Key Insights

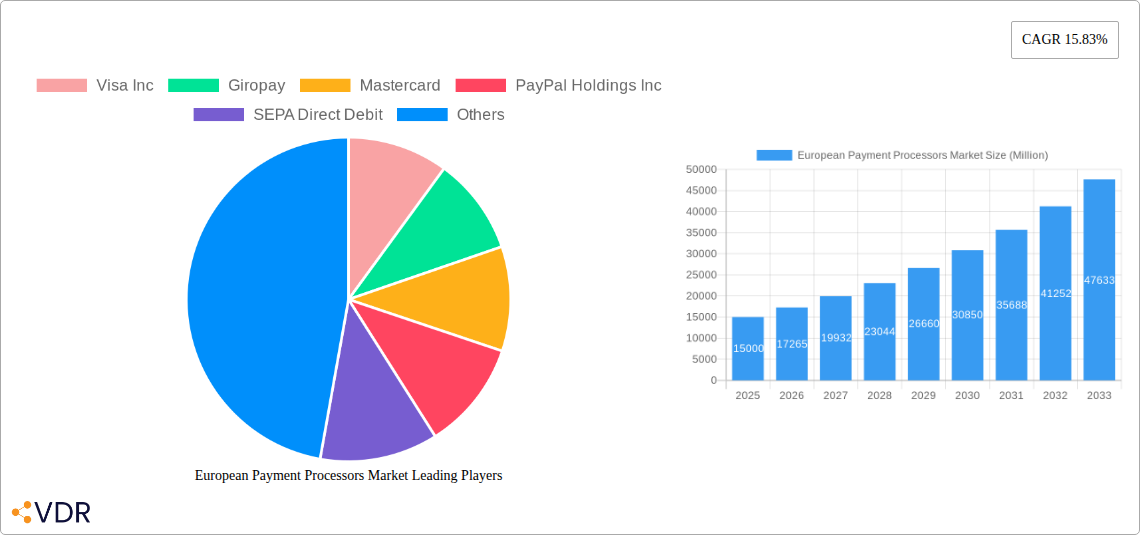

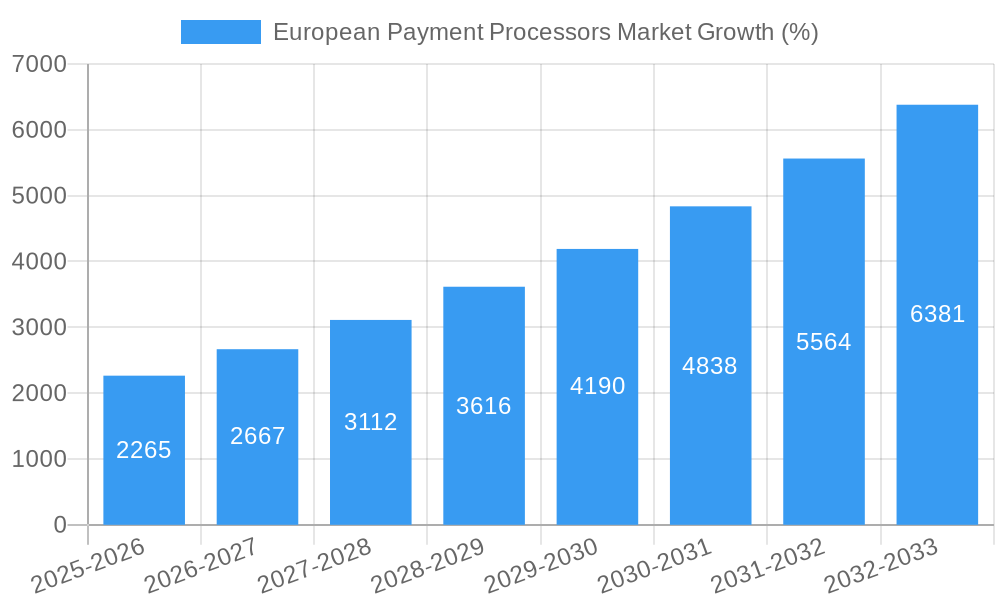

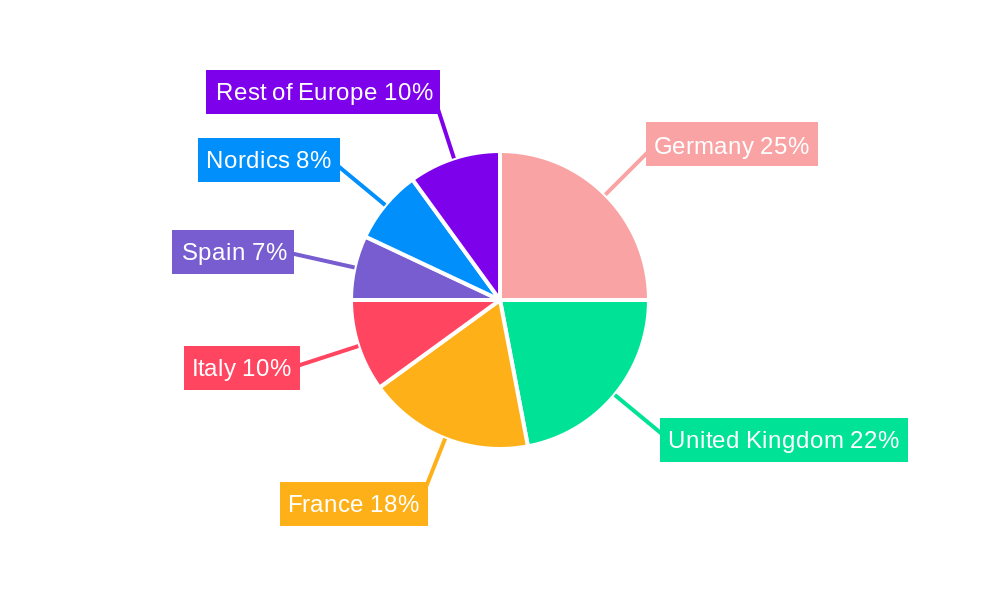

The European payment processors market is experiencing robust growth, projected to reach a substantial size driven by the increasing adoption of digital payment methods and the expanding e-commerce sector. A compound annual growth rate (CAGR) of 15.83% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several key factors. The rising popularity of online shopping across various sectors, including retail, entertainment, and healthcare, is a major driver. Furthermore, the increasing penetration of smartphones and the expanding reach of high-speed internet access are facilitating the shift towards digital payments. Technological advancements such as mobile wallets, contactless payments, and improved security measures further contribute to the market's expansion. Regional variations exist, with Germany, the United Kingdom, and France leading the market due to their advanced digital infrastructure and high consumer adoption rates. However, growth is also anticipated in other regions, such as the Nordics and Eastern Europe, as digital financial inclusion progresses. The market is segmented by payment mode (Point of Sale, Online Sales), end-user industry (Retail, Entertainment, Healthcare, Hospitality), and country, allowing for targeted market penetration strategies. Competition is fierce amongst established players like Visa, Mastercard, and PayPal, alongside regional specialists such as Giropay, Bancontact, and iDEAL, creating a dynamic and innovative market landscape.

The market's future growth will be influenced by several factors. Regulations impacting data privacy and security will continue to shape industry practices. The increasing demand for seamless and secure payment experiences will drive innovation in areas such as biometric authentication and fraud prevention. Moreover, the emergence of new technologies like blockchain and cryptocurrencies could potentially disrupt the existing payment ecosystem. Addressing consumer concerns regarding data security and promoting financial literacy will be crucial for sustained market expansion. The market's segmentation strategy provides opportunities for specialized services tailored to specific industry needs and customer preferences, further fueling competitive growth and market diversification. Competition will remain intense, with companies focusing on strategic partnerships, acquisitions, and technological advancements to maintain a competitive edge.

European Payment Processors Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European Payment Processors Market, covering the period 2019-2033. It delves into market dynamics, growth trends, dominant segments, key players, and emerging opportunities, offering invaluable insights for industry professionals, investors, and strategists. The report segments the market by country (United Kingdom, Germany, France, Spain, Italy, Nordics, Rest of Europe), payment mode (Point of Sale, Online Sale), and end-user industry (Retail, Entertainment, Healthcare, Hospitality, Others). The market size is presented in Million units.

European Payment Processors Market Market Dynamics & Structure

The European payment processors market is characterized by a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration is relatively high, with major players like Visa Inc, Mastercard, and PayPal Holdings Inc holding significant market share. However, the landscape is increasingly competitive with the emergence of fintech companies and niche players catering to specific segments. Technological innovation, driven by advancements in mobile payments, digital wallets, and open banking, is a key driver. Regulatory frameworks, such as PSD2 (Payment Services Directive 2) and GDPR (General Data Protection Regulation), significantly impact market operations and security standards. The rise of digital payments is creating a shift away from traditional methods, leading to a competitive landscape where both established players and new entrants are vying for market dominance. M&A activity is prevalent, as larger firms seek to consolidate their position and expand their service offerings. The increasing adoption of contactless payments further propels this shift.

- Market Concentration: High, with top players holding xx% market share in 2024.

- Technological Innovation: Key drivers include mobile payments, digital wallets, and open banking.

- Regulatory Framework: PSD2 and GDPR shape security standards and market operations.

- Competitive Substitutes: Increasing competition from fintech companies and alternative payment methods.

- End-User Demographics: Shifting demographics and increased digital adoption drive market growth.

- M&A Activity: xx M&A deals were recorded between 2019 and 2024, resulting in increased market consolidation. Further xx deals are projected from 2025-2033

European Payment Processors Market Growth Trends & Insights

The European Payment Processors Market experienced robust growth during the historical period (2019-2024), driven by factors such as increasing e-commerce adoption, rising smartphone penetration, and expanding digital financial inclusion. The market size grew from xx Million in 2019 to xx Million in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. The forecast period (2025-2033) is expected to witness continued expansion, with a projected CAGR of xx%, reaching xx Million by 2033. This growth will be fueled by the increasing popularity of digital wallets, the expansion of contactless payments, and the growing adoption of Buy Now Pay Later (BNPL) services. Technological advancements in areas like Artificial Intelligence (AI) and blockchain are also expected to drive market expansion. Further, the rising preference for cashless transactions, particularly among younger demographics, will significantly influence growth. The market penetration of digital payment methods is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in European Payment Processors Market

The United Kingdom, Germany, and France are the dominant markets within Europe, accounting for a combined xx% of the total market value in 2024. The UK's robust e-commerce sector and advanced digital infrastructure contribute to its leading position. Germany benefits from a large and technologically advanced population, while France's strong retail sector drives payment processing volume. Online sales are currently the fastest-growing segment, surpassing Point of Sale transactions in several key markets. The retail sector holds the largest market share among end-user industries, followed by entertainment and hospitality.

- Dominant Regions: UK, Germany, France

- Key Drivers (UK): Strong e-commerce sector, advanced digital infrastructure

- Key Drivers (Germany): Large and digitally advanced population

- Key Drivers (France): Strong retail sector

- Fastest-growing Segment: Online Sales

- Largest End-user Industry: Retail

European Payment Processors Market Product Landscape

The European payment processors market offers a diverse range of products, including payment gateways, POS terminals, mobile payment solutions, and digital wallets. Innovation is focused on enhancing security, improving user experience, and expanding functionality. Key features include enhanced fraud detection mechanisms, seamless integration with e-commerce platforms, and support for various payment methods. The market also sees a growing adoption of biometric authentication and tokenization technologies to enhance security.

Key Drivers, Barriers & Challenges in European Payment Processors Market

Key Drivers: Increasing e-commerce adoption, rising smartphone penetration, government initiatives promoting digital payments, and the expanding adoption of mobile wallets and contactless payments are key drivers of market growth.

Challenges: Stringent regulatory compliance requirements, such as PSD2 and GDPR, along with concerns regarding data security and fraud prevention pose significant challenges. The intensifying competition from both established players and emerging fintech startups further complicates the market dynamics. Cross-border payment complexities and the need for interoperability among different payment systems present an operational hurdle.

Emerging Opportunities in European Payment Processors Market

Emerging opportunities include the growing adoption of open banking APIs, the expansion of BNPL services, the integration of blockchain technology for secure and transparent transactions, and the growing demand for personalized payment solutions catering to niche consumer needs. Untapped markets within Eastern Europe and the development of innovative payment solutions for the healthcare and government sectors represent significant growth potential.

Growth Accelerators in the European Payment Processors Market Industry

Technological advancements, particularly in AI and machine learning, are accelerating market growth by enhancing fraud detection, improving customer service, and personalizing the payment experience. Strategic partnerships between established payment processors and fintech companies are driving innovation and expanding market reach. Further, government initiatives to promote digital financial inclusion are creating a more favorable environment for market expansion.

Key Players Shaping the European Payment Processors Market Market

- Visa Inc

- Giropay

- Mastercard

- PayPal Holdings Inc

- SEPA Direct Debit

- Bancontact

- Melio Payments

- Multibanco

- Klarna

- iDEAL

Notable Milestones in European Payment Processors Market Sector

- May 2022: The European Union's antitrust regulator accused Apple of restricting rivals' access to its payment technology.

- May 2022: Thames Technology launched the first metal card with a dual interface manufactured in Europe.

- May 2022: PingPong Payments partnered with BNP Paribas to expand in Europe's D2C market.

- May 2022: Paysafe expanded its partnership with Visa to integrate Visa Direct.

In-Depth European Payment Processors Market Market Outlook

The European Payment Processors Market is poised for continued strong growth in the forecast period, driven by the factors outlined above. Opportunities abound for companies to capitalize on technological advancements, expand into underserved markets, and forge strategic partnerships to further consolidate their positions. The market's future depends on the ability of players to navigate regulatory changes, enhance security measures, and provide innovative and seamless payment experiences. The increasing adoption of digital payment methods and the shift towards a cashless society will continue to propel market growth, creating a dynamic and competitive landscape for years to come.

European Payment Processors Market Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (includes Mobile Wallets)

- 1.1.3. Cash

- 1.1.4. Others

-

1.2. Online Sale

- 1.2.1. Others (

-

1.1. Point of Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

European Payment Processors Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

European Payment Processors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased digitalisation and decreased cash usage and Real-Time Payments; The digital economy's expansion and changing consumer behaviour; Regulation

- 3.2.2 specifically PSD2 and Open Banking

- 3.3. Market Restrains

- 3.3.1. High Costs Associated With Testing Equipment

- 3.4. Market Trends

- 3.4.1. Increasing use of Digital wallets while shopping online

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Payment Processors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.1.4. Others

- 5.1.2. Online Sale

- 5.1.2.1. Others (

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. Germany European Payment Processors Market Analysis, Insights and Forecast, 2019-2031

- 7. France European Payment Processors Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy European Payment Processors Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom European Payment Processors Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands European Payment Processors Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden European Payment Processors Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe European Payment Processors Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Visa Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Giropay

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Mastercard

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 PayPal Holdings Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 SEPA Direct Debit

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Bancontact

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Melio Payments

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Multibanco

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Klarna*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 iDEAL

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Visa Inc

List of Figures

- Figure 1: European Payment Processors Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European Payment Processors Market Share (%) by Company 2024

List of Tables

- Table 1: European Payment Processors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European Payment Processors Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 3: European Payment Processors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: European Payment Processors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: European Payment Processors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: European Payment Processors Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 14: European Payment Processors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: European Payment Processors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark European Payment Processors Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Payment Processors Market?

The projected CAGR is approximately 15.83%.

2. Which companies are prominent players in the European Payment Processors Market?

Key companies in the market include Visa Inc, Giropay, Mastercard, PayPal Holdings Inc, SEPA Direct Debit, Bancontact, Melio Payments, Multibanco, Klarna*List Not Exhaustive, iDEAL.

3. What are the main segments of the European Payment Processors Market?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased digitalisation and decreased cash usage and Real-Time Payments; The digital economy's expansion and changing consumer behaviour; Regulation. specifically PSD2 and Open Banking.

6. What are the notable trends driving market growth?

Increasing use of Digital wallets while shopping online.

7. Are there any restraints impacting market growth?

High Costs Associated With Testing Equipment.

8. Can you provide examples of recent developments in the market?

May 2022- The European Union's antitrust regulator has accused Apple of restricting rivals' access to its payment technology, forcing the company to change its business practices and expose it to a massive fine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Payment Processors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Payment Processors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Payment Processors Market?

To stay informed about further developments, trends, and reports in the European Payment Processors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence