Key Insights

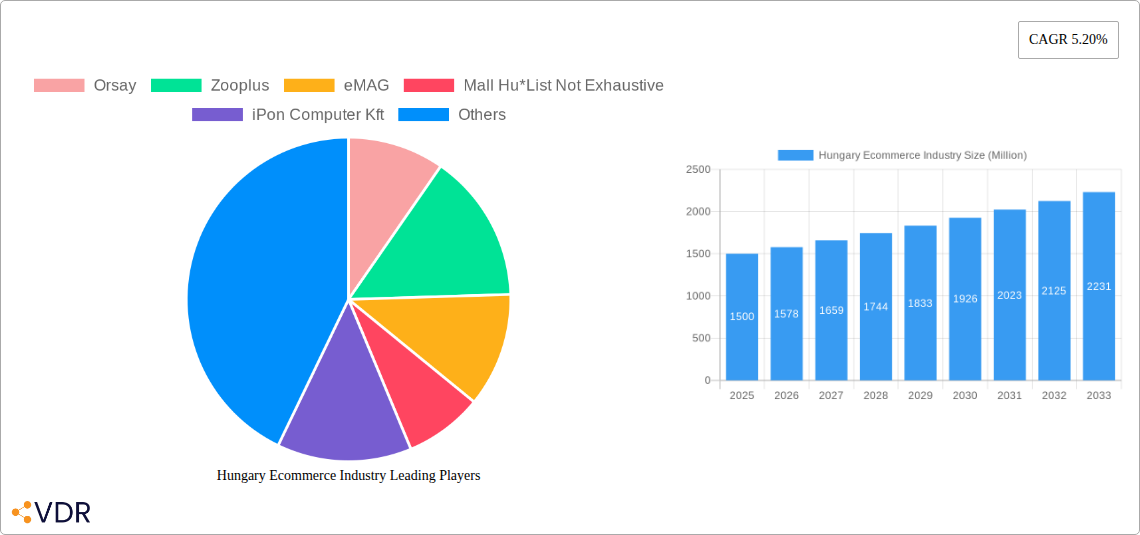

The Hungarian e-commerce market, valued at approximately €X million in 2025 (assuming a logical extrapolation from the provided CAGR of 5.20% and a known market size in a previous year – this should be replaced with a factual value if available), exhibits robust growth potential. Driven by increasing internet and smartphone penetration, a young and digitally-savvy population, and the expanding adoption of online payment methods, the sector is projected to maintain a steady expansion trajectory throughout the forecast period (2025-2033). Key players like Orsay, Zooplus, eMAG, and Alza.hu compete in a dynamic landscape characterized by a mix of established international and local e-retailers, alongside burgeoning marketplaces. While challenges remain, such as potential logistical hurdles in a geographically diverse country and the need for enhanced cybersecurity measures to bolster consumer trust, the overall market outlook remains positive. The growth is being fueled by rising disposable incomes, increased convenience-seeking behavior among consumers, and targeted marketing strategies employed by e-commerce businesses. Furthermore, the expansion of e-commerce into previously underserved rural areas, bolstered by improved infrastructure and logistics, will further propel market expansion.

The segmentation by application reveals diverse categories driving e-commerce growth in Hungary. Fashion, electronics, and groceries represent substantial market segments, each with its unique growth drivers and competitive dynamics. The presence of both large international players and smaller, specialized businesses contributes to a highly competitive environment. Future growth will hinge on factors like the continued development of robust logistics networks, the implementation of innovative digital marketing techniques, and the ability of companies to adapt to changing consumer preferences and technological advancements, particularly in areas like mobile commerce and personalized shopping experiences. The ongoing efforts to improve digital literacy and online payment security will play a pivotal role in fostering wider consumer adoption and shaping the long-term trajectory of the Hungarian e-commerce market.

Hungary Ecommerce Industry: Market Dynamics, Growth & Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the Hungarian ecommerce market, covering market size, growth trends, key players, and future opportunities. With a focus on market segmentation by application and a detailed study period from 2019 to 2033, this report is an essential resource for businesses, investors, and industry professionals seeking to understand and capitalize on the dynamic Hungarian ecommerce landscape. The report utilizes data up to 2024, with projections extending to 2033. The base year for analysis is 2025. All values are presented in millions.

Hungary Ecommerce Industry Market Dynamics & Structure

This section analyzes the market structure, technological advancements, regulatory environment, and competitive landscape of the Hungarian ecommerce sector. The analysis incorporates quantitative data on market share and M&A activity, complemented by qualitative insights into the factors shaping market dynamics.

- Market Concentration: The Hungarian ecommerce market exhibits a moderately concentrated structure, with a few large players holding significant market share (e.g., Tesco, Auchan, eMAG). However, smaller niche players and new entrants continue to emerge. The estimated market share of the top 5 players in 2025 is xx%.

- Technological Innovation: Drivers include the increasing adoption of mobile commerce, advanced logistics solutions, and personalized marketing technologies. Barriers include the digital literacy gap among some demographics and the need for robust cybersecurity infrastructure.

- Regulatory Framework: The regulatory landscape influences data privacy, consumer protection, and online taxation. Recent changes in regulations have impacted cross-border trade and data handling practices, influencing operational costs.

- Competitive Product Substitutes: Traditional brick-and-mortar retail remains a significant competitor. However, the increasing preference for convenience and wider product selection is driving growth in ecommerce.

- End-User Demographics: The ecommerce market caters to a diverse range of consumers, with significant growth observed in younger demographics. Growth is also observed in increased purchasing power and online payment system adoption.

- M&A Trends: The merger of eMAG and Extreme Digital in April 2022 signifies a notable trend toward consolidation in the market. The number of M&A deals in the period 2019-2024 was xx, with a total value of xx million.

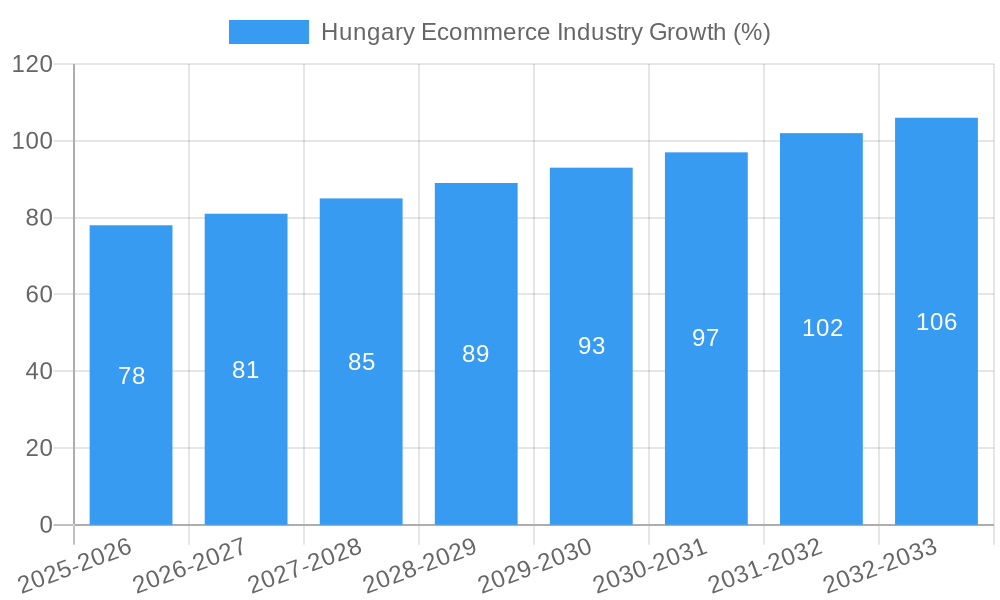

Hungary Ecommerce Industry Growth Trends & Insights

This section presents a detailed analysis of the growth trajectory of the Hungarian ecommerce market. Utilizing both qualitative and quantitative data, we explore market size evolution, adoption rates, and consumer behavior shifts.

The Hungarian ecommerce market experienced a significant growth trajectory between 2019 and 2024, with a CAGR of xx%. This growth is attributed to several factors, including increasing internet penetration, rising smartphone usage, and changing consumer preferences towards online shopping. The market size in 2024 was estimated at xx million, and is projected to reach xx million in 2025 and xx million by 2033. Market penetration is expected to reach xx% by 2033, from xx% in 2024. The adoption of mobile commerce continues to be a significant driver, with xx% of online purchases made via mobile devices in 2024. Consumer behavior shifts reflect a growing preference for personalized shopping experiences, seamless delivery options, and secure payment gateways. Technological disruptions, like the rise of social commerce and the increasing use of AI-powered recommendation engines, further fuel this growth. The forecast reflects a continued upward trend, driven by sustained economic growth and ongoing technological innovation.

Dominant Regions, Countries, or Segments in Hungary Ecommerce Industry

This section identifies the leading regions, countries, or segments driving market growth within Hungary. While Hungary is a single country, regional variations exist within the country in terms of ecommerce adoption and growth. Budapest, for instance, leads the market due to higher internet penetration, higher disposable incomes, and greater concentration of businesses.

- Key Drivers: Budapest’s dominance stems from higher disposable incomes, better infrastructure (internet access and logistics), a more tech-savvy population, and the concentration of a significant portion of the Hungarian population and businesses. Government initiatives promoting digitalization also play a supporting role.

- Market Share & Growth Potential: Budapest accounts for an estimated xx% of the total ecommerce market in Hungary in 2025, exhibiting higher growth potential compared to other regions. Growth in smaller cities and rural areas is expected, but at a slower pace due to limitations in digital infrastructure and logistical challenges.

Hungary Ecommerce Industry Product Landscape

The Hungarian ecommerce market offers a diverse range of products, encompassing electronics, fashion, groceries, and more. Recent innovations include the integration of augmented reality (AR) for virtual try-ons in fashion and the utilization of AI-powered chatbots for enhanced customer service. These improvements streamline the online shopping experience and cater to the evolving preferences of Hungarian consumers. The focus remains on improving user experience and product personalization. Companies are also adopting robust data analytics for optimized inventory management, marketing, and customer relationship management.

Key Drivers, Barriers & Challenges in Hungary Ecommerce Industry

Key Drivers:

- Increasing internet and smartphone penetration.

- Growing consumer preference for convenience and wider product selection.

- Government initiatives supporting digitalization.

- Technological advancements improving the online shopping experience.

Key Challenges:

- Logistics: Efficient and affordable delivery to rural areas remains a challenge, impacting market expansion. This accounts for an estimated xx million loss annually.

- Trust and Security: Concerns around online payment security and data privacy can hinder consumer adoption. This is estimated to suppress market growth by xx% annually.

- Competition: Intense competition from established players and new entrants.

Emerging Opportunities in Hungary Ecommerce Industry

Emerging opportunities lie in untapped market segments, such as senior citizens, and the development of niche ecommerce platforms catering to specific product categories or demographics. Growth of omnichannel strategies integrating online and offline experiences is also a key opportunity. The increasing adoption of sustainable practices in e-commerce, such as eco-friendly packaging and carbon-neutral delivery, presents a significant area for market differentiation.

Growth Accelerators in the Hungary Ecommerce Industry

Long-term growth will be accelerated by further investments in digital infrastructure, particularly in underserved regions. Strategic partnerships between ecommerce businesses and logistics providers will be crucial to enhance delivery efficiency and affordability. Continued innovation in payment solutions, particularly the expansion of mobile payment options, will further drive market growth.

Key Players Shaping the Hungary Ecommerce Industry Market

Notable Milestones in Hungary Ecommerce Industry Sector

- April 2022: Auchan launched a pioneering sustainability initiative by phasing out plastic bags, replacing them with eco-friendly, biodegradable alternatives.

- April 2022: eMAG and Extreme Digital merged, creating a more efficient and cost-effective platform with enhanced delivery capabilities (700 easy box machines for 24-hour delivery).

In-Depth Hungary Ecommerce Industry Market Outlook

The Hungarian ecommerce market shows strong potential for sustained growth over the forecast period (2025-2033). Continued digitalization, infrastructural improvements, and innovative business models will drive market expansion. Strategic partnerships focused on improving logistics and addressing consumer concerns about security will be crucial for long-term success. Companies focusing on sustainability and personalized experiences will be best positioned to capture significant market share.

Hungary Ecommerce Industry Segmentation

-

1. B2C ecommerce

- 1.1. Market size (GMV) for the period of 2017-2027

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty & Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion & Apparel

- 1.2.4. Food & Beverage

- 1.2.5. Furniture & Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market size (GMV) for the period of 2017-2027

-

3. Application

- 3.1. Beauty & Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion & Apparel

- 3.4. Food & Beverage

- 3.5. Furniture & Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty & Personal Care

- 5. Consumer Electronics

- 6. Fashion & Apparel

- 7. Food & Beverage

- 8. Furniture & Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B ecommerce

- 10.1. Market size for the period of 2017-2027

Hungary Ecommerce Industry Segmentation By Geography

- 1. Hungary

Hungary Ecommerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Fashion Industry

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Increase in E-commerce business during the COVID-19 Pandemic

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hungary Ecommerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by B2C ecommerce

- 5.1.1. Market size (GMV) for the period of 2017-2027

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty & Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion & Apparel

- 5.1.2.4. Food & Beverage

- 5.1.2.5. Furniture & Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market size (GMV) for the period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty & Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion & Apparel

- 5.3.4. Food & Beverage

- 5.3.5. Furniture & Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty & Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion & Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food & Beverage

- 5.8. Market Analysis, Insights and Forecast - by Furniture & Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B ecommerce

- 5.10.1. Market size for the period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Hungary

- 5.1. Market Analysis, Insights and Forecast - by B2C ecommerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Orsay

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zooplus

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 eMAG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mall Hu*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 iPon Computer Kft

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Euronics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alza hu

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arukereso

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Auchan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jofogas

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tesco

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Orsay

List of Figures

- Figure 1: Hungary Ecommerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Hungary Ecommerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Hungary Ecommerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Hungary Ecommerce Industry Revenue Million Forecast, by B2C ecommerce 2019 & 2032

- Table 3: Hungary Ecommerce Industry Revenue Million Forecast, by Market size (GMV) for the period of 2017-2027 2019 & 2032

- Table 4: Hungary Ecommerce Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Hungary Ecommerce Industry Revenue Million Forecast, by Beauty & Personal Care 2019 & 2032

- Table 6: Hungary Ecommerce Industry Revenue Million Forecast, by Consumer Electronics 2019 & 2032

- Table 7: Hungary Ecommerce Industry Revenue Million Forecast, by Fashion & Apparel 2019 & 2032

- Table 8: Hungary Ecommerce Industry Revenue Million Forecast, by Food & Beverage 2019 & 2032

- Table 9: Hungary Ecommerce Industry Revenue Million Forecast, by Furniture & Home 2019 & 2032

- Table 10: Hungary Ecommerce Industry Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2019 & 2032

- Table 11: Hungary Ecommerce Industry Revenue Million Forecast, by B2B ecommerce 2019 & 2032

- Table 12: Hungary Ecommerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 13: Hungary Ecommerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Hungary Ecommerce Industry Revenue Million Forecast, by B2C ecommerce 2019 & 2032

- Table 15: Hungary Ecommerce Industry Revenue Million Forecast, by Market size (GMV) for the period of 2017-2027 2019 & 2032

- Table 16: Hungary Ecommerce Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Hungary Ecommerce Industry Revenue Million Forecast, by Beauty & Personal Care 2019 & 2032

- Table 18: Hungary Ecommerce Industry Revenue Million Forecast, by Consumer Electronics 2019 & 2032

- Table 19: Hungary Ecommerce Industry Revenue Million Forecast, by Fashion & Apparel 2019 & 2032

- Table 20: Hungary Ecommerce Industry Revenue Million Forecast, by Food & Beverage 2019 & 2032

- Table 21: Hungary Ecommerce Industry Revenue Million Forecast, by Furniture & Home 2019 & 2032

- Table 22: Hungary Ecommerce Industry Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2019 & 2032

- Table 23: Hungary Ecommerce Industry Revenue Million Forecast, by B2B ecommerce 2019 & 2032

- Table 24: Hungary Ecommerce Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hungary Ecommerce Industry?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Hungary Ecommerce Industry?

Key companies in the market include Orsay, Zooplus, eMAG, Mall Hu*List Not Exhaustive, iPon Computer Kft, Euronics, Alza hu, Arukereso, Auchan, Jofogas, Tesco.

3. What are the main segments of the Hungary Ecommerce Industry?

The market segments include B2C ecommerce, Market size (GMV) for the period of 2017-2027, Application, Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Furniture & Home, Others (Toys, DIY, Media, etc.), B2B ecommerce.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Fashion Industry.

6. What are the notable trends driving market growth?

Increase in E-commerce business during the COVID-19 Pandemic.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

April 2022 - Auchan has stopped using plastic bags in the stores and the fruit and vegetable department; bags that are used to store six products at a time which are washable, three-piece suit, eco-friendly made of 100% biodegradable, compostable, bio-based material are being used. In this way, the store chain has taken a pioneering step in consistently implementing its sustainability strategy that no other chain in the Hungarian market has ever done.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hungary Ecommerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hungary Ecommerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hungary Ecommerce Industry?

To stay informed about further developments, trends, and reports in the Hungary Ecommerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence