, and reports in the Indonesia CPaaS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence