Key Insights

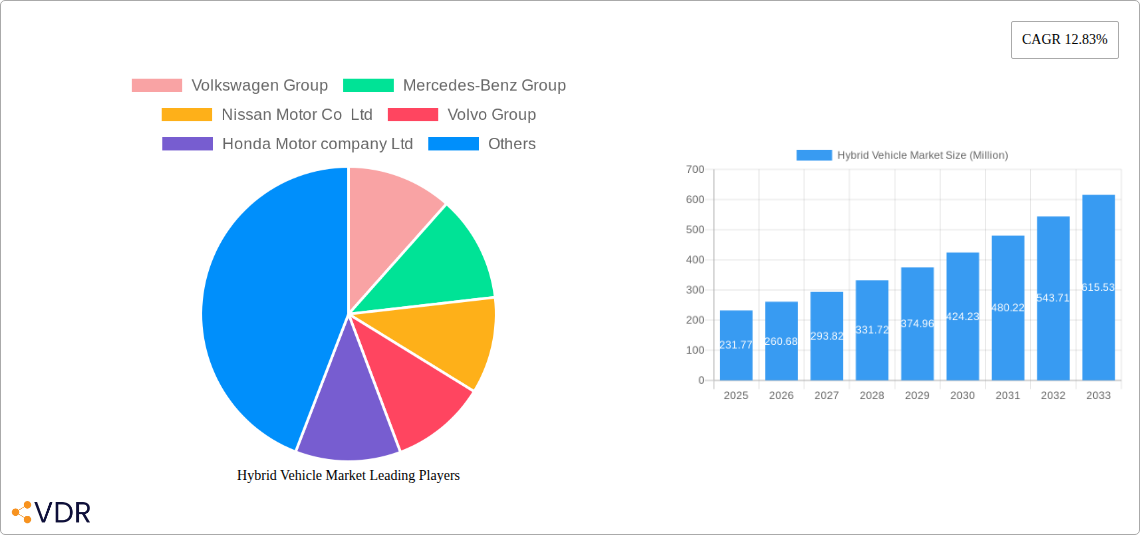

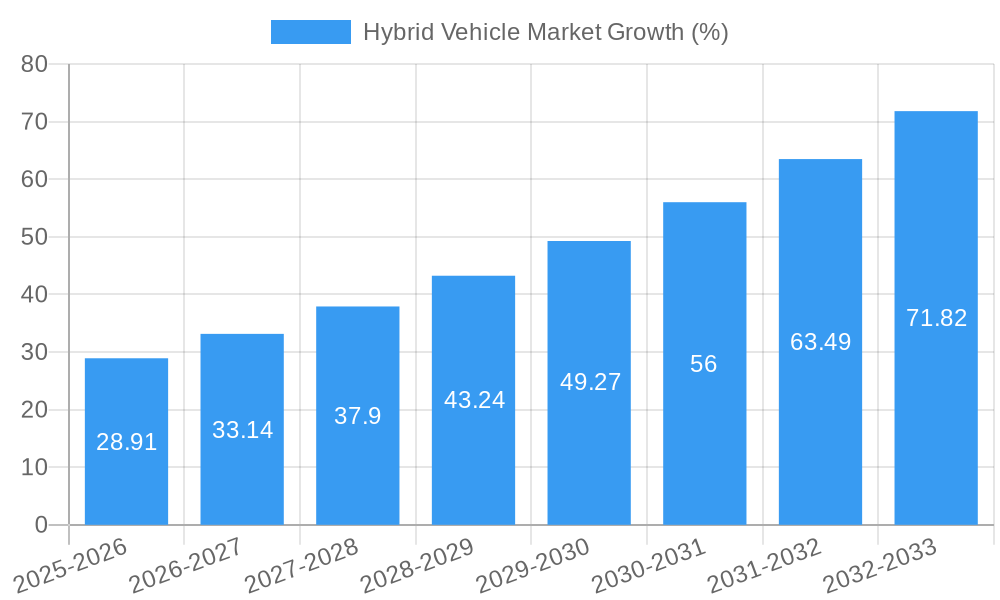

The global hybrid vehicle market is experiencing robust growth, projected to reach a market size of $231.77 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.83% from 2025 to 2033. Several key drivers fuel this expansion. Increasing environmental concerns and stringent government regulations aimed at reducing carbon emissions are pushing consumers and manufacturers towards more fuel-efficient and environmentally friendly vehicles. Technological advancements leading to improved battery technology, increased electric range, and reduced costs are also contributing to the market's growth. Furthermore, rising fuel prices and the increasing awareness of the economic benefits of hybrid vehicles, such as lower running costs, are positively impacting market demand. The market is segmented by vehicle type (passenger cars and commercial vehicles) and hybrid type (micro-hybrid, mild-hybrid, full-hybrid, and plug-in hybrid). Passenger cars currently dominate the market, but the commercial vehicle segment is poised for significant growth driven by fleet operators seeking to improve fuel efficiency and reduce their environmental footprint. Leading manufacturers such as Toyota, Honda, Volkswagen, and Hyundai are investing heavily in research and development to improve hybrid technology and expand their product portfolios, further stimulating market competition and innovation.

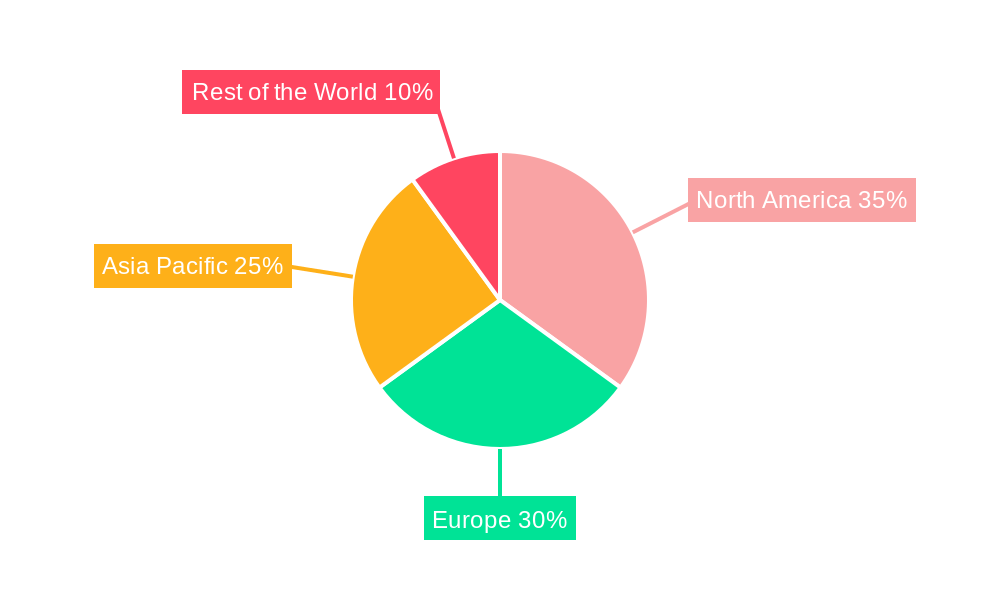

Regional analysis reveals strong market penetration in North America, Europe, and Asia Pacific. North America benefits from strong consumer demand for fuel-efficient vehicles and supportive government policies. Europe is a key market due to its stringent emission standards and government incentives for hybrid vehicle adoption. Asia Pacific, particularly China and Japan, are major players due to high production volumes and significant domestic demand. However, challenges remain. High initial purchase prices compared to conventional vehicles remain a barrier for some consumers, although this gap is progressively narrowing due to technological advancements and economies of scale. Furthermore, the development and implementation of robust charging infrastructure, especially for plug-in hybrids, is crucial for market expansion in certain regions. Despite these challenges, the long-term outlook for the hybrid vehicle market remains highly positive, fueled by continuous technological improvements, supportive government policies, and a growing global awareness of environmental sustainability.

Hybrid Vehicle Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Hybrid Vehicle Market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report leverages extensive data and qualitative analysis to offer valuable insights for industry professionals, investors, and strategic decision-makers. The parent market is the broader Automotive Market, while the child market is specifically Hybrid Vehicles. The report forecasts a market size of xx Million units by 2033.

Hybrid Vehicle Market Dynamics & Structure

This section delves into the intricate structure of the hybrid vehicle market, analyzing key aspects influencing its growth trajectory. Market concentration is moderately high, with key players holding significant market share. However, the entry of new players and technological advancements continue to shape the competitive landscape. Technological innovation, primarily driven by improvements in battery technology, electric motor efficiency, and powertrain integration, is a crucial driver. Stringent regulatory frameworks promoting fuel efficiency and emission reductions further accelerate market growth. The rise of electric vehicles (EVs) presents a significant competitive substitute, however, the hybrid vehicle market retains a strong niche due to its lower upfront cost and longer driving range compared to EVs in many applications. End-user demographics are expanding beyond early adopters, encompassing a broader spectrum of consumers seeking fuel efficiency and environmental responsibility. Finally, the ongoing consolidation through M&A activities contributes to market restructuring and innovation.

- Market Concentration: Moderately high, with top 10 players holding approximately 75% market share in 2024.

- Technological Innovation Drivers: Battery technology advancements, electric motor efficiency improvements, powertrain integration.

- Regulatory Frameworks: Stringent emission standards and fuel efficiency regulations driving demand.

- Competitive Product Substitutes: Electric Vehicles (EVs) represent the primary competitive threat.

- End-User Demographics: Expanding beyond early adopters to include price-sensitive and environmentally conscious consumers.

- M&A Trends: Moderate activity, with approximately xx M&A deals recorded between 2019-2024, resulting in increased market consolidation and technological advancements.

Hybrid Vehicle Market Growth Trends & Insights

The hybrid vehicle market witnessed significant growth during the historical period (2019-2024), exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributable to a confluence of factors, including increasing consumer awareness of environmental concerns, government incentives promoting eco-friendly vehicles, and technological advancements that enhance hybrid vehicle performance and affordability. Market penetration has steadily increased, reaching xx% in 2024, and is projected to surpass xx% by 2033. Technological disruptions, such as advancements in battery technology and the integration of smart features, continue to shape consumer preferences and drive adoption. A notable shift in consumer behavior is observed, with increasing demand for plug-in hybrid electric vehicles (PHEVs) due to their extended electric-only range. The forecast period (2025-2033) anticipates continued robust growth, driven by sustained government support, technological innovation, and expanding consumer base. The market size is expected to reach xx Million units by 2033.

Dominant Regions, Countries, or Segments in Hybrid Vehicle Market

The Hybrid Vehicle Market showcases strong regional disparities. [Region X](Region X details) currently dominates the market, accounting for approximately xx% of global sales in 2024, driven by favorable government policies, robust economic growth, and well-developed charging infrastructure. [Country Y](Country Y Details) within Region X emerges as a leading national market, benefiting from strong domestic demand and government incentives. In terms of segments, Passenger Cars constitute the largest share, exceeding xx Million units in 2024, while the Plug-in Hybrid (PHEV) segment exhibits the highest growth rate among hybrid vehicle types, fueled by advancements in battery technology and increasing consumer preference for longer electric range.

- Key Drivers in Region X: Government subsidies, strong economic growth, extensive charging infrastructure.

- Dominance Factors in Country Y: High domestic demand, supportive government policies.

- Growth Potential in Passenger Cars Segment: Strong demand driven by consumer preference and technological improvements.

- High Growth in PHEV Segment: Driven by improved battery technology and longer electric range.

Hybrid Vehicle Market Product Landscape

The hybrid vehicle market offers a diverse range of products, catering to varying consumer needs and preferences. Innovations focus on improving fuel efficiency, enhancing performance, and incorporating advanced technological features such as advanced driver-assistance systems (ADAS) and connected car technologies. Key performance metrics include fuel economy (measured in mpg or l/100km), electric-only range (for PHEVs), and CO2 emissions. Unique selling propositions (USPs) often revolve around superior fuel efficiency compared to conventional vehicles, reduced emissions, and the incorporation of advanced technology features. Technological advancements are continuous, with emphasis on lightweight materials, improved battery technologies, and more efficient powertrain designs.

Key Drivers, Barriers & Challenges in Hybrid Vehicle Market

Key Drivers:

- Government regulations promoting fuel efficiency and emission reduction.

- Growing consumer awareness of environmental concerns and rising fuel prices.

- Technological advancements making hybrid vehicles more affordable and efficient.

- Increasing availability of charging infrastructure, particularly for PHEVs.

Key Challenges & Restraints:

- High initial purchase price compared to conventional vehicles.

- Limited driving range for some hybrid models (especially non-PHEVs).

- Concerns about battery lifespan and replacement costs.

- Dependence on rare earth minerals for battery production, leading to supply chain disruptions and geopolitical risks. This impacted market growth by approximately xx% in 2022.

Emerging Opportunities in Hybrid Vehicle Market

- Expanding into developing markets with growing middle classes and increasing vehicle ownership.

- Development of hybrid powertrains for commercial vehicles, including trucks and buses.

- Integration of advanced technologies such as autonomous driving and vehicle-to-grid (V2G) capabilities.

- Customization of hybrid vehicles to meet specific needs of different consumer segments.

Growth Accelerators in the Hybrid Vehicle Market Industry

Several factors will propel the long-term growth of the hybrid vehicle market. Continued technological advancements, particularly in battery technology and powertrain efficiency, will play a significant role. Strategic partnerships between automotive manufacturers, battery suppliers, and technology companies will foster innovation and accelerate market expansion. Government policies supportive of hybrid vehicle adoption, such as tax incentives and emission reduction targets, will further stimulate demand. Expansion into new markets and diverse applications, including commercial vehicles, will create additional growth opportunities.

Key Players Shaping the Hybrid Vehicle Market Market

- Volkswagen Group

- Mercedes-Benz Group

- Nissan Motor Co Ltd

- Volvo Group

- Honda Motor company Ltd

- Hyundai Motor Company

- Kia Motors Corporation

- BMW AG

- Toyota Motor Corporation

- BYD Co Lt

- Ford Motor Company

Notable Milestones in Hybrid Vehicle Market Sector

- October 2022: BYD opened its first store in Brasilia, Brazil, expanding its presence in a key emerging market. This marked a significant step in BYD's global expansion strategy.

- October 2022: Korea Fuel-Tech Corporation invested USD 10 million in a new plant in Alabama, boosting the supply chain for hybrid vehicle fuel systems. This investment underscores growing confidence in the hybrid vehicle market's expansion.

- November 2022: Wuling Motors launched the Almaz Hybrid in Indonesia, furthering the adoption of hybrid vehicles in Southeast Asia. This product launch signifies an important step in market penetration.

- November 2022: Toyota South Africa Motors (TSAM) imported RAV4 PHEVs to test market response and infrastructure needs. This pilot program signifies Toyota's phased approach to introducing plug-in hybrid technology.

In-Depth Hybrid Vehicle Market Market Outlook

The hybrid vehicle market is poised for continued robust growth throughout the forecast period. Technological breakthroughs, particularly in battery technology and powertrain efficiency, will fuel this expansion. Strategic partnerships and collaborations will drive innovation and accelerate market penetration. Expanding into new markets and diversifying applications will unlock additional growth potential. Governments' continued support for hybrid vehicle adoption, coupled with increasing consumer demand for fuel-efficient and environmentally friendly vehicles, positions the market for sustained success in the long term. The market is projected to maintain strong growth, propelled by the factors outlined above, and presents significant opportunities for both established players and new entrants.

Hybrid Vehicle Market Segmentation

-

1. Hybrid Vehicle Type

- 1.1. Micro-hybrid

- 1.2. Mild-hybrid

- 1.3. Full-hybrid

- 1.4. Plug-in Hybrid

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

Hybrid Vehicle Market Segmentation By Geography

-

1. North America

- 1.1. United states

- 1.2. Canada

- 1.3. Rest of North america

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Norway

- 2.6. Netherlands

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Hybrid Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fuel Economy Norms and Government Incentives

- 3.3. Market Restrains

- 3.3.1. Growing Demand For Battery Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Passenger Car is Anticipated to Register Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hybrid Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hybrid Vehicle Type

- 5.1.1. Micro-hybrid

- 5.1.2. Mild-hybrid

- 5.1.3. Full-hybrid

- 5.1.4. Plug-in Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Hybrid Vehicle Type

- 6. North America Hybrid Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Hybrid Vehicle Type

- 6.1.1. Micro-hybrid

- 6.1.2. Mild-hybrid

- 6.1.3. Full-hybrid

- 6.1.4. Plug-in Hybrid

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Hybrid Vehicle Type

- 7. Europe Hybrid Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Hybrid Vehicle Type

- 7.1.1. Micro-hybrid

- 7.1.2. Mild-hybrid

- 7.1.3. Full-hybrid

- 7.1.4. Plug-in Hybrid

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Hybrid Vehicle Type

- 8. Asia Pacific Hybrid Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Hybrid Vehicle Type

- 8.1.1. Micro-hybrid

- 8.1.2. Mild-hybrid

- 8.1.3. Full-hybrid

- 8.1.4. Plug-in Hybrid

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Hybrid Vehicle Type

- 9. Rest of the World Hybrid Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Hybrid Vehicle Type

- 9.1.1. Micro-hybrid

- 9.1.2. Mild-hybrid

- 9.1.3. Full-hybrid

- 9.1.4. Plug-in Hybrid

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Hybrid Vehicle Type

- 10. North America Hybrid Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United states

- 10.1.2 Canada

- 10.1.3 Rest of North america

- 11. Europe Hybrid Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Norway

- 11.1.6 Netherlands

- 11.1.7 Rest of Europe

- 12. Asia Pacific Hybrid Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 India

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Hybrid Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Volkswagen Group

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Mercedes-Benz Group

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Nissan Motor Co Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Volvo Group

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Honda Motor company Ltd

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Hyundai Motor Company

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Kia Motors Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 BMW AG

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Toyota Motor Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 BYD Co Lt

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Ford Motor Company

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Volkswagen Group

List of Figures

- Figure 1: Global Hybrid Vehicle Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Hybrid Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Hybrid Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Hybrid Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Hybrid Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Hybrid Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Hybrid Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Hybrid Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Hybrid Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Hybrid Vehicle Market Revenue (Million), by Hybrid Vehicle Type 2024 & 2032

- Figure 11: North America Hybrid Vehicle Market Revenue Share (%), by Hybrid Vehicle Type 2024 & 2032

- Figure 12: North America Hybrid Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 13: North America Hybrid Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 14: North America Hybrid Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Hybrid Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Hybrid Vehicle Market Revenue (Million), by Hybrid Vehicle Type 2024 & 2032

- Figure 17: Europe Hybrid Vehicle Market Revenue Share (%), by Hybrid Vehicle Type 2024 & 2032

- Figure 18: Europe Hybrid Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 19: Europe Hybrid Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 20: Europe Hybrid Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Hybrid Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Hybrid Vehicle Market Revenue (Million), by Hybrid Vehicle Type 2024 & 2032

- Figure 23: Asia Pacific Hybrid Vehicle Market Revenue Share (%), by Hybrid Vehicle Type 2024 & 2032

- Figure 24: Asia Pacific Hybrid Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 25: Asia Pacific Hybrid Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 26: Asia Pacific Hybrid Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Hybrid Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Hybrid Vehicle Market Revenue (Million), by Hybrid Vehicle Type 2024 & 2032

- Figure 29: Rest of the World Hybrid Vehicle Market Revenue Share (%), by Hybrid Vehicle Type 2024 & 2032

- Figure 30: Rest of the World Hybrid Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 31: Rest of the World Hybrid Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 32: Rest of the World Hybrid Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Hybrid Vehicle Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Hybrid Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Hybrid Vehicle Market Revenue Million Forecast, by Hybrid Vehicle Type 2019 & 2032

- Table 3: Global Hybrid Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Global Hybrid Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Hybrid Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United states Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North america Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Hybrid Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Norway Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Netherlands Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Hybrid Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Hybrid Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: South America Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Middle East and Africa Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Hybrid Vehicle Market Revenue Million Forecast, by Hybrid Vehicle Type 2019 & 2032

- Table 27: Global Hybrid Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 28: Global Hybrid Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United states Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of North america Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Hybrid Vehicle Market Revenue Million Forecast, by Hybrid Vehicle Type 2019 & 2032

- Table 33: Global Hybrid Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 34: Global Hybrid Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Germany Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Kingdom Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: France Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Norway Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Netherlands Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Europe Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Hybrid Vehicle Market Revenue Million Forecast, by Hybrid Vehicle Type 2019 & 2032

- Table 43: Global Hybrid Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 44: Global Hybrid Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Hybrid Vehicle Market Revenue Million Forecast, by Hybrid Vehicle Type 2019 & 2032

- Table 51: Global Hybrid Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 52: Global Hybrid Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: South America Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Middle East and Africa Hybrid Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hybrid Vehicle Market?

The projected CAGR is approximately 12.83%.

2. Which companies are prominent players in the Hybrid Vehicle Market?

Key companies in the market include Volkswagen Group, Mercedes-Benz Group, Nissan Motor Co Ltd, Volvo Group, Honda Motor company Ltd, Hyundai Motor Company, Kia Motors Corporation, BMW AG, Toyota Motor Corporation, BYD Co Lt, Ford Motor Company.

3. What are the main segments of the Hybrid Vehicle Market?

The market segments include Hybrid Vehicle Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 231.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Fuel Economy Norms and Government Incentives.

6. What are the notable trends driving market growth?

Passenger Car is Anticipated to Register Highest Growth.

7. Are there any restraints impacting market growth?

Growing Demand For Battery Electric Vehicles.

8. Can you provide examples of recent developments in the market?

November 2022: Toyota South Africa Motors (TSAM) announced the importation of several RAV4 Plug-In Hybrid Vehicles (PHEV) to test customer response, vehicle behavior, infrastructure requirements, and other technical aspects, as well as educate customers on plug-in technology. It is also the second phase of TSAM's New Energy Vehicle (NEV) roll-out strategy, following the hybrid vehicle expansion strategy across Toyota's mainstream product lines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hybrid Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hybrid Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hybrid Vehicle Market?

To stay informed about further developments, trends, and reports in the Hybrid Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence