Key Insights

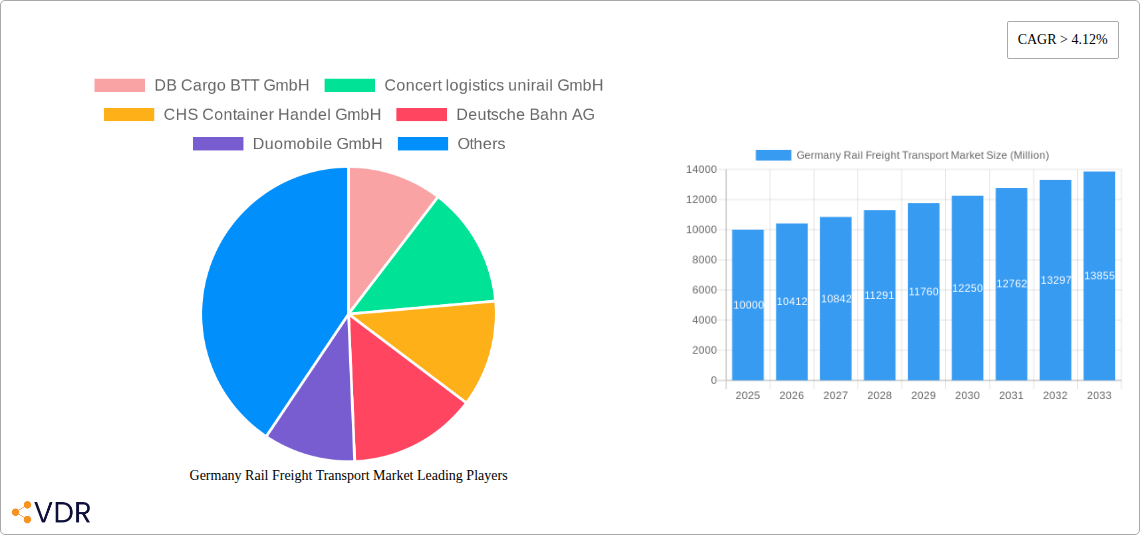

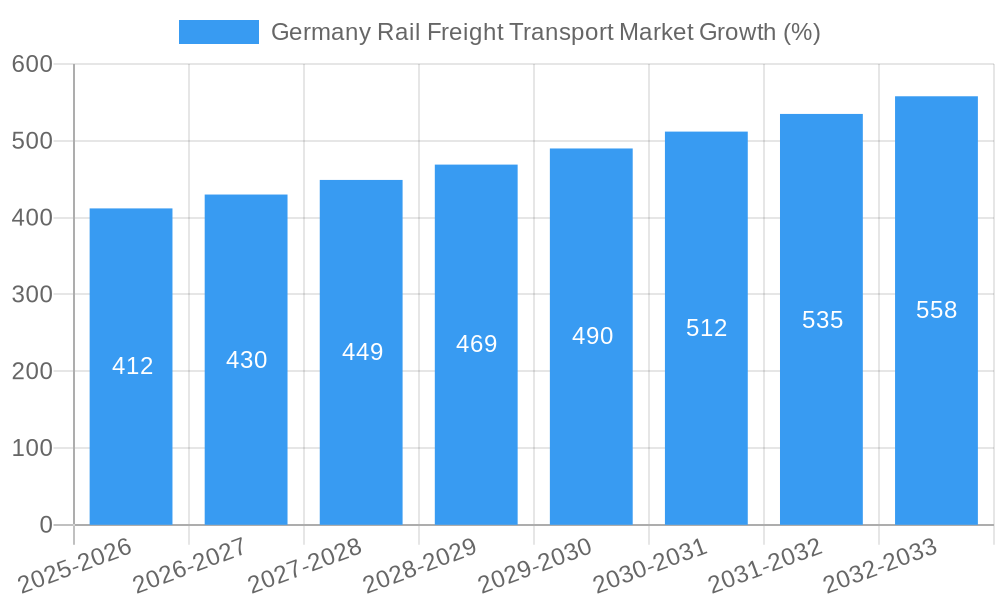

The German rail freight transport market, valued at approximately €X million in 2025 (assuming a reasonable market size based on similar European markets and the provided CAGR), is projected to experience robust growth, exceeding a 4.12% CAGR from 2025 to 2033. This expansion is fueled by several key drivers. Increased emphasis on sustainable transportation solutions within the European Union is pushing businesses to shift from road to rail, reducing carbon emissions and improving logistical efficiency. Furthermore, ongoing infrastructure investments in Germany's rail network, aimed at improving capacity and speed, are facilitating the movement of larger volumes of freight. The growing e-commerce sector and subsequent demand for efficient last-mile delivery solutions also contribute to the market's growth, with intermodal transportation playing a crucial role. However, challenges remain. Competition from road transport, particularly for shorter distances, and potential labor shortages within the rail industry pose significant restraints on market expansion. The market is segmented by service type (transportation, allied services like maintenance and storage), cargo type (containerized, non-containerized, liquid bulk), and destination (domestic, international). Key players like DB Cargo, Concert Logistics, and others operate within this competitive landscape, focusing on various segments to capture market share.

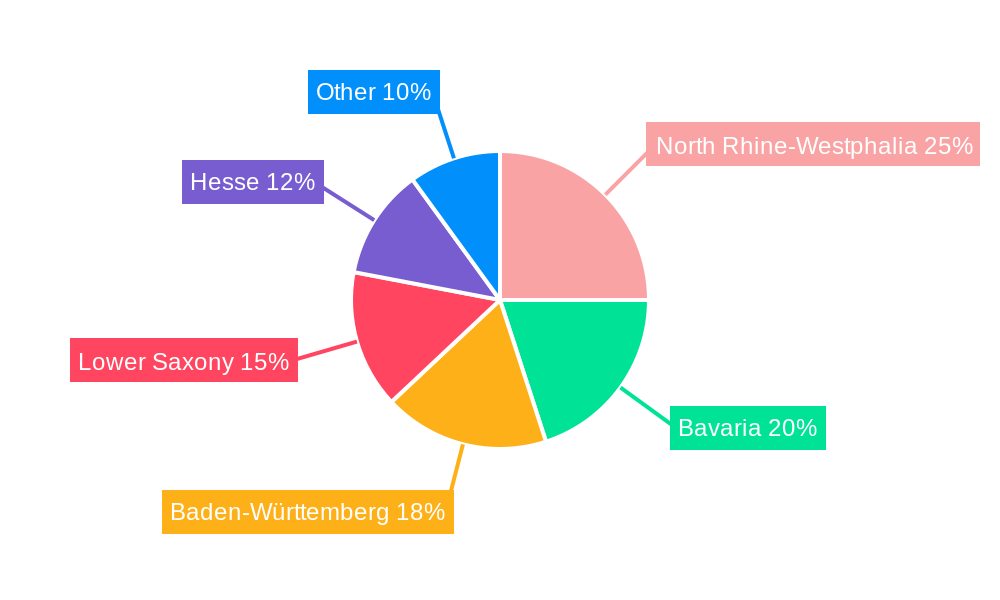

The regional distribution of the market reflects Germany's industrial and economic hubs. North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse are the leading regions, driven by their strong manufacturing sectors and logistical infrastructure. The forecast period (2025-2033) anticipates consistent market growth, though the rate may fluctuate slightly year-to-year based on economic conditions and government policies. The market's future trajectory will largely depend on the continued success of sustainable transportation initiatives, infrastructure development, and the ability of rail freight operators to address operational challenges and offer competitive services. This makes understanding the dynamics within each market segment crucial for stakeholders in the German rail freight sector.

Germany Rail Freight Transport Market: A Comprehensive Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany rail freight transport market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market by service (Transportation, Services Allied to Transportation), cargo type (Containerized, Non-containerized, Liquid Bulk), and destination (Domestic, International), offering granular insights for informed decision-making. Key players like DB Cargo BTT GmbH, Deutsche Bahn AG, and others are profiled, providing a clear picture of the competitive landscape. This report is indispensable for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic market. The market size in 2025 is estimated to be xx Million.

Germany Rail Freight Transport Market Dynamics & Structure

The German rail freight transport market is characterized by a moderate level of concentration, with Deutsche Bahn AG holding a significant market share (estimated at xx% in 2025). However, a competitive landscape exists with numerous smaller players, including DB Cargo BTT GmbH, Concert logistics unirail GmbH, and others vying for market share. Technological innovation is crucial, driven by the need for increased efficiency, automation, and sustainability. Stringent regulatory frameworks govern safety, emissions, and infrastructure access, impacting market dynamics. Substitute modes of transport, such as road and inland waterway transport, present competitive pressure, forcing rail freight providers to constantly adapt. The market shows some evidence of consolidation, with M&A activity (approximately xx deals between 2019-2024, representing xx Million in value) mostly focused on smaller players seeking synergies and improved operational efficiencies. Innovation barriers include high capital expenditures for infrastructure upgrades and new technologies, as well as the need for extensive regulatory approvals.

- Market Concentration: Moderately concentrated, with DB AG holding a significant share (xx% in 2025).

- Technological Innovation: Focus on automation, digitalization, and sustainable solutions.

- Regulatory Framework: Stringent safety and environmental regulations.

- Competitive Substitutes: Road and inland waterway transport.

- M&A Activity: Moderate level of consolidation, with xx deals and xx Million in value (2019-2024).

- Innovation Barriers: High capital expenditure, regulatory hurdles.

Germany Rail Freight Transport Market Growth Trends & Insights

The German rail freight transport market experienced steady growth in the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to factors such as increasing industrial production, e-commerce growth driving demand for containerized freight, and government initiatives promoting rail transport as a more sustainable alternative. However, the COVID-19 pandemic impacted growth temporarily, followed by a subsequent rebound. Technological disruptions, particularly in areas of automation and digital logistics solutions, are accelerating efficiency and reshaping operational models. Consumer behavior shifts, primarily driven by increasing environmental awareness and corporate sustainability goals, are boosting demand for environmentally friendly rail transport options. The forecast period (2025-2033) is projected to witness continued market growth, driven by consistent demand and investment in infrastructure modernization. Market penetration of intermodal transport is expected to reach xx% by 2033, driven by efficiency gains.

Dominant Regions, Countries, or Segments in Germany Rail Freight Transport Market

The Rhine-Ruhr region remains the dominant segment in the German rail freight transport market, driven by its high industrial concentration and extensive rail network infrastructure. Within the service segment, Transportation accounts for the largest share (xx% in 2025), with significant potential for growth in Services Allied to Transportation, spurred by investments in rail infrastructure maintenance and modernization. Containerized cargo, including intermodal transport, is the leading cargo type, driven by increasing e-commerce and global trade. Domestic transport accounts for a larger share compared to international transport due to the strong domestic industrial base, but international transport is also expected to grow at a higher rate.

- Key Growth Drivers:

- Strong industrial base in the Rhine-Ruhr region.

- Government initiatives promoting rail transport.

- Increasing demand for sustainable transport solutions.

- E-commerce growth driving demand for containerized freight.

- Investments in infrastructure modernization.

- Dominant Segments: Rhine-Ruhr region, Transportation services, Containerized cargo, Domestic transport.

Germany Rail Freight Transport Market Product Landscape

The German rail freight transport market is witnessing ongoing innovations in rolling stock, including the introduction of higher-capacity freight wagons and advanced technologies for improved efficiency and safety. Innovative applications include the use of IoT sensors for real-time tracking and predictive maintenance. Performance metrics are focused on reducing transit times, improving on-time delivery, and minimizing environmental impact. Unique selling propositions center on optimized logistics solutions, enhanced tracking capabilities, and commitment to sustainability. Technological advancements are increasing automation, reducing operational costs, and bolstering efficiency.

Key Drivers, Barriers & Challenges in Germany Rail Freight Transport Market

Key Drivers:

- Growing industrial production and e-commerce.

- Government initiatives promoting sustainable transportation.

- Technological advancements enhancing efficiency and safety.

Key Challenges & Restraints:

- High infrastructure investment requirements (estimated at xx Million annually for infrastructure upgrades).

- Competition from road transport (estimated to cost rail xx Million in lost revenue annually due to competition).

- Regulatory complexities and bureaucratic processes (estimated to create xx Million in annual compliance costs).

Emerging Opportunities in Germany Rail Freight Transport Market

Emerging opportunities lie in the increasing adoption of intermodal transport, the growth of last-mile delivery solutions integrated with rail, and the development of specialized transport solutions for specific cargo types (e.g., refrigerated containers). Untapped markets include expanding rail freight connectivity to less-served regions and developing specialized services for the growing renewable energy sector.

Growth Accelerators in the Germany Rail Freight Transport Market Industry

Technological breakthroughs in automation, AI-powered logistics optimization, and sustainable fuel technologies are poised to significantly accelerate market growth. Strategic partnerships between rail operators, logistics providers, and technology companies will further enhance efficiency and innovation. Market expansion strategies focusing on developing rail freight corridors to support emerging industrial hubs and e-commerce logistics centers will be crucial for long-term expansion.

Key Players Shaping the Germany Rail Freight Transport Market Market

- DB Cargo BTT GmbH

- Concert logistics unirail GmbH

- CHS Container Handel GmbH

- Deutsche Bahn AG

- Duomobile GmbH

- DeltaRail GmbH

- EKB Container Logistik

- EKOL Logistik GmbH

- Conro container GmbH

- Container Terminal Dortmund GmbH (CTD)

Notable Milestones in Germany Rail Freight Transport Market Sector

- November 2022: Deutsche Bahn AG (DB) partners with Siemens Mobility to develop a next-generation high-speed train.

- January 2023: Delta Rail launches a new rail freight service between France and Duisburg, Germany.

In-Depth Germany Rail Freight Transport Market Market Outlook

The future of the German rail freight transport market appears bright, driven by sustained demand, government support for sustainable transport, and ongoing technological advancements. Strategic opportunities lie in capitalizing on the growth of e-commerce, developing innovative logistics solutions, and expanding rail connectivity to underserved regions. The market is expected to show a CAGR of xx% during the forecast period (2025-2033), reaching a value of xx Million by 2033. Companies that effectively embrace technological innovation and strategic partnerships are well-positioned to benefit from this significant growth potential.

Germany Rail Freight Transport Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Services

-

2. Cargo Type

- 2.1. Containerized (Includes Intermodal)

- 2.2. Non-containerized

- 2.3. Liquid Bulk

-

3. Destination

- 3.1. Domestic

- 3.2. International

Germany Rail Freight Transport Market Segmentation By Geography

- 1. Germany

Germany Rail Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of digital infrastructure and rise in the number of millennials; Higher internet penetration

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Competition from established brands

- 3.4. Market Trends

- 3.4.1 Rising investment in infrastructure

- 3.4.2 digitalization and modal shift

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Containerized (Includes Intermodal)

- 5.2.2. Non-containerized

- 5.2.3. Liquid Bulk

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North Rhine-Westphalia Germany Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DB Cargo BTT GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Concert logistics unirail GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CHS Container Handel GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Deutsche Bahn AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Duomobile GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DeltaRail GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EKB Container Logistik

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 EKOL Logistik GmbH**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Conro container GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Container Terminal Dortmund GmbH (CTD)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DB Cargo BTT GmbH

List of Figures

- Figure 1: Germany Rail Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Rail Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Rail Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Rail Freight Transport Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Germany Rail Freight Transport Market Revenue Million Forecast, by Cargo Type 2019 & 2032

- Table 4: Germany Rail Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 5: Germany Rail Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Germany Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North Rhine-Westphalia Germany Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Bavaria Germany Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Baden-Württemberg Germany Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Lower Saxony Germany Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Hesse Germany Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Rail Freight Transport Market Revenue Million Forecast, by Service 2019 & 2032

- Table 13: Germany Rail Freight Transport Market Revenue Million Forecast, by Cargo Type 2019 & 2032

- Table 14: Germany Rail Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 15: Germany Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Rail Freight Transport Market?

The projected CAGR is approximately > 4.12%.

2. Which companies are prominent players in the Germany Rail Freight Transport Market?

Key companies in the market include DB Cargo BTT GmbH, Concert logistics unirail GmbH, CHS Container Handel GmbH, Deutsche Bahn AG, Duomobile GmbH, DeltaRail GmbH, EKB Container Logistik, EKOL Logistik GmbH**List Not Exhaustive, Conro container GmbH, Container Terminal Dortmund GmbH (CTD).

3. What are the main segments of the Germany Rail Freight Transport Market?

The market segments include Service, Cargo Type, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of digital infrastructure and rise in the number of millennials; Higher internet penetration.

6. What are the notable trends driving market growth?

Rising investment in infrastructure. digitalization and modal shift.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Competition from established brands.

8. Can you provide examples of recent developments in the market?

January 2023- Delta Rail, a subsidiary of Modalis Group and a French multimodal operator, will launch a new rail freight service between Chalon-sur-Saone in eastern France and Duisburg. The new service will go live on February 28th. It will link the Delta Rail hub in Chalons and the VIIA terminal in Macon, France, to the Rhenania Worms AG terminal in Worms and the Samskip terminal in Duisburg, Germany.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Rail Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Rail Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Rail Freight Transport Market?

To stay informed about further developments, trends, and reports in the Germany Rail Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence