Key Insights

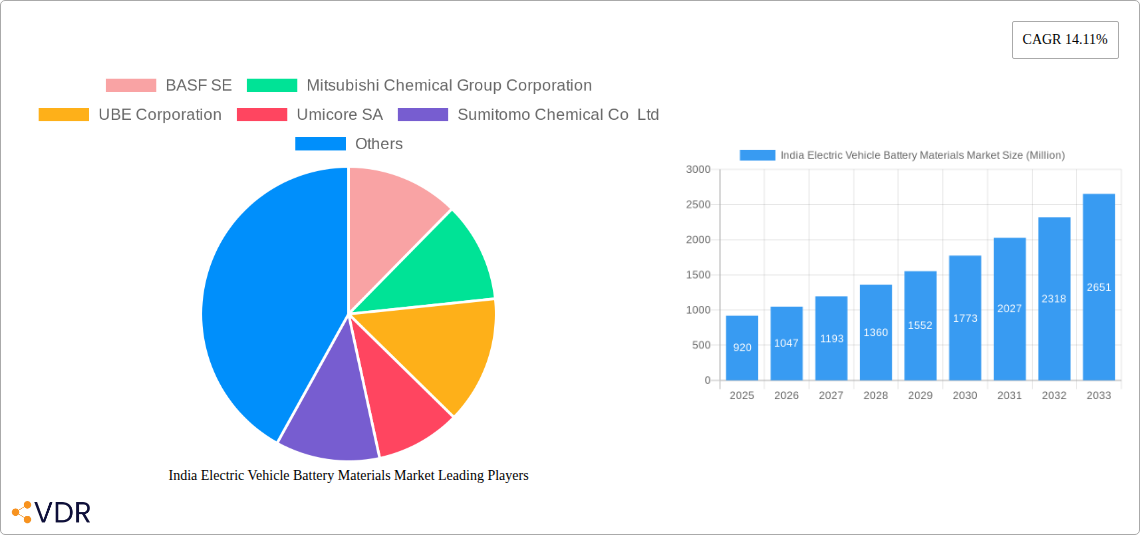

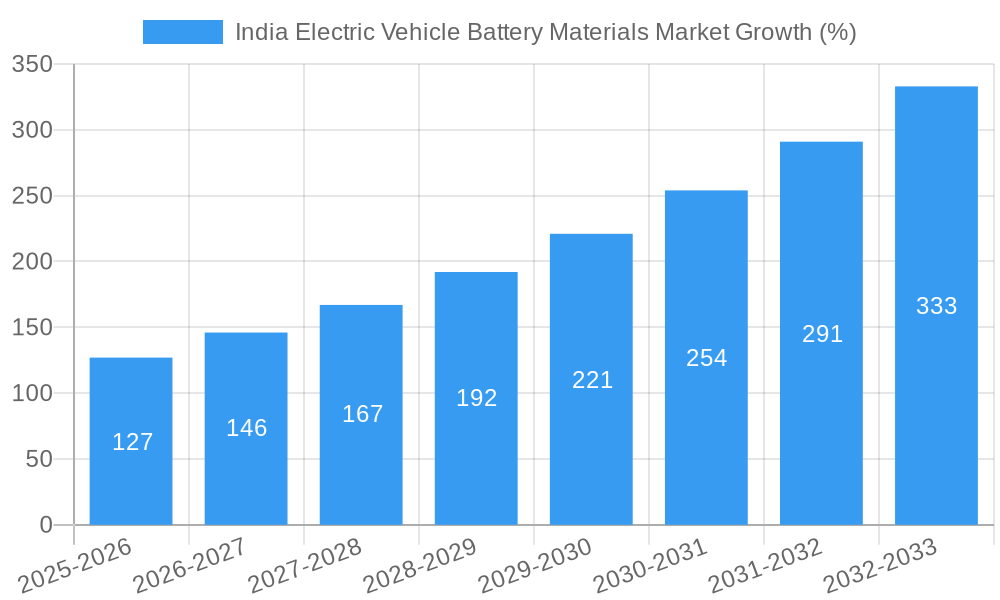

The India Electric Vehicle (EV) Battery Materials market is poised for significant growth, projected to reach a market size of approximately $0.92 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 14.11% from 2025 to 2033. This robust expansion is driven by the Indian government's strong push towards EV adoption, including substantial incentives and supportive policies aimed at reducing reliance on fossil fuels and promoting cleaner transportation. Furthermore, increasing environmental concerns and rising fuel prices are accelerating the demand for EVs, consequently boosting the market for battery materials. Key players such as BASF SE, Mitsubishi Chemical Group Corporation, and UBE Corporation are strategically investing in expanding their production capacities and R&D efforts to cater to this burgeoning demand. The market segmentation is likely diverse, encompassing various battery chemistries (like lithium-ion, lead-acid, etc.) and material types (cathode materials, anode materials, electrolytes, etc.), each with its own growth trajectory influenced by technological advancements and cost considerations. However, challenges such as the dependence on imports for certain raw materials and the need for robust recycling infrastructure to address environmental concerns may act as restraints on market growth.

The forecast period of 2025-2033 anticipates substantial growth across all segments, with lithium-ion battery materials likely dominating due to their higher energy density and performance. The regional distribution of the market is expected to be concentrated in major industrial hubs and urban centers across India, reflecting the higher concentration of EV adoption in these areas. The competitive landscape is marked by a mix of both international and domestic players, with intense competition expected in the coming years. Continuous innovation in battery technology, focusing on improving energy density, lifespan, and safety, will be crucial for sustained market growth. The development of domestic sourcing of raw materials and strengthening the recycling ecosystem will also be vital for the long-term sustainability and competitiveness of the Indian EV battery materials market.

India Electric Vehicle Battery Materials Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the India Electric Vehicle (EV) Battery Materials market, encompassing the parent market of EV batteries and the child market of battery materials. It offers invaluable insights into market dynamics, growth trends, key players, and future opportunities, providing essential information for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. Market values are presented in million units.

India Electric Vehicle Battery Materials Market Dynamics & Structure

The Indian EV battery materials market is experiencing dynamic growth, driven by government initiatives promoting EV adoption, increasing environmental concerns, and declining battery costs. Market concentration is currently moderate, with several large players and a growing number of smaller, specialized firms. Technological innovation, particularly in lithium-ion battery technologies and cathode materials, is a significant driver. The regulatory framework, while evolving, is increasingly supportive of domestic manufacturing and the development of a robust EV ecosystem. Competition from alternative energy storage solutions is relatively limited, with lithium-ion batteries dominating the market. End-user demographics are shifting towards a younger, more environmentally conscious consumer base. M&A activity is increasing, reflecting the strategic importance of securing access to raw materials and technological capabilities.

- Market Concentration: Moderate, with a mix of large multinational and domestic companies.

- Technological Innovation: Focus on improving battery energy density, lifespan, and safety.

- Regulatory Framework: Supportive policies promoting domestic manufacturing and EV adoption.

- Competitive Substitutes: Limited, with lithium-ion batteries maintaining market dominance.

- End-User Demographics: Shifting towards younger, environmentally conscious consumers.

- M&A Activity: Increasing, driven by securing raw materials and technologies. xx M&A deals in the last 5 years.

India Electric Vehicle Battery Materials Market Growth Trends & Insights

The Indian EV battery materials market is projected to witness robust growth over the forecast period. Market size is expanding significantly, driven by surging EV sales and increasing demand for energy storage solutions. Adoption rates are accelerating, fueled by government incentives, declining battery prices, and improving battery technology. Technological disruptions, such as advancements in solid-state batteries and improved battery management systems (BMS), are further stimulating market growth. Consumer behavior shifts towards sustainable transportation options are creating a favorable environment for market expansion. The CAGR for the period 2025-2033 is estimated at xx%, with market penetration reaching xx% by 2033.

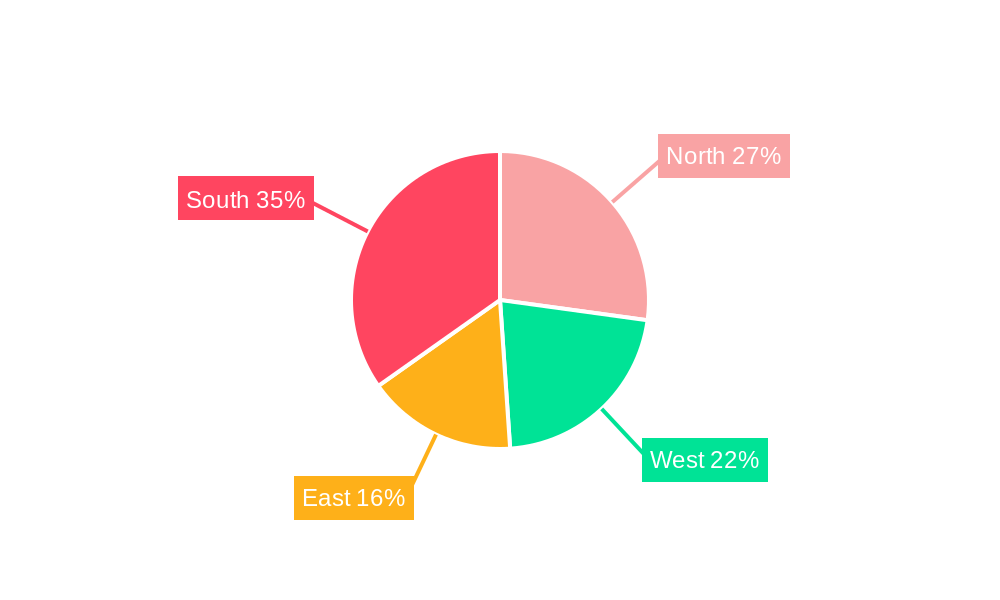

Dominant Regions, Countries, or Segments in India Electric Vehicle Battery Materials Market

The growth of the Indian EV battery materials market is not uniform across all regions and segments. States with robust EV policies and well-developed infrastructure, such as Maharashtra, Tamil Nadu, and Gujarat, are leading in terms of market share and growth potential. The lithium-ion battery segment dominates, owing to its high energy density and relatively low cost. The cathode materials segment is also exhibiting strong growth, driven by increasing demand for high-performance batteries. Key drivers for regional dominance include favorable government policies, access to raw materials, and presence of established manufacturing facilities.

- Leading Regions: Maharashtra, Tamil Nadu, Gujarat.

- Key Drivers: Government incentives, infrastructure development, raw material availability.

- Dominant Segment: Lithium-ion batteries, followed by cathode materials.

India Electric Vehicle Battery Materials Market Product Landscape

The Indian EV battery materials market features a diverse range of products, including lithium-ion battery components (cathode, anode, electrolyte, separator), battery management systems (BMS), and battery recycling technologies. Product innovations focus on improving battery performance, safety, and sustainability. Unique selling propositions are centered around energy density, cycle life, and cost-effectiveness. Technological advancements encompass improved manufacturing processes and the development of advanced battery chemistries.

Key Drivers, Barriers & Challenges in India Electric Vehicle Battery Materials Market

Key Drivers:

- Government initiatives promoting EV adoption and domestic manufacturing.

- Growing environmental concerns and the need for sustainable transportation.

- Decreasing battery costs and improving battery technology.

Challenges:

- Supply chain disruptions impacting raw material availability. (Quantifiable impact: xx% increase in raw material costs in 2024)

- Regulatory hurdles and complex approval processes.

- Intense competition from established and emerging players.

Emerging Opportunities in India Electric Vehicle Battery Materials Market

Emerging opportunities include the expansion into untapped rural markets, the development of innovative battery applications (e.g., grid-scale energy storage), and the growth of the battery recycling industry. Evolving consumer preferences towards sustainable and technologically advanced EVs also present significant opportunities.

Growth Accelerators in the India Electric Vehicle Battery Materials Market Industry

Technological breakthroughs in battery chemistries, particularly solid-state batteries, are poised to accelerate market growth. Strategic partnerships between automotive manufacturers, battery producers, and materials suppliers are creating a synergistic ecosystem. Market expansion strategies, such as capacity expansions and geographical diversification, will further propel the market forward.

Key Players Shaping the India Electric Vehicle Battery Materials Market Market

- BASF SE

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Umicore SA

- Sumitomo Chemical Co Ltd

- Exide Industries

- Arkema SA

- Amara Raja

- List Not Exhaustive

Notable Milestones in India Electric Vehicle Battery Materials Sector

- February 2024: Hindalco Industries announced an INR 800 crore (~USD 96.4 million) investment in a new aluminum foil plant for EV battery applications.

- January 2024: Aether Industries, Himadri Speciality Chemicals, and Tata Chemicals invested in lithium-ion battery production, highlighting significant investments in domestic manufacturing capacity. Aether Industries announced a strategic agreement for electrolyte additives. Himadri plans a 2 lakh tonne per annum facility. Ami Organics signed an MoU for electrolyte manufacturing and a second with the Gujarat government for a USD 36 million facility.

In-Depth India Electric Vehicle Battery Materials Market Outlook

The Indian EV battery materials market is poised for sustained growth, driven by strong government support, increasing consumer demand, and technological advancements. Strategic opportunities exist in developing a robust domestic supply chain, investing in advanced battery technologies, and capitalizing on the growing battery recycling market. The market's future potential is significant, with substantial opportunities for both established and emerging players.

India Electric Vehicle Battery Materials Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion Battery

- 1.2. Lead-Acid Battery

- 1.3. Others

-

2. Material

- 2.1. Cathode

- 2.2. Anode

- 2.3. Electrolyte

- 2.4. Separator

- 2.5. Others

India Electric Vehicle Battery Materials Market Segmentation By Geography

- 1. India

India Electric Vehicle Battery Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Type to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-Acid Battery

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cathode

- 5.2.2. Anode

- 5.2.3. Electrolyte

- 5.2.4. Separator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BASF SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Chemical Group Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UBE Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Umicore SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sumitomo Chemical Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Exide Industries

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Arkema SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amara Raja*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 BASF SE

List of Figures

- Figure 1: India Electric Vehicle Battery Materials Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Electric Vehicle Battery Materials Market Share (%) by Company 2024

List of Tables

- Table 1: India Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: India Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 4: India Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2019 & 2032

- Table 5: India Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2019 & 2032

- Table 6: India Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2019 & 2032

- Table 7: India Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: India Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 10: India Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2019 & 2032

- Table 11: India Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: India Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2019 & 2032

- Table 13: India Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Electric Vehicle Battery Materials Market?

The projected CAGR is approximately 14.11%.

2. Which companies are prominent players in the India Electric Vehicle Battery Materials Market?

Key companies in the market include BASF SE, Mitsubishi Chemical Group Corporation, UBE Corporation, Umicore SA, Sumitomo Chemical Co Ltd, Exide Industries, Arkema SA, Amara Raja*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi.

3. What are the main segments of the India Electric Vehicle Battery Materials Market?

The market segments include Battery Type, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.92 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

6. What are the notable trends driving market growth?

Lithium-ion Battery Type to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

8. Can you provide examples of recent developments in the market?

February 2024: Hindalco Industries planned to invest INR 800 crore (~USD 96.4 million) to build a new aluminum foil plant near Sambalpur in Odisha, India. The facility aims to produce high-quality battery foil for the rapidly growing electric vehicle and energy storage system markets.January 2024: Indian companies such as Aether Industries, Himadri Speciality Chemicals, and Tata Chemicals invested in lithium-ion battery production. Aether Industries has recently announced a strategic agreement with a global lithium-ion battery producer to expand into the electrolyte additives market. This agreement includes the commercial supply of one electrolyte additive, and discussions have begun to develop three additional products. Himadri Speciality Chemicals is also planning to establish a manufacturing facility for lithium-ion battery components with a total capacity of 2 lakh tonnes per annum. Ami Organics has signed a non-binding MoU with a global manufacturer of electrolytes. The company is also set to sign an MoU with the Gujarat government to set up a dedicated manufacturing facility at a cost of around USD 36 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Electric Vehicle Battery Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Electric Vehicle Battery Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Electric Vehicle Battery Materials Market?

To stay informed about further developments, trends, and reports in the India Electric Vehicle Battery Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence