Key Insights

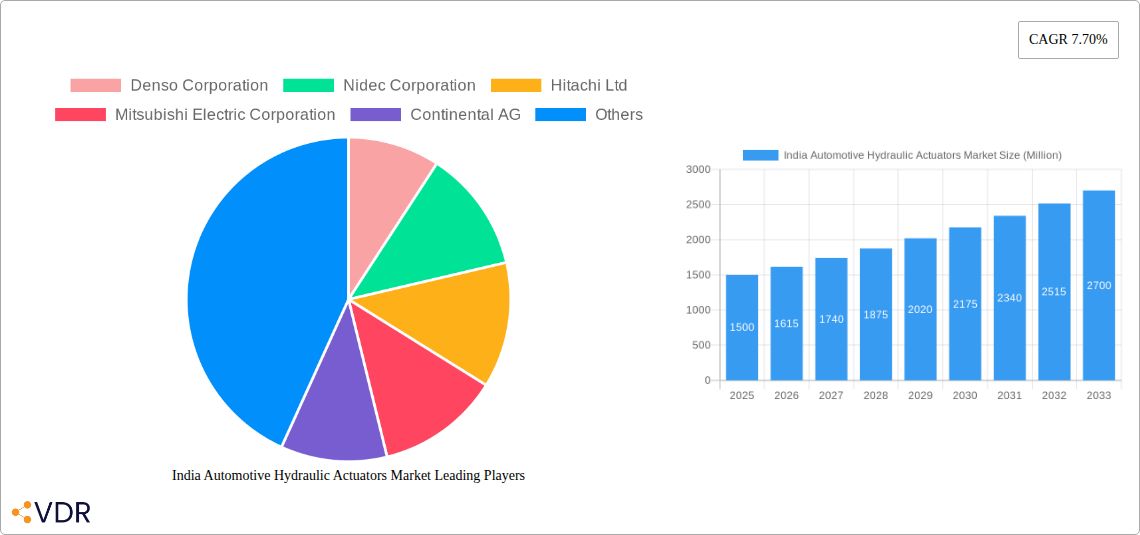

The India Automotive Hydraulic Actuators Market is poised for significant growth, driven by the burgeoning automotive industry and increasing demand for advanced driver-assistance systems (ADAS) and comfort features in passenger and commercial vehicles. The market, valued at approximately ₹1500 million (estimated based on provided CAGR and market size) in 2025, is projected to experience a robust Compound Annual Growth Rate (CAGR) of 7.70% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the expanding Indian automotive sector, particularly the passenger car segment, is a primary driver. Secondly, the rising adoption of technologically advanced actuators for enhanced vehicle performance and safety features like electronic stability control (ESC) and brake-by-wire systems is boosting demand. The increasing preference for comfort features, including power seats and automated climate control systems, further contributes to market expansion. Furthermore, government initiatives promoting the adoption of advanced safety technologies in vehicles are indirectly propelling growth within this sector. While challenges like the price sensitivity of the market and potential disruptions in the global supply chain exist, the overall outlook remains optimistic. Segmentation analysis reveals robust growth across various actuator applications, including throttle, seat adjustment, brake, and closure actuators, with the passenger car segment leading the way. Growth across different regions within India – North, South, East, and West – is anticipated to be influenced by the distribution of automotive manufacturing hubs and consumer preferences in each region.

The competitive landscape is characterized by the presence of both global and domestic players, each vying for market share through product innovation, strategic partnerships, and investments in research and development. Key players such as Denso, Nidec, Hitachi, Mitsubishi Electric, Continental, BorgWarner, Bosch, and Aptiv are strategically positioned to benefit from this market growth. Future growth will depend on factors such as the successful integration of hydraulic actuators within electric and hybrid vehicle architectures, increasing automation in vehicle manufacturing, and the development of more efficient and cost-effective hydraulic actuator technologies. The market's trajectory suggests substantial opportunities for companies that can effectively address the growing demand for advanced and reliable automotive hydraulic actuators within the Indian context.

India Automotive Hydraulic Actuators Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Automotive Hydraulic Actuators Market, encompassing market dynamics, growth trends, regional performance, product landscape, and key players. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. The market is segmented by vehicle type (passenger car and commercial vehicle) and application type (throttle actuator, seat adjustment actuator, brake actuator, closure actuator, and others). The report’s insights are invaluable for industry professionals, investors, and strategic decision-makers seeking a thorough understanding of this rapidly evolving market. Total market value is projected at XX Million units by 2033.

India Automotive Hydraulic Actuators Market Dynamics & Structure

The Indian automotive hydraulic actuators market is characterized by moderate concentration, with key players vying for market share. Technological innovation, primarily in areas like electromechanical actuators and advanced control systems, is a significant driver. Stringent regulatory frameworks concerning vehicle safety and emissions influence product development and adoption. The market witnesses competition from alternative technologies like electric actuators but retains relevance due to cost-effectiveness and established applications in legacy systems. End-user demographics, particularly the growing middle class and increased vehicle ownership, fuel market expansion. M&A activity remains moderate, with strategic alliances and partnerships being more prevalent than large-scale acquisitions.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on improving efficiency, reducing weight, and enhancing control precision.

- Regulatory Framework: Stringent safety and emission norms drive adoption of advanced actuators.

- Competitive Substitutes: Electric actuators pose a challenge but hydraulic actuators maintain cost advantage.

- M&A Activity: Primarily strategic alliances and partnerships rather than large-scale acquisitions. XX deals observed in the historical period.

India Automotive Hydraulic Actuators Market Growth Trends & Insights

The India Automotive Hydraulic Actuators Market is experiencing robust growth, driven by increasing vehicle production, rising disposable incomes, and infrastructural development. The market size witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching XX Million units by 2033. The passenger car segment currently dominates, but the commercial vehicle segment is expected to experience faster growth due to rising freight transportation demands. Technological disruptions, such as the integration of advanced driver-assistance systems (ADAS) and autonomous driving features, are significantly impacting market dynamics. Consumer preferences are shifting towards enhanced vehicle safety, comfort, and fuel efficiency, furthering the demand for advanced actuators. Market penetration for hydraulic actuators in various applications continues to grow, particularly in braking systems and power steering.

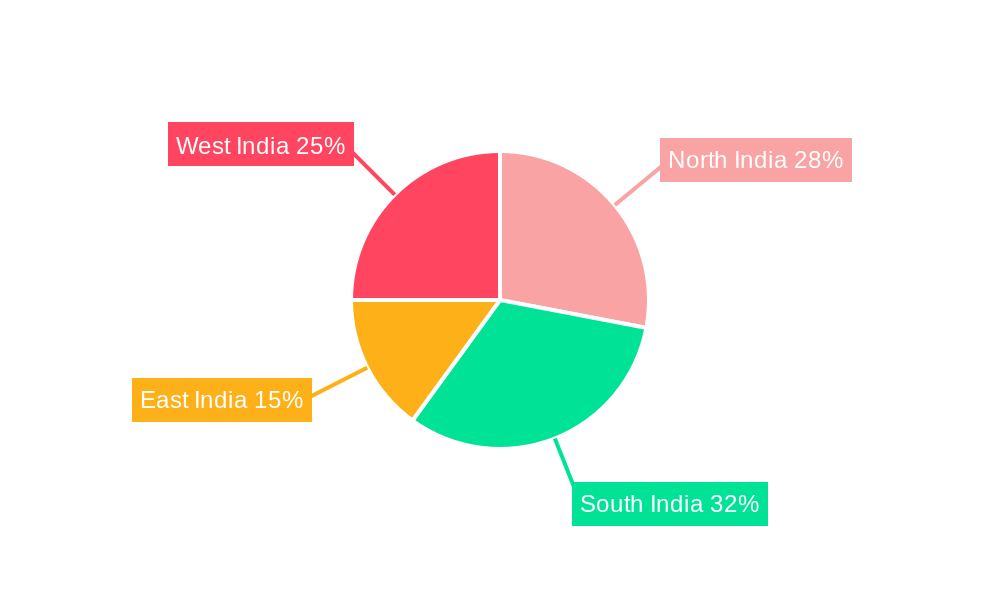

Dominant Regions, Countries, or Segments in India Automotive Hydraulic Actuators Market

The Southern and Western regions of India are currently the leading markets for automotive hydraulic actuators, driven by robust automotive manufacturing hubs and higher vehicle ownership rates. Within the segments, the passenger car segment holds the largest market share, followed by the commercial vehicle segment. Among application types, brake actuators command the largest share due to their critical role in vehicle safety.

- Key Drivers (Southern & Western Regions): Established automotive manufacturing clusters, higher vehicle density, and supportive government policies.

- Passenger Car Segment Dominance: High demand for passenger vehicles and integration of hydraulic actuators in various systems.

- Brake Actuator Leadership: Safety regulations and increasing demand for advanced braking systems.

- Commercial Vehicle Growth Potential: Rising freight transportation and infrastructure development.

India Automotive Hydraulic Actuators Market Product Landscape

The product landscape is characterized by a range of hydraulic actuators tailored to different vehicle applications, offering varying performance characteristics in terms of force, speed, and precision. Continuous improvement focuses on enhancing efficiency, durability, and integration with electronic control units (ECUs). Unique selling propositions frequently include compact designs, improved responsiveness, and enhanced reliability under demanding operating conditions. Technological advancements are focused on miniaturization, improved sealing technologies, and the incorporation of smart sensors for enhanced monitoring and control.

Key Drivers, Barriers & Challenges in India Automotive Hydraulic Actuators Market

Key Drivers: Rising automotive production, growing demand for advanced safety features, increasing vehicle electrification (though indirectly impacting hydraulic actuator use in some systems), and government initiatives promoting vehicle safety.

Challenges: Fluctuating raw material prices, potential substitution by electric actuators, and complexities in supply chain management impacting production and delivery timelines. Increased regulatory scrutiny also poses a challenge for maintaining cost-effectiveness. The impact of supply chain disruptions on production is estimated to be a xx% reduction in output in the worst-case scenarios.

Emerging Opportunities in India Automotive Hydraulic Actuators Market

Emerging opportunities lie in the growing demand for advanced driver-assistance systems (ADAS), increasing penetration in commercial vehicles, and the development of lightweight and energy-efficient actuators. Untapped markets exist in rural areas and smaller cities as vehicle ownership expands. Innovative applications of hydraulic actuators in areas like active suspension systems present significant growth potential.

Growth Accelerators in the India Automotive Hydraulic Actuators Market Industry

Technological breakthroughs in hydraulic actuator design, strategic collaborations between component suppliers and OEMs, and expansion into new vehicle segments such as electric vehicles (despite the overall trend towards electric actuators, some niches remain for hydraulic systems) will accelerate market growth. Aggressive marketing strategies focused on promoting the benefits of reliable and cost-effective hydraulic actuators will also aid the market's growth.

Key Players Shaping the India Automotive Hydraulic Actuators Market Market

- Denso Corporation

- Nidec Corporation

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Continental AG

- BorgWarner Inc

- Robert Bosch GmbH

- Aptiv

Notable Milestones in India Automotive Hydraulic Actuators Market Sector

- 2021: Introduction of a new generation of high-efficiency hydraulic actuators by a major player.

- 2022: Several key partnerships forged between hydraulic actuator manufacturers and automotive OEMs.

- 2023: Launch of a new regulation aimed at improving vehicle safety standards, impacting demand for high-performance actuators.

In-Depth India Automotive Hydraulic Actuators Market Market Outlook

The Indian Automotive Hydraulic Actuators Market is poised for continued growth, driven by strong vehicle production, increasing safety standards, and advancements in actuator technology. Strategic partnerships, technological innovations focusing on efficiency and performance, and targeted market expansion efforts will shape the future landscape. The market offers lucrative opportunities for established players and new entrants alike, promising substantial returns in the coming decade.

India Automotive Hydraulic Actuators Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Application Type

- 2.1. Throttle Actuator

- 2.2. Seat Adjustment Actuator

- 2.3. Brake Actuator

- 2.4. Closure Actuator

- 2.5. Others

India Automotive Hydraulic Actuators Market Segmentation By Geography

- 1. India

India Automotive Hydraulic Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for ADAS Integration

- 3.3. Market Restrains

- 3.3.1. High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Rising Demand for Fuel-Efficient Vehicles Will Help the Hydraulic Actuators Market to Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automotive Hydraulic Actuators Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Throttle Actuator

- 5.2.2. Seat Adjustment Actuator

- 5.2.3. Brake Actuator

- 5.2.4. Closure Actuator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North India India Automotive Hydraulic Actuators Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Automotive Hydraulic Actuators Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Automotive Hydraulic Actuators Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Automotive Hydraulic Actuators Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Denso Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nidec Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hitachi Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mitsubishi Electric Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Continental AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BorgWarner Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Robert Bosch GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Aptiv Pl

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Denso Corporation

List of Figures

- Figure 1: India Automotive Hydraulic Actuators Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Automotive Hydraulic Actuators Market Share (%) by Company 2024

List of Tables

- Table 1: India Automotive Hydraulic Actuators Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Automotive Hydraulic Actuators Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: India Automotive Hydraulic Actuators Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 4: India Automotive Hydraulic Actuators Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Automotive Hydraulic Actuators Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Automotive Hydraulic Actuators Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Automotive Hydraulic Actuators Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Automotive Hydraulic Actuators Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Automotive Hydraulic Actuators Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Automotive Hydraulic Actuators Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: India Automotive Hydraulic Actuators Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 12: India Automotive Hydraulic Actuators Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automotive Hydraulic Actuators Market?

The projected CAGR is approximately 7.70%.

2. Which companies are prominent players in the India Automotive Hydraulic Actuators Market?

Key companies in the market include Denso Corporation, Nidec Corporation, Hitachi Ltd, Mitsubishi Electric Corporation, Continental AG, BorgWarner Inc, Robert Bosch GmbH, Aptiv Pl.

3. What are the main segments of the India Automotive Hydraulic Actuators Market?

The market segments include Vehicle Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for ADAS Integration.

6. What are the notable trends driving market growth?

Rising Demand for Fuel-Efficient Vehicles Will Help the Hydraulic Actuators Market to Grow.

7. Are there any restraints impacting market growth?

High Upfront Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automotive Hydraulic Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automotive Hydraulic Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automotive Hydraulic Actuators Market?

To stay informed about further developments, trends, and reports in the India Automotive Hydraulic Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence