Key Insights

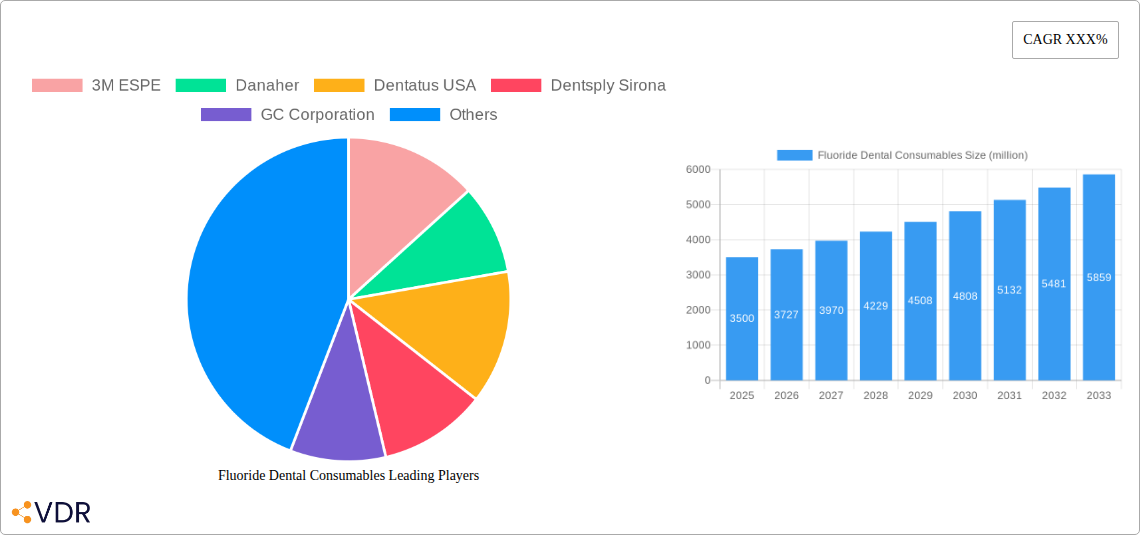

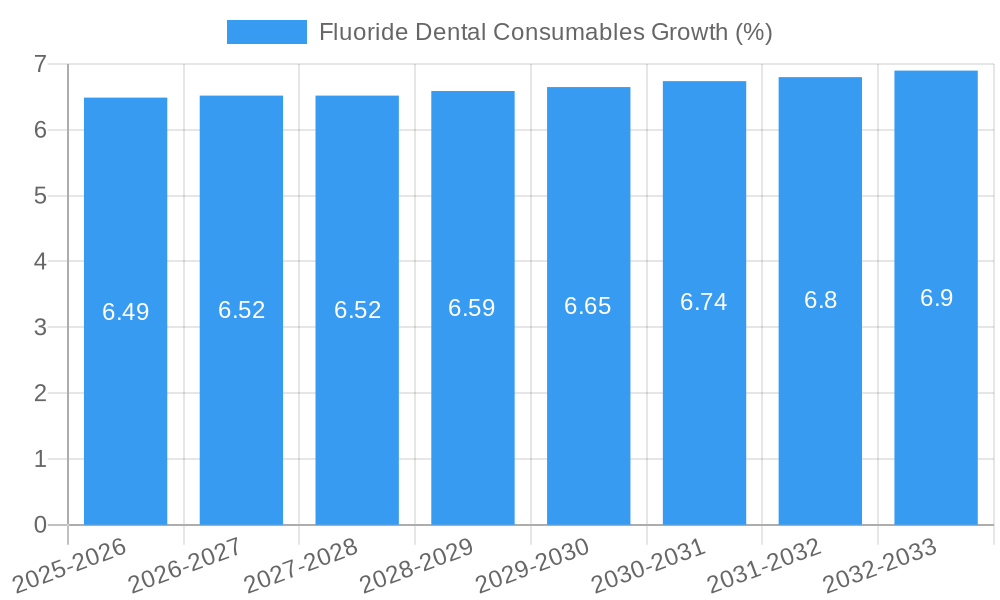

The global Fluoride Dental Consumables market is projected to experience substantial growth, driven by an increasing awareness of oral hygiene and preventive dental care. With an estimated market size of approximately $3.5 billion in 2025, the market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of around 6.5% over the forecast period of 2025-2033. This robust growth is fueled by several key factors, including the rising prevalence of dental caries, a growing demand for professional dental treatments, and the continuous innovation in fluoride-delivery systems offering enhanced efficacy and patient compliance. Dental hospitals and clinics are expected to remain the dominant application segment, accounting for a significant share due to the routine use of fluoride varnishes, rinses, and topical gels in professional settings. Furthermore, the increasing integration of advanced fluoride formulations and the expansion of dental insurance coverage are poised to further propel market expansion.

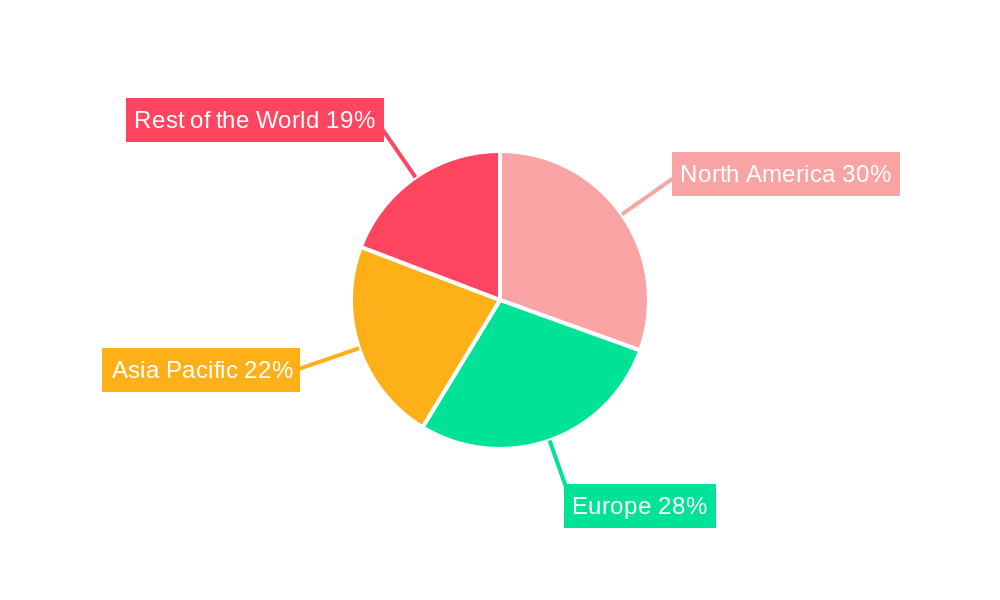

The market is characterized by a diverse range of products, with topical gels and varnishes holding a significant share, appealing to both professional and consumer-based applications. While the market benefits from strong drivers, certain restraints such as the fluctuating cost of raw materials and stringent regulatory approvals for new product formulations could pose challenges. However, the increasing adoption of fluoride treatments in academic and research institutions, coupled with a growing emphasis on oral health in emerging economies, presents lucrative opportunities. Key players are actively engaged in research and development, focusing on creating novel and user-friendly fluoride consumables. Regions like North America and Europe currently lead the market, attributed to well-established healthcare infrastructures and high disposable incomes. However, the Asia Pacific region is expected to witness the fastest growth, driven by a burgeoning middle class, improving access to dental care, and increasing investments in dental infrastructure.

Fluoride Dental Consumables Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the global Fluoride Dental Consumables market, covering historical trends, current dynamics, and future projections. With a study period spanning from 2019 to 2033 and a base year of 2025, this report delves into market structure, growth drivers, regional dominance, product innovations, key challenges, emerging opportunities, and the strategic landscape of leading industry players. Leveraging high-traffic keywords and detailed segment analysis, this report is optimized for SEO and designed to engage industry professionals seeking actionable insights. The report presents all quantitative values in million units.

Fluoride Dental Consumables Market Dynamics & Structure

The global Fluoride Dental Consumables market is characterized by a moderate to high market concentration, with a few key players dominating the landscape. Technological innovation remains a primary driver, propelled by advancements in fluoride delivery systems and formulation efficacy, aiming to enhance caries prevention and remineralization. The regulatory framework, driven by health organizations and dental associations, plays a crucial role in dictating product approvals and market access, influencing product development and adoption rates. Competitive product substitutes, though limited in direct efficacy for comprehensive caries prevention, include alternative remineralization agents and advanced oral hygiene practices. End-user demographics are shifting towards a greater awareness of preventive dentistry, particularly among aging populations and parents seeking early childhood caries prevention. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, gain market share, and enhance technological capabilities.

- Market Concentration: Dominated by a blend of large multinational corporations and specialized niche players.

- Technological Innovation Drivers: Focus on sustained release fluoride, bioavailable formulations, and ease of application.

- Regulatory Frameworks: Stringent approvals by FDA, EMA, and other national health authorities, impacting product launches.

- Competitive Product Substitutes: Sealants, high-fluoride toothpaste (prescription-based), and xylitol-based products.

- End-User Demographics: Growing demand from pediatric dentistry, geriatric care, and individuals with high caries risk.

- M&A Trends: Strategic acquisitions to broaden product offerings and expand geographical reach.

- Innovation Barriers: High R&D costs, lengthy regulatory approval processes, and the need for robust clinical validation.

Fluoride Dental Consumables Growth Trends & Insights

The Fluoride Dental Consumables market is projected to witness significant growth driven by a confluence of factors including increasing global prevalence of dental caries, rising oral health awareness, and an expanding healthcare infrastructure. The market size is estimated to grow from $1,250 million in 2019 to an anticipated $2,100 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 4.5% during the forecast period of 2025–2033. Adoption rates for fluoride-based preventive treatments are steadily increasing as dental professionals and patients recognize their efficacy in reducing tooth decay. Technological disruptions are emerging in the form of novel fluoride delivery systems, such as microencapsulated fluoride and bioadhesive formulations, offering enhanced patient compliance and prolonged therapeutic effects. Consumer behavior shifts are also playing a pivotal role, with a growing preference for minimally invasive preventive procedures and a proactive approach to oral health maintenance, extending beyond basic hygiene to professional treatments. The increasing emphasis on public health initiatives and the integration of fluoride treatments into routine dental check-ups are further bolstering market penetration. The global market for fluoride dental consumables is expected to reach $1,780 million in the estimated year of 2025.

Dominant Regions, Countries, or Segments in Fluoride Dental Consumables

The North America region is anticipated to be a dominant force in the global Fluoride Dental Consumables market, driven by a highly developed healthcare infrastructure, high disposable incomes, and a strong emphasis on preventive dental care. The United States, in particular, is a key contributor due to its extensive network of dental hospitals and clinics, robust research and development activities, and a large patient pool with a high demand for advanced dental treatments. The Application segment of Dental Hospitals and Clinics is expected to lead market growth, accounting for approximately 65% of the total market share. This dominance is attributed to the widespread availability of fluoride treatments as standard practice during patient visits, coupled with a growing preference for professional preventive interventions. The Type segment of Topical Gel is also a significant contributor, valued at approximately $550 million in 2025, due to its ease of application, cost-effectiveness, and proven efficacy in caries prevention.

- Dominant Region: North America, with the United States as a leading country.

- Key Drivers in North America:

- Advanced dental healthcare infrastructure.

- High disposable income and healthcare spending.

- Strong emphasis on preventive dentistry and public health campaigns.

- Presence of major market players and R&D hubs.

- Leading Application Segment: Dental Hospitals and Clinics, driven by routine preventive care and increasing patient awareness.

- Significant Type Segment: Topical Gel, due to its widespread use, affordability, and clinical effectiveness.

- Market Share (Application): Dental Hospitals and Clinics (approx. 65%), Dental Academic and Research Institutions (approx. 20%), Forensic Laboratory (approx. 5%), Others (approx. 10%).

- Market Share (Type): Varnish (approx. 30%), Rinsing (approx. 15%), Topical Gel (approx. 40%), Others (approx. 15%).

- Growth Potential: Significant opportunities in emerging economies due to increasing dental awareness and access to care.

Fluoride Dental Consumables Product Landscape

The product landscape of Fluoride Dental Consumables is characterized by continuous innovation focused on enhancing therapeutic efficacy and patient experience. Key product developments include advanced varnish formulations offering sustained fluoride release, bioadhesive gels that adhere to tooth surfaces for prolonged protection, and low-concentration fluoride rinses for daily preventive care. Innovations are also geared towards improving palatability and reducing the risk of fluorosis in pediatric populations. Performance metrics are centered on caries reduction rates, remineralization potential, and patient compliance. Unique selling propositions often lie in the specific fluoride compounds used (e.g., sodium fluoride, stannous fluoride, amine fluoride), their concentration, and the delivery system's ability to ensure optimal contact and retention time.

Key Drivers, Barriers & Challenges in Fluoride Dental Consumables

Key Drivers: The growth of the Fluoride Dental Consumables market is primarily propelled by the escalating global prevalence of dental caries, a persistent oral health concern. Increasing public awareness regarding preventive dental care and the proven efficacy of fluoride treatments in combating tooth decay are significant market boosters. Furthermore, a growing aging population, which is more susceptible to root caries, and rising healthcare expenditures globally are contributing to market expansion. Technological advancements in formulation and delivery systems are also key drivers, offering improved patient compliance and therapeutic outcomes.

Key Barriers & Challenges: Significant challenges include the stringent regulatory approval processes that can delay product launches and increase R&D costs. Supply chain disruptions, particularly for raw materials and specialized components, can impact production and availability, as observed during recent global events. Competitive pressures from alternative preventive measures, although not direct substitutes for robust caries prevention, require continuous product differentiation. Concerns regarding potential overexposure to fluoride and the risk of fluorosis, especially in younger age groups, necessitate careful product formulation and professional guidance, acting as a restraint.

Emerging Opportunities in Fluoride Dental Consumables

Emerging opportunities in the Fluoride Dental Consumables market lie in the development of novel, patient-friendly delivery systems for home-use prophylaxis and enhanced professional application. There is a significant untapped market in developing regions where oral health awareness and access to professional dental care are increasing. Innovative applications, such as fluoride-releasing dental materials that integrate preventive properties into restorative treatments, present a promising avenue. Evolving consumer preferences for personalized oral care solutions and demand for products with aesthetic benefits (e.g., stain removal alongside fluoride protection) also represent growing opportunities.

Growth Accelerators in the Fluoride Dental Consumables Industry

Several catalysts are accelerating long-term growth in the Fluoride Dental Consumables industry. Technological breakthroughs in material science are enabling the development of fluoride materials with superior bioactivity and sustained release properties. Strategic partnerships between manufacturers and dental associations are crucial for disseminating best practices and promoting widespread adoption of fluoride treatments. Market expansion strategies targeting underserved populations and geographical regions, coupled with the integration of fluoride consumables into comprehensive dental health programs, are significant growth accelerators. The increasing focus on oral-microbiome research may also unveil new avenues for fluoride-based interventions.

Key Players Shaping the Fluoride Dental Consumables Market

- 3M ESPE

- Danaher

- Dentatus USA

- Dentsply Sirona

- GC Corporation

- Zimmer Biomet Holdings

- Institut Straumann AG

- Ivoclar Vivadent

- Mitsui Chemicals

- Shofu

- Ultradent Products

- VOCO GmbH

- Young Innovations

Notable Milestones in Fluoride Dental Consumables Sector

- 2019: Launch of new high-fluoride varnish formulations with improved taste profiles.

- 2020: Increased demand for home-use fluoride rinses and gels due to public health measures.

- 2021: significant M&A activity as larger companies acquired specialized fluoride consumable producers.

- 2022: Introduction of bioadhesive fluoride gels for prolonged tooth surface protection.

- 2023: Development of novel fluoride delivery systems for pediatric patients with enhanced safety features.

- 2024: Increased research into the synergistic effects of fluoride with other oral care ingredients.

In-Depth Fluoride Dental Consumables Market Outlook

The future outlook for the Fluoride Dental Consumables market is highly positive, driven by sustained growth accelerators such as continuous technological innovation in delivery systems and formulations. Strategic partnerships and market expansion into emerging economies will further bolster market penetration. The increasing global focus on preventive healthcare, coupled with a growing understanding of the critical role of fluoride in combating dental caries across all age groups, will create substantial future market potential. Key strategic opportunities lie in developing personalized oral care solutions, integrating fluoride treatments into comprehensive dental management protocols, and leveraging advancements in biomaterials for enhanced therapeutic outcomes.

Fluoride Dental Consumables Segmentation

-

1. Application

- 1.1. Dental Hospitals and Clinics

- 1.2. Dental Academic and Research Institutions

- 1.3. Forensic Laboratory

- 1.4. Others

-

2. Type

- 2.1. Varnish

- 2.2. Rinsing

- 2.3. Topical Gel

- 2.4. Others

Fluoride Dental Consumables Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fluoride Dental Consumables REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fluoride Dental Consumables Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Dental Hospitals and Clinics

- 5.1.2. Dental Academic and Research Institutions

- 5.1.3. Forensic Laboratory

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Varnish

- 5.2.2. Rinsing

- 5.2.3. Topical Gel

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fluoride Dental Consumables Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Dental Hospitals and Clinics

- 6.1.2. Dental Academic and Research Institutions

- 6.1.3. Forensic Laboratory

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Varnish

- 6.2.2. Rinsing

- 6.2.3. Topical Gel

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Fluoride Dental Consumables Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Dental Hospitals and Clinics

- 7.1.2. Dental Academic and Research Institutions

- 7.1.3. Forensic Laboratory

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Varnish

- 7.2.2. Rinsing

- 7.2.3. Topical Gel

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Fluoride Dental Consumables Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Dental Hospitals and Clinics

- 8.1.2. Dental Academic and Research Institutions

- 8.1.3. Forensic Laboratory

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Varnish

- 8.2.2. Rinsing

- 8.2.3. Topical Gel

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Fluoride Dental Consumables Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Dental Hospitals and Clinics

- 9.1.2. Dental Academic and Research Institutions

- 9.1.3. Forensic Laboratory

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Varnish

- 9.2.2. Rinsing

- 9.2.3. Topical Gel

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Fluoride Dental Consumables Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Dental Hospitals and Clinics

- 10.1.2. Dental Academic and Research Institutions

- 10.1.3. Forensic Laboratory

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Varnish

- 10.2.2. Rinsing

- 10.2.3. Topical Gel

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 3M ESPE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Danaher

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dentatus USA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dentsply Sirona

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GC Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zimmer Biomet Holdings

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Institut Straumann AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ivoclar Vivadent

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mitsui Chemicals

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shofu

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ultradent Products

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 VOCO GmbH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Young Innovations

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 3M ESPE

List of Figures

- Figure 1: Global Fluoride Dental Consumables Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Fluoride Dental Consumables Revenue (million), by Application 2024 & 2032

- Figure 3: North America Fluoride Dental Consumables Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Fluoride Dental Consumables Revenue (million), by Type 2024 & 2032

- Figure 5: North America Fluoride Dental Consumables Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Fluoride Dental Consumables Revenue (million), by Country 2024 & 2032

- Figure 7: North America Fluoride Dental Consumables Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fluoride Dental Consumables Revenue (million), by Application 2024 & 2032

- Figure 9: South America Fluoride Dental Consumables Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Fluoride Dental Consumables Revenue (million), by Type 2024 & 2032

- Figure 11: South America Fluoride Dental Consumables Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Fluoride Dental Consumables Revenue (million), by Country 2024 & 2032

- Figure 13: South America Fluoride Dental Consumables Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Fluoride Dental Consumables Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Fluoride Dental Consumables Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Fluoride Dental Consumables Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Fluoride Dental Consumables Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Fluoride Dental Consumables Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Fluoride Dental Consumables Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Fluoride Dental Consumables Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Fluoride Dental Consumables Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Fluoride Dental Consumables Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Fluoride Dental Consumables Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Fluoride Dental Consumables Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Fluoride Dental Consumables Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Fluoride Dental Consumables Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Fluoride Dental Consumables Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Fluoride Dental Consumables Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Fluoride Dental Consumables Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Fluoride Dental Consumables Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Fluoride Dental Consumables Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fluoride Dental Consumables Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Fluoride Dental Consumables Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Fluoride Dental Consumables Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Fluoride Dental Consumables Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Fluoride Dental Consumables Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Fluoride Dental Consumables Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Fluoride Dental Consumables Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Fluoride Dental Consumables Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Fluoride Dental Consumables Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Fluoride Dental Consumables Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Fluoride Dental Consumables Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Fluoride Dental Consumables Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Fluoride Dental Consumables Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Fluoride Dental Consumables Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Fluoride Dental Consumables Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Fluoride Dental Consumables Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Fluoride Dental Consumables Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Fluoride Dental Consumables Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Fluoride Dental Consumables Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Fluoride Dental Consumables Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fluoride Dental Consumables?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Fluoride Dental Consumables?

Key companies in the market include 3M ESPE, Danaher, Dentatus USA, Dentsply Sirona, GC Corporation, Zimmer Biomet Holdings, Institut Straumann AG, Ivoclar Vivadent, Mitsui Chemicals, Shofu, Ultradent Products, VOCO GmbH, Young Innovations.

3. What are the main segments of the Fluoride Dental Consumables?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fluoride Dental Consumables," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fluoride Dental Consumables report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fluoride Dental Consumables?

To stay informed about further developments, trends, and reports in the Fluoride Dental Consumables, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence