Key Insights

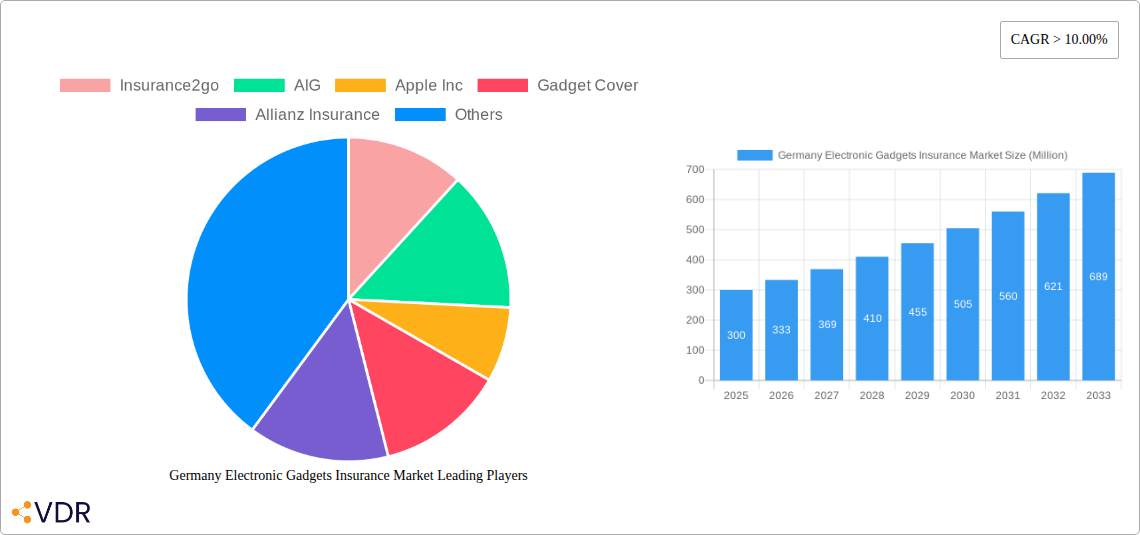

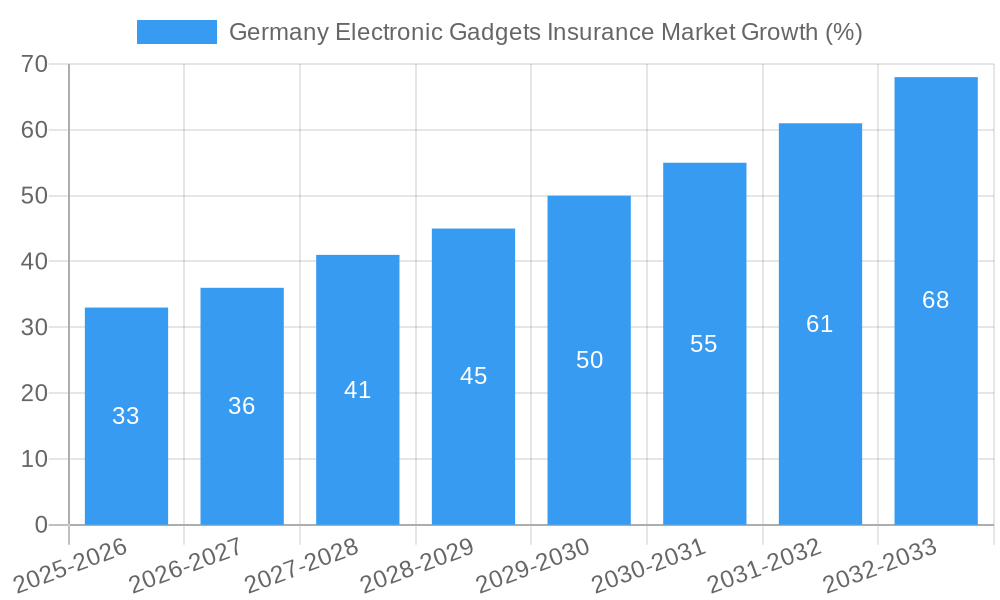

The German electronic gadgets insurance market is experiencing robust growth, fueled by increasing smartphone and wearable device ownership, coupled with rising consumer awareness of the risks associated with gadget damage or theft. The market's Compound Annual Growth Rate (CAGR) exceeding 10% from 2019-2033 signals significant expansion potential. This growth is driven by several key factors: the increasing affordability of electronic gadgets, making them more accessible to a wider population; enhanced insurance product offerings tailored to specific gadget types and customer needs (e.g., bundled home insurance with gadget coverage); and improved digital distribution channels, making it easier to purchase and manage policies online. While the market is relatively mature, emerging trends such as extended warranty programs integrated with insurance and the rise of subscription-based insurance models are further propelling growth. However, competitive pressures from numerous insurers – including established players like Allianz and AIG and newcomers such as Insurance2go and Gadget Cover – could moderate profit margins. Moreover, potential restraints include economic fluctuations impacting consumer spending and the increasing sophistication of gadget repair options that may lessen the demand for insurance. The market segmentation likely includes various coverage levels (basic, comprehensive), device types (smartphones, laptops, tablets, wearables), and customer demographics (age, income). Based on the provided information and general market knowledge, the total market size in 2025 can be conservatively estimated at €300 million (using a range appropriate for the German Market considering comparable markets and the provided CAGR).

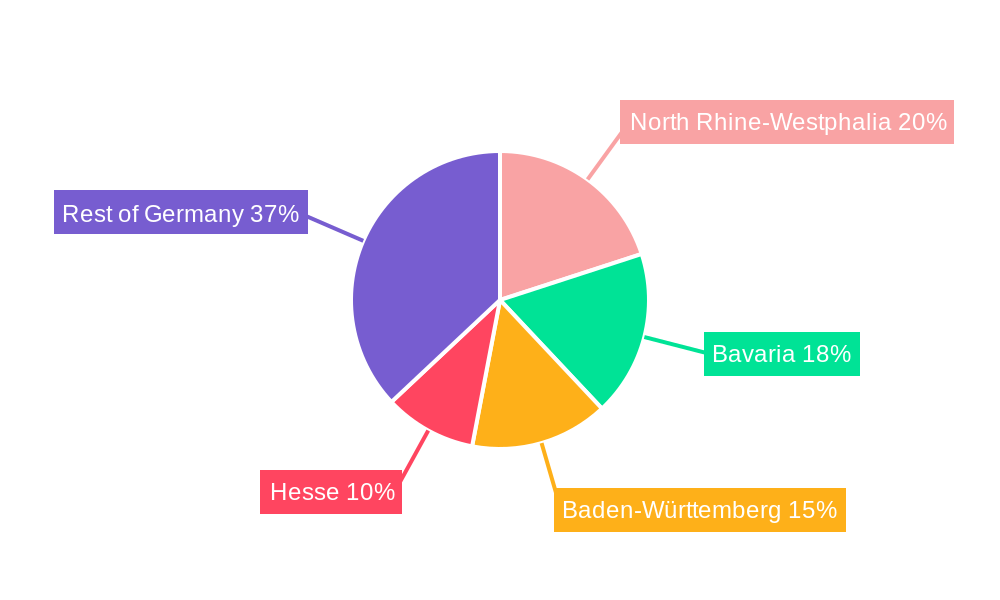

The forecast period (2025-2033) presents opportunities for both established and new entrants to capitalize on the market expansion. Strategic partnerships between insurance providers and electronics retailers could significantly boost market penetration. Furthermore, personalized insurance packages, leveraging data analytics to assess risk profiles, are poised to gain traction. The focus on customer experience, with streamlined claims processes and proactive customer support, will be crucial for differentiating in a competitive landscape. Addressing concerns about data privacy and transparency in insurance policies will also be vital for building trust and long-term sustainability. Regional variations within Germany might exist, reflecting differences in consumer behavior and income levels across different states. Growth could be concentrated in urban areas with higher gadget ownership and awareness of insurance benefits. The market is expected to reach approximately €800 million by 2033 assuming a consistently high CAGR.

Germany Electronic Gadgets Insurance Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Germany Electronic Gadgets Insurance Market, covering market dynamics, growth trends, dominant segments, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is designed for industry professionals, investors, and strategists seeking to understand this dynamic market. The report delves into the parent market of insurance and the child market of electronic gadgets insurance in Germany, offering granular insights into market segmentation and performance. Market values are presented in million units.

Germany Electronic Gadgets Insurance Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the German electronic gadgets insurance sector. The market exhibits a moderate level of concentration, with key players holding significant market share, although a fragmented landscape exists among smaller niche providers. Technological innovation, particularly in claims processing and risk assessment through AI and IoT, is a key driver. The regulatory framework, including data protection laws (GDPR) and consumer protection regulations, significantly influences market operations. Competitive substitutes, such as extended warranties offered by retailers, impact market growth. End-user demographics, especially the increasing adoption of smartphones and other electronic gadgets among younger generations, fuel market expansion.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of market share in 2024.

- Technological Innovation: AI-powered claims processing and IoT-based risk assessment are major drivers.

- Regulatory Framework: GDPR and consumer protection laws influence market practices.

- Competitive Substitutes: Extended warranties offered by retailers pose a competitive threat.

- End-User Demographics: High smartphone penetration amongst younger demographics fuels market growth.

- M&A Trends: xx M&A deals were recorded between 2019 and 2024, indicating a consolidating market.

Germany Electronic Gadgets Insurance Market Growth Trends & Insights

The German electronic gadgets insurance market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. This growth is attributed to increasing smartphone and electronic device ownership, rising consumer awareness of the need for protection against damage and theft, and the introduction of innovative insurance products. Market penetration is estimated at xx% in 2024, with significant potential for future expansion. Technological disruptions, such as the integration of wearable technology into insurance offerings, are transforming the industry. Consumer behavior shifts towards online purchasing and digital engagement also drive growth. The forecast period (2025-2033) projects a CAGR of xx%, leading to a market size of xx million units by 2033. This projection considers factors like increasing disposable income, evolving consumer preferences for digital insurance solutions, and further technological advancements.

Dominant Regions, Countries, or Segments in Germany Electronic Gadgets Insurance Market

The German electronic gadgets insurance market displays robust growth across major urban centers, driven by higher disposable incomes and increased electronic device ownership. The most dominant segment is smartphone insurance, followed by laptop and tablet insurance. Key growth drivers include favorable economic policies promoting digital adoption, well-developed digital infrastructure enabling convenient online insurance purchases, and a rising consumer preference for convenience and protection.

- Key Drivers:

- Higher disposable incomes in urban areas.

- High smartphone and electronic device penetration.

- Favorable economic policies supporting digital adoption.

- Well-developed digital infrastructure for online purchasing.

- Consumer preference for convenient insurance solutions.

- Dominant Regions: Major urban centers like Berlin, Munich, and Hamburg show the highest growth.

Germany Electronic Gadgets Insurance Market Product Landscape

The German market offers a range of electronic gadgets insurance products, including single-device coverage, multi-device plans, and bundled offerings with other insurance products. Products are differentiated by coverage levels ( accidental damage, theft, liquid damage), deductibles, and service features (such as quick repair services). Technological advancements include the use of AI for faster claims processing and real-time risk assessment. Unique selling propositions include bundled offers with device repair services and extended warranties.

Key Drivers, Barriers & Challenges in Germany Electronic Gadgets Insurance Market

Key Drivers: Increasing smartphone penetration, rising consumer awareness of the need for protection, and technological advancements in insurance offerings. The growing trend of online insurance purchasing and the development of innovative insurance products further fuel market expansion.

Challenges: Intense competition from established insurers and emerging tech companies, regulatory complexities related to data privacy and consumer protection, and potential supply chain disruptions impacting repair and replacement services. These challenges can potentially limit market growth.

Emerging Opportunities in Germany Electronic Gadgets Insurance Market

Untapped opportunities exist in expanding insurance coverage to encompass wearables, smart home devices, and other emerging electronic gadgets. Personalized insurance offerings tailored to individual needs and usage patterns represent a promising area. Strategic partnerships with device manufacturers and retailers offer avenues for expanding market reach and distribution.

Growth Accelerators in the Germany Electronic Gadgets Insurance Market Industry

Technological breakthroughs in AI and IoT for claims processing and risk management, coupled with strategic partnerships between insurers and technology companies, are driving substantial growth. Expanding product offerings to include emerging device categories and personalized insurance plans presents significant opportunities.

Key Players Shaping the Germany Electronic Gadgets Insurance Market Market

- Insurance2go

- AIG

- Apple Inc

- Gadget Cover

- Allianz Insurance

- Assurant Inc

- Sunrise

- Switched on Insurance

- Tinhat

- At&T Inc (List Not Exhaustive)

Notable Milestones in Germany Electronic Gadgets Insurance Market Sector

- May 2022: AIG named one of DiversityInc's Top 50 Companies for Diversity.

- April 2022: Assurant Inc. integrates Nationwide's Insurance Verification Digital Product into its HOIVerifySM solution.

In-Depth Germany Electronic Gadgets Insurance Market Market Outlook

The German electronic gadgets insurance market exhibits strong growth potential, driven by technological innovation, increasing consumer awareness, and favorable economic conditions. Strategic partnerships, expansion into new product segments, and the adoption of advanced technologies will shape future market dynamics. The market is poised for significant growth over the forecast period (2025-2033), offering lucrative opportunities for established players and new entrants alike.

Germany Electronic Gadgets Insurance Market Segmentation

-

1. Coverage Type

- 1.1. Physical Damage

- 1.2. Electronic Damage

- 1.3. Data Protection

- 1.4. Virus Protection

- 1.5. Theft Protection

-

2. Device Type

- 2.1. Laptops

- 2.2. Mobile Devices

- 2.3. Cameras

- 2.4. Computers

- 2.5. Tablets

-

3. End User

- 3.1. Corporate

- 3.2. Individual

Germany Electronic Gadgets Insurance Market Segmentation By Geography

- 1. Germany

Germany Electronic Gadgets Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Digitization & Demand for Electronic Gadgets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Electronic Gadgets Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 5.1.1. Physical Damage

- 5.1.2. Electronic Damage

- 5.1.3. Data Protection

- 5.1.4. Virus Protection

- 5.1.5. Theft Protection

- 5.2. Market Analysis, Insights and Forecast - by Device Type

- 5.2.1. Laptops

- 5.2.2. Mobile Devices

- 5.2.3. Cameras

- 5.2.4. Computers

- 5.2.5. Tablets

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Corporate

- 5.3.2. Individual

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Insurance2go

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AIG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Apple Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gadget Cover

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Allianz Insurance

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Assurant Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sunrise

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Switched on Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tinhat

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 At&T Inc **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Insurance2go

List of Figures

- Figure 1: Germany Electronic Gadgets Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Electronic Gadgets Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by Coverage Type 2019 & 2032

- Table 3: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 4: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by Coverage Type 2019 & 2032

- Table 7: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 8: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by End User 2019 & 2032

- Table 9: Germany Electronic Gadgets Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Electronic Gadgets Insurance Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Germany Electronic Gadgets Insurance Market?

Key companies in the market include Insurance2go, AIG, Apple Inc, Gadget Cover, Allianz Insurance, Assurant Inc, Sunrise, Switched on Insurance, Tinhat, At&T Inc **List Not Exhaustive.

3. What are the main segments of the Germany Electronic Gadgets Insurance Market?

The market segments include Coverage Type, Device Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Digitization & Demand for Electronic Gadgets.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In May 2022, for the fifth consecutive year, American International Group, Inc. has been named one of DiversityInc's Top 50 Companies for Diversity, the leading assessment of diversity management in corporate America. AIG has elevated its rank every year since first reaching the Top 50 in 2018 and improved from 37th to 32nd place in 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Electronic Gadgets Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Electronic Gadgets Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Electronic Gadgets Insurance Market?

To stay informed about further developments, trends, and reports in the Germany Electronic Gadgets Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence