Key Insights

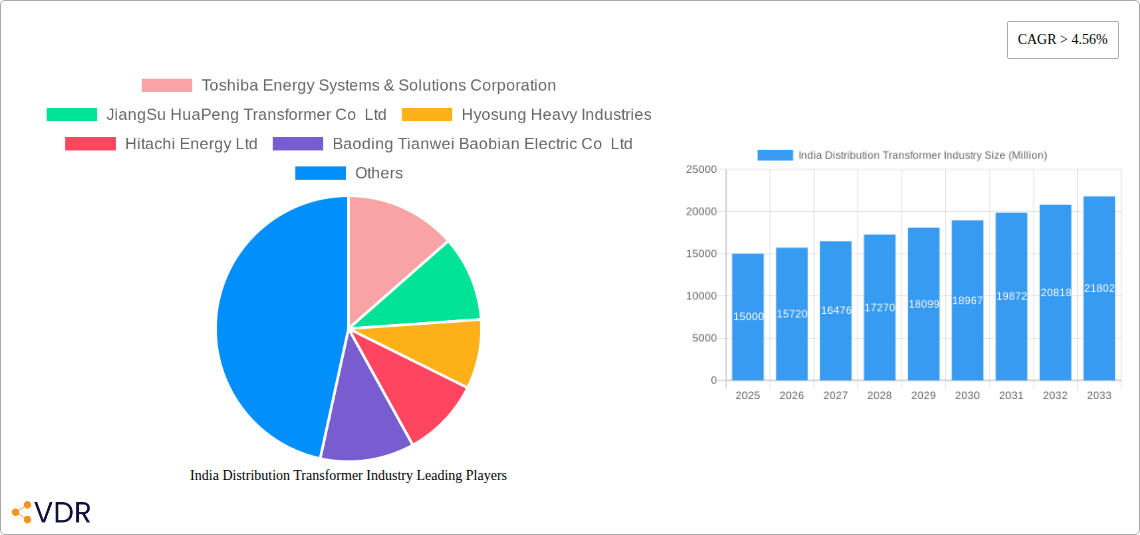

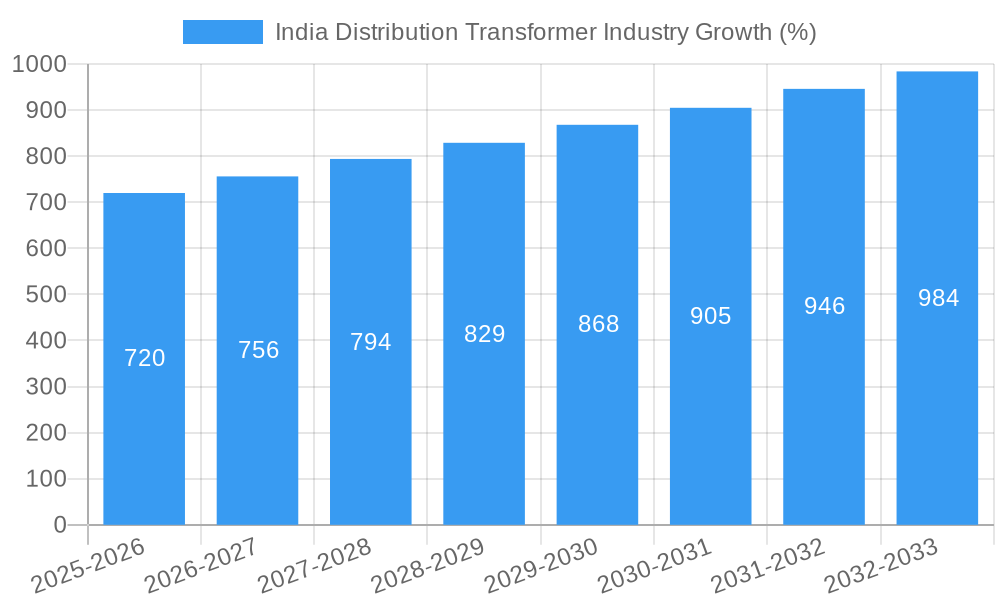

The India distribution transformer market, valued at approximately ₹15,000 million (estimated) in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 4.56% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the ongoing expansion of India's power grid infrastructure to meet the rising electricity demands of a rapidly growing population and industrial sector is a major catalyst. Secondly, the government's initiatives to improve rural electrification and enhance the reliability of power supply are further stimulating market growth. The increasing adoption of smart grids and the integration of renewable energy sources, such as solar and wind power, also contribute significantly. Finally, a shift towards higher capacity transformers (above 2500 kVA) to handle increasing loads is observed. This trend is particularly prominent in urban areas and industrial zones experiencing rapid development.

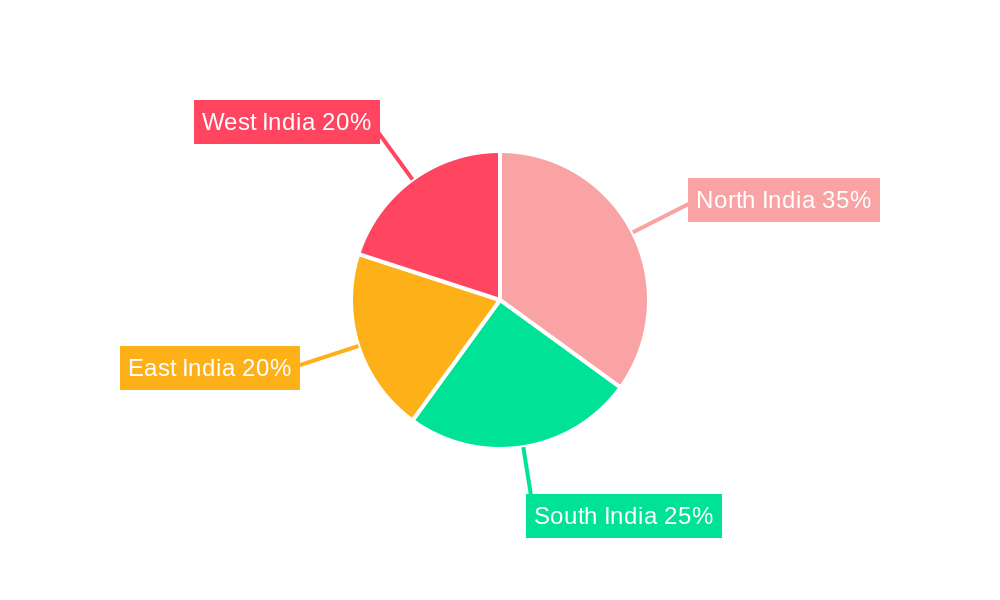

Market segmentation reveals strong demand across various categories. Oil-filled transformers continue to dominate, although dry-type transformers are gaining traction due to their enhanced safety and environmental benefits. Pad-mounted transformers are widely preferred for their ease of installation and maintenance, especially in urban settings. Three-phase transformers constitute a larger share compared to single-phase ones, reflecting the needs of commercial and industrial consumers. Regional variations exist, with North and West India exhibiting comparatively higher growth rates owing to greater industrial activity and infrastructure development in these regions. Leading players like Toshiba, Jiangsu HuaPeng, Hyosung, and others are actively participating in this expanding market, engaging in strategic partnerships and technological advancements to solidify their market positions. The market faces challenges including fluctuating raw material prices and increasing competition. However, the long-term growth prospects remain positive, underpinned by India's continuous infrastructural investments and economic progress.

India Distribution Transformer Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India distribution transformer industry, covering market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects the market's trajectory through the forecast period (2025-2033). This report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market. The market is segmented by capacity (Below 500 kVA, 500 kVA - 2500 kVA, Above 2500 kVA), type (Oil-filled, Dry Type), mounting type (Pad-mounted, Pole-mounted), and phase (Single Phase, Three Phase).

India Distribution Transformer Industry Market Dynamics & Structure

The Indian distribution transformer market is characterized by a moderately concentrated landscape with both domestic and international players vying for market share. Technological innovation, driven by the need for improved efficiency, reliability, and smart grid integration, is a key driver. Stringent regulatory frameworks, including those related to energy efficiency and safety standards, significantly impact market dynamics. The rise of renewable energy sources and the expansion of the electricity grid are creating significant demand. Competitive substitutes, such as advanced power electronics, are emerging, but their penetration remains limited. End-user demographics, particularly the growing urban population and industrialization, are fueling market growth. M&A activity has been moderate, with strategic acquisitions aimed at expanding market reach and technological capabilities.

- Market Concentration: Moderately concentrated, with top 10 players holding xx% market share (2024).

- Technological Innovation: Focus on energy efficiency, smart grid integration, and digitalization.

- Regulatory Framework: Stringent standards on safety, reliability, and energy efficiency.

- Competitive Substitutes: Limited penetration of advanced power electronics.

- End-User Demographics: Driven by urbanization and industrial expansion.

- M&A Trends: Moderate activity, focused on strategic expansion and technology acquisition. xx M&A deals recorded in 2024.

India Distribution Transformer Industry Growth Trends & Insights

The Indian distribution transformer market has witnessed robust growth over the historical period (2019-2024), driven by increasing electricity demand and government initiatives to expand grid infrastructure. The market size (in Million units) is estimated at xx in 2025 and is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. Adoption rates are increasing across all segments, particularly in rural electrification projects. Technological disruptions, such as the adoption of smart transformers and digital monitoring systems, are transforming the industry. Consumer behavior is shifting towards greater demand for energy-efficient and reliable transformers, influencing product development and market strategies. Factors such as government policies promoting renewable energy integration and smart grid deployments are significantly impacting growth.

Dominant Regions, Countries, or Segments in India Distribution Transformer Industry

The growth of the Indian distribution transformer market is geographically diverse, but certain regions and segments demonstrate stronger performance. The states of Maharashtra, Gujarat, and Tamil Nadu lead in terms of market size and growth due to higher industrial activity and urbanization. Within the segmentation, the demand for 500 kVA - 2500 kVA capacity transformers holds the largest market share, followed by the below 500 kVA segment. Oil-filled transformers dominate the market in terms of type, while pad-mounted transformers are the most widely adopted mounting type. Three-phase transformers account for the majority of the market share, driven by industrial and commercial applications.

- Key Growth Drivers:

- Government initiatives for rural electrification and grid modernization.

- Rapid urbanization and industrialization.

- Rising demand for reliable and efficient power distribution.

- Dominant Segments:

- Capacity: 500 kVA - 2500 kVA (xx% market share in 2024)

- Type: Oil-filled (xx% market share in 2024)

- Mounting Type: Pad-mounted (xx% market share in 2024)

- Phase: Three Phase (xx% market share in 2024)

India Distribution Transformer Industry Product Landscape

The Indian distribution transformer market offers a range of products catering to diverse applications and requirements. Innovation is focused on improving energy efficiency, enhancing reliability, and incorporating smart grid technologies. Products include oil-filled and dry-type transformers with various capacity ratings and mounting options. Key selling propositions emphasize durability, low maintenance, and compliance with stringent safety standards. Technological advancements include the integration of digital sensors, communication interfaces, and advanced protection systems.

Key Drivers, Barriers & Challenges in India Distribution Transformer Industry

Key Drivers: The primary drivers are the increasing demand for electricity, government initiatives for grid modernization and renewable energy integration, and the growth of industrial and commercial sectors. Favorable government policies, including subsidies and incentives for renewable energy, are also boosting market growth.

Challenges: Key challenges include the dependence on imports for certain raw materials, infrastructural limitations in remote areas hindering installation and maintenance, and competitive pressure from both domestic and international players. Supply chain disruptions can significantly impact production and delivery timelines, potentially affecting project schedules and costs.

Emerging Opportunities in India Distribution Transformer Industry

Emerging opportunities lie in the growing adoption of smart grid technologies, the expansion of renewable energy sources, and the increasing demand for energy-efficient solutions. Untapped markets in rural electrification present significant potential for growth. Innovative applications, such as microgrids and distributed generation systems, are gaining traction. The evolution of consumer preferences towards sustainable and technologically advanced solutions creates opportunities for specialized product development and market differentiation.

Growth Accelerators in the India Distribution Transformer Industry Industry

Technological advancements, strategic partnerships between manufacturers and power distribution companies, and government policies supporting infrastructure development are key growth catalysts. The development of advanced materials, improved manufacturing processes, and the adoption of Industry 4.0 technologies will further enhance efficiency and productivity. Investments in research and development will lead to innovations in smart grid integration and energy storage technologies.

Key Players Shaping the India Distribution Transformer Industry Market

- Toshiba Energy Systems & Solutions Corporation

- Jiangsu HuaPeng Transformer Co Ltd

- Hyosung Heavy Industries

- Hitachi Energy Ltd

- Baoding Tianwei Baobian Electric Co Ltd

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Siemens Energy AG

- CG Power and Industrial Solutions Ltd

- Bharat Heavy Electricals Limited

- *List Not Exhaustive

Notable Milestones in India Distribution Transformer Industry Sector

- December 2021: The Transformers & Rectifiers India Ltd. secured orders worth INR 72 crore from Gujarat Energy Transmission Corporation (GETCO) for various transformers, including distribution transformers.

- December 2021: Tata Power Delhi Distribution Ltd (DDL), in collaboration with Toshiba Transmission & Distribution Systems (India) Pvt. Ltd, installed a 630 kVA submersible distribution transformer in New Delhi, showcasing innovative substation design.

In-Depth India Distribution Transformer Industry Market Outlook

The Indian distribution transformer market is poised for continued growth, driven by robust electricity demand and ongoing infrastructure development. Strategic partnerships, technological advancements, and government initiatives will further accelerate market expansion. Opportunities exist for companies to capitalize on the increasing adoption of smart grid technologies and the growing demand for renewable energy integration. The market presents a compelling landscape for both established players and new entrants seeking to participate in this dynamic and rapidly evolving sector.

India Distribution Transformer Industry Segmentation

-

1. Capacity

- 1.1. Below 500 kVA

- 1.2. 500 kVA - 2500 kVA

- 1.3. Above 2500 kVA

-

2. Type

- 2.1. Oil-filled

- 2.2. Dry Type

-

3. Mounting Type

- 3.1. Pad-mounted

- 3.2. Pole-mounted

-

4. Phase

- 4.1. Single Phase

- 4.2. Three Phase

India Distribution Transformer Industry Segmentation By Geography

- 1. India

India Distribution Transformer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; High Electricity Demand from Industries4.; Enhancement in Economic Activities

- 3.3. Market Restrains

- 3.3.1. 4.; The Complex Maintenance Process of Components And the Emergence of Toxic Wastes that Affect the Environment

- 3.4. Market Trends

- 3.4.1. Below 500 kVA Capacity to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Distribution Transformer Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. Below 500 kVA

- 5.1.2. 500 kVA - 2500 kVA

- 5.1.3. Above 2500 kVA

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Oil-filled

- 5.2.2. Dry Type

- 5.3. Market Analysis, Insights and Forecast - by Mounting Type

- 5.3.1. Pad-mounted

- 5.3.2. Pole-mounted

- 5.4. Market Analysis, Insights and Forecast - by Phase

- 5.4.1. Single Phase

- 5.4.2. Three Phase

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. North India India Distribution Transformer Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Distribution Transformer Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Distribution Transformer Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Distribution Transformer Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Toshiba Energy Systems & Solutions Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 JiangSu HuaPeng Transformer Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hyosung Heavy Industries

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hitachi Energy Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Baoding Tianwei Baobian Electric Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mitsubishi Electric Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Schneider Electric SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Siemens Energy AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 CG Power and Industrial Solutions Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bharat Heavy Electricals Limited*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Toshiba Energy Systems & Solutions Corporation

List of Figures

- Figure 1: India Distribution Transformer Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Distribution Transformer Industry Share (%) by Company 2024

List of Tables

- Table 1: India Distribution Transformer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Distribution Transformer Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: India Distribution Transformer Industry Revenue Million Forecast, by Capacity 2019 & 2032

- Table 4: India Distribution Transformer Industry Volume K Units Forecast, by Capacity 2019 & 2032

- Table 5: India Distribution Transformer Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 6: India Distribution Transformer Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 7: India Distribution Transformer Industry Revenue Million Forecast, by Mounting Type 2019 & 2032

- Table 8: India Distribution Transformer Industry Volume K Units Forecast, by Mounting Type 2019 & 2032

- Table 9: India Distribution Transformer Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 10: India Distribution Transformer Industry Volume K Units Forecast, by Phase 2019 & 2032

- Table 11: India Distribution Transformer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 12: India Distribution Transformer Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 13: India Distribution Transformer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Distribution Transformer Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 15: North India India Distribution Transformer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: North India India Distribution Transformer Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: South India India Distribution Transformer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South India India Distribution Transformer Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: East India India Distribution Transformer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: East India India Distribution Transformer Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: West India India Distribution Transformer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: West India India Distribution Transformer Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: India Distribution Transformer Industry Revenue Million Forecast, by Capacity 2019 & 2032

- Table 24: India Distribution Transformer Industry Volume K Units Forecast, by Capacity 2019 & 2032

- Table 25: India Distribution Transformer Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: India Distribution Transformer Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 27: India Distribution Transformer Industry Revenue Million Forecast, by Mounting Type 2019 & 2032

- Table 28: India Distribution Transformer Industry Volume K Units Forecast, by Mounting Type 2019 & 2032

- Table 29: India Distribution Transformer Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 30: India Distribution Transformer Industry Volume K Units Forecast, by Phase 2019 & 2032

- Table 31: India Distribution Transformer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: India Distribution Transformer Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Distribution Transformer Industry?

The projected CAGR is approximately > 4.56%.

2. Which companies are prominent players in the India Distribution Transformer Industry?

Key companies in the market include Toshiba Energy Systems & Solutions Corporation, JiangSu HuaPeng Transformer Co Ltd, Hyosung Heavy Industries, Hitachi Energy Ltd, Baoding Tianwei Baobian Electric Co Ltd, Mitsubishi Electric Corporation, Schneider Electric SE, Siemens Energy AG, CG Power and Industrial Solutions Ltd, Bharat Heavy Electricals Limited*List Not Exhaustive.

3. What are the main segments of the India Distribution Transformer Industry?

The market segments include Capacity, Type, Mounting Type, Phase.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; High Electricity Demand from Industries4.; Enhancement in Economic Activities.

6. What are the notable trends driving market growth?

Below 500 kVA Capacity to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; The Complex Maintenance Process of Components And the Emergence of Toxic Wastes that Affect the Environment.

8. Can you provide examples of recent developments in the market?

In December 2021, The Transformers & Rectifiers India Ltd. was awarded orders of various transformers, including distribution transformers, for the total contract value of INR 72 crore from Gujarat Energy Transmission Corporation (GETCO).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Distribution Transformer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Distribution Transformer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Distribution Transformer Industry?

To stay informed about further developments, trends, and reports in the India Distribution Transformer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence