Key Insights

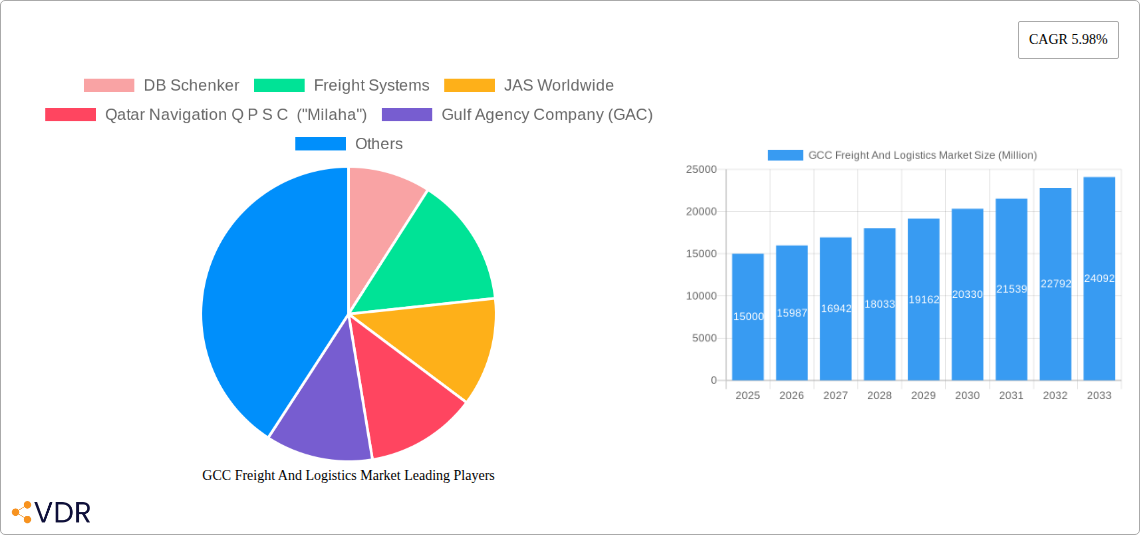

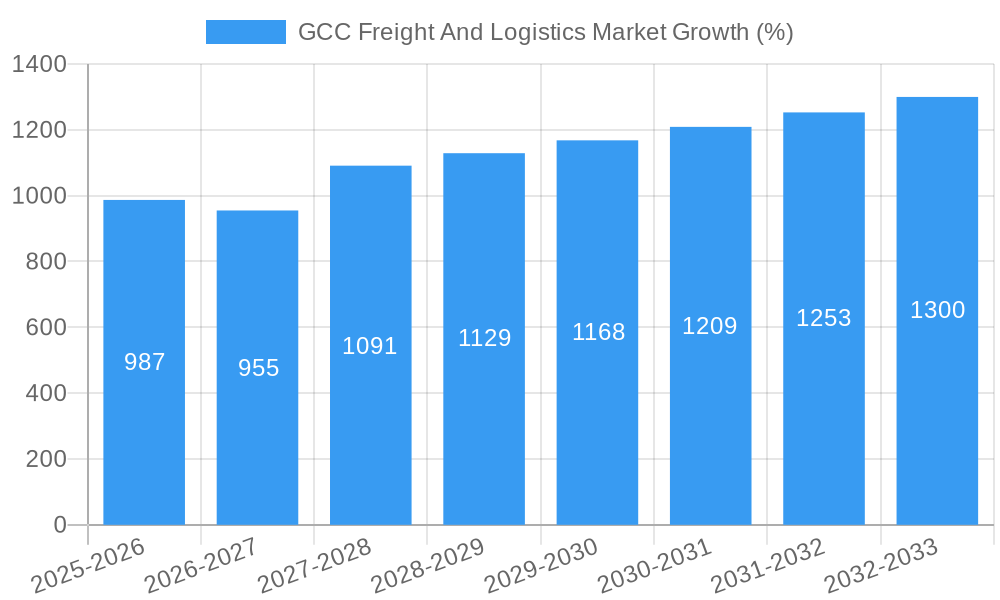

The GCC Freight and Logistics market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 5.98% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector within the GCC is significantly increasing demand for efficient and reliable delivery services, particularly in temperature-controlled logistics for perishable goods. Furthermore, substantial investments in infrastructure projects across the region, including port expansions and improved road networks, are enhancing logistics efficiency and attracting further investment. Government initiatives promoting diversification of economies and increased trade are also contributing to market growth. Growth is particularly strong in the Courier, Express, and Parcel (CEP) segment, driven by the rising popularity of online shopping. The Oil and Gas, Construction, and Manufacturing sectors remain significant end-users, consistently requiring efficient freight and logistics solutions for raw materials and finished goods. However, challenges remain, including fluctuating oil prices, which can impact overall economic activity and transportation costs. Geopolitical stability also plays a crucial role; sustained peace and stability will be vital for continued market expansion. Competition within the market is intense, with both large multinational players and regional companies vying for market share. The continued investment in technology, particularly in areas like digitalization and automation, will shape the future of the market, leading to enhanced efficiency and cost-effectiveness.

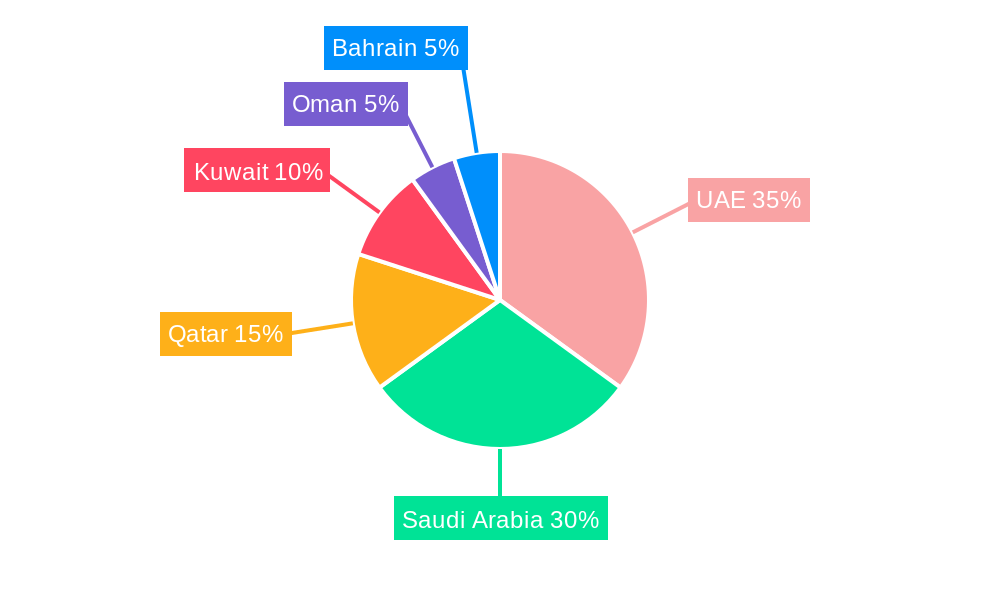

The segmentation of the GCC freight and logistics market reveals a diverse landscape. The UAE and Saudi Arabia currently hold the largest market shares, reflecting their advanced infrastructure and economic activity. However, other GCC nations are also witnessing significant growth, driven by government investments and improving connectivity. The temperature-controlled segment is expected to see above-average growth due to the increasing demand for the safe transport of pharmaceuticals and food products. Looking ahead, the market is expected to witness increased consolidation through mergers and acquisitions, as companies strive to enhance their service offerings and gain a competitive edge. Sustainable practices, such as the adoption of fuel-efficient vehicles and eco-friendly packaging, are also gaining traction, reflecting a growing awareness of environmental concerns. The focus will shift towards integrated logistics solutions that offer end-to-end visibility and traceability, enhancing transparency and efficiency across the entire supply chain.

GCC Freight and Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the GCC freight and logistics market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, growth trends, key players, and future opportunities across the UAE, Saudi Arabia, Qatar, and the Rest of GCC. The report segments the market by end-user industry (Agriculture, Fishing & Forestry, Construction, Manufacturing, Oil & Gas, Mining & Quarrying, Wholesale & Retail Trade, Others) and logistics function (Courier, Express & Parcel (CEP), Temperature Controlled, Other Services). The market size is presented in Million units.

GCC Freight and Logistics Market Market Dynamics & Structure

The GCC freight and logistics market is characterized by moderate concentration, with a few large players alongside numerous smaller, specialized firms. Technological innovation, particularly in areas like automation, digitization, and sustainable logistics, is a key driver. Stringent regulatory frameworks, aimed at improving efficiency and safety, influence market operations. Competitive pressures from substitute services (e.g., e-commerce delivery networks) are growing. End-user demographics show a shift towards e-commerce, influencing demand for last-mile delivery solutions. The market has witnessed a moderate level of M&A activity in recent years, driven by consolidation and expansion strategies.

- Market Concentration: Moderately concentrated, with the top 5 players holding an estimated xx% market share in 2025.

- Technological Innovation: Significant investments in automation (e.g., robotics, AI), digitalization (e.g., blockchain, IoT), and sustainable solutions (e.g., electric vehicles).

- Regulatory Landscape: Stringent regulations on safety, security, and environmental compliance.

- M&A Activity: An estimated xx M&A deals in the last 5 years, primarily driven by consolidation and expansion into new segments.

- Innovation Barriers: High initial investment costs for new technologies, lack of skilled workforce, and data security concerns.

GCC Freight and Logistics Market Growth Trends & Insights

The GCC freight and logistics market is experiencing robust growth, driven by expanding e-commerce, increasing industrial activity, and government initiatives supporting infrastructure development. The market size is projected to reach xx Million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of autonomous vehicles and drone delivery, are reshaping logistics operations. Consumer behavior shifts towards online shopping and faster delivery expectations are further fueling market expansion.

(Note: The XXX mentioned in the prompt needs to be replaced with the data source used to create this analysis).

Dominant Regions, Countries, or Segments in GCC Freight and Logistics Market

The UAE and Saudi Arabia are the dominant markets within the GCC, accounting for approximately xx% and xx% of the total market share in 2025, respectively. Their strong economies, extensive infrastructure, and strategic locations contribute to their dominance. Within end-user industries, Manufacturing and Wholesale & Retail Trade are the largest segments, driven by high industrial output and the flourishing e-commerce sector. Within logistics functions, Courier, Express & Parcel (CEP) and Temperature Controlled services show significant growth potential.

- Key Drivers for UAE & Saudi Arabia:

- Robust economic growth and diversification strategies.

- Significant investments in transportation infrastructure (ports, airports, roads).

- Government initiatives to boost the logistics sector (e.g., Saudi Vision 2030).

- Key Drivers for Manufacturing and Wholesale & Retail Trade:

- Increased industrial production and manufacturing output.

- Explosive growth of e-commerce and online retail.

- Growing demand for efficient and reliable delivery services.

GCC Freight and Logistics Market Product Landscape

The GCC freight and logistics market showcases a diverse range of products and services, encompassing traditional freight forwarding, warehousing, and distribution alongside emerging technologies such as autonomous vehicles and drone delivery. These innovations offer improved efficiency, reduced costs, and enhanced tracking capabilities. Companies are increasingly focusing on value-added services like customized solutions, real-time tracking, and temperature-controlled transportation to gain a competitive edge.

Key Drivers, Barriers & Challenges in GCC Freight And Logistics Market

Key Drivers:

- Expanding e-commerce sector driving demand for last-mile delivery.

- Government investments in infrastructure development.

- Rising industrialization and manufacturing activity.

- Focus on supply chain optimization and efficiency improvements.

Key Challenges:

- Competition from international and regional players.

- Fluctuations in global fuel prices and their impact on transportation costs.

- Skill gaps and shortage of qualified logistics professionals.

- Dependence on road transportation and associated traffic congestion issues. This results in an estimated xx% increase in delivery times and xx Million units in lost revenue annually.

Emerging Opportunities in GCC Freight And Logistics Market

- Growth of the e-commerce sector presents significant opportunities for last-mile delivery and specialized logistics solutions.

- Increasing demand for sustainable and environmentally friendly logistics practices creates opportunities for green logistics providers.

- Development of smart logistics solutions using IoT, AI, and big data analytics presents opportunities for technology providers.

Growth Accelerators in the GCC Freight and Logistics Market Industry

The long-term growth of the GCC freight and logistics market is fueled by several factors. Technological advancements such as the integration of artificial intelligence and the Internet of Things for efficient route optimization and real-time tracking are key. Strategic partnerships between logistics providers and e-commerce companies further enhance market growth. Furthermore, continued government investments in infrastructure development and initiatives supporting logistics sector growth play a crucial role in accelerating market expansion.

Key Players Shaping the GCC Freight and Logistics Market Market

- DB Schenker

- Freight Systems

- JAS Worldwide

- Qatar Navigation Q P S C ("Milaha")

- Gulf Agency Company (GAC)

- DHL Group

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Saudi Post- SPL (including Naqel Express)

- Almajdouie

- Gulf Warehousing Company (GWC)

- Bahri

- Jenae Logistics LLC

- Al-Futtaim Logistics

- Kuehne + Nagel

- Flow Progressive Logistics

- Masstrans Freight LLC

- Al Madina Logistics

- Wared Logistic

- Hala Supply Chain Services

- SA Talke

- SMSA Express

- Elite Co

- Mac World Logistic LLC

- Asyad

- Aramex

- Sharaf Group

- Saudi Transport & Investment Co (Mubarrad)

- Globelink West Star Shipping LLC

- DP World

- RAK Logistics

Notable Milestones in GCC Freight and Logistics Market Sector

- March 2024: Aramex inaugurated a new regional office in Riyadh, Saudi Arabia, strengthening its presence and contributing to Saudi Vision 2030 logistics goals.

- March 2024: Aramex introduced a fleet of electric motorcycles in the UAE, advancing its sustainability initiatives and aiming for a 98% EV fleet by 2030.

- January 2024: Kuehne + Nagel launched its Book & Claim insetting solution for electric vehicles, enhancing its decarbonization offerings.

In-Depth GCC Freight and Logistics Market Market Outlook

The future of the GCC freight and logistics market appears bright, driven by sustained economic growth, infrastructure development, and technological innovation. Opportunities abound in e-commerce logistics, sustainable solutions, and the integration of advanced technologies. Strategic partnerships and investments in human capital will be crucial for companies seeking to capitalize on the market's immense potential. The market is poised for continued expansion, with significant opportunities for growth and innovation in the coming years.

GCC Freight And Logistics Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

GCC Freight And Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Freight And Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America GCC Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Logistics Function

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.2.1.1. By Destination Type

- 6.2.1.1.1. Domestic

- 6.2.1.1.2. International

- 6.2.1.1. By Destination Type

- 6.2.2. Freight Forwarding

- 6.2.2.1. By Mode Of Transport

- 6.2.2.1.1. Air

- 6.2.2.1.2. Sea and Inland Waterways

- 6.2.2.1.3. Others

- 6.2.2.1. By Mode Of Transport

- 6.2.3. Freight Transport

- 6.2.3.1. Pipelines

- 6.2.3.2. Rail

- 6.2.3.3. Road

- 6.2.4. Warehousing and Storage

- 6.2.4.1. By Temperature Control

- 6.2.4.1.1. Non-Temperature Controlled

- 6.2.4.1. By Temperature Control

- 6.2.5. Other Services

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America GCC Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Logistics Function

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.2.1.1. By Destination Type

- 7.2.1.1.1. Domestic

- 7.2.1.1.2. International

- 7.2.1.1. By Destination Type

- 7.2.2. Freight Forwarding

- 7.2.2.1. By Mode Of Transport

- 7.2.2.1.1. Air

- 7.2.2.1.2. Sea and Inland Waterways

- 7.2.2.1.3. Others

- 7.2.2.1. By Mode Of Transport

- 7.2.3. Freight Transport

- 7.2.3.1. Pipelines

- 7.2.3.2. Rail

- 7.2.3.3. Road

- 7.2.4. Warehousing and Storage

- 7.2.4.1. By Temperature Control

- 7.2.4.1.1. Non-Temperature Controlled

- 7.2.4.1. By Temperature Control

- 7.2.5. Other Services

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe GCC Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Logistics Function

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.2.1.1. By Destination Type

- 8.2.1.1.1. Domestic

- 8.2.1.1.2. International

- 8.2.1.1. By Destination Type

- 8.2.2. Freight Forwarding

- 8.2.2.1. By Mode Of Transport

- 8.2.2.1.1. Air

- 8.2.2.1.2. Sea and Inland Waterways

- 8.2.2.1.3. Others

- 8.2.2.1. By Mode Of Transport

- 8.2.3. Freight Transport

- 8.2.3.1. Pipelines

- 8.2.3.2. Rail

- 8.2.3.3. Road

- 8.2.4. Warehousing and Storage

- 8.2.4.1. By Temperature Control

- 8.2.4.1.1. Non-Temperature Controlled

- 8.2.4.1. By Temperature Control

- 8.2.5. Other Services

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa GCC Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Logistics Function

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.2.1.1. By Destination Type

- 9.2.1.1.1. Domestic

- 9.2.1.1.2. International

- 9.2.1.1. By Destination Type

- 9.2.2. Freight Forwarding

- 9.2.2.1. By Mode Of Transport

- 9.2.2.1.1. Air

- 9.2.2.1.2. Sea and Inland Waterways

- 9.2.2.1.3. Others

- 9.2.2.1. By Mode Of Transport

- 9.2.3. Freight Transport

- 9.2.3.1. Pipelines

- 9.2.3.2. Rail

- 9.2.3.3. Road

- 9.2.4. Warehousing and Storage

- 9.2.4.1. By Temperature Control

- 9.2.4.1.1. Non-Temperature Controlled

- 9.2.4.1. By Temperature Control

- 9.2.5. Other Services

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific GCC Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Logistics Function

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.2.1.1. By Destination Type

- 10.2.1.1.1. Domestic

- 10.2.1.1.2. International

- 10.2.1.1. By Destination Type

- 10.2.2. Freight Forwarding

- 10.2.2.1. By Mode Of Transport

- 10.2.2.1.1. Air

- 10.2.2.1.2. Sea and Inland Waterways

- 10.2.2.1.3. Others

- 10.2.2.1. By Mode Of Transport

- 10.2.3. Freight Transport

- 10.2.3.1. Pipelines

- 10.2.3.2. Rail

- 10.2.3.3. Road

- 10.2.4. Warehousing and Storage

- 10.2.4.1. By Temperature Control

- 10.2.4.1.1. Non-Temperature Controlled

- 10.2.4.1. By Temperature Control

- 10.2.5. Other Services

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Freight Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JAS Worldwide

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Qatar Navigation Q P S C ("Milaha")

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gulf Agency Company (GAC)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DHL Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Saudi Post- SPL (including Naqel Express)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Almajdouie

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gulf Warehousing Company (GWC)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bahri

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Jenae Logistics LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Al-Futtaim Logistics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Kuehne + Nagel

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Flow Progressive Logistics

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Masstrans Freight LLC

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Al Madina Logistics

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Wared Logistic

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Hala Supply Chain Services

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 SA Talke

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 SMSA Express

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Elite Co

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Mac World Logistic LLC

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Asyad

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Aramex

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Sharaf Group

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Saudi Transport & Investment Co (Mubarrad)

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Globelink West Star Shipping LLC

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 DP World

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 RAK Logistics

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global GCC Freight And Logistics Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America GCC Freight And Logistics Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 3: North America GCC Freight And Logistics Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 4: North America GCC Freight And Logistics Market Revenue (Million), by Logistics Function 2024 & 2032

- Figure 5: North America GCC Freight And Logistics Market Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 6: North America GCC Freight And Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America GCC Freight And Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America GCC Freight And Logistics Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 9: South America GCC Freight And Logistics Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 10: South America GCC Freight And Logistics Market Revenue (Million), by Logistics Function 2024 & 2032

- Figure 11: South America GCC Freight And Logistics Market Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 12: South America GCC Freight And Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 13: South America GCC Freight And Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe GCC Freight And Logistics Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 15: Europe GCC Freight And Logistics Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 16: Europe GCC Freight And Logistics Market Revenue (Million), by Logistics Function 2024 & 2032

- Figure 17: Europe GCC Freight And Logistics Market Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 18: Europe GCC Freight And Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe GCC Freight And Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa GCC Freight And Logistics Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 21: Middle East & Africa GCC Freight And Logistics Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 22: Middle East & Africa GCC Freight And Logistics Market Revenue (Million), by Logistics Function 2024 & 2032

- Figure 23: Middle East & Africa GCC Freight And Logistics Market Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 24: Middle East & Africa GCC Freight And Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa GCC Freight And Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific GCC Freight And Logistics Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 27: Asia Pacific GCC Freight And Logistics Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 28: Asia Pacific GCC Freight And Logistics Market Revenue (Million), by Logistics Function 2024 & 2032

- Figure 29: Asia Pacific GCC Freight And Logistics Market Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 30: Asia Pacific GCC Freight And Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific GCC Freight And Logistics Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global GCC Freight And Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global GCC Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Global GCC Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Global GCC Freight And Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global GCC Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: Global GCC Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 7: Global GCC Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global GCC Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: Global GCC Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 13: Global GCC Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global GCC Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 18: Global GCC Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 19: Global GCC Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global GCC Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 30: Global GCC Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 31: Global GCC Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global GCC Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 39: Global GCC Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 40: Global GCC Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific GCC Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Freight And Logistics Market?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the GCC Freight And Logistics Market?

Key companies in the market include DB Schenker, Freight Systems, JAS Worldwide, Qatar Navigation Q P S C ("Milaha"), Gulf Agency Company (GAC), DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Saudi Post- SPL (including Naqel Express), Almajdouie, Gulf Warehousing Company (GWC), Bahri, Jenae Logistics LLC, Al-Futtaim Logistics, Kuehne + Nagel, Flow Progressive Logistics, Masstrans Freight LLC, Al Madina Logistics, Wared Logistic, Hala Supply Chain Services, SA Talke, SMSA Express, Elite Co, Mac World Logistic LLC, Asyad, Aramex, Sharaf Group, Saudi Transport & Investment Co (Mubarrad), Globelink West Star Shipping LLC, DP World, RAK Logistics.

3. What are the main segments of the GCC Freight And Logistics Market?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

March 2024: Aramex had strengthened its presence in Saudi Arabia with the inauguration of a new regional office in Riyadh, to significantly enhance Aramex's capabilities to serve new and existing businesses across the region and also to boost the Kingdom's logistics infrastructure and to contribute to the Vision 2030 goal of establishing Saudi Arabia as a global logistics hub.March 2024: Aramex had introduced a fleet of fully electric motorcycles to its last-mile delivery vehicles in the United Arab Emirates (UAE). This initiative is part of Aramex’s long-term strategic goal to achieve a total fleet of 98% Electric Vehicles (EVs) by 2030, aligned with Science Based Targets initiative (SBTi) target that Aramex is committed to. The e-bikes were introduced after intensive testing of several different models and manufacturers, and Aramex finalized the selected model based on its enduring performance and stability, particularly in local weather conditions.January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Freight And Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Freight And Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Freight And Logistics Market?

To stay informed about further developments, trends, and reports in the GCC Freight And Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence