Key Insights

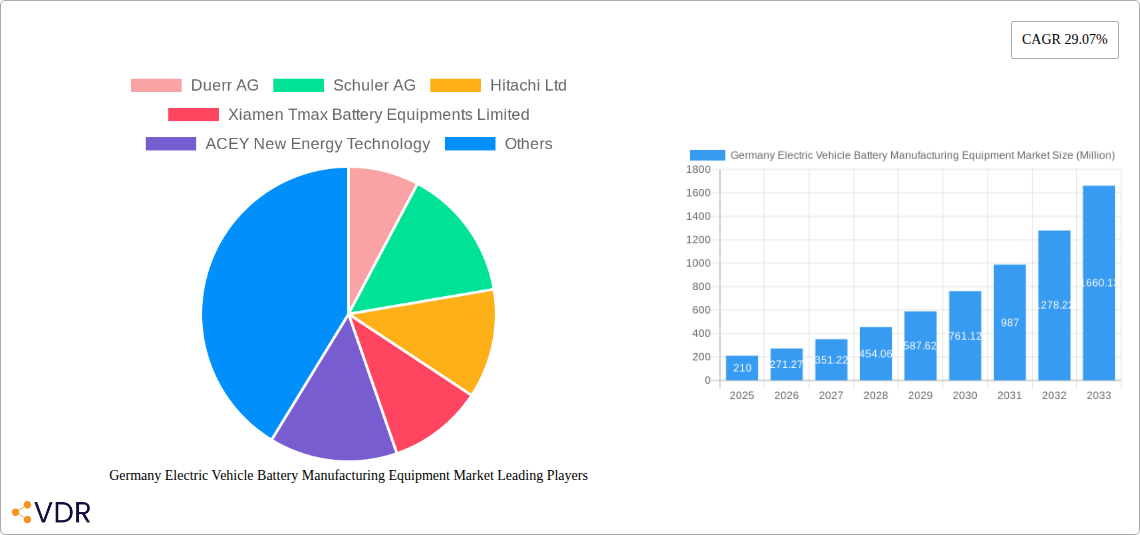

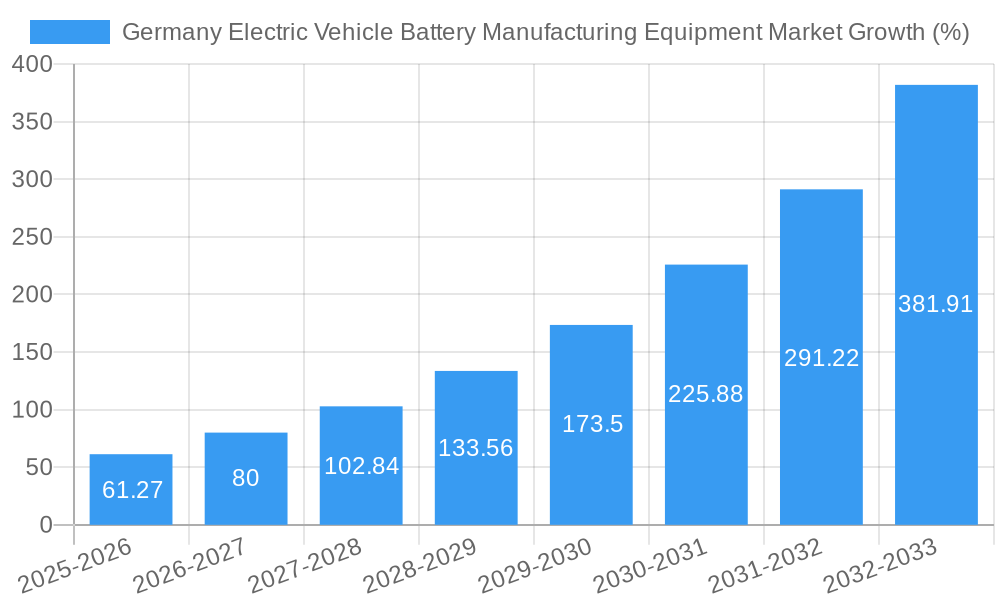

The German electric vehicle (EV) battery manufacturing equipment market is experiencing robust growth, projected to reach €0.21 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 29.07% from 2025 to 2033. This significant expansion is fueled by several key drivers. The German government's strong commitment to electromobility, coupled with substantial investments in domestic battery production, creates a favorable environment for market expansion. Furthermore, the increasing demand for EVs within Germany and across Europe necessitates a parallel surge in battery manufacturing capacity, thereby driving demand for sophisticated and efficient manufacturing equipment. Leading companies like Dürr AG, Schuler AG, and Hitachi Ltd are well-positioned to capitalize on this growth, leveraging their expertise in automation, precision engineering, and advanced materials handling. The market's segmentation likely includes equipment for cell production, module assembly, pack integration, and testing, each experiencing unique growth trajectories based on technological advancements and evolving production processes. Competitive intensity remains high, with both established international players and emerging domestic companies vying for market share. While challenges like supply chain disruptions and potential skill shortages in specialized engineering roles exist, the overall outlook for the German EV battery manufacturing equipment market remains exceptionally positive through 2033, promising substantial returns for investors and significant contributions to Germany's burgeoning EV sector.

The continued growth will be influenced by factors such as advancements in battery technology, particularly solid-state batteries and improvements in energy density, which demand specialized equipment. Government incentives and regulations aimed at fostering domestic battery production and reducing reliance on foreign suppliers will further stimulate market expansion. However, maintaining a competitive edge will require continuous innovation and adaptation to the rapidly changing technological landscape. Companies will need to prioritize Research and Development (R&D) investments, strategic partnerships, and talent acquisition to navigate the intricacies of this dynamic and rapidly growing market. The ability to offer customized solutions and integrated manufacturing lines tailored to the specific needs of battery manufacturers will be crucial for achieving success. Therefore, long-term market success hinges on a commitment to technological leadership, operational efficiency, and strategic adaptation to the evolving requirements of the EV industry.

Germany Electric Vehicle Battery Manufacturing Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany Electric Vehicle (EV) Battery Manufacturing Equipment market, encompassing market dynamics, growth trends, regional insights, and key player strategies. With a focus on the parent market (German EV manufacturing) and the child market (EV battery manufacturing equipment), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are presented in million units.

Germany Electric Vehicle Battery Manufacturing Equipment Market Market Dynamics & Structure

The German EV battery manufacturing equipment market is experiencing significant growth driven by the nation's ambitious EV adoption targets and increasing domestic production of EV batteries. Market concentration is moderate, with several key players competing alongside emerging companies. Technological innovation, particularly in automation and advanced materials processing, is a major driver. Stringent environmental regulations and government incentives further support market expansion. The competitive landscape is characterized by both organic growth and strategic mergers & acquisitions (M&A).

- Market Concentration: Moderate, with a top 5 market share of approximately xx%.

- Technological Innovation: Focus on automation, AI-powered process optimization, and advanced materials handling.

- Regulatory Framework: Supportive government policies and environmental regulations drive adoption.

- Competitive Substitutes: Limited direct substitutes; competition primarily among equipment types and features.

- End-User Demographics: Primarily large-scale battery manufacturers and OEMs.

- M&A Trends: Significant M&A activity observed in recent years, with xx major deals concluded between 2019 and 2024, totaling an estimated value of xx million units.

Germany Electric Vehicle Battery Manufacturing Equipment Market Growth Trends & Insights

The German EV battery manufacturing equipment market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market size is estimated at xx million units in 2025, driven by increasing EV sales and government investments in battery manufacturing. Technological advancements, such as the adoption of solid-state battery technologies, will further stimulate demand. Consumer preferences towards sustainable mobility and the increasing affordability of EVs contribute to this growth. Market penetration for advanced equipment is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Germany Electric Vehicle Battery Manufacturing Equipment Market

The market is concentrated in key industrial regions of Germany, such as Bavaria and Baden-Württemberg, benefiting from established automotive manufacturing clusters and supportive infrastructure. These regions attract significant foreign direct investment and offer access to a skilled workforce.

- Key Drivers: Strong government support for EV manufacturing, readily available skilled labor, existing automotive infrastructure, and strategic location within Europe.

- Dominance Factors: High concentration of battery manufacturers and OEMs, well-developed supply chains, and strong investor confidence.

- Growth Potential: Continued expansion is expected, fueled by the increasing demand for EV batteries and government incentives.

Germany Electric Vehicle Battery Manufacturing Equipment Market Product Landscape

The market encompasses a wide range of equipment, including mixing and blending systems, electrode coating lines, cell assembly and packaging machinery, and testing and quality control systems. Recent innovations focus on improving efficiency, reducing production costs, and enhancing battery performance. Key selling points include automation levels, throughput capacity, and precision.

Key Drivers, Barriers & Challenges in Germany Electric Vehicle Battery Manufacturing Equipment Market

Key Drivers: The burgeoning EV market, government subsidies for domestic battery production, and advancements in battery technology are driving market growth. Stringent environmental regulations in Germany also push the adoption of efficient manufacturing equipment.

Key Barriers & Challenges: High initial investment costs for advanced equipment, potential supply chain disruptions, and intense competition among both established and emerging players pose challenges. These challenges translate to xx% of the market being potentially negatively impacted by supply chain disruptions in 2024.

Emerging Opportunities in Germany Electric Vehicle Battery Manufacturing Equipment Market

Untapped opportunities exist in the development and adoption of equipment for next-generation battery technologies, such as solid-state and lithium-sulfur batteries. The increasing demand for battery recycling equipment also presents a significant growth opportunity. Furthermore, the market can benefit from tailored solutions meeting the unique needs of smaller battery manufacturers.

Growth Accelerators in the Germany Electric Vehicle Battery Manufacturing Equipment Market Industry

Technological breakthroughs in automation and artificial intelligence are key accelerators. Strategic partnerships between equipment manufacturers and battery producers facilitate innovation and market penetration. Expansion into new markets and product diversification strategies will contribute to sustained growth.

Key Players Shaping the Germany Electric Vehicle Battery Manufacturing Equipment Market Market

- Duerr AG

- Schuler AG

- Hitachi Ltd

- Xiamen Tmax Battery Equipments Limited

- ACEY New Energy Technology

- IPG Photonics Corporation

- Wuxi Lead Intelligent Equipment Co Ltd

- Targray Technology International Inc

- Xiamen Lith Machine Limited

- Robert Bosch Manufacturing Solutions GmbH *List Not Exhaustive

Notable Milestones in Germany Electric Vehicle Battery Manufacturing Equipment Sector

- February 2024: Epsilon Advanced Materials (EAM) acquired a lithium-ion phosphate (LFP) cathode active material technology center in Moosburg, Germany. This significantly impacts the upstream supply chain for LFP batteries in Germany.

- July 2023: Epsilon Advanced Materials (EAM) completed the acquisition of a lithium-ion phosphate (LFP) cathode active material technology center in Moosburg, Germany. Similar impact as February 2024, highlighting consistent investment and strategic moves in this sector.

In-Depth Germany Electric Vehicle Battery Manufacturing Equipment Market Market Outlook

The German EV battery manufacturing equipment market holds substantial long-term growth potential. Continued technological advancements, strategic collaborations, and government support will drive further expansion. Companies that leverage automation, develop sustainable solutions, and adapt to evolving battery technologies will be best positioned to capitalize on future opportunities. The focus on circular economy principles and battery recycling will also create niche markets for specialized equipment.

Germany Electric Vehicle Battery Manufacturing Equipment Market Segmentation

-

1. Process

- 1.1. Mixing

- 1.2. Coating

- 1.3. Calendaring

- 1.4. Slitting and Electrode Making

- 1.5. Other Processes

-

2. Battery

- 2.1. Lithium-ion

- 2.2. Lead-acid

- 2.3. Nickel Metal Hydride Battery

- 2.4. Other Batteries

Germany Electric Vehicle Battery Manufacturing Equipment Market Segmentation By Geography

- 1. Germany

Germany Electric Vehicle Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 29.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption of Electric Vehicles4.; Supportive Government Regulations and Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Electric Vehicles4.; Supportive Government Regulations and Policies

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Electric Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Electric Vehicle Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Mixing

- 5.1.2. Coating

- 5.1.3. Calendaring

- 5.1.4. Slitting and Electrode Making

- 5.1.5. Other Processes

- 5.2. Market Analysis, Insights and Forecast - by Battery

- 5.2.1. Lithium-ion

- 5.2.2. Lead-acid

- 5.2.3. Nickel Metal Hydride Battery

- 5.2.4. Other Batteries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Duerr AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Schuler AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xiamen Tmax Battery Equipments Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ACEY New Energy Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IPG Photonics Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wuxi Lead Intelligent Equipment Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Targray Technology International Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Xiamen Lith Machine Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Robert Bosch Manufacturing Solutions GmbH*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysis6 5 List of Other Prominent Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Duerr AG

List of Figures

- Figure 1: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Electric Vehicle Battery Manufacturing Equipment Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Electric Vehicle Battery Manufacturing Equipment Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Process 2019 & 2032

- Table 4: Germany Electric Vehicle Battery Manufacturing Equipment Market Volume Billion Forecast, by Process 2019 & 2032

- Table 5: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Battery 2019 & 2032

- Table 6: Germany Electric Vehicle Battery Manufacturing Equipment Market Volume Billion Forecast, by Battery 2019 & 2032

- Table 7: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Germany Electric Vehicle Battery Manufacturing Equipment Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Process 2019 & 2032

- Table 10: Germany Electric Vehicle Battery Manufacturing Equipment Market Volume Billion Forecast, by Process 2019 & 2032

- Table 11: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Battery 2019 & 2032

- Table 12: Germany Electric Vehicle Battery Manufacturing Equipment Market Volume Billion Forecast, by Battery 2019 & 2032

- Table 13: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Germany Electric Vehicle Battery Manufacturing Equipment Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Electric Vehicle Battery Manufacturing Equipment Market?

The projected CAGR is approximately 29.07%.

2. Which companies are prominent players in the Germany Electric Vehicle Battery Manufacturing Equipment Market?

Key companies in the market include Duerr AG, Schuler AG, Hitachi Ltd, Xiamen Tmax Battery Equipments Limited, ACEY New Energy Technology, IPG Photonics Corporation, Wuxi Lead Intelligent Equipment Co Ltd, Targray Technology International Inc, Xiamen Lith Machine Limited, Robert Bosch Manufacturing Solutions GmbH*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysis6 5 List of Other Prominent Companie.

3. What are the main segments of the Germany Electric Vehicle Battery Manufacturing Equipment Market?

The market segments include Process, Battery.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.21 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption of Electric Vehicles4.; Supportive Government Regulations and Policies.

6. What are the notable trends driving market growth?

Increasing Adoption of Electric Vehicles.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Electric Vehicles4.; Supportive Government Regulations and Policies.

8. Can you provide examples of recent developments in the market?

February 2024: Epsilon Advanced Materials (EAM) completed the acquisition of a lithium-ion phosphate (LFP) cathode active material technology center in Moosburg, Germany. This acquisition positions India as the first Asian country outside China to produce LFP cathode materials. EAM plans to begin constructing its facility in India in 2024, with a large-scale customer qualification plant set to be operational by 2025 and expected to reach a capacity of 100,000 tons by 2030.July 2023: Epsilon Advanced Materials (EAM) completed the acquisition of a lithium-ion phosphate (LFP) cathode active material technology center in Moosburg, Germany. This acquisition positions India as the first Asian country outside of China to produce LFP cathode materials. EAM plans to begin construction of its facility in India in 2024, with a large-scale customer qualification plant set to be operational by 2025 and expected to reach a capacity of 100,000 tons by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Electric Vehicle Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Electric Vehicle Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Electric Vehicle Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the Germany Electric Vehicle Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence