Key Insights

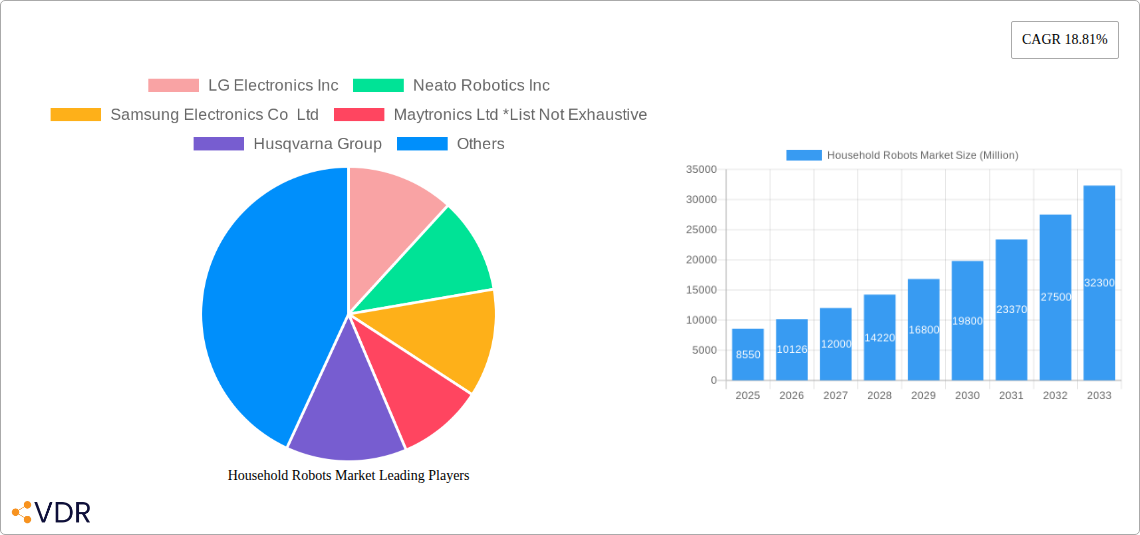

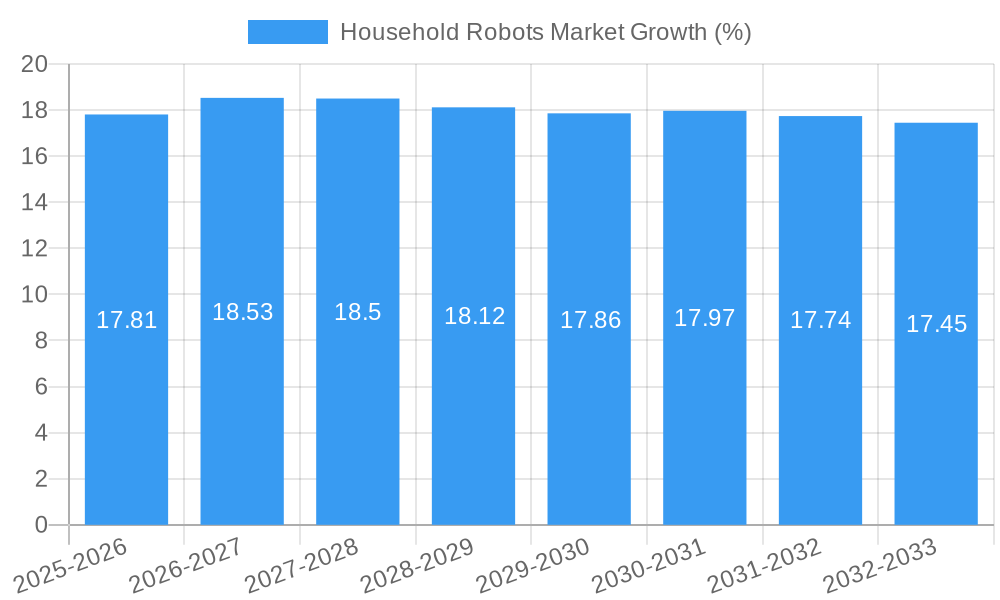

The global household robots market is experiencing robust growth, projected to reach \$8.55 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 18.81% from 2025 to 2033. This expansion is fueled by several key factors. Increasing disposable incomes in developed and developing economies are driving consumer demand for automated home solutions that enhance convenience and efficiency. Technological advancements, such as improved navigation systems, AI-powered features (like object recognition and smart home integration), and longer battery life, are making household robots more sophisticated and appealing. Furthermore, the rising adoption of smart homes and the growing awareness of the benefits of automation are contributing to market growth. The market segmentation reveals that robotic vacuum and mopping currently dominate, followed by lawn mowing and pool cleaning. Companionship robots, though a smaller segment currently, are showing significant potential for future growth, driven by an aging population and increased demand for elderly care assistance. Key players like iRobot, Ecovacs Robotics, and Samsung are driving innovation and competition within the market.

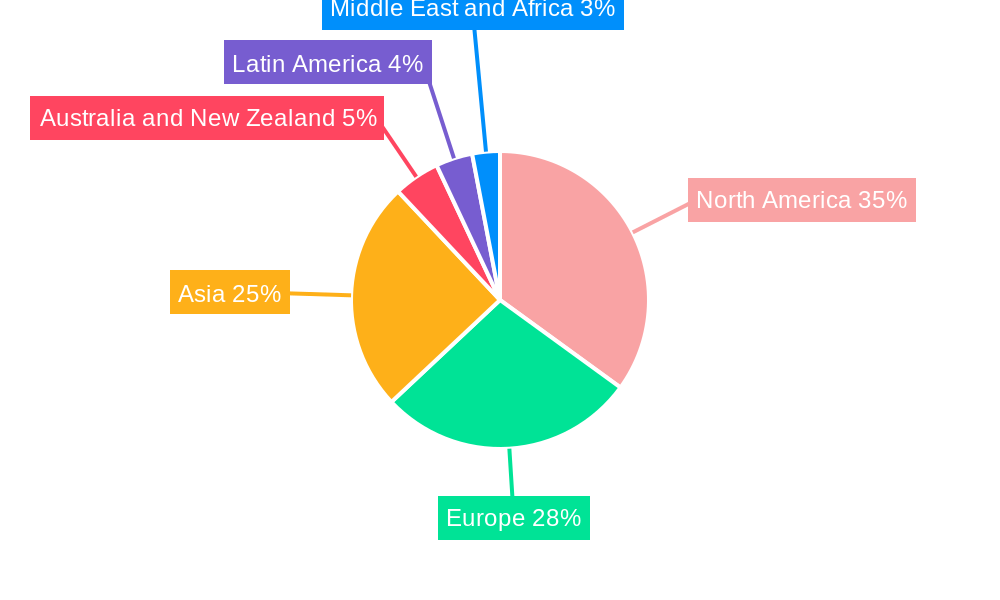

The market's geographical distribution likely reflects varying levels of technological adoption and economic development. North America and Europe are anticipated to hold significant market shares due to high consumer spending and early adoption of smart home technologies. However, Asia-Pacific is expected to witness rapid growth in the coming years, propelled by rising urbanization, increased disposable income, and a burgeoning middle class. While challenges remain, including high initial costs and potential concerns about data privacy, the overall trend points to a continued expansion of the household robotics market. Continued innovation in areas like AI, battery technology, and user interface will be crucial for sustained growth. Manufacturers will need to focus on addressing consumer concerns regarding cost and data security to fully capitalize on the market's potential.

Household Robots Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Household Robots Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report leverages extensive data analysis to offer valuable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by application into Robotic Vacuum and Mopping, Lawn Mowing, Pool Cleaning, Companionship, and Other Applications. Key players include iRobot Corporation, Ecovacs Robotics Inc, LG Electronics Inc, and many more. The report projects a total market size of xx Million units by 2033.

Household Robots Market Dynamics & Structure

The Household Robots Market is characterized by moderate concentration, with several key players vying for market share. Technological innovation, driven by advancements in AI, sensors, and battery technology, is a key growth driver. Regulatory frameworks concerning data privacy and safety standards are shaping market development. The market faces competition from traditional cleaning methods, but the convenience and efficiency offered by robots are driving adoption. End-user demographics, particularly among tech-savvy households with disposable income, are crucial for market expansion. M&A activity is relatively frequent, signaling consolidation and strategic partnerships.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: AI-powered navigation, improved battery life, and enhanced cleaning capabilities are key innovation drivers.

- Regulatory Landscape: Regulations concerning data privacy and product safety are increasingly important.

- Competitive Substitutes: Traditional cleaning methods and manual labor remain significant substitutes.

- End-User Demographics: Higher adoption rates among higher-income households and tech-savvy consumers.

- M&A Activity: xx M&A deals were recorded in the period 2019-2024, indicating market consolidation.

Household Robots Market Growth Trends & Insights

The Household Robots Market experienced significant growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to rising disposable incomes, increasing urbanization, and a growing preference for convenient and efficient home cleaning solutions. Technological disruptions, including advancements in AI and robotics, have further fueled market expansion. Consumer behavior is shifting towards smart home technology and automated solutions, leading to increased adoption rates. The market is expected to continue its growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033). Market penetration remains relatively low, indicating significant untapped potential, particularly in developing economies. Technological advancements in areas such as object recognition and self-emptying dustbins are driving demand. Increased integration with smart home ecosystems is further expanding market appeal.

Dominant Regions, Countries, or Segments in Household Robots Market

North America currently holds the largest market share in the Household Robots Market, driven by high adoption rates of smart home technologies and a robust technological infrastructure. Within the application segments, Robotic Vacuum and Mopping dominates, accounting for xx% of the market in 2024.

- North America: High consumer spending on technological appliances and advanced infrastructure contribute to its leading position.

- Europe: Growing adoption of smart home technologies and improving consumer confidence.

- Asia-Pacific: Rapid urbanization and rising disposable incomes are driving market growth in this region.

- Robotic Vacuum & Mopping: This segment's dominance is due to its relative affordability and widespread appeal.

- Lawn Mowing: Growth driven by time constraints among homeowners and the rising popularity of smart gardening solutions.

- Pool Cleaning: Increasing demand for convenient and efficient pool maintenance solutions.

Household Robots Market Product Landscape

The Household Robots Market offers a diverse range of products, including robotic vacuum cleaners, robotic lawnmowers, and pool cleaning robots. Recent innovations focus on improved navigation systems, increased battery life, and enhanced cleaning performance. Many models feature smart home integration, allowing for remote control and scheduling. Unique selling propositions often include advanced features like self-emptying dustbins, obstacle avoidance, and app-based control.

Key Drivers, Barriers & Challenges in Household Robots Market

Key Drivers:

- Increasing demand for convenient and efficient home cleaning solutions.

- Technological advancements in AI, sensors, and battery technology.

- Rising disposable incomes and urbanization.

- Growing adoption of smart home technologies.

Key Barriers & Challenges:

- High initial cost of purchase.

- Concerns regarding data privacy and security.

- Limited interoperability between different smart home systems.

- Supply chain disruptions impacting manufacturing and delivery. This resulted in a xx% decrease in product availability in Q1 2024.

Emerging Opportunities in Household Robots Market

- Expanding into untapped markets in developing economies.

- Development of specialized robots for niche applications (e.g., window cleaning, gutter cleaning).

- Integration with other smart home devices and ecosystems.

- Growing demand for robots with enhanced AI capabilities and improved personalization features.

Growth Accelerators in the Household Robots Market Industry

Technological breakthroughs in areas such as AI, computer vision, and sensor technology will play a pivotal role in accelerating market growth. Strategic partnerships between manufacturers and smart home technology providers will facilitate wider adoption. Expansion into new geographic markets and the development of innovative applications will further fuel market expansion.

Key Players Shaping the Household Robots Market Market

- LG Electronics Inc

- Neato Robotics Inc

- Samsung Electronics Co Ltd

- Maytronics Ltd

- Husqvarna Group

- Roborock Technology Co Ltd

- bObsweep Inc

- Blue Frog Robotics Inc

- SharkNinja Operating LLC

- iRobot Corporation

- ILIFE Innovation Ltd

- Ecovacs Robotics Inc

- Panasonic Corporation

Notable Milestones in Household Robots Market Sector

- January 2024: ECOVACS unveiled its next-generation of whole-home robotics, showcasing advancements in floor, air, ceiling, window, and lawn care robots. The launch of the DEEBOT X2 COMBO and WINBOT W2 OMNI highlighted enhanced automation and ease of use.

- April 2024: iRobot Corp. launched the Roomba Combo Essential, a 2-in-1 robot vacuum and mop, marking a milestone in affordability and user-friendliness. The company also announced surpassing 50 million robots sold globally.

In-Depth Household Robots Market Market Outlook

The Household Robots Market is poised for substantial growth in the coming years, driven by technological advancements, rising consumer demand, and strategic market expansion initiatives. The increasing affordability and user-friendliness of these devices will contribute to wider market penetration. Focus on developing more specialized and customized cleaning robots will also open up opportunities for further growth. The integration of these robots into broader smart home ecosystems will continue to drive market expansion.

Household Robots Market Segmentation

-

1. Application

- 1.1. Robotic Vacuum and Mopping

- 1.2. Lawn Mowing

- 1.3. Pool Cleaning

- 1.4. Companionship and Other Applications

Household Robots Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Household Robots Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Research and Development Investments and Wide Range of Applications; Rapid Urbanization

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment

- 3.4. Market Trends

- 3.4.1. Robotic Vacuum and Mopping is Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Robotic Vacuum and Mopping

- 5.1.2. Lawn Mowing

- 5.1.3. Pool Cleaning

- 5.1.4. Companionship and Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Robotic Vacuum and Mopping

- 6.1.2. Lawn Mowing

- 6.1.3. Pool Cleaning

- 6.1.4. Companionship and Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Robotic Vacuum and Mopping

- 7.1.2. Lawn Mowing

- 7.1.3. Pool Cleaning

- 7.1.4. Companionship and Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Robotic Vacuum and Mopping

- 8.1.2. Lawn Mowing

- 8.1.3. Pool Cleaning

- 8.1.4. Companionship and Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Australia and New Zealand Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Robotic Vacuum and Mopping

- 9.1.2. Lawn Mowing

- 9.1.3. Pool Cleaning

- 9.1.4. Companionship and Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Latin America Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Robotic Vacuum and Mopping

- 10.1.2. Lawn Mowing

- 10.1.3. Pool Cleaning

- 10.1.4. Companionship and Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Middle East and Africa Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Robotic Vacuum and Mopping

- 11.1.2. Lawn Mowing

- 11.1.3. Pool Cleaning

- 11.1.4. Companionship and Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. North America Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 LG Electronics Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Neato Robotics Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Samsung Electronics Co Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Maytronics Ltd *List Not Exhaustive

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Husqvarna Group

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Roborock Technology Co Ltd

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 bObsweep Inc

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Blue Frog Robotics Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 SharkNinja Operating LLC

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 iRobot Corporation

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 ILIFE Innovation Ltd

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Ecovacs Robotics Inc

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Panasonic Corporation

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.1 LG Electronics Inc

List of Figures

- Figure 1: Global Household Robots Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Household Robots Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Household Robots Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Household Robots Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Household Robots Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Household Robots Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Asia Household Robots Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Asia Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Australia and New Zealand Household Robots Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Australia and New Zealand Household Robots Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Australia and New Zealand Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Australia and New Zealand Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Household Robots Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America Household Robots Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Latin America Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East and Africa Household Robots Market Revenue (Million), by Application 2024 & 2032

- Figure 35: Middle East and Africa Household Robots Market Revenue Share (%), by Application 2024 & 2032

- Figure 36: Middle East and Africa Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Middle East and Africa Household Robots Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Household Robots Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Household Robots Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Household Robots Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Household Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Household Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Household Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Household Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Household Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Household Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Household Robots Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Household Robots Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Household Robots Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Household Robots Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Household Robots Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Household Robots Market Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Household Robots Market?

The projected CAGR is approximately 18.81%.

2. Which companies are prominent players in the Household Robots Market?

Key companies in the market include LG Electronics Inc, Neato Robotics Inc, Samsung Electronics Co Ltd, Maytronics Ltd *List Not Exhaustive, Husqvarna Group, Roborock Technology Co Ltd, bObsweep Inc, Blue Frog Robotics Inc, SharkNinja Operating LLC, iRobot Corporation, ILIFE Innovation Ltd, Ecovacs Robotics Inc, Panasonic Corporation.

3. What are the main segments of the Household Robots Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Research and Development Investments and Wide Range of Applications; Rapid Urbanization.

6. What are the notable trends driving market growth?

Robotic Vacuum and Mopping is Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

High Cost of Equipment.

8. Can you provide examples of recent developments in the market?

April 2024 - iRobot Corp introduced the Roomba combo essential robot an affordable and easy-to use 2-in-1 robot vacuum and mop. At USD 275, the Roomba Combo Essential delivers the cleaning essentials customers loved about the best-selling1 Roomba 600 Series – but with better performance and an impressive set of features that make it even simpler to clean the way they want. The company also announced it has surpassed the milestone of selling more than 50 million robots worldwide

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Household Robots Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Household Robots Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Household Robots Market?

To stay informed about further developments, trends, and reports in the Household Robots Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence