Key Insights

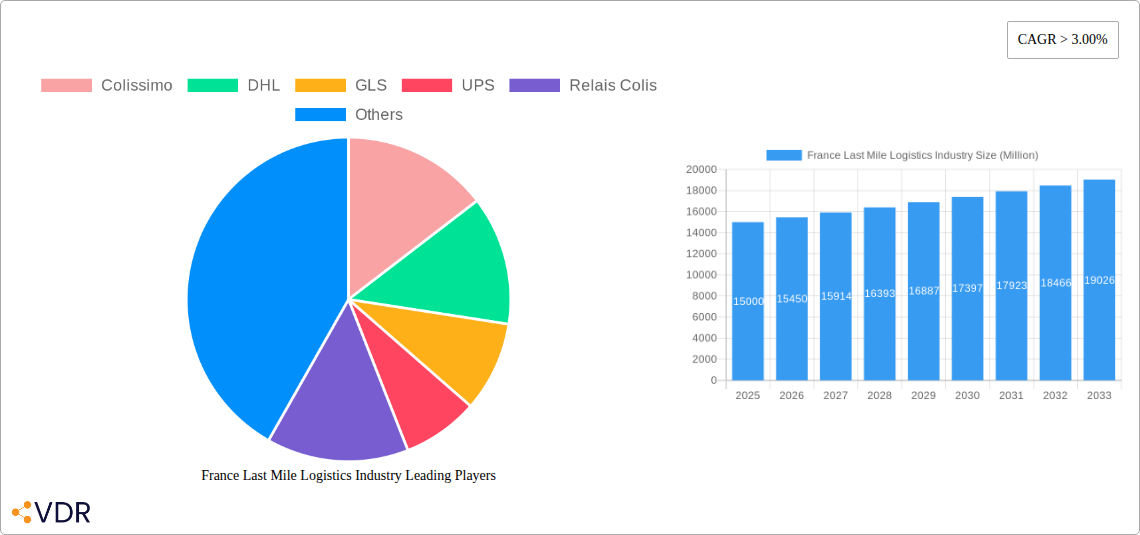

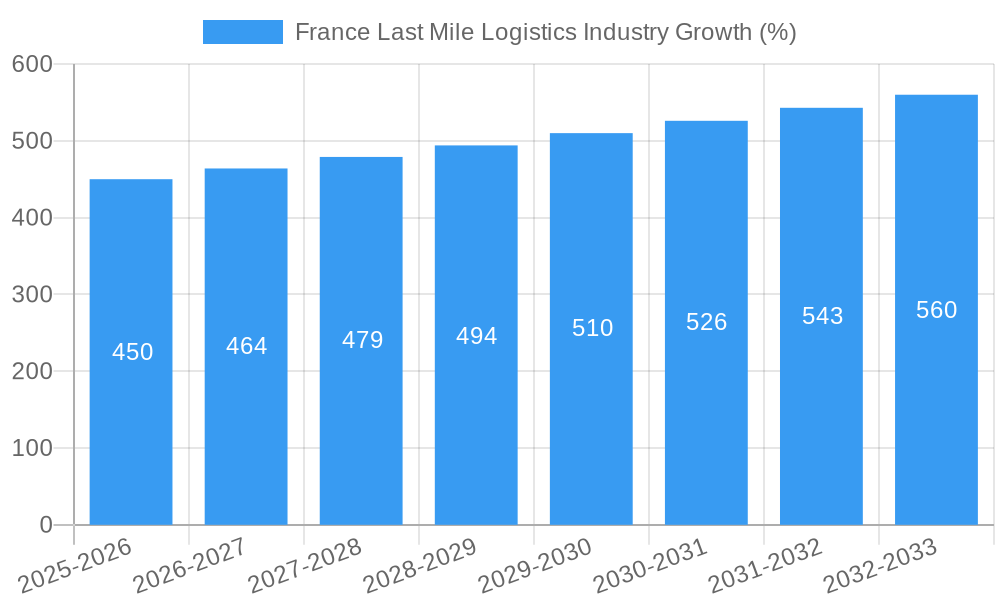

The French last-mile logistics market, valued at approximately €15 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) exceeding 3% through 2033. This expansion is driven by several key factors. The burgeoning e-commerce sector in France fuels a significant demand for efficient and reliable last-mile delivery solutions. Consumers increasingly expect faster and more convenient delivery options, including same-day and evening delivery, putting pressure on logistics providers to innovate and invest in advanced technologies. Furthermore, the growth of omnichannel retailing, where customers interact with businesses across multiple channels, necessitates seamless last-mile integration to meet diverse fulfillment needs. The rise of sustainable delivery practices, including electric vehicle fleets and optimized routing algorithms, also contributes to market growth, as businesses prioritize environmental responsibility. Competitive pressures among established players like Colissimo, DHL, FedEx, and DPD, alongside the emergence of innovative startups, further stimulate market dynamism.

However, the French last-mile logistics market also faces challenges. Rising fuel costs and labor shortages exert pressure on operating margins. Congestion in urban areas, particularly in major cities like Paris, complicates efficient delivery and increases delivery times. Furthermore, maintaining high levels of service quality while managing cost pressures presents an ongoing challenge for logistics providers. The increasing demand for specialized delivery services, such as temperature-controlled transport for pharmaceuticals or bulky goods delivery, requires adaptation and investment in specialized infrastructure and expertise. The successful navigation of these challenges will be crucial for continued market growth and profitability for companies operating within this dynamic sector. Segmentation analysis reveals that the B2C segment currently dominates, fueled by e-commerce growth, but the B2B sector is also expected to show significant expansion driven by increasing supply chain demands.

France Last Mile Logistics Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the France last mile logistics industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for businesses operating in or considering entry into the French last mile delivery market, encompassing both the parent market (Logistics) and the child market (Last Mile Delivery). We forecast a xx Million unit market size in 2025, representing a significant opportunity for strategic players.

France Last Mile Logistics Industry Market Dynamics & Structure

This section analyzes the structure and dynamics of the French last mile logistics market, considering market concentration, technological advancements, regulatory landscapes, competitive substitutes, and end-user demographics. We examine the impact of mergers and acquisitions (M&A) activities, providing both qualitative and quantitative insights.

- Market Concentration: The French last mile logistics market exhibits a moderately concentrated structure, with key players like Colissimo, DHL, GLS, UPS, and FedEx holding significant market share. However, smaller niche players and regional operators also contribute significantly. We estimate that the top 5 players account for approximately xx% of the market in 2025.

- Technological Innovation: Drivers include automation (robotics, AI), IoT-enabled tracking, and the increasing adoption of delivery optimization software. Barriers include high initial investment costs and the need for robust integration with existing systems.

- Regulatory Framework: Regulations related to data privacy (GDPR), emissions standards, and delivery timeframes significantly impact operational strategies. Changes in legislation consistently require adaptation and compliance.

- Competitive Product Substitutes: The emergence of crowdsourced delivery services and alternative transportation modes (e.g., e-bikes, cargo drones) are altering the competitive landscape.

- End-User Demographics: The market is fueled by the growth of e-commerce, particularly in B2C and C2C segments, shaping demand for speed, convenience, and diverse delivery options.

- M&A Trends: The past five years have seen xx M&A deals in the French last mile logistics sector, primarily focused on expanding service areas and acquiring specialized technologies.

France Last Mile Logistics Industry Growth Trends & Insights

This section analyzes the historical (2019-2024) and projected (2025-2033) growth of the France last mile logistics industry using data from XXX. We delve into market size evolution, adoption rates of new technologies, technological disruptions, and evolving consumer behavior.

The French last mile logistics market has experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024), driven primarily by the surge in e-commerce. We project a CAGR of xx% during the forecast period (2025-2033). The increasing preference for same-day and next-day delivery options is a major factor influencing market growth. Technological disruptions, such as the adoption of autonomous vehicles and drone delivery, are expected to accelerate growth further. Shifting consumer behavior towards online shopping, personalized delivery experiences, and heightened expectations for transparency are also contributing to this growth. Market penetration of last-mile delivery services is anticipated to reach xx% by 2033.

Dominant Regions, Countries, or Segments in France Last Mile Logistics Industry

This section identifies the leading regions/segments (B2B, B2C, C2C) driving market growth within France.

- Dominant Segment: The B2C segment is the largest and fastest-growing segment, owing to the booming e-commerce sector and increasing consumer demand for convenient delivery options. It holds approximately xx% of the market share in 2025. The B2B segment, though smaller, is also exhibiting significant growth, driven by supply chain optimization initiatives across various industries. C2C is a growing segment, fueled by peer-to-peer marketplaces and online resale platforms.

- Key Drivers:

- Strong e-commerce growth, particularly in urban areas.

- Government initiatives promoting digitalization and logistics infrastructure development.

- Increased consumer demand for faster and more convenient delivery options.

- Development of specialized logistics solutions tailored to different industries.

France Last Mile Logistics Industry Product Landscape

The French last mile logistics industry is characterized by a wide range of services, including standard delivery, express delivery, same-day delivery, and specialized handling for fragile or temperature-sensitive goods. Technological advancements are driving innovation, with the integration of real-time tracking systems, delivery optimization software, and autonomous delivery vehicles becoming increasingly prevalent. Companies are also focusing on developing unique selling propositions such as sustainable delivery options and enhanced customer communication capabilities.

Key Drivers, Barriers & Challenges in France Last Mile Logistics Industry

Key Drivers: The increasing penetration of e-commerce, government support for logistics infrastructure, and technological advancements such as automated sorting facilities and route optimization software are key drivers. The rising demand for same-day and next-day delivery is also pushing market growth.

Key Challenges & Restraints: High labor costs, congestion in urban areas, and the need to comply with increasingly stringent environmental regulations pose significant challenges. Competition is intense, with established players and new entrants vying for market share. Supply chain disruptions, particularly during peak seasons, can also impact delivery performance. We estimate that these challenges reduce the potential market growth by xx% annually.

Emerging Opportunities in France Last Mile Logistics Industry

Emerging opportunities include the expansion of micro-fulfillment centers to reduce delivery times, the growing adoption of drone delivery for remote areas, and the increasing demand for sustainable and eco-friendly delivery solutions. The development of innovative last-mile solutions tailored to specific customer segments, such as elderly or disabled individuals, also presents significant opportunities.

Growth Accelerators in the France Last Mile Logistics Industry

Technological breakthroughs in automation, artificial intelligence, and data analytics are key growth catalysts. Strategic partnerships between logistics providers and e-commerce platforms are streamlining operations and enhancing delivery efficiency. Expansion into underserved markets and the development of specialized services for specific industries will further drive growth.

Key Players Shaping the France Last Mile Logistics Industry Market

- Colissimo

- DHL (DHL)

- GLS (GLS)

- UPS (UPS)

- Relais Colis

- FedEx (FedEx)

- DPD (DPD)

- XPO Logistics (XPO Logistics)

- Mondial Relay

- Chronospost

Notable Milestones in France Last Mile Logistics Industry Sector

- 2021: Increased investment in electric vehicle fleets by major players.

- 2022: Launch of several micro-fulfillment centers in major cities.

- 2023: Implementation of new regulations related to sustainable delivery practices.

- 2024: Significant increase in the use of AI-powered route optimization software.

In-Depth France Last Mile Logistics Industry Market Outlook

The French last mile logistics market is poised for continued strong growth, driven by e-commerce expansion, technological innovation, and supportive government policies. Strategic opportunities exist for companies that can leverage technology to optimize delivery operations, offer sustainable solutions, and provide personalized customer experiences. We forecast significant market expansion in the coming years, creating attractive investment opportunities for both established players and new entrants.

France Last Mile Logistics Industry Segmentation

-

1. Service Type

- 1.1. Business-to-Business (B2B)

- 1.2. Business-to-Consumer (B2C)

- 1.3. Customer-to-Consumer (C2C)

France Last Mile Logistics Industry Segmentation By Geography

- 1. France

France Last Mile Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services

- 3.4. Market Trends

- 3.4.1. Biggest challenges in last mile delivery

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Last Mile Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Business-to-Business (B2B)

- 5.1.2. Business-to-Consumer (B2C)

- 5.1.3. Customer-to-Consumer (C2C)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Colissimo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GLS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UPS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Relais Colis

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DPD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 XPO Logistics**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mondial Relay

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Chronospost

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Colissimo

List of Figures

- Figure 1: France Last Mile Logistics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Last Mile Logistics Industry Share (%) by Company 2024

List of Tables

- Table 1: France Last Mile Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Last Mile Logistics Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: France Last Mile Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: France Last Mile Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: France Last Mile Logistics Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 6: France Last Mile Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Last Mile Logistics Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the France Last Mile Logistics Industry?

Key companies in the market include Colissimo, DHL, GLS, UPS, Relais Colis, FedEx, DPD, XPO Logistics**List Not Exhaustive, Mondial Relay, Chronospost.

3. What are the main segments of the France Last Mile Logistics Industry?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China.

6. What are the notable trends driving market growth?

Biggest challenges in last mile delivery.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Last Mile Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Last Mile Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Last Mile Logistics Industry?

To stay informed about further developments, trends, and reports in the France Last Mile Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence